Patch Management Market by Component (Patch Management Software and Services), Service (Consulting, Support & Integration), Deployment (Cloud and On-Premises), Vertical (BFSI, Government & Defense, IT & Telecom), and Region - Global Forecast to 2024

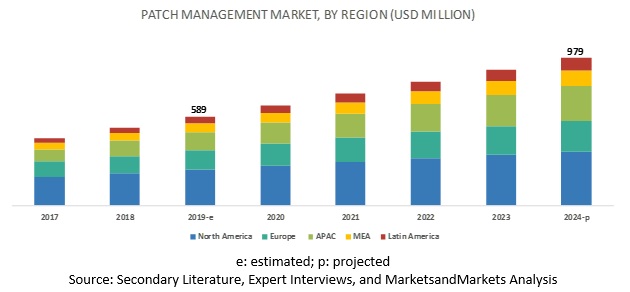

[130 Pages Report] The global patch management market size is expected to grow from USD 589 million in 2019 to USD 979 million by 2024, at a Compound Annual Growth Rate (CAGR) of 10.7% during the forecast period. The increasing vulnerabilities to promote patch management solutions and increasing deployment of third-party applications are the major factors driving the growth of the market. Application compatibility and patch testing issues are some of the challenges.

By vertical, BFSI to contribute to the growth of the patch management market during the forecast period

The Banking, Financial Services, and Insurance (BFSI) vertical is prone to cyberattacks, as it tends to have all the financial information of customers and business organizations. The vertical frequently introduces new and improved financial products and services to enhance business operations, which makes it attractive for fraudsters to target sensitive customer information. Therefore, the systems and software applications in the banking and financial organizations need to be regularly updated. Patch management applications help the organizations not only monitor and report missing/operation-critical patches but also help to update system applications regularly. Furthermore, the emerging trend of cloud banking creates the need for securing confidential business and financial data on a real-time basis. This trend is expected to increase the adoption of patch management applications in the BFSI vertical.

By deployment, on-premises segment to hold the highest market share during the forecast period

On-premises solutions provide organizations with full control over all their platforms, applications, systems, and data, which can be handled and managed by their own IT staff. On-premises deployment is a traditional approach to implement patch management solutions across enterprises. The organizations where user credentials are critical for business operations would prefer the on-premises deployment, as it provides them with the flexibility to control their IT systems. Government and defense, and BFSI verticals prefer on-premises security because they cannot afford to lose their sensitive data, financial records, accounting information, and money transfers.

By region, Europe to grow at a significant CAGR during the forecast period

Europe comprises various countries that are economically stable and technologically advanced. The UK, Germany, and France are key countries considered for market analysis in Europe. The patch management market in Europe is witnessing strong growth with significant market share generated by this region. The European countries have formed a regulatory body named ENISA, which has been working to make Europe cyber secure. Additionally, under European Union’s GDPR, the Information Commissioner’s Office (ICO) imposed enforcement actions on non-compliant organizations, which will include an investigation into the organization’s practices and a mandate to address any aspect that falls short on the GDPR’s cybersecurity requirements. Moreover, awareness regarding the benefits of patching, coupled with an increase in the number of applications and Operating System (OS), has led to the widespread acceptance of patch management solutions.

Key Patch Management Market Players

The major vendors in the patch management market are IBM (US), Microsoft (US), Symantec (US), Micro Focus (UK), Qualys (US), SolarWinds (US), Ivanti (US), ManageEngine (US), ConnectWise (US), Avast (Czech Republic), Automox (US), SecPod (India), GFI Software (US), Jamf (US), Chef Software (US), and SysAid Technologies (Israel).

