Orthopedic Software Market by Product (Orthopedic -Pre-operative Planning, EHR, PACS, RCM, PM) Applications (Joint Replacement, Fracture Management, Pediatric Assessment) Mode of Delivery, End User (Hospitals, Ambulatory Centers) & Region - Global Forecasts to 2025

Market Growth Outlook Summary

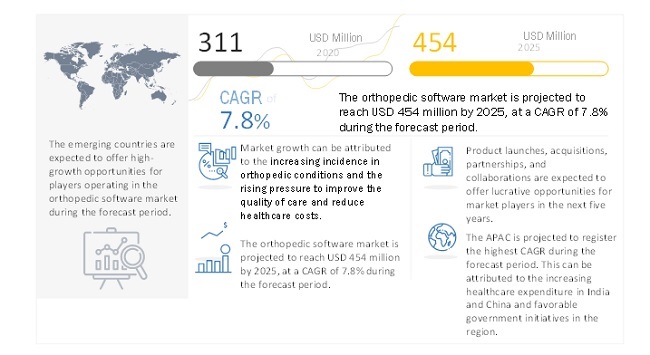

The global orthopedic software market growth forecasted to transform from $311 million in 2020 to $454 million by 2025, driven by a CAGR of 7.8%. The increasing incidence of orthopedic conditions due to the rising geriatric population, rising pressure to improve the quality of care and reduce healthcare costs, rising adoption of EHRs and other eHealth solutions, and the growing demand for minimally invasive treatments are the major factors driving the growth of this market. However, reluctance among orthopedicians to use orthopedic software due to privacy- and data security-related concerns, shortage of trained and skilled resources, and requirement of heavy infrastructure investments and high cost of deployment of software solutions are expected to restrain the growth of this market during the forecast period.

In this report, orthopedic software market, by the type of product, mode of delivery, application, end user, and region

To know about the assumptions considered for the study, Request for Free Sample Report

Orthopedic Software Market Dynamics

Drivers: Increasing incidence of orthopedic conditions due to the rising geriatric population

Musculoskeletal conditions can be a major burden on patients and healthcare systems as a whole. Osteoarthritis, osteoporosis, rheumatoid arthritis, and lower back pain are some of the most commonly occurring musculoskeletal conditions globally. Increasing life expectancy and the growth in the geriatric population are expected to make osteoarthritis the fourth-leading cause of disability by 2020. According to the National Osteoporosis Foundation, around 54 million people aged 50 years and above were affected by osteoporosis and low bone mass; this figure is expected to reach around 64.4 million by 2030.

The incidence of other orthopedic conditions is also expected to increase in the coming years in line with the growth in the geriatric population. According to a study conducted by the United Nations Department of Economic and Social Affairs, by 2050, around 21% of the world’s population is expected to be aged 60 years and above.

Restrains: Shortage of trained and skilled resources

The shortage of qualified resources is a major barrier to implementing as well as the efficient use of orthopedic software in healthcare facilities. Currently, the demand for HCIT professionals far exceeds their supply in both developing and developed markets. According to a report by the US Bureau of Labor Statistics, hospitals and physician practices in the US needed an additional 35,000 HCIT workers till 2018. The bureau stated that an additional 41,000 professionals would be required in the healthcare information management (HIM) field by 2022 in the US. Other major markets such as Germany, the Netherlands, England, and Australia are also witnessing a significant shortage of HCIT professionals.

The effective utilization of orthopedic software demands strong IT infrastructure and support within the organization as well as at the solution provider’s end. In a healthcare organization, there is a continuous need for technical support for maintaining the server and network. If the maintenance is inadequate, it leads to the generation of screen loads, which slows down several procedures. As healthcare organizations become increasingly sophisticated with their IT initiatives, human resource leaders are experiencing a new set of hiring challenges. Although healthcare IT jobs are projected to increase from 15% to 37% by 2020, the inability to fill IT positions has forced some hospitals to keep projects on hold. The lack of in-house IT experts, as well as a trained workforce with cross-functional skills, may hinder the growth of the orthopedic software market during the forecast period.

Opportunities: Availability of orthopedic software as cloud-based solutions and their use in mobile platforms

The healthcare industry has witnessed several advancements in the field of information technology. Moreover, owing to the rising use of smartphones and tablets, mobile applications are increasingly penetrating the orthopedics market. The combined benefits of mobility, accessible interfaces, storage capacity, and wireless access make these solutions perfect for use by orthopedic surgeons. These solutions enable easy access to reference information from any location and facilitate easy sharing of images, videos, and audio clips among orthopedic surgeons. Currently, most of the orthopedicians are utilizing these technologies to increase the accessibility to patient records from remote locations, thereby improving workflow efficiency. According to a study conducted by HIMSS, in the US, nearly 75% of clinicians used mobile technology to collect patient data in 2018 as compared to 30% in 2011.

