Optical Waveguide Market Size, Share, Trends, Statistics, Industry Growth Analysis Report by Type (Planar, Channel), Material (Glass, Polymer, Semiconductor), Propagation (Single-mode, Multi-mode), Refractive Index (Step-index, Graded-index), Interconnect Level, End-user Industry and Region – Global Forecast to 2028

Updated on : October 22, 2024

Optical Waveguide Market Size & Growth

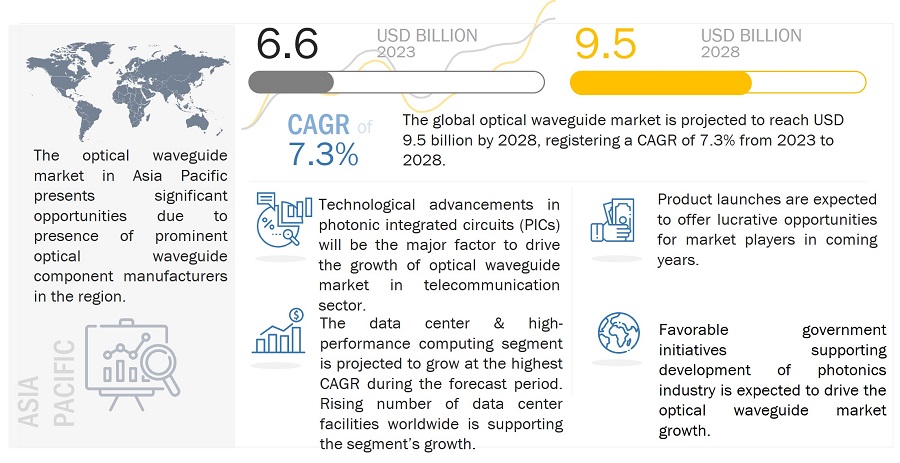

Global Optical Waveguide Market size is expected to reach USD 9.5 billion by 2028 from USD 6.6 billion in 2023; it Growing at a Compound Annual Growth Rate (CAGR) of 7.3% from 2023 to 2028.

Rising number of data centers worldwide, technological advancements in photonic integrated circuits (PICs), and surging demand for high bandwidth are the factors driving the growth of the optical waveguide industry.

Optical Waveguide Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Optical Waveguide Market Growth Dynamics

Driver : Technological advancements in photonic integrated circuits (PICs)

A photonic integrated circuit (PIC) is a chip that contains photonic components, which works on the principle of data transmission through photons or light. In PICs, photons travel through optical components such as waveguides, polarizers, and phase shifters, which are equivalent to resistors, transistors, capacitors, and electrical wires. PICs offer high-end features such as miniature footprints, low-loss transmission, large bandwidth, freedom from electric short circuits, and immunity from electromagnetic interference (EMI). These PICs are witnessing high adoption among emerging use cases such as data center interconnect (DCI), telecommunication, high-performance computing (HPC), and optical computing. Several companies are emphasizing developing technically advanced PIC solutions to cater to emerging use cases in the market. For instance, in December 2022, OpenLight (US) developed a new 800G DR8 photonic integrated circuit (PIC), which is targeted for data center interconnect (DCI) applications. The newly developed PIC is fully validated for applications in transceivers for DCI applications. Such technological advancements will amplify the growth of optical waveguide market.

Restraint: Issues associated with designing and fabricating optical waveguides

The major factor restraining the adoption of optical waveguides is issues faced in the design and fabrication process. The designing of optical waveguides requires expertise in physics and engineering as they are designed to meet unique requirements and mainly rely on a specific set of waveguide transmission protocols. The optical waveguides are fragile, expensive, and prone to transmission losses. They are tested and manufactured with the help of customized equipment and require significant capital investment. Also, due to the miniaturized footprint, there are several challenges to integrating optical waveguides into microchips and integrated circuits (ICs). The requirements like miniaturization and ruggedness for such components without compromising performance characteristics lead to additional design and fabrication expenses. Thus, the high cost and time required for manufacturing and deploying the optical waveguides prove to be a restraint in the optical waveguide market growth.

Opportunity : Rising investments in augmented/mixed reality (AR/MR) market

Investments in the augmented/mixed reality (AR/MR) market have witnessed massive growth over the past few years. Companies such as Intel Corporation (US), Meta Platforms, Inc. (US), Qualcomm, Inc. (US), Alphabet, Inc. (US), and Samsung Electronics Co., Ltd (South Korea) are heavily investing in AR/MR market. These players are extensively investing in the development of near-eye devices (NEDs) such as smart glasses and head-up displays. In near-eye devices (NEDs), the optical waveguides help bend and combine light to direct it into the eye and create virtual images, which can be observed by the wearer and are overlaid onto the environment. They propagate a light field via the mechanism of total internal reflection, bouncing light between the inner and outer edges of the waveguide layer with minimal light leakage.

Private firms are funding several research institutes, and venture capitalists and governments are funding some. Industries such as enterprise, retail, healthcare, military & defense, industrial, and consumer electronics are embracing the benefits of augmented/mixed reality (AR/MR) technologies. Enterprises are emphasizing implementing inorganic growth strategies such as partnerships and collaborations to develop AR/MR technologies. For instance, in October 2022, Dispelix Oy (Finland), ColorChip (Israel), and Maradin (Israel) announced a partnership to further advance Laser Beam Scanning (LBS) solutions for AR glasses. The collaboration integrates Dispelix diffractive waveguide displays, Color Chip PLC (Planar Light Circuit) beam combiner, and Maradin MEMS projection technology for Laser Beam Scanning (LBS).

