Parkinson's Disease Treatment Market by Drug Class (Carbidopa/Levodopa, Dopamine Receptor Agonists, MAO-Inhibitors), Distribution Channel (Hospital, Online, Retail Pharmacies), Patient Care Setting (Hospitals, Clinics) - Global Forecast to 2022

[113 Pages Report] The Parkinson’s disease treatment market was valued at USD 3.99 billion in 2016 and expected to grow at a CAGR of 6.1% from 2017 to 2022 to reach USD 5.69 billion in 2022. The carbidopa/levodopa drug class is projected to register highest CAGR during forecast period. The major driving factors for this market include ageing population and government funding for research, growing healthcare awareness. The base year considered for the study is 2016, and the forecast has been provided for the period between 2018 and 2023.

Market Dynamics

Drivers

- Growth in ageing population and the associated increase in the prevalence of parkinson’s disease

- Government funding for research

Restraint

- Availability of alternative treatments

Opportunities

- Patent expiry of branded drugs

- Strong pipeline

The objectives of this study are as follows:

- To define, describe, and forecast the global Parkinson’s disease therapeutic drugs market by drug class, distribution channel, treatment facility, and region

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions, namely, North America, Europe, Asia, and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as product launches, agreements, expansions, acquisitions, and other developments in the global Parkinson’s disease therapeutic drugs market

Research Methodology

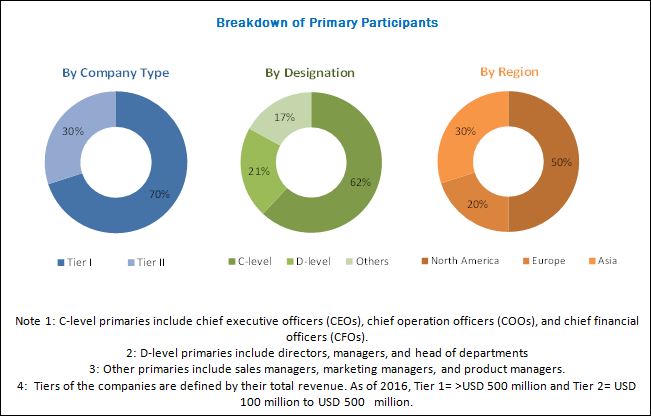

Top-down and bottom-up approaches were used to estimate and validate the size of the global Parkinson’s disease treatment market and to estimate the size of various other dependent submarkets. The overall market size was used in the top-down approach to estimate the sizes of other individual markets (mentioned in the market segmentation-by drug class, distribution channel, patient care setting, and region) through percentage splits from secondary and primary research. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the market segment revenues obtained. Various secondary sources referred to for this research study include publications from government sources such as the white papers; articles from recognized authors; gold standard and silver standard websites, directories, and databases; corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; research journals; press releases; and trade, business, and professional associations have been used to identify and collect information useful for this extensive commercial study of the Parkinson’s disease treatment market. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Key players operating in the Parkinson’s disease treatment market include Teva (Israel), Novartis AG (Switzerland), GSK (UK), AbbVie (US), Merck (US), Boehringer Ingelheim (Germany), Impax Laboratories (US), Lundbeck (Denmark), UCB (Belgium), Valeant Pharmaceuticals (Canada), Acadia (US), Sun Pharma (India), Wockhardt (India), Dr. Reddy’s (India), Intas (India), US WorldMeds (US), Zydus Cadila (India), Cipla (India), Strides (India), 1 A Pharma (India), and Upsher-Smith (US).

Major Market Developments

- In 2016, ACADIA Pharmaceuticals, Inc. (U.S.) received FDA approval for its NUPLAZID drug

- In 2016, Sun Pharmaceutical Industries Ltd. (India) entered distribution agreement with Mitsubishi Tanabe Pharma Corporation (Japan) to distribute 14 prescription brands that include Parkinson’s disease drug Parlodel in Japan

Critical questions the report answers:

- How the market developments of key players impact the overall industry?

- What are the restraining factors for this market?

Currently, a wide range of treatments is available for alleviating the symptoms of Parkinson’s disease. Medication is the first line therapy for treating the disease; however, they are not effective in all stages of the disease. In the severe stages, medications do not show pharmacological action in relieving disease symptoms. Neurologists perform thalamotomy, pallidotomy, or implant deep brain stimulation (DBS) devices in order to ease symptoms.