Micro Focus (UK) is prominently recognized for offering security solutions and services to a wide range of customers across different verticals. The company’s robust solution and service portfolios, and its ability to cater to a broad customer base have helped Micro Focus build a strong customer base across regions. Micro Focus has become the largest pure-play software player, post its merger with HPE’s software division and NetIQ. The company’s innovative offerings make it one of the most trusted and deployed solution providers in the patch management market. It makes investments in organic and inorganic growth strategies, depending on the evaluation of its security portfolio. It has been consistently focusing on strengthening its portfolio with the help of new product launches and product enhancements. Furthermore, Micro Focus plans to expand its presence and strengthen its market position by adopting effective partnership strategies. Its robust partner ecosystem comprises existing partners and new partners from NetIQ’s acquisition. It also has a specific partner program, partner portal, and partner community. This illustrates its focus on achieving growth and increasing its presence by following the strategy of managing its partners, which include business partners, solution partners, consulting and System Integrator (SI) partners, authorized distributors, training partners (commercial and academic), and authorized instructors.

Scope of Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Components (Patch Management Software and Services), Services (Consulting, Training and Education, and Support and Integration) Deployment (On-premises and Cloud), Verticals, and Regions |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

IBM (US), Microsoft (US), Symantec (US), Micro Focus (UK), Qualys (US), SolarWinds (US), Ivanti (US), ManageEngine (US), ConnectWise (US), Avast (Czech Republic), Automox (US),SecPod (India), GFI Software (US), Jamf (US), Chef Software (US), and SysAid Technologies (Israel). |

This research report categorizes the patch management market to forecast revenues and analyze trends in each of the following submarkets:

By Component, the patch management market has been segmented as follows:

- Patch Management Software Services

- Support and Integration

- Training and Education

- Consulting

By Deployment, the market has been segmented as follows:

- On-premises

- Cloud

By Vertical, the patch management market has been segmented as follows:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology (IT) and Telecom

- Healthcare

- Government and Defense

- Retail

- Education

- Others (Energy and Utilities, Manufacturing, Media and Entertainment, and Transportation)

By Region, the market has been segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- Germany

- Rest of Europe

- APAC

- India

- China

- Japan

- ANZ

- Rest of APAC

- MEA

- Middle East

- Africa

- Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In April 2019, SolarWinds enhanced its SolarWinds MSP product portfolio by adding patch management for Mac capabilities. This capability is embedded with built-in checks and automated maintenance tasks, including a unique managed patch solution, and the ability to use templates or custom scripts, thereby, offering a seamless experience for monitoring, managing, and protecting Mac devices across customer environments.

- In February 2019, IBM partnered with Qualys to integrate Qualys’s patch management solution with IBM’s X-Force Red’s vulnerability management services. This integration is expected to enable IBM to automate vulnerability prioritization and patching, which will reduce the time for vulnerability remediation.

- In February 2019, Micro Focus acquired Interset, an Machine Learning (ML) and User and Entity Behavior Analytics (UEBA) application provider. This acquisition is expected to strengthen the cybersecurity portfolio of Micro Focus by leveraging key attributes of Interset’s technology, which include ML and advanced-analytics models, to supplement its big data analytics software Vertica and add more value to its ArcSight Security Information and Event Management (SIEM) correlation engine.

- In February 2019, Qualys launched Patch Management, a cloud-based application that provides automated patch deployment capabilities and orchestrates full life cycle vulnerability management of OS and third-party software across global hybrid environments.

Key Questions Addressed by the Report:

- Where would all these developments drive the industry in the mid to long term?

- What are the upcoming industry solutions for the market?

- Which are the major factors expected to drive the market?

- Which region is projected to offer high growth for vendors in the patch management market?

Frequently Asked Questions (FAQ):

What is the definition of Patch Management Market?

Patch management is a holistic approach to update Operating System (OS), software, and third-party applications across an organization’s Information Technology (IT) infrastructure. The patch management software manages necessary software updates automatically and more efficiently. It involved identifying missing patches and deploying them, which help organizations detect lack of security features and keep their systems up to date. The software provides various features, such as vulnerability management, compliance management, auditing, and reporting, and supports various computing devices, such as PCs, laptops, tablets, and smartphones.

What are the major tools used in patch management?

