Passenger Car Seat Market by Type & Technology (Powered, Heated, Ventilated, Memory, Massage), Trim Material (Genuine, Synthetic, Fabric, Foam), Component (Armrest, Belt, Headrest, Height Adjuster, Recliner), EV (BEV, PHEV, FCEV) - Global Forecast to 2030

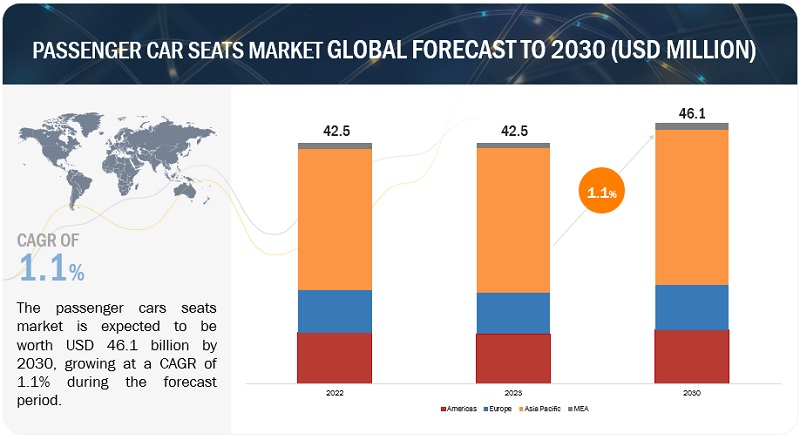

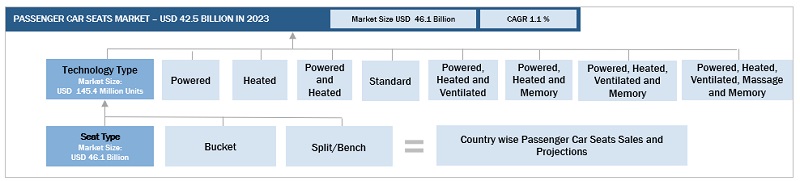

[269 Pages Report] The global passenger car seat market size was valued at USD 42.5 billion by 2023 and is expected to reach USD 46.1 billion in 2030, at a CAGR of 1.1% during the forecast period 2023 to 2030. The increasing stringency in regulations and safety standards for vehicles, technological advancements & innovation in the seating segment, and increasing focus on electric vehicles and others are driving the passenger car seat market. Asia Pacific and the Americas will remain the top regional market for this product.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Passenger Car Seat Market Dynamics

DRIVER: Rising adoption of powered seats in mid-segment cars & SUVs

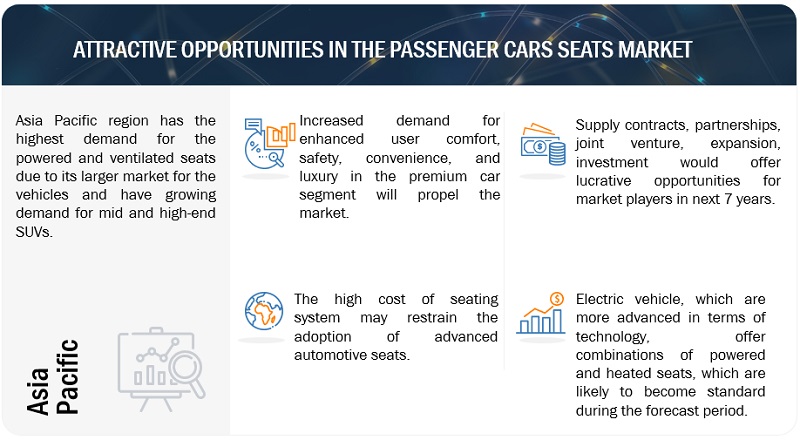

Over time, the popularity of SUVs has nearly doubled due to a sharp shift in consumer preference for larger vehicles. The IEA estimates that by 2022, there will be more than 36 million additional SUVs on the road globally. SUVs account for over half of all vehicles sold in the US and one-third of vehicles sold in Europe. India currently has fewer SUV sales than western nations. However, OEMs are releasing affordable compact SUVs, which is drawing customers. Because they are more affordable than full-size SUVs, tiny SUVs are becoming more and more popular in India.

SUVs come have a range of seat configurations. For instance, full-size SUVs typically have a last/third row that is a 60/40 split bench/bucket and a first and second row with bucket seats. First row bucket seats are standard in compact SUVs, and second row bench or bucket seats (which may or may not be divided) are optional. Full-size SUV seats may be heated, cooled, and powered by technology. Leather may also be used for the seats. The demand for powered and ventilated/heated seats is rising along with the global demand for SUVs.

RESTRAINT: High cost of advanced modular seats compared to conventional seats

adjustable seats Compared to standard chairs, seats that are motorized, heated, ventilated, massaged, and climate-controlled offer more comfort and convenience. But only expensive cars may use them because of their exorbitant price. In most mid-range SUVs, powered, heated, and ventilated applications are now becoming commercially available, but OEMs mostly offer massage seats in high-end vehicles. For instance, automakers Mercedes-Benz, BMW, Jaguar, and Cadillac offer front passenger massage seats. Memory seats are a standard feature in the top-end models of the majority of medium and premium passenger automobile models in developed nations.

Small and inexpensive cars in the A, B, and C classes typically come with standard seats. Heated seats are more in demand in North America and Europe's developed nations, and they are available in the majority of D, E, and F models. In various high-end car segments including E, F, SUV-D, and SUV E, ventilated seats are available, as well as for the back seats. A small number of luxury car manufacturers, including Mercedes-Benz, BMW, and Jaguar, offer massage seats in their high-end vehicles. Memory seats are a standard feature in the top-end models of the majority of medium and premium passenger automobile models in developed nations. Memory seats for the driver are available in Mercedes-Benz, Audi A8, Porsche, and BMW vehicles. However, the economic segment particularly in developing nations holds the market's primary trap. The passenger car seat market for modular seats may suffer as a result of this.

OPPORTUNITY: Growing focus on autonomous cars and increasing preference for ride sharing

With the intention of creating and launching a fully automated driving experience, the automobile industry is putting more of its attention into the development of advanced driver aid systems. Additionally, consumers' preferences for on-demand mobility services like ride- and car-sharing have increased. A study by the Victoria Transport Policy Institute (VTPI) found that just 30% of fully autonomous cars are expected to be privately owned and that more than 70% of them will be used for ride sharing.

The steering wheel will be replaced by various interiors that are centered on the passenger because L4 & L5 autonomous vehicles would require little to no driver intervention. The longevity of seats will be crucial as car sharing becomes more popular. Privacy will be essential when multiple commuters are in the same car at the same time. As a result, multizone climate control or independent listening zones with speakers linked to each headrest will be used. Along with the newest technology features, seats must be cozy, safe, and secure. As a result, OEM and consumer preferences will force seat makers to invent or acquire fresh, appealing products that make use of emerging technologies. For instance, Adient Plc just unveiled the A118 Concept, a vehicle that is designed for urban use and is powered by electricity and autonomous driving. The four main usage situations for autonomous vehicles Lounge, Communication, Cargo, and Baby Plus are addressed by this concept, which offers solutions. In 2019, Lear Corporation purchased EXO Technologies, an Israeli company that leads the development of unique GPS technology and offers high accuracy locating solutions for applications involving connected and autonomous vehicles. Hyundai Transys has been creating seats for driverless vehicles since 2016. Easy Access, Autonomous, Communication, Relax, and Cargo are the 5 modes that are offered for these seats. Each mode adopts a new posture thanks to the floor's forward-backward tracking, the 180-degree swivel base, and the lighter, smaller seat, which maximizes available space.

