Optical Satellite Market by Size (Small, Medium, Large), Application (Earth Observation, Communication), Operational Orbit (LEO, MEO/GEO), Component (Imaging and Sensing Systems, Optical Communication System), End User, and Region - Global Forecast to 2028

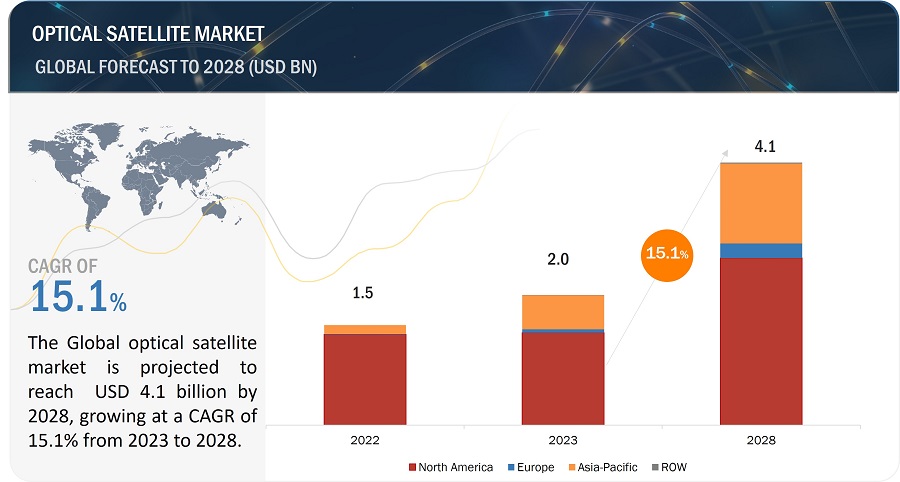

[230 Pages Report] The Optical Satellite Market size is projected to grow from USD 2.0 billion in 2023 to USD 4.1 billion by 2028, growing at a CAGR of 15.1 % from 2023 to 2028.

Optical Satellite Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Optical satellite Market Dynamics

Driver: Technological advancements in optical satellite communication

Technological advancements in optical satellite communication have revolutionized how data is transmitted in space and between space and Earth. Small Satellites, satellite-enabled Internet of Things, in-orbit services, advanced ground systems, artificial intelligence, advanced payload systems, spacecraft propulsion, very high throughput satellites, and flexible launch services are a few technological trends in the Optical Satellite Industry. Satellite avionics are also advancing towards miniaturized and radiation-tolerant systems. Smart avionic systems enable onboard equipment health and usage monitoring as well as precise guidance, navigation, and control (GNC).

Italian start-up AIKO offers advanced flight software that brings E-4-level autonomy to satellites, covering both onboard and ground systems. By leveraging artificial intelligence (AI), AIKO crafts tailored algorithms for autonomous mission command and data management. Additionally, AI is employed to identify and adapt to essential mission events in satellites, enabling capabilities such as failure detection, data prioritization, and mission re-strategizing.

The International Telecommunication Union (ITU) has suggested four potential application scenarios for the integration of satellite-to-ground 5G. These scenarios include relay stations, cell call-backs, satellite communication on the move (SOTM), and hybrid multicast situations. Additionally, the ITU has highlighted essential supporting elements such as the interoperability of network function virtualization (NFV) and software-defined network (SDN), support for multicast, and intelligent routing capabilities.

Restraints: High development cost of optical satellite systems

Developing optical satellite systems involves significant investments in research and technology. However, the high installation cost is a major factor limiting the use of these systems. The cost of launching a satellite into orbit is expensive, and building and maintaining an optical satellite also incurs significant costs. These costs depend on various factors, such as the size and complexity of the satellite, the type of sensors used, and the lifespan of the satellite.

The procurement process not only involves purchasing hardware and software but also training, maintenance, and support services, all of which add to the overall expenditure. Upgrading legacy systems and modernizing existing communications systems to meet evolving requirements can also be costly. Retrofitting or replacing outdated or incompatible systems with newer technologies requires substantial investments. Optical satellites require ongoing maintenance, upgrades, and support throughout their lifecycle. Recurring costs, including software updates, hardware replacements, and cybersecurity measures, need to be factored into budget planning.

Defense budgets often face competing demands from various areas, such as personnel, training, equipment, and infrastructure. Balancing these priorities can limit the available funds for optical satellite infrastructure and technology investments. Overcoming budget constraints requires careful resource allocation, prioritization of communication needs, and seeking innovative approaches to maximize the impact of available funds.

Opportunities: Increase in government investments in space-based infrastructure and services

Governments worldwide are increasingly investing in space-based infrastructure and services, such as military surveillance, weather monitoring, and navigational systems. This boosts demand for ground stations that can help connect to different satellites and offer secure and dependable communication. Government-funded space initiatives have grown significantly in recent years, including the NASA Artemis program for lunar exploration and the Copernicus program for earth observation run by the European Space Agency.

The Indian Space Research Organization (ISRO) launched its first military communication satellite in 2020, necessitating ground stations with secure and dependable communication capabilities. Galileo is a new generation of navigation satellites that the European Union is funding, and it requires ground stations that can receive and analyze its satellite signals. The US government also invests in the smallsat ecosystem and will likely continue investing upstream and downstream.

