Optical Film Market by Film Type (Polarizing Film, Backlight Unit Film, ITO Film), Application (Television, Desktop Monitors & Laptops, Smartphones & Tablets, Signage/Large Format display, Automotive Display), Region-Global Forecast to 2024

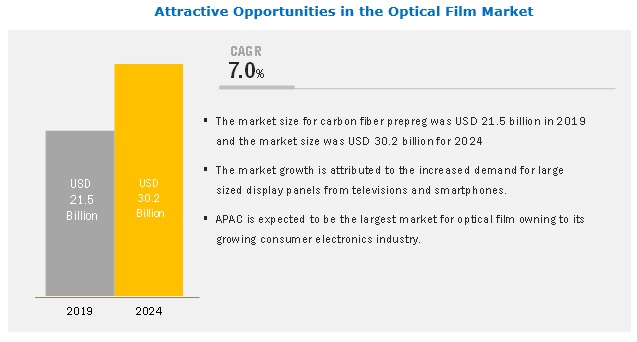

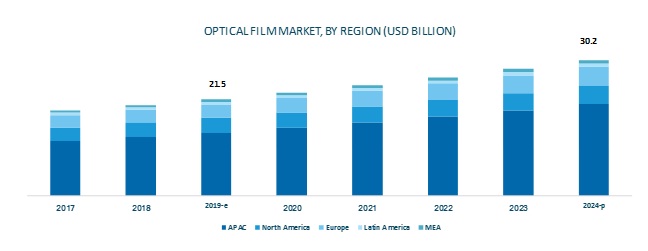

The optical film market is projected to grow USD 30.2 billion by 2024, at a CAGR of 7.0% between 2019 and 2024. The market is growing due to the increasing demand from the televisions and smartphones & tablets application for large display panels.

The television application is expected to be the largest consumer of optical film, globally.

The major applications in the optical film market include television, smartphones & tablets, desktop monitors & laptops, signage/large format display, and automotive display. The television application accounted for a major share of the market, in terms of value and volume. High acceptance of optical film in LED and LCD is the key reason for the high consumption of optical film in the television application. This growth is driven by the increase in the screen size of LCD and OLED displays of televisions. A number of consumer electronics industry leaders produce LCD televisions in varying sizes and configurations due to the increase in demand for larger television units among the end users, which, in turn, is supporting the growth of the optical film market.

The polarizing film segment to account for a major share of the optical film market, in terms of value, during the forecast period

The polarizing film segment dominates the overall optical film market, in terms of value, as it is widely applicable in both LCD and OLED displays for various applications. Polarizing film converts non-polarized light into linearly polarized light by transmitting only the incident beam that propagates in one direction and absorbing all other beams. Recognizing letters and graphics without the polarizers would be impossible. A polarizing film is one of the core elements of LCD and OLED technology that enables display of images on LCD and OLED screen.

APAC is expected to lead the optical film market during the forecast period.

APAC accounts for the largest market share of optical film, globally, due to the rapid growth of end-use industries such as consumer electronics, automotive, industrial, optical equipment, and lighting. Countries in APAC such as South Korea, China, and Japan have the presence of the largest optical film manufacturers, globally, such as LG Chem, Ltd. (South Korea), Hyosung Chemical (South Korea), Toray Industries Inc (Japan), Sumitomo Chemical Co., Ltd. (Japan), Zeon Corporation (Japan), and Kolon Industries Inc. (South Korea). All these factors are driving the demand for optical film in the televisions and smartphones & tablets applications in this region.

The optical film market comprises major solution providers, such as LG Chem, Ltd. (South Korea), Hyosung Chemical (South Korea), Toray Industries Inc (Japan), Sumitomo Chemical Co., Ltd. (Japan), 3M (U.S.), Zeon Corporation (Japan), Kolon Industries Inc. (South Korea), Sanritz Co., Ltd. (Japan), Nitto Denko Corporation (Japan), and Samsung SDI (Japan).