Moreover, the focus on gene therapy research has increased. According to the Parkinson's Disease Clinic and Research Center, University of California, US, gene therapy for Parkinson’s disease has shown promising results in phase I studies. Phase II and III studies are currently under progress. Surgical treatments, restriction on the use of medications in severe stages of the disease, and the increased focus on gene therapy research are expected to restrain the demand for therapeutic drugs used in Parkinson’s disease.

Target Audience for this Report:

- Parkinson’s disease treatment product manufacturers

- Parkinson’s disease treatment dealers and suppliers

- Human identification service providers

- Parkinson’s disease associations

- Academic institutions

- Venture capitalists

- Consulting firms

- Government bodies

Value Addition for the Buyer:

This report aims to provide insights into the global Parkinson’s disease treatment market. It provides valuable information on the market classification by drug class, distribution channels, and patient care setting. Details on regional markets for these segments have also been presented in this report. In addition, leading players in the market are profiled to understand the strategies undertaken by them to be competitive in this market.

Scope of the Report:

This report categorizes the market into the following segments:

By Drug Class

- Levodopa/carbidopa

- Dopamine Receptor Agonists

- MAO-Inhibitors

- COMT-inhibitors

- Anticholinergics

- Other Drugs

By Distribution Channel

- Hospital Pharmacies

- Retailer Pharmacies

- Online Pharmacies

By Patient Care Setting

- Hospitals

- Clinics

By Region

-

North America

- US

- Canada

- Europe

-

Asia

- China

- Japan

- Rest of Asia (RoA)

- Rest of the World (RoW)

Customization Options:

- Company Information: Detailed company profiles of five or more market players

- Opportunities Assessment: A detailed report underlining the various growth opportunities presented in the market

Parkinson’s disease treatment is used to treat the symptoms of Parkinson’s disease, generally, medication is the first line treatment for this disease. The global Parkinson’s disease treatment market is expected to reach USD 5.69 billion by 2022 from USD 4.24 billion in 2017, at a CAGR of 6.1%. Rising geriatric population and government funding for research on Parkinson’s disease are the driving factors for this market.

The Parkinson’s disease treatment market is segmented on the basis of drug class, distribution channel, patient care setting, and region. On the basis of drug class, the market is segmented into carbidopa/levodopa, dopamine receptor agonists, MAO-inhibitors, COMT-inhibitors, anticholinergics and other drugs. The carbidopa/levodopa segment is expected to account for the largest share of the market in 2017. The growth in this segment is primarily attributed to the potency of the drug.

By distribution channel, the market is segmented into hospital pharmacies, retailer pharmacies, and online pharmacies. In 2017, the hospital pharmacies segment accounted for the largest share of the market. Increasing number of patient visits to the hospital due to the availability of diagnostic laboratories and presence of skilled neurologists are driving the growth of hospital pharmacies segment.

On the basis of patient care setting, the Parkinson’s disease treatment market is segmented into hospitals and clinics. In 2017, hospitals are expected to account for the largest share of the market. Robust health infrastructure and presence of skilled neurologists are the driving factors for hospital segment.

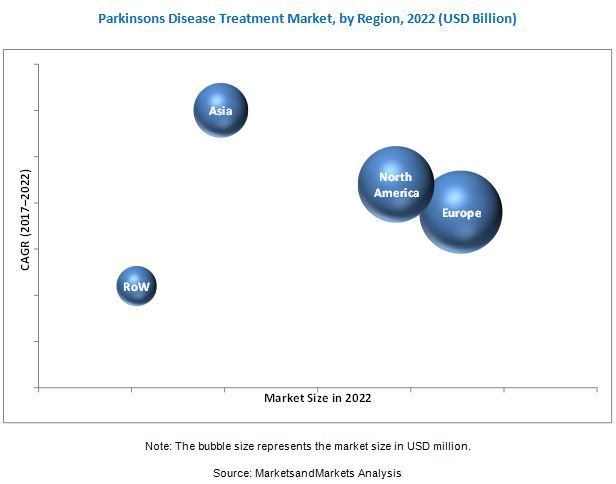

By region, the Parkinson’s disease treatment market is segmented into North America, Europe, Asia, and the Rest of the World (RoW). The market is dominated by Europe, followed by North America, however, the Asian region is expected to witness the highest growth during the forecast period. Asia is expected to witness the highest CAGR, with the growth in this market centered at Japan, China, and India. The increasing number of generic drug manufacturers and rising aging populaion across are key factors driving the market in Asia. However, availability of alternative treatments is going to restrain this market.