For many countries, government investments in R&D and start-ups are seen as a way to address societal challenges, facilitate independence from imports, and become a global solution provider in space. In 2022, government funding for space exploration reached USD 25.5 billion, reflecting a 59% growth over the past decade. According to a recent report by Euroconsult titled ‘Prospects for Space Exploration,’ global governmental spending on space exploration is projected to hit USD 31 billion in the coming decade. India’s space sector is acclaimed for its economical satellite production. Furthermore, the 2022-23 Union Budget has designated USD 137 billion for the Department of Space.

Challenges: Operational limitations associated with harsh and remote environments

Operating optical satellite systems in harsh and remote environments can be challenging due to extreme weather, rugged terrains, and electromagnetic interference. To ensure consistent performance, designing and deploying robust communication infrastructure capable of withstanding these conditions is essential. Additionally, the systems must be resilient to electromagnetic interference caused by natural phenomena or deliberate jamming attempts. Overcoming these challenges is crucial to ensure uninterrupted and reliable communication for military operations in diverse geographic and environmental conditions.

Market Ecosystem Map: Optical Satellite Market

Based on the size, the large satellite segment is estimated to lead the Optical Satellite market in 2023

Based on the size, the optical satellite market has been segmented broadly into small, medium and large satellites. Here large satellite is leading this segment in 2023. The large satellite segment within the optical satellite market offers lucrative opportunities. Sectors like agriculture, infrastructure, and defense depend on these satellites to make informed decisions. Furthermore, technological advancements have made large optical satellites more cost-efficient and accessible, enhancing their market presence. These satellites offer enhanced Earth observation, remote sensing, and communication capabilities, making them indispensable for various businesses in today's competitive landscape.

Based on the operational orbit, MEO/GEO segment is estimated to lead the Optical Satellite market in 2023.

Based on operational orbit, the optical satellite market has been segmented into LEO and MEO/GEO. LEO orbit is expected to lead the market in 2023. The MEO/GEO segment in the optical satellite market is thriving due to its distinct advantages in delivering persistent global connectivity. Medium Earth Orbit (MEO) and Geosynchronous Earth Orbit (GEO) satellites offer low latency, high bandwidth, and wide coverage, making them ideal for high-demand applications such as broadband internet, mobile communication, and data transfer. Their reliability and ability to reach remote areas attract businesses aiming to expand their services globally, making MEO/GEO satellites a lucrative investment for those seeking a competitive edge in the telecommunications and data services sectors.

Based on the end user, the commercial segment dominates the market & is projected to witness the largest share in 2023.

Based on the end user, the optical satellite market has been segmented into Commercial, Government and Defense. The commercial sector seems to dominate the market in 2023. The commercial sector in the optical satellite market is propelled by demand for earth observation data and imaging services across industries such as agriculture, logistics, and urban planning, driving the need for optical satellites with high-resolution capabilities that are essential for data-driven decision-making. Also, advancements in satellite technology have considerably reduced the cost of developing and launching optical satellites, facilitating market entry for private companies and intensifying market competition.

Based on the application, Communication seem to dominate this segment and is estimated to account for the larger share of the optical satellite market in 2023

Based on the Application, the optical satellite market has been segmented into earth observation and communication. The communication segment to dominate the optical satellite market in 2023. The optical satellite market's communication segment is predominantly powered by the growing worldwide need for improved connectivity and rapid data transfer. Optical satellites play a critical role in delivering broadband internet, mobile communication, and broadcasting services, especially in remote or underserved regions, meeting the demands of both businesses and consumers. The expansion of the Internet of Things (IoT) and the necessity for seamless communication networks further intensify this requirement. Continuous advancements in satellite technology and data processing enhance the effectiveness and reliability of communication services, while cost-efficient satellite solutions are widening market access. These factors collectively drive the growth of the communication segment, aligning with the evolving connectivity needs of businesses and consumers.

Optical Satellite Market by Region

To know about the assumptions considered for the study, download the pdf brochure

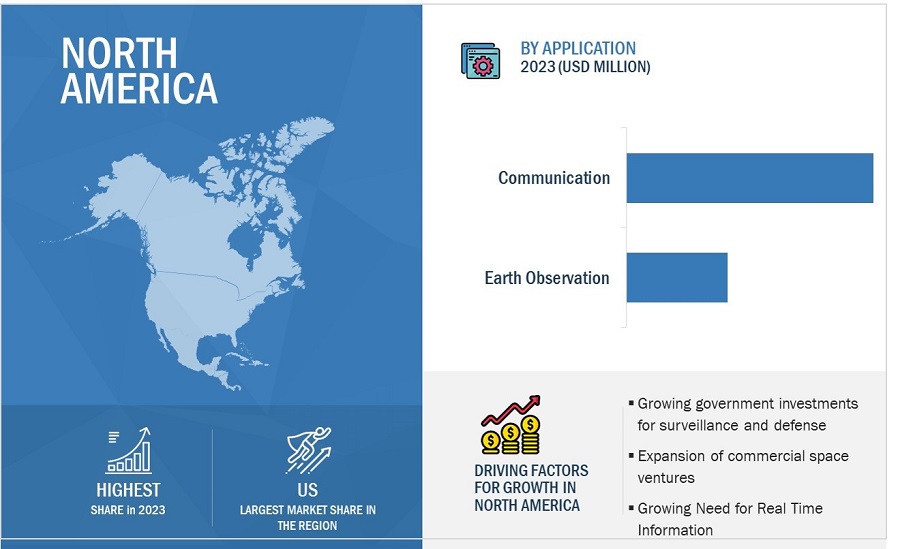

The North America market is projected to have the largest share in 2023 in the optical satellite

