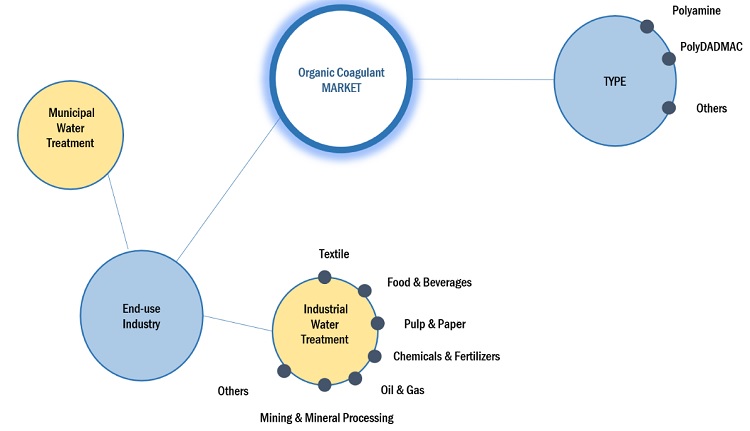

Organic Coagulant Market by Type (Polyamine, Polydadmac), Application (Municipal Water Treatment, Industrial Water Treatment), and Region (Asia Pacific, North America, Europe, Middle East & Africa, South America) - Global Forecast to 2027

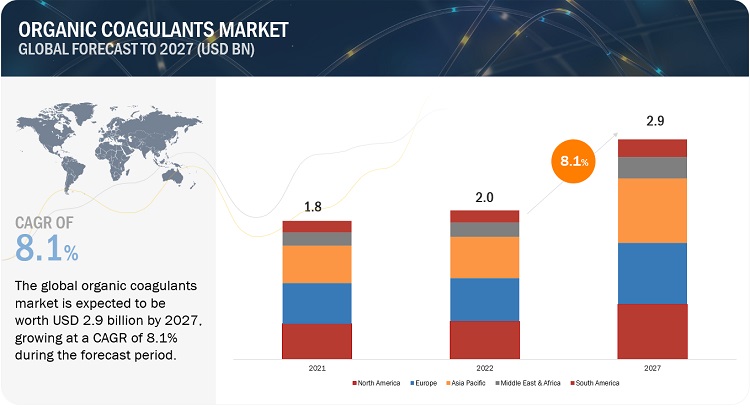

The global organic coagulant market size is projected to reach USD 2.9 billion by 2027 from USD 2.0 billion in 2022, at a CAGR of 8.1% during the forecast period. The growing demand for organic coagulants is due to declining freshwater resources, and the harmful effects of inorganic coagulants. Moreover, the rising population and rapid urbanization increase the demand for safe and clean water in emerging economies such as India, China, Brazil, and others.

Global Organic Coagulant Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Organic Coagulant Market Dynamics

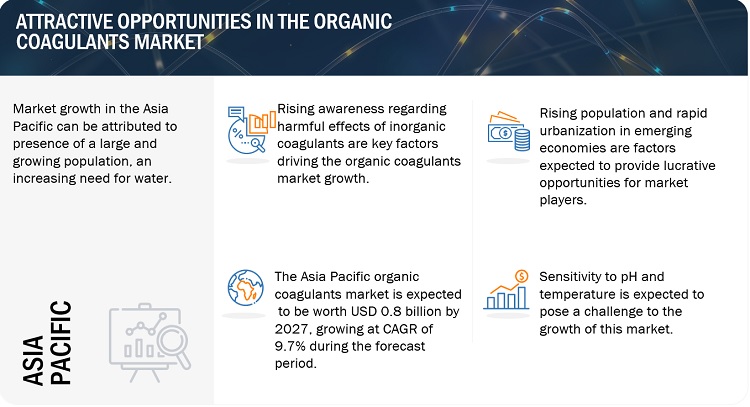

Driver: Harmful effect of inorganic coagulant

Inorganic coagulants, such as aluminum and iron salts, have been used for decades to treat drinking water and wastewater due to their effectiveness in removing impurities and contaminants from water. However, they have also been associated with several hazards and drawbacks. They have the potential to produce harmful by-products, such as trihalomethanes (THMs), when they react with organic matter in water. Limiting the development of THMs in treated water is crucial because they are considered to be carcinogenic and can pose a health risk to humans. The use of inorganic coagulants may cause heavy metals to accumulate in the treated water, which could be harmful to human health.

