Optical Coating Market by Technology (Vacuum Deposition, E-Beam Evaporation, Sputtering Process, and Ion Assisted Deposition (IAD)), Type, End-Use Industry, and Region (APAC, North America, Europe, and Rest of World) - Global Forecasts to 2028

Updated on : November 11, 2025

Optical Coating Market

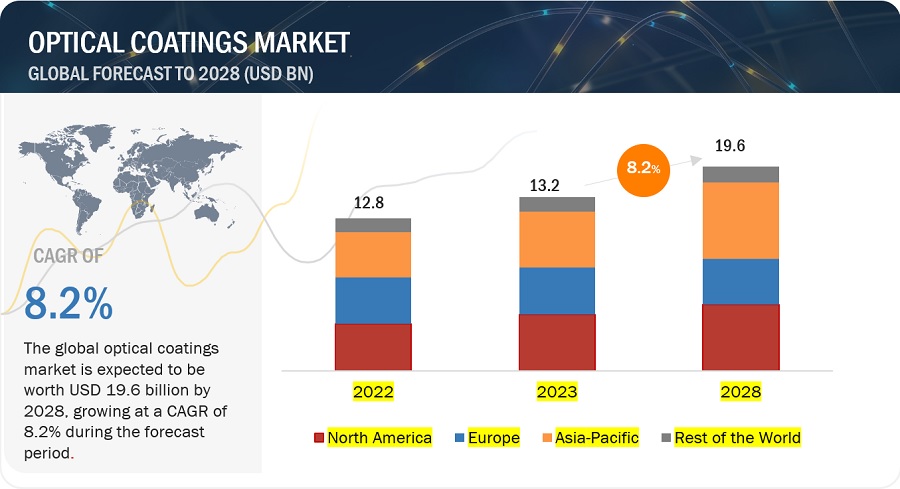

The global optical coating market was valued at USD 13.2 billion in 2023 and is projected to reach USD 19.6 billion by 2028, growing at 8.2% cagr from 2023 to 2028. The optical coatings industry is experiencing growth due to the expanding manufacturing and industrial sectors. Emerging economies like China, India, and Southeast Asian countries are witnessing industrialization and infrastructure development, driving the demand for optical coatings. Rapid urbanization, construction projects, and industrial growth in these regions lead to increased demand for optical coatings across multiple industries. These include electronics & semiconductors, military & defense, transportation, telecommunication/optical communication, infrastructure, solar power, medical, and others. The rising production activities and infrastructure development contribute significantly to the demand for optical coatings components.

Optical Coating Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Optical Coating Market

Optical Coating Market Dynamics

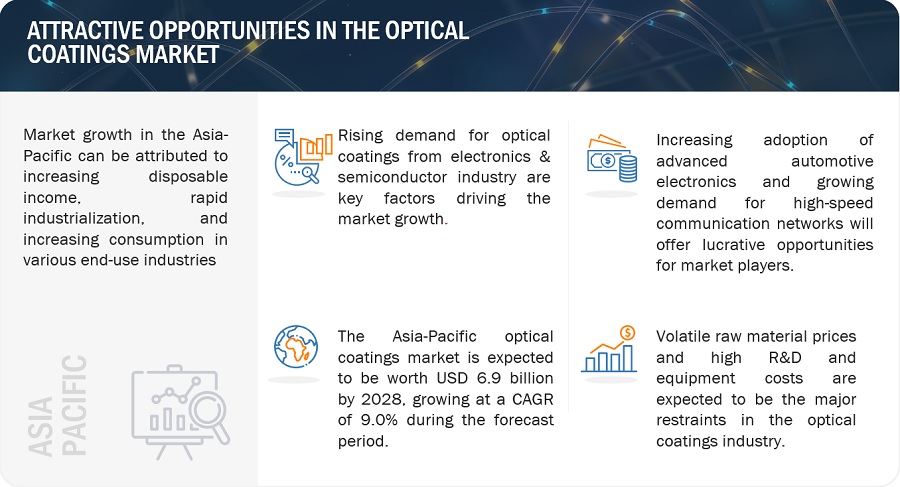

Driver: Rise in demand for optical coatings from electronics & semiconductor industry

Optical coatings have diverse applications in industries like semiconductors, high-temperature lamp tubing, telecommunication, optics, and microelectronics. In the electronics & semiconductor sector, they play a vital role in printed circuit board (PCB) coating, ICs, and wafer modification, enabling components to withstand high-temperature gradients and rapid thermal processing. Advancements in this industry have led to the use of new-generation wafers, driving demand for high-purity optical coatings that enhance product performance. Optical coatings are also increasingly integrated into smartphones, including screens, camera lenses, and semiconductor chips, enhancing touch sensing and display capabilities. The growing adoption of optical coatings in smart devices fuels market growth.

Restraint: Volatility in raw material prices

The manufacturing process of optical coatings relies on various raw materials, including oxides (aluminum, zirconium, titanium, selenium), fluorides (strontium, calcium, magnesium), and metals (copper, gold, silver). The prices of these raw materials, especially metals and oxides like TiO2, indium, gold, copper, and silver, are volatile and can impact manufacturing costs. Fluctuations in raw material prices affect the profitability and overall market costs of optical coatings, potentially limiting market growth. However, recent years have shown a decline in metal costs. Immediate fluctuations can create restrictions on market growth, and changes in the value of precious metals like gold and platinum impact the overall cost and demand for high-end applications using optical coatings.

Opportunities: Increasing adoption of advanced automotive electronics

The demand for automotive electronics is increasing in the transportation industry due to factors like rising income levels, the need for safer driving experiences, intelligent transport systems, and environmental concerns. Optical coatings play a vital role in advanced automotive electronics systems. The development of driver assistance systems, communication technologies, and entertainment features in vehicles provides opportunities for the optical coatings market. Optical coatings are used in various automotive components such as switches, light guides, headlamp lenses, and taillights. They also offer protection for display windows in public transportation vehicles. Preferred types of optical coatings in transportation include anti-reflection (AR) coatings, high reflective coatings, and filter coatings.