The major tools used in patch management are SolarWinds Patch Manager, Microsoft SCCM Patch Management, HEAT PatchLink, ManageEngine Patch Manager Plus, Ivanti Windows Patch, Kaseya VSA Patch Management, SecPod, GFI LanGuard, Comodo ONE Windows Patch management, Quest KACE Patch Management, and Symantec Patch Management Solution.

What is the market size of the patch management market?

The global patch management market size is expected to grow from USD 589 million in 2019 to USD 979 million by 2024, at a Compound Annual Growth Rate (CAGR) of 10.7% during the forecast period.

Who are the key players in the patch management market?

The major vendors in the patch management market are IBM, Microsoft, Symantec, Micro Focus, Qualys, SolarWinds, Ivanti, ManageEngine, ConnectWise, Avast, Automox, SecPod, GFI Software, Jamf, Chef Software, and SysAid Technologies.

Which are the major factors expected to drive the patch management market?

The increasing vulnerabilities to promote patch management solutions and increasing deployment of third-party applications are the major factors driving the growth of the patch management market, while application compatibility and patch testing issues are some of the challenges. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 19)

2.1 RESEARCH DATA

FIGURE 1 PATCH MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 2 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

2.4 MARKET FORECAST

TABLE 1 FACTOR ANALYSIS

2.5 COMPETITIVE LEADERSHIP METHODOLOGY

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 27)

TABLE 2 PATCH MANAGEMENT MARKET SIZE AND GROWTH, 2017–2024 (USD MILLION, Y-O-Y %)

FIGURE 3 GLOBAL MARKET TO WITNESS A SIGNIFICANT GROWTH DURING THE FORECAST PERIOD

FIGURE 4 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

FIGURE 5 NORTH AMERICA TO ACCOUNT FOR THE HIGHEST MARKET SHARE IN 2019

FIGURE 6 FASTEST-GROWING SEGMENTS OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 31)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE MARKET

FIGURE 7 INCREASING NEED TO SECURE SOFTWARE APPLICATIONS AND OPERATING SYSTEMS ACROSS VERTICALS TO FUEL THE GROWTH OF THE MARKET

4.2 PATCH MANAGEMENT MARKET, BY COMPONENT, 2019

FIGURE 8 PATCH MANAGEMENT SOFTWARE SEGMENT TO ACCOUNT FOR A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY SERVICE, 2019–2024

FIGURE 9 SUPPORT AND INTEGRATION SEGMENT TO ACCOUNT FOR THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

4.4 MARKET, MARKET SHARE OF TOP 3 VERTICALS AND REGIONS, 2019

FIGURE 10 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL AND NORTH AMERICA REGION TO ACCOUNT FOR THE HIGHEST MARKET SHARES IN 2019

4.5 MARKET, BY DEPLOYMENT, 2019

FIGURE 11 ON-PREMISES SEGMENT TO ACCOUNT FOR A HIGHER MARKET SHARE IN 2019

4.6 MARKET INVESTMENT SCENARIO

FIGURE 12 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENT IN THE NEXT 5 YEARS

5 MARKET OVERVIEW (Page No. - 34)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PATCH MANAGEMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing vulnerabilities to promote patch management solutions