Challenge: Challenges associated while embedding optical waveguide components into small circuits

Challenges associated while embedding optical waveguide components into small circuits are expected to impact the market growth. Implanting different waveguide components into nanometer (nm) sized integrated circuits is a critical task. Also, due to the thermal effect, it is a big challenge to embed these components at a nanometer scale. Optical/photonic devices are susceptible to waveguide dimensions, requiring nanometer-scale control over a full wafer and having a considerable variation in a refractive index. It is possible to overcome this challenge with active tuning and temperature control, but this can severely impact the power consumption of the optical links. Thus, embedding waveguide components into smaller circuits pose a major challenge to the growth of the optical waveguide market.

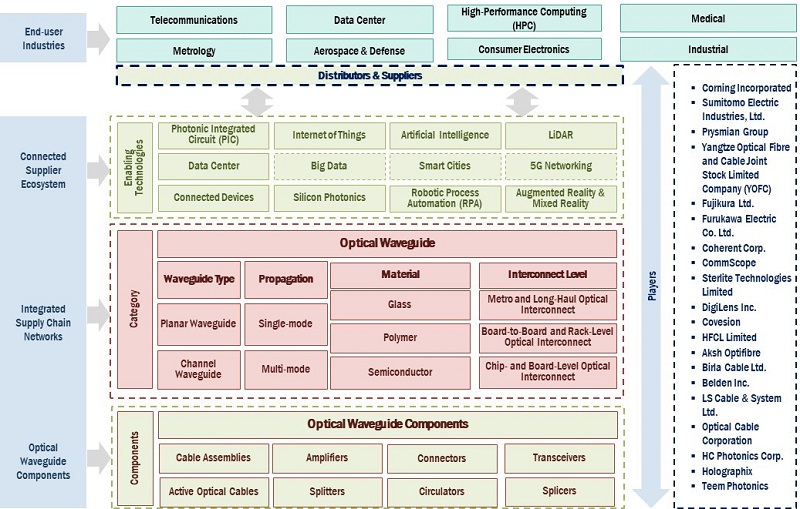

Optical Waveguide Ecosystem

Optical Waveguide Market Key Trends :

The optical waveguide market is experiencing robust growth, driven by key optical waveguide market trends such as the increasing demand for high-speed data transmission and advancements in telecommunications infrastructure. Recent trends highlight a surge in the adoption of optical waveguides in data centers, 5G networks, and consumer electronics, propelled by their superior bandwidth and efficiency over traditional copper cables. Innovations in materials and fabrication techniques are further enhancing the performance and integration of optical waveguides in various applications. Additionally, the push towards miniaturization and higher density interconnects is fostering the development of compact and flexible optical waveguide solutions, aligning with the evolving needs of modern technology ecosystems.

Optical Waveguide Market Share:

The optical waveguide market analysis also underscores the importance of continuous innovation and adaptation to emerging technological trends. As the demand for high-speed data communication grows, manufacturers are focusing on developing advanced optical waveguide solutions that offer superior performance and integration capabilities. The rise of smart cities, autonomous vehicles, and advanced healthcare applications are creating new opportunities for optical waveguides. However, manufacturers must navigate challenges such as supply chain disruptions and competitive pressures from alternative technologies like wireless communication and traditional copper cables. By addressing these challenges and leveraging technological advancements, the optical waveguide market is well-positioned for sustained growth and innovation.

Optical Waveguide Market Segmentation :

Channel waveguide segment to dominate market during the forecast period.

The channel waveguide segment is expected to lead the market during the forecast period. The segment’s growth can be attributed to its two-way transverse optical confinement property that delivers better speed and bandwidth. The channel waveguide components, such as active optical cables, optical fibers, and fiber cables, can be bent or curved as per the requirement to change the direction of the guided wave or to give a lateral shift. The rapid adoption of access technologies such as Fiber to the Home/ Fiber to the Building (FTTH/FTTB) will drive the ubiquitous deployment of fiber-rich networks, supporting the channel waveguide market growth during the forecast period.

The glass segment is expected to hold high market share from 2022 to 2028.

The glass segment is expected to hold high market share during the forecast period. The optical waveguides made up of glass material have a higher numerical aperture than those of polymers. The glass material allows more light rays to pass into the system and transfer through a large spectrum, ranging from 200–2,200 nm. The glass-based optical waveguides can withstand corrosive chemicals and extreme temperatures and operate in challenging environments. Their ability to transmit both visible and infrared lights, along with their increasing uptake in augmented reality and mixed reality solutions, are some of the major factors for the growth of this segment.

The single-mode propagation segment to grow at high CAGR during the forecast period

The single-mode segment is projected to be a fast-growing propagation segment during the forecast period. The growth of this segment can be attributed to the high adoption rate of single-mode optical waveguides for long-distance telecom networking applications. Single-mode waveguide components have a much smaller core size of about 9 µm compared to a multi-mode waveguide with a core size of 50 µm or above. Single-mode waveguides can carry signals at a much greater speed and over longer distances than multi-mode waveguides. The increasing developments in 5G network infrastructure, the rising prevalence of optical networks, and the growing adoption of 5G connectivity worldwide are expected to fuel the growth of the single-mode optical waveguide market size during the forecast period.

The board-to-board and rack-level optical interconnect segment held high market share in 2022

The board-to-board and rack-level optical interconnect segment held high market share in 2022. The market growth is credited to the increasing adoption of optical interconnect waveguide solutions for data communication applications in cloud computing, high-performance computing, and data centers. Adding to this, the growing adoption of IoT, machine learning, and big data has also contributed significantly to the increased demand for high-performance computing applications and data centers. This is expected to fuel the market growth for the board-to-board and rack-level optical interconnects segment over the forecast period.

Market for telecommunication segment to hold the largest share throughout the forecast period

The telecommunication accounted for a high market share, in terms of value, in 2022. The segment’s growth is driven by the growing number of subscribers for various fixed-point and wireless communication devices, the availability of inexpensive communication devices, low-cost services offered by telecom service providers, and an increasing Internet user base across the globe. According to July 2022 statistics by the International Telecommunication Union (ITU), around 5.9 billion individuals, i.e., 66% of the world’s total population, were using internet services in 2022. Over 1.1 billion individuals were estimated to have come online from 2019 to 2022, with a 24% increase during this period. Also, the increasing deployment of 5G networks worldwide has led to the adoption of optical waveguide components as it helps to interconnect 5G base stations to achieve high-speed data transmission. These factors are driving the demand for optical waveguide solutions in the telecommunication industry.