Mobile interfaces enable organizations that have a database of thousands of documents and reference files to access the required information in a quick and efficient manner. Some of the commonly used apps by orthopedic surgeons include AO Surgery Reference, BoneFeed, AO Classification, and AAOS Code X-Lite.

Cloud-based orthopedic software are also finding greater acceptance by orthopedicians, as these solutions help organizations to share information in real-time and free up IT staff to focus on more critical tasks. This increases the productivity and cost-efficiency of processes in healthcare organizations. Cloud-based solutions can also be easily adjusted and scaled up or down by service providers without incurring any capital expenditure. Owing to the various advantages provided by cloud-based and mobile solutions, an increasing number of market players, including Medstrat, Inc. (US) and Materialise NV (Belgium), are focusing on developing these solutions.

Challenges: Consolidation of technologies due to mergers between healthcare set-ups

Consolidation of technologies, through mergers and acquisitions between healthcare organizations, is aimed at providing clinical and financial benefits to the healthcare organizations undertaking these consolidations. However, this trend can pose problems for orthopedic specialty clinics. When specialty clinics join larger hospitals, the pre-existing technologies of larger hospitals are fused into the existing technologies within specialty clinics. Specialty clinics are used to utilizing certain tools and have their own workflow for diagnosing and treating patients. The consolidation of technologies under such circumstances often prevents specialty clinics from utilizing their technologies. This, in turn, compels them to use the technologies that are at the disposal of larger hospitals. This may result in the lower adoption of orthopedic software by specialty clinics.

The Orthopedics PACS segment accounted for the largest market share in 2019.

Based on products, the orthopedic software market is segmented into orthopedic digital templating/preoperative planning software, orthopedic electronic health records (EHRs), orthopedic practice management (PM), orthopedic picture archiving and communication systems (PACS), and orthopedic revenue cycle management (RCM). In 2019, the orthopedic picture archiving and communication systems (PACS) segment accounted for 32.9% of the global orthopedic software market. The availability of orthopedic PACS integrated with digital templating software increases the demand for orthopedic PACS as it enables surgeons to undertake digital templating more effectively. This reduces the focus on tedious surgical procedures. It also reduces the extra costs required for the sterilization of equipment

The On-premises segment accounted for the largest market share in 2019.

Based on the mode of delivery, the orthopedic software market is segmented into on-premise and cloud-based models. In 2019, the on-premise models segment accounted for a larger share of 79.1% of the orthopedic software market. This can be attributed to the enhanced control and safety of patient data offered by on-premise solutions.

The Joint Replacement segment accounted for the largest market share in 2019.

Based on applications, the orthopedic software market is segmented into four major categories—joint replacement, fracture management, pediatric assessment, and other applications. In 2019, the joint replacement segment accounted for the largest share of 50.9% of the market. This segment also registered the highest CAGR of 8.5% during the forecast period. The rising incidence of chronic conditions has spurred a corresponding increase in the number of joint surgeries performed and, by extension, the number of revision surgeries conducted; this is driving the market growth. However, due to the impact of COVID-19, non-emergency surgeries have been pushed back. This is expected to reduce the demand for orthopedic surgical devices in the coming months.

The Hospitals segment accounted for the largest market share in 2019

By end user, the orthopedic software market is segmented into hospitals, ambulatory care centers, and other end users. The hospitals segment holds a major share of the orthopedic software market. In 2019, it accounted for 75.6% of the market. The high demand for orthopedic software among hospitals, owing to the emergence of the COVID-19 pandemic and the need for patient data for PHM, is the key driver of market growth.

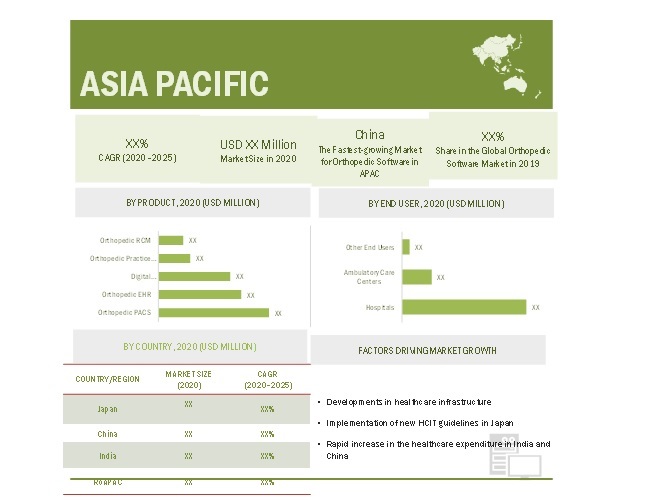

Asia Pacific recorded the highest CAGR for orthopedic software market in 2019

The orthopedic software market is segmented into five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2019, North America accounted for the largest share of 70.9% of the market during the forecast period. Factors such as the rising adoption of EHRs, government initiatives for the development of the healthcare system, and the growing number of ongoing research activities are driving the growth of the orthopedic software market in North America.

