Overactive Bladder Treatment Market Size by Drug type (Anticholinergic (Solifenacin, Oxybutynin, Tolterodine, Darifenacin), Mirabegron), Botox, Neuromodulation, Disease Type (Idopathic OAB and Neurogenic OAB) & Region - Global Forecast to 2027

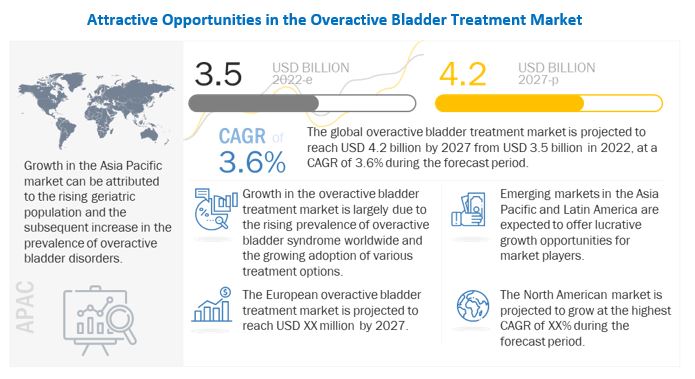

The size of global overactive bladder treatment market in terms of revenue was estimated to be worth $3.5 billion in 2022 and is poised to reach $4.2 billion by 2027, growing at a CAGR of 3.6% from 2022 to 2027. The research study consists of an industry trend analysis, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Increasing number of patients with overactive bladder, adequate reimbursement policies for the treatment option available are some of the major factors upsurging the market growth. Additionally, increased investment in development of novel drugs and devices is furthermore expected to drive the growth of market. However, product recalls and social stigma are some of the major reasons anticipated to restrict market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Overactive Bladder Treatment Market Dynamics

DRIVER: Growing R&D investments and the launch of novel therapies in the coming years

At present, biopharmaceutical and pharmaceutical companies are investing in innovative therapies for overactive bladder treatment, which are expected to be launched during the forecast period. For instance, Taiho Pharmaceutical is developing TAC-302, a drug currently in Phase II development. This is an orally bioavailable drug that can be used to treat overactive bladder by stimulating neurite outgrowth activity in cultured peripheral neurons. The launch of novel treatment options will increase the adoption of treatment subsequently driving the growth of market.

RESTRAINT: Frequent product recalls

Overactive bladder is a chronic medical condition that impacts the quality of life of a significant amount of the population. Frequent recalls of drugs used for treating OAB may limit market growth in the coming years. In June 2021, Cipla recalled 7,228 bottles of Solifenacin Succinate tablets in the US due to manufacturing issues. Such frequent recalls by leading pharmaceutical companies impede the growth of the market.

OPPORTUNITY: Novel treatments, robust pipelines, and patent cliff of certain drugs

There are currently more than 30 candidates for OAB in clinical trial pipelines. Of these, three are in Phase II, seven in Phase III, and sixteen in Phase IV. This robust pipeline and the subsequent launch of newer drugs and therapies in the market are expected to drive the market for overactive bladder treatment. Samsung Medical Center is studying potential biomarkers such as Nerve Growth Factor (NGF), prostaglandin E2 (PGE2), and adenosine triphosphate (ATP) in OAB patients and the effect of these drugs on them. This will assist in predicting treatment responsiveness to provide individualized treatments. Such developments are expected to provide considerable growth opportunities for players in the OAB treatment market.

