Oil Immersed Power Transformer Market by Installation (Pad-Mounted, Pole-Mounted, Substation Installation), Voltage (Low, Medium, High), Phase (Single, Three), End User (Industrial, Residential & Commercial, Utilities) and Region - Global Forecast to 2028

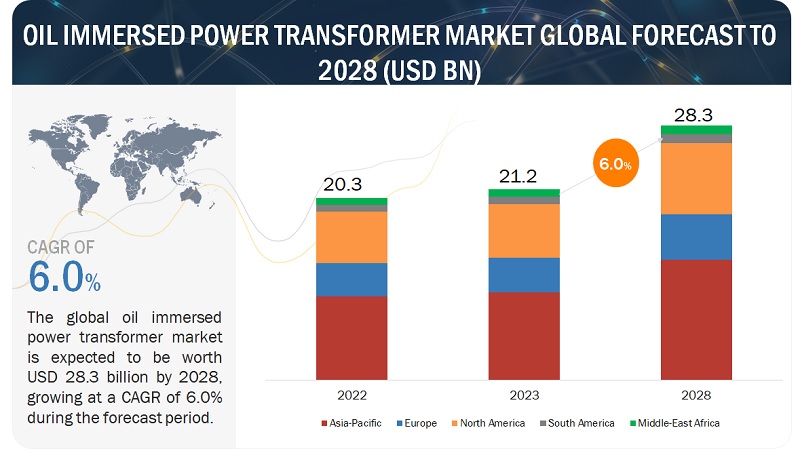

[244 Pages Report] The global oil immersed power transformer market in terms of revenue was estimated to be worth $21.2 billion in 2023 and is poised to reach $28.3 billion by 2028, growing at a CAGR of 6.0% from 2023 to 2028. The increasing use of IoT technology for home and building automation has raised the bar for effective energy management. As a result of these advancements, there is a greater need for oil immersed power transformers in order to monitor and optimise energy use. The commercial, service, and residential sectors all significantly aided in the market's growth, even though the industrial sector was a major factor in creating this demand.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Oil Immersed Power Transformer Market Dynamics

Driver: Integrating Renewable Energy for Sustainable Power Solutions.

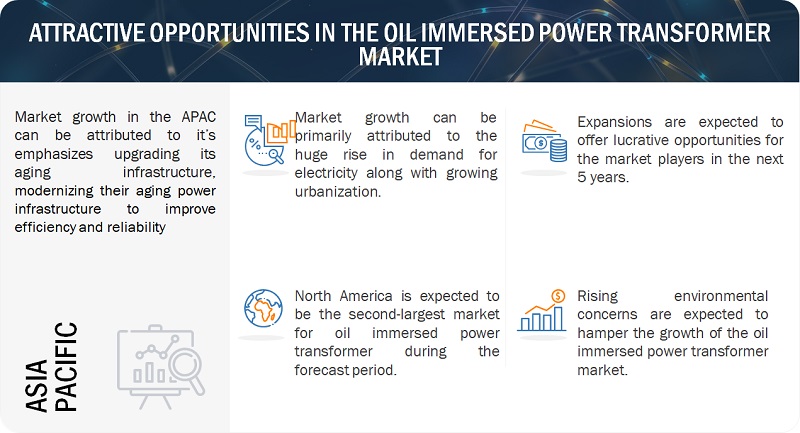

The integration of renewable energy sources has emerged as a crucial driver in establishing sustainable power solutions worldwide. As the global community grapples with the challenges of climate change and seeks to reduce its dependence on fossil fuels, renewable energy technologies have become key components of a cleaner and more sustainable energy future. One significant driver behind the integration of renewable energy is the urgent need to mitigate the environmental impacts associated with conventional energy sources. Fossil fuels, such as coal, oil, and natural gas, have long been the dominant contributors to electricity generation, but their combustion releases greenhouse gases, contributing to climate change and air pollution. Renewable energy, including solar, wind, hydro, and geothermal power, offers a cleaner alternative by harnessing natural processes that do not produce harmful emissions. Another driver for incorporating renewable energy into power solutions is the quest for energy independence and resilience. Many regions are seeking to diversify their energy portfolios to reduce vulnerability to supply disruptions and price fluctuations in fossil fuel markets. Renewable sources, being abundant and locally available, provide a more decentralized and resilient energy infrastructure. This diversification contributes to energy security, reduces reliance on finite resources, and promotes a more sustainable and self-sufficient energy ecosystem.