Based on region, the optical satellite market has been segmented into North America, Europe, Asia Pacific and Rest of the World (RoW). North America region seems to dominate the market in 2023. North America has a long history of innovation in satellite technology. The region is home to renowned satellite manufacturers such as SpaceX, and Lockheed Martin Corporation. These organizations have a wealth of technical expertise that enables them to develop and deploy cutting-edge technologies, including optical satellites and their support systems. North America satellite manufacturers have been investing heavily in optical satellite technology. This is because they recognize the potential of this technology to revolutionize communication and earth imagery capabilities.

Key Market Players

The Optical Satellite Companies are dominated by a few globally established players such as SpaceX (US), Lockheed Martin Corporation (US), Ball Corporation (US), Airbus Defence and Space (Germany), L3Harris Technologies, Inc. (US), among others, are the key manufacturers that secured optical satellite contracts in the last few years. The primary focus was given to the contracts and new product development due to the changing requirements of homeland security, and defense users across the world.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Value

|

USD 2.0 billion in 2023 |

| Projected Value | USD 4.1 billion by 2028 |

| Growth Rate | CAGR of 15.1% |

|

Market size available for years |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By size, by operational orbit, by component, by application, by end user, and by region |

|

Geographies covered |

North America, Europe, Asia Pacific, Rest of the world |

|

Companies covered |

SpaceX (US), Lockheed Martin Corporation (US), Ball Corporation (US), Airbus Defence and Space (Germany), and L3Harris Technologies Corporation (US) are some of the major players in the optical satellite market. (27 Companies) |

Optical Satellite Market Highlights

The study categorizes the optical satellite market based on size, operational orbit, application, component, end user, and region.

|

Segment |

Subsegment |

|

By Size |

|

|

By Operational Orbit |

|

|

By Application |

|

|

By Component |

|

|

By End User |

|

|

By Region |

|

Recent Developments

- In April 2023, Ball Corporation partnered with Loft Federal and Microsoft to collaborate on the Space Development Agency’s NExT contract, an experimental testbed of 10 satellites. The satellites are scheduled to be launched in 2024.

- In March 2023, L3Harris Technologies, Inc. was awarded a contract by Maxar Technologies to design and build a reflector antenna for two geostationary communication satellites.

- In March 2023, Airbus won a contract from Angola for Earth observation satellite Angeo-1. Angeo-1, the first high-performance Angolan Earth observation satellite, will be manufactured by Airbus Defence and Space in France, strengthening the collaboration between the two countries.

- In February 2020, SpaceX has received a contract from NASA to launch a satellite aimed at examining the oceanographic and atmospheric factors influencing global climate change.

Frequently Asked Questions:

Which are the major companies in the optical satellite market? What are their major strategies to strengthen their market presence?

Some of the key players in the optical satellite market are SpaxeX (US), Lockheed Martin Corporation (US), Ball Corporation (US), Airbus Defence and Space (Germany), L3Harris Technologies, Inc. (US), among others are the key manufacturers that secured optical satellite contracts in the last few years. Contracts were the key strategies these companies adopted to strengthen their optical satellite market presence.

What are the drivers and opportunities for the optical satellite market?

The optical satellite market experiences robust growing demand for multimedia services, demand for Earth observation data, expanding applications in agriculture, defense, and disaster monitoring, and advancements in satellite technology. Opportunities lie in the increasing need for real-time data, the rise of commercial space ventures, and the potential for satellite-based communications and 5G infrastructure expansion. Technological advancements in sensor and communication systems fuel the imperative for modernization and upgrades. Export opportunities and international collaborations play a pivotal role, facilitating partnerships for joint development and procurement.

Which region is expected to grow most in the next five years?