The Asia Pacific, on the other hand, is expected to record the highest growth during the forecast period. Lower penetration of orthopedic software in this market, the need to improve healthcare infrastructures, and the rising need to curtail healthcare costs will drive the growth of the orthopedic market in this region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Some of the prominent players in the orthopedic software market include Materialise NV (Belgium), Brainlab AG (Germany), Medstrat, Inc. (US), CureMD Healthcare (US), Greenway Health (US), NextGen Healthcare LLC (US), McKesson Corporation (US), GE Healthcare (US), Philips Healthcare (Netherlands), and Merge Healthcare Incorporated (US).

Scope of Report

The study categorizes the orthopedic software market based on By Type of Product, Mode of Delivery, Application, and End User at the regional and global level.

By Type of Product

- Orthopedic Picture Archiving and Communication Systems (PACS)

- Orthopedic Electronic health records

- Digital templating/Pre-operative Planning software

- Orthopedic Practice management

- orthopedic revenue cycle management (RCM)

By Mode of Delivery

- on-premises software

- Cloud-based software

By Application

- Joint Replacement

- Fracture Management

- Pediatric Assessment

- Others

By End Users

- Hospitals

- Ambulatory Care centers

- Others (research centers, government organizations)

Recent Developments

- In 2020, MTBC (US) acquired CareCloud Corporation (US). The acquisition of CareCloud Corporation helped MTBC yield greater operating efficiencies, accelerate growth, and provide more flexibility for future expansion.

- In 2019, Smith & Nephew (US) announced the acquisition Of Brainlab AG (Germany) Orthopedic Joint Reconstruction This acquisition supports Smith & Nephew’s strategy to invest in best-in-class technologies that expand its multi-asset digital surgery and robotic ecosystem.

- In 2019, Allscripts Healthcare Solutions (US) entered into a partnership with Premier Orthopaedics Group (US) Through this partnership, Allscripts will integrate a suite of solutions into the technology Premier currently uses. This combined technology and single platform will make it easier for Premier physicians to integrate information about a patient’s care across the ambulatory care continuum.

- In 2019, NextGen Healthcare LLC (US) announced the launch of new HER Behavioral Health Suite

- In 2018, Materialise N.V.( Belgium) entered into a collaboration with Carestream Health (US) Through this collaboration, both companies developed a work-in-progress zero footprint deployment of a pre-operative planning solution for orthopedists, leveraging Materialise’s OrthoView software.

Frequently Asked Questions (FAQ):

Which type of product is leading the by type of product segment?

Based on products, the orthopedic software market is segmented into orthopedic digital templating/preoperative planning software, orthopedic electronic health records (EHRs), orthopedic practice management (PM), orthopedic picture archiving and communication systems (PACS), and orthopedic revenue cycle management (RCM). In 2019, the orthopedic picture archiving and communication systems (PACS) segment accounted for the largest share of the global orthopedic software market. The availability of orthopedic PACS integrated with digital templating software increases the demand for orthopedic PACS as it enables surgeons to undertake digital templating more effectively. This reduces the focus on tedious surgical procedures. It also reduces the extra costs required for the sterilization of equipment.

Which is the leading application segment for orthopedic software market?

Based on applications, the orthopedic software market is segmented into four major categories—joint replacement, fracture management, pediatric assessment, and other applications. In 2019, the joint replacement segment accounted for the largest share of the market. This segment also registered the highest CAGR during the forecast period. The rising incidence of chronic conditions has spurred a corresponding increase in the number of joint surgeries performed and, by extension, the number of revision surgeries conducted; this is driving the market growth. However, due to the impact of COVID-19, non-emergency surgeries have been pushed back. This is expected to reduce the demand for orthopedic surgical devices in the coming months.

Which is the leading type of mode of delivery of orthopedic software market?

Based on the mode of delivery, the orthopedic software market is segmented into on-premise and cloud-based models. In 2019, the on-premise models segment accounted for a larger share of 79.1% of the orthopedic software market. This can be attributed to the enhanced control and safety of patient data offered by on-premise solutions.

Who are the key players operating in the orthopedic software market?

The orthopedic software market is highly competitive. The prominent players operating in this market include Materialise NV (Belgium), Brainlab AG (Germany), Medstrat, Inc. (US), CureMD Healthcare (US), Greenway Health (US), NextGen Healthcare LLC (US), McKesson Corporation (US), GE Healthcare (US), Philips Healthcare (Netherlands), and Merge Healthcare Incorporated (US).