5.2.1.2 Growing demand for up-to-date OS/applications

5.2.1.3 Increasing deployment of third-party applications

5.2.1.4 Favorable government regulations

5.2.2 RESTRAINTS

5.2.2.1 Low priority of vulnerability remediation

5.2.3 OPPORTUNITIES

5.2.3.1 Cultural shift from manual to automated patch management

5.2.3.2 Increasing market for mobile and web platforms

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness about cybersecurity

5.2.4.2 Application compatibility and patch testing issues

5.3 USE CASES

5.3.1 MICRO FOCUS

5.3.2 ANUNTA TECHNOLOGIES

5.3.3 HEIMDAL SECURITY

5.3.4 GFI SOFTWARE

5.4 OPPORTUNITIES FOR MANAGED SERVICE PROVIDERS

5.4.1 PALISADE SECURE

5.4.2 ANUNTA TECHNOLOGIES

6 PATCH MANAGEMENT MARKET, BY COMPONENT (Page No. - 40)

6.1 INTRODUCTION

FIGURE 14 PATCH MANAGEMENT SOFTWARE SEGMENT TO DOMINATE DURING THE FORECAST PERIOD

TABLE 3 MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

6.2 PATCH MANAGEMENT SOFTWARE

6.2.1 NEED TO ELIMINATE VULNERABILITIES AND IMPROVE PRODUCT FUNCTIONALITIES TO DRIVE GROWTH OF PATCH MANAGEMENT SOFTWARE SEGMENT

FIGURE 15 NORTH AMERICA TO DOMINATE THE PATCH MANAGEMENT SOFTWARE SEGMENT DURING THE FORECAST PERIOD

TABLE 4 PATCH MANAGEMENT SOFTWARE, BY REGION, 2017–2024 (USD MILLION)

6.3 SERVICES

6.3.1 GROWING NEED TO SAFEGUARD MOBILE AS WELL AS WEB APPLICATIONS TO DRIVE GROWTH OF SERVICES SEGMENT

FIGURE 16 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 5 PATCH MANAGEMENT SERVICE, BY REGION, 2017–2024 (USD THOUSAND)

7 PATCH MANAGEMENT MARKET, BY SERVICE (Page No. - 45)

7.1 INTRODUCTION

FIGURE 17 SUPPORT AND INTEGRATION SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 6 MARKET SIZE, BY SERVICE, 2017–2024 (USD MILLION)

7.2 CONSULTING

7.2.1 NEED TO PREVENT REVENUE LOSSES, MINIMIZE RISKS, UNDERSTAND MATURITY OF SECURITY SOLUTIONS, AND ENHANCE SECURITY IN EXISTING IT SYSTEMS TO FUEL GROWTH OF CONSULTING SEGMENT

FIGURE 18 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 7 CONSULTING: MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

7.3 TRAINING AND EDUCATION

7.3.1 INCREASING DEMAND OF CRITICAL SKILLS FOR IMPROVING OVERALL SECURITY OF PERSONAL DEVICES, LAPTOPS, AND OTHER COMPUTING DEVICES DRIVING GROWTH OF TRAINING AND EDUCATION SEGMENT

FIGURE 19 NORTH AMERICA TO DOMINATE THE TRAINING AND EDUCATION SEGMENT DURING THE FORECAST PERIOD

TABLE 8 TRAINING AND EDUCATION: MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

7.4 SUPPORT AND INTEGRATION

7.4.1 TECHNOLOGY SHIFT FROM TRADITIONAL TO DIGITAL PAYMENTS FOR IMPROVING CUSTOMER EXPERIENCE DRIVING GROWTH OF SUPPORT AND INTEGRATION SEGMENT

FIGURE 20 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 9 SUPPORT AND INTEGRATION: MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

8 PATCH MANAGEMENT MARKET, BY FEATURE (Page No. - 51)

8.1 INTRODUCTION

8.2 VULNERABILITY MANAGEMENT

8.2.1 INCREASING DEMAND FOR API-BASED INTEGRATION SERVICES TO FUEL THE ADOPTION OF VULNERABILITY MANAGEMENT APPLICATIONS

8.3 COMPLIANCE MANAGEMENT AND REPORTING

8.3.1 RISING DEMAND FOR REPORTING VARIOUS VULNERABILITIES TO FUEL THE ADOPTION OF COMPLIANCE MANAGEMENT AND REPORTING APPLICATIONS

9 MARKET, BY DEPLOYMENT (Page No. - 53)

9.1 INTRODUCTION

FIGURE 21 CLOUD DEPLOYMENT TO HOLD A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 10 MARKET SIZE, BY DEPLOYMENT, 2017–2024 (USD MILLION)