Mirabergon dominant the type segment in overactive bladder treatment industry

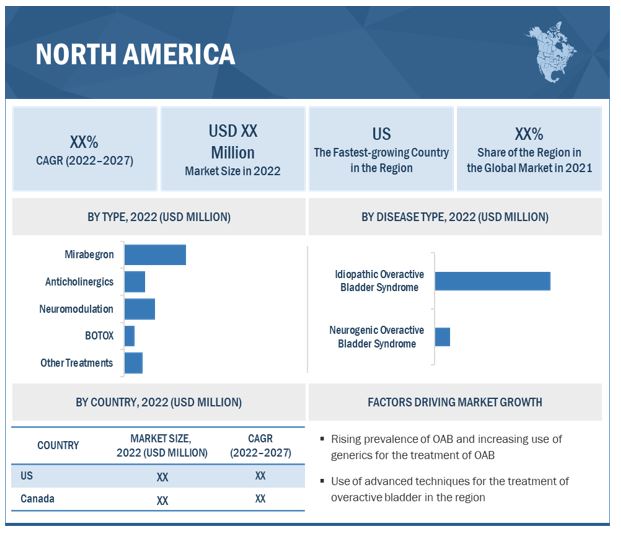

Based on type, the overactive bladder treatment market is segmented into anticholinergics, mirabegron, BOTOX, neuromodulation, and other treatments. Mirabegron held a dominant share of the market, owing factors such as fewer side-effects & less risk of dementia. The neuromodulation segment is anticipated to grow at significant CAGR owing to increased adoption and investment by market players for launch of novel SNM & PTNS devices.

The idiopathic overactive bladder dominated the overactive bladder treatment industry

Based on disease type, the overactive bladder treatment market is segmented into idiopathic and neurogenic overactive bladder syndromes. The idiopathic overactive bladder syndrome segment accounted for a larger market share due to the higher prevalence of idiopathic overactive bladder disorders. Furthermore, increased use of SNM therapy for the patients with idiopathic overactive bladder is anticipated to contribute towards the segmental growth.

North America accounted for largest share in overactive bladder treatment industry

Geographically, the overactive bladder treatment market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America held dominant share followed by Europe. The dominance of the region is attributable to the various factors such as increased incidence of patients with overactive bladder in US, favorable reimbursement policies for the treatment options. Additionally, preference of companies operating in the market coupled with ANDA and FDA approval for the various treatment is up-surging the growth of market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the global overactive bladder treatment (OAB) market include Astellas Pharma Inc. (Japan), Teva Pharmaceutical Industries Ltd. (Israel), Pfizer Inc. (US), Medtronic Plc (Ireland), AbbVie Inc. (US), Viatris Inc. (US), Hisamitsu Pharmaceutical Co., Inc. (Japan), Johnson & Johnson Services, Inc. (US), Endo Pharmaceuticals Inc. (Ireland) and among others

Scope of the Overactive Bladder Treatment Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$3.5 billion |

|

Projected Revenue Size by 2027 |

$4.2 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 3.6% |

|

Market Driver |

Growing R&D investments and the launch of novel therapies in the coming years |

|

Market Opportunity |

Novel treatments, robust pipelines, and patent cliff of certain drugs |

This report categorizes the overactive bladder treatment market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Anticholinergics

- Mirabegron

- BOTOX

- Neuromodulation

- Other Treatments.

By Disease Type

- Idiopathic Overactive Bladder

- Neurogenic Overactive Bladder

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- Italy

- Spain

- UK

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- Rest of Asia Pacific

-

Latin America

- Mexico

- Brazil

- Rest of Latin America

- Middle East & Africa

Recent Developments of Overactive Bladder Treatment Industry

- In March 2021, Myrbetriq received the U.S. Food and Drug Administration approval to treat neurogenic detrusor overactivity (NDO), a bladder dysfunction related to neurological impairment, in children ages three years and older.

- In December 2020, FDA approved GEMTESA (Vibegron) for the treatment of adults with overactive bladder (OAB). Vibegron is a small molecule, selective human beta-3 adrenergic agonist developed by Urovant Sciences, a subsidiary of Sumitovant Biopharma

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global overactive bladder treatment market?

The global overactive bladder treatment market boasts a total revenue value of $4.2 billion by 2027.

What is the estimated growth rate (CAGR) of the global overactive bladder treatment market?