Presence of skilled professional in the hospital care setting drives the grwoth of parkinsons disease treatment market

Hospital

Hospitals segment is estimated to account for the largest share of the Parkinson’s disease treatment market in 2017. This segment includes large, medium-sized, and small hospitals as well as critical care centers. Growth in this market can largely be attributed to the patient visits to hospitals are very high owing to the availability of diagnostic laboratories for diagnosing diseases; and presence of skilled professionals.

Clinics

Clinics, also known as outpatient clinics or ambulatory care clinics, are healthcare facilities where outpatients are treated. In comparison with hospitals, clinics are expected to hold a smaller share of the overall market in the coming years mainly due to the shortage of neurologists in these facilities. In addition, most clinics do not have in-house diagnostic laboratories, owing to which most patients prefer hospitals.

Teva (Israel), AbbVie (US), Boehringer Ingelheim (Germany) Lundbeck (Denmark), Acadia (US), Sun Pharma (India), US WorldMeds (US), Dr. Reddy’s (India), are the top players in this market. These companies have a broad product portfolio with comprehensive features and a strong geographical presence.

Frequently Asked Questions (FAQ):

Which is the leading drug class in the Parkinson’s disease treatment market?

Which one is the leading distribution channel for Parkinson’s disease treatment market?

Who are the key players operating in the Parkinson’s disease treatment market?

Who is the leading patient care setting in the Parkinson’s disease treatment market?

Which geographical region is dominating in Parkinson’s disease treatment Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Parkinson's Disease Treatment Market: Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Markets Covered

1.2.2 Years Considered for the Study

1.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Parkinson's Disease Treatment Market: Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Parkinson's Disease Treatment Market: Executive Summary (Page No. - 23)

4 Parkinson's Disease Treatment Market: Premium Insights (Page No. - 27)

4.1 Parkinson’s Disease Treatment Market Overview

4.2 Geographic Analysis: Market, By Drug Class

4.3 Geographic Analysis of the Market, By Country

4.4 Geographic Analysis of the Market

5 Parkinson's Disease Treatment Market: Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in Aging Population and the Associated Increase in the Prevalence of Parkinson’s Disease

5.2.1.2 Government Funding for Research

5.2.2 Restraints

5.2.2.1 Availability of Alternative Treatments

5.2.3 Opportunities

5.2.3.1 Patent Expiry of Branded Drugs

5.2.3.2 Strong Drug Pipeline

6 Parkinson’s Disease Treatment Market, By Drug Class (Page No. - 36)

6.1 Introduction

6.2 Carbidopa/Levodopa

6.3 Dopamine Receptor Agonists

6.4 Mao Inhibitors

6.5 Comt Inhibitors

6.6 Anticholinergics

6.7 Other Drugs

7 Parkinson’s Disease Treatment Market, By Distribution Channel (Page No. - 47)

7.1 Introduction

7.2 Hospital Pharmacies

7.3 Retailer Pharmacies

7.4 Online Pharmacies

8 Parkinson’s Disease Treatment Market, By Patient Care Setting (Page No. - 52)

8.1 Introduction

8.2 Hospitals

8.3 Clinics

9 Parkinson’s Disease Treatment Market, By Region (Page No. - 57)

9.1 Introduction

9.2 Europe

9.3 North America

9.3.1 U.S.

9.3.2 Canada

9.4 Asia

9.4.1 Japan

9.4.2 China

9.4.3 Rest of Asia

9.5 Rest of the World

10 Company Profiles (Page No. - 77)

(Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, Recent Developments)*

10.1 GSK

10.2 Merck

10.3 Novartis

10.4 Teva

10.5 Boehringer Ingelheim

10.6 Impax

10.7 Abbvie

10.8 Valeant Pharmaceuticals

10.9 Lundbeck

10.10 Sun Pharma

10.11 Wockhardt

10.12 Acadia

10.13 UCB

*Details on Marketsandmarkets View, Overview, Products Offered, Product Offering Scorecard, Business Strategy Scorecard, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 105)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Introducing RT: Real-Time Market Intelligence