Optical Waveguide Market Regional Analysis :

Optical waveguide market in Asia Pacific to grow at highest CAGR during the forecast period

The Asia Pacific optical waveguide market share is expected to grow at the highest CAGR during the forecast period. The market growth is driven by favorable government initiatives to support the growth of the photonics and semiconductor industries in the region. For instance, in December 2022, the Chinese government announced to roll out USD 143 billion financial incentive package for the next five years, i.e., by 2027. This financial incentive will provide tax credits and subsidies to boost the region’s research and production of semiconductors and photonics. Similarly, in September 2022, the Government of India announced financial support of 50% CAPEX for the companies setting up silicon photonics, display, and semiconductor fabrication units in the country. Such supportive government initiatives will amplify the growth of the optical waveguide market during the forecast period.

Optical Waveguide Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Optical Waveguide Companies - Key Market Players:

The optical waveguide companies such as

- Corning Incorporated (US),

- Sumitomo Electric Industries, Ltd. (Japan),

- Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC) (China),

- Fujikura Ltd. (Japan),

- Prysmian Group (Italy),

- Furukawa Electric Co., Ltd. (Japan),

- Coherent Corp. (US),

- CommScope (US),

- Sterlite Technologies Limited (India), and

- DigiLens Inc. (US).

Optical Waveguide Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 6.6 Billion |

| Projected Market Size | USD 9.5 Billion |

| Growth Rate | 7.3% CAGR |

|

Optical waveguide market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Companies covered |

The major market players include Corning Incorporated (US), Sumitomo Electric Industries, Ltd. (Japan), Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC) (China), Fujikura Ltd. (Japan), Prysmian Group (Italy), Furukawa Electric Co., Ltd. (Japan), Coherent Corp. (US), CommScope (US), Sterlite Technologies Limited (India), DigiLens Inc. (US), and Others- total 27 players have been covered |

Optical Waveguide Market Size & Highlights

This research report categorizes the optical waveguide market based on type, trends, material, propagation, refractive index, interconnect level, end-user industry, and region.

|

Aspect |

Details |

|

Optical Waveguide Market Size, By Type : |

|

|

By Material : |

|

|

By Propagation : |

|

|

Optical waveguide market size, By Refractive Index : |

|

|

By Interconnect Level : |

|

|

Optical Waveguide Market Size, By End-user Industry : |

|

|

By Region: |

|

Recent Developments in Optical Waveguide Industry :

- In March 2022, Sumitomo Electric Industries, Ltd. (Japan) launched a new Z2C fusion splicer featuring its proprietary NanoTune AI (artificial intelligence) programmed fusion technology. Launching the new splicer will help its users significantly improve work efficiency at optical network construction sites.

- In January 2022, Corning Incorporated (US) launched new glass composition to advance the development of augmented and mixed reality (AR/MR) diffractive waveguides for wearable devices. The new 2.0 high-index glass allows users to see more through AR wearables by creating larger, clearer images paired with lighter, sleeker device designs. The new product launch will help the company to accelerate the mass adoption of augmented reality (AR) technology.

- In January 2022, DigiLens Inc. (US) launched the next iteration of its near-to-eye optical technology, the Crystal30 waveguide, built using DigiLens’ Volume Bragg Gratings (VBG) class of technology and has a measured efficiency rating of over 500 nits per lumen (n/L). This makes the new Crystal30 waveguide the most efficient diffractive waveguide and enables DigiLens partners to create XR experiences that are compatible in indoor and outdoor bright environments.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the optical waveguide market during 2023-2028?

The global optical waveguide market is expected to record the CAGR of 7.3% from 2023-2028.

Which regions are expected to pose significant demand for optical waveguides from 2023-2028?

Asia Pacific is expected to pose significant demand from 2023 to 2028. Major economies such as China, India, Japan and South Korea are expected to have a high potential for the future growth of the market.

What are the major driving factors and opportunities in the optical waveguide market?

Rising number of data centers worldwide, technological advancements in photonic integrated circuits (PICs), and surging demand for high bandwidth are the factors driving the growth of the optical waveguide market. Growing deployment of 5G telecommunication networks, and rising investments in augmented/mixed reality (AR/MR) market are projected to create lucrative opportunities for the players operating in the optical waveguide market during the forecast period.

Which are the significant players operating in optical waveguide market?

Key players operating in the optical waveguide market are Corning Incorporated (US), Sumitomo Electric Industries, Ltd. (Japan), Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC) (China), Fujikura Ltd. (Japan), Prysmian Group (Italy), Furukawa Electric Co., Ltd. (Japan), Coherent Corp. (US), CommScope (US), Sterlite Technologies Limited (India), and DigiLens Inc. (US).

Which are the major end-user industries of the optical waveguide market?