The global overactive bladder treatment market has an estimated compound annual growth rate (CAGR) of 3.6% and a revenue size in the region of $3.5 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 OVERACTIVE BLADDER TREATMENT INDUSTRY DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH APPROACH

FIGURE 1 RESEARCH DESIGN

2.1.1 PRIMARY RESEARCH

FIGURE 2 OVERACTIVE BLADDER TREATMENT MARKET: PRIMARY RESPONDENTS

2.1.2 TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: REVENUE-BASED ESTIMATION

2.2 DATA TRIANGULATION APPROACH

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY RESEARCH

2.2.2 COVID-19-SPECIFIC ASSUMPTIONS

2.3 RESEARCH LIMITATIONS

2.4 RISK ASSESSMENT

2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.5.1 SUPPLY SIDE

2.5.2 DEMAND SIDE

2.5.2.1 Insights from primary experts

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 6 MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 7 MARKET, BY DISEASE TYPE 2022 VS. 2027 (USD MILLION)

FIGURE 8 GEOGRAPHICAL SNAPSHOT OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 OVERACTIVE BLADDER TREATMENT MARKET OVERVIEW

FIGURE 9 RISING PREVALENCE OF OVERACTIVE BLADDER SYNDROME AND FAVORABLE REIMBURSEMENT POLICIES ARE KEY FACTORS DRIVING MARKET GROWTH

4.2 ASIA PACIFIC: MARKET SHARE, BY TYPE AND COUNTRY (2021)

FIGURE 10 MIRABEGRON ACCOUNTED FOR THE LARGEST SHARE OF THE ASIA PACIFIC MARKET IN 2021

4.3 MARKET SHARE, BY DISEASE TYPE, 2022 VS. 2027

FIGURE 11 IDIOPATHIC OVERACTIVE BLADDER SYNDROME SEGMENT WILL CONTINUE TO DOMINATE THE MARKET IN 2027

4.4 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 12 US TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 OVERACTIVE BLADDER TREATMENT INDUSTRY: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

TABLE 1 MARKET: IMPACT ANALYSIS

5.2.1 MARKET DRIVERS

5.2.1.1 Rising prevalence of overactive bladder syndrome

5.2.1.2 Rapidly aging population and subsequent rise in incidence of diseases characterized by OAB

FIGURE 14 PROJECTED GROWTH IN THE ELDERLY POPULATION ABOVE 60, 2015 VS. 2030 VS. 2050

5.2.1.3 Development and use of innovative intravesical therapies

5.2.1.4 Growing R&D investments and the launch of novel therapies in the coming years

5.2.2 MARKET RESTRAINTS

5.2.2.1 Frequent product recalls

5.2.2.2 Increased side effects of anticholinergic drugs

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Novel treatments, robust pipelines, and patent cliff of certain drugs

5.2.4 MARKET CHALLENGES

5.2.4.1 Social stigma and lack of awareness about OAB

5.3 IMPACT OF UNCERTAINTIES ON THE OVERACTIVE BLADDER TREATMENT MARKET

FIGURE 15 SPECTRUM OF SCENARIOS BASED ON THE IMPACT OF UNCERTAINTIES ON THE GROWTH OF THE MARKET

5.4 IMPACT OF COVID-19 ON THE OVERACTIVE BLADDER TREATMENT INDUSTRY

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 16 REVENUE SHIFT AND NEW POCKETS FOR THE MARKET

5.6 VALUE CHAIN ANALYSIS

FIGURE 17 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASE

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 18 DIRECT DISTRIBUTION—THE PREFERRED STRATEGY OF PROMINENT COMPANIES

5.8 ECOSYSTEM ANALYSIS

FIGURE 19 ECOSYSTEM ANALYSIS OF THE PHARMACEUTICAL INDUSTRY

FIGURE 20 ECOSYSTEM ANALYSIS OF THE UROLOGY DEVICES INDUSTRY

5.9 REGULATORY SCENARIO

5.9.1 PHARMACEUTICAL INDUSTRY

5.9.1.1 Regulatory requirements

5.9.1.1.1 EU regulations

5.9.1.1.2 US regulations

5.9.2 MEDICAL DEVICE INDUSTRY

5.9.2.1 Regulatory requirements

5.9.2.1.1 EU regulations

5.9.2.1.2 US regulations

TABLE 2 LIST OF REGULATORY AUTHORITIES

5.10 TECHNOLOGY ANALYSIS

5.11 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 3 MARKET: LIST OF CONFERENCES AND EVENTS

5.12 PATENT ANALYSIS

FIGURE 21 LIST OF MAJOR PATENTS IN THE MARKET

TABLE 4 OVERVIEW OF PATENTS IN THE MARKET

5.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT FROM NEW ENTRANTS

5.13.2 THREAT FROM SUBSTITUTES

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 BARGAINING POWER OF SUPPLIERS