Restraint: Availability of alternative technologies

The advanced technologies minimize the use of organic coagulants in water treatment processes. The development of filtration and ultrafiltration technologies is displacing chemical treatment systems to a large extent. Water treatment frequently uses membrane filtration, but conventional membranes constructed of polymers derived from fossil fuels have the potential to harm the environment. In order to create the membranes for green membrane filtration, renewable and biodegradable materials including cellulose, chitin, and chitosan are used.

Opportunity: Rising population and rapid urbanization in emerging economies

The rising population in emerging economies can have a significant impact on the Organic Coagulant Industry. With the increase in population, there is a growing demand for clean water, which requires effective treatment processes to remove contaminants and impurities. Emerging economies are making significant investments in water treatment facilities and wastewater treatment plants as they continue to expand and update their infrastructure. This increased investment is likely to drive demand for organic coagulants, as they are an effective and environmentally friendly solution for water treatment.

Challenges: Sensitivity to pH and temperature

The fact that organic coagulants can be sensitive to changes in pH and temperature is the major challenge. Changes in these factors can, therefore, have a big impact on how well the organic coagulant works. They are most effective in a narrow range of pH and temperature conditions. Whereas at very high temperatures, the organic coagulant may break down or become less effective, while at very low temperatures, the coagulation process may be slowed or reduced. The pH and temperature of the water must be carefully regulated by water treatment facilities during the treatment process to ensure the coagulant's effectiveness. This can be tough and expensive, and it can be particularly difficult in conditions where the pH or temperature of the water is unpredictable or impossible to regulate.

Organic Coagulant Market Ecosystem

By application, oil & gas in industrial water treatment is projected to estimate the highest CAGR during the forecast period in the organic coagulant market

Oil & gas is a major end-user of organic coagulants. In oil & gas drilling and fracking operations, a large quantity of water is required. Many chemicals are mixed with water, and their concentrations and compositions vary with the rock formation. In onshore operations, water is normally sourced from nearby water treatment plants, while in offshore operations, seawater is used, which requires more treatment apart from the normal filtration process.

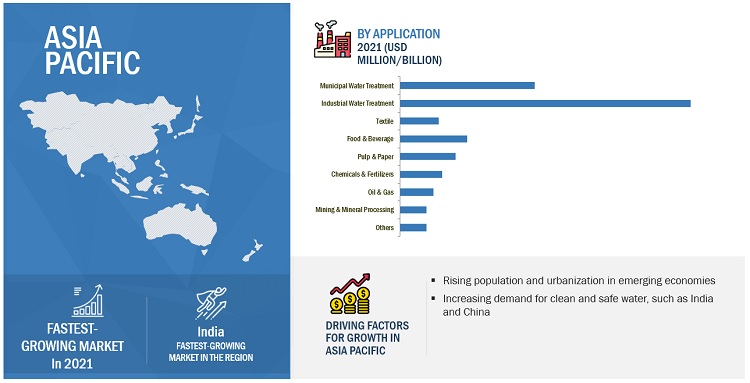

Asia Pacific is projected to be fastest growing amongst other regions in the organic coagulant market, in terms of value

The demand is mainly driven by factors such as rising demand for clean and safe water, growing population and urbanization, and stringent regulations governing water treatment and purification. It is the largest crude oil importing region, globally. The region consists of the majority of emerging economies of the world such as China, Japan, India, South Korea, Indonesia, and others, and is projected to be a leading market for organic coagulants.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in the organic coagulant market Kemira Oyj (Finland), SNF Group (France), BASF SE (Germany), Veolia (France), ECOLAB (US), Kurita Water Industries Ltd (Japan), Baker Hughes Company (US), Solenis (US), USALCO (US) and Buckman (US). The organic coagulant market report analyzes the key growth strategies, such as new product launches, investments & expansions, joint ventures, agreements, partnerships, and mergers & acquisitions adopted by the leading market players between 2019 and 2022.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2018-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (KT); Value (USD Million/Billion) |

|

Segments |

Type, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Kemira Oyj (Finland), SNF Group (France), BASF SE (Germany), Veolia (France), ECOLAB (US), Kurita Water Industries Ltd (Japan), Baker Hughes Company (US), Solenis (US), USALCO (US) and Buckman (US) are the key players in the market. |

This report categorizes the global organic coagulants market based on type, application, and region.