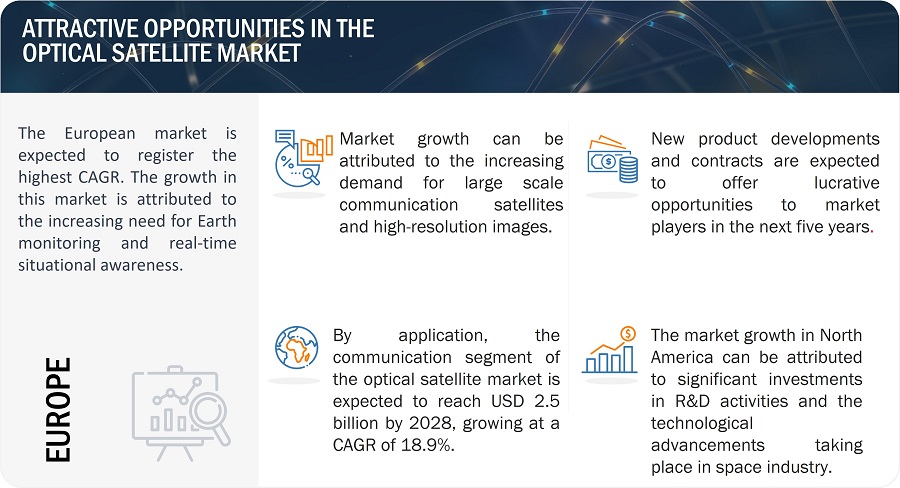

The market in Europe is projected to grow at the highest CAGR from 2023 to 2028, showcasing strong demand for optical satellite in the region. One key factor driving the Europe market is the rising demand for optical satellite due to on-going tensions between the countries and security threats.

Which application type of optical satellite will significantly lead in the coming years?

A communication segment of the optical satellite market is projected to witness the highest CAGR due to the increasing need for the high-speed data and real time information systems between 2023 to 2028.

Which are the key technology trends prevailing in the optical satellite market?

Technological trends in optical satellite are reshaping the industry. Advances in small satellite constellations, enhanced miniaturization of payloads, increased use of high-resolution imaging, and advanced propulsion systems for orbital maneuverability. Additionally, the integration of artificial intelligence and machine learning for data analysis and improved optical sensors for superior Earth observation capabilities are prominent developments. These trends drive innovation in optical satellite, offering businesses growth opportunities and a competitive edge in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Technological advancements in optical satellite communication- Growing demand for multimedia services- Booming cloud computing market- Rapid development of new satellite constellations- Need for Earth observation imagery and analyticsRESTRAINTS- High development cost of optical satellite systems- Lack of standardized communication protocolsOPPORTUNITIES- Rise in adoption of cloud-based services- Increased government investments in space-based infrastructure and servicesCHALLENGES- Implications of cloud cover- Operational limitations associated with harsh and remote environments

- 5.3 RECESSION IMPACT ANALYSIS

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.5 VALUE CHAIN ANALYSIS

-

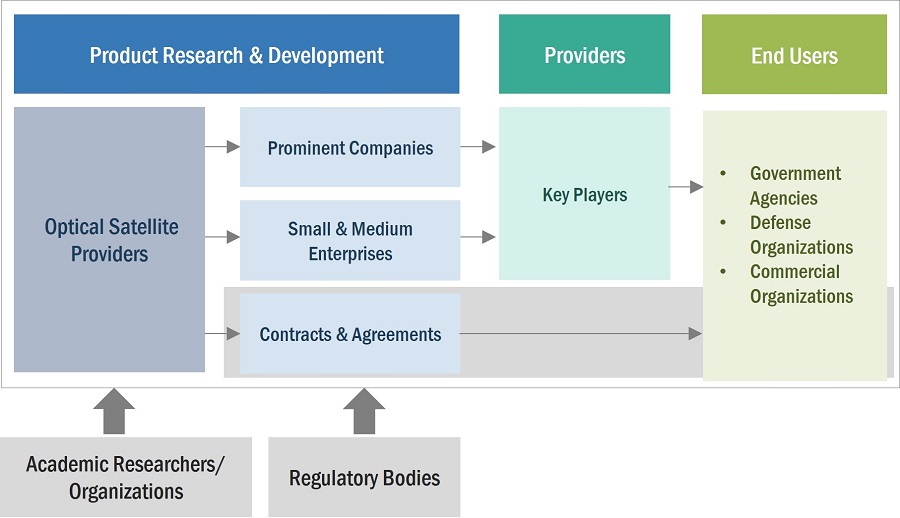

5.6 ECOSYSTEM MAPPING

- 5.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.8 USE CASE ANALYSISOPTICAL INTER-SATELLITE DATA RELAY SERVICEOPTICAL INTER-SATELLITE COMMUNICATION

- 5.9 TRADE DATA ANALYSIS

- 5.10 REGULATORY LANDSCAPE

- 5.11 OPERATIONAL DATA

- 5.12 PRICING ANALYSIS

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSINTEGRATION OF ADVANCED TECHNOLOGIESLASER COMMUNICATION RELAY SYSTEMSCLOUD COMPUTING5GATP TECHNOLOGY

-

6.3 IMPACT OF MEGATRENDSSATELLITE INTERNET OF THINGSSATCOM-ON-THE-MOVEINTELLIGENT OPTICAL SATELLITE COMMUNICATIONHYBRID SATELLITE-TERRESTRIAL RELAY NETWORK

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS

- 6.6 TECHNOLOGICAL ROADMAP TO OPTICAL SATELLITE MARKET

- 7.1 INTRODUCTION

-

7.2 SMALLCOST-EFFECTIVENESS AND ACCESSIBILITY TO DRIVE GROWTH

-

7.3 MEDIUMRAPID ADVANCEMENTS IN TECHNOLOGY TO DRIVE GROWTH

-

7.4 LARGERISING DEMAND FOR ADVANCED IMAGING CAPABILITIES TO DRIVE GROWTH

- 8.1 INTRODUCTION

-

8.2 COMMUNICATIONINCREASING POPULARITY OF STREAMING MEDIA TO DRIVE GROWTHSATELLITE-TO-SATELLITESATELLITE-TO-GROUND

-

8.3 EARTH OBSERVATIONBOOST IN ENVIRONMENTAL MONITORING AND URBAN PLANNING TO DRIVE GROWTHSURVEILLANCE AND MONITORINGSCIENTIFIC RESEARCHWEATHER MONITORINGDISASTER MANAGEMENTEARLY WARNING SYSTEMSOTHER IMAGING AND VIDEO OPERATIONS

