OT Firewall Security Market - Global Forecast to 2029

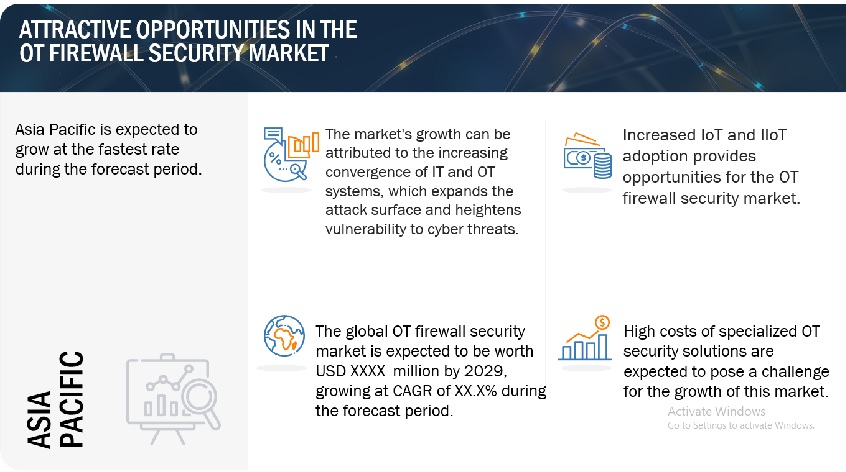

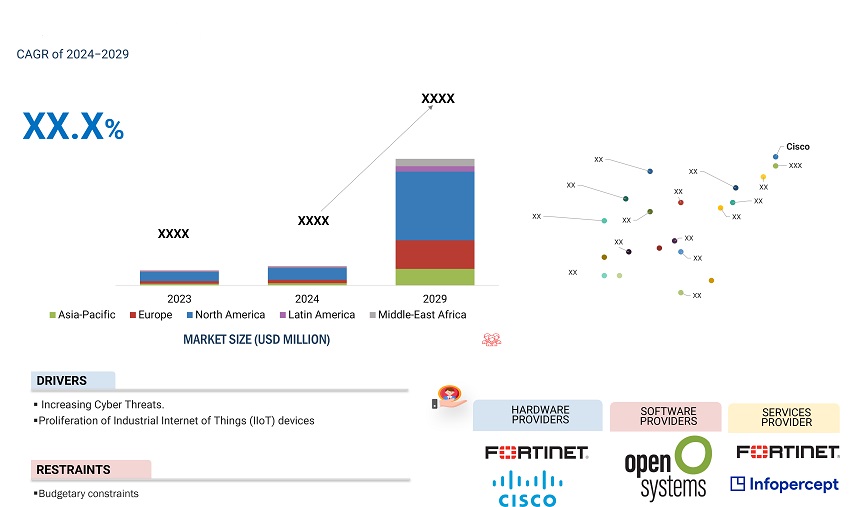

The global OT firewall security market size is projected to grow from USD XXXX million in 2024 to USD XXXX million by 2029 at a Compound Annual Growth Rate (CAGR) of XX.X% during the forecast period. The development of Industrial Internet of Things (IIoT) devices, as well as the convergence of IT and OT systems, are significant growth drivers in the OT firewall security industry. As companies implement linked devices for real-time monitoring and management, new risks develop, needing strong security measures. Integrated security solutions that target both IT and OT environments are growing in popularity, improving overall protection and operational resilience. This change is pushing the adoption of modern OT firewall solutions capable of protecting vital systems from changing cyber threats, assuring continuous operations, and adhering to demanding regulatory standards.