On the basis of type, the organic coagulant market has been segmented as follows:

- Polyamine

- PolyDADMAC

- Others

On the basis of application, the organic coagulant market has been segmented as follows:

- Municipal water treatment

-

Industrial water treatment

- Textile

- Food & beverage

- Pulp & paper

- Chemicals & fertilizers

- Oil & gas

- Mining & mineral processing

- Others

On the basis of region, the organic coagulant market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In September 2021, Kemira Ojy has opened an R&D center in Pujiang Town, Shanghai, China. This has helped the company to meet rapidly growing market demand and to develop renewable, biodegradable, and recyclable products in the Asia-Pacific.

- In November 2022, Veolia, Vision Invest, and ADQ signed an agreement with the Abu Dhabi National Oil Company Refining (ADNOC Refining) for the treatment of hazardous industrial waste. This agreement has strengthened the company's market presence in the Middle East.

- In April 2022, Kurita Water Industries Ltd has opened new research and development base in Akishima-shi, Tokyo. This has helped the company to expand its portfolio with leading-edge technologies and comprehensive solutions related to water and the environment.

Frequently Asked Questions (FAQ):

What is the current size of the global organic coagulant market?

Global organic coagulant market size is estimated to reach USD 2.9 Billion by 2027 from USD 2.0 Billion in 2022, at a CAGR of 8.1% during the forecast period.

Who are the winners in the global organic coagulant market?

Companies such as Kemira Oyj (Finland), SNF Group (France), BASF SE (Germany), Veolia (France), ECOLAB (US), Kurita Water Industries Ltd (Japan), Baker Hughes Company (US), Solenis (US), USALCO (US) and Buckman (US). They have the potential to broaden their product portfolio and compete with other key market players.

What are some of the drivers in the market?

The harmful effect of inorganic coagulant drives the market.

Which segment on the basis of application is expected to garner the highest traction within the organic coagulants market?

Based on application, industrial water treatment segment held the largest share of the organic coagulant market in 2021.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use partnerships, expansions, acquisitions, and collaborations as important growth tactics. .

What is the market for organic coagulants?

The global organic coagulant market size is projected to reach USD 2.9 billion by 2027 from USD 2.0 billion in 2022, at a CAGR of 8.1% during the forecast period. The growing demand for organic coagulants is due to declining freshwater resources, and the harmful effects of inorganic coagulants.

How big is the organic coagulant market?

Organic Coagulant Market is projected to reach USD 2.9 billion by 2027, at a CAGR of 8.1% from USD 2.0 billion in 2022.

What is an organic coagulant?

Organic coagulants are generally used for solid & liquid separation and sludge generation. Organic formulations are based on the following chemistries. PolyAMINEs and PolyDADMACs – The most widely used organic coagulants, which are cationic in nature and function by charge neutralization alone.

What is the cheapest coagulant?

The cheapest coagulant commonly used in water treatment is alum (aluminum sulfate), as it is widely available, effective, and low-cost compared to alternatives like ferric chloride or polymer-based coagulants?.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 IMPACT OF RECESSION

-

5.3 MARKET DYNAMICSDRIVERS- Stringent regulatory and sustainability mandates for protecting environment- Declining freshwater resources- Harmful effects of inorganic coagulantsRESTRAINTS- Availability of alternative technologiesOPPORTUNITIES- Rising population and rapid urbanization in emerging economiesCHALLENGES- Sensitivity to pH and temperature

-

5.4 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSORGANIC COAGULANT MANUFACTURERSDISTRIBUTORSEND-USE INDUSTRIES

-

5.5 PORTER’S FIVE FORCE ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.6 MACROECONOMIC INDICATORSGLOBAL GDP TRENDS

