Packaging Automation Solution Market by Product Type (Automated Packagers, Packaging Robots, and Automated Conveyors & Sortation Systems), Function (Case Packaging, Palletizing), Software and Service, Industry, and Geography - Global Forecast to 2022

The packaging automation solution market was valued at USD 28.39 Billion in 2015 and is expected to reach USD 52.42 Billion by 2022, growing at a CAGR of 8.68% during the forecast period. The base year considered for this study is 2015, and the forecast period considered is between 2016 and 2022.

The objectives of the study are as follows:

- To define, describe, and forecast the packaging automation solution market on the basis of function, software and service, product type, industry, and geography

- To forecast the market size for various segments with regard to four main regions, namely, North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments in the packaging automation solution market

- To strategically profile the key players, comprehensively analyze their core competencies, and describe the competitive landscape of the market

- To analyze competitive developments such as joint ventures, mergers and acquisitions, new product developments, and research and development in the market

The packaging automation solution market was valued at USD 28.39 Billion in 2015 and is expected to reach USD 52.42 Billion by 2022, growing at a CAGR of 8.68% during the forecast period. The increasing adoption of automation solutions across various industries, increasing need for supply chain integration, and reduction in labor costs are the major drivers for the solution market. Also, the advancements in technology such as wireless technology, autonomous control, and wearable computing are driving the packaging automation.

This report covers the packaging automation solution market on the basis of product type, function, software and service, industry, and geography. Food and beverages and logistics and warehousing industries are expected to hold the largest share of the overall packaging automation during the forecast period. The rising adoption of automated packaging systems is driving the growth of this market for the food and beverages industry. The packaging automation for the food and beverages industry is expected to grow at the highest rate between 2016 and 2022.

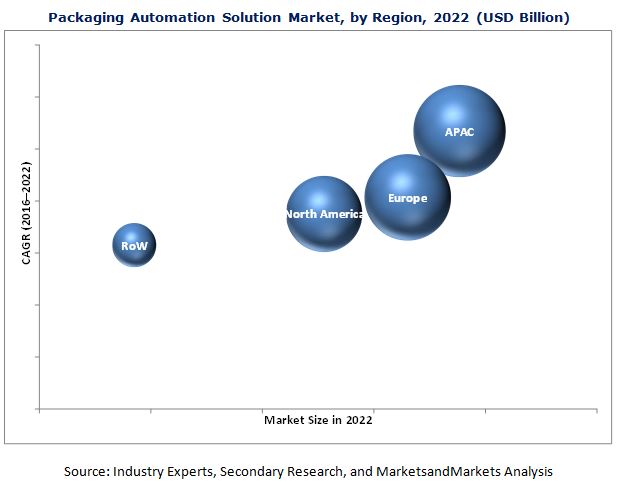

Europe held the largest share of the packaging automation in 2015. Germany is a major contributor to the growth of the packaging automation solution market in Europe. The high growth of the market in Europe can be attributed to the fast adoption of new technology by the masses and the presence of several manufacturing industries and also packaging automation providers in the region; these companies offer a wide range of automated packaging systems for applications in industries such as food and beverages, logistics and warehousing, retail, healthcare, chemical, automotive, and aerospace and defense.

The packaging automation solution market in APAC is expected to grow at a high rate between 2016 and 2022. The increasing number of players and the high growth in food and beverages and healthcare industries is the major factor driving the growth of the market in APAC.

Factors such as high capital cost and high level of maintenance required for automated packaging systems are restraining the growth of the packaging automation solution market. This report discusses the drivers, restraints, opportunities, and challenges pertaining to the packaging automation. In addition, it analyzes the current market scenario and forecasts the market size till 2022.