11.5 Available Customizations

11.6 Related Reports

11.7 Author Details

List of Tables (66 Tables)

Table 1 Global Parkinson’s Disease Treatment Market Summary

Table 2 Ageing Population, By Region, 2015 vs 2030

Table 3 Market: List of Pipeline Drugs

Table 4 Market, By Drug Class, 2016–2022 (USD Million)

Table 5 Carbidopa/Levodopa Market, By Region, 2015–2022 (USD Million)

Table 6 North America: Carbidopa/Levodopa Market, By Country, 2015–2022 (USD Million)

Table 7 Asia: Carbidopa/Levodopa Market, By Country, 2015–2022 (USD Million)

Table 8 Dopamine Receptor Agonists Market, By Region, 2015–2022 (USD Million)

Table 9 North America: Dopamine Receptor Agonists Market, By Country, 2015–2022 (USD Million)

Table 10 Asia: Dopamine Receptor Agonists Market, By Country, 2015–2022 (USD Million)

Table 11 Mao Inhibitors Market, By Region, 2015–2022 (USD Million)

Table 12 North America: Mao Inhibitors Market, By Country, 2015–2022 (USD Million)

Table 13 Asia: Mao Inhibitors Market, By Country, 2015–2022 (USD Million)

Table 14 Comt Inhibitors Market, By Region, 2015–2022 (USD Million)

Table 15 North America: Comt Inhibitors Market, By Country, 2015–2022 (USD Million)

Table 16 Asia: Comt Inhibitors Market, By Country, 2015–2022 (USD Million)

Table 17 Anticholinergics Market, By Region, 2015–2022 (USD Million)

Table 18 North America: Anticholinergics Market, By Country, 2015–2022 (USD Million)

Table 19 Asia: Anticholinergics Market, By Country, 2015–2022 (USD Million)

Table 20 Other Drugs Market, By Region, 2015–2022 (USD Million)

Table 21 North America: Other Drugs Market, By Country, 2015–2022 (USD Million)

Table 22 Asia: Other Drugs Market, By Country, 2015–2022 (USD Million)

Table 23 Parkinson’s Disease Treatment Market, By Distribution Channel, 2015–2022 (USD Million)

Table 24 Market for Hospital Pharmacies, By Region, 2015–2022 (USD Million)

Table 25 North America: Market for Hospital Pharmacies, By Country, 2015–2022 (USD Million)

Table 26 Parkinson’s Disease Treatment Market for Retail Pharmacies, By Region, 2015–2022 (USD Million)

Table 27 North America: Market for Retailer Pharmacies, By Country, 2015–2022 (USD Million)

Table 28 Market for Online Pharmacies, By Region, 2015–2022 (USD Million)

Table 29 North America: Parkinson’s Disease Treatment Market for Online Pharmacies, By Country, 2015–2022 (USD Million)

Table 30 Market, By Patient Care Setting, 2015–2022 (USD Million)

Table 31 Market for Hospitals, By Region, 2015–2022 (USD Million)

Table 32 North America: Parkinson’s Disease Treatment Market for Hospitals, By Country, 2015–2022 (USD Million)

Table 33 Asia: Market for Hospitals, By Country, 2015–2022 (USD Million)

Table 34 Market for Clinics, By Region, 2015–2022 (USD Million)

Table 35 North America: Parkinson’s Disease Treatment Market for Clinics, By Country, 2015–2022 (USD Million)

Table 36 Asia: Parkinson’s Disease Treatment Market for Clinics, By Country, 2015–2022 (USD Million)

Table 37 Global Market, By Region, 2015–2022 (USD Million)

Table 38 Europe: Market, By Drug Class, 2015–2022 (USD Million)

Table 39 Europe: Parkinson’s Disease Treatment Market, By Distribution Channel, 2015–2022 (USD Million)

Table 40 Europe: Market, By Patient Care Setting, 2015–2022 (USD Million)

Table 41 North America: Parkinson’s Disease Treatment Market, By Country, 2015–2022 (USD Million)

Table 42 North America: Market, By Drug Class, 2015–2022 (USD Million)

Table 43 North America: Parkinson’s Disease Treatment Market, By Distribution Channel, 2015–2022 (USD Million)