- 9.1 INTRODUCTION

-

9.2 LEONEED FOR INSTANT CONNECTIVITY AND LOW-LATENCY COVERAGE TO DRIVE GROWTH

-

9.3 MEO/GEORISING PREFERENCE FOR HIGH-SPEED DATA TRANSMISSION TO DRIVE GROWTH

- 10.1 INTRODUCTION

-

10.2 GOVERNMENTSURGE IN NATIONAL SECURITY CONCERNS TO DRIVE GROWTH

-

10.3 COMMERCIALCOMMERCIALIZATION OF OPTICAL SATELLITES TO DRIVE GROWTH

-

10.4 DEFENSEESCALATING DEMAND FOR REAL-TIME DATA AND IMAGING TO DRIVE GROWTH

- 11.1 INTRODUCTION

-

11.2 IMAGING AND SENSING SYSTEMSVISIBLE SPECTRUM AND PANCHROMATICULTRAVIOLET AND INFRAREDLASER-BASED

-

11.3 OPTICAL COMMUNICATION SYSTEMSSATELLITE-TO-SATELLITE COMMUNICATIONSATELLITE-TO-GROUND COMMUNICATION

- 12.1 INTRODUCTION

- 12.2 REGIONAL RECESSION IMPACT ANALYSIS

-

12.3 NORTH AMERICAPESTLE ANALYSISRECESSION IMPACT ANALYSISUS- Increasing influx of small satellite launches to drive growthCANADA- Rising deployment of optical satellites to drive growth

-

12.4 EUROPEPESTLE ANALYSISRECESSION IMPACT ANALYSISUK- Increasing demand for high-speed data transmission to drive growthFRANCE- New satellite launches by domestic space companies to drive growthGERMANY- Boost in government investments to drive growthITALY- Innovations in satellite technologies to drive growthRUSSIA- Rising development of domestic space systems to drive growthREST OF EUROPE

-

12.5 ASIA PACIFICPESTLE ANALYSISRECESSION IMPACT ANALYSISCHINA- Rapid development of new satellites to drive growthJAPAN- Rise in launch of optical satellites to drive growthINDIA- Domestic emphasis on space-based Earth observation to drive growthSOUTH KOREA- Presence of key space technology companies to drive growthREST OF ASIA PACIFIC

-

12.6 REST OF THE WORLDPESTLE ANALYSISRECESSION IMPACT ANALYSISMIDDLE EAST & AFRICA- Rising demand for high-definition video streaming and cloud computing applications to drive growthLATIN AMERICA- Increasing focus on space development to drive growth

- 13.1 INTRODUCTION

- 13.2 MARKET RANKING ANALYSIS, 2022

-

13.3 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

13.4 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

13.5 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSEXPANSIONS

-

14.1 KEY PLAYERSBALL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLOCKHEED MARTIN CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSPACEX- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAIRBUS DEFENCE AND SPACE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMITSUBISHI ELECTRIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsAAC CLYDE SPACE- Business overview- Products/Solutions/Services offered- Recent developmentsHONEYWELL INTERNATIONAL INC.- Business overview- Products/Solutions/Services offered- Recent developmentsTHALES GROUP- Business overview- Products/Solutions/Services offered- Recent developmentsPLANET LABS PBC- Business overview- Products/Solutions/Services offered- Recent developmentsRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsMAXAR TECHNOLOGIES- Business overview- Products/Solutions/Services offeredBAE SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsHENSOLDT- Business overview- Products/Solutions/Services offered- Recent developmentsIMAGESAT INTERNATIONAL- Business overview- Products/Solutions/Services offered- Recent developmentsOHB SE- Business overview- Products/Solutions/Services offeredTERRAN ORBITAL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsSATELLOGIC- Business overview- Products/Solutions/Services offered- Recent developments

-

14.2 OTHER PLAYERSPIXXELLASER TECHNOLOGY, INC.SITAEL S.P.A.TRANSCELESTIALALÉN SPACENANOAVIONICSWARPSPACE INC.GALAXEYE SPACE SOLUTIONS PVT LTD.