9.2 ON-PREMISES

9.2.1 GROWING NEED TO SAFEGUARD SENSITIVE DATA, FINANCIAL RECORDS, ACCOUNTING INFORMATION, AND MONEY TRANSFERS TO FUEL THE GROWTH OF ON-PREMISES DEPLOYMENT

FIGURE 22 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 11 ON-PREMISES: MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

9.3 CLOUD

9.3.1 NEED TO BRIDGE THE GAP OF MISSING/CRITICAL PATCHES THROUGH AUTOMATED PATCH MANAGEMENT TO DRIVE THE GROWTH OF CLOUD DEPLOYMENT

FIGURE 23 NORTH AMERICA TO DOMINATE THE CLOUD DEPLOYMENT DURING THE FORECAST PERIOD

TABLE 12 CLOUD: MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

10 PATCH MANAGEMENT MARKET, BY VERTICAL (Page No. - 58)

10.1 INTRODUCTION

FIGURE 24 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 13 MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.2.1 GROWING NEED TO MONITOR AND REPORT MISSING/OPERATION CRITICAL PATCHES TO DRIVE GROWTH OF MARKET IN BFSI VERTICAL

FIGURE 25 NORTH AMERICA TO DOMINATE THE BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL DURING THE FORECAST PERIOD

TABLE 14 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

10.3 GOVERNMENT AND DEFENSE

10.3.1 NEED FOR SECURED DEFENSE-BASED SYSTEMS AND APPLICATIONS DRIVING GROWTH OF PATCH MANAGEMENT MARKET IN DEFENSE VERTICAL

TABLE 15 GOVERNMENT AND DEFENSE: MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

10.4 RETAIL

10.4.1 NEED TO REDUCE CYBER RISKS AND MAINTAIN IT INFRASTRUCTURE SECURITY TO DRIVE THE MARKET GROWTH IN RETAIL VERTICAL

TABLE 16 RETAIL: MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

10.5 HEALTHCARE

10.5.1 NEED TO PROTECT PATIENT DATA AND PAYMENT INFORMATION TO DRIVE THE MARKET GROWTH IN HEALTHCARE VERTICAL

FIGURE 26 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 17 HEALTHCARE: MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

10.6 IT AND TELECOM

10.6.1 INCREASED ATTACKS ON CRITICAL INFRASTRUCTURE TO DRIVE THE MARKET GROWTH IN IT AND TELECOM VERTICAL

TABLE 18 IT AND TELECOM: MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

10.7 EDUCATION

10.7.1 NEED TO AVOID BUG-AFFECTED APPLICATIONS AND SYSTEMS DRIVING THE MARKET GROWTH IN EDUCATION VERTICAL

TABLE 19 EDUCATION: MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

10.8 OTHERS

TABLE 20 OTHERS: MARKET SIZE, BY REGION, 2017–2024 (USD THOUSAND)

11 PATCH MANAGEMENT MARKET, BY REGION (Page No. - 67)

11.1 INTRODUCTION

FIGURE 27 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE IN THE MARKET DURING THE FORECAST PERIOD

FIGURE 28 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD, 2019–2024

TABLE 21 MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 30 SERVICES SEGMENT TO GROW AT A HIGHER CAGR IN NORTH AMERICA DURING THE FORECAST PERIOD

TABLE 22 NORTH AMERICA: PATCH MANAGEMENT MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 23 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2017–2024 (USD MILLION)

TABLE 24 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT, 2017–2024 (USD MILLION)

TABLE 25 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2017–2024 (USD THOUSAND)

TABLE 26 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

11.2.1 UNITED STATES

11.2.1.1 Rapid growth in technological innovations and increased use of internet to drive the growth of the market in the US

11.2.2 CANADA

11.2.2.1 Government initiatives to secure network system to set the growth of the market in Canada

11.3 EUROPE

FIGURE 31 PATCH MANAGEMENT SOFTWARE SEGMENT TO HAVE A LARGER MARKET SIZE IN EUROPE DURING THE FORECAST PERIOD

TABLE 27 EUROPE: PATCH MANAGEMENT MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 28 EUROPE: MARKET SIZE, BY SERVICE, 2017–2024 (USD THOUSAND)