ATTRACTIVE OPPORTUNITIES IN THE OT FIREWALL SECURITY MARKET

To know about the assumptions considered for the study, Request for Free Sample Report

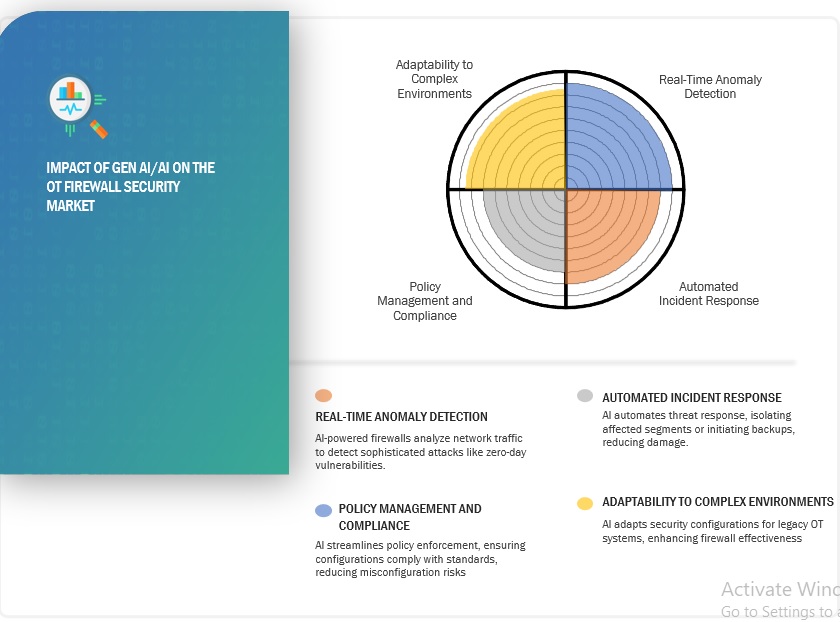

IMPACT OF AI/GEN AI ON THE OT FIREWALL SECURITY MARKET

AI and generative AI are transforming OT firewall security by improving threat detection, automating responses, and adapting to complex environments, enhancing overall protection and efficiency.

OT FIREWALL SECURITY MARKET DYNAMICS

Driver: Increasing cyberattacks drives the demand of OT firewall security solution

The rising frequency and sophistication of cyberattacks on operational technology (OT) systems necessitates the implementation of comprehensive OT firewall security solutions. For example, Waterfall Security's 2024 Threat Report found a 19% increase in cyberattacks in 2023, affecting over 500 physical operations worldwide. This increase, combined with growing concerns about overlooked ransomware occurrences, highlights the vulnerability in vital infrastructure. Incidents such as the Tata Power attack in 2022 and the Oldsmar Water Treatment breach in 2021 demonstrate how poor credential hygiene and weak network segmentation can severely disrupt essential services. Furthermore, attacks on industrial giants such as Toyota and Bridgestone demonstrate the interrelated nature of OT settings, where supplier compromises may interrupt production and supply chains. As OT systems become more integrated with IT networks, comprehensive OT firewall protection is required to reduce cyber threats and ensure operational continuity.

Restraint: Budgetory constraints

Budget limitations are a major obstacle to securing OT environments, particularly for small and medium-sized enterprises (SMEs). A JumpCloud survey found that 41% of SMEs intend to reduce cybersecurity budgets in the upcoming year due to economic pressures. Consequently, 72% of IT administrators acknowledge that these cuts will elevate the risk of cyber threats. This financial strain precludes SMEs from investing in key OT firewall protection, making critical systems more exposed to hacks and operational interruptions.

Opportunity: Industry 4.0 adoption creates opportunity for OT firewall growth

The growing adoption of Industry 4.0 and Industrial Internet of Things (IIoT) technologies is creating a demand for OT firewall security solutions. With the incorporation of IIoT devices and sensors into production environments, 76% of SCADAfence's OT specialists anticipate high or severe security concerns. This integration increases the attack surface, exposing OT networks to cyber threats previously limited to IT systems. Open Systems’ September 2023 release of its dedicated OT firewall highlights the growing need for network visibility, traffic monitoring, and threat mitigation within OT environments. Effective methods such as network segmentation and real-time traffic monitoring are critical for detecting and isolating malicious activity before it causes problems. With 43% of network teams seeing IoT and OT devices as key drivers of network strategy, effective OT firewall deployment is vital for protecting critical infrastructure and enabling secure digital transformation.