Restraints: Balancing High Initial Investments and Environmental Concerns in Transformer Adoption for Sustainable Power Infrastructure.

The adoption of transformers in the quest for sustainable power infrastructure necessitates a delicate balance between high initial investments and pressing environmental concerns. While transformers are indispensable components in power distribution, their production and deployment often involve substantial upfront costs, posing a financial challenge for many stakeholders. However, the long-term benefits of sustainable power infrastructure cannot be overstated. Transformers are pivotal in enhancing energy efficiency, optimizing power transmission, and facilitating the integration of renewable energy sources, which is imperative for mitigating climate change and reducing greenhouse gas emissions. One aspect of this delicate balance lies in the incorporation of environmentally conscious technologies and practices in transformer design and manufacturing. The industry is witnessing a paradigm shift towards eco-friendly alternatives, such as dry-type transformers or those using bio-based insulating oils, which not only contribute to reduced environmental impact but also align with global sustainability goals. The focus on minimizing the ecological footprint of transformers reflects a commitment to fostering a cleaner energy ecosystem.

Opportunities: Innovations in Transformer Management, Eco-Friendly Solutions, and Smart Grid Technologies for a Sustainable Future.

In the pursuit of a sustainable energy future, innovations in transformer management, eco-friendly solutions, and smart grid technologies have emerged as crucial pillars of progress. Transformer management has witnessed transformative advancements, with the integration of intelligent monitoring systems and predictive maintenance technologies. These innovations enable real-time assessment of transformer health, minimizing downtime, and optimizing operational efficiency. Simultaneously, a notable shift towards eco-friendly solutions is reshaping the transformer landscape. The industry is increasingly adopting dry-type transformers and alternative insulating fluids, minimizing environmental impact and aligning with green energy objectives. Additionally, the integration of smart grid technologies is revolutionizing the way power is generated, transmitted, and consumed. Smart grids enable real-time communication and data exchange, enhancing grid reliability, facilitating the seamless integration of renewable energy sources, and empowering consumers with greater control over their energy consumption. Collectively, these innovations not only pave the way for a more sustainable and resilient energy infrastructure but also contribute significantly to the global transition towards cleaner, more efficient, and environmentally conscious power systems.

Challenges: Aging Infrastructure, Environmental Impact, Operational Stress, and Integration with Renewable Energy Sources

The power sector is confronted with a multifaceted challenge encompassing aging infrastructure, environmental concerns, operational stress, and the imperative to seamlessly integrate with renewable energy sources. Aging infrastructure poses a risk to the reliability and efficiency of power systems, necessitating strategic upgrades and replacements to meet modern energy demands. Simultaneously, the environmental impact of conventional power generation methods underscores the urgency to transition towards cleaner alternatives. The stress on operational efficiency arises from the evolving energy landscape and the need for grid modernization. Transformers, as vital components of power infrastructure, are pivotal in addressing these challenges. Innovations in transformer technologies, such as eco-friendly insulating fluids and smart grid integration, are instrumental in mitigating environmental impact and enhancing operational resilience. Furthermore, the integration of renewable energy sources requires transformers to adapt to fluctuating energy patterns, emphasizing the need for smart and adaptable transformer solutions. Effectively addressing these interconnected challenges is crucial for building a sustainable and resilient energy infrastructure capable of meeting the demands of the future.

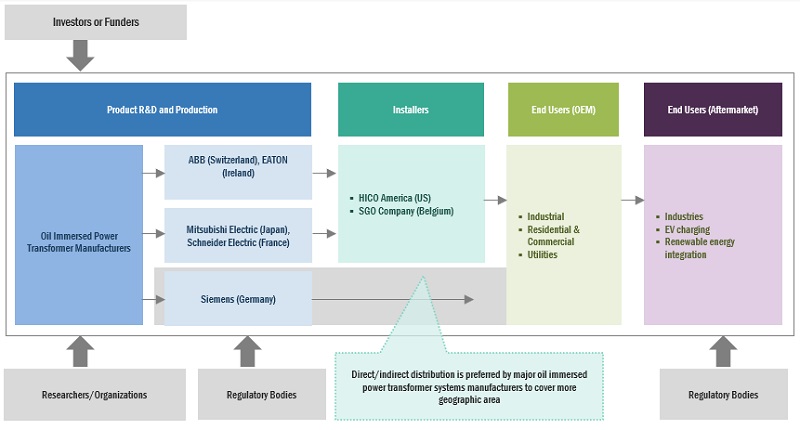

Oil Immersed Power Transformer Market Ecosystem

The oil immersed power transformer market is characterised by the presence of well-established, financially stable companies with significant experience in producing power transformers and related components. These companies are well-established in the market and offer a diverse range of products. Utilizing cutting-edge technologies, they uphold vast international networks for sales and marketing. Some of the leading companies in this oil filled power transformer market are Mitsubishi Electric (Japan), Eaton (Ireland), ABB (Switzerland), Siemens (Germany), and Schneider Electric (France).