Telecommunication, data center & high-performance computing (HPC), medical, metrology, aerospace & defense, consumer electronics, and industrial are the major end-user industries of the optical waveguide market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising number of data centers worldwide- Technological advancements in photonic integrated circuits (PICs)- Surging demand for high bandwidthRESTRAINTS- Issues associated with designing and fabricating optical waveguidesOPPORTUNITIES- Growing deployment of 5G telecommunication networks- Rising investments in augmented/mixed reality (AR/MR) marketCHALLENGES- Challenges associated while embedding optical waveguide components into small circuits

-

5.3 TECHNOLOGY ANALYSISOPTICAL WAVEGUIDE FABRICATION PROCESSES- Lithography- Microreplication- Photo-addressed method

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM ANALYSIS

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.7 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

- 5.8 AVERAGE SELLING PRICE (ASP) ANALYSIS

-

5.9 CASE STUDY ANALYSISAIM PHOTONICS AND SPARK PHOTONICS TEAMED UP TO DEVELOP HANDS-ON EDUCATIONAL PHOTONIC INTEGRATED CIRCUIT (PIC) CHIPALMA TELECOM UPGRADED ITS NETWORK USING FTTP SOLUTION OFFERED BY CORNING INCORPORATEDCOMMSCOPE HELPED E-FIBER COMMERCIALIZE FTTX NETWORKS IN NETHERLANDS

- 5.10 TRADE ANALYSIS

-

5.11 PATENT ANALYSISPATENT ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

- 5.13 TARIFF ANALYSIS

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY STANDARDS- International Organization for Standardization (ISO)/International Electrotechnical Commission (IEC)- International Telecommunication Union (ITU) StandardsGOVERNMENT REGULATIONS- US- Europe- China- India

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 PLANAR WAVEGUIDERISING DEMAND FOR OPTICAL TRANSCEIVERS IN DATA CENTERS

-

6.3 CHANNEL WAVEGUIDEGROWING USE OF CHANNEL WAVEGUIDES TO MEET LONG-DISTANCE AND HIGH-BANDWIDTH REQUIREMENTS

- 6.4 UNIT SHIPMENTS OF OPTICAL WAVEGUIDE-BASED COMPONENTS

- 7.1 INTRODUCTION

-

7.2 GLASSGLASS-BASED OPTICAL WAVEGUIDES DELIVER HIGH PERFORMANCE IN EXTREME CONDITIONS

-

7.3 POLYMERPOLYMER-BASED OPTICAL WAVEGUIDES OFFER HIGH FLEXIBILITY

-

7.4 SEMICONDUCTORSEMICONDUCTOR-BASED OPTICAL WAVEGUIDES USED IN PHOTONIC INTEGRATED CIRCUITS (PICS)

- 8.1 INTRODUCTION

-

8.2 SINGLE-MODEGROWING PREFERENCE FOR OPTICAL WAVEGUIDES WITH SINGLE-MODE PROPAGATION AMONG TELECOMMUNICATION COMPANIES

-

8.3 MULTI-MODEGROWING DEMAND FOR UNLIMITED BANDWIDTH CAPACITY

- 9.1 INTRODUCTION

-

9.2 STEP-INDEXRISING USE OF STEP-INDEX IN SHORT-DISTANCE APPLICATIONS

-

9.3 GRADED-INDEXRISING USE OF GRADED-INDEX FOR LOW ATTENUATION AND HIGHER BANDWIDTH SIGNAL TRANSMISSION

- 10.1 INTRODUCTION

-

10.2 METRO AND LONG-HAUL OPTICAL INTERCONNECTRISING ADOPTION OF METRO AND LONG-HAUL OPTICAL INTERCONNECTS IN TELECOMMUNICATION NETWORKS

-

10.3 BOARD-TO-BOARD AND RACK-LEVEL OPTICAL INTERCONNECTINCREASING DEMAND FOR BOARD-TO-BOARD AND RACK-LEVEL OPTICAL INTERCONNECTIONS FOR FAST AND ENERGY-EFFICIENT SYSTEMS

-

10.4 CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECTSURGING USE OF CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECTIONS IN DATA CENTERS

- 11.1 INTRODUCTION

-

11.2 TELECOMMUNICATIONSCOST EFFICIENCY, HIGHER BANDWIDTH, AND HIGHER SPEED THAN COPPER WAVEGUIDES

-

11.3 DATA CENTER & HIGH-PERFORMANCE COMPUTING (HPC)GROWING USE OF OPTICAL WAVEGUIDES FOR HIGH-SPEED DATA TRANSMISSION

-

11.4 MEDICALRISE IN BIO-COMPATIBLE OPTICAL WAVEGUIDES IN PHOTO MEDICAL APPLICATIONS

-

11.5 METROLOGYRISING ADOPTION OF OPTICAL WAVEGUIDE-BASED INSPECTION DEVICES

-

11.6 AEROSPACE & DEFENSEINCREASING MILITARY BUDGETS WORLDWIDE

-

11.7 CONSUMER ELECTRONICSADVANCEMENTS IN AUGMENTED REALITY/MIXED REALITY (AR/MR) TECHNOLOGIES

-

11.8 INDUSTRIALRISING ADOPTION OF OPTICAL WAVEGUIDE-BASED SENSORS IN INDUSTRIAL SENSING APPLICATIONS

- 11.9 OTHERS

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Rising investments in development of telecommunication and data center infrastructuresCANADA- Growing demand for high-speed networkingMEXICO- Increasing internet penetration

-

12.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Strengthening of FTTH network under “Gigabit Strategy”UK- Presence of large-scale telecommunication service providersFRANCE- Increasing investments in deployment of submarine fiber networkREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Increasing investments by Chinese telecommunication operators in deployment of 5G infrastructureINDIA- Government-led initiatives to increase broadband connectivity across rural areasJAPAN- Presence of prominent optical waveguide component manufacturersSOUTH KOREA- Proliferation of data centersREST OF ASIA PACIFIC

-

12.5 ROWROW: RECESSION IMPACTMIDDLE EAST & AFRICA- Increasing data center establishmentsSOUTH AMERICA- Rising investments in deployment of subsea communication cables

-

13.1 OVERVIEWOVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR COMPANIES

- 13.2 REVENUE ANALYSIS

- 13.3 MARKET SHARE ANALYSIS (2022)

-

13.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.5 STARTUP/ SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.6 COMPETITIVE BENCHMARKING