5.13.5 DEGREE OF COMPETITION

5.14 PRICING ANALYSIS

TABLE 6 COST OF DRUGS USED IN OVERACTIVE BLADDER TREATMENT IN VARIOUS REGIONS (GENERICS)

TABLE 7 COST OF BOTOX AND NEUROMODULATION USED IN OVERACTIVE BLADDER TREATMENT IN VARIOUS REGIONS

TABLE 8 COST OF BRANDED DRUGS USED IN OVERACTIVE BLADDER TREATMENT IN VARIOUS REGIONS

5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

FIGURE 22 KEY STAKEHOLDERS IN PHARMACEUTICAL COMPANIES AND THEIR INFLUENCE ON THE BUYING PROCESS

FIGURE 23 KEY BUYING CRITERIA FOR OVERACTIVE BLADDER TREATMENT PRODUCTS AMONG END USERS

5.16 PIPELINE ANALYSIS

FIGURE 24 PIPELINE ANALYSIS: PHASES OF DRUGS IN CLINICAL TRIALS

6 OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE (Page No. - 71)

6.1 INTRODUCTION

TABLE 9 MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 10 OVERACTIVE BLADDER TREATMENT MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2 MIRABEGRON

6.2.1 FEWER SIDE EFFECTS COMPARED WITH ANTICHOLINERGICS ARE LIKELY TO PROPEL THE GROWTH OF THIS MARKET SEGMENT

TABLE 11 MARKET FOR MIRABEGRON, BY REGION, 2020–2027 (USD MILLION)

6.3 ANTICHOLINERGICS

TABLE 12 MARKET FOR ANTICHOLINERGICS, BY REGION, 2020–2027 (USD MILLION)

TABLE 13 MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

6.3.1 SOLIFENACIN

6.3.1.1 Solifenacin is more effective than other anticholinergics in reducing the frequency of incontinence—a key factor driving market growth

TABLE 14 MARKET FOR SOLIFENACIN, BY REGION, 2020–2027 (USD MILLION)

6.3.2 OXYBUTYNIN

6.3.2.1 Oxybutynin is the most widely prescribed anticholinergic drug in the OAB market

TABLE 15 MARKET FOR OXYBUTYNIN, BY REGION, 2020–2027 (USD MILLION)

6.3.3 FESOTERODINE

6.3.3.1 Fesoterodine exhibits antimuscarinic effects on the muscarinic acetylcholine receptors in the detrusor muscle, leading to a decrease in bladder contractions

TABLE 16 MARKET FOR FESOTERODINE, BY REGION, 2020–2027 (USD MILLION)

6.3.4 DARIFENACIN

6.3.4.1 Cost of darifenacin is higher than other anticholinergics, which is likely to restrain market growth to a certain extent

TABLE 17 MARKET FOR DARIFENACIN, BY REGION, 2020–2027 (USD MILLION)

6.3.5 TOLTERODINE

6.3.5.1 Tolterodine is the third-most-prescribed drug for OAB as it has fewer side effects and offers long-term clinical efficacy

TABLE 18 OVERACTIVE BLADDER TREATMENT MARKET FOR TOLTERODINE, BY REGION, 2020–2027 (USD MILLION)

6.3.6 TROSPIUM

6.3.6.1 Trospium is associated with a lower incidence of dry mouth, as a result of which its discontinuation rate is relatively low

TABLE 19 MARKET FOR TROSPIUM, BY REGION, 2020–2027 (USD MILLION)

6.3.7 OTHER ANTICHOLINERGICS

TABLE 20 MARKET FOR OTHER ANTICHOLINERGICS, BY REGION, 2020–2027 (USD MILLION)

6.4 BOTOX

6.4.1 HIGHER EFFICACY OF BOTOX THAN ANTICHOLINERGICS MAKES IT A POPULAR TREATMENT ALTERNATIVE

TABLE 21 MARKET FOR BOTOX, BY REGION, 2020–2027 (USD MILLION)

6.5 NEUROMODULATION

6.5.1 INCREASING ADOPTION OF NEUROMODULATION FOR OVERACTIVE BLADDER TREATMENT TO DRIVE GROWTH IN THIS MARKET SEGMENT

TABLE 22 MARKET FOR NEUROMODULATION, BY REGION, 2020–2027 (USD MILLION)