Oil immersed power transformer Pad-mounted segment, by installation, to grow at highest CAGR from 2023 to 2028.

The Pad-mounted segment within the oil immersed power transformer market is poised for the highest Compound Annual Growth Rate (CAGR) from 2023 to 2028. This remarkable growth can be attributed to several key factors. Pad-mounted transformers, installed at ground level within protective enclosures, are gaining prominence due to their space-efficient design and aesthetic appeal, making them particularly suitable for urban and suburban settings with limited space. The increased emphasis on modernizing power distribution infrastructure further amplifies the demand for these transformers, given their ease of maintenance and accessibility. Additionally, advancements in solid insulation technologies, such as epoxy resin, contribute to enhanced performance, safety, and environmental sustainability, driving the preference for Pad-mounted transformers. As urbanization and infrastructure development continue, the Pad-mounted segment is expected to experience substantial growth, reaffirming its position as a key player in the market during the forecast period.

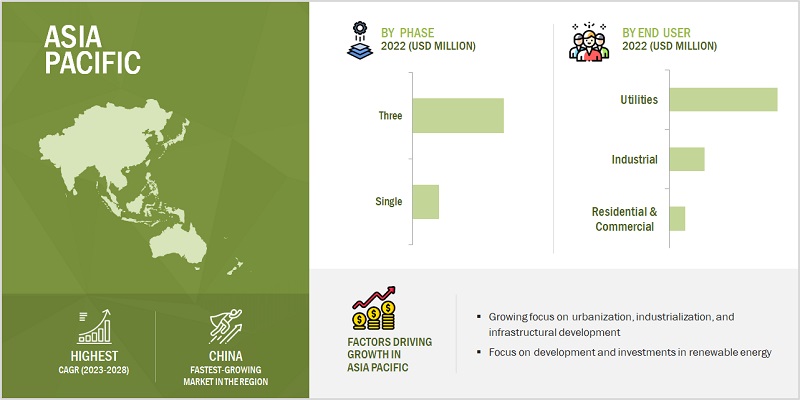

Three phase segment, by phase, to emerge as largest segment of oil immersed power transformer market.

The Three-phase segment is anticipated to emerge as the largest segment in the oil immersed power transformer market, exhibiting robust growth over the forecast period. This dominance is attributed to the widespread adoption of three-phase transformers in power transmission and distribution systems globally. Three-phase transformers are preferred for their efficiency in handling large power loads and their capability to transmit power over long distances with reduced energy losses. As industrialization, urbanization, and infrastructure development continue to drive the demand for electricity, the need for reliable and scalable power distribution solutions becomes paramount. The inherent advantages of three-phase transformers, including balanced power transmission and simplified grid design, position them as a cornerstone technology in meeting these escalating energy demands. Consequently, the Three-phase segment is poised to play a pivotal role in the oil filled transformer market, reflecting its significance in ensuring efficient and stable power distribution across diverse industries.

Industrial segment, by end user, to have highest market share from 2023 to 2028.

The Industrial segment, categorized by end user, is projected to command the highest market share in the oil immersed power transformer market from 2023 to 2028. This dominance is driven by the escalating power requirements of industrial facilities worldwide, particularly in manufacturing, heavy machinery, and other industrial sectors. As industries continue to expand and modernize, the demand for reliable and efficient power distribution solutions, such as oil-immersed transformers, intensifies. These transformers play a crucial role in ensuring a stable and continuous power supply for industrial operations, contributing to enhanced productivity and operational efficiency. Moreover, the need for upgrading and replacing aging infrastructure in industrial settings further propels the demand for oil-immersed power transformers. The Industrial segment is poised to remain a key driver of the market, reflecting the essential role of these transformers in sustaining the power-intensive operations of industrial facilities across various global regions.

Asia Pacific to account for largest market size during forecast period.