-

5.7 TARIFFS AND REGULATIONSREGULATIONS- North America- European Union (EU)- CHINA

-

5.8 TECHNOLOGY ANALYSISNEW TECHNOLOGIES – ORGANIC COAGULANTS

-

5.9 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEPUBLICATION TRENDS - LAST 10 YEARSINSIGHTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

5.10 RAW MATERIAL ANALYSISCHITINBROWN SEAWEEDETHYLENEDIAMINEDIALLYL DIMETHYL AMMONIUM CHLORIDE (DADMAC)

-

5.11 TRADE ANALYSISIMPORT TRADE ANALYSISEXPORT TRADE ANALYSIS

-

5.12 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY TYPEAVERAGE SELLING PRICE, BY COMPANY

-

5.13 ECOSYSTEM MAPPING

-

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15 KEY CONFERENCES & EVENTS DURING 2023–2024

-

5.16 KEY FACTORS AFFECTING BUYING DECISIONSQUALITYSERVICE

-

5.17 CASE STUDY ANALYSISMUNICIPAL WASTEWATER TREATMENT PLANT IN USINDUSTRIAL WASTEWATER TREATMENT PLANT IN US

-

6.1 INTRODUCTIONPOLYAMINEPOLYDADMACOTHER TYPES

- 7.1 INTRODUCTION

- 7.2 MUNICIPAL WATER TREATMENT

-

7.3 INDUSTRIAL WATER TREATMENTTEXTILE- Household- Fashion & clothing- Technical textilesFOOD & BEVERAGE- Food- BeveragesPULP & PAPER- Wrapping & packaging- PrintingCHEMICALS & FERTILIZERS- Chemical manufacturing- FertilizersOIL& GAS- Upstream- Midstream- DownstreamMINING & MINERAL PROCESSING- Metal processing- MiningOTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 ASIA PACIFICCHINA- Focus on water treatment industry to drive marketJAPAN- Promotion of public-private partnerships to accelerate wastewater treatmentINDIAPROVISION OF SAFE AND ADEQUATE DRINKING WATER THROUGH INDIVIDUAL HOUSEHOLD TAP CONNECTIONS TO DRIVE MARKETSOUTH KOREA- Rising need for domestic and industrial wastewater treatment to drive marketINDONESIA- Boosting access to treated water to increase demand for organic coagulantsREST OF ASIA PACIFIC

-

8.3 EUROPEGERMANY- Municipal and industrial water treatment applications to drive marketUK- Commercial, domestic, and municipal sectors to increase demand for water and wastewater treatmentFRANCE- Creation of new networks and water treatment and decontamination facilities to increase demand for organic coagulantsITALY- Stringent environmental policies and increase in tourism to propel demand for organic coagulantsSPAIN- Upgradation of water treatment utilities, revised directives and laws, and investments by foreign companies to drive marketREST OF EUROPE

-

8.4 NORTH AMERICAUS- Municipal, mining, food & beverage, and oil & gas to drive marketCANADA- Municipal, oil & gas, water utilities, food & beverage, and mining sectors to drive marketMEXICO- Significant growth of water and wastewater sector to drive market

-

8.5 MIDDLE EAST & AFRICASAUDI ARABIA- Launch of various initiatives to improve wastewater treatment services and reduce water scarcity to drive growthSOUTH AFRICA- Rising demand for freshwater due to rapid increase in industrialization and population to drive marketUAE- National water reuse policy, 2020 requiring industries to treat and reuse a certain percentage of wastewater to drive marketREST OF MIDDLE EAST & AFRICA

-

8.6 SOUTH AMERICABRAZIL- Reduced freshwater sources, adverse climate conditions, and regulatory measures to support growth of marketARGENTINA- National Water Plan to improve access to drinking water and sanitationREST OF SOUTH AMERICA

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 9.3 MARKET EVALUATION FRAMEWORK

- 9.4 REVENUE ANALYSIS

-

9.5 RANKING OF KEY PLAYERSSNF GROUPKEMIRA OYJBASF SEVEOLIAECOLAB

- 9.6 MARKET SHARE ANALYSIS

-

9.7 COMPANY EVALUATION MATRIX, TIER 1STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 9.8 STRENGTH OF PRODUCT PORTFOLIO FOR TIER 1 COMPANIES, 2022