CHALLENGE: Challenges faced by textile & seat trim material suppliers

Textiles and trim materials are frequently employed in passenger car interiors and have potential for use in additional places. Polyester fabrics are created using polyamide, rayon, and polypropylene, all of which have a polyester foundation. Alternative materials like nonwoven polyesters are also being taken into consideration as a foam replacement for laminate composites in body fabric and car interiors. These items reduce total seat weight and improve seat comfort. Customers are quite familiar with the fabrics and trim materials they physically come into contact with, in particular the headliners and fabrics used throughout the inside of the car, as well as the seat upholstery or body cloth. The Journal of Textile & Apparel reports that over 13 million automobiles were produced in North America in 2020, using approximately. Each inside seat requires 6 yards of fabric, or 75 million liner yards annually. The interior trim of cars, such as the seat coverings, carpets, roofs, and door liners, makes up almost two thirds of the textiles used in them. The remainder is used to strengthen airbags, safety belts, tires, noses and other components. The materials needed to upholster a standard vehicle interior, including seat covers, weigh about 30kg (65lbs), according to Automotive World magazine observations. Future predictions indicate a rise in demand for polyester fabrics as seat trim material.

A competitive environment is developing for material suppliers as a result of the expanding demand for textiles and trim materials. To meet consumer demand, OEMs and Tier-I suppliers continuously introduce new seat designs to the passenger car seat market. These novel forms necessitate the use of cutting-edge trim materials and techniques when creating the seat assembly. As a result, the suppliers of trim materials work tirelessly to satisfy OEM and seat supplier demands.

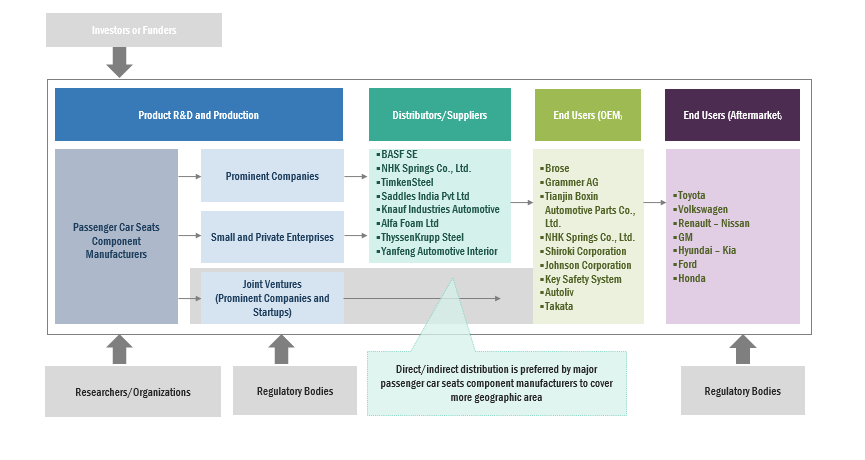

Passenger car seat Market Ecosystem.

The major OEMs of the passenger car seat market have the latest technologies, diversified portfolios, and strong distribution networks globally. The major players in the market are Adient Plc (US), Faurecia (France), Lear Corporation (US), Toyota Boshoku Corporation (Japan), and Magna International (Canada).

Powered seats have the highest market in the Asia Pacific region for technology.

Powered seats can be adjusted with a button, making it easy to find a comfortable position. This is especially helpful for people with limited mobility or back pain. It can be customized to fit the individual needs of the driver or passenger. These powered seats often have additional advanced features such as memory settings, heated and ventilated options, massage functions, and integrated lumbar support. Furthermore, technological advancements and the decreasing cost of powered seat systems have played a crucial role in their wider adoption.

Similarly, the SUV segment in the Asia Pacific region has also witnessed a surge in the adoption of powered seats. SUVs are increasingly popular among consumers due to their spaciousness, versatility, and ability to navigate diverse terrains. Powered seats are a premium feature in SUVs, adding to these vehicles' overall comfort and luxury quotient. Additionally, economies of scale and improved manufacturing processes have reduced costs, making powered seats more affordable for consumers. The passenger car seat market for powered seats in the Asia Pacific region was 4.0 million units in 2023 and is projected to grow by 5.8 million units by 2030 by volume. With passenger cars and SUVs experiencing substantial growth in the Asia Pacific market, the demand for powered seats is poised to expand, presenting lucrative opportunities for automotive manufacturers and suppliers operating in the region.

Seat belts will dominate the passenger car seats component market.

Seat belts are one of the most important safety features in passenger cars, and they account for the highest passenger car seat market share in components. In 2022, according to MarketsandMarkets the global market for seat belts in passenger cars had a volume of 286.2 million units and will reach 320 million units by 2030, and it is expected to grow at a CAGR of 1.6%. Seat belts are highly effective in reducing the risk of injury or death in a car crash. According to the National Highway Traffic Safety Administration (NHTSA) 2021, seat belts reduce the risk of death by 45% and the risk of serious injury by 50%. Third, seat belts are required by law in most countries. All new passenger cars sold in these countries must have seat belts. The increasing number of passenger cars sold worldwide and the growing awareness of the importance of seat belts in preventing injuries in car crashes. In addition, new technologies, such as active seat belts, are expected to increase the demand for seat belts in passenger cars. Active seat belts are designed to tighten automatically in the event of a crash, which can help to reduce the severity of injuries. Passenger car safety systems manufacturers continue to invest in research and development to introduce advanced seat belt technologies, driving innovation and further expanding the market's potential.

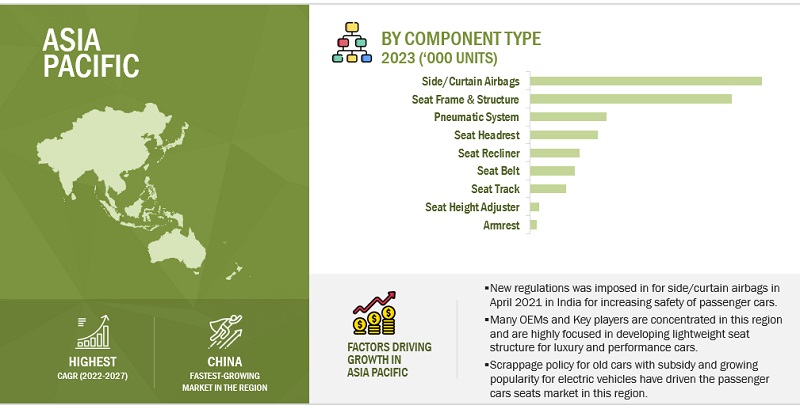

Asia Pacific is the fastest-growing market for side and curtain airbags for passenger car seats.