Which geographical region is dominating in orthopedic software market?

The orthopedic software market is segmented into five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2019, North America accounted for the largest share of 70.9% of the market during the forecast period. Factors such as the rising adoption of EHRs, government initiatives for the development of the healthcare system, and the growing number of ongoing research activities are driving the growth of the orthopedic software market in North America.

The Asia Pacific, on the other hand, is expected to record the highest growth during the forecast period. Lower penetration of orthopedic software in this market, the need to improve healthcare infrastructures, and the rising need to curtail healthcare costs will drive the growth of the orthopedic market in this region. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.2.2 MARKETS COVERED

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19 ECONOMIC ASSESSMENT

2.8 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ORTHOPEDIC SOFTWARE MARKET

3 EXECUTIVE SUMMARY (Page No. - 37)

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ORTHOPEDIC SOFTWARE MARKET OVERVIEW

4.2 ASIA PACIFIC: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION AND COUNTRY (2019)

4.3 ORTHOPEDIC SOFTWARE MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

4.4 REGIONAL MIX: ORTHOPEDIC SOFTWARE MARKET (2020?2025)

4.5 ORTHOPEDIC SOFTWARE MARKET: DEVELOPED VS. DEVELOPING MARKETS

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing incidence of orthopedic conditions due to the rising geriatric population

5.2.1.2 Rising pressure to improve the quality of care and reduce healthcare costs

5.2.1.3 Rising adoption of EHRs and other eHealth solutions

5.2.1.4 Growing demand for minimally invasive treatments

5.2.2 RESTRAINTS

5.2.2.1 Reluctance among orthopedicians to use orthopedic software due to privacy- and data security-related concerns

5.2.2.2 Shortage of trained and skilled resources

5.2.2.3 Heavy infrastructure investments and high cost of deployment

5.2.3 OPPORTUNITIES

5.2.3.1 Availability of orthopedic software as cloud-based solutions and their use in mobile platforms

5.2.3.2 Shift toward patient-centric healthcare delivery

5.2.4 CHALLENGES

5.2.4.1 Consolidation of technologies due to mergers between healthcare set-ups

5.2.4.2 Lack of interoperability and integration

5.2.4.3 Reluctance to adopt advanced solutions due to lack of awareness

6 INDUSTRY INSIGHTS (Page No. - 54)

6.1 INTRODUCTION

6.2 COVID-19 IMPACT ANALYSIS

6.2.1 IMPACT OF COVID-19 ON THE ORTHOPEDIC SOFTWARE MARKET

6.3 HCIT EXPENDITURE ANALYSIS

6.3.1 NORTH AMERICA

6.3.2 EUROPE

6.3.3 ASIA PACIFIC

6.4 HCIT ADOPTION TRENDS IN THE US

6.5 REGULATORY ANALYSIS

6.5.1 NORTH AMERICA

6.5.1.1 US

6.5.1.2 Canada

6.5.2 ASIA PACIFIC

6.6 INDUSTRY TRENDS

6.6.1 INTEGRATION OF ORTHOPEDIC EHR WITH PRACTICE MANAGEMENT SOFTWARE

6.6.2 CLOUD COMPUTING

6.6.3 MIXED REALITY IN ORTHOPEDICS

6.6.4 AI PLATFORMS

7 ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT (Page No. - 66)

7.1 INTRODUCTION

7.2 ORTHOPEDIC PICTURE ARCHIVING AND COMMUNICATION SYSTEMS (PACS)

7.2.1 AVAILABILITY OF ORTHOPEDIC PACS INTEGRATED WITH DIGITAL TEMPLATING SOFTWARE HAS INCREASED THEIR DEMAND

7.3 ORTHOPEDIC ELECTRONIC HEALTH RECORDS

7.3.1 THE USE OF EHRS ENABLES ORTHOPEDICIANS TO CONVERT PAPER FILES INTO ELECTRONICALLY FORMATTED RECORDS

7.4 ORTHOPEDIC DIGITAL TEMPLATING/PREOPERATIVE PLANNING SOFTWARE

7.4.1 INTEGRATION AND AUTOMATIC STORAGE OF IMAGES IN PACS FURTHER INCREASES THE FOCUS ON PREOPERATIVE PLANNING SOFTWARE

7.5 ORTHOPEDIC PRACTICE MANAGEMENT

7.5.1 WORKFLOW AUTOMATION AND REDUCTION OF CLAIM SUBMISSION ARE SOME OF THE ADVANTAGES OF ORTHOPEDIC PRACTICE MANAGEMENT

7.6 ORTHOPEDIC REVENUE CYCLE MANAGEMENT (RCM)

7.6.1 USE OF ADVANCED REVENUE CYCLE MANAGEMENT SOFTWARE HELPS PROMOTE THE EFFICIENT MANAGEMENT OF CLINICAL AND FINANCIAL DATA