Challenge: Lack of skilled professionals

The lack of cybersecurity expertise poses an important challenge to OT firewall security. The ISC2 Cybersecurity Workforce Study identifies a 4.8 million professional shortfall, with 90% of firms reporting talent shortages, particularly in essential industries such as utilities and manufacturing. This talent shortage has a direct impact on operational technology security, as firms struggle to build and operate OT firewalls efficiently. According to a Fortinet survey, 87% of CEOs attribute data losses to a lack of cybersecurity competence. Furthermore, the protracted recruiting procedure, with 20% of firms needing more than six months to fill posts, heightens the risk, leaving OT systems open to cyber attacks.

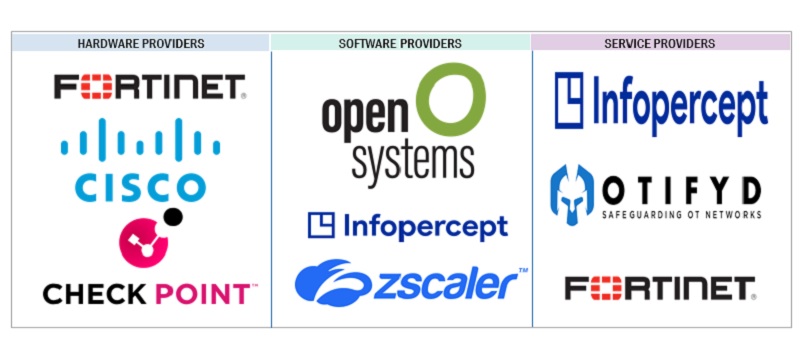

OT Firewall Security Market Ecosystem

The OT Firewall Security Market ecosystem comprises hardware, software, and service providers working together to safeguard critical infrastructure from evolving cyber threats. Hardware solutions offer robust physical defenses, while software ensures advanced threat detection and real-time monitoring. Service providers deliver expert support, implementation, and maintenance, enabling organizations to enhance their cybersecurity posture. This integrated ecosystem addresses the growing need for comprehensive OT security across industries like energy, manufacturing, and transportation.

To know about the assumptions considered for the study, download the pdf brochure

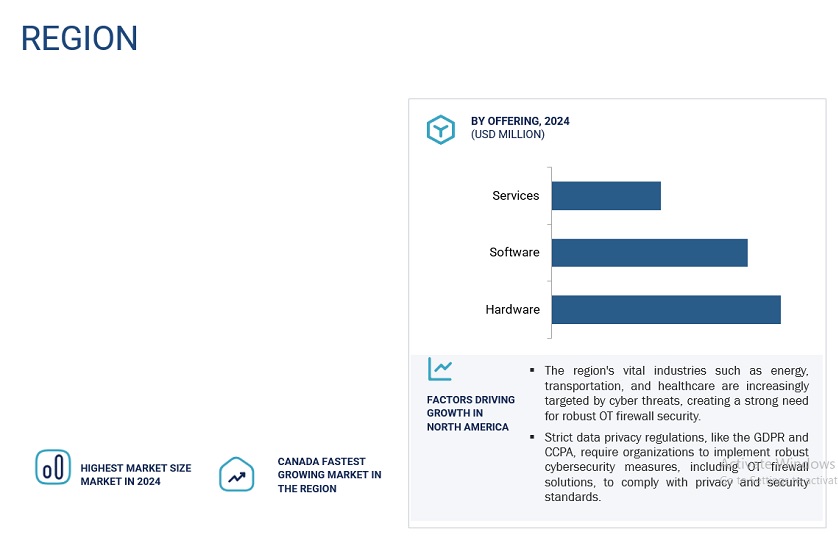

Based on the offering, the software segment will dominate the market during the forecast period.

The software segment dominates the OT Firewall Security market because of its complete security features, sophisticated threat detection, and cost-effectiveness. Solutions like Unified Threat Management (UTM) and Next-Generation Firewalls (NGFW) are popular among enterprises as these solutions meet different security demands on a single platform. The use of AI and machine learning in software firewalls enhances real-time anomaly detection and response. Additionally, software solutions are more scalable and integrate seamlessly with existing IT infrastructures, providing cost-effective and flexible security for organizations, particularly small and medium-sized enterprises (SMEs). These factors, along with regulatory compliance features, drive the segment’s dominance.