- 9.9 BUSINESS STRATEGY EXCELLENCE FOR TIER 1 COMPANIES, 2022

-

9.10 STARTUP AND SME COMPANY EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 9.11 STRENGTH OF PRODUCT PORTFOLIO (STARTUPS AND SMES)

- 9.12 STARTUP AND SME BUSINESS STRATEGY EXCELLENCE

-

9.13 COMPETITIVE BENCHMARKINGCOMPANY TYPE FOOTPRINTCOMPANY APPLICATION FOOTPRINTCOMPANY REGION FOOTPRINTCOMPANY FOOTPRINT

-

9.14 COMPETITIVE SCENARIODEALSOTHERS

-

10.1 KEMIRA OYJBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

10.2 SNF GROUPBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

10.3 BASF SEBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

10.4 ECOLABBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

10.5 VEOLIABUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTSMNM VIEW- Right to win- Strategic choices- Weaknesses and competitive threats

-

10.6 KURITA WATER INDUSTRIES LTD.BUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS

-

10.7 BAKER HUGHES COMPANYBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFERED

-

10.8 SOLENISBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS

-

10.9 USALCOBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS

-

10.10 BUCKMANBUSINESS OVERVIEWPRODUCTS/SOLUTIONS/SERVICES OFFEREDRECENT DEVELOPMENTS

-

10.11 OTHER PLAYERSARIES CHEMICAL, INC.CINETICA QUIMICAGEO SPECIALTY CHEMICALS INC.HYDRITE CHEMICALZINKAN ENTERPRISES, INC.AMCON EUROPE S.R.O.BLACK ROSE INDUSTRIES LTD.CHEMBOND WATER TECHNOLOGIES LIMITEDAOS TREATMENT SOLUTIONS, LLCCHEMTREAT, INC.WUXI LANSEN CHEMICALS CO., LTD.AQUACHEM INDUSTRIES LLCAULICK CHEMICAL SOLUTIONS INC.CROMOGENIA UNITS S.A.DELTA CHEMICAL CORP

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS & EXCLUSIONS

- TABLE 2 STAKEHOLDERS IN VALUE CHAIN OF ORGANIC COAGULANTS

- TABLE 3 PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 TRENDS OF PER CAPITA GDP (USD), 2020–2022

- TABLE 5 GDP GROWTH ESTIMATE AND PROJECTION FOR KEY COUNTRIES, 2023–2027

- TABLE 6 LIST OF PATENTS BY SHANXI BEIQUAN ENVIRONMENTAL PROTECTION TECHNOLOGY CO., LTD.

- TABLE 7 LIST OF PATENTS BY KEMIRA OYJ

- TABLE 8 LIST OF PATENTS BY DEXERIALS CORP.

- TABLE 9 LIST OF PATENTS BY SANYO CHEMICAL IND. LTD.

- TABLE 10 TOP 10 PATENT OWNERS (US) DURING LAST 10 YEARS

- TABLE 11 REGION-WISE IMPORT TRADE (USD THOUSAND)

- TABLE 12 REGION-WISE EXPORT TRADE (USD THOUSAND)

- TABLE 13 AVERAGE SELLING PRICE, BY TYPE (USD/KG)

- TABLE 14 AVERAGE SELLING PRICE, BY COMPANY (USD/KG)

- TABLE 15 DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 16 ORGANIC COAGULANTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 17 ORGANIC COAGULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 18 ORGANIC COAGULANTS MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 19 ORGANIC COAGULANTS MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 20 ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 21 ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 22 ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 23 ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 24 ORGANIC COAGULANTS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 25 ORGANIC COAGULANTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 26 ORGANIC COAGULANTS MARKET, BY REGION, 2018–2021 (KILOTON)

- TABLE 27 ORGANIC COAGULANTS MARKET, BY REGION, 2022–2027 (KILOTON)