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 IMPACT OF PORTER’S FIVE FORCES

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 COUNTRY-WISE IMPORT DATA, 2019–2022

- TABLE 6 COUNTRY-WISE EXPORT DATA, 2019–2022

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 OPTICAL SATELLITE LAUNCHES, BY APPLICATION, 2021–2023 (UNITS)

- TABLE 12 AVERAGE SELLING PRICE OF OPTICAL SATELLITES, BY COMMUNICATION APPLICATION (USD MILLION)

- TABLE 13 AVERAGE SELLING PRICE OF OPTICAL SATELLITES, BY EARTH OBSERVATION APPLICATION (USD MILLION)

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF OPTICAL SATELLITES, BY APPLICATION (%)

- TABLE 15 KEY BUYING CRITERIA FOR OPTICAL SATELLITES, BY END USER

- TABLE 16 KEY CONFERENCES AND EVENTS, 2023−2024

- TABLE 17 KEY PATENTS

- TABLE 18 OPTICAL SATELLITE MARKET, BY SIZE, 2020−2022 (USD MILLION)

- TABLE 19 OPTICAL SATELLITE MARKET, BY SIZE, 2023−2028 (USD MILLION)

- TABLE 20 OPTICAL SATELLITE MARKET, BY APPLICATION, 2020−2022 (USD MILLION)

- TABLE 21 OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 22 OPTICAL SATELLITE MARKET, BY OPERATIONAL ORBIT, 2020–2022 (USD MILLION)

- TABLE 23 OPTICAL SATELLITE MARKET, BY OPERATIONAL ORBIT, 2023–2028 (USD MILLION)

- TABLE 24 OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 25 OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 26 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 27 OPTICAL SATELLITE MARKET, BY REGION, 2020−2022 (USD MILLION)

- TABLE 28 OPTICAL SATELLITE MARKET, BY REGION, 2023−2030 (USD MILLION)

- TABLE 29 NORTH AMERICA: OPTICAL SATELLITE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 30 NORTH AMERICA: OPTICAL SATELLITE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 32 NORTH AMERICA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 35 US: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 36 US: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 37 US: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 38 US: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 39 CANADA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 40 CANADA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 41 CANADA: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 42 CANADA: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 43 EUROPE: OPTICAL SATELLITE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 44 EUROPE: OPTICAL SATELLITE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 45 EUROPE: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 46 EUROPE: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 EUROPE: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 48 EUROPE: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 49 UK: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 50 UK: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 51 UK: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 52 UK: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 53 FRANCE: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 54 FRANCE: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 55 FRANCE: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 56 FRANCE: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 57 GERMANY: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 58 GERMANY: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 59 GERMANY: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 60 GERMANY: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 61 ITALY: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 62 ITALY: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 63 ITALY: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 64 ITALY: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 65 RUSSIA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 66 RUSSIA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 67 RUSSIA: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 68 RUSSIA: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 69 REST OF EUROPE: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 70 REST OF EUROPE: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 71 REST OF EUROPE: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 72 REST OF EUROPE: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 74 ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 76 ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 79 CHINA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 80 CHINA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 81 CHINA: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 82 CHINA: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 83 JAPAN: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 84 JAPAN: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 85 JAPAN: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 86 JAPAN: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 87 INDIA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 88 INDIA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 89 INDIA: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 90 INDIA: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 91 SOUTH KOREA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 92 SOUTH KOREA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 93 SOUTH KOREA: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 94 SOUTH KOREA: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 98 REST OF ASIA PACIFIC: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 99 REST OF THE WORLD: OPTICAL SATELLITE MARKET, BY REGION 2020–2022 (USD MILLION)

- TABLE 100 REST OF THE WORLD: OPTICAL SATELLITE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 REST OF THE WORLD: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 102 REST OF THE WORLD: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 103 REST OF THE WORLD: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 104 REST OF THE WORLD: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 109 LATIN AMERICA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 110 LATIN AMERICA: OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 LATIN AMERICA: OPTICAL SATELLITE MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 112 LATIN AMERICA: OPTICAL SATELLITE MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 113 STRATEGIES ADOPTED BY KEY PLAYERS IN OPTICAL SATELLITE MARKET

- TABLE 114 COMPANY FOOTPRINT

- TABLE 115 APPLICATION FOOTPRINT

- TABLE 116 REGION FOOTPRINT

- TABLE 117 OPTICAL SATELLITE MARKET: KEY START-UPS/SMES

- TABLE 118 OPTICAL SATELLITE MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 119 OPTICAL SATELLITE MARKET: PRODUCT LAUNCHES, JANUARY 2020– DECEMBER 2023

- TABLE 120 OPTICAL SATELLITE MARKET: DEALS, JANUARY 2020–DECEMBER 2023

- TABLE 121 OPTICAL SATELLITE MARKET: EXPANSIONS, JANUARY 2020–DECEMBER 2023

- TABLE 122 BALL CORPORATION: COMPANY OVERVIEW

- TABLE 123 BALL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 BALL CORPORATION: DEALS

- TABLE 125 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 126 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 128 SPACEX: COMPANY OVERVIEW

- TABLE 129 SPACEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 SPACEX: DEALS

- TABLE 131 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 132 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 134 L3HARRIS TECHNOLOGIES, INC.: OTHERS

- TABLE 135 AIRBUS DEFENCE AND SPACE: COMPANY OVERVIEW

- TABLE 136 AIRBUS DEFENCE AND SPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 AIRBUS DEFENCE AND SPACE: DEALS

- TABLE 138 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 139 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 140 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 141 AAC CLYDE SPACE: COMPANY OVERVIEW

- TABLE 142 AAC CLYDE SPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 AAC CLYDE SPACE: PRODUCT LAUNCHES

- TABLE 144 AAC CLYDE SPACE: DEALS

- TABLE 145 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 146 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 HONEYWELL INTERNATIONAL INC: DEALS