Some of the major companies operating in the packaging automation solution market are Rockwell Automation (U.S.), ABB Ltd. (Switzerland), Mitsubishi Electric Corp. (Japan), Schneider Electric SE (France), Emerson Electric Co. (U.S.), Swisslog Holding AG (Switzerland), Siemens AG (Germany), Automated Packaging Systems, Inc. (U.S.), Kollmorgen (U.S.), and BEUMER Group GmbH & Co., KG (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Packaging Automation Solution Market

4.2 Packaging Automation Solution Market in APAC

4.3 Packaging Automation Solution Market: Developed vs Developing Markets, 2016 and 2022 (USD Billion)

4.4 Packaging Automation Solution Market in APAC to Record High CAGR, Between 2016 and 2022

4.5 Packaging Automation Solution Market, By Industry

4.6 Packaging Automation Solution Market, By Product Type

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Product Type

5.2.2 By Software & Services

5.2.3 By Function

5.2.4 By Industry

5.2.5 By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Adoption of Automation Solutions Across Various Industries

5.3.1.2 Increasing Need for Supply Chain Integration

5.3.1.3 Reduction in Labor Costs

5.3.2 Restraints

5.3.2.1 High Capital Cost

5.3.2.2 High Level of Maintenance Required

5.3.3 Opportunities

5.3.3.1 Huge Scope of Growth in the E-Commerce and Retail Sectors

5.3.3.2 Growing Opportunities for Customized Packaging Automation Solutions

5.3.4 Challenges

5.3.4.1 Standardization of Solutions to Cater to Various Compatibility Requirements and Real-Time Technical Challenges

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Value Chain Analysis: Packaging Automation Solution Market

6.3 Key Trends in the Packaging Automation Solution Market

6.4 Porter’s Five Forces Analysis

6.4.1 Bargaining Power of Suppliers

6.4.2 Bargaining Power of Buyers

6.4.3 Threat of New Entrants

6.4.4 Threat of Substitutes

6.4.5 Intensity of Competitive Rivalry

7 Packaging Automation Solution Market, By Software and Services (Page No. - 47)

7.1 Introduction

7.2 Software

7.3 Services

8 Packaging Automation Solution Market, By Function (Page No. - 50)

8.1 Introduction

8.2 Case Packaging

8.3 Palletizing

8.4 Labeling

8.5 Bagging

8.6 Filling

8.7 Capping

8.8 Wrapping

8.9 Others

9 Packaging Automation Solution Market, By Product Type (Page No. - 54)

9.1 Introduction

9.2 Automated Packagers

9.3 Packaging Robots

9.4 Automated Conveyor & Sortation Systems

10 Packaging Automation Solution Market, By Industry (Page No. - 63)

10.1 Introduction

10.2 Food and Beverages

10.3 Logistics and Warehousing

10.3.1 E-Commerce

10.4 Healthcare

10.4.1 Medical Device

10.4.2 Pharmaceutical

10.5 Chemical

10.6 Retail

10.7 Semiconductor and Electronics

10.8 Aerospace and Defense

10.9 Automotive

10.10 Others

11 Geographical Analysis (Page No. - 91)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 U.K.

11.3.2 Germany

11.3.3 France

11.3.4 Rest of Europe

11.4 APAC

11.4.1 China

11.4.2 India

11.4.3 South Korea

11.4.4 Japan

11.4.5 Rest of APAC

11.5 Rest of the World

11.5.1 Middle-East & Africa

11.5.2 Latin America

12 Competitive Landscape (Page No. - 109)

12.1 Introduction

12.2 Ranking for Packaging Automation Solution Market Players

12.3 Competitive Scenario

12.3.1 New Product Launches and Developments

12.3.2 Acquisitions

12.3.3 Agreements and Contracts

12.3.4 Expansion

13 Company Profiles (Page No. - 115)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

13.1 Introduction

13.2 Rockwell Automation, Inc.

13.3 ABB Ltd.

13.4 Mitsubishi Electric Corp.

13.5 Schneider Electric Se

13.6 Emerson Electric Co.

13.7 Swisslog Holding AG

13.8 Siemens AG

13.9 Automated Packaging Systems, Inc.

13.10 Kollmorgen

13.11 Beumer Group GmbH & Co., Kg

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 139)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (71 Tables)