Challenges: Stringent government regulations

Stringent government regulations pose challenges for the optical coatings market. Regulations focus on product safety, environmental sustainability, and performance. Compliance requires research, development, and investment to find alternative materials and processes. Manufacturers may need to modify equipment or waste management practices, impacting costs. Staying updated with evolving regulations is crucial. Non-compliance leads to penalties and damage to reputation. Overall, regulatory compliance requires significant resources and a delicate balance between compliance, cost-efficiency, and high-performance coatings.

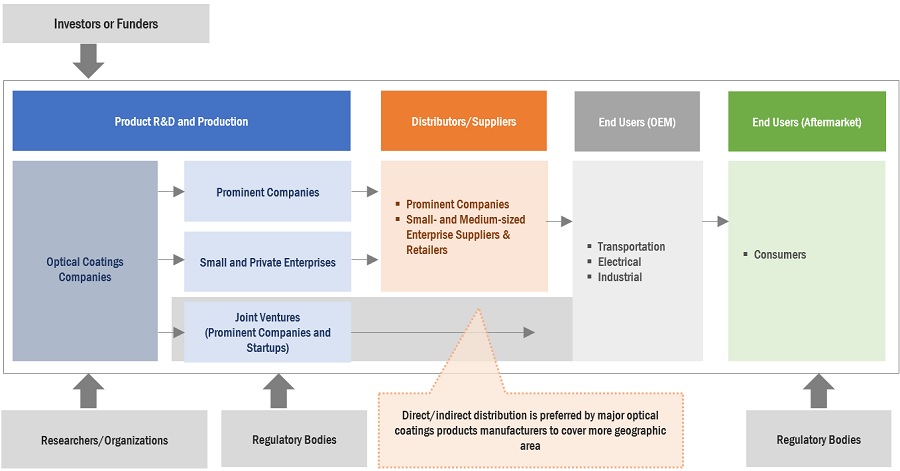

Optical Coating Market Ecosystem

By technology, Vacuum deposition accounted for the highest CAGR during the forecast period

Vacuum deposition technology is employed to deposit thin films onto a substrate within a vacuum environment. It involves heating a material source, either solid or vapor, to generate a vaporized or ionized form. This vapor then condenses onto the substrate, creating a thin film layer. Physical vapor deposition (PVD), such as evaporation and sputtering, and chemical vapor deposition (CVD) are common techniques used in vacuum deposition. This technology offers precise control over film thickness, composition, and properties. It finds extensive application in the electronics, optics, and coatings industries for producing high-quality thin films utilized in semiconductors, optical coatings, and protective layers.

By Type, AR Coatings accounted for the highest CAGR during the forecast period

AR coatings, also known as anti-reflective coatings, are thin layers applied to optical components like lenses, mirrors, and display screens. Their main purpose is to minimize reflection and glare by reducing the amount of light reflected from the component's surface. This results in improved light transmission and clearer visual quality. AR coatings work by modifying the refractive index of the coated surface, allowing light to pass through more efficiently. They offer advantages such as enhanced contrast, reduced eye strain, and improved image sharpness. Widely used in industries such as optics, consumer electronics, and eyewear, AR coatings enhance both the functionality and appearance of optical components.

By End Use Industry, Electronics & semiconductor accounted for the highest CAGR during the forecast period

Optical coatings are essential in the electronics and semiconductor industry for applications like printed circuit board (PCB) coatings and integrated circuits (ICs). They are used in various devices such as mobile phone keypads, LED lighting, and optical storage devices. Major types include AR coatings, filter coatings, and beamsplitter coatings. Optical coatings withstand harsh environments and enhance optical component performance. Increasing demand for high-quality coated components in semiconductor applications drives their growth in the industry. Coatings ensure precise optical performance, functionality, and durability of electronic and semiconductor devices.

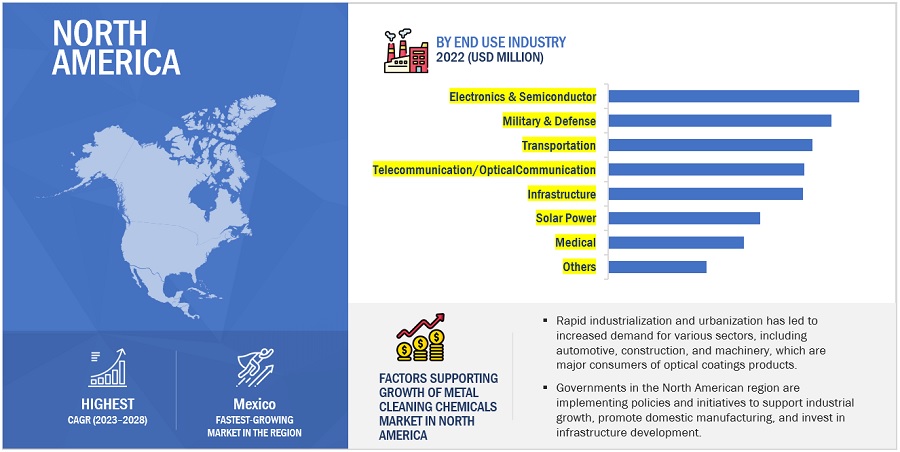

North America is projected to account for the highest CAGR in the optical coatings market during the forecast period

The North America region, particularly countries like US, Canada, and Mexico, is undergoing rapid industrialization and urbanization. This has led to increased demand for various sectors, including construction, automotive, and machinery, which are major consumers of optical coatings products. The growing infrastructure development projects and industrial base are driving the growth of the optical coatings market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Optical Coating Market Players

Optical coatings market comprises key manufacturers such as DuPont (US), PPG Industries Ohio, Inc. (US), Nippon Sheet Glass Co., Ltd. (Japan), ZEISS Group (Germany), Newport Corporation (US), Inrad Optics, Inc. (US), Artemis Optical Limited (England), Abrisa Technologies (US), Reynard Corporation (US), Coherent Corp. (US) and others. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the optical coatings industry. The major focus was given to the new product development due to the changing requirements of transportation and electronics product consumers across the world.