The demand for side and curtain airbags is high because of the increased demand for safety features in vehicles, the rising number of road accidents, and the growing number of government regulations mandating airbags in vehicles. According to MarketsandMarkets, the Asia Pacific side and curtain airbags market is projected to grow at a CAGR of 26.4% from 2023 to 2030. It is expected to account for 46.6% of the global passenger car seat market share by 2030. Few new regulations have been implemented in the Asia Pacific region for side and curtain airbags. For instance, In April 2021, India's road transport ministry mandated the installation of side and curtain airbags in all passenger cars. This applied to all vehicles manufactured after April 1, 2021. In China, the Ministry of Industry, and Information Technology (MIIT) has announced plans to mandate the installation of side and curtain airbags in all passenger cars by 2025. This regulation is still in the draft stage but is expected to be finalized soon. These new regulations are being implemented in response to the increasing number of road accidents in the Asia Pacific region. Side and curtain airbags are considered some of the most useful safety features available, and they can help reduce the severity of injuries in the event of a crash. In addition to these, other countries will consider the mandate to install side and curtain airbags in all passenger cars, such as Indonesia, Malaysia, and the Philippines. This growth is driven by several factors, including the increasing demand for vehicle safety features, the rising number of road accidents in the region, and the growing number of government regulations mandating airbags.

The bench/split bench seat is projected as the fastest-growing market for passenger car seats.

Split/bench seats are more affordable than bucket seats, which makes them a more attractive option for budget-minded buyers. These seats offer more flexibility, as they can be folded down to create more cargo space and are often seen as more comfortable than bucket seats, especially for larger passengers.

National Highway Traffic Safety Administration (NHTSA) November 2022, under the title ‘Passenger Vehicle Seating Capacity and Arrangements’ it was mentioned that according to their survey, In the US, about 70% of SUVs and minivans have a split or bench seat in the second row. This is compared to only about 20% of sedans. Also, the most common type of second-row seat in SUVs and minivans was a 60/40 split bench seat, followed by a 50/50 split bench seat, and in sedans, the most common type of second-row seat was a bench seat. Overall, the passenger car seat market for bench/split seats in passenger cars is expected to grow significantly in the coming years. Several factors drive this growth, including the increasing demand for affordable vehicles, the growing popularity of SUVs and minivans, and the rising demand for flexibility.

Key Market Players

The passenger car seat market is consolidated. Adient Plc (US), Faurecia (France), Lear Corporation (US), Toyota Boshoku Corporation (Japan), and Magna International (Canada) are the key companies operating in passenger car seat manufacturing. These companies adopted new product launches, partnerships, and joint ventures to gain traction in the market.

Scope of the Report

|

Report Attribute |

Details |

|

Base year for estimation |

2030 |

|

Forecast period |

2023 - 2030 |

|

Market Growth forecast |

USD 46.1 Billion by 2030 from USD 42.6 Billion in 2023 at 1.1% CAGR |

|

Top Players |

Adient Plc (US), Faurecia (France), Lear Corporation (US), Toyota Boshoku Corporation (Japan), and Magna International (Canada) |

|

Segments Covered |

Passenger Car Seat Market - By Technology, By Seat Type, By Component, Electric Passenger Cars, By Propulsion, By Region. |

|

By Region |

Asia Pacific, Americas, Europe, and MEA |

The study Categorises

By Technology:

- Heated seats;

- Heated and powered seats;

- Standard seats;

- Powered seats;

- Powered, heated and memory seats;

- Powered, heated, and ventilated seats;

- Powered, heated, ventilated,and memory seats;

- Powered, heated, ventilated, massage, and memory seats

By Seat Type

- Bucket

- split/bench

By Trim Material

- Fabric,

- Genuine Leather,

- Synthetic Leather

By Component Type

- Armrest,

- Pneumatic System,

- Seat Belt,

- Seat Frame & Structure,

- Seat Headrest,

- Seat Height Adjuster,

- Seat Recliner,

- Seat Track,

- Side/Curtain Airbag

Electric Passenger Car Seat Market, By Propulsion

- Battery Electric Vehicle,

- Fuel Cell Electric Vehicle

- Plug-In Hybrid Electric Vehicle

By Region

- Asia Pacific,

- Americas,

- Europe,

- MEA

Recent Developments

- In April 2023, Faurecia announced the development of its Zero-Gravity Captain Chair, a rear passenger seating solution that delivers advanced well-being tailored for the Chinese passenger car seat market. Inspired by NASA’s space exploration, the seat can be set to a “zero gravity” position, which reclines it to an almost flat angle.

- In April 2023, Faurecia introduced the new “Skin Light Panel” that offers weight reduction, extra room for rear passengers, improved recyclability, and cost savings. This new Skin Light Panel also delivers perfect integration into the full seat, including rear airbag management. The seating panel has a smooth finish, high-performance scratch-resistance material, and life-long durability.

- Lear Corporation has announced the strategic acquisition of InTouch Automation, a supplier of Industry 4.0 technologies and complex automated testing equipment critical in producing automotive seats. InTouch’s product portfolio allows Lear Corporation to collect and analyze real-time data while standardizing testing procedures throughout its just-in-time (JIT) seating production process.

- In October 2022, Lear Corporation announced that the company's premium and fully recyclable ReNewKnit sueded material will launch in seating and door panel applications with a global automaker in 2024. ReNewKnit is a Lear Corporation exclusive, first-to-market automotive textile fully recyclable at its end of life. ReNewKnit will strengthen the company's sustainable solutions technology portfolio while supporting our carbon reduction goals.

- In April 2022, Toyota Boshoku developed an IoT (Internet of Things) seat cover equipped with a system that assesses the driver’s fatigue and mitigates sleepiness during driving and started a demonstration test for transport companies.

Frequently Asked Questions (FAQ):

What are the leading technologies and trends being adopted in passenger car seats?

Eco-friendly and sustainable materials, lightweight materials, connected seats, active safety features, etc., are the recent trend and technology in passenger car seats.

What are the new revenue opportunities in the passenger car seat market?

Customization and personalization seats, electric and autonomous vehicle seating, and Luxury features are the new revenue opportunities in the passenger car seat market.

What is the new material-wise opportunities in the passenger car seats market?

Bio-based materials, natural fibers, advanced composites, 3d printing and additive manufacturing, natural and vegan leather alternatives, acoustic and noise-reducing materials, smart and active materials, and lightweight materials have new opportunities in trim material market for passenger car seats.

Many companies are operating in the passenger car seat market across the globe. Do you know who the front leaders are and what strategies they have adopted?

Established seat manufacturers such as Adient Plc lead the passenger car seat market. (US), Lear Corporation (US), Faurecia (France), Toyota Boshoku Corporation (Japan), and Magna International Inc. (Canada). These companies adopted several strategies to gain traction in the market. New product development, partnership, and joint venture strategy have been the most dominating strategy adopted by major players from 2018 to 2022, which helped them to innovate on their offerings and broaden their customer base.

How does the demand for passenger cars vary by region?