- 13.7 OPTICAL WAVEGUIDE MARKET: COMPANY FOOTPRINT

-

13.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

-

14.1 KEY PLAYERSCORNING INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSUMITOMO ELECTRIC INDUSTRIES, LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewYANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY (YOFC)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFUJIKURA LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPRYSMIAN GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFURUKAWA ELECTRIC CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsCOHERENT CORP. (FORMER II-VI INCORPORATED)- Business overview- Products/Solutions/Services offered- Recent developmentsCOMMSCOPE HOLDING COMPANY, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsSTERLITE TECHNOLOGIES LIMITED- Business overview- Products/Solutions/Services offered- Recent developmentsDIGILENS INC.- Business overview- Products/Solutions/Services offered- Recent developments

-

14.2 OTHER PLAYERSCOVESION LTD.HFCLQUINSTAR TECHNOLOGY, INC.AKSH OPTIFIBREART PHOTONICS GMBHRPG CABLES (DIVISION OF KEC INTERNATIONAL LIMITED)MITSUBISHI CHEMICAL GROUP CORPORATIONASAHI KASEI CORPORATIONBIRLA CABLE LTD.ORBIS OYAUXORA (SHENZHEN), INC.BELDEN INC.LS CABLE & SYSTEM LTD.OPTICAL CABLE CORPORATIONHC PHOTONICS CORP.HOLOGRAPHIX LLCTEEM PHOTONICS

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT

- TABLE 2 OPTICAL WAVEGUIDE ECOSYSTEM: COMPANIES AND THEIR ROLE

- TABLE 3 OPTICAL WAVEGUIDE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 AVERAGE SELLING PRICE OF OPTICAL WAVEGUIDE COMPONENTS

- TABLE 5 AVERAGE SELLING PRICE OF OPTICAL FIBERS OFFERED BY MAJOR MARKET PLAYERS TO TOP THREE END-USER INDUSTRIES

- TABLE 6 AVERAGE SELLING PRICE OF OPTICAL TRANSCEIVERS BASED ON DATA RATES

- TABLE 7 LIST OF TOP PATENT OWNERS IN LAST 10 YEARS

- TABLE 8 LIST OF MAJOR PATENTS PERTAINING TO OPTICAL WAVEGUIDE MARKET

- TABLE 9 OPTICAL WAVEGUIDE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 10 MFN TARIFF FOR HS CODE 900110 EXPORTED BY US

- TABLE 11 MFN TARIFF FOR HS CODE 900110 EXPORTED BY CHINA

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES (%)

- TABLE 17 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

- TABLE 18 OPTICAL WAVEGUIDE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 19 OPTICAL WAVEGUIDE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 20 PLANAR WAVEGUIDE: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 21 PLANAR WAVEGUIDE: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 CHANNEL WAVEGUIDE: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 CHANNEL WAVEGUIDE: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 OPTICAL WAVEGUIDE COMPONENT MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 25 OPTICAL WAVEGUIDE COMPONENT MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 26 OPTICAL FIBER MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 27 OPTICAL FIBER MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 28 OPTICAL FIBER MARKET, BY TYPE, 2019–2022 (MILLION FIBER KILOMETER)

- TABLE 29 OPTICAL FIBER MARKET, BY TYPE, 2023–2028 (MILLION FIBER KILOMETER)

- TABLE 30 OPTICAL WAVEGUIDE COMPONENT MARKET, BY TYPE, 2019–2022 (MILLION UNITS)

- TABLE 31 OPTICAL WAVEGUIDE COMPONENT MARKET, BY TYPE, 2023–2028 (MILLION UNITS)

- TABLE 32 OPTICAL WAVEGUIDE MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 33 OPTICAL WAVEGUIDE MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 34 GLASS: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 35 GLASS: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 POLYMER: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 POLYMER: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 SEMICONDUCTOR: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 SEMICONDUCTOR: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 OPTICAL WAVEGUIDE MARKET, BY PROPAGATION, 2019–2022 (USD MILLION)

- TABLE 41 OPTICAL WAVEGUIDE MARKET, BY PROPAGATION, 2023–2028 (USD MILLION)

- TABLE 42 SINGLE-MODE: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 SINGLE-MODE: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 MULTI-MODE: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 MULTI-MODE: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 OPTICAL WAVEGUIDE MARKET, BY INTERCONNECT LEVEL, 2019–2022 (USD MILLION)

- TABLE 47 OPTICAL WAVEGUIDE MARKET, BY INTERCONNECT LEVEL, 2023–2028 (USD MILLION)

- TABLE 48 METRO AND LONG-HAUL OPTICAL INTERCONNECT: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 METRO AND LONG-HAUL OPTICAL INTERCONNECT: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 BOARD-TO-BOARD AND RACK-LEVEL OPTICAL INTERCONNECT: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 BOARD-TO-BOARD AND RACK-LEVEL OPTICAL INTERCONNECT: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECT: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECT: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 OPTICAL WAVEGUIDE MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 55 OPTICAL WAVEGUIDE MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 56 TELECOMMUNICATIONS: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 TELECOMMUNICATIONS: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 DATA CENTER & HIGH-PERFORMANCE COMPUTING (HPC): OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 DATA CENTER & HIGH-PERFORMANCE COMPUTING (HPC): OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 MEDICAL: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 MEDICAL: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 METROLOGY: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 METROLOGY: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 AEROSPACE & DEFENSE: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 AEROSPACE & DEFENSE: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 CONSUMER ELECTRONICS: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 CONSUMER ELECTRONICS: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 INDUSTRIAL: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 INDUSTRIAL: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 OTHERS: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 OTHERS: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: OPTICAL WAVEGUIDE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: OPTICAL WAVEGUIDE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: OPTICAL WAVEGUIDE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: OPTICAL WAVEGUIDE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: OPTICAL WAVEGUIDE MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: OPTICAL WAVEGUIDE MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: OPTICAL WAVEGUIDE MARKET, BY PROPAGATION, 2019–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: OPTICAL WAVEGUIDE MARKET, BY PROPAGATION, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: OPTICAL WAVEGUIDE MARKET, BY INTERCONNECT LEVEL, 2019–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: OPTICAL WAVEGUIDE MARKET, BY INTERCONNECT LEVEL, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: OPTICAL WAVEGUIDE MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: OPTICAL WAVEGUIDE MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: OPTICAL WAVEGUIDE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 87 EUROPE: OPTICAL WAVEGUIDE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: OPTICAL WAVEGUIDE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 89 EUROPE: OPTICAL WAVEGUIDE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: OPTICAL WAVEGUIDE MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 91 EUROPE: OPTICAL WAVEGUIDE MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: OPTICAL WAVEGUIDE MARKET, BY PROPAGATION, 2019–2022 (USD MILLION)