Scope of the Optical Film Market Report

|

Report Metric |

Details |

|

Years considered for the study |

2017–2024 |

|

Base year |

2018 |

|

Forecast period |

2019–2024 |

|

Units considered |

Value (USD Million), Volume (Million Square Meter |

|

Segments |

Film Type, Application, and Region |

|

Regions |

North America, Europe, APAC, the MEA, and Latin America |

|

Companies |

LG Chem, Ltd. (South Korea), Hyosung Chemical (South Korea), Toray Industries Inc. (Japan), Sumitomo Chemical Co., Ltd. (Japan), 3M (US), Zeon Corporation (Japan), Kolon Industries Inc. (South Korea), Sanritz Co., Ltd. (Japan), Nitto Denko Corporation (Japan), and Samsung SDI (Japan). |

This research report categorizes the optical film market based on film type, application, and region.

On the basis of film type, the optical film market has been segmented as follows:

- Polarizing Film

- Backlight Unit Film

- ITO Film

On the basis of application, the optical film market has been segmented as follows:

- Television

- Desktop Monitors & Laptops

- Smartphones & Tablets

- Signage/Large Format Display

- Automotive Display

- Others (smart electronic wearables, control panel display, camera, smart mirrors, lighting, and light microscope)

On the basis of region, the optical film market has been segmented as follows:

- APAC

- North America

- Europe

- MEA

- Latin America

Recent Developments

- In March 2017, Sumitomo Chemical increased the production capacity of its film-based touchscreens panels for flexible OLED displays. Due to increased demand for OLED displays, the company has increased the production capacity of films-based touchscreens, which, in turn, will drive the optical film market.

- In October 2018, Zeon Corporation expanded the production capacity of ZeonorFilm optical film. The company plans to expand its manufacturing plant in Takaoka City, Japan. Due to the increasing demand for optical films, the company expanded its production capabilities. The operations are expected to begin from October 2019, which will help the company to grow its optical film business as well increase its revenue.

- In May 2015, Samsung SDI signed Memorandum of Understanding with China’s Wuxi City for building a new polarizer plant to cater to the increasing demand for big screen TV from China in the polarizing film market. The company has planned to set up a production line so that its products can be applied to the biggest market of eighth-generation LCD panels.

Key Questions addressed by the report

- What are the major applications of optical film?

- Which industry is the major consumer of optical film?

- Which region is the largest and fastest-growing market for optical film?

- What are the major film types used in optical film?

- What are the major strategies adopted by leading market players?

Frequently Asked Questions (FAQ):

How big is the optical film market ?

The optical film market is projected to grow USD 30.2 billion by 2024, at a CAGR of 7.0% between 2019 and 2024.

Who leading market players in optical film market ?

LG Chem, Ltd. (South Korea), Hyosung Chemical (South Korea), Toray Industries Inc. (Japan), Sumitomo Chemical Co., Ltd. (Japan), 3M (US), Zeon Corporation (Japan), Kolon Industries Inc. (South Korea), Sanritz Co., Ltd. (Japan), Nitto Denko Corporation (Japan), and Samsung SDI (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Regions Covered

1.4.1 Years Considered for the Study

1.5 Currency

1.6 Unit Considered

1.7 Limitations

1.8 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

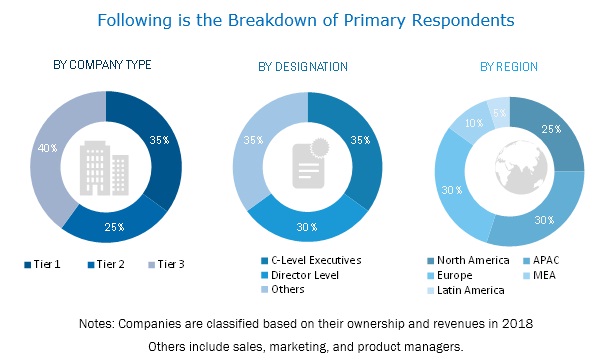

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in the Optical Film Market

4.2 Optical Film Market, By Film Type

4.3 Optical Film Market Size, By Application

4.4 Optical Film Market, By Application and Country

4.5 Optical Film Market: Major Countries

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Smartphones, Tablets, and Other Similar Consumer Electronic Devices