Table 1 Intensity of Competitive Rivalry and Bargaining Power of Suppliers Had A Major Impact on the Overall Packaging Automation Solution Market in 2015

Table 2 Packaging Automation Solution Market, By Software & Services, 2013–2022 (USD Billion)

Table 3 Packaging Automation Solution Market, By Function, 2013–2022 (USD Billion)

Table 4 Packaging Automation Solution Market, By Product Type, 2013–2022 (USD Billion)

Table 5 Packaging Automation Solution Market, By Product Type, 2013–2022 (Thousand Units)

Table 6 Packaging Automation Solution Market for Automated Packagers, By Industry, 2013–2022 (USD Billion)

Table 7 Packaging Automation Solution Market for Automated Packagers, By Function, 2013–2022 (USD Billion)

Table 8 Packaging Automation Solution Market for Packaging Robots, By Industry, 2013–2022 (USD Billion)

Table 9 Packaging Automation Solution Market for Packaging Robots, By Function, 2013–2022 (USD Billion)

Table 10 Packaging Automation Solution Market for Automated Conveyor & Sortation Systems, By Industry, 2013–2022 (USD Billion)

Table 11 Packaging Automation Solution Market for Automated Conveyor & Sortation Systems, By Function, 2013–2022 (USD Billion)

Table 12 Packaging Automation Solution Market, By Industry, 2013–2022 (USD Billion)

Table 13 Packaging Automation Solution Market for Food & Beverages Industry, By Region, 2013–2022 (USD Billion)

Table 14 Packaging Automation Solution Market in North America for Food & Beverages Industry, By Country, 2013–2022 (USD Billion)

Table 15 Packaging Automation Solution Market in Europe for Food & Beverages Industry, By Country, 2013–2022 (USD Billion)

Table 16 Packaging Automation Solution Market in APAC for Food & Beverages Industry, By Country, 2013–2022 (USD Billion)

Table 17 Packaging Automation Solution Market in RoW for Food & Beverages Industry, By Country, 2013–2022 (USD Billion)

Table 18 Packaging Automation Solution Market for Logistics & Warehousing Industry, By Region, 2013–2022 (USD Billion)

Table 19 Packaging Automation Solution Market in North America for Logistics & Warehousing Industry, By Country, 2013–2022 (USD Million)

Table 20 Packaging Automation Solution Market in Europe for Logistics & Warehousing Industry, By Country, 2013–2022 (USD Billion)

Table 21 Packaging Automation Solution Market in APAC for Logistics & Warehousing Industry, By Country, 2013–2022 (USD Billion)

Table 22 Packaging Automation Solution Market in RoW for Logistics & Warehousing Industry, By Country, 2013–2022 (USD Million)

Table 23 Packaging Automation Solution Market for Healthcare Industry, By Region, 2013–2022 (USD Billion)

Table 24 Packaging Automation Solution Market in North America for Healthcare Industry, By Country, 2013–2022 (USD Billion)

Table 25 Packaging Automation Solution Market in Europe for Healthcare Industry, By Country, 2013–2022 (USD Billion)

Table 26 Packaging Automation Solution Market in APAC for Healthcare Industry, By Country, 2013–2022 (USD Billion)

Table 27 Packaging Automation Solution Market in RoW for Healthcare Industry, By Country, 2013–2022 (USD Million)

Table 28 Packaging Automation Solution Market for Chemical Industry, By Region, 2013–2022 (USD Billion)

Table 29 Packaging Automation Solution Market in North America for Chemical Industry, By Country, 2013–2022 (USD Million)

Table 30 Packaging Automation Solution Market in Europe for Chemical Industry, By Country, 2013–2022 (USD Million)

Table 31 Packaging Automation Solution Market in APAC for Chemical Industry, By Country, 2013–2022 (USD Million)

Table 32 Packaging Automation Solution Market in RoW for Chemical Industry, By Country, 2013–2022 (USD Million)

Table 33 Packaging Automation Solution Market for Retail Industry, By Region, 2013–2022 (USD Billion)