Asia Pacific is set to dominate the oil immersed power transformer market, holding the largest market size throughout the forecast period. This regional prominence can be attributed to a confluence of factors driving substantial demand for reliable power infrastructure. The rapid industrialization, urbanization, and infrastructural development initiatives in countries such as China, India, and Southeast Asian nations are fostering a significant increase in electricity consumption. As a response to this surge in demand, there is a heightened need for robust power transmission and distribution networks, wherein oil-immersed power transformers play a crucial role. Additionally, governmental investments in upgrading and expanding power grids, coupled with a growing focus on renewable energy integration, contribute to the escalating demand for these transformers. Asia Pacific's status as the largest market reflects not only its current energy requirements but also its strategic initiatives toward building resilient and modern power infrastructure to meet the future needs of a dynamic and burgeoning economy.

Key Market Players

ABB (Switzerland), General Electric (US), Siemens (Germany), Schneider Electric (France), Eaton Corporation (Ireland), Mitsubishi Electric (Japan), Hitachi (Japan), Legrand (France), Hyundai Electric (South Korea), Fuji Electric (Japan), and Toshiba (Japan).

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Installation, By Phase, By Voltage, and By End User |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East and Africa, and South America |

|

Companies covered |

ABB (Switzerland), General Electric (US), Siemens (Germany), Schneider Electric (France), Mitsubishi Electric (Japan), Eaton Corporation (Ireland), Hitachi (Japan), Hyundai Electric (South Korea), Fuji Electric (Japan), Toshiba corporation (Japan), Voltamp (India), MGM Transformer Company (California), Yuebian Electric Co., Ltd. (China), CG Power and Industrial Solutions (India), Nissin Electric (Japan), Daihen Corporation (Japan), Jiangshan Scotech Electric Co., Ltd. (China), Ningbo Ironcube Works International Co., Ltd. (China), Chint Group (China), Alfanar Group (Saudi Arabia) and Nissisn Electric (South Korea) |

The market is classified in this research report based on installation, phase, voltage, end user, and region.

Based on installation, the oil immersed power transformer market has been segmented as follows:

- Pad-mounted

- Pole-mounted

- Substation Installation

Based on phase, the market has been segmented as follows:

- Single

- Three

Based on voltage, the market has been segmented as follows:

- Low

- Medium

- High

Based on end user, the market has been segmented as follows:

- Industrial

- Residential & Commercial

- Utilities

Based on regions, the market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East and Africa

Recent Developments

- In April 2022, ABB and Samsung Electronics collaborated to jointly develop technologies aimed at energy conservation, efficient energy management, and the intelligent integration of the Internet of Things (IoT) in both residential and commercial buildings.

- In August 2020, Schneider Electric concluded a transaction that integrated its Low Voltage and Industrial Automation business in India with Larsen & Toubro's Electrical and Automation business.

- In December 2021, ABB partnered with Mitsubishi Electric to develop and manufacture transformers using advanced amorphous metal core technology. This collaboration leverages the expertise of both companies to deliver high-performance and compact transformers for demanding applications.

Frequently Asked Questions (FAQ):

What is the current size of the global oil immersed power transformer market?

The global oil immersed power transformer market is estimated to be USD 28.3 billion in 2028.

What are the major drivers for oil immersed power transformer market?

The oil immersed power transformer market is propelled by several key drivers that collectively shape its growth trajectory. The increasing global demand for a reliable and efficient power supply remains a primary driver, spurred by factors such as urbanization, industrialization, and infrastructural development. As electricity consumption rises, there is a heightened need for robust power transmission and distribution infrastructure, with oil-immersed transformers playing a pivotal role. The integration of renewable energy sources into the power grid, coupled with ongoing efforts to modernize existing grid systems, further amplifies the market's expansion. Advancements in smart grid technologies, coupled with the imperative to address growing electricity demand, underscore the significance of oil-immersed power transformers in ensuring a stable and resilient power supply, positioning them as essential components in the evolving energy landscape.

Which End user has the largest market share in the oil immersed power transformer market?

The industrial end-user segment commands the largest market share in the oil immersed power transformer market. This dominance is driven by the substantial electricity requirements of industrial facilities, ranging from manufacturing plants to heavy machinery operations. As industries expand globally, particularly in developing economies, the demand for reliable and efficient power distribution solutions, such as oil-immersed transformers, has witnessed significant growth. These transformers play a critical role in ensuring a stable and uninterrupted power supply for various industrial processes, thereby enhancing overall productivity and operational efficiency. The industrial sector's dependence on electricity-intensive operations and the necessity to replace or upgrade aging power infrastructure further contribute to the substantial market share held by the industrial end-user segment in the oil immersed power transformer market.