8 ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY (Page No. - 78)

8.1 INTRODUCTION

8.2 ON-PREMISE

8.2.1 ON-PREMISE SOLUTIONS REDUCE THE RISK OF DATA BREACHES AND OTHER SECURITY ISSUES-A KEY FACTOR DRIVING GROWTH

8.3 CLOUD-BASED

8.3.1 CLOUD-BASED SOLUTIONS HELP HEALTHCARE ORGANIZATIONS SHARE AND INTEGRATE INFORMATION FROM DISPARATE LOCATIONS IN REAL-TIME

9 ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION (Page No. - 83)

9.1 INTRODUCTION

9.2 JOINT REPLACEMENT

9.2.1 INCREASING INCIDENCE OF ARTHRITIS AND OBESITY IS EXPECTED TO DRIVE MARKET GROWTH

9.3 FRACTURE MANAGEMENT

9.3.1 RISING INCIDENCE OF FRACTURES IS EXPECTED TO DRIVE THE DEMAND FOR FRACTURE MANAGEMENT SOFTWARE

9.4 PEDIATRIC ASSESSMENT

9.4.1 RISING INCIDENCE OF ORTHOPEDIC PROBLEMS IN THE PEDIATRIC POPULATION WILL BE THE MAIN GROWTH DRIVER FOR THIS MARKET

9.5 OTHER APPLICATIONS

10 ORTHOPEDIC SOFTWARE MARKET, BY END USER (Page No. - 90)

10.1 INTRODUCTION

10.2 HOSPITALS

10.2.1 HOSPITALS ARE THE MAJOR END USERS OF SOFTWARE SOLUTIONS

10.3 AMBULATORY CARE CENTERS

10.3.1 OFFICE-BASED PHYSICIANS ARE THE MAJOR ADOPTERS OF STANDALONE ORTHOPEDIC SOFTWARE SOLUTIONS

10.4 OTHER END USERS

11 ORTHOPEDIC SOFTWARE MARKET, BY REGION (Page No. - 95)

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 US

11.2.1.1 The US is the largest market for orthopedic software

11.2.2 CANADA

11.2.2.1 Efforts to enhance healthcare delivery will drive market growth

11.3 EUROPE

11.3.1 GERMANY

11.3.1.1 High healthcare spending to support the adoption of orthopedic software solutions in Germany

11.3.2 UK

11.3.2.1 The UK is rapidly transforming its organizations into paperless environments through EHRs-a key factor driving market growth

11.3.3 FRANCE

11.3.3.1 Government support for HCIT indicates the potential for market growth in France

11.3.4 ITALY

11.3.4.1 Rising geriatric population and shortage of healthcare personnel are key growth drivers in Italy

11.3.5 SPAIN

11.3.5.1 Insufficient personnel and low IT adoption indicate opportunities for market growth

11.3.6 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 JAPAN

11.4.1.1 Japan has one of the highest adoption rates of EMR and orthopedic software in the Asia Pacific

11.4.2 CHINA

11.4.2.1 Absence of a patient-centered model may challenge the adoption of orthopedic software in the country

11.4.3 INDIA

11.4.3.1 India is currently one of the lucrative emerging regions in the field of eHealth

11.4.4 REST OF ASIA PACIFIC

11.5 LATIN AMERICA

11.5.1 IMPLEMENTATION OF FAVORABLE GOVERNMENT INITIATIVES IN SEVERAL LATIN AMERICAN COUNTRIES TO SUPPORT MARKET GROWTH

11.6 MIDDLE EAST AND AFRICA

11.6.1 GROWING MEDICAL TOURISM TO SUPPORT MARKET GROWTH IN THE MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE (Page No. - 137)