Optical Coating Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Million/Billion) |

|

Segments |

Technology, Type, End-Use Industry, and Region |

|

Regions |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies |

The major players are DuPont (US), PPG Industries Ohio, Inc. (US), Nippon Sheet Glass Co., Ltd. (Japan), ZEISS Group (Germany), Newport Corporation (US), Inrad Optics, Inc. (US), Artemis Optical Limited (England), Abrisa Technologies (US), Reynard Corporation (US), and Coherent Corp. (US). |

This research report categorizes the global optical coatings market based on Technology, Type, End-Use Industry, and Region

Optical Coating Market on the basis of Technology:

- Vacuum Deposition Technology

- E-Beam Evaporation Technology

- Sputtering Process

- Ion-Assisted Deposition (IAD) Technology

Optical Coating Market on the basis of Type:

- AR Coatings

- High Reflective Coatings

- Transparent Conductive Coatings

- Filter Coatings

- Beamsplitter Coatings

- EC Coatings

- Others

Optical Coating Market on the basis of End-Use Industry:

- Electronics & Semiconductor

- Military & Defense

- Transportation

- Telecommunication/Optical Communication

- Infrastructure

- Solar Power

- Medical

- Others

Optical Coating Market on the basis of Region:

- North America

- Asia Pacific

- Europe

- Rest of the World

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- Om June 29, 2023, PPG Industries Ohio, Inc and Satys, a French industrial group specializing in aircraft sealing, painting, and surface treatment, have formed a partnership to offer electrocoating (e-coat) services for original equipment manufacturer (OEM) aircraft components.

- On May 23, 2023, in a collaborative effort, PPG and Entrotech Inc. have established a joint venture aimed at delivering paint films, which encompass multi-layered coatings featuring at least one layer of paint.

- On June 21, 2023, DuPont and JetCool Technologies Inc., known as JetCool, have recently formed a collaboration aimed at promoting the widespread use of advanced liquid cooling technology. This collaboration focuses on enhancing thermal management solutions for various high-power electronic applications, including semiconductors, data centers, and high-performance computing systems. By joining forces, DuPont and JetCool aim to drive innovation and facilitate the adoption of more efficient cooling techniques in these demanding sectors.

- On March 29, 2023, ZEISS Group has initiated the construction process for expanding the ZEISS Semiconductor Manufacturing Technology (SMT) segment's Wetzlar site. The planned expansion involves dedicating an area exceeding 12,000 square meters to the development and production of lithography optics for microchip manufacturing on a global scale. This strategic move by ZEISS is driven by the increasing global demand for microchips in the semiconductor industry.

- On February 02, 2022, Nippon Sheet Glass Co., Ltd has unveiled MAGNAVI, an innovative glass fiber known for its exceptional strength and high modulus. Designed as a reinforcement option for fiber reinforced plastics (FRP) and fiber reinforced thermoplastics (FRTP), MAGNAVI™ offers the highest mechanical properties among all glass fibers. Furthermore, it retains the inherent qualities of glass fibers such as radio-permeability and heat resistance.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the optical coatings market?

The major driving factors for the optical coatings market are the rise in demand for optical coatings from electronics & semiconductor industry, growing solar power industry to drive the market, and technological advancement in optical equipment and fabrication process.

What are the major challenges in the optical coatings market?

The major challenging factor faced by the optical coatings market are stringent government regulations and maintaining the environmental durability of optical coatings.

What are the restraining factors in the optical coatings market?

The major restraining factor faced by the optical coatings market are volatility in raw material prices and high R&D and equipment cost.

What is the key opportunity in the optical coatings market?

Increasing adoption of advanced automotive electronics and growing demand for high-speed communication networks are the key opportunities in the optical coatings market.

What are the end-use industries where optical coatings components are used?

The optical coatings components are majorly used in Electronics & Semiconductor, Military & Defense, Transportation, Telecomm/Optical Communication, Infrastructure, Solar Power, Medical, and Others (green energy, entertainment, and instrumentation) industries.

What are the technologies used in the optical coatings market?

Vacuum Deposition, E-Beam Evaporation, Sputtering Process, and Ion-Assisted Deposition (IAD) technologies used in the optical coatings market.

What are the types in the overall optical coatings market used?

AR Coatings, High Reflective Coatings, Transparent Conductive Coatings, Filter Coatings, Beamsplitter Coatings, EC Coatings, and Others (polarized coating, optical protective, and UV coating). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rise in demand for optical coatings from electronics & semiconductor industry- Growing solar power industry to drive market- Technological advancements in optical equipment and fabrication processesRESTRAINTS- Volatility in raw material prices- High R&D and equipment costOPPORTUNITIES- Increasing adoption of advanced automotive electronics- Growing demand for high-speed communication networksCHALLENGES- Stringent government regulations- Maintaining environmental durability of optical coatings

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSESREVENUE SHIFT & NEW REVENUE POCKETS FOR OPTICAL COATING MANUFACTURERSREVENUE SHIFT FOR OPTICAL COATINGS PLAYERS

-

5.6 TARIFF AND REGULATORY LANDSCAPE ANALYSISTHE AMERICAN ASSOCIATION OF PHYSICISTS IN MEDICINE (AAPM)

-

5.7 REGULATORY BODIES AND GOVERNMENT AGENCIESREGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS- International Traffic in Arms Regulations (ITAR)- The American Precision Optics Manufacturers Association (APOMA)