- TABLE 28 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 29 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 30 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 31 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 32 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 33 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 34 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 35 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 36 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 37 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 38 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 39 ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 40 CHINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 41 CHINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 42 CHINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 43 CHINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 44 JAPAN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 45 JAPAN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 46 JAPAN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 47 JAPAN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 48 INDIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 49 INDIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 50 INDIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 51 INDIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 52 SOUTH KOREA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 53 SOUTH KOREA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 54 SOUTH KOREA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 55 SOUTH KOREA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 56 INDONESIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 57 INDONESIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 58 INDONESIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 59 INDONESIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 60 REST OF ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 61 REST OF ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 63 REST OF ASIA PACIFIC: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 64 EUROPE: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 65 EUROPE: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 66 EUROPE: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 67 EUROPE: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 68 EUROPE: ORGANIC COAGULANTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 69 EUROPE: ORGANIC COAGULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 70 EUROPE: ORGANIC COAGULANTS MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 71 EUROPE: ORGANIC COAGULANTS MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 72 EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 73 EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 74 EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 75 EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 76 GERMANY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 77 GERMANY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 78 GERMANY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 79 GERMANY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 80 UK: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 81 UK: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 82 UK: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 83 UK: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 84 FRANCE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 85 FRANCE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 86 FRANCE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 87 FRANCE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 88 ITALY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 89 ITALY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 90 ITALY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 91 ITALY: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 92 SPAIN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 93 SPAIN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 94 SPAIN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 95 SPAIN: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 96 REST OF EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 97 REST OF EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 98 REST OF EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 99 REST OF EUROPE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 100 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 101 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 102 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 103 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 104 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 105 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 106 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 107 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 108 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 109 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 110 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 111 NORTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 112 US: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 113 US: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 114 US: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 115 US: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 116 CANADA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 117 CANADA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 118 CANADA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 119 CANADA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 120 MEXICO: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 121 MEXICO: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 122 MEXICO: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 123 MEXICO: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 124 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 127 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 128 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 131 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 132 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 135 MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 136 SAUDI ARABIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 137 SAUDI ARABIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 138 SAUDI ARABIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 139 SAUDI ARABIA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 140 SOUTH AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 141 SOUTH AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 142 SOUTH AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 143 SOUTH AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 144 UAE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 145 UAE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 146 UAE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 147 UAE: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 148 REST OF MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 149 REST OF MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 151 REST OF MIDDLE EAST & AFRICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 152 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 153 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 154 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2018–2021 (KILOTON)

- TABLE 155 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY COUNTRY, 2022–2027 (KILOTON)

- TABLE 156 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 157 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 158 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2018–2021 (KILOTON)

- TABLE 159 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY TYPE, 2022–2027 (KILOTON)

- TABLE 160 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 161 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 162 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 163 SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 164 BRAZIL: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 165 BRAZIL: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 166 BRAZIL: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 167 BRAZIL: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 168 ARGENTINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 169 ARGENTINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 170 ARGENTINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 171 ARGENTINA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 172 REST OF SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 173 REST OF SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 174 REST OF SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2018–2021 (KILOTON)

- TABLE 175 REST OF SOUTH AMERICA: ORGANIC COAGULANTS MARKET, BY APPLICATION, 2022–2027 (KILOTON)

- TABLE 176 MARKET EVALUATION FRAMEWORK

- TABLE 177 REVENUE ANALYSIS OF KEY COMPANIES, 2019–2021 (USD BILLION)

- TABLE 178 DEGREE OF COMPETITION

- TABLE 179 DETAILED LIST OF COMPANIES

- TABLE 180 OVERALL TYPE FOOTPRINT

- TABLE 181 OVERALL APPLICATION FOOTPRINT

- TABLE 182 OVERALL REGION FOOTPRINT

- TABLE 183 OVERALL COMPANY FOOTPRINT

- TABLE 184 DEALS, 2018–2022

- TABLE 185 OTHERS, 2018–2022

- TABLE 186 KEMIRA OYJ: COMPANY OVERVIEW

- TABLE 187 KEMIRA OYJ: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 188 KEMIRA OYJ: DEALS

- TABLE 189 KEMIRA OYJ: OTHER DEVELOPMENTS

- TABLE 190 SNF GROUP: COMPANY OVERVIEW

- TABLE 191 SNF GROUP: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 192 SNF GROUP: DEALS