The market growth in Asia Pacific countries such as China, Japan, and India can be attributed to the increasing demand for vehicles. Due to the increased vehicle production and sales, China is estimated to be the region's fastest-growing market for automotive seats. The need for powered and heated seats is expected to grow in this region, owing to the increasing demand for mid and high-end SUVs.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of powered seats in mid-segment cars and SUVsRESTRAINTS- High cost of advanced modular seats than conventional seatsOPPORTUNITIES- Growing focus on lightweight materials in passenger car seats and ridesharingCHALLENGES- Challenges faced by textile and seat trim material suppliers

-

5.3 SUPPLY CHAINPASSENGER CAR SEATS COMPONENT MANUFACTURERSPASSENGER CAR SEAT MANUFACTURERSOEMS

-

5.4 ECOSYSTEM MAPPING

-

5.5 TRENDS/DISRUPTIONS IMPACTING PASSENGER CAR SEATS MARKET

- 5.6 AVERAGE SELLING PRICE ANALYSIS OF PASSENGER CAR SEATS, BY REGION AND TYPE

- 5.7 AVERAGE SELLING PRICE ANALYSIS OF PASSENGER CAR SEATS, BY TRIM MATERIAL

- 5.8 VALUE CHAIN ANALYSIS

-

5.9 TRADE ANALYSISIMPORT DATAEXPORT DATA

-

5.10 PATENT ANALYSIS

-

5.11 CASE STUDIESCASE STUDY 1CASE STUDY 2CASE STUDY 3

- 5.12 REGULATORY LANDSCAPE

-

5.13 TECHNOLOGY OVERVIEWADIENT AI18 SEATING SOLUTION FOR RIDESHARINGGENTHERM CLIMATE CONTROL SEATS (CCS)FORD RECONFIGURABLE SEATSLEAR OFFERS POWERED AND ADAPTABLE SEATING SYSTEM (CONFIGURE+)LEAR TO OFFER PROACTIVE POSTUREADIENT COMFORTTHIN SEATADIENT PRE-ADJUST SEATLEAR CORPORATION INTU INTELLIGENT SEATING SYSTEMMERCEDES-BENZ MBUX INTERIOR ASSISTANTFORD KINETIC SEAT TECHNOLOGY

- 5.14 BUYING CRITERIA

- 5.15 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.17 RECESSION IMPACTINTRODUCTIONREGIONAL MACROECONOMIC OVERVIEWANALYSIS OF KEY ECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIESECONOMIC STAGFLATION (SLOWDOWN) VS. ECONOMIC RECESSION- Europe- Asia Pacific- AmericasECONOMIC OUTLOOK/PROJECTIONS

- 5.18 IMPACT OF RECESSION ON AUTOMOTIVE PRODUCTION

-

6.1 INTRODUCTIONINDUSTRY INSIGHTS

- 6.2 STANDARD SEATS

- 6.3 POWERED SEATS

- 6.4 HEATED AND POWERED SEATS

- 6.5 HEATED SEATS

- 6.6 POWERED, HEATED, AND MEMORY SEATS

- 6.7 POWERED, HEATED, AND VENTILATED SEATS

- 6.8 POWERED, HEATED, VENTILATED, AND MEMORY SEATS

- 6.9 POWERED, HEATED, VENTILATED, MASSAGE, AND MEMORY SEATS

-

7.1 INTRODUCTIONINDUSTRY INSIGHTS

- 7.2 BUCKET

- 7.3 SPLIT/BENCH

-

8.1 INTRODUCTIONINDUSTRY INSIGHTS

- 8.2 ARMRESTS

- 8.3 PNEUMATIC SYSTEMS

- 8.4 SEAT BELTS

- 8.5 SEAT FRAMES AND STRUCTURES

- 8.6 SEAT HEADRESTS

- 8.7 SEAT HEIGHT ADJUSTERS

- 8.8 SEAT RECLINERS

- 8.9 SEAT TRACKS

- 8.10 SIDE/CURTAIN AIRBAGS

-

9.1 INTRODUCTIONINDUSTRY INSIGHTS

- 9.2 SYNTHETIC LEATHER

- 9.3 GENUINE LEATHER

-

9.4 FABRICSPOLYESTER FLAT WOVEN FABRICSWOVEN VELOUR FABRICSPVC AND OTHER FABRICS

- 9.5 POLYURETHANE FOAM

-

10.1 INTRODUCTIONINDUSTRY INSIGHTS

- 10.2 BATTERY ELECTRIC VEHICLES (BEV)

- 10.3 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEV)

- 10.4 FUEL CELL ELECTRIC VEHICLES (FCEV)

-

11.1 INTRODUCTIONINDUSTRY INSIGHTS

-

11.2 AMERICASUS- Demand for powered seats to drive marketMEXICO- SUV segment expected to boost marketCANADA- High demand for luxury vehicles to push market growthBRAZIL- Carpooling and renting to increase salesARGENTINA- Inclination toward seating comfort features to lead marketOTHER COUNTRIES- Economic development and improving standards to drive market

-

11.3 ASIA PACIFICCHINA- High share of standard seats to boost marketINDIA- Increased demand for powered seats in SUVs and sedan cars to drive marketINDONESIA- Demand for mid and high-end SUVs to fuel marketJAPAN- Rising demand for comfort features in passenger cars to drive marketSOUTH KOREA- Rising demand for featured seats for sedans and SUVs to boost marketTHAILAND- Growing demand for powered seats for small and mid-end cars to drive marketREST OF ASIA PACIFIC- Increased vehicle production to encourage market growth

-

11.4 EUROPEFRANCE- Demand for powered and heated seats for SUVs and mid-segment cars to drive marketGERMANY- Tourist traveling and ridesharing to drive marketITALY- Increased passenger car production to drive marketRUSSIA- Growth in SUV segment to propel marketSPAIN- Rising demand for premium and mid-segment cars to boost marketTURKEY- Mid-end passenger vehicles to drive marketUK- Premium and sports cars to lead to market growthREST OF EUROPE- Standard seats to dominate market

-

11.5 MIDDLE EAST & AFRICAIRAN- Mid- and high-end passenger vehicles to boost marketSOUTH AFRICA- Increase in demand for premium cars to boost marketREST OF MIDDLE EAST & AFRICA- Demand for comfort and safety features to fuel market

- 12.1 ASIA PACIFIC TO BE KEY MARKET FOR PASSENGER CAR SEATS

- 12.2 POWERED AND COMBINATION OF POWERED AND HEATED SEATS - KEY FOCUS AREAS

- 12.3 CONCLUSION

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS

- 13.3 MARKET REVENUE ANALYSIS

-

13.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.5 COMPETITIVE SCENARIOSPRODUCT LAUNCHESDEALSEXPANSIONSOTHER DEVELOPMENTS

- 13.6 RIGHT TO WIN

-

14.1 KEY PLAYERSADIENT PLC- Business overview- Products offered- Recent developments- MnM viewFAURECIA- Business overview- Products offered- Recent developments- MnM viewLEAR CORPORATION- Business overview- Products offered- MnM viewTOYOTA BOSHOKU CORPORATION- Business overview- Products offered- Recent developments- MnM viewMAGNA INTERNATIONAL- Business overview- Products offered- Recent developments- MnM viewTS TECH- Business overview- Products offered- Recent developmentsAISIN CORPORATION- Business overview- Products offered- Recent developmentsNHK SPRING CO., LTD.- Business overview- Products offeredTACHI-S- Business overview- Products offered- Recent developmentsGENTHERM- Business overview- Products offered