5.2.1.2 Construction and Upgrading of New and Existing Display Panel Manufacturing Plants in APAC

5.2.1.3 Ever-Increasing Average Screen Size and Resolution of Lcd Television

5.2.1.4 Emerging Display Technologies—Micro Led and True Quantum Dot

5.2.2 Restraints

5.2.2.1 Exclusivity and Intellectual Property (Ip) Protection of Emerging and Advanced Display Materials

5.2.2.2 High Volatility in Prices of Indium Tin Oxide

5.2.3 Opportunities

5.2.3.1 Emerging Use Cases: Smart Display, Smart Mirror, and Smart Home Appliances

5.2.3.2 Continuous Development of Application Products

5.2.4 Challenges

5.2.4.1 Reducing Demand for Backlight Unit Films Due to Shift Towards the Oled Technology

5.2.4.2 High Prices of New and Advanced Materials

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Bargaining Power of Suppliers

5.3.3 Bargaining Power of Buyers

5.3.4 Threat of New Entrants

5.3.5 Intensity of Rivalry

6 Optical Film Market, By Film Type (Page No. - 38)

6.1 Introduction

6.2 Polarizing Film

6.2.1 Polarizing Film is Expected to Have High Demand From Oled Smartphone Displays

6.3 Backlight Unit Film (Blu)

6.3.1 Backlight Unit Film is Expected to Have High Demand From Large Lcd Televisions

6.4 ITO Film

6.4.1 Growing Demand for Touch Panel-Based Displays is Driving the Demand for ITO Film

7 Optical Film Market, By Application (Page No. - 45)

7.1 Introduction

7.2 Television

7.2.1 10.5 Generation Television Display Panel Production Lines is Driving the Demand for Optical Films

7.3 Desktop MonITOrs & Laptops

7.3.1 APAC is the Largest Optical Film Market in Desktop MonITOr & Laptop Application

7.4 Smartphones & Tablets

7.4.1 High Demand From China and India is Driving the Consumption of Optical Film in the Smartphone & Tablet Application

7.5 Signage/Large Format Display

7.5.1 High Demand From Retail, Hospitality, and Entertainment Industries is Driving the Demand for Optical Film

7.6 Automotive Display

7.6.1 Increasing Adoption of Displays in Cars is Driving the Demand of Optical Films in Automotive Displays

7.7 Others

8 Optical Film Market, By Region (Page No. - 56)

8.1 Introduction

8.2 APAC

8.2.1 South Korea

8.2.1.1 The Country Dominates the Optical Film Market in the APAC Region

8.2.2 China

8.2.2.1 China is the Fastest-Growing Market of Optical Film at the Global Level

8.2.3 Japan

8.2.3.1 High Demand in the Television Application is Driving the Market in Japan

8.2.4 Taiwan

8.2.4.1 Television and Smartphone Applications are Boosting the Demand for Optical Film in Taiwan

8.3 North America

8.3.1 US

8.3.1.1 The US Dominates the Optical Film Market in North America

8.3.2 Canada

8.3.2.1 Consumer, Automotive, Retail, Medical, and Industrial Sectors to Be Major Users of Optical Film in Canada

8.4 Europe

8.4.1 UK

8.4.1.1 There is A High Demand for Polarizing and Backlight Unit Optical Films in the UK

8.4.2 Germany

8.4.2.1 Germany is the Second-Largest Manufacturer of Optical Film in Europe

8.4.3 France

8.4.3.1 The Use of Optical Film for Various Applications in the Consumer Electronics Industry is Boosting the Market Growth