12.1 OVERVIEW

12.2 COMPETITIVE LEADERSHIP MAPPING

12.2.1 STARS

12.2.2 EMERGING LEADERS

12.2.3 PERVASIVE COMPANIES

12.2.4 EMERGING COMPANIES

12.3 PRODUCT MATRIX, BY COMPANY

12.4 R&D EXPENDITURE OF KEY PLAYERS IN THE ORTHOPEDIC SOFTWARE MARKET, 2018 VS. 2019 (USD MILLION)

12.5 MARKET SHARE ANALYSIS

12.6 COMPETITIVE SITUATIONS & TRENDS

12.6.1 PRODUCT LAUNCHES

12.6.2 PARTNERSHIPS AND COLLABORATIONS

12.6.3 ACQUISITIONS

13 COMPANY PROFILES (Page No. - 145)

13.1 BRAINLAB AG

13.1.1 BUSINESS OVERVIEW

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT DEVELOPMENTS

13.1.3.1 Partnerships

13.1.3.2 Acquisitions

13.1.4 MNM VIEW

13.2 GE HEALTHCARE (A DIVISION OF GENERAL ELECTRIC COMPANY)

13.2.1 BUSINESS OVERVIEW

13.2.2 GE HEALTHCARE: COMPANY SNAPSHOT (2019)

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.2.5 MNM VIEW

13.3 MATERIALISE N.V.

13.3.1 BUSINESS OVERVIEW

13.3.2 MATERIALISE N.V.: COMPANY SNAPSHOT (2019)

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.3.5 MNM VIEW

13.4 MERGE HEALTHCARE (AN IBM CORPORATION COMPANY)

13.4.1 BUSINESS OVERVIEW

13.4.2 MERGE HEALTHCARE (AN IBM CORPORATION): COMPANY SNAPSHOT

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.4.5 MNM VIEW

13.5 MEDSTRAT, INC.

13.5.1 BUSINESS OVERVIEW

13.5.2 PRODUCT PORTFOLIO

13.5.3 RECENT DEVELOPMENTS

13.5.4 MNM VIEW

13.6 PHILIPS HEALTHCARE (A DIVISION OF KONINKLIJKE PHILIPS N.V.)

13.6.1 BUSINESS OVERVIEW

13.6.2 PHILIPS: COMPANY SNAPSHOT

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 CUREMD HEALTHCARE

13.7.1 BUSINESS OVERVIEW

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 GREENWAY HEALTH, LLC.

13.8.1 BUSINESS OVERVIEW

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 NEXTGEN HEALTHCARE INFORMATION SYSTEMS, LLC.

13.9.1 BUSINESS OVERVIEW

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 MCKESSON CORPORATION

13.10.1 BUSINESS OVERVIEW

13.10.2 MCKESSON CORPORATION: COMPANY SNAPSHOT (2019)

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

13.11.1 BUSINESS OVERVIEW

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 ECLINICALWORKS

13.12.1 BUSINESS OVERVIEW

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENTS

13.13 ATHENAHEALTH, INC. (A VERITAS CAPITAL COMPANY)

13.13.1 BUSINESS OVERVIEW

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENTS

13.14 DRCHRONO

13.14.1 BUSINESS OVERVIEW

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENTS

13.15 CARECLOUD CORPORATION

13.15.1 BUSINESS OVERVIEW

13.15.2 PRODUCTS OFFERED

13.15.3 RECENT DEVELOPMENTS

13.16 EXSCRIBE ORTHOPAEDIC HEALTHCARE SOLUTIONS

13.17 NEUSOFT MEDICAL SYSTEMS CO., LTD

13.18 7D SURGICAL

13.19 ADVANCED DATA SYSTEMS CORPORATION

13.2 MODERNIZING MEDICINE

14 APPENDIX (Page No. - 181)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

LIST OF TABLES (116 Tables)

TABLE 1 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

TABLE 2 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IMPACT ANALYSIS

TABLE 3 NORTH AMERICA: HEALTHCARE EXPENDITURE, BY COUNTRY

TABLE 4 US: OFFICE-BASED PHYSICIAN EHR ADOPTION (2004-2017)

TABLE 5 US: HOSPITAL EHR ADOPTION (2007-2018)

TABLE 6 KEY CLOUD COMPUTING TOOLS & SAAS AVAILABLE IN THE MARKET

TABLE 7 ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 8 ORTHOPEDIC PACS SOFTWARE OFFERED BY KEY MARKET PLAYERS

TABLE 9 ORTHOPEDIC PACS MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 10 ORTHOPEDIC EHR SOFTWARE OFFERED BY KEY MARKET PLAYERS

TABLE 11 ORTHOPEDIC EHR MARKET, BY COUNTRY 2018-2025 (USD MILLION)

TABLE 12 ORTHOPEDIC DIGITAL TEMPLATING/PREOPERATIVE PLANNING SOFTWARE OFFERED BY KEY MARKET PLAYERS

TABLE 13 ORTHOPEDIC DIGITAL TEMPLATING SOFTWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 14 ORTHOPEDIC PRACTICE MANAGEMENT SOFTWARE OFFERED BY KEY MARKET PLAYERS

TABLE 15 ORTHOPEDIC PRACTICE MANAGEMENT MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 16 CLOUD-BASED ORTHOPEDIC SOFTWARE OFFERED BY KEY MARKET PLAYERS

TABLE 17 ORTHOPEDIC RCM MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 18 ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 19 ON-PREMISE ORTHOPEDIC SOFTWARE OFFERED BY KEY MARKET PLAYERS

TABLE 20 ON-PREMISE ORTHOPEDIC SOFTWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 21 CLOUD-BASED ORTHOPEDIC SOFTWARE OFFERED BY KEY MARKET PLAYERS