- TABLE 193 SNF GROUP: OTHER DEVELOPMENTS

- TABLE 194 BASF SE: COMPANY OVERVIEW

- TABLE 195 BASF SE: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 196 BASF SE: OTHER DEVELOPMENTS

- TABLE 197 ECOLAB: COMPANY OVERVIEW

- TABLE 198 ECOLAB: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 199 ECOLAB: DEALS

- TABLE 200 ECOLAB: OTHER DEVELOPMENTS

- TABLE 201 VEOLIA: COMPANY OVERVIEW

- TABLE 202 VEOLIA: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 203 VEOLIA: DEALS

- TABLE 204 VEOLIA: OTHER DEVELOPMENTS

- TABLE 205 KURITA WATER INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 206 KURITA WATER INDUSTRIES LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 207 KURITA WATER INDUSTRIES LTD.: DEALS

- TABLE 208 KURITA WATER INDUSTRIES LTD.: OTHER DEVELOPMENTS

- TABLE 209 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- TABLE 210 BAKER HUGHES COMPANY: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 211 SOLENIS: COMPANY OVERVIEW

- TABLE 212 SOLENIS: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 213 SOLENIS: DEALS

- TABLE 214 USALCO: COMPANY OVERVIEW

- TABLE 215 USALCO: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 216 USALCO: DEALS

- TABLE 217 BUCKMAN: COMPANY OVERVIEW

- TABLE 218 BUCKMAN: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 219 BUCKMAN: OTHER DEVELOPMENTS

- TABLE 220 ARIES CHEMICAL, INC.: COMPANY OVERVIEW

- TABLE 221 CINETICA QUIMICA: COMPANY OVERVIEW

- TABLE 222 GEO SPECIALTY CHEMICALS INC: COMPANY OVERVIEW

- TABLE 223 HYDRITE CHEMICAL: COMPANY OVERVIEW

- TABLE 224 ZINKAN ENTERPRISES, INC.: COMPANY OVERVIEW

- TABLE 225 AMCON EUROPE S.R.O.: COMPANY OVERVIEW

- TABLE 226 BLACK ROSE INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 227 CHEMBOND WATER TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- TABLE 228 AOS TREATMENT SOLUTIONS, LLC: COMPANY OVERVIEW

- TABLE 229 CHEMTREAT, INC.: COMPANY OVERVIEW

- TABLE 230 WUXI LANSEN CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 231 AQUACHEM INDUSTRIES LLC: COMPANY OVERVIEW

- TABLE 232 AULICK CHEMICAL SOLUTIONS INC.: COMPANY OVERVIEW

- TABLE 233 CROMOGENIA UNITS S.A.: COMPANY OVERVIEW

- TABLE 234 DELTA CHEMICAL CORP: COMPANY OVERVIEW

- FIGURE 1 ORGANIC COAGULANTS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 POLYDADMAC SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 7 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGER SHARE OF ORGANIC COAGULANTS MARKET

- FIGURE 8 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES IN ORGANIC COAGULANTS MARKET DURING FORECAST PERIOD

- FIGURE 10 POLYAMINE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 INDUSTRIAL SEGMENT TO LEAD MARKET BY 2027

- FIGURE 12 MARKET IN INDIA TO GROW AT HIGHEST CAGR

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ORGANIC COAGULANTS MARKET

- FIGURE 14 OVERVIEW OF VALUE CHAIN OF ORGANIC COAGULANTS MARKET

- FIGURE 15 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 16 PATENTS REGISTERED (2012 TO 2022)

- FIGURE 17 NUMBER OF PATENTS DURING LAST 10 YEARS

- FIGURE 18 TOP JURISDICTIONS

- FIGURE 19 TOP APPLICANTS’ ANALYSIS

- FIGURE 20 REGION-WISE IMPORT TRADE (USD THOUSAND)

- FIGURE 21 REGION-WISE EXPORT TRADE (USD THOUSAND)

- FIGURE 22 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- FIGURE 23 ORGANIC COAGULANTS MARKET ECOSYSTEM

- FIGURE 24 NATURE-BASED ORGANIC COAGULANTS TO DRIVE GROWTH

- FIGURE 25 SUPPLIER SELECTION CRITERIA

- FIGURE 26 POLYDADMAC SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 27 ORGANIC COAGULANTS MARKET SEGMENTATION, BY APPLICATION