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

-

15.4 CUSTOMIZATION OPTIONSPASSENGER CAR SEATS MARKET, BY VEHICLE BODY TYPE- Sedan- SUV- HatchbackPASSENGER CAR SEATS MARKET, BY SEAT MATERIAL TYPE- Aluminum- Steel- Carbon FiberDETAILED ANALYSIS AND PROFILING OF ADDITIONAL MARKET PLAYERS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

- TABLE 1 ASSUMPTIONS AND RISK ASSESSMENT

- TABLE 2 PASSENGER CAR MODELS WITH GENUINE LEATHER SEATS, 2022

- TABLE 3 AVERAGE COST OF SEATS, BY TECHNOLOGY, 2022 (USD)

- TABLE 4 PASSENGER CAR SEATS MARKET: ROLE OF COMPANIES IN SUPPLY CHAIN SYSTEM

- TABLE 5 PASSENGER CAR SEATS: AVERAGE PRICE ANALYSIS, 2022 (USD)

- TABLE 6 PASSENGER CAR SEATS, BY TRIM MATERIAL: AVERAGE PRICE ANALYSIS, 2022 (USD/ METER)

- TABLE 7 US: IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 8 FRANCE: IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 9 GERMANY: IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 10 MEXICO: IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 11 BELGIUM: IMPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 12 GERMANY: EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 13 POLAND: EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 14 CZECH REPUBLIC: EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 15 CHINA: EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 16 MEXICO: EXPORT SHARE, BY COUNTRY (VALUE %)

- TABLE 17 INNOVATION AND PATENT REGISTRATIONS, 2020−2022

- TABLE 18 SAFETY REGULATIONS, BY COUNTRY/REGION

- TABLE 19 KEY BUYING CRITERIA FOR DIFFERENT PASSENGER CAR SEATS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 21 PASSENGER CAR SEATS MARKET: KEY CONFERENCES AND EVENTS

- TABLE 22 KEY ECONOMIC INDICATORS FOR SELECT COUNTRIES, 2021–2022

- TABLE 23 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2018–2026 (USD BILLION)

- TABLE 24 EUROPE: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 25 ASIA PACIFIC KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 26 AMERICAS: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 27 GDP GROWTH PROJECTIONS FOR KEY COUNTRIES, 2024–2027 (% GROWTH)

- TABLE 28 MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 29 PASSENGER CAR SEATS MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 30 STANDARD SEATS MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 31 STANDARD SEATS MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 32 SELECT MODELS WITH POWERED SEATS, 2022

- TABLE 33 POWERED SEATS MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 34 POWERED SEATS MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 35 SELECT MODELS WITH HEATED AND POWERED SEATS, 2022

- TABLE 36 HEATED AND POWERED SEATS MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 37 HEATED AND POWERED SEATS MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 38 SELECT MODELS WITH HEATED SEATS, 2022

- TABLE 39 HEATED SEATS MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 40 HEATED SEATS MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 41 SELECT MODELS WITH POWERED, HEATED, AND MEMORY SEATS, 2022

- TABLE 42 POWERED, HEATED, AND MEMORY SEATS MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 43 POWERED, HEATED, AND MEMORY SEATS MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 44 SELECT MODELS WITH POWERED, HEATED, AND VENTILATED SEATS, 2022

- TABLE 45 POWERED, HEATED, AND VENTILATED SEATS MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 46 POWERED, HEATED, AND VENTILATED SEATS MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 47 SELECT MODELS WITH POWERED, HEATED, VENTILATED, AND MEMORY SEATS, 2022

- TABLE 48 POWERED, HEATED, VENTILATED, AND MEMORY SEATS MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 49 POWERED, HEATED, VENTILATED, AND MEMORY SEATS MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 50 SELECT MODELS WITH POWERED, HEATED, VENTILATED, MASSAGE, AND MEMORY SEATS, 2022

- TABLE 51 POWERED, HEATED, VENTILATED, MASSAGE, AND MEMORY SEATS MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 52 POWERED, HEATED, VENTILATED, MASSAGE, AND MEMORY SEATS MARKET, BY REGION, 2023–2030 (‘000 UNITS)

- TABLE 53 PASSENGER CAR SEATS MARKET, BY SEAT TYPE, 2018–2022 (MILLION UNITS)

- TABLE 54 MARKET, BY SEAT TYPE, 2023–2030 (MILLION UNITS)

- TABLE 55 MARKET, BY SEAT TYPE, 2018–2022 (USD BILLION)

- TABLE 56 MARKET, BY SEAT TYPE, 2023–2030 (USD BILLION)

- TABLE 57 SAFETY REGULATION FOR BUCKET SEATS

- TABLE 58 SELECT MODELS WITH BUCKET SEATS, 2022

- TABLE 59 BUCKET SEATS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 60 BUCKET SEATS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 61 BUCKET SEATS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 62 BUCKET SEATS MARKET, BY REGION, 2023–2030 (USD BILLION)

- TABLE 63 SAFETY REGULATIONS FOR REAR SEATS IN PASSENGER CAR

- TABLE 64 SELECT MODELS WITH SPLIT/BENCH SEATS, 2022

- TABLE 65 SPLIT/BENCH SEATS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 66 SPLIT/BENCH SEATS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 67 SPLIT/BENCH SEATS MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 68 SPLIT/BENCH SEATS MARKET, BY REGION, 2023–2030 (USD BILLION)

- TABLE 69 PASSENGER CAR SEATS MARKET, BY COMPONENT, 2018-2022 (MILLION UNITS)

- TABLE 70 MARKET, BY COMPONENT, 2023–2030 (MILLION UNITS)

- TABLE 71 MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 72 MARKET, BY COMPONENT, 2023–2030 (USD MILLION)

- TABLE 73 MODELS WITH ARMRESTS, 2022

- TABLE 74 ARMRESTS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 75 ARMRESTS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 76 ARMRESTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 77 ARMRESTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 78 PNEUMATIC SYSTEMS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 79 PNEUMATIC SYSTEMS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 80 PNEUMATIC SYSTEMS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 81 PNEUMATIC SYSTEMS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 82 SEAT BELTS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 83 SEAT BELTS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 84 SEAT BELTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 85 SEAT BELTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 86 SEAT FRAMES AND STRUCTURES MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 87 SEAT FRAMES AND STRUCTURES MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 88 SEAT FRAMES AND STRUCTURES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 89 SEAT FRAMES AND STRUCTURES MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 90 SEAT HEADRESTS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 91 SEAT HEADRESTS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 92 SEAT HEADRESTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 93 SEAT HEADRESTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 94 SEAT HEIGHT ADJUSTERS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 95 SEAT HEIGHT ADJUSTERS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 96 SEAT HEIGHT ADJUSTERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 97 SEAT HEIGHT ADJUSTERS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 98 SEAT RECLINERS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 99 SEAT RECLINERS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 100 SEAT RECLINERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 101 SEAT RECLINERS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 102 SEAT TRACKS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 103 SEAT TRACKS MARKET, BY REGION, 2023–2030 (MILLION UNITS)