- TABLE 93 EUROPE: OPTICAL WAVEGUIDE MARKET, BY PROPAGATION, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: OPTICAL WAVEGUIDE MARKET, BY INTERCONNECT LEVEL, 2019–2022 (USD MILLION)

- TABLE 95 EUROPE: OPTICAL WAVEGUIDE MARKET, BY INTERCONNECT LEVEL, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: OPTICAL WAVEGUIDE MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 97 EUROPE: OPTICAL WAVEGUIDE MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: OPTICAL WAVEGUIDE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 99 ASIA PACIFIC: OPTICAL WAVEGUIDE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: OPTICAL WAVEGUIDE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: OPTICAL WAVEGUIDE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: OPTICAL WAVEGUIDE MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: OPTICAL WAVEGUIDE MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: OPTICAL WAVEGUIDE MARKET, BY PROPAGATION, 2019–2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: OPTICAL WAVEGUIDE MARKET, BY PROPAGATION, 2023–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: OPTICAL WAVEGUIDE MARKET, BY INTERCONNECT LEVEL, 2019–2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: OPTICAL WAVEGUIDE MARKET, BY INTERCONNECT LEVEL, 2023–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: OPTICAL WAVEGUIDE MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: OPTICAL WAVEGUIDE MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 110 ROW: OPTICAL WAVEGUIDE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 111 ROW: OPTICAL WAVEGUIDE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 112 ROW: OPTICAL WAVEGUIDE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 113 ROW: OPTICAL WAVEGUIDE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 114 ROW: OPTICAL WAVEGUIDE MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 115 ROW: OPTICAL WAVEGUIDE MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 116 ROW: OPTICAL WAVEGUIDE MARKET, BY PROPAGATION, 2019–2022 (USD MILLION)

- TABLE 117 ROW: OPTICAL WAVEGUIDE MARKET, BY PROPAGATION, 2023–2028 (USD MILLION)

- TABLE 118 ROW: OPTICAL WAVEGUIDE MARKET, BY INTERCONNECT LEVEL, 2019–2022 (USD MILLION)

- TABLE 119 ROW: OPTICAL WAVEGUIDE MARKET, BY INTERCONNECT LEVEL, 2023–2028 (USD MILLION)

- TABLE 120 ROW: OPTICAL WAVEGUIDE MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 121 ROW: OPTICAL WAVEGUIDE MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 122 OVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR COMPANIES

- TABLE 123 OPTICAL WAVEGUIDE MARKET: DEGREE OF COMPETITION

- TABLE 124 OPTICAL WAVEGUIDE MARKET: STARTUPS

- TABLE 125 STARTUP/SME MATRIX: DETAILED LIST OF KEY STARTUPS

- TABLE 126 OPTICAL WAVEGUIDE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SME

- TABLE 127 COMPANY FOOTPRINT

- TABLE 128 COMPANY TYPE FOOTPRINT

- TABLE 129 COMPANY MATERIAL FOOTPRINT

- TABLE 130 COMPANY PROPAGATION FOOTPRINT

- TABLE 131 COMPANY INTERCONNECT LEVEL FOOTPRINT

- TABLE 132 COMPANY END-USER INDUSTRY FOOTPRINT

- TABLE 133 COMPANY REGIONAL FOOTPRINT

- TABLE 134 PRODUCT LAUNCHES, 2019–2022

- TABLE 135 DEALS, 2019–2022

- TABLE 136 CORNING INCORPORATED: COMPANY OVERVIEW

- TABLE 137 CORNING INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 CORNING INCORPORATED: DEALS

- TABLE 139 CORNING INCORPORATED: PRODUCT LAUNCHES

- TABLE 140 CORNING INCORPORATED: OTHERS

- TABLE 141 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 142 SUMITOMO ELECTRIC INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 SUMITOMO ELECTRIC INDUSTRIES, LTD.: DEALS

- TABLE 144 SUMITOMO ELECTRIC INDUSTRIES, LTD.: PRODUCT LAUNCHES

- TABLE 145 YANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY (YOFC): COMPANY OVERVIEW

- TABLE 146 YANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY (YOFC): PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 147 YANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY (YOFC): DEALS

- TABLE 148 YANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY (YOFC): PRODUCT LAUNCHES

- TABLE 149 YANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY (YOFC): OTHERS

- TABLE 150 FUJIKURA LTD.: COMPANY OVERVIEW

- TABLE 151 FUJIKURA LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 152 FUJIKURA LTD.: DEALS

- TABLE 153 FUJIKURA LTD.: PRODUCT LAUNCHES

- TABLE 154 FUJIKURA LTD.: OTHERS

- TABLE 155 PRYSMIAN GROUP: COMPANY OVERVIEW

- TABLE 156 PRYSMIAN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 PRYSMIAN GROUP: DEALS

- TABLE 158 PRYSMIAN GROUP: PRODUCT LAUNCHES

- TABLE 159 PRYSMIAN GROUP: OTHERS

- TABLE 160 FURUKAWA ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 161 FURUKAWA ELECTRIC CO., LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 162 FURUKAWA ELECTRIC CO., LTD.: DEALS