TABLE 29 EUROPE: MARKET SIZE, BY DEPLOYMENT, 2017–2024 (USD MILLION)

TABLE 30 EUROPE: MARKET SIZE, BY VERTICAL, 2017–2024 (USD THOUSAND)

TABLE 31 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

11.3.1 UNITED KINGDOM

11.3.1.1 Government regulations working as a catalyst to drive the growth of the market in the UK

11.3.2 GERMANY

11.3.2.1 Changing market dynamics due to business expansion strategies by large enterprises to fuel the growth of the market in Germany

11.3.3 REST OF EUROPE

11.4 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 33 SERVICES SEGMENT TO GROW AT A HIGHER CAGR IN ASIA PACIFIC DURING THE FORECAST PERIOD

TABLE 32 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 33 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2017–2024 (USD THOUSAND)

TABLE 34 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT, 2017–2024 (USD MILLION)

TABLE 35 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2017–2024 (USD THOUSAND)

TABLE 36 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2024 (USD THOUSAND)

11.4.1 CHINA

11.4.1.1 Changing paradigm of cybersecurity industry to drive the growth of patch management technology in China

11.4.2 JAPAN

11.4.2.1 Adoption of patch management solutions for third-party application providers to drive the market in Japan

11.4.3 INDIA

11.4.3.1 Government initiatives to fuel the growth of the patch management market in India

11.4.4 AUSTRALIA AND NEW ZEALAND

11.4.4.1 Adoption of cybersecurity regulations to drive the growth of the market in ANZ

11.4.5 REST OF ASIA PACIFIC

11.5 MIDDLE EAST AND AFRICA

FIGURE 34 PATCH MANAGEMENT SOFTWARE SEGMENT TO HAVE A LARGER MARKET SIZE IN MIDDLE EAST AND AFRICA DURING THE FORECAST PERIOD

TABLE 37 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2017–2024 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT, 2017–2024 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2017–2024 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

11.5.1 MIDDLE EAST

11.5.1.1 Adoption of patch management solution by enterprises to improve security to drive the growth of the market in the Middle East

11.5.2 AFRICA

11.5.2.1 Changing paradigm of the cybersecurity industry to drive the growth of patch management technology in Africa

11.6 LATIN AMERICA

FIGURE 35 SERVICES SEGMENT TO GROW AT A HIGHER CAGR IN LATIN AMERICA DURING THE FORECAST PERIOD

TABLE 42 LATIN AMERICA: PATCH MANAGEMENT MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 43 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2017–2024 (USD THOUSAND)

TABLE 44 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT, 2017–2024 (USD MILLION)

TABLE 45 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2017–2024 (USD THOUSAND)

TABLE 46 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2024 (USD MILLION)

11.6.1 BRAZIL

11.6.1.1 Growing adoption of patch management solution by enterprises to improve business security in Brazil

11.6.2 MEXICO

11.6.2.1 Recent government initiatives to drive the growth of the market in Mexico

11.6.3 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE (Page No. - 89)

12.1 INTRODUCTION

12.2 COMPETITIVE LEADERSHIP MAPPING

TABLE 47 EVALUATION CRITERIA

12.2.1 VISIONARY LEADERS

12.2.2 DYNAMIC DIFFERENTIATORS

12.2.3 INNOVATORS

12.2.4 EMERGING COMPANIES

FIGURE 36 PATCH MANAGEMENT MARKET (GLOBAL), COMPETITIVE LEADERSHIP MAPPING, 2019

12.3 COMPETITIVE SCENARIO

FIGURE 37 KEY DEVELOPMENTS BY THE LEADING PLAYERS IN THE MARKET DURING 2017–2019

12.3.1 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 48 NEW PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS, 2018–2019