- TABLE 104 SEAT TRACKS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 105 SEAT TRACKS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 106 SIDE/CURTAIN AIRBAGS MARKET, BY REGION, 2018–2022 (MILLION UNITS)

- TABLE 107 SIDE/CURTAIN AIRBAGS MARKET, BY REGION, 2022–2030 (MILLION UNITS)

- TABLE 108 SIDE/CURTAIN AIRBAGS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 109 SIDE/CURTAIN AIRBAGS MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 110 PASSENGER CAR SEATS MARKET, BY TRIM MATERIAL, 2018–2022 (‘000 SQUARE METERS)

- TABLE 111 MARKET, BY TRIM MATERIAL, 2023–2030 (‘000 SQUARE METERS)

- TABLE 112 MARKET, BY TRIM MATERIAL, 2018–2022 (USD MILLION)

- TABLE 113 MARKET, BY TRIM MATERIAL 2023–2030 (USD MILLION)

- TABLE 114 MODELS WITH SYNTHETIC LEATHER SEATS, 2022

- TABLE 115 SYNTHETIC LEATHER SEATS MARKET, BY REGION, 2018–2022 (‘000 SQUARE METERS)

- TABLE 116 SYNTHETIC LEATHER SEATS MARKET, BY REGION, 2023–2030 (‘000 SQUARE METERS)

- TABLE 117 SYNTHETIC LEATHER SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 118 SYNTHETIC LEATHER SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 119 MODELS WITH GENUINE LEATHER SEATS, 2022

- TABLE 120 GENUINE LEATHER SEATS MARKET, BY REGION, 2018–2022 (‘000 SQUARE METERS)

- TABLE 121 GENUINE LEATHER SEATS MARKET, BY REGION, 2023–2030 (‘000 SQUARE METERS)

- TABLE 122 GENUINE LEATHER SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 123 GENUINE LEATHER SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 124 MODELS WITH FABRIC SEATS, 2022

- TABLE 125 FABRIC SEATS MARKET, BY REGION, 2018–2022 (‘000 SQUARE METERS)

- TABLE 126 FABRIC SEATS MARKET, BY REGION, 2023–2030 (‘000 SQUARE METERS)

- TABLE 127 FABRIC SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 128 FABRIC SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 129 POLYESTER FLAT WOVEN FABRIC SEATS MARKET, BY REGION, 2018–2022 (‘000 SQUARE METERS)

- TABLE 130 POLYESTER FLAT WOVEN FABRIC SEATS MARKET, BY REGION, 2023–2030 (‘000 SQUARE METERS)

- TABLE 131 POLYESTER FLAT WOVEN FABRIC SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 132 POLYESTER FLAT WOVEN FABRIC SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 133 WOVEN VELOUR FABRIC SEATS MARKET, BY REGION, 2018–2022 (‘000 SQUARE METERS)

- TABLE 134 WOVEN VELOUR FABRIC SEATS MARKET, BY REGION, 2023–2030 (‘000 SQUARE METERS)

- TABLE 135 WOVEN VELOUR FABRIC SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 136 WOVEN VELOUR FABRIC SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 137 PVC AND OTHER FABRIC SEATS MARKET, BY REGION, 2018–2022 (‘000 SQUARE METERS)

- TABLE 138 PVC AND OTHER FABRIC SEATS MARKET, BY REGION, 2023–2030 (‘000 SQUARE METERS)

- TABLE 139 PVC AND OTHER FABRIC SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 140 PVC AND OTHER FABRIC SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 141 POLYURETHANE FOAM SEATS MARKET, BY REGION, 2018–2022 (‘000 KGS)

- TABLE 142 POLYURETHANE FOAM SEATS MARKET, BY REGION, 2023–2030 (‘000 KGS)

- TABLE 143 POLYURETHANE FOAM SEATS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 144 POLYURETHANE FOAM SEATS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 145 ELECTRIC PASSENGER CAR SEATS MARKET, BY PROPULSION TYPE, 2018–2022 (‘000 UNITS)

- TABLE 146 ELECTRIC MARKET, BY PROPULSION TYPE, 2023–2030 (‘000 UNITS)

- TABLE 147 BEV SEATS MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 148 BEV SEATS MARKET, BY TECHNOLOGY, 2022–2030 (‘000 UNITS)

- TABLE 149 PHEV SEATS MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 150 PHEV SEATS MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 151 FCEV SEATS MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 152 FCEV SEATS MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 153 MARKET, BY REGION, 2018–2022 (‘000 UNITS)

- TABLE 154 MARKET, BY REGION, 2022–2030 (‘000 UNITS)

- TABLE 155 AMERICAS: MARKET, BY COUNTRY, 2018–2022 (‘000 UNITS)

- TABLE 156 AMERICAS: MARKET, BY COUNTRY, 2023–2030 (‘000 UNITS)

- TABLE 157 US: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 158 US: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 159 US: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 160 MEXICO: MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 161 MEXICO: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 162 MEXICO: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 163 CANADA: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 164 CANADA: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 165 CANADA: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNIT)

- TABLE 166 BRAZIL: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 167 BRAZIL: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 168 BRAZIL: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 169 ARGENTINA: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 170 ARGENTINA: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 171 ARGENTINA: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 172 OTHER COUNTRIES: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 173 OTHER COUNTRIES: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 174 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (‘000 UNITS)

- TABLE 175 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2030 (‘000 UNITS)

- TABLE 176 CHINA: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 177 CHINA: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 178 CHINA: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 179 INDIA: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 180 INDIA: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 181 INDIA: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 182 INDONESIA: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 183 INDONESIA: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 184 JAPAN: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 185 JAPAN: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 186 JAPAN: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 187 SOUTH KOREA: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 188 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 189 SOUTH KOREA: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 190 THAILAND: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 191 THAILAND: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 192 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 193 REST OF ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 194 EUROPE: MARKET, BY COUNTRY, 2018–2022 (‘000 UNITS)

- TABLE 195 EUROPE: MARKET, BY COUNTRY, 2022–2030 (‘000 UNITS)

- TABLE 196 FRANCE: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 197 FRANCE: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 198 FRANCE: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 199 GERMANY: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 200 GERMANY: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 201 GERMANY: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 202 ITALY: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 203 ITALY: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 204 ITALY: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 205 RUSSIA: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 206 RUSSIA: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 207 RUSSIA: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 208 SPAIN: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 209 SPAIN: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 210 SPAIN: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 211 TURKEY: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 212 TURKEY: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 213 UK: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 214 UK: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 215 UK: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 216 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNIT)

- TABLE 217 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNIT)

- TABLE 218 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (‘000 UNITS)

- TABLE 219 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2030 (‘000 UNITS)

- TABLE 220 IRAN: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 221 IRAN: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 222 IRAN: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 223 SOUTH AFRICA: PASSENGER CAR MODELS WITH ADVANCED SEATING TECHNOLOGY, 2022

- TABLE 224 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 225 SOUTH AFRICA: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 226 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2018–2022 (‘000 UNITS)

- TABLE 227 REST OF MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2023–2030 (‘000 UNITS)