The cloud deployment mode is expected to grow at the highest CAGR during the forecast period.

Cloud deployment is experiencing rapid growth in the OT firewall security market due to its cost-effectiveness, scalability, and ease of setup. Cloud-based solutions decrease the need for costly hardware and continual IT maintenance, making them particularly appealing to small and medium-sized organizations (SMEs). Cloud services provide scalability, allowing businesses to modify security resources based on demand while minimizing expenses. Furthermore, innovative features such as Al-powered threat detection, automatic upgrades, and centralized administration improve security. Cloud-based firewalls are also ideal for remote work and scattered networks, which increases their attractiveness as enterprises seek more flexible and resilient security solutions.

Based on region, North America is expected to account for the largest market share during the forecast period.

North America has the highest market share in the OT firewall security market, owing to its strong economic influence, early adoption of technology, and strict data privacy rules. The region's developed economies, especially the United States and Canada, invest significantly on cybersecurity. As technology centers and digital transformation pioneers, North American firms are eager to adopt modern security solutions. In addition, stringent regulations such as GDPR and CCPA require firms to improve their cybersecurity safeguards. The presence of critical infrastructure sectors such as energy, transportation, and healthcare further underscores the importance of strong OT firewall protections.

Key Market Players

The key players in the OT firewall security market are Cisco (US), Palo Alto Networks (US), Check Point (US), Fortinet (US) ,Open Systems (Switzerland) , Zscaler (US), OPSWAT (US), Barracuda Networks (US), OTIFYD (England), Infopercept (India), and others.

Recent Developments:

- In February 2024, Fortinet introduced the FortiGate Rugged 70G with 5G Dual Modem, a small, ruggedized appliance that provides better networking, AI-powered security, and 5G connectivity for OT settings. Its SP5 CPU provides 8 Gbps firewall throughput, two 5G modems for high availability, and a rugged architecture, making it perfect for safeguarding distant ATMs and critical infrastructure.

- In November 2023, Palo Alto Networks introduced PA-450R, a ruggedized next-generation firewall designed for industrial environments. This firewall, designed for OT environments like power substations, uses machine learning to improve threat blocking and provides three times the performance of earlier models. The company further strengthened its OT security offerings with mobile device identification, risk visibility for 5G-connected devices, and enhanced threat evaluation tools.

- In September 2023, Open Systems announced its OT Firewall to improve critical infrastructure security. The solution offers organizations with improved control and visibility over IIoT traffic, allowing rapid threat detection and mitigation. With 24/7 managed services and network segmentation assistance, it assists enterprises in securing OT environments, assuring compliance with the rising demand for strong cybersecurity in Industry 4.0 adoption.

Frequently Asked Questions (FAQ):

What are the opportunities in the global OT firewall security market?

The key opportunities in the OT firewall security market include IT-OT integration, AI-driven threat detection, and the rise of cloud-based solutions, enhancing security and efficiency in critical infrastructure sectors.

What is the definition of the OT firewall security market?

According to MnM, “An OT firewall is a dedicated security solution designed to safeguard industrial systems such as ICS (Industrial Control Systems), SCADA (Supervisory Control and Data Acquisition), and other operational technology environments from cyber threats. It works by analyzing and regulating incoming and outgoing network traffic according to predefined security rules. While OT firewalls share similar core functionalities with traditional IT firewalls, they are specifically engineered to endure challenging industrial environments and support low-latency, real-time communication, essential for maintaining operational efficiency."

Which region is expected to show the highest market share in the OT firewall security market?

North America is expected to account for the largest market share during the forecast period.

What are the major market players covered in the report?

Major vendors, namely, include Cisco (US), Palo Alto Networks (US), Check Point (US), Fortinet (US), Open Systems (Switzerland), Zscaler (US), OPSWAT (US), Barracuda Networks (US), OTIFYD (England), Infopercept (India), and others.

What is the current size of the global OT firewall security market?

In 2024, the global OT firewall security market is estimated to reach USD XXXX million.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in OT Firewall Security Market