Which is the largest-growing region during the forecast period in the oil immersed power transformer market?

The Asia Pacific region emerges as the fastest-growing market during the forecast period in the oil immersed power transformer market. This dynamic growth is propelled by rapid industrialization, urbanization, and robust infrastructure development initiatives across countries such as China, India, and Southeast Asia. As these economies expand, there is a heightened demand for reliable and efficient power distribution solutions, with oil-immersed transformers playing a pivotal role in meeting this surge in electricity consumption. Governmental investments in modernizing power grids, coupled with a strong emphasis on renewable energy integration, further drive the demand for these transformers in the region. Asia Pacific's proactive approach toward building resilient and advanced power infrastructure to cater to the evolving energy landscape positions it as a key growth hub in the oil immersed power transformer market during the forecast period.

Which is the fastest-growing segment in the oil immersed power transformer market during the forecast period?

The Pad-mounted segment is poised to be the fastest-growing segment in the oil immersed power transformer market during the forecast period. This accelerated growth is attributed to the increasing preference for pad-mounted transformers, particularly in urban and suburban environments where space efficiency and aesthetic considerations are crucial. The design of pad-mounted transformers, installed at ground level within protective enclosures, aligns with the evolving needs of modern infrastructure. As urbanization and the expansion of power distribution networks continue, the demand for these transformers rises significantly. Advancements in solid insulation technologies and the ease of maintenance associated with pad-mounted transformers further contribute to their growing popularity. The segment's robust growth underscores its relevance in the oil immersed power transformer market, driven by the imperative for efficient and space-conscious power distribution solutions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Modernization of energy infrastructure- Incorporation of renewable energy for sustainable power solutionsRESTRAINTS- High initial investment- Safety compliance related to oil-immersed power transformersOPPORTUNITIES- Innovations in transformer management and smart grid technologies- Integration of energy storage solutions into power gridsCHALLENGES- Aging infrastructure and other operational constraints- Shortage of skilled workforce

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 VALUE CHAIN ANALYSISRAW MATERIAL PROVIDERS/SUPPLIERSCOMPONENT MANUFACTURERSOIL-IMMERSED POWER TRANSFORMER MANUFACTURERS/ASSEMBLERSDISTRIBUTORSEND USERSPOST-SALES SERVICES

-

5.5 TECHNOLOGY ANALYSISDIGITALIZATIONSUSTAINABLE TECHNOLOGIES

- 5.6 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.7 ECOSYSTEM MAPPING

-

5.8 PATENT ANALYSIS

-

5.9 CASE STUDY ANALYSISOVERHEATING OF OIL-IMMERSED POWER TRANSFORMER AT MAPLE CREEK WIND FARM- Problem- SolutionOIL LEAK FROM POWER TRANSFORMER AT CENTRAL CITY SUBSTATION- Problem- SolutionAGING OF OIL-IMMERSED POWER TRANSFORMER AT BIG RIVER SUBSTATION- Problem- Solution

-

5.10 TRADE DATA ANALYSISTRADE ANALYSIS RELATED TO LIQUID DIELECTRIC TRANSFORMERS WITH POWER HANDLING CAPACITY <= 650 KVA- Import data- Export dataTRADE ANALYSIS RELATED TO LIQUID DIELECTRIC TRANSFORMERS WITH POWER HANDLING CAPACITY > 10,000 KVA- Import data- Export data

-

5.11 PRICING ANALYSISAVERAGE SELLING PRICE OF OIL-IMMERSED POWER TRANSFORMERS, BY VOLTAGEAVERAGE SELLING PRICE OF OIL-IMMERSED POWER TRANSFORMERS, BY REGION

-

5.12 TARIFF AND REGULATORY LANDSCAPETARIFFS RELATED TO OIL-IMMERSED POWER TRANSFORMERSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSCODES AND REGULATIONS RELATED TO OIL-IMMERSED POWER TRANSFORMERS

- 5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIASTAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 PAD-MOUNTEDRISE IN DEMAND FOR EFFICIENT ELECTRICITY DISTRIBUTION TO DRIVE GROWTH