6.6 OTHER TREATMENTS

TABLE 23 MARKET FOR OTHER TREATMENTS, BY REGION, 2020–2027 (USD MILLION)

7 OVERACTIVE BLADDER TREATMENT MARKET, BY DISEASE TYPE (Page No. - 85)

7.1 INTRODUCTION

TABLE 24 MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

7.2 IDIOPATHIC OVERACTIVE BLADDER SYNDROME

7.2.1 AVAILABILITY OF REIMBURSEMENTS FOR DRUGS USED TO TREAT IDIOPATHIC OAB TO FUEL GROWTH IN THIS MARKET

TABLE 25 IDIOPATHIC OVERACTIVE-BLADDER TREATMENT MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 NEUROGENIC OVERACTIVE BLADDER SYNDROME

TABLE 26 NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 27 NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

7.3.1 PARKINSON'S DISEASE

7.3.1.1 Increased use of anticholinergics and beta-adrenergic agonists for the treatment of Parkinson’s disease to drive market growth

TABLE 28 NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET FOR PARKINSON’S DISEASE, BY REGION, 2020–2027 (USD MILLION)

7.3.2 STROKES

7.3.2.1 Rising prevalence of strokes to increase the incidence of OAB and fuel the demand for OAB treatment

TABLE 29 NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET FOR STROKES, BY REGION, 2020–2027 (USD MILLION)

7.3.3 MULTIPLE SCLEROSIS

7.3.3.1 Favorable reimbursement policies to support the growth of the OAB treatment market for MS

TABLE 30 NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET FOR MULTIPLE SCLEROSIS, BY REGION, 2020–2027 (USD MILLION)

7.3.4 SPINAL CORD INJURIES

7.3.4.1 High prevalence of bladder overactivity in SCI contributes to the growth of the neurogenic bladder overactivity treatment market

TABLE 31 NEUROGENIC OVERACTIV-BLADDER TREATMENT MARKET FOR SPINAL CORD INJURIES, BY REGION, 2020–2027 (USD MILLION)

7.3.5 OTHER DISORDERS

TABLE 32 NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET FOR OTHER DISORDERS, BY REGION, 2020–2027 (USD MILLION)

8 OVERACTIVE BLADDER TREATMENT MARKET, BY REGION (Page No. - 95)

8.1 INTRODUCTION

TABLE 33 MARKET, BY REGION, 2020–2027 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 25 NORTH AMERICA: OVERACTIVE BLADDER TREATMENT MARKET SNAPSHOT

TABLE 34 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 36 NORTH AMERICA: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 38 NORTH AMERICA: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.2.1 US

8.2.1.1 Favorable reimbursement policies make the US the largest market for bladder overactivity treatment

TABLE 39 US: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 40 US: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 41 US: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 42 US: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Increased use of and demand for BOTOX to treat overactive bladder to drive market growth in Canada

TABLE 43 CANADA: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 44 CANADA: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 45 CANADA: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 46 CANADA: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.3 EUROPE

TABLE 47 EUROPE: OVERACTIVE BLADDER TREATMENT INDUSTRY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 48 EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 49 EUROPE: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 50 EUROPE: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 51 EUROPE: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.3.1 GERMANY

8.3.1.1 Aging population and a high prevalence of OAB, especially in women, are expected to increase target patient groups in Germany

TABLE 52 GERMANY: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 53 GERMANY: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 54 GERMANY: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 55 GERMANY: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.3.2 UK

8.3.2.1 Initiatives and awareness campaigns in the UK to drive growth in the OAB market

TABLE 56 ANNUAL COST OF OVERACTIVE BLADDER TREATMENT IN THE UK

TABLE 57 UK: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 UK: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 59 UK: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 60 UK: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.3.3 FRANCE

8.3.3.1 Low reimbursement rate in France compared to other countries may limit market growth to a certain extent

TABLE 61 REIMBURSEMENT RATES FOR OVERACTIVE BLADDER TREATMENT IN FRANCE

TABLE 62 FRANCE: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 63 FRANCE: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 64 FRANCE: OVERACTIVE BLADDER TREATMENT INDUSTRY, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 65 FRANCE: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Italian pharmaceutical industry is expected to offer lucrative growth opportunities to OAB drug manufacturers