- TABLE 228 KEY PLAYER STRATEGIES

- TABLE 229 PASSENGER CAR SEARS MARKET: PRODUCT LAUNCHES, APRIL 2022–APRIL 2023

- TABLE 230 MARKET: DEALS, FEBRUARY 2022–APRIL 2023

- TABLE 231 MARKET: EXPANSIONS, 2022–2023

- TABLE 232 MARKET: OTHER DEVELOPMENTS, FEBRUARY 2022

- TABLE 233 RIGHT TO WIN, 2022–2023

- TABLE 234 ADIENT PLC: COMPANY OVERVIEW

- TABLE 235 ADIENT PLC: PRODUCTS OFFERED

- TABLE 236 ADIENT PLC: PRODUCT DEVELOPMENTS

- TABLE 237 ADIENT PLC: DEALS

- TABLE 238 ADIENT PLC: OTHER DEVELOPMENTS

- TABLE 239 FAURECIA: COMPANY OVERVIEW

- TABLE 240 FAURECIA: PRODUCTS OFFERED

- TABLE 241 FAURECIA: PRODUCT DEVELOPMENTS

- TABLE 242 FAURECIA: DEALS

- TABLE 243 FAURECIA: OTHER DEVELOPMENTS

- TABLE 244 LEAR: COMPANY OVERVIEW

- TABLE 245 LEAR CORPORATION: PRODUCTS OFFERED

- TABLE 246 LEAR CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 247 LEAR CORPORATION: DEALS

- TABLE 248 LEAR CORPORATION: OTHER DEVELOPMENTS

- TABLE 249 TOYOTA BOSHOKU CORPORATION: COMPANY OVERVIEW

- TABLE 250 TOYOTA BOSHOKU CORPORATION: PRODUCTS OFFERED

- TABLE 251 TOYOTA BOSHOKU CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 252 TOYOTA BOSHOKU CORPORATION: DEALS

- TABLE 253 TOYOTA BOSHOKU CORPORATION: OTHER DEVELOPMENTS

- TABLE 254 MAGNA INTERNATIONAL: COMPANY OVERVIEW

- TABLE 255 MAGNA INTERNATIONAL: PRODUCTS OFFERED

- TABLE 256 MAGNA INTERNATIONAL: PRODUCT DEVELOPMENTS

- TABLE 257 MAGNA INTERNATIONAL: DEALS

- TABLE 258 MAGNA INTERNATIONAL: OTHER DEVELOPMENTS

- TABLE 259 TS TECH: COMPANY OVERVIEW

- TABLE 260 TS TECH: PRODUCTS OFFERED

- TABLE 261 TS TECH: PRODUCT DEVELOPMENTS

- TABLE 262 TS TECH: OTHER DEVELOPMENTS

- TABLE 263 AISIN CORPORATION: COMPANY OVERVIEW

- TABLE 264 AISIN CORPORATION: PRODUCTS OFFERED

- TABLE 265 AISIN CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 266 NHK SPRING CO., LTD.: COMPANY OVERVIEW

- TABLE 267 NHK SPRING CO., LTD.: PRODUCTS OFFERED

- TABLE 268 NHK SPRINGS CO., LTD.: OTHER DEVELOPMENTS

- TABLE 269 TACHI-S: COMPANY OVERVIEW

- TABLE 270 TACHI-S: PRODUCTS OFFERED

- TABLE 271 TACHI-S: DEALS

- TABLE 272 TACHI-S: OTHER DEVELOPMENTS

- TABLE 273 GENTHERM: COMPANY OVERVIEW

- TABLE 274 PRODUCTS OFFERED

- FIGURE 1 MARKET SEGMENTATION: PASSENGER CAR SEATS MARKET

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH METHODOLOGY MODEL

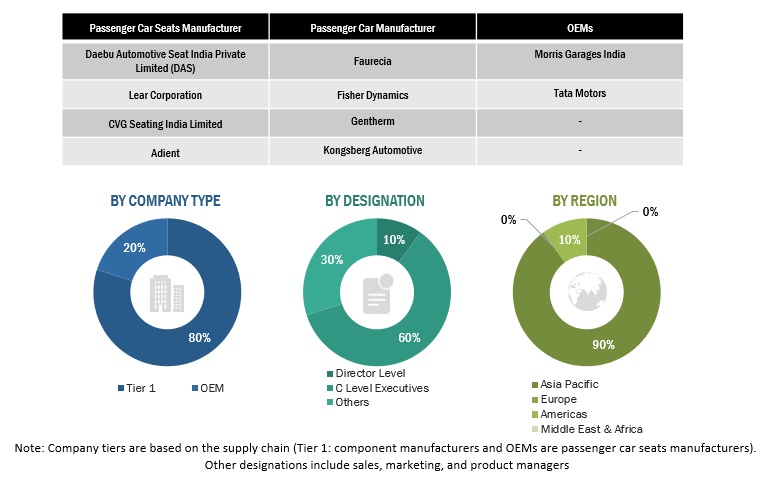

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 BOTTOM-UP APPROACH: MARKET, BY TECHNOLOGY TYPE

- FIGURE 6 TOP-DOWN APPROACH: MARKET, BY COMPONENT

- FIGURE 7 TOP-DOWN APPROACH: MARKET, BY TRIM MATERIAL

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 MARKET, BY REGION, 2023 VS. 2030 (USD MILLION)

- FIGURE 10 CUSTOMER INCLINATION TOWARD COMFORT AND LUXURY FEATURES TO DRIVE MARKET

- FIGURE 11 BUCKET SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2023 (USD MILLION)

- FIGURE 12 SYNTHETIC LEATHER SEGMENT LED MARKET 2023 (USD MILLION)

- FIGURE 13 STANDARD SEGMENT TO HAVE HIGHER MARKET SHARE DURING FORECAST PERIOD (‘000 UNITS)

- FIGURE 14 SIDE/CURTAIN AIRBAGS SEGMENT TO HAVE HIGHEST GROWTH DURING FORECAST PERIOD (USD MILLION)

- FIGURE 15 BEV SEGMENT TO LEAD MARKET DURING FORECAST PERIOD (‘000 UNIT)

- FIGURE 16 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2023

- FIGURE 17 MARKET: DRIVER, CHALLENGES, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 GLOBAL PREMIUM PASSENGER CAR PRODUCTION, 2018–2022 (MILLION UNITS)

- FIGURE 19 NEW REGISTRATIONS OF SUVS, BY KEY COUNTRY, 2018–2022 (MILLION UNITS)

- FIGURE 20 MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 21 MARKET ECOSYSTEM

- FIGURE 22 AUTONOMOUS CAR AND RIDESHARING PRESENT NEW REVENUE SHIFT FOR PASSENGER CAR SEAT MANUFACTURERS

- FIGURE 23 VALUE CHAIN ANALYSIS: AUTOMOTIVE SEATS MARKET

- FIGURE 24 KEY BUYING CRITERIA FOR AUTOMOTIVE SEATS

- FIGURE 25 MARKET, BY TECHNOLOGY, 2023 VS. 2030 (‘000 UNITS)

- FIGURE 26 MARKET, BY SEAT TYPE, 2023 VS. 2030 (USD MILLION)