-

6.3 POLE-MOUNTEDNEED FOR MORE EXTENSIVE AND EFFECTIVE COVERAGE TO DRIVE GROWTH

-

6.4 SUBSTATION-BASEDRAPID INTEGRATION OF SMART GRID SOLUTIONS TO DRIVE GROWTH

- 7.1 INTRODUCTION

-

7.2 SINGLEEASY INSTALLATION AND MAINTENANCE TO DRIVE GROWTH

-

7.3 THREEEFFICIENT POWER TRANSMISSION AND DISTRIBUTION TO DRIVE GROWTH

- 8.1 INTRODUCTION

-

8.2 LOW (BELOW 36 KV)LOW RISK OF ELECTRICAL SHOCKS AND BETTER CONTROL IN CONFINED SPACES TO DRIVE GROWTH

-

8.3 MEDIUM (36–69 KV)IMPROVED PERFORMANCE AND ELECTRIC STABILITY TO DRIVE GROWTH

-

8.4 HIGH (ABOVE 69 KV)INTEGRATION OF ADVANCED MONITORING AND CONTROL SYSTEMS TO DRIVE GROWTH

- 9.1 INTRODUCTION

-

9.2 INDUSTRIALROBUST DESIGN AND INSULATION PROPERTIES OF OIL-IMMERSED TRANSFORMERS TO DRIVE GROWTH- Oil & Gas- Pharmaceutical- Automotive- Steel- Chemical- Food & Beverage

-

9.3 RESIDENTIAL & COMMERCIALNEED FOR UNINTERRUPTED SUPPLY OF ELECTRICITY TO DRIVE GROWTH

-

9.4 UTILITIESPROACTIVE MAINTENANCE STRATEGIES AND ENVIRONMENTAL CONSCIOUSNESS TO DRIVE GROWTH

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICRECESSION IMPACT ANALYSISCHINA- Rapid industrialization and adoption of three-phase oil-immersed transformers to drive growthINDIA- Smart grid initiatives and independent power producers to drive growthJAPAN- Advancement of electricity infrastructure and replacement of aging transformers to drive growthSOUTH KOREA- Modernization programs for power distribution networks to drive growthREST OF ASIA PACIFIC

-

10.3 NORTH AMERICARECESSION IMPACT ANALYSIS- US- Canada- Mexico

-

10.4 EUROPERECESSION IMPACT ANALYSIS- Germany- UK- Italy- France- Spain- Rest of Europe

-

10.5 SOUTH AMERICABRAZIL- Adoption of higher voltage transformers to drive growthARGENTINA- Renovar program to drive growthREST OF SOUTH AMERICA

-

10.6 MIDDLE EAST & AFRICASAUDI ARABIA- Vision 2030 initiative to drive growthUAE- Dubai Clean Energy Strategy 2050 to drive growthREST OF GCC- Consistent economic growth and compliance with international regulations to drive marketSOUTH AFRICA- Expansion of nation grid infrastructure to drive growthNIGERIA- Rural Electrification Agency and transmission rehabilitation and expansion program to drive growthREST OF MIDDLE EAST & AFRICA

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS, 2022

- 11.4 REVENUE ANALYSIS, 2018–2022

-

11.5 COMPANY EVALUATION MATRIX, 2022STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.6 STARTUP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.7 COMPETITIVE SCENARIOSPRODUCT LAUNCHESDEALSOTHERS

-

12.1 KEY PLAYERSABB- Business overview- Products offered- Recent developments- MnM viewSCHNEIDER ELECTRIC- Business overview- Products offered- Recent developments- MnM viewGENERAL ELECTRIC- Business overview- Products offered- Recent developments- MnM viewSIEMENS- Business overview- Products offered- Recent developments- MnM viewEATON- Business overview- Products offered- Recent developments- MnM viewNINGBO IRONCUBE WORKS INTERNATIONAL CO., LTD.- Business overview- Products offeredMITSUBISHI ELECTRIC- Business overview- Products offered- Recent developmentsHITACHI- Business overview- Products offered- Recent developmentsHYUNDAI ELECTRIC- Business overview- Products offeredFUJI ELECTRIC- Business overview- Products offered- Recent developmentsCROMPTON GREAVES POWER AND INDUSTRIAL SOLUTIONS- Business overview- Products offeredNISSIN ELECTRIC- Business overview- Products offeredALFANAR GROUP- Business overview- Products offered- Recent developmentsJIANGSHAN SCOTECH ELECTRICAL CO., LTD.- Business overview- Products offeredTOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION- Business overview- Products offered