- FIGURE 28 INDIA TO BE FASTEST-GROWING ORGANIC COAGULANTS MARKET BETWEEN 2022 & 2027

- FIGURE 29 ASIA PACIFIC: ORGANIC COAGULANTS MARKET SNAPSHOT

- FIGURE 30 EUROPE: ORGANIC COAGULANTS MARKET SNAPSHOT

- FIGURE 31 NORTH AMERICA: ORGANIC COAGULANTS MARKET SNAPSHOT

- FIGURE 32 COMPANIES ADOPTED INVESTMENTS & EXPANSIONS AND PRODUCT DEVELOPMENTS AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2022

- FIGURE 33 RANKING OF TOP FIVE PLAYERS IN ORGANIC COAGULANTS MARKET

- FIGURE 34 ORGANIC COAGULANTS MARKET SHARE, BY COMPANY, 2022

- FIGURE 35 COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2022

- FIGURE 36 COMPANY EVALUATION MATRIX FOR STARTUPS AND SMES, 2022

- FIGURE 37 KEMIRA OYJ: COMPANY SNAPSHOT

- FIGURE 38 SNF GROUP: COMPANY SNAPSHOT

- FIGURE 39 BASF SE: COMPANY SNAPSHOT

- FIGURE 40 ECOLAB: COMPANY SNAPSHOT

- FIGURE 41 VEOLIA: COMPANY SNAPSHOT

- FIGURE 42 KURITA WATER INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 43 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the organic coagulant market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The Organic Coagulant Industry comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the organic coagulant market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the organic coagulant industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, raw material, type, end-use industries, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of organic coagulant and future outlook of their business which will affect the overall market.

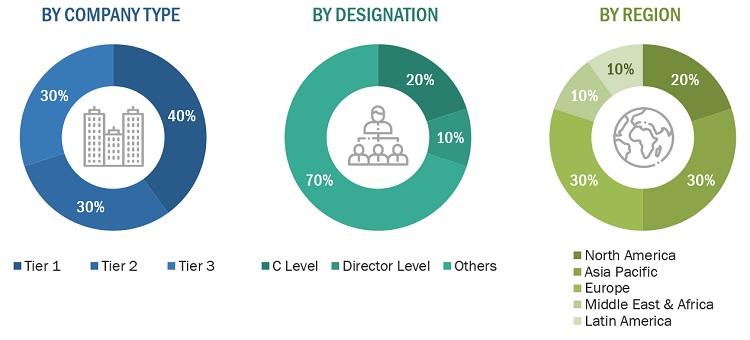

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

BASF SE |

Sales Director |

|

Ecolab |

Sales Manager |

|

Kemira Oyj |

Director |

|

Huntsman Corporation |

Marketing Manager |

|

Wanhua |

R&D Manager |

|

|

|

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the organic coagulant market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

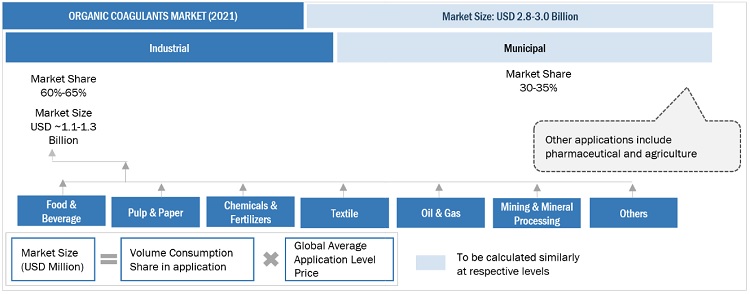

Organic Coagulant Market: Bottum-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Organic Coagulant Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Organic coagulants are liquid chemicals with high coagulating efficiency to their polymer structures and the strength of cationic charges. These coagulants can be used to remove a wide variety of hazardous materials from water, ranging from organic matter and pathogens to inorganics and toxic materials such as arsenic, phosphorus, and fluoride

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the organic coagulants market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on type, application, and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Organic Coagulant Market