8.5 Latin America

8.5.1 Brazil

8.5.1.1 Penetration of Smartphones and Other Touch Display Devices are Expected to Boost the Demand for Optical Film

8.5.2 Mexico

8.5.2.1 Rising Exports of Tablets and Smartphones to the US is Expected to Boost the Demand for Optical Film

8.5.3 Rest of Latin America

8.6 MEA

8.6.1 South Africa

8.6.1.1 Growing Industrialization and Urbanization is Primarily Driving Demand for Optical Film

8.6.2 Saudi Arabia

8.6.2.1 Increasing Demand for Electronic Displays is Expected to Drive the Market

8.6.3 Rest of MEA

9 Competitive Landscape (Page No. - 80)

9.1 Introduction

9.1.1 New Product Developments

9.1.2 Expansions

9.2 Market Ranking

9.3 Competitive Leadership Mapping, 2018

9.3.1 Introduction

9.3.2 Visionary Leaders

9.3.3 Dynamic Differentiators

9.3.4 Emerging Companies

9.3.5 Innovators

9.4 Competitive Benchmarking

9.4.1 Strength of Product Portfolio

9.4.2 Business Strategy Excellence

10 Company Profiles (Page No. - 87)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 LG Chem, Ltd.

10.2 Hyosung Chemical

10.3 Toray Industries Inc

10.4 Sumitomo Chemical Co., Ltd.

10.5 3M

10.6 Zeon Corporation

10.7 Kolon Industries, Inc.

10.8 Sanritz Co., Ltd.

10.9 Nitto Denko Corporation

10.1 Samsung SDI

10.11 Other Companies

10.11.1 Mitsubishi Chemical Corporation

10.11.2 Dexerials Corporation

10.11.3 Benq Materials Corporation

10.11.4 SKC Inc.

10.11.5 Polatechno Co., Ltd.

10.11.6 Suntechopt Corporation

10.11.7 Cheng Mei Materials Technology Corp.

10.11.8 Shenzhen Sheng Wave Optoelectronic Technology Co., Ltd. (Sapo)

10.11.9 Teijin Limited

10.11.10 Toyobo Co. Ltd.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 108)

11.1 Insights From Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (62 Tables)

Table 1 Optical Film Market Size, 2017–2024

Table 2 Optical Film Market Size, By Film Type, 2017–2024 (Msqm)

Table 3 Optical Film Market Size, By Film Type, 2017–2024 (USD Million)

Table 4 Polarizing Film Market Size, By Region, 2017–2024 (Msqm)

Table 5 Polarizing Film Market Size, By Region, 2017–2024 (USD Million)

Table 6 Backlight Unit Film Market Size, By Region, 2017–2024 (Msqm)

Table 7 Backlight Unit Film Market Size, By Region, 2017–2024 (USD Million)

Table 8 ITO Film Market Size, By Region, 2017–2024 (Msqm)

Table 9 ITO Film Market Size, By Region, 2017–2024 (USD Million)

Table 10 Optical Film Market Size, By Application, 2017–2024 (Msqm)

Table 11 Optical Film Market Size, By Application, 2017–2024 (USD Million)

Table 12 Optical Film Market Size in Television, By Region, 2017–2024 (Msqm)

Table 13 Optical Film Market Size in Television, By Region, 2017–2024, (USD Million)

Table 14 Optical Film Market Size in Desktop Monitor & Laptop, By Region, 2017–2024 (Msqm)

Table 15 Optical Film Market Size in Desktop Monitor & Laptop, By Region, 2017–2024, (USD Million)

Table 16 Optical Film Market Size in Smartphone & Tablet, By Region, 2017–2024 (Msqm)

Table 17 Optical Film Market Size in Smartphone & Tablet, By Region, 2017–2024, (USD Million)