Table 34 Packaging Automation Solution Market in North America for Retail Industry, By Country, 2013–2022 (USD Billion)

Table 35 Packaging Automation Solution Market in Europe for Retail Industry, By Country, 2013–2022 (USD Million)

Table 36 Packaging Automation Solution Market in APAC for Retail Industry, By Country, 2013–2022 (USD Million)

Table 37 Packaging Automation Solution Market in RoW for Retail Industry, By Country, 2013–2022 (USD Million)

Table 38 Packaging Automation Solution Market for Semiconductor & Electronics Industry, By Region, 2013–2022 (USD Billion)

Table 39 Packaging Automation Solution Market in North America for Semiconductor & Electronics Industry, By Country, 2013–2022 (USD Million)

Table 40 Packaging Automation Solution Market in Europe for Semiconductor & Electronics Industry, By Country, 2013–2022 (USD Million)

Table 41 Packaging Automation Solution Market in APAC for Semiconductor & Electronics Industry, By Country, 2013–2022 (USD Million)

Table 42 Packaging Automation Solution Market in RoW for Semiconductor & Electronics Industry, By Country, 2013–2022 (USD Million)

Table 43 Packaging Automation Solution Market for Aerospace & Defense Industry, By Region, 2013–2022 (USD Million)

Table 44 Packaging Automation Solution Market in North America for Aerospace & Defense Industry, By Country, 2013–2022 (USD Million)

Table 45 Packaging Automation Solution Market in Europe for Aerospace & Defense Industry, By Country, 2013–2022 (USD Million)

Table 46 Packaging Automation Solution Market in APAC for Aerospace & Defense Industry, By Country, 2013–2022 (USD Million)

Table 47 Packaging Automation Solution Market in RoW for Aerospace & Defense Industry, By Country, 2013–2022 (USD Million)

Table 48 Packaging Automation Solution Market for Automotive Industry, By Region, 2013–2022 (USD Million)

Table 49 Packaging Automation Solution Market in North America for Automotive Industry, By Country, 2013–2022 (USD Million)

Table 50 Packaging Automation Solution Market in Europe for Automotive Industry, By Country, 2013–2022 (USD Million)

Table 51 Packaging Automation Solution Market in APAC for Automotive Industry, By Country, 2013–2022 (USD Million)

Table 52 Packaging Automation Solution Market in RoW for Automotive Industry, By Country, 2013–2022 (USD Million)

Table 53 Packaging Automation Solution Market for Other Industries, By Region, 2013–2022 (USD Million)

Table 54 Packaging Automation Solution Market in North America for Other Industries, By Country, 2013–2022 (USD Million)

Table 55 Packaging Automation Solution Market in Europe for Other Industries, By Country, 2013–2022 (USD Million)

Table 56 Packaging Automation Solution Market in APAC for Other Industries, By Country, 2013–2022 (USD Million)

Table 57 Packaging Automation Solution Market in RoW for Other Industries, By Country, 2013–2022 (USD Million)

Table 58 Global Packaging Automation Solution Market, By Region, 2013–2022 (USD Billion)

Table 59 Packaging Automation Solution Market in North America, By Industry, 2013–2022 (USD Billion)

Table 60 Packaging Automation Solution Market in North America, By Country, 2013–2022 (USD Billion)

Table 61 Packaging Automation Solution Market in Europe, By Industry, 2013–2022 (USD Billion)

Table 62 Packaging Automation Solution Market in Europe, By Country, 2013–2022 (USD Billion)

Table 63 Packaging Automation Solution Market in APAC, By Industry, 2013–2022 (USD Billion)

Table 64 Packaging Automation Solution Market in APAC, By Country, 2013–2022 (USD Billion)

Table 65 Packaging Automation Solution Market in RoW, By Industry, 2013–2022 (USD Billion)

Table 66 Packaging Automation Solution Market in RoW, By Region, 2013–2022 (USD Million)