TABLE 22 CLOUD-BASED ORTHOPEDIC SOFTWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 23 ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 24 ORTHOPEDIC SOFTWARE MARKET FOR JOINT REPLACEMENT, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 25 ORTHOPEDIC SOFTWARE MARKET FOR FRACTURE MANAGEMENT, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 26 ORTHOPEDIC SOFTWARE MARKET FOR PEDIATRIC ASSESSMENT, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 27 ORTHOPEDIC SOFTWARE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 28 ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 29 ORTHOPEDIC SOFTWARE MARKET FOR HOSPITALS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 30 ORTHOPEDIC SOFTWARE MARKET FOR AMBULATORY CARE CENTERS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 31 ORTHOPEDIC SOFTWARE MARKET FOR OTHER END USERS, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 32 ORTHOPEDIC SOFTWARE MARKET, BY REGION, 2018-2025 (USD MILLION)

TABLE 33 NORTH AMERICA: ORTHOPEDIC SOFTWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 34 NORTH AMERICA: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 35 NORTH AMERICA: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 36 NORTH AMERICA: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 37 NORTH AMERICA: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 38 US: MACROECONOMIC INDICATORS FOR THE ORTHOPEDIC SOFTWARE MARKET

TABLE 39 US: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 40 US: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 41 US: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 42 US: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 43 CANADA: MACROECONOMIC INDICATORS FOR THE ORTHOPEDIC SOFTWARE MARKET

TABLE 44 CANADA: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 45 CANADA: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 46 CANADA: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 47 CANADA: ORTHOPEDIC SOFTWARE MARKET, BY END USER 2018-2025 (USD MILLION)

TABLE 48 EHEALTH PRIORITIES FOR HEALTHCARE PROVIDERS IN EUROPE, BY COUNTRY, 2019

TABLE 49 EUROPE: ORTHOPEDIC SOFTWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 50 EUROPE: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 51 EUROPE: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 52 EUROPE: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 53 EUROPE: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 54 GERMANY: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 55 GERMANY: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 56 GERMANY: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 57 GERMANY: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 58 UK: MACROECONOMIC INDICATORS FOR THE ORTHOPEDIC SOFTWARE MARKET

TABLE 59 UK: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 60 UK: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 61 UK: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 62 UK: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 63 FRANCE: MACROECONOMIC INDICATORS FOR THE ORTHOPEDIC SOFTWARE MARKET

TABLE 64 FRANCE: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 65 FRANCE: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 66 FRANCE: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 67 FRANCE: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 68 ITALY: MACROECONOMIC INDICATORS FOR THE ORTHOPEDIC SOFTWARE MARKET

TABLE 69 ITALY: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 70 ITALY: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 71 ITALY: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 72 ITALY: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 73 SPAIN: MACROECONOMIC INDICATORS FOR THE ORTHOPEDIC SOFTWARE MARKET

TABLE 74 SPAIN: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 75 SPAIN: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 76 SPAIN: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 77 SPAIN: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 78 ROE: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 79 ROE: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 80 ROE: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 81 ROE: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 82 APAC: ORTHOPEDIC SOFTWARE MARKET, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 83 APAC: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 84 APAC: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 85 APAC: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 86 APAC: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 87 JAPAN: MACROECONOMIC INDICATORS FOR THE ORTHOPEDIC SOFTWARE MARKET

TABLE 88 JAPAN: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 89 JAPAN: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 90 JAPAN: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 91 JAPAN: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 92 CHINA: MACROECONOMIC INDICATORS FOR THE ORTHOPEDIC SOFTWARE MARKET

TABLE 93 CHINA: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 94 CHINA: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 95 CHINA: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 96 CHINA: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 97 INDIA: MACROECONOMIC INDICATORS FOR THE ORTHOPEDIC SOFTWARE MARKET

TABLE 98 INDIA: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 99 INDIA: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 100 INDIA: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 101 INDIA: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 102 ROAPAC: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 103 ROAPAC: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 104 ROAPAC: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 105 ROAPAC: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 106 LATIN AMERICA: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 107 LATIN AMERICA: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 108 LATIN AMERICA: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 109 LATIN AMERICA: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 110 MIDDLE EAST AND AFRICA: ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2018-2025 (USD MILLION)

TABLE 111 MIDDLE EAST AND AFRICA: ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 112 MIDDLE EAST AND AFRICA: ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2018-2025 (USD MILLION)

TABLE 113 MIDDLE EAST AND AFRICA: ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2018-2025 (USD MILLION)

TABLE 114 KEY PRODUCT LAUNCHES

TABLE 115 KEY PARTNERSHIPS AND COLLABORATIONS

TABLE 116 KEY ACQUISITIONS

LIST OF FIGURES (33 Figures)