Table 18 Optical Film Market Size in Signage & Large Format Display, By Region, 2017–2024 (Msqm)

Table 19 Optical Film Market Size in Signage & Large Format Display, By Region, 2017–2024, (USD Million)

Table 20 Optical Film Market Size in Automotive Display, By Region, 2017–2024 (Msqm)

Table 21 Optical Film Market Size in Automotive Display, By Region, 2017–2024, (USD Million)

Table 22 Optical Film Market Size in Other Applications, By Region, 2017–2024 (Msqm)

Table 23 Optical Film Market Size in Other Applications, By Region, 2017–2024, (USD Million)

Table 24 APAC: By Market Size, By Film Type, 2017–2024 (Msqm)

Table 25 APAC: By Market Size, By Film Type, 2017–2024 (USD Million)

Table 26 APAC: By Market Size, By Application, 2017–2024 (Msqm)

Table 27 APAC: By Market Size, By Application, 2017–2024 (USD Million)

Table 28 APAC: By Market Size, By Country, 2017–2024 (Msqm)

Table 29 APAC: By Market Size, By Country, 2017–2024 (USD Million)

Table 30 South Korea: By Market Size, Country, By Application, 2017–2024 (Msqm)

Table 31 South Korea: By Market Size, Country, By Application, 2017–2024 (USD Million)

Table 32 North America: By Market Size, By Film Type, 2017–2024 (Msqm)

Table 33 North America: By Market Size, By Film Type, 2017–2024 (USD Million)

Table 34 North America: By Market Size, By Application, 2017–2024 (Msqm)

Table 35 North America: By Market Size, By Application, 2017–2024 (USD Million)

Table 36 North America: By Market Size, By Country, 2017–2024 (Msqm)

Table 37 North America: By Market Size, By Country, 2017–2024 (USD Million)

Table 38 US: By Market Size, Country, By Application, 2017–2024 (Msqm)

Table 39 US.: By Market Size, Country, By Application,2017–2024 (USD Million)

Table 40 Europe: By Market Size, By Film Type, 2017–2024 (Msqm)

Table 41 Europe: By Market Size, By Film Type, 2017–2024 (USD Million)

Table 42 Europe: By Market Size, By Application, 2017–2024 (Msqm)

Table 43 Europe: By Market Size, By Application, 2017–2024 (USD Million)

Table 44 Europe: By Market Size, By Country, 2016–2023 (Msqm)

Table 45 Europe: By Market Size, By Country, 2016–2023 (USD Million)

Table 46 UK: By Market Size, By Application, 2017–2024 (Msqm)

Table 47 UK: By Market Size, By Application, 2017–2024 (USD Million)

Table 48 Latin America: By Market Size, By Film Type, 2017–2024 (Msqm)

Table 49 Latin America: By Market Size, By Film Type, 2017–2024 (USD Million)

Table 50 Latin America: By Market Size, By Application, 2017–2024 (Msqm)

Table 51 Latin America: By Market Size, By Application, 2017–2024 (USD Million)

Table 52 Latin America: By Market Size, By Country, 2017–2024 (Msqm)

Table 53 Latin America: By Market Size, By Country, 2017–2024 (USD Million)

Table 54 MEA: By Market Size, By Film Type, 2017–2024 (Msqm)

Table 55 MEA: By Market Size, By Film Type, 2017–2024 (USD Million)

Table 56 MEA: By Market Size, By Application, 2017–2024 (Msqm)

Table 57 MEA: By Market Size, By Application, 2017–2024 (USD Million)

Table 58 MEA: By Market Size, By Country, 2017–2024 (Msqm)

Table 59 MEA: By Market Size, By Country, 2017–2024 (USD Million)

Table 60 New Product Developments, 2014–2018

Table 61 Expansions, 2014–2018

Table 62 Market Ranking of Key Players, 2018

List of Figures (44 Figures)