-

5.8 SUPPLY CHAIN ANALYSISRAW MATERIAL SUPPLIERSOPTICAL COATINGS MANUFACTURERSDISTRIBUTORS AND SUPPLIERSEND USERS

-

5.9 ECOSYSTEM

-

5.10 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.11 KEY CONFERENCES & EVENTS IN 2023–2024

- 5.12 TRADE ANALYSIS

-

5.13 PATENT ANALYSISDOCUMENT ANALYSISJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

-

5.14 CASE STUDYOPTICAL COATINGS FOR ACHIEVING HIGH-EFFICIENCY LED LIGHTING- Introduction- Background- Challenge- Optical coating solutions- Case study example: Office lighting upgrade- Benefits and results- Manufacturing processes- Future developments and trends- Conclusion

-

5.15 MACROECONOMIC OVERVIEWGLOBAL GDP OUTLOOK

- 5.16 PRICING ANALYSIS

- 5.17 IMPACT OF RECESSION: REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

- 6.1 INTRODUCTION

-

6.2 VACUUM DEPOSITION TECHNOLOGYPRECISE CONTROL OVER COATING THICKNESS, OPTICAL PROPERTIES, AND LAYER COMPOSITION TO DRIVE MARKET

-

6.3 E-BEAM EVAPORATION TECHNOLOGYEXCELLENT COATING UNIFORMITY AND HIGH PURITY PROPERTIES TO DRIVE MARKET

-

6.4 SPUTTERING PROCESSVERSATILITY IN DEPOSITION OF WIDE RANGE OF MATERIALS ONTO VARIOUS SUBSTRATES TO DRIVE MARKET

-

6.5 ION-ASSISTED DEPOSITION (IAD) TECHNOLOGYENHANCEMENT OF ADHESION BETWEEN COATING AND SUBSTRATE, FILM DENSITY, AND RESISTANCE TO ENVIRONMENTAL FACTORS TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 AR COATINGSEXPANDING ELECTRONICS & SEMICONDUCTOR, SOLAR POWER, AND TRANSPORTATION SECTORS TO DRIVE MARKET

-

7.3 HIGH REFLECTIVE COATINGSLASER OPTICS, REFLECTING TELESCOPES, CAVITY MIRRORS, AND SPACE-RELATED USES TO DRIVE MARKET

-

7.4 TRANSPARENT CONDUCTIVE COATINGSDEMAND FOR LCD FABRICATIONS, TOUCH PANELS, DISPLAY WINDOWS, LAMINATED DISPLAY PACKAGES, HEATERS, AND SOLAR CELLS TO DRIVE MARKET

-

7.5 FILTER COATINGSAPPLICATIONS SUCH AS GAS DETECTION, FLAME DETECTION, AND MOTION SENSORS TO DRIVE MARKET

-

7.6 BEAMSPLITTER COATINGSTELECOMMUNICATION/OPTICAL COMMUNICATION, ELECTRONICS & SEMICONDUCTOR, AND GREEN ENERGY SECTORS TO DRIVE MARKET

-

7.7 EC COATINGSDEMAND FOR ENERGY SAVING AND REDUCTION OF CO2 EMISSIONS TO DRIVE MARKET

- 7.8 OTHERS

- 8.1 INTRODUCTION

-

8.2 ELECTRONICS & SEMICONDUCTORABILITY TO WITHSTAND CHALLENGING ENVIRONMENTAL CONDITIONS TO DRIVE MARKET

-

8.3 MILITARY & DEFENSEENHANCEMENT OF SAFETY AND PROTECTION OF MILITARY PERSONNEL TO DRIVE MARKET

-

8.4 TRANSPORTATIONRISING DEMAND FOR HIGH-QUALITY, HIGH-EFFICIENCY, AND ABRASION-RESISTANT COMPONENTS TO DRIVE MARKET

-

8.5 TELECOMMUNICATION/OPTICAL COMMUNICATIONEFFICIENCY AND PERFORMANCE OF OPTICAL COMMUNICATION INFRASTRUCTURE TO DRIVE MARKET

-

8.6 INFRASTRUCTUREDEMAND FOR SUSTAINABLE AND ENERGY-EFFICIENT INFRASTRUCTURE TO DRIVE MARKET

-

8.7 SOLAR POWERGOVERNMENT INITIATIVES TO PROMOTE RENEWABLE ENERGY USAGE TO DRIVE MARKET

-

8.8 MEDICALOPTIMAL PERFORMANCE AND RELIABILITY OF COMPONENTS IN HEALTHCARE TO DRIVE MARKET

- 8.9 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Government incentives to promote adoption of energy-efficient technologies to boost marketCANADA- Well-established automotive sector and sizable consumer base to drive marketMEXICO- Consumer electronics, automotive, and solar energy sectors to drive market

-

9.3 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Industrial growth, focus on electric vehicles, and supportive government policies to drive marketINDIA- Expanding technology, industrial sector, and consumer electronics to drive marketJAPAN- Technological advancements in construction and automotive sectors to drive marketSOUTH KOREA- Emphasis on innovation and strong industrial foundation to drive marketREST OF ASIA PACIFIC

-

9.4 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Strong industries, advanced technology, and focus on precision engineering to boost marketUK- Consumer electronics, aerospace, and automotive industries to drive marketRUSSIA- Military & defense end use industry to drive marketFRANCE- Electronics sector to offer attractive opportunities for market growthREST OF EUROPE

-

9.5 REST OF THE WORLDIMPACT OF RECESSION ON THE REST OF THE WORLD (ROW)BRAZIL- Expanding industrial and technological sectors to drive marketOTHERS

- 10.1 OVERVIEW

-

10.2 MARKET SHARE ANALYSISRANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- 10.3 KEY COMPANIES’ FIVE-YEAR REVENUE ANALYSIS

-

10.4 COMPANY EVALUATION MATRIX (OVERALL MARKET), 2022STARSPERVASIVE LEADERSPARTICIPANTSEMERGING LEADERS

- 10.5 COMPETITIVE BENCHMARKING OF OVERALL MARKET

-

10.6 START-UPS/SMES EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.7 DETAILED LIST OF KEY START-UPS/SMESCOMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

-

10.8 COMPETITIVE SCENARIORECENT DEVELOPMENTSDEALSOTHER DEVELOPMENTS

-

11.1 MAJOR PLAYERSDUPONT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPPG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNIPPON SHEET GLASS CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewZEISS GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNEWPORT CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINRAD OPTICS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARTEMIS OPTICAL LIMITED- Business overview- Products/Solutions/Services offered- Recent developmentsABRISA TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewREYNARD CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsCOHERENT CORP.- Business overview- Products/Solutions/Services offered- Recent developments

-

11.2 ADDITIONAL PLAYERSCASCADE OPTICAL CORPORATIONBENEQMATERION CORPORATIONDEPOSITION SCIENCES, INC. (DSI)LAMBDA RESEARCH OPTICS INC.MLD TECHNOLOGIESEVAPORATED COATINGS, INC.ANDOVER CORPORATIONVISIMAX TECHNOLOGIES INC.OPHIR OPTRONICS SOLUTIONS LTD.JANOS TECHNOLOGY LLCDENTON VACUUMNANO QUARZ WAFERALLUXAASML BERLIN (BERLINER GLAS)

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

-

12.3 CONFORMAL COATINGS MARKETMARKET DEFINITIONCONFORMAL COATINGS MARKET, BY TYPECONFORMAL COATINGS MARKET, BY END-USE INDUSTRYCONFORMAL COATINGS MARKET, BY REGION

-

12.4 VAPOR DEPOSITION MARKETMARKET DEFINITIONCVD & PVD, BY TECHNOLOGYCVD & PVD EQUIPMENT MARKET, BY END-USE INDUSTRYCVD & PVD, BY REGION

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 OPTICAL COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 OPTICAL COATING MARKET: SUPPLY CHAIN

- TABLE 3 ECOSYSTEM OF OPTICAL COATINGS MARKET

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS (%)

- TABLE 5 KEY BUYING CRITERIA FOR KEY END USE INDUSTRIES

- TABLE 6 OPTICAL COATINGS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 7 OPTICAL FIBERS AND OPTICAL FIBER BUNDLES, IMPORT DATA, HS CODE: 9001, 2022 (USD MILLION)

- TABLE 8 OPTICAL FIBERS AND OPTICAL FIBER BUNDLES, EXPORT DATA, HS CODE: 9001, 2022 (USD MILLION)

- TABLE 9 LIST OF PATENTS BY SEMICONDUCTOR ENERGY LABORATORY

- TABLE 10 LIST OF PATENTS BY 3M INNOVATIVE PROPERTIES CO

- TABLE 11 LIST OF PATENTS BY SAMSUNG DISPLAY SOLUTIONS

- TABLE 12 US: PATENT OWNERS BETWEEN 2013 AND 2022

- TABLE 13 WORLD GDP GROWTH PROJECTION, 2021–2028 (USD TRILLION)

- TABLE 14 OPTICAL COATINGS MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 15 OPTICAL COATING MARKET, BY TECHNOLOGY, 2022–2028 (USD MILLION)

- TABLE 16 OPTICAL COATINGS MARKET IN VACUUM DEPOSITION TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

- TABLE 17 OPTICAL COATING MARKET IN VACUUM DEPOSITION TECHNOLOGY, BY REGION, 2022–2028 (USD MILLION)

- TABLE 18 OPTICAL COATINGS MARKET IN E-BEAM EVAPORATION TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

- TABLE 19 OPTICAL COATING MARKET IN E-BEAM EVAPORATION TECHNOLOGY, BY REGION, 2022–2028 (USD MILLION)

- TABLE 20 OPTICAL COATINGS MARKET IN SPUTTERING PROCESS, BY REGION, 2018–2021 (USD MILLION)

- TABLE 21 OPTICAL COATING MARKET IN SPUTTERING PROCESS, BY REGION, 2022–2028 (USD MILLION)

- TABLE 22 OPTICAL COATINGS MARKET IN ION-ASSISTED (IAD) DEPOSITION TECHNOLOGY, BY REGION, 2018–2021 (USD MILLION)

- TABLE 23 OPTICAL COATING MARKET IN ION-ASSISTED (IAD) DEPOSITION TECHNOLOGY, BY REGION, 2022–2028 (USD MILLION)

- TABLE 24 OPTICAL COATINGS MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 25 OPTICAL COATING MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 26 AR COATINGS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 27 AR COATINGS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 28 HIGH REFLECTIVE COATINGS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 29 HIGH REFLECTIVE COATINGS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 30 TRANSPARENT CONDUCTIVE COATINGS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 31 TRANSPARENT CONDUCTIVE COATINGS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 32 FILTER COATINGS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 33 FILTER COATINGS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 34 BEAMSPLITTER COATINGS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 35 BEAMSPLITTER COATINGS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 36 EC COATINGS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 37 EC COATINGS MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 38 OTHER TYPE OPTICAL COATINGS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 39 OTHER TYPE OPTICAL COATING MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 40 OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 41 OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 42 OPTICAL COATINGS MARKET IN ELECTRONICS & SEMICONDUCTOR, BY REGION, 2018–2021 (USD MILLION)

- TABLE 43 OPTICAL COATING MARKET IN ELECTRONICS & SEMICONDUCTOR, BY REGION, 2022–2028 (USD MILLION)

- TABLE 44 OPTICAL COATINGS MARKET IN MILITARY & DEFENSE, BY REGION, 2018–2021 (USD MILLION)

- TABLE 45 OPTICAL COATING MARKET IN MILITARY & DEFENSE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 46 OPTICAL COATINGS MARKET IN TRANSPORTATION, BY REGION, 2018–2021 (USD MILLION)

- TABLE 47 OPTICAL COATING MARKET IN TRANSPORTATION, BY REGION, 2022–2028 (USD MILLION)

- TABLE 48 OPTICAL COATINGS MARKET IN TELECOMMUNICATION/OPTICAL COMMUNICATION, BY REGION, 2018–2021 (USD MILLION)

- TABLE 49 OPTICAL COATING MARKET IN TELECOMMUNICATION/OPTICAL COMMUNICATION, BY REGION, 2022–2028 (USD MILLION)

- TABLE 50 OPTICAL COATINGS MARKET IN INFRASTRUCTURE, BY REGION, 2018–2021 (USD MILLION)

- TABLE 51 OPTICAL COATING MARKET IN INFRASTRUCTURE, BY REGION, 2022–2028 (USD MILLION)

- TABLE 52 OPTICAL COATINGS MARKET IN SOLAR POWER, BY REGION, 2018–2021 (USD MILLION)

- TABLE 53 OPTICAL COATING MARKET IN SOLAR POWER, BY REGION, 2022–2028 (USD MILLION)

- TABLE 54 OPTICAL COATINGS MARKET IN MEDICAL, BY REGION, 2018–2021 (USD MILLION)

- TABLE 55 OPTICAL COATING MARKET IN MEDICAL, BY REGION, 2022–2028 (USD MILLION)

- TABLE 56 OPTICAL COATINGS MARKET IN OTHER END USE INDUSTRIES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 57 OPTICAL COATING MARKET IN OTHER END USE INDUSTRIES, BY REGION, 2022–2028 (USD MILLION)

- TABLE 58 OPTICAL COATINGS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 59 OPTICAL COATING MARKET, BY REGION, 2022–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: OPTICAL COATINGS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 61 NORTH AMERICA: OPTICAL COATING MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 63 NORTH AMERICA: MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 65 NORTH AMERICA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 67 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2022–2028 (USD MILLION)

- TABLE 68 US: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 69 US: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 70 US: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 71 US: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 72 CANADA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 73 CANADA: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 74 CANADA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 75 CANADA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 76 MEXICO: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 77 MEXICO: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 78 MEXICO: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 79 MEXICO: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: OPTICAL COATINGS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 81 ASIA PACIFIC: OPTICAL COATING MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 87 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2022–2028 (USD MILLION)

- TABLE 88 CHINA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 89 CHINA: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 90 CHINA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 91 CHINA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 92 INDIA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 93 INDIA: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 94 INDIA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 95 INDIA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 96 JAPAN: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 97 JAPAN: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 98 JAPAN: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 99 JAPAN: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 100 SOUTH KOREA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 101 SOUTH KOREA: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 102 SOUTH KOREA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 103 SOUTH KOREA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 108 EUROPE: OPTICAL COATINGS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 109 EUROPE: OPTICAL COATING MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 110 EUROPE: MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 111 EUROPE: MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 112 EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 113 EUROPE: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 114 EUROPE: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 115 EUROPE: MARKETS, BY TECHNOLOGY, 2022–2028 (USD MILLION)

- TABLE 116 GERMANY: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 117 GERMANY: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 118 GERMANY: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 119 GERMANY: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 120 UK: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 121 UK: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 122 UK: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 123 UK: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 124 RUSSIA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 125 RUSSIA: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 126 RUSSIA: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 127 RUSSIA: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 128 FRANCE: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 129 FRANCE: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 130 FRANCE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 131 FRANCE: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 132 REST OF EUROPE: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 133 REST OF EUROPE: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 134 REST OF EUROPE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 135 REST OF EUROPE: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 136 REST OF THE WORLD: OPTICAL COATINGS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 137 REST OF THE WORLD: OPTICAL COATING MARKET, BY COUNTRY, 2022–2028 (USD MILLION)

- TABLE 138 REST OF THE WORLD: MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 139 REST OF THE WORLD: MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 140 REST OF THE WORLD: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 141 REST OF THE WORLD: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 142 REST OF THE WORLD: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 143 REST OF THE WORLD: MARKET, BY TECHNOLOGY, 2022–2028 (USD MILLION)

- TABLE 144 BRAZIL: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 145 BRAZIL: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 146 BRAZIL: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 147 BRAZIL: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 148 OTHER COUNTRIES: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018–2021 (USD MILLION)

- TABLE 149 OTHER COUNTRIES: OPTICAL COATING MARKET, BY END USE INDUSTRY, 2022–2028 (USD MILLION)

- TABLE 150 OTHER COUNTRIES: MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 151 OTHER COUNTRIES: MARKET, BY TYPE, 2022–2028 (USD MILLION)

- TABLE 152 COMPANIES ADOPTED INVESTMENTS & EXPANSIONS AND MERGERS & ACQUISITIONS AS KEY GROWTH STRATEGIES BETWEEN 2020 AND 2023

- TABLE 153 OPTICAL COATINGS MARKET: DEGREE OF COMPETITION

- TABLE 154 DETAILED LIST OF KEY PLAYERS

- TABLE 155 PRODUCT LAUNCHES, 2019–2023

- TABLE 156 DEALS, 2019–2023

- TABLE 157 OTHER DEVELOPMENTS, 2019–2023

- TABLE 158 DUPONT: COMPANY OVERVIEW

- TABLE 159 DUPONT: PRODUCT LAUNCHES

- TABLE 160 DUPONT: DEALS

- TABLE 161 DUPONT: OTHERS

- TABLE 162 PPG: COMPANY OVERVIEW

- TABLE 163 PPG: DEALS

- TABLE 164 PPG: OTHERS

- TABLE 165 NIPPON SHEET GLASS CO., LTD.: COMPANY OVERVIEW

- TABLE 166 NIPPON SHEET GLASS CO., LTD.: PRODUCT LAUNCHES

- TABLE 167 NIPPON SHEET GLASS CO., LTD.: DEALS

- TABLE 168 NIPPON SHEET GLASS CO., LTD.: OTHERS

- TABLE 169 ZEISS GROUP: COMPANY OVERVIEW

- TABLE 170 ZEISS GROUP: PRODUCT LAUNCHES

- TABLE 171 ZEISS GROUP: DEALS

- TABLE 172 ZEISS GROUP: OTHERS

- TABLE 173 NEWPORT CORPORATION: COMPANY OVERVIEW

- TABLE 174 NEWPORT CORPORATION: DEALS

- TABLE 175 INRAD OPTICS, INC.: COMPANY OVERVIEW

- TABLE 176 INRAD OPTICS, INC.: PRODUCT LAUNCHES

- TABLE 177 ARTEMIS OPTICAL LIMITED: COMPANY OVERVIEW

- TABLE 178 ARTEMIS OPTICAL LIMITED: DEALS

- TABLE 179 ARTEMIS OPTICAL LIMITED: OTHERS

- TABLE 180 ABRISA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 181 ABRISA TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 182 ABRISA TECHNOLOGIES: DEALS

- TABLE 183 ABRISA TECHNOLOGIES: OTHERS

- TABLE 184 REYNARD CORPORATION: COMPANY OVERVIEW

- TABLE 185 REYNARD CORPORATION: PRODUCT LAUNCHES

- TABLE 186 REYNARD CORPORATION: OTHERS

- TABLE 187 COHERENT CORP.: COMPANY OVERVIEW

- TABLE 188 COHERENT CORP.: PRODUCT LAUNCHES

- TABLE 189 COHERENT CORP.: DEALS

- TABLE 190 CASCADE OPTICAL CORPORATION: COMPANY OVERVIEW

- TABLE 191 BENEQ: COMPANY OVERVIEW

- TABLE 192 MATERION CORPORATION: COMPANY OVERVIEW

- TABLE 193 DEPOSITION SCIENCES, INC. (DSI): COMPANY OVERVIEW

- TABLE 194 LAMBDA RESEARCH OPTICS INC.: COMPANY OVERVIEW

- TABLE 195 MLD TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 196 EVAPORATED COATINGS, INC.: COMPANY OVERVIEW

- TABLE 197 ANDOVER CORPORATION: COMPANY OVERVIEW

- TABLE 198 VISIMAX TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 199 OPHIR OPTRONICS SOLUTIONS LTD.: COMPANY OVERVIEW

- TABLE 200 JANOS TECHNOLOGY LLC: COMPANY OVERVIEW

- TABLE 201 DENTON VACUUM: COMPANY OVERVIEW

- TABLE 202 NANO QUARZ WAFER: COMPANY OVERVIEW

- TABLE 203 ALLUXA: COMPANY OVERVIEW

- TABLE 204 ASML BERLIN (BERLINER GLAS): COMPANY OVERVIEW

- TABLE 205 CONFORMAL COATINGS MARKET, BY TYPE, 2018–2025 (TON)

- TABLE 206 CONFORMAL COATINGS MARKET, BY TYPE, 2018–2025 (USD THOUSAND)

- TABLE 207 CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2025 (TON)

- TABLE 208 CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2018–2025 (USD THOUSAND)

- TABLE 209 CONFORMAL COATINGS MARKET, BY REGION, 2018–2025 (TON)

- TABLE 210 CONFORMAL COATINGS MARKET, BY REGION, 2018–2025 (USD THOUSAND)

- TABLE 211 CVD TECHNOLOGY MARKET, BY EQUIPMENT & MATERIAL, 2012–2019 (USD MILLION)

- TABLE 212 PVD TECHNOLOGY MARKET, EQUIPMENT & MATERIAL, 2012–2019 (USD MILLION)

- TABLE 213 CVD EQUIPMENT MARKET, BY END-USE INDUSTRY, 2012–2019 (USD MILLION)

- TABLE 214 PVD EQUIPMENT MARKET, BY END-USE INDUSTRY, 2012–2019 (USD MILLION)

- TABLE 215 CVD TECHNOLOGY MARKET, BY REGION, 2012–2019 (USD MILLION)

- TABLE 216 PVD TECHNOLOGY MARKET, BY REGION, 2012–2019 (USD MILLION)

- FIGURE 1 OPTICAL COATINGS MARKET SEGMENTATION

- FIGURE 2 OPTICAL COATING MARKET: RESEARCH DESIGN

- FIGURE 3 OPTICAL COATINGS MARKET: SUPPLY-SIDE APPROACH – 1

- FIGURE 4 OPTICAL COATING MARKET: SUPPLY-SIDE APPROACH - 2

- FIGURE 5 OPTICAL COATINGS MARKET: SUPPLY-SIDE APPROACH – 3

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 VACUUM DEPOSITION TECHNOLOGY TO LEAD OPTICAL COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 10 AR COATINGS SEGMENT TO DOMINATE OPTICAL COATING MARKET DURING FORECAST PERIOD

- FIGURE 11 ELECTRONICS & SEMICONDUCTOR END USE INDUSTRY TO LEAD OPTICAL COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA LED OPTICAL COATINGS MARKET IN 2022

- FIGURE 13 OPTICAL COATINGS MARKET IN NORTH AMERICA TO OFFER ATTRACTIVE OPPORTUNITIES DURING FORECAST PERIOD

- FIGURE 14 US AND ELECTRONICS & SEMICONDUCTOR END USE INDUSTRY LARGEST MARKETS FOR OPTICAL COATINGS IN NORTH AMERICA IN 2022

- FIGURE 15 VACUUM DEPOSITION SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 16 FILTER COATINGS SEGMENT TO GROW AT HIGHEST CAGR IN OPTICAL COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 17 SOLAR POWER SEGMENT TO BE FASTEST-GROWING END USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN OPTICAL COATINGS MARKET

- FIGURE 19 OPTICAL COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 20 PRODUCTION PROCESS CONTRIBUTES MOST VALUE TO OVERALL PRICE OF OPTICAL COATINGS

- FIGURE 21 REVENUE SHIFT FOR OPTICAL COATING MANUFACTURERS

- FIGURE 22 SUPPLY CHAIN OF OPTICAL COATINGS INDUSTRY

- FIGURE 23 OPTICAL COATINGS MARKET: ECOSYSTEM

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END USE INDUSTRIES

- FIGURE 25 KEY BUYING CRITERIA FOR KEY END USE INDUSTRIES

- FIGURE 26 GRANTED PATENTS ACCOUNT FOR 4% OF TOTAL COUNT BETWEEN 2013 AND 2022

- FIGURE 27 NUMBER OF PATENTS BETWEEN 2013 AND 2022

- FIGURE 28 NUMBER OF PATENTS, BY JURISDICTION

- FIGURE 29 TOP TEN COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 30 VACUUM DEPOSITION TECHNOLOGY TO DRIVE OPTICAL COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 31 AR COATINGS SEGMENT TO DOMINATE OVERALL COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 32 ELECTRONICS & SEMICONDUCTOR END USE INDUSTRY TO DRIVE OPTICAL COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR OPTICAL COATINGS DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: OPTICAL COATINGS MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: OPTICAL COATINGS MARKET SNAPSHOT

- FIGURE 36 MARKET SHARE, BY KEY PLAYER (2022)

- FIGURE 37 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- FIGURE 38 REVENUE ANALYSIS OF KEY COMPANIES, 2018–2022

- FIGURE 39 COMPANY EVALUATION MATRIX, 2022

- FIGURE 40 START-UPS AND SMES EVALUATION MATRIX, 2022

- FIGURE 41 DUPONT: COMPANY SNAPSHOT

- FIGURE 42 PPG: COMPANY SNAPSHOT

- FIGURE 43 NIPPON SHEET GLASS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 44 ZEISS GROUP: COMPANY SNAPSHOT

- FIGURE 45 INRAD OPTICS, INC.: COMPANY SNAPSHOT

- FIGURE 46 COHERENT CORP: COMPANY SNAPSHOT

Extensive secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource have been used to identify and collect information for this technical, market-oriented, and commercial study of the optical coatings market. In-depth interviews were conducted with various primary respondents which included key industry participants, subject matter experts (SMEs), C-level executives of key industry players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers; publications from recognized websites; and databases. Secondary research has mainly been used to obtain key information about the supply chain of the industry, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both, market- and technology-oriented perspectives.

The market size of optical coatings has been estimated based on secondary data available through paid and unpaid sources, and by analyzing the product portfolios of key companies. This data has been further validated through various primary sources.

Primary Research

The optical coatings market comprises various stakeholders in the supply chain and includes suppliers, manufacturers, and end-product manufacturers. Various primary sources from the supply and demand sides of the optical coatings industry have been interviewed to obtain qualitative and quantitative information. Primary participants from the supply side include key opinion leaders, executives, vice presidents, and CEOs of companies in the market. Primary sources from the demand side include experts from end-use industries, associations, and institutions involved in the market, and key opinion leaders.

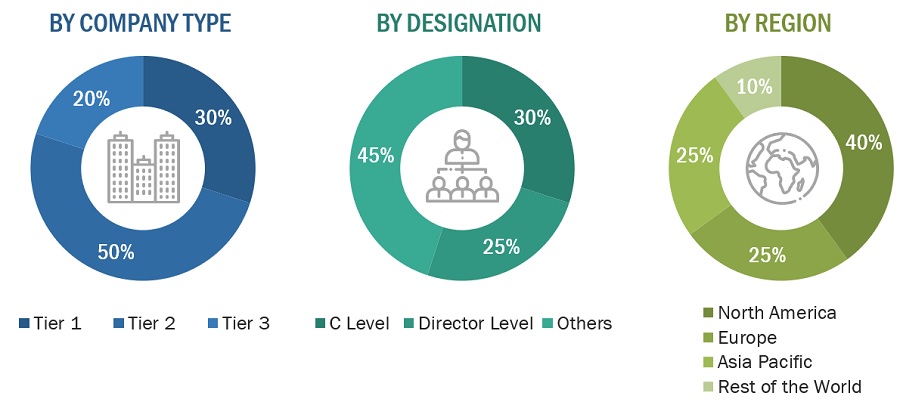

Following is the breakdown of primary respondents—

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 5 Billion; Tier 2: USD 1 Billion– USD 5 Billion; and Tier 3: <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The supply-side and demand-side approaches have been extensively used, along with several data triangulation methods, for market size estimation and forecast of the overall market segments listed in this report. Extensive qualitative and quantitative data were analyzed to list key information/insights throughout the report. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of annual reports, reviews, optical coatings associations, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. To complete the overall market estimation process and arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. Data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Optical coating involves applying thin layers of specialized materials onto optical components like lenses and mirrors. This process enhances the components' reflection, transmission, and durability properties, resulting in improved overall performance and efficiency of optical systems.

Key stakeholders

- Raw material suppliers and producers

- Optical coatings manufacturers

- Optical coatings distributors/suppliers

- Regulatory bodies

- Local governments

Report Objectives

- To define, describe, and forecast the size of the optical coatings market in terms of value

- To provide information about the factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To forecast and analyze the market based on technology, type and end-use industry

- To analyze and forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific, and Rest of the World, along with their respective key countries

- To analyze competitive developments such as mergers & acquisitions, joint ventures, and investments & expansions in the market

- To analyze opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC Optical coatings Market

- Further breakdown of Rest of Europe Optical coatings Market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Optical Coating Market