- TABLE 148 THALES GROUP: COMPANY OVERVIEW

- TABLE 149 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 THALES GROUP: DEALS

- TABLE 151 PLANET LABS PBC: COMPANY OVERVIEW

- TABLE 152 PLANET LABS PBC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 PLANET LABS PBC: PRODUCT LAUNCHES

- TABLE 154 PLANET LABS PBC: DEALS

- TABLE 155 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 156 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 157 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 158 MAXAR TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 159 MAXAR TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 161 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 BAE SYSTEMS: DEALS

- TABLE 163 HENSOLDT: COMPANY OVERVIEW

- TABLE 164 HENSOLDT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 HENSOLDT: DEALS

- TABLE 166 IMAGESAT INTERNATIONAL: COMPANY OVERVIEW

- TABLE 167 IMAGESAT INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 IMAGESAT INTERNATIONAL: DEALS

- TABLE 169 OHB SE: COMPANY OVERVIEW

- TABLE 170 OHB SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 TERRAN ORBITAL CORPORATION: COMPANY OVERVIEW

- TABLE 172 TERRAN ORBITAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 TERRAN ORBITAL CORPORATION: PRODUCT LAUNCHES

- TABLE 174 SATELLOGIC: COMPANY OVERVIEW

- TABLE 175 SATELLOGIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 SATELLOGIC: DEALS

- TABLE 177 PIXXEL: COMPANY OVERVIEW

- TABLE 178 LASER TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 179 SITAEL S.P.A.: COMPANY OVERVIEW

- TABLE 180 TRANSCELESTIAL: COMPANY OVERVIEW

- TABLE 181 ALÉN SPACE: COMPANY OVERVIEW

- TABLE 182 NANOAVIONICS: COMPANY OVERVIEW

- TABLE 183 WARPSPACE INC.: COMPANY OVERVIEW

- TABLE 184 GALAXEYE SPACE SOLUTIONS PVT LTD.: COMPANY OVERVIEW

- FIGURE 1 OPTICAL SATELLITE MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 COMMUNICATION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 9 LARGE SATELLITES TO SECURE LEADING MARKET POSITION IN 2028

- FIGURE 10 COMMERCIAL TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 11 MEO/GEO SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- FIGURE 12 EUROPE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 INCREASE IN DEMAND FOR EARTH MONITORING AND REAL-TIME INFORMATION

- FIGURE 14 COMMERCIAL SEGMENT TO ACQUIRE MAXIMUM MARKET SHARE IN 2023

- FIGURE 15 COMMUNICATION TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 16 RUSSIA TO BE FASTEST-GROWING COUNTRY DURING FORECAST PERIOD

- FIGURE 17 OPTICAL SATELLITE MARKET DYNAMICS

- FIGURE 18 RECESSION IMPACT ANALYSIS

- FIGURE 19 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 20 VALUE CHAIN ANALYSIS

- FIGURE 21 ECOSYSTEM MAPPING

- FIGURE 22 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF OPTICAL SATELLITES, BY APPLICATION

- FIGURE 24 KEY BUYING CRITERIA FOR OPTICAL SATELLITES, BY END USER

- FIGURE 25 SUPPLY CHAIN ANALYSIS

- FIGURE 26 TOP PATENT OWNERS

- FIGURE 27 EVOLUTION OF OPTICAL SATELLITES

- FIGURE 28 OPTICAL SATELLITE MARKET, BY SIZE, 2023–2028

- FIGURE 29 OPTICAL SATELLITE MARKET, BY APPLICATION, 2023–2028

- FIGURE 30 OPTICAL SATELLITE MARKET, BY OPERATIONAL ORBIT, 2023–2028

- FIGURE 31 OPTICAL SATELLITE MARKET, BY END USER, 2023–2028

- FIGURE 32 OPTICAL SATELLITE MARKET, BY REGION, 2023–2028

- FIGURE 33 NORTH AMERICA: OPTICAL SATELLITE MARKET SNAPSHOT

- FIGURE 34 EUROPE: OPTICAL SATELLITE MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: OPTICAL SATELLITE MARKET SNAPSHOT

- FIGURE 36 REST OF THE WORLD: OPTICAL SATELLITE MARKET SNAPSHOT

- FIGURE 37 MARKET RANKING OF TOP FIVE PLAYERS, 2022

- FIGURE 38 OPTICAL SATELLITE MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 39 OPTICAL SATELLITE MARKET: START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 40 BALL CORPORATION: COMPANY SNAPSHOT

- FIGURE 41 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 43 AIRBUS DEFENCE AND SPACE: COMPANY SNAPSHOT

- FIGURE 44 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 AAC CLYDE SPACE: COMPANY SNAPSHOT

- FIGURE 46 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 47 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 48 PLANET LABS PBC: COMPANY SNAPSHOT

- FIGURE 49 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 MAXAR TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 51 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 52 HENSOLDT: COMPANY SNAPSHOT