FIGURE 1 ORTHOPEDIC SOFTWARE MARKET SEGMENTATION

FIGURE 2 RESEARCH DESIGN

FIGURE 3 PRIMARY SOURCES

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 5 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

FIGURE 7 TOP-DOWN APPROACH

FIGURE 8 MARKET DATA TRIANGULATION METHODOLOGY

FIGURE 9 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 10 SCENARIOS OF THE RECOVERY OF THE GLOBAL ECONOMY

FIGURE 11 ORTHOPEDIC SOFTWARE MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 12 ORTHOPEDIC SOFTWARE MARKET, BY MODE OF DELIVERY, 2020 VS. 2025 (USD MILLION)

FIGURE 13 ORTHOPEDIC SOFTWARE MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 14 ORTHOPEDIC SOFTWARE MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 15 GEOGRAPHICAL SNAPSHOT OF THE ORTHOPEDIC SOFTWARE MARKET

FIGURE 16 INCREASING INCIDENCE OF ORTHOPEDIC CONDITIONS DUE TO THE GROWING GERIATRIC POPULATION IS A KEY FACTOR DRIVING MARKET GROWTH

FIGURE 17 JAPAN ACCOUNTED FOR THE LARGEST SHARE OF THE APAC ORTHOPEDIC SOFTWARE MARKET IN 2019

FIGURE 18 CHINA TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

FIGURE 19 NORTH AMERICA WILL CONTINUE TO DOMINATE THE ORTHOPEDIC SOFTWARE MARKET IN 2025

FIGURE 20 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING THE FORECAST PERIOD

FIGURE 21 DEMOGRAPHIC GROWTH TRENDS: ELDERLY POPULATION, BY REGION

FIGURE 22 CLOUD ADOPTION IN THE US HEALTH SECTOR (2016)

FIGURE 23 TOTAL NUMBER OF KNEE AND HIP REPLACEMENT SURGERIES, BY COUNTRY (2017)

FIGURE 24 TOTAL NUMBER OF ESTIMATED HIP FRACTURES (IN MILLIONS)

FIGURE 26 NORTH AMERICA: ORTHOPEDIC SOFTWARE MARKET SNAPSHOT

FIGURE 28 ASIA PACIFIC: ORTHOPEDIC SOFTWARE MARKET SNAPSHOT

FIGURE 29 MARKET EVALUATION FRAMEWORK: PARTNERSHIPS AND COLLABORATIONS-THE MOST WIDELY ADOPTED STRATEGY

FIGURE 30 ORTHOPEDIC SOFTWARE MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 31 ORTHOPEDIC SOFTWARE MARKET SHARE ANALYSIS, 2019

FIGURE 32 NEXTGEN HEALTHCARE INFORMATION SYSTEMS, LLC: COMPANY SNAPSHOT (2020)

FIGURE 33 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY SNAPSHOT (2019)

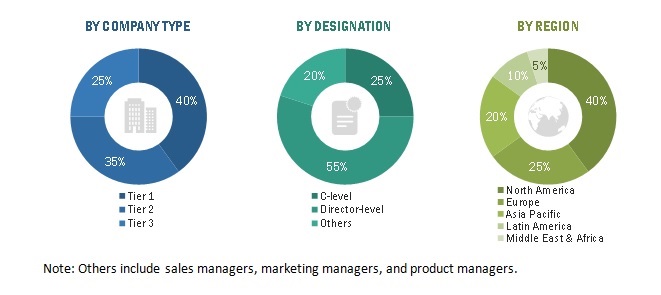

This study involved four major activities for estimating the current size of the orthopedic software market. Exhaustive secondary research was conducted to collect information on the market as well as its peer and parent markets. The next step focused on validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Revenue Share Analysis, Parent Market and top-down approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to identify and collect information for this study. These secondary sources include annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, and databases.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies operating in the patient registry software market. Primary sources from the demand side include experts from hospitals and government organizations and third party associates (tpa) and research centers. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on the key industry trends and key market dynamics, such as market drivers, restraints, challenges, and opportunities.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation

The total size of the orthopedic software market was arrived at after data triangulation from two different approaches, as mentioned below.

Approach to calculate the revenue of different players in the orthopedic software market

The size of the orthopedic software market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global orthopedic software market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the orthopedic software market based on product, mode of delivery, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa, along with the major countries in these regions

- To profile the key players and comprehensively analyze their market shares and core competencies2 in the orthopedic software market

- To track and analyze competitive developments such as partnerships, collaborations, acquisitions, product developments, geographic expansions, and R&D activities in the orthopedic software market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of top companies

Geographic Analysis

- Further breakdown of the RoAPAC market into South Korea, New Zealand, Australia, Singapore, and other countries

- Further breakdown of the RoE market into Russia, the Netherlands, Switzerland, and other countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Orthopedic Software Market