- FIGURE 27 MARKET, BY COMPONENT, 2023 VS. 2030 (USD MILLION)

- FIGURE 28 MARKET, BY TRIM MATERIAL, 2023 VS. 2030 (USD MILLION)

- FIGURE 29 ELECTRIC MARKET, BY PROPULSION TYPE, 2023 VS. 2030 (‘000 UNITS)

- FIGURE 30 MARKET, BY REGION, 2023 VS. 2030 (‘000 UNITS)

- FIGURE 31 AMERICAS: AUTOMOTIVE SEATS MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 33 MARKET SHARE ANALYSIS, 2021–2022

- FIGURE 34 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2020 VS. 2022

- FIGURE 35 COMPETITIVE EVALUATION MATRIX, 2022

- FIGURE 36 ADIENT PLC: COMPANY SNAPSHOT

- FIGURE 37 FAURECIA: COMPANY SNAPSHOT

- FIGURE 38 LEAR CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 TOYOTA BOSHOKU CORPORATION: COMPANY SNAPSHOT

- FIGURE 40 MAGNA INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 41 TS TECH: COMPANY SNAPSHOT

- FIGURE 42 AISIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 43 NHK SPRING CO., LTD.: COMPANY SNAPSHOT

- FIGURE 44 TACHI-S: COMPANY SNAPSHOT

- FIGURE 45 GENTHERM: COMPANY SNAPSHOT

The research study involved various secondary sources, such as company annual reports/presentations, industry association publications, passenger car seats magazine articles, directories, technical handbooks, world economic outlook, trade websites, technical articles, and databases, which were used to identify and collect information for an extensive study of the passenger car seat market. Primary sources—experts from related industries, automobile OEMs, and suppliers—were interviewed to obtain and verify critical information and assess prospects and market estimations.

Secondary Research

Secondary sources referred to in this research study include automotive industry organizations such as the Organization Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive seats associations. The secondary data was collected and analysed to arrive at the overall market size, which was further validated by primary research.

Primary Research

Extensive primary research was conducted after obtaining an understanding of the passenger car seat market scenario through secondary research. Approximately 70% of the primary interviews were conducted from the passenger car seats providers and component/system providers, and 30% from the end users across Americas, Europe, and Asia Pacific. The primary data was collected through questionnaires, emails, and telephonic interviews. Various departments within organizations, including sales, operations, and administrations, were contacted to provide a holistic viewpoint in the report while canvassing primaries.

After interacting with industry participants, some brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the opinions of in-house subject matter experts, led to the findings delineated in the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

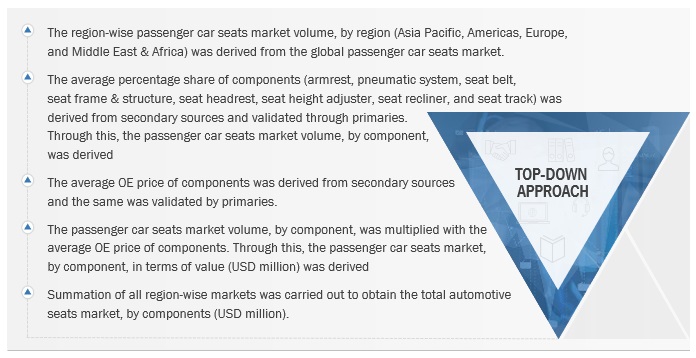

The bottom-up approach was used to estimate and validate the market size in terms of volume, for passenger car seats, by technology, where the country-level production numbers of the passenger car were multiplied by the country-level penetration of each seat technology (derived from model mapping) to obtain the country-level seat market, by passenger car and technology, in terms of volume. The country-level passenger car seat market size, by technology in terms of volume, was added to derive the regional and further, the global market, by technology (powered; standard; heated & powered; powered, heated, & memory; powered, heated, & ventilated; powered, heated, ventilated, & memory; and powered, heated, ventilated, memory, & massage) in terms of volume. And the similar approach was followed to derive the market, by seat type (bucket type and split seat type) and by region (Asia Pacific, Europe, Americas, and Middle East and Africa).

passenger car seat Market: Bottom-Up Approach

passenger car seat Market: Top-Down Approach

While estimating the regional market size for passenger car seats, by component, the regional share of armrests, pneumatic systems, seat belts, seat frames & structures, seat headrests, seat height adjusters, seat recliners, seat tracks, and side/curtain airbags were identified and multiplied with the regional market size, in terms of volume. The regional market size, in terms of volume, was then multiplied with the regional-level average OE price (AOP) of components. This resulted in the regional market size of the passenger car market, by component, in terms of value.

Top-Down Approach

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by the primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analysed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Market Definition

A passenger car seat is a component that provides support and a comfortable seating posture to the driver and co-passengers while maintaining their safety. The seat structure consists of several components, including the armrest, pneumatic system, seat belt, seat frame & structure, seat headrest, seat height adjuster, seat recliner, and seat track. Its main function is to provide occupant support, occupant position, and occupant safety.

Stakeholders

- Automotive Original Equipment Manufacturers (OEMs)

- Manufacturers of Automotive Seat Systems

- Component Suppliers for Automotive Seat Systems

- Raw Material Suppliers of Automotive Seats and Components

- Raw Material Suppliers of Automotive Seat Fabrics/Trims

- Regional Manufacturer Associations and Automobile Associations

- Traders, Distributors, and Suppliers of Automotive Seat Systems

- Automotive Industry as an End-use Industry and Regional Automobile Associations

Report Objectives

-

To define, describe, and forecast the size of the global passenger car seat market in terms of value (USD million) and volume (million units)

- By technology (heated; powered; standard; powered & heated; powered, heated, & memory; powered, heated, & ventilated; powered, heated, ventilated, & memory; and powered, heated, ventilated, memory, & massage) at the country and regional level

- By seat type (bucket and bench/split bench) at the regional level

- By trim material (fabric, genuine leather, and synthetic leather), at the regional level.

- By component (armrest, pneumatic system, seat belt, seat frame & structure, seat headrest, seat height adjuster, seat recliner, seat track, and side/curtain airbag) at the regional level

- Electric passenger car seat market, by propulsion type (battery electric vehicle, fuel cell electric vehicle and plug-in hybrid electric vehicle) at the regional level

- By region (Asia Pacific, Europe, Americas, and Middle East and Africa)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market.

- To analyze the competitive landscape of the global players in the market, along with their market share/ranking.

- To analyze the competitive leadership mapping of the global passenger cars seats manufacturers and passenger car seats component suppliers in the market.

- To analyze recent developments, including expansions and new product launches, undertaken by key industry participants in the market

- To strategically analyze the market with trade analysis, case studies, patent analysis, supply chain analysis, market ecosystem, pricing analysis, and the recession impact.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.A

The following customization options are available for the report:

Passenger Car Seat Market, By Vehicle Body Type

- Sedan

- Hatchback

- SUVs

Passenger Car Seat Market, By Seat Material Type

- Aluminum

- Steel

- Carbon Fiber

Detailed Analysis And Profiling Of Additional Market Players

Growth opportunities and latent adjacency in Passenger Car Seat Market