-

12.2 OTHER PLAYERSMGM TRANSFORMER COMPANYVOLTAMPYUEBIAN ELECTRIC CO., LTD.DAIHEN CORPORATIONCHINT GROUP

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 OIL-IMMERSED POWER TRANSFORMER MARKET, BY INSTALLATION

- TABLE 2 OIL-IMMERSED POWER TRANSFORMER MARKET, BY VOLTAGE

- TABLE 3 OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE

- TABLE 4 OIL-IMMERSED POWER TRANSFORMER MARKET, BY END USER

- TABLE 5 OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION

- TABLE 6 OIL-IMMERSED POWER TRANSFORMER MARKET SNAPSHOT

- TABLE 7 PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 9 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 10 PATENT ANALYSIS, 2020–2023

- TABLE 11 IMPORT SCENARIO FOR HS CODE 850421, BY COUNTRY, 2020–2022 (USD)

- TABLE 12 EXPORT SCENARIO FOR HS CODE 850421, BY COUNTRY, 2020–2022 (USD)

- TABLE 13 IMPORT SCENARIO FOR HS CODE 850423, BY COUNTRY, 2020–2022 (USD)

- TABLE 14 EXPORT SCENARIO FOR HS CODE 850423, BY COUNTRY, 2020–2022 (USD)

- TABLE 15 AVERAGE SELLING PRICE OF OIL-IMMERSED POWER TRANSFORMERS, BY VOLTAGE

- TABLE 16 AVERAGE SELLING PRICE OF OIL-IMMERSED POWER TRANSFORMERS, BY REGION (USD MILLION/UNIT)

- TABLE 17 IMPORT TARIFFS FOR HS 850421 LIQUID DIELECTRIC TRANSFORMERS, WITH POWER HANDLING CAPACITY > 10.000 KVA, 2022

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 CODES AND REGULATIONS RELATED TO OIL-IMMERSED POWER TRANSFORMERS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 24 KEY BUYING CRITERIA, BY END USER

- TABLE 25 OIL-IMMERSED POWER TRANSFORMER MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 26 PAD-MOUNTED: OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 POLE-MOUNTED: OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 SUBSTATION-BASED: OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 29 OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 30 SINGLE: OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 31 THREE: OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 OIL-IMMERSED POWER TRANSFORMER MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 33 OIL-IMMERSED POWER TRANSFORMER MARKET, BY VOLTAGE, 2021–2028 (UNITS)

- TABLE 34 LOW (BELOW 36 KV): OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 35 MEDIUM (36–69 KV): OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 HIGH (ABOVE 69 KV): OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 OIL-IMMERSED POWER TRANSFORMER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 38 OIL-IMMERSED POWER TRANSFORMER MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 39 INDUSTRIAL: OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 INDUSTRIAL: OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 41 INDUSTRIAL: OIL-IMMERSED POWER TRANSFORMER MARKET, BY SUBSEGMENT, 2021–2028 (USD MILLION)

- TABLE 42 RESIDENTIAL & COMMERCIAL: OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 RESIDENTIAL & COMMERCIAL: OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 44 UTILITIES: OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 UTILITIES: OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 46 OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 47 OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (UNITS)

- TABLE 48 ASIA PACIFIC: OIL-IMMERSED POWER TRANSFORMER MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: OIL-IMMERSED POWER TRANSFORMER MARKET, BY VOLTAGE RATING, 2021–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: OIL-IMMERSED POWER TRANSFORMER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 52 ASIA PACIFIC: OIL-IMMERSED POWER TRANSFORMER MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 53 ASIA PACIFIC: OIL-IMMERSED POWER TRANSFORMER MARKET, BY SUBSEGMENT, 2021–2028 (USD MILLION)

- TABLE 54 ASIA PACIFIC: OIL-IMMERSED POWER TRANSFORMER MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 CHINA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 56 INDIA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 57 JAPAN: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 58 SOUTH KOREA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 59 REST OF ASIA PACIFIC: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 65 NORTH AMERICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY SUBSEGMENT, 2021–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: OIL IMMERSED POWER TRANSFORMER MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 US: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 68 CANADA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 69 MEXICO: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 70 EUROPE: OIL-IMMERSED POWER TRANSFORMER MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 71 EUROPE: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 72 EUROPE: OIL-IMMERSED POWER TRANSFORMER MARKET, BY VOLTAGE RATING, 2021–2028 (USD MILLION)