- TABLE 163 FURUKAWA ELECTRIC CO., LTD.: PRODUCT LAUNCHES

- TABLE 164 FURUKAWA ELECTRIC CO., LTD.: OTHERS

- TABLE 165 COHERENT CORP.: COMPANY OVERVIEW

- TABLE 166 COHERENT CORP.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 167 COHERENT CORP.: DEALS

- TABLE 168 COHERENT CORP.: PRODUCT LAUNCHES

- TABLE 169 COHERENT CORP.: OTHERS

- TABLE 170 COMMSCOPE HOLDING COMPANY, INC.: COMPANY OVERVIEW

- TABLE 171 COMMSCOPE HOLDING COMPANY, INC.: PRODUCT/SOLUTION/ SERVICE OFFERINGS

- TABLE 172 COMMSCOPE HOLDING COMPANY, INC.: DEALS

- TABLE 173 COMMSCOPE HOLDING COMPANY, INC.: PRODUCT LAUNCHES

- TABLE 174 STERLITE TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- TABLE 175 STERLITE TECHNOLOGIES LIMITED: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 176 STERLITE TECHNOLOGIES LIMITED: DEALS

- TABLE 177 STERLITE TECHNOLOGIES LIMITED: PRODUCT LAUNCHES

- TABLE 178 DIGILENS INC.: COMPANY OVERVIEW

- TABLE 179 DIGILENS INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 180 DIGILENS INC.: DEALS

- TABLE 181 DIGILENS INC.: PRODUCT LAUNCHES

- FIGURE 1 OPTICAL WAVEGUIDE MARKET: SEGMENTATION

- FIGURE 2 OPTICAL WAVEGUIDE MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE OF MARKET PLAYERS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 GDP GROWTH PROJECTIONS TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 8 REVENUE PROJECTIONS FOR OPTICAL WAVEGUIDE MARKET, 2019–2028

- FIGURE 9 CHANNEL WAVEGUIDE SEGMENT TO DOMINATE OPTICAL WAVEGUIDE MARKET DURING FORECAST PERIOD

- FIGURE 10 GLASS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 SINGLE-MODE SEGMENT TO REGISTER HIGHER CAGR BETWEEN 2023 AND 2028

- FIGURE 12 CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECT SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 13 DATA CENTER & HIGH-PERFORMANCE COMPUTING (HPC) SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 14 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF OPTICAL WAVEGUIDE MARKET DURING FORECAST PERIOD

- FIGURE 15 GROWING DEPLOYMENT OF 5G TELECOMMUNICATION NETWORKS

- FIGURE 16 CHANNEL WAVEGUIDE SEGMENT TO HOLD LARGER SHARE OF OPTICAL WAVEGUIDE MARKET DURING FORECAST PERIOD

- FIGURE 17 GLASS SEGMENT TO HOLD LARGEST SHARE OF OPTICAL WAVEGUIDE MARKET DURING FORECAST PERIOD

- FIGURE 18 SINGLE-MODE AND METRO AND LONG-HAUL OPTICAL INTERCONNECT SEGMENTS TO HOLD LARGEST SHARES OF OPTICAL WAVEGUIDE MARKET IN 2023

- FIGURE 19 TELECOMMUNICATIONS SEGMENT TO LEAD OPTICAL WAVEGUIDE MARKET DURING FORECAST PERIOD

- FIGURE 20 ASIA PACIFIC TO HOLD LARGEST SHARE OF OPTICAL WAVEGUIDE MARKET IN 2023

- FIGURE 21 OPTICAL WAVEGUIDE MARKET IN CHINA TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 22 OPTICAL WAVEGUIDE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 OPTICAL WAVEGUIDE MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 24 OPTICAL WAVEGUIDE MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 25 OPTICAL WAVEGUIDE MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 26 OPTICAL WAVEGUIDE MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 27 OPTICAL WAVEGUIDE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 OPTICAL WAVEGUIDE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 TRENDS AND DISRUPTIONS IN OPTICAL WAVEGUIDE MARKET

- FIGURE 30 AVERAGE SELLING PRICE OF OPTICAL FIBERS OFFERED BY MAJOR MARKET PLAYERS TO TOP THREE END-USER INDUSTRIES

- FIGURE 31 IMPORT DATA FOR HS CODE 900110, BY COUNTRY, 2017–2021

- FIGURE 32 EXPORT DATA FOR HS CODE 900110, BY COUNTRY, 2017–2021

- FIGURE 33 NUMBER OF PATENTS GRANTED PER YEAR, 2013–2022

- FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

- FIGURE 37 CHANNEL WAVEGUIDE SEGMENT TO DOMINATE OPTICAL WAVEGUIDE MARKET DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN OPTICAL WAVEGUIDE MARKET FOR PLANAR WAVEGUIDE SEGMENT DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO HOLD LARGEST SHARE OF OPTICAL WAVEGUIDE MARKET FOR CHANNEL WAVEGUIDE SEGMENT DURING FORECAST PERIOD

- FIGURE 40 GLASS SEGMENT TO DOMINATE OPTICAL WAVEGUIDE MARKET DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN OPTICAL WAVEGUIDE MARKET FOR GLASS SEGMENT DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC TO HOLD LARGEST SHARE OF OPTICAL WAVEGUIDE MARKET FOR POLYMER SEGMENT DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC TO HOLD LARGEST SHARE OF OPTICAL WAVEGUIDE MARKET FOR SEMICONDUCTOR SEGMENT DURING FORECAST PERIOD

- FIGURE 44 SINGLE-MODE SEGMENT TO DOMINATE OPTICAL WAVEGUIDE MARKET DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN OPTICAL WAVEGUIDE MARKET FOR SINGLE-MODE SEGMENT DURING FORECAST PERIOD