TABLE 66 ITALY: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 67 ITALY: OVERACTIVE MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 68 ITALY: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 69 ITALY: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 Changing demographics and high OAB prevalence in Spain offer significant growth opportunities for the bladder overactivity treatment market

TABLE 70 SPAIN: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 71 SPAIN: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 SPAIN: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 73 SPAIN: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 74 REST OF EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 75 REST OF EUROPE: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 76 REST OF EUROPE: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 77 REST OF EUROPE: NEUROGENIC BLADDER-TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.4 ASIA PACIFIC

FIGURE 26 ASIA PACIFIC: OVERACTIVE BLADDER TREATMENT MARKET SNAPSHOT

TABLE 78 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 82 ASIA PACIFIC: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.4.1 JAPAN

8.4.1.1 Advancements in treatment options to fuel growth in the market in Japan

TABLE 83 JAPAN: OVERACTIVE BLADDER TREATMENT INDUSTRY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 84 JAPAN: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 85 JAPAN: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 86 JAPAN: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.4.2 CHINA

8.4.2.1 Growing adoption of BOTOX for OAB treatment makes China a lucrative market

TABLE 87 CHINA: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 CHINA: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 CHINA: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 90 CHINA: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.4.3 INDIA

8.4.3.1 India is the world’s largest producer of generic drugs— a key factor driving market growth

TABLE 91 INDIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 92 INDIA: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 93 INDIA: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 94 INDIA: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.4.4 AUSTRALIA

8.4.4.1 Growing aging population is likely to increase the number of patients suffering from OAB in Australia—a major factor supporting the growth of this market

TABLE 95 AUSTRALIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 96 AUSTRALIA: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 AUSTRALIA: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 98 AUSTRALIA: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.4.5 REST OF ASIA PACIFIC

TABLE 99 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 REST OF ASIA PACIFIC: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 101 REST OF ASIA PACIFIC: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 102 REST OF ASIA PACIFIC: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.5 LATIN AMERICA

TABLE 103 LATIN AMERICA: OVERACTIVE BLADDER TREATMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 104 LATIN AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 105 LATIN AMERICA: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 106 LATIN AMERICA: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 107 LATIN AMERICA: NEUROGENIC OVERACTIVEBLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.5.1 BRAZIL

8.5.1.1 Increased use of overactive bladder drugs in the country to drive growth in the market

FIGURE 27 DISTRIBUTION OF POPULATION IN BRAZIL (ABOVE-60 AGE GROUP), 2004–2050

TABLE 108 BRAZIL: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 BRAZIL: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 110 BRAZIL: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 111 BRAZIL: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.5.2 MEXICO

8.5.2.1 Rising prevalence of OAB to drive growth in the market in Mexico

TABLE 112 MEXICO: OVERACTIVE BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 MEXICO: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 MEXICO: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 115 MEXICO: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.5.3 REST OF LATIN AMERICA

TABLE 116 REST OF LATIN AMERICA: OVERACTIVE BLADDER TREATMENT INDUSTRY, BY TYPE, 2020–2027 (USD MILLION)

TABLE 117 REST OF LATIN AMERICA: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 REST OF LATIN AMERICA: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 119 REST OF LATIN AMERICA: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.6 MIDDLE EAST & AFRICA

8.6.1 RISING AWARENESS OF OAB IS LIKELY TO DRIVE THE GROWTH OF THE MARKET IN THE MIDDLE EAST & AFRICA

TABLE 120 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 121 MIDDLE EAST & AFRICA: MARKET FOR ANTICHOLINERGICS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 122 MIDDLE EAST & AFRICA: MARKET, BY DISEASE TYPE, 2020–2027 (USD MILLION)

TABLE 123 MIDDLE EAST & AFRICA: NEUROGENIC OVERACTIVE-BLADDER TREATMENT MARKET, BY TYPE, 2020–2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 149)

9.1 INTRODUCTION

9.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

FIGURE 28 OVERACTIVE BLADDER TREATMENT MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