Table 67 Top 5 Players in the Global Packaging Automation Solution Market

Table 68 New Product Launches and Developments, 2015–2016

Table 69 Acquisitions, 2014–2016

Table 70 Agreements and Contracts, 2013–2016

Table 71 Expansion, 2016

List of Figures (54 Figures)

Figure 1 Markets Covered

Figure 2 Global Packaging Automation Solution Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Packaging Automation Solution Market, 2013–2022 (USD Billion)

Figure 7 Packaging Automation Solution Market, By Function, 2015 vs 2022

Figure 8 Food & Beverages Industry to Record Highest CAGR in Packaging Automation Solution Market, Between 2016 and 2022

Figure 9 Europe Held Highest Market Share in Global Packaging Automation Solution Market in 2016

Figure 10 Region-Wise Market Size of Top 2 Industries in Packaging Automation Solution Market, 2016

Figure 11 Packaging Automation Solution Market to Record High CAGR, Between 2016 and 2022

Figure 12 China to Hold the Largest Share of the Packaging Automation Solution Market in APAC, By 2022

Figure 13 China and the U.S. to Lead the Packaging Automation Solution Market, By 2022

Figure 14 China to Register the Highest CAGR in the Packaging Automation Solution Market, Between 2016 and 2022

Figure 15 Food & Beverages to Dominate the Packaging Automation Solution Market, Between 2016 and 2022

Figure 16 Automated Packagers to Dominate the Packaging Automation Solution Market, By 2022

Figure 17 Packaging Automation Solution Market, By Geography

Figure 18 Increasing Adoption of Automation Solutions to Drive the Packaging Automation Solution Market

Figure 19 Value Chain Analysis of Packaging Automation Solution (2015): Major Value Added During the Assembly Stage

Figure 20 Packaging Automation Solution Market: Porter’s Five Forces Analysis

Figure 21 Packaging Automation Solution Market: Porter’s Five Forces Analysis

Figure 22 High Impact of Bargaining Power of Suppliers on Packaging Automation Solution Market, 2015

Figure 23 Medium Impact of Bargaining Power of Buyers on Packaging Automation Solution Market, 2015

Figure 24 High Impact of Threat of New Entrants on Packaging Automation Solution Market, 2015

Figure 25 Low Impact of Threat of Substitutes on Packaging Automation Solution Market, 2015

Figure 26 High Impact of Intensity of Competitive Rivalry on Packaging Automation Solution Market, 2015

Figure 27 Packaging Automation Solution Market for Software to Record High CAGR By 2022

Figure 28 Palletizing Function to Record Highest CAGR Between 2016 and 2022

Figure 29 Packaging Robots to Record Highest CAGR By 2022

Figure 30 Automated Packagers Market for Food & Beverages Industry to Register Highest CAGR, By 2022

Figure 31 Packaging Automation Solution Market for Food & Beverages Industry Expected to Record Highest CAGR During Forecast Period

Figure 32 Packaging Automation Solution Market for Logistics & Warehousing Industry to Record Highest CAGR in APAC During the Forecast Period

Figure 33 APAC to Lead the Packaging Automation Solution Market for Healthcare Industry, By Value, By 2022

Figure 34 Geographic Snapshot: APAC to Record the Highest CAGR Between 2016 and 2022

Figure 35 China to Record Highest CAGR in Global Packaging Automation Solution Market, Between 2016 and 2022

Figure 36 Overview of Packaging Automation Solution Market in North America, 2015

Figure 37 Overview of Packaging Automation Solution Market in Europe, 2015

Figure 38 Overview of Packaging Automation Solution Market in APAC, 2015

Figure 39 Companies Adopted New Product Launches and Developments as the Key Growth Strategy Between 2013 and 2016

Figure 40 Market Evaluation Framework: New Product Launches and Developments Fueled Market Growth Between 2013 and 2016

Figure 41 Battle for Market Share: New Product Launches & Developments and Acquisitions Were the Key Strategies Between 2013 and 2016