- FIGURE 46 ASIA PACIFIC TO HOLD LARGEST SHARE OF OPTICAL WAVEGUIDE MARKET FOR MULTI-MODE SEGMENT DURING FORECAST PERIOD

- FIGURE 47 OPTICAL WAVEGUIDE MARKET, BY REFRACTIVE INDEX

- FIGURE 48 CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN OPTICAL WAVEGUIDE MARKET FOR METRO AND LONG-HAUL OPTICAL INTERCONNECT SEGMENT DURING FORECAST PERIOD

- FIGURE 50 ASIA PACIFIC TO BE LARGEST OPTICAL WAVEGUIDE MARKET FOR BOARD-TO-BOARD AND RACK-LEVEL OPTICAL INTERCONNECT SEGMENT DURING FORECAST PERIOD

- FIGURE 51 ASIA PACIFIC TO BE LARGEST OPTICAL WAVEGUIDE MARKET FOR CHIP- AND BOARD-LEVEL OPTICAL INTERCONNECT SEGMENT DURING FORECAST PERIOD

- FIGURE 52 TELECOMMUNICATIONS SEGMENT TO LEAD OPTICAL WAVEGUIDE MARKET DURING FORECAST PERIOD

- FIGURE 53 ASIA PACIFIC TO DOMINATE OPTICAL WAVEGUIDE MARKET FOR TELECOMMUNICATIONS SEGMENT DURING FORECAST PERIOD

- FIGURE 54 ASIA PACIFIC TO DOMINATE OPTICAL WAVEGUIDE MARKET FOR DATA CENTER & HIGH-PERFORMANCE COMPUTING (HPC) SEGMENT DURING FORECAST PERIOD

- FIGURE 55 ASIA PACIFIC TO DOMINATE OPTICAL WAVEGUIDE MARKET FOR MEDICAL SEGMENT DURING FORECAST PERIOD

- FIGURE 56 ASIA PACIFIC TO DOMINATE OPTICAL WAVEGUIDE MARKET FOR METROLOGY SEGMENT DURING FORECAST PERIOD

- FIGURE 57 ASIA PACIFIC TO DOMINATE OPTICAL WAVEGUIDE MARKET FOR AEROSPACE & DEFENSE SEGMENT DURING FORECAST PERIOD

- FIGURE 58 ASIA PACIFIC TO DOMINATE OPTICAL WAVEGUIDE MARKET FOR CONSUMER ELECTRONICS SEGMENT DURING FORECAST PERIOD

- FIGURE 59 ASIA PACIFIC TO DOMINATE OPTICAL WAVEGUIDE MARKET FOR INDUSTRIAL SEGMENT DURING FORECAST PERIOD

- FIGURE 60 ASIA PACIFIC TO DOMINATE OPTICAL WAVEGUIDE MARKET DURING FORECAST PERIOD

- FIGURE 61 NORTH AMERICA: SNAPSHOT OF OPTICAL WAVEGUIDE MARKET

- FIGURE 62 US TO DOMINATE NORTH AMERICAN OPTICAL WAVEGUIDE MARKET DURING FORECAST PERIOD

- FIGURE 63 EUROPE: SNAPSHOT OF OPTICAL WAVEGUIDE MARKET

- FIGURE 64 GERMANY TO DOMINATE EUROPEAN OPTICAL WAVEGUIDE MARKET DURING FORECAST PERIOD

- FIGURE 65 ASIA PACIFIC: SNAPSHOT OF OPTICAL WAVEGUIDE MARKET

- FIGURE 66 CHINA TO DOMINATE ASIA PACIFIC OPTICAL WAVEGUIDE MARKET DURING FORECAST PERIOD

- FIGURE 67 OPTICAL WAVEGUIDE REVENUE ANALYSIS OF TOP FIVE COMPANIES, 2018–2022

- FIGURE 68 OPTICAL WAVEGUIDE MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 69 STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 70 CORNING INCORPORATED: COMPANY SNAPSHOT

- FIGURE 71 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 72 YANGTZE OPTICAL FIBRE AND CABLE JOINT STOCK LIMITED COMPANY (YOFC): COMPANY SNAPSHOT

- FIGURE 73 FUJIKURA LTD.: COMPANY SNAPSHOT

- FIGURE 74 PRYSMIAN GROUP: COMPANY SNAPSHOT

- FIGURE 75 FURUKAWA ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 76 COHERENT CORP.: COMPANY SNAPSHOT

- FIGURE 77 COMMSCOPE HOLDING COMPANY, INC.: COMPANY SNAPSHOT

- FIGURE 78 STERLITE TECHNOLOGIES LIMITED: COMPANY SNAPSHOT

The study involved four major activities in estimating the size for optical waveguide market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies, white papers, and articles by recognized authors have been referred. Secondary research has been done to obtain key information about the market’s supply chain, the value chain, the pool of key market players, and market segmentation according to industry trends, regions, and developments from both market and technology perspectives.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the optical waveguide market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of primary interviews have been conducted with the demand side and 75% with the supply side. These primary data have been collected through telephonic interviews, questionnaires, and e-mails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, we have implemented both top-down and bottom-up approaches to estimate and validate the size of the optical waveguide market and various other dependent submarkets. The key players in the optical waveguide market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire research methodology includes the study of annual and financial reports of top players and interviews with experts (such as CEOs, COOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Optical Waveguide Market: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the optical waveguide market in terms of value based on type, material, propagation, interconnect level, end-use industry, and region

- To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To study the impact of the recession on the optical waveguide market

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the optical waveguide market

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s Five Forces analysis, and regulations pertaining to the optical waveguide market

- To provide a detailed overview of the value chain of the optical waveguide ecosystem

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying the high-growth segments of the optical waveguide market

- To strategically profile key players, comprehensively analyze their market positions in terms of ranking and core competencies2, and provide a competitive landscape of the market

- To analyze strategic approaches such as product launches, acquisitions, agreements, collaborations, and partnerships in the optical waveguide market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Optical Waveguide Market