- FIGURE 53 IMAGESAT INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 54 OHB SE: COMPANY SNAPSHOT

- FIGURE 55 TERRAN ORBITAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 SATELLOGIC: COMPANY SNAPSHOT

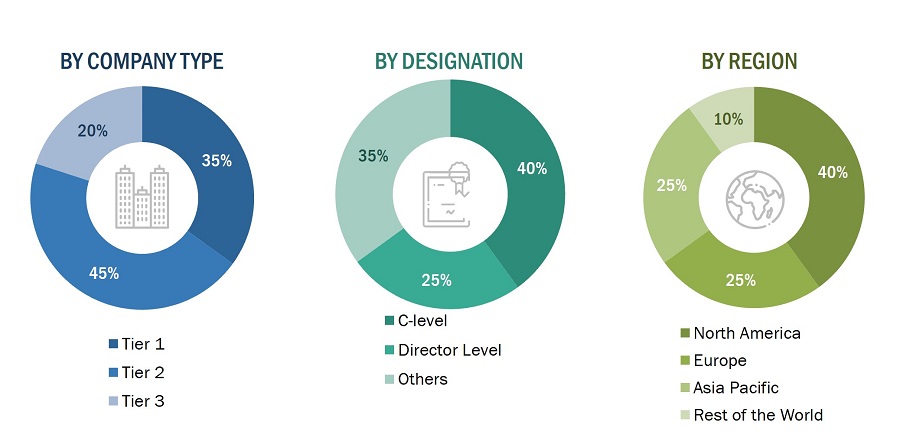

The study involved four major activities in estimating the current size of the Optical Satellite Market. Exhaustive secondary research was done to collect information on the optical satellite market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Demand-side analyses were carried out to estimate the overall size of the market. After that, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the optical satellite market.

Secondary Research:

The market ranking of companies was determined using secondary data made available through paid and unpaid sources and by analyzing the product portfolios of major companies. These companies the performance on the basis of the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to for this research study included financial statements of companies offering optical satellite and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the optical satellite market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information regarding the optical satellite market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, ROW which includes the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

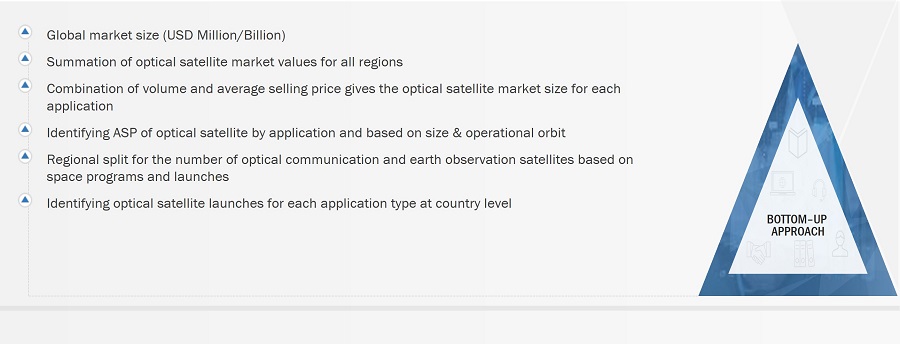

Market Size Estimation

The market sizing of the market was undertaken from the demand side. The market was upsized at a regional level based on procurements and launches planned by country. Such procurements provide information on each application demand aspects of optical satellite. For each application, all possible end users in optical satellite market were identified.

Note: An analysis of technological, military funding, year-on-year launches, and operational cost were carried out to arrive at the CAGR and understand the market dynamics of all countries in the report. The market share for all sizes, operational orbit, component, application, and end user was based on the recent and upcoming launches of optical satellite in every country from 2023 to 2028.

Optical Satellite Market Size: Bottom-up Approach

Optical Satellite Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure that was implemented in the market engineering process to make this report on the optical satellite market.

Market Definition

Optical satellites are a critical component of the Earth observation and communication landscape. These satellites are equipped with advanced optical sensors and imaging technology, enabling them to capture high-resolution images of Earth's surface and atmosphere from space. The data they provide is invaluable for a wide range of applications, including environmental monitoring, agriculture, disaster response, urban planning, and national security. The optical satellite industry encompasses various key players, including satellite manufacturers, operators, data service providers, and technology firms. With the increasing demand for accurate and timely Earth observation and communication data in government, commercial, and research sectors, this market is in a phase of sustained growth.

Market Stakeholders

- Manufacturers of optical satellite

- System Integrators

- Original Equipment Manufacturers (OEM)

- Space Organizations

- Regulatory Authorities

Report Objectives

- To define, describe, and forecast the size of the optical satellite market based on size, operational orbit, application, component, end user, and region.

- To indicate the size of the various segments of the optical satellite market based on four regions—North America, Europe, Asia Pacific, Rest of the world—along with key countries in each of these regions.

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To determine industry trends, market trends, and technology trends prevailing in the market

- To analyze micro markets concerning individual technological trends, prospects, and their contribution to the overall market

- To provide a detailed competitive landscape of the market and analyze competitive growth strategies such as product launches and developments, contracts, partnerships, agreements, and collaborations adopted by key players in the market.

- To identify the detailed financial positions, product portfolios, and key developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market rank analysis and core competencies.

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Optical Satellite Market

- Profiling of other market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Optical Satellite Market.

Growth opportunities and latent adjacency in Optical Satellite Market