Figure 1 Optical Film: Market Segmentation

Figure 2 Optical Film Market: Research Design

Figure 3 Optical Film Market: Bottom-Up Approach

Figure 4 Optical Film Market: Top-Down Approach

Figure 5 Television Dominated Overall Optical Film Market

Figure 6 Polarizing Film Dominated the Overall Optical Film Market

Figure 7 APAC to Be Fastest-Growing Market of Optical Film

Figure 8 Increasing Display Panel Sizes of Television and Smartphones to Drive the Market

Figure 9 ITO Film to Be Fastest-Growing Optical Film Segment

Figure 10 Television to Be the Largest Application

Figure 11 South Korea has the Largest Share in Optical Film Market

Figure 12 China to Register Highest Cagr in Optical Film Market

Figure 13 Drivers, Restraints, Opportunities, and Threats in the Optical Film Market

Figure 14 Optical Films Market: Porter’s Five Forces Analysis

Figure 15 ITO Film Segment to Witness Highest Cagr During Forecast Period

Figure 16 APAC to Drive the Polarizing Film Market

Figure 17 APAC to Drive the Backlight Unit Film Market

Figure 18 APAC to Drive the ITO Film Market

Figure 19 Television to Be the Leading Application of Optical Film Market

Figure 20 APAC to Be the Biggest Market of Optical Film in the Television Application

Figure 21 APAC to Be the Biggest Market for Optical Film in Desktop Monitors & Laptops Application

Figure 22 APAC to Be the Biggest Market for Optical Film in Smartphone & Tablet Application

Figure 23 APAC to Witness Highest Cagr in Signage & Large Format Display Application

Figure 24 Europe to Be the Biggest Market for Optical Film in Automotive Display Application

Figure 25 China to Be the Fastest-Growing Optical Film Market

Figure 26 APAC: Optical Film Market Snapshot

Figure 27 North America: Optical Film Market Snapshot

Figure 28 Europe: Optical Film Market Snapshot

Figure 29 Brazil to Lead the Optical Film Market in Latin America

Figure 30 South Africa to Be the Largest Optical Film Market in MEA

Figure 31 Companies Adopted Expansion as the Key Growth Strategy Between 2014 and 2018

Figure 32 Optical Film Market, Competitive Leadership Mapping, 2018

Figure 33 LG Chem, Ltd.: Company Snapshot

Figure 34 Hyosung Chemical: Company Snapshot

Figure 35 Hyosung Chemical: SWOT Analysis

Figure 36 Toray Industries Inc: Company Snapshot

Figure 37 Toray Industries Inc.: SWOT Analysis

Figure 38 Sumitomo Chemical Co., Ltd.: Company Snapshot

Figure 39 Sumitomo Chemical Co., Ltd.: SWOT Analysis

Figure 40 3M: Company Snapshot

Figure 41 3M: SWOT Analysis

Figure 42 Zeon Corporation: Company Snapshot

Figure 43 Kolon Industries, Inc: Company Snapshot

Figure 44 Samsung SDI: Company Snapshot

The study involved four major activities in estimating the current market size for optical film. Exhaustive secondary research was done to collect information on the market, the peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva were referred, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications & articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The optical film market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of various applications such as television, smartphones & tablets, desktop monitors & laptops, and automotive display. The supply side is characterized by advancements in technology and diverse applications. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total optical film market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- n The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both demand and supply sides in the television, smartphones & tablets, desktop monitors & laptops, automotive display, and other applications.

Report Objectives

- To define, describe, and forecast the optical film market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market size on the basis of film type and application

- To define, describe, and forecast the market size on the basis of five regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the optical film market in Rest of Europe

- A further breakdown of the optical film market in Rest of APAC

- A further breakdown of the optical film market in Rest of Latin America

- A further breakdown of the Optical Film market in Rest of MEA

Company Information

- Detailed analysis and profiling of additional market players (up to ten)

Growth opportunities and latent adjacency in Optical Film Market