- TABLE 73 EUROPE: OIL-IMMERSED POWER TRANSFORMER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 74 EUROPE: OIL-IMMERSED POWER TRANSFORMER MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 75 EUROPE: OIL-IMMERSED POWER TRANSFORMER MARKET, BY SUBSEGMENT, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: OIL-IMMERSED POWER TRANSFORMER MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 GERMANY: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 78 UK: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 79 ITALY: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 80 FRANCE: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 81 SPAIN: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 82 REST OF EUROPE: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 83 SOUTH AMERICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 84 SOUTH AMERICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 85 SOUTH AMERICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY VOLTAGE, 2021–2028 (USD MILLION)

- TABLE 86 SOUTH AMERICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 87 SOUTH AMERICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 88 SOUTH AMERICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY SUBSEGMENT, 2021–2028 (USD MILLION)

- TABLE 89 SOUTH AMERICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 90 BRAZIL: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 91 ARGENTINA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 92 REST OF SOUTH AMERICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 93 MIDDLE EAST & AFRICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY INSTALLATION, 2021–2028 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY VOLTAGE RATING, 2021–2028 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY END USER, 2021–2028 (UNITS)

- TABLE 98 MIDDLE EAST & AFRICA: INDUSTRIAL: OIL-IMMERSED POWER TRANSFORMER MARKET, BY SUBSEGMENT, 2021–2028 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 100 SAUDI ARABIA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 101 UAE: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 102 REST OF GCC: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 103 SOUTH AFRICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 104 NIGERIA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 105 REST OF MIDDLE EAST & AFRICA: OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2021–2028 (USD MILLION)

- TABLE 106 STRATEGIES ADOPTED BY KEY PLAYERS, 2019–2022

- TABLE 107 OIL-IMMERSED POWER TRANSFORMER MARKET: DEGREE OF COMPETITION

- TABLE 108 INSTALLATION FOOTPRINT

- TABLE 109 VOLTAGE FOOTPRINT

- TABLE 110 PHASE FOOTPRINT

- TABLE 111 END USER FOOTPRINT

- TABLE 112 REGION FOOTPRINT

- TABLE 113 COMPANY FOOTPRINT

- TABLE 114 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 115 KEY STARTUPS/SMES

- TABLE 116 PRODUCT LAUNCHES, 2019–2023

- TABLE 117 DEALS, 2019–2023

- TABLE 118 OTHERS, 2019–2023

- TABLE 119 ABB: COMPANY OVERVIEW

- TABLE 120 ABB: PRODUCTS OFFERED

- TABLE 121 ABB: DEALS

- TABLE 122 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 123 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

- TABLE 124 SCHNEIDER ELECTRIC: DEALS

- TABLE 125 GENERAL ELECTRIC: COMPANY OVERVIEW

- TABLE 126 GENERAL ELECTRIC: PRODUCTS OFFERED

- TABLE 127 GENERAL ELECTRIC: DEALS

- TABLE 128 SIEMENS: COMPANY OVERVIEW

- TABLE 129 SIEMENS: PRODUCTS OFFERED

- TABLE 130 SIEMENS: PRODUCT LAUNCHES

- TABLE 131 SIEMENS: DEALS

- TABLE 132 EATON: COMPANY OVERVIEW

- TABLE 133 EATON: PRODUCTS OFFERED

- TABLE 134 EATON: DEALS

- TABLE 135 NINGBO IRONCUBE WORKS INTERNATIONAL CO., LTD.: COMPANY OVERVIEW

- TABLE 136 NINGBO IRONCUBE WORKS INTERNATIONAL CO., LTD.: PRODUCTS OFFERED

- TABLE 137 MITSUBISHI ELECTRIC: COMPANY OVERVIEW

- TABLE 138 MITSUBISHI ELECTRIC: PRODUCTS OFFERED

- TABLE 139 MITSUBISHI ELECTRIC: DEALS

- TABLE 140 HITACHI: COMPANY OVERVIEW

- TABLE 141 HITACHI: PRODUCTS OFFERED

- TABLE 142 HITACHI: DEALS

- TABLE 143 HITACHI: OTHERS

- TABLE 144 HYUNDAI ELECTRIC: COMPANY OVERVIEW

- TABLE 145 HYUNDAI ELECTRIC: PRODUCTS OFFERED

- TABLE 146 FUJI ELECTRIC: COMPANY OVERVIEW

- TABLE 147 FUJI ELECTRIC: PRODUCTS OFFERED

- TABLE 148 FUJI ELECTRIC: PRODUCT LAUNCHES

- TABLE 149 CROMPTON GREAVES POWER AND INDUSTRIAL SOLUTIONