Palm Oil Derivatives Market

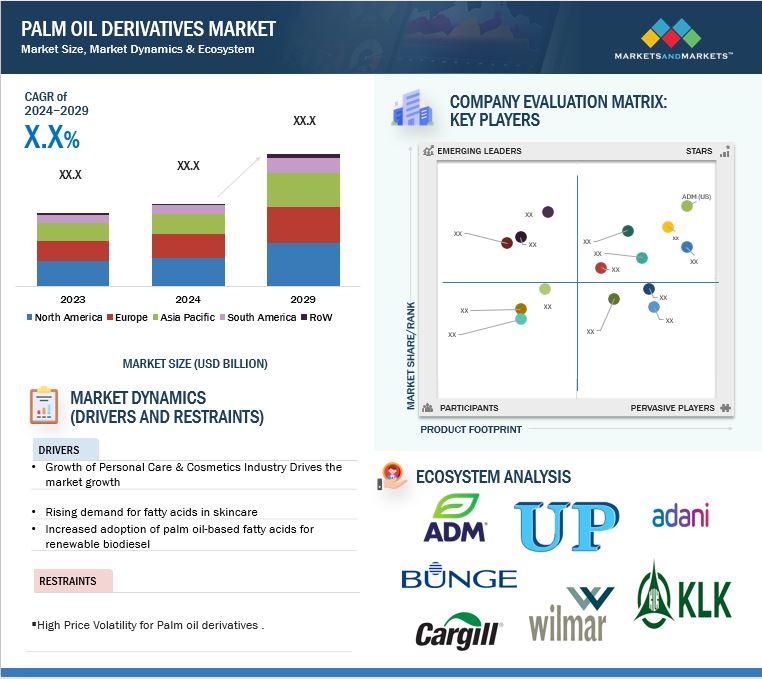

The palm oil derivatives market is estimated at USD XX.XX billion in 2024 and is projected to reach USD XX.XX billion by 2029, at a CAGR of X.X% from 2024 to 2029. Rising demand in diversified industries such as food and beverages, personal care, cosmetics, biodiesel, and pharmaceuticals has brought forth significant growth in the global palm oil derivatives market. Palm oil derivatives are cost-effective, versatile, and abundant, which makes them crucial for applications such as emulsifiers for food and surfactants and industrial lubricants. The market is further enhanced by pressure for sustainability and eco-friendliness from consumers and industries.

Based on the data from USDA released in 2024,palm oil production during the period of 2023/2024 stands at approximately 77.28 million metric tons as against the 76.56 million metric tons witnessed during 2022/2023. Indonesia currently dominates production globally with 44 million metric tons or 57%, then comes Malaysia at 19.71 million metric tons or 26%, while Thailand is fifth at 3.6 million metric tons or 5%. Therefore, the 2% of average growth over the 10-year period shows sustained growth in the palm oil industry over the last ten years.

This steady growth ensures a robust and reliable supply of raw materials for derivative products, allowing industries to meet increasing demand for sustainable and high-performing alternatives. As production scales up, the palm oil derivatives market will further benefit from enhanced availability and cost efficiency, solidifying its global importance.

Global Palm Oil Derivatives Market Trends

Market Dynamics

Drivers:

Growth of Personal Care & Cosmetics Industry Drives the Market Growth

The expanding personal care and cosmetics industry is a significant driver for the palm oil derivatives market, with all the palm-based ingredients being the backbone in formulating such diverse products as soaps and shampoos, lotions, and skincare items, among others. Fatty alcohols, used in emulsifiers and surfactants, and glycerin, for instance, are known for their moisturizing properties. The growth of this sector is due to increased consumer spending in personal care, fueled by increasing disposable incomes and increased awareness of hygiene and skincare.

According to the Personal Care Products Council's June 2024 report, the personal care industry supports 4.6 million jobs, generates USD 203.3 billion in labor income, and contributes USD 308.7 billion to the GDP, highlighting the economic impact of the sector. Since 2020, GDP contributions have increased by 15%, while total employment has grown by 17%. The personal care market growth further demanding the raw materials for production that palm oil derivatives form part of. This expansion coupled with a shift toward natural formulations also boosts the role of sustainably sourced palm oil derivatives in fostering continuous market growth.

Restraint:

High Price Volatility for Palm Oil Derivatives

Palm oil is considered to be a commodity that is extremely exposed to the risks of various factors such as the global economic condition, trade, and agricultural policies other than crop productivity. The recent economic changes with the Ukraine-Russia war are slowing down the growth of the palm oil derivatives market. According to a June 2023 report by the International Institute for Sustainable Development, the pandemic severely affected sustainability efforts in the palm oil sector, as a 91% increase in the FAO global edible oils price index since June 2021 shifted the focus to maintaining domestic food security and the economic viability of palm oil operations. The war in Ukraine exacerbated the situation, slowing the palm oil sector’s recovery. Additionally, the report noted that crude palm oil (CPO) prices have doubled over the last five years, from an average of USD 560 per tonne in 2018 to USD 1,156 per tonne in 2022 (International Monetary Fund, 2023).

Petroleum price increases are also boosting the rise in commodity prices, particularly the palm oil derivatives. The fast-changing economic conditions of developing nations lead to increased demand for energy and also as a source of transport fuel, raising oil prices. This further raises the agricultural cost of production.

Opportunity:

Biodiesel Industry Offers High Growth Potential of Palm Oil Derivative Products

It does have an immense opportunity associated with the increasing demand for the world's renewable energy sources because of a growing biodiesel market. The most important derivative from palm oil in its use for biodiesel manufacture is the fatty acid methyl esters, which exhibit efficacy, biodegradability, and compatibility with engines used for diesel. Governments around the world are imposing renewable energy mandates and blending requirements to reduce carbon emissions, which is further driving the demand for biodiesel and, consequently, palm oil derivatives.

Indonesia, the world's largest palm oil producer, has further expanded its B30 biodiesel program, which uses 30% crude palm oil. These initiatives clearly highlight the pivotal role that palm oil derivatives are to play in the energy transition and thus provide growth opportunities for producers in both domestic and international markets.

Challenge:

EU's deforestation ban disrupts palm oil supply for palm oil derivatives industry in European countries

The EU's Deforestation-Free Regulation, effective June 2023, is poised to create a major headache in the palm oil derivatives space. Since palm oil remains one of the most vital raw materials used to generate fatty acids in wide-reaching personal care, food, and industrial applications, its supply chains will face pressure because of stricter compliance requirements. Producers have to prove that their products are not linked to deforestation or forest degradation as reported by Center for Strategic and International Studies in May 2024. Failure to comply can result in fines from good confiscation to an up-to 4% of yearly turnover in the EU.

This regulation is likely to cause supply shortages since most palm oil producers cannot meet the stringent requirements. The cost of derivatives of palm oil is likely to go up, causing ripples in industries that use these products. Manufacturers in Europe will be faced with higher raw material costs, delayed production, and reduced availability of derivatives. This may affect global markets. The regulation calls for urgency in sustainable sourcing to stabilize the market and ensure compliance.

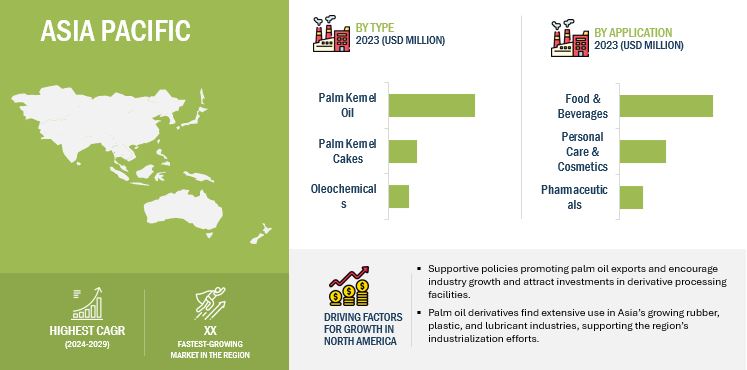

Palm kernel oil holds largest market share in by type segment in the palm oil derivatives market.

The palm kernel oil is the leading segment of the palm oil derivatives market. It is widely applied in a number of industries because it has versatile applications. This oil is richly used in producing fatty acids, fatty alcohols, and surfactants, which are essential parts of personal care products, soaps, detergents, and cosmetics. Palm kernel oil is also applied in the food industry for its stability at elevated temperatures, thus highly applicable in frying and baking.

The growth perspective for palm kernel oil is strong due to the increase in demand in personal care, food, and biofuel production. The preference of sustainable ingredients and consumer choices that add to environmental consciousness further add strength to the market stance of this derivative, where positive growth is expected for palm kernel oil derivatives.

Market Ecosystem

The food application segment holds the largest share in the palm oil derivatives market.

The food application segment dominates the global palm oil derivatives market, driven by its versatile use in products like margarine, baked goods, confectionery, and processed foods. Palm oil derivatives such as palm kernel oil are widely valued for neutral flavor, extended shelf life, and cost efficiency, making it integral to food formulations. Increasing consumer demand for convenient and packaged food products, particularly in emerging economies, fuels market growth.