Table 44 North America: Market, By Patient Care Setting, 2015–2022 (USD Million)

Table 45 US: Market, By Drug Class, 2015–2022 (USD Million)

Table 46 US: Parkinson’s Disease Treatment Market, By Distribution Channel, 2015–2022 (USD Million)

Table 47 US: Market, By Patient Care Setting, 2015–2022 (USD Million)

Table 48 Canada: Parkinson’s Disease Treatment Market, By Drug Class, 2015–2022 (USD Million)

Table 49 Canada: Parkinson’s Disease Treatment Market, By Distribution Channel, 2015–2022 (USD Million)

Table 50 Canada: Market, By Patient Care Setting, 2015–2022 (USD Million)

Table 51 Asia: Parkinson’s Disease Treatment Market, By Country, 2015–2022 (USD Million)

Table 52 Asia: Market, By Drug Class, 2015–2022 (USD Million)

Table 53 Asia: Market, By Distribution Channel, 2015–2022 (USD Million)

Table 54 Asia: Parkinson’s Disease Treatment Market, By Patient Care Setting, 2015–2022 (USD Million)

Table 55 Japan: Market, By Drug Class, 2015–2022 (USD Million)

Table 56 Japan: Market, By Distribution Channel, 2015–2022 (USD Million)

Table 57 Japan: Parkinson’s Disease Treatment Market, By Patient Care Setting, 2015–2022 (USD Million)

Table 58 China: Market, By Drug Class, 2015–2022 (USD Million)

Table 59 China: Market, By Distribution Channel, 2015–2022 (USD Million)

Table 60 China: Parkinson’s Disease Treatment Market, By Patient Care Setting, 2015–2022 (USD Million)

Table 61 RoA: Market, By Drug Class, 2015–2022 (USD Million)

Table 62 RoA: Parkinson’s Disease Treatment Market, By Distribution Channel, 2015–2022 (USD Million)

Table 63 RoA: Market, By Patient Care Setting, 2015–2022 (USD Million)

Table 64 RoW: Parkinson’s Disease Treatment Market, By Drug Class, 2015–2022 (USD Million)

Table 65 RoW: Market, By Distribution Channel, 2015–2022 (USD Million)

Table 66 RoW: Market, By Patient Care Setting, 2015–2022 (USD Million)

List of Figures (33 Figures)

Figure 1 Global Parkinson’s Disease Treatment Market

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Parkinson’s Disease Treatment Market: Bottom-Up Approach

Figure 5 Market: Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Global Parkinson’s Disease Treatment Market, By Drug Class, 2017 vs 2022

Figure 8 Global Market, By Distribution Channel, 2017 vs 2022

Figure 9 Global Market, By Patient Care Setting, 2017 vs 2022

Figure 10 Global Market, By Region, 2017 vs 2022

Figure 11 Increasing Prevalence of Parkinson’s Disease to Drive the Growth of the Parkinson’s Disease Treatment Market

Figure 12 Carbidopa/Levodopa Segment and Japan to Account for the Largest Market Share in 2017

Figure 13 Japan to Register the Highest CAGR During the Forecast Period

Figure 14 Europe to Register the Highest Markest Share During the Forecast Period

Figure 15 Parkinson’s Disease Treatment Market: Drivers, Restraints, and Opportunities

Figure 16 Hospital Pharmacies to Continue to Dominate the Market During the Forecast Period

Figure 17 Hospitals Segment to Dominate the Market During the Forecast Period

Figure 18 Parkinson’s Disease Treatment Market: Geographic Snapshot (2017-2022)

Figure 19 North America: Market Snapshot

Figure 20 Asia: Market Snapshot

Figure 21 GSK .: Company Snapshot

Figure 22 Merck: Company Snapshot

Figure 23 Novartis: Company Snapshot

Figure 24 Teva : Company Snapshot

Figure 25 Boehringer Ingelheim: Company Snapshot

Figure 26 Impax: Company Snapshot

Figure 27 Abbvie.: Company Snapshot

Figure 28 Valeant: Company Snapshot

Figure 29 Lundbeck: Company Snapshot

Figure 30 Sun Pharma: Company Snapshot

Figure 31 Wockhardt: Company Snapshot

Figure 32 Acadia.: Company Snapshot

Figure 33 UCB: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Parkinson's Disease Treatment Market