9.3 MARKET SHARE ANALYSIS

FIGURE 29 MARKET: MARKET SHARE ANALYSIS OF KEY PLAYERS (2021)

TABLE 124 MARKET: DEGREE OF COMPETITION

9.4 REVENUE ANALYSIS

FIGURE 30 REVENUE ANALYSIS FOR KEY COMPANIES (2019–2021)

9.5 COMPANY EVALUATION QUADRANT

9.5.1 STARS

9.5.2 EMERGING LEADERS

9.5.3 PERVASIVE PLAYERS

9.5.4 PARTICIPANTS

FIGURE 31 OVERACTIVE BLADDER TREATMENT INDUSTRY: COMPANY EVALUATION MATRIX, 2021

9.6 COMPETITIVE BENCHMARKING OF TOP 20 PLAYERS

9.6.1 COMPANY FOOTPRINT (20 COMPANIES)

TABLE 125 COMPANY FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE MARKET

9.6.2 COMPANY PRODUCT FOOTPRINT (20 COMPANIES)

TABLE 126 PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE MARKET

9.6.3 COMPANY REGIONAL FOOTPRINT (20 COMPANIES)

TABLE 127 REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE MARKET

9.7 COMPANY EVALUATION QUADRANT: START-UPS/SMES

9.7.1 PROGRESSIVE COMPANIES

9.7.2 STARTING BLOCKS

9.7.3 RESPONSIVE COMPANIES

9.7.4 DYNAMIC COMPANIES

FIGURE 32 OVERACTIVE BLADDER TREATMENT MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2021

9.7.5 COMPETITIVE BENCHMARKING OF START-UP/SME PLAYERS

TABLE 128 MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 129 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (START-UPS/SMES)

9.8 COMPETITIVE SCENARIO AND TRENDS

9.8.1 PRODUCT LAUNCHES & APPROVALS

TABLE 130 PRODUCT LAUNCHES & APPROVALS, JANUARY 2019–MAY 2022

9.8.2 DEALS

TABLE 131 DEALS, JANUARY 2019–MAY 2022

10 COMPANY PROFILES (Page No. - 163)

10.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

10.1.1 ASTELLAS PHARMA INC.

TABLE 132 ASTELLAS PHARMA INC.: BUSINESS OVERVIEW

FIGURE 33 ASTELLAS PHARMA INC.: COMPANY SNAPSHOT (2021)

10.1.2 TEVA PHARMACEUTICAL INDUSTRIES LTD.

TABLE 133 TEVA PHARMACEUTICAL INDUSTRIES LTD.: BUSINESS OVERVIEW

FIGURE 34 TEVA PHARMACEUTICAL INDUSTRIES LTD.: COMPANY SNAPSHOT (2021)

10.1.3 PFIZER INC.

TABLE 134 PFIZER INC.: BUSINESS OVERVIEW

FIGURE 35 PFIZER INC.: COMPANY SNAPSHOT (2021)

10.1.4 ABBVIE INC.

TABLE 135 ABBVIE INC.: BUSINESS OVERVIEW

FIGURE 36 ABBVIE INC.: COMPANY SNAPSHOT (2021)

10.1.5 VIATRIS INC.

TABLE 136 VIATRIS INC.: BUSINESS OVERVIEW

FIGURE 37 VIATRIS INC.: COMPANY SNAPSHOT (2021)

10.1.6 HISAMITSU PHARMACEUTICAL CO., INC.

TABLE 137 HISAMITSU PHARMACEUTICAL CO., INC.: BUSINESS OVERVIEW

FIGURE 38 HISAMITSU PHARMACEUTICAL CO., INC.: COMPANY SNAPSHOT (2020)

10.1.7 JOHNSON & JOHNSON SERVICES, INC.

TABLE 138 JOHNSON & JOHNSON SERVICES, INC.: BUSINESS OVERVIEW

FIGURE 39 JOHNSON & JOHNSON SERVICES, INC.: COMPANY SNAPSHOT (2021)