Moreover, the palm oil derivatives also respond to the growing demand for trans-fat-free, according to global healthy eating patterns. The demographic growth in Asia-Pacific and Africa is further fueling the need for palm oil derivatives in food applications, helped by significant production platforms in Indonesia and Malaysia.

Manufacturers are utilizing the versatility of palm oil derivatives in the production of functional food ingredients such as emulsifiers, stabilizers, and flavor enhancers, which keeps it relevant in the global food industry. The food segment is likely to maintain its leading position in the palm oil derivatives market, given a strong supply chain and diverse applications.

The Asia Pacific region is anticipated to experience the fastest growth between 2024 and 2029.

Asia Pacific is the market leader in the palm oil derivatives market, led by leading palm oil producers like Indonesia and Malaysia. These countries account for a vast share of global palm oil production and therefore provide the basis of a strong supply chain to such derivatives as fatty acids, glycerin, and fatty alcohols.

The demand from personal care, food, and the growing biodiesel industries is creating strong demand in the region. With the growth of economies in the region, consumer spending increases, and industrial applications rise, the market is going to grow exponentially. The key players in the market are IOI Corporation Berhad (Malasia), Kuala Lumpur Kepong Berhad (Malaysia), and Musim Mas Group (Singapore), which are going to shape the future of the market with sustainability and product innovation to meet the rising demand.

Key Market Players

• ADM (US)

• Wilmar International Ltd (Singapore)

• United Plantations Berhad (Malaysia)

• IOI Corporation Berhad (Malaysia)

• SD Guthrie Berhad (Malaysia)

• Kuala Lumpur Kepong Berhad (Malaysia)

• PT Sampoerna Agro (Indonesia)

• Univanich Palm Oil Public Co. Ltd. (Thailand)

• PT Bakrie Sumatera Plantations Tbk. (Indonesia)

• Cargill, Incorporated (USA)

• Astra Agro Lestari (Indonesia)

• Asian Agri (Indonesia)

• Musim Mas Group (Singapore)

• Bumitama Agri Ltd. (Singapore)

• New Britain Palm Oil Limited (Group) (Papua New Guinea)

These market players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In March 2024, Astra Agro Lestari inaugurated a new extraction plant in Sumatra, significantly boosting its palm kernel oil production capacity. This development positions the company to meet rising domestic and international demand, enhancing its presence in the palm oil derivatives market by ensuring a steady supply for industries like food, cosmetics, and biodiesel manufacturing.

- In November 2023, Bunge and Musim Mas Group's joint effort to train 1,000 smallholder farmers in sustainable palm oil production enhances Musim Mas' leadership in sustainability. This initiative supports global deforestation goals, enhances smallholder livelihoods, and reinforces Musim Mas' market position in palm oil derivatives by promoting eco-friendly practices and ensuring a sustainable supply chain.

- In October 2023, Univanich introduced an eco-friendly palm kernel cake product line for animal feed, addressing the growing demand for sustainable agricultural inputs. This innovation strengthens Univanich’s position in the palm oil derivatives market by appealing to environmentally conscious buyers, expanding its market reach, and enhancing its reputation as a provider of sustainable solutions.

Frequently Asked Questions (FAQ):

What is the current size of the palm oil derivatives market?

The palm oil derivatives market is estimated at USD XX.XX billion in 2024 and is projected to reach USD XX.XX billion by 2029, at a CAGR of X.X% from 2024 to 2029.

Which are the key players in the palm oil derivatives market, and how intense is the competition?

Key players include ADM (US), Cargill, Incorporated (US), IOI Corporation Berhad (Malaysia), Wilmar International Ltd (Singapore), and United Plantations Berhad (Malaysia). The market competition is intense, with continuous R&D investments, mergers, acquisitions, and innovations in palm oil derivatives market.

Which region is projected to account for the largest share of the palm oil derivatives market?

Asia-Pacific has the largest share in the palm oil derivatives market, mainly because of high production in Indonesia and Malaysia, increasing demand for food and personal care products, and growing biodiesel adoption, encouraged by government initiatives and sustainability efforts.

What kind of information is provided in the company profiles section?

The company profiles cover comprehensive business overviews, financial data, geographic reach, product lines, strategic initiatives, and key innovations, offering detailed insights into the companies' market strategies.

What are the key factors driving the growth of the palm oil derivatives market?

The demand for cosmetics products, growth in the food, and biodiesel industries, consumer awareness of the cost-effectiveness, versatility, and widespread availability of palm oil derivatives globally, contribute to the driving forces of the palm oil derivatives market.

Growth opportunities and latent adjacency in Palm Oil Derivatives Market