12.3.2 PARTNERSHIPS AND COLLABORATIONS

TABLE 49 PARTNERSHIPS AND COLLABORATIONS, 2017–2019

12.3.3 MERGERS AND ACQUISITIONS

TABLE 50 MERGERS AND ACQUISITIONS, 2017–2019

13 COMPANY PROFILES (Page No. - 95)

13.1 INTRODUCTION

(Business Overview, Products & Solutions, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

FIGURE 38 GEOGRAPHIC REVENUE MIX OF MAJOR PLAYERS

13.2 IBM

FIGURE 39 IBM: COMPANY SNAPSHOT

FIGURE 40 IBM: SWOT ANALYSIS

13.3 SYMANTEC

FIGURE 41 SYMANTEC: COMPANY SNAPSHOT

FIGURE 42 SYMANTEC: SWOT ANALYSIS

13.4 MICRO FOCUS

FIGURE 43 MICRO FOCUS: COMPANY SNAPSHOT

FIGURE 44 MICRO FOCUS: SWOT ANALYSIS

13.5 QUALYS

FIGURE 45 QUALYS: COMPANY SNAPSHOT

FIGURE 46 QUALYS: SWOT ANALYSIS

13.6 SOLARWINDS

FIGURE 47 SOLARWINDS: COMPANY SNAPSHOT

FIGURE 48 SOLARWINDS: SWOT ANALYSIS

13.7 IVANTI

13.8 MANAGEENGINE, A DIVISION OF ZOHO CORPORATION

13.9 CONNECTWISE

13.10 AVAST

FIGURE 49 AVAST: COMPANY SNAPSHOT

13.11 AUTOMOX

13.12 MICROSOFT

FIGURE 50 MICROSOFT: COMPANY SNAPSHOT

13.13 SECPOD

13.14 GFI LANGUARD SOFTWARE

13.15 JAMF

13.16 CHEF SOFTWARE

13.17 SYSAID TECHNOLOGIES

*Details on Business Overview, Products & Solutions, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 124)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

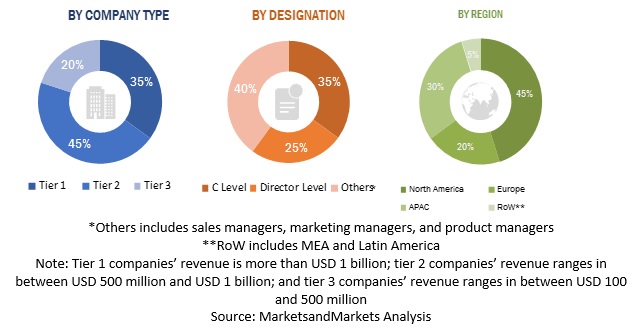

The study involved 4 major activities in estimating the current market size for the patch management market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the patch management market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The information regarding patch management was consolidated from secondary sources inclusive of various governing bodies, such as US-CERT, Computer Security Resource Center (CSRC), and Canadian Centre for Cyber Security. Moreover, additional information was collected from summits and conferences, such as the RSA Conference, Security Professionals Conference, Gartner Security & Risk Management Summit, and Qualys Security Conference.

Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology oriented perspectives.

Primary Research

In the market engineering process, both top-down and bottom-up approaches were extensively used, along with several data triangulation methods to perform market estimation and market forecasting for the overall market segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information/insights throughout the report.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types; industry trends; key players; the competitive landscape of different market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

To know about the assumptions considered for the study, download the pdf brochure

Patch Management Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the patch management market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Various factors impacting the patch management market, such as recent developments, regulations, technology maturity, government initiatives, research and development, vertical spending, threat landscape, funding, cloud adoption, internet and mobile technology, and mergers and acquisitions, have been considered in the study.

Report Objectives

- To define, describe, and forecast the patch management market by component (patch management software and services), service (consulting, training and education, and support and integration), deployment (on-premises and cloud), vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders, by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegment

- To analyze the competitive developments, such as product/service launches and product enhancements, partnerships, collaborations, business expansions, and mergers and acquisitions, in the patch management market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Patch Management Market