10.1.8 ENDO PHARMACEUTICALS INC.

TABLE 139 ENDO PHARMACEUTICALS INC.: BUSINESS OVERVIEW

FIGURE 40 ENDO PHARMACEUTICALS INC.: COMPANY SNAPSHOT

10.1.9 LUPIN

TABLE 140 LUPIN: BUSINESS OVERVIEW

FIGURE 41 LUPIN: COMPANY SNAPSHOT (2021)

10.1.10 AMNEAL PHARMACEUTICALS LLC

TABLE 141 AMNEAL PHARMACEUTICALS LLC: BUSINESS OVERVIEW

FIGURE 42 AMNEAL PHARMACEUTICALS LLC: COMPANY SNAPSHOT (2021)

10.1.11 SUN PHARMACEUTICAL INDUSTRIES LTD.

TABLE 142 SUN PHARMACEUTICAL INDUSTRIES LTD.: BUSINESS OVERVIEW

FIGURE 43 SUN PHARMACEUTICAL INDUSTRIES LTD.: COMPANY SNAPSHOT (2021)

10.1.12 GLENMARK

TABLE 143 GLENMARK: BUSINESS OVERVIEW

FIGURE 44 GLENMARK: COMPANY SNAPSHOT (2021)

10.1.13 MACLEODS PHARMACEUTICALS LTD.

TABLE 144 MACLEODS PHARMACEUTICALS LTD.: BUSINESS OVERVIEW

FIGURE 45 MACLEODS PHARMACEUTICALS LTD.: COMPANY SNAPSHOT (2021)

10.1.14 MEDTRONIC

TABLE 145 MEDTRONIC: BUSINESS OVERVIEW

FIGURE 46 MEDTRONIC: COMPANY SNAPSHOT (2021)

10.1.15 AJANTA PHARMA

TABLE 146 AJANTA PHARMA: BUSINESS OVERVIEW

FIGURE 47 AJANTA PHARMA: COMPANY SNAPSHOT (2021)

10.1.16 GRANULES INDIA LIMITED

TABLE 147 GRANULES INDIA LIMITED: BUSINESS OVERVIEW

FIGURE 48 GRANULES INDIA LIMITED: COMPANY SNAPSHOT (2021)

10.2 OTHER PLAYERS

10.2.1 UROVANT SCIENCES

TABLE 148 UROVANT SCIENCES: BUSINESS OVERVIEW

10.2.2 APOTEX INC.

TABLE 149 APOTEX INC.: BUSINESS OVERVIEW

10.2.3 LABORIE

TABLE 150 LABORIE: BUSINESS OVERVIEW

10.2.4 INTAS PHARMACEUTICALS LTD.

TABLE 151 INTAS PHARMACEUTICALS LTD.: BUSINESS OVERVIEW

10.2.5 BAYER AG

TABLE 152 BAYER AG: BUSINESS OVERVIEW

10.2.6 MEDYTOX

TABLE 153 MEDYTOX: BUSINESS OVERVIEW

10.2.7 ALTHERX PHARMACEUTICALS

TABLE 154 ALTHERX PHARMACEUTICALS: BUSINESS OVERVIEW

10.2.8 TAIHO PHARMACEUTICAL CO., LTD.

TABLE 155 TAIHO PHARMACEUTICAL CO., LTD.: BUSINESS OVERVIEW

10.2.9 HUGEL, INC.

TABLE 156 HUGEL, INC.: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 203)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the overactive bladder treatment market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the overactive bladder treatment market. The secondary sources used for this study include American Urological Association (AUA), National Center for Biotechnology Information (NCBI), National Library of Medicine (NLM), European Association of Urology (EAU), Bladder Health UK, Urology Care Foundation (UCF), National Association for Continence (NAFC), National Institutes of Health (NIH), Pharmaceutical Research and Manufacturers of America (PhRMA), Centers for Disease Control and Prevention (CDC), US Food and Drug Administration (FDA), European Medicines Agency (EMA), Lens.org., ClinicalTrials.gov, PubMed, Annual Reports, SEC Filings, Medicaid, Expert Interviews and MarketsandMarkets Analysis, among others. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the overactive bladder treatment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the overactive bladder treatment business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global overactive bladde (OAB) treatment market based on the type, disease type and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall overactive bladde (OAB) treatment market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and R&D activities in the overactive bladder treatment(OAB) market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Overactive Bladder Treatment Market