Figure 42 Geographic Revenue Mix of Major Players

Figure 43 Rockwell Automation, Inc.: Company Snapshot

Figure 44 Rockwell Automation Inc.: SWOT Analysis

Figure 45 ABB Ltd.: Company Snapshot

Figure 46 ABB Ltd.: SWOT Analysis

Figure 47 Mitsubishi Electric Corp.: Company Snapshot

Figure 48 Mitsubishi Electric Corp.: SWOT Analysis

Figure 49 Schneider Electric SE: Company Snapshot

Figure 50 Schneider Electric SE: SWOT Analysis

Figure 51 Emerson Electric Co.: Company Snapshot

Figure 52 Emerson Electric Co. : SWOT Analysis

Figure 53 Swisslog Holding AG: Company Snapshot

Figure 54 Siemens AG: Company Snapshot

The research methodology includes the use of primary and secondary data. Both top-down and bottom-up approaches have been used to estimate and validate the size of the market as well as of the other dependent submarkets in the overall packaging automation solution market. Key players in the market have been identified through secondary research. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Some of these secondary sources include organizations and associations such as World Packaging Organization, Packaging World, Automation World, International Society of Automation, Association for Packaging and Processing Technologies, and Organization for Machine Automation and Control, among others.

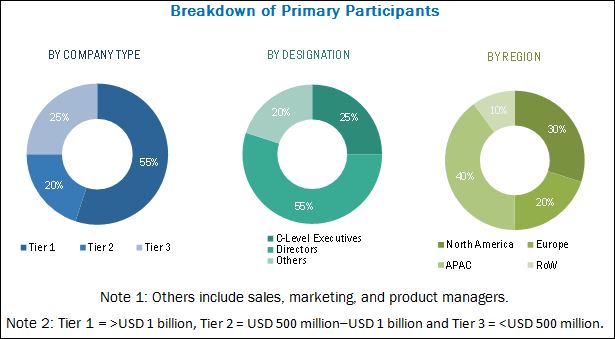

The research methodology includes the study of the annual and financial reports of the top market players and extensive interviews for key insights with industry leaders such as CEOs, VPs, directors, and marketing executives. All the percentage shares and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. The breakdown of the profiles of primaries has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The value chain of the packaging automation solution market includes original equipment manufacturers for packaging automation solutions, packaging software vendors, distributors, and manufacturing equipment suppliers. The major companies that are part of the value chain include Rockwell Automation (U.S.), ABB Ltd. (Switzerland), Mitsubishi Electric Corp. (Japan), Schneider Electric SE (France), Emerson Electric Co. (U.S.), Swisslog Holding AG (Switzerland), Siemens AG (Germany), Automated Packaging Systems, Inc. (U.S.), Kollmorgen (U.S.), and BEUMER Group GmbH & Co., KG (Germany), among others.

Target Audience

- Raw material and manufacturing equipment suppliers

- Original equipment manufacturers (OEMs)

- Product manufacturers

- Original design manufacturers (ODMs) and OEM technology solution providers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

- Governments, financial institutions, and investment communities

- Analysts and strategic business planners

- End users

“The study answers several questions for the target audiences, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Report Scope

In this report, the packaging automation solution market has been segmented as follows:

Packaging Automation Solution Market, by Product Type

- Automated Packagers

- Packaging Robots

- Automated Conveyors and Sortation Systems

Packaging Automation Solution Market, by Function

- Case Packaging

- Palletizing

- Labeling

- Bagging

- Filling

- Capping

- Wrapping

- Others

Packaging Automation Solution Market, by Software and Service

- Software

- Services

Packaging Automation Solution Market, by Industry

- Food and Beverages

- Healthcare

- Logistics and Warehousing

- Chemical

- Retail

- Semiconductor and Electronics

- Aerospace and Defense

- Automotive

- Others

Packaging Automation Solution Market, by Geography

- North America

- Europe

- Asia-Pacific (APAC)

- Rest of the World (RoW)

Company Profiles: Detailed analysis of the major companies present in the packaging automation solution market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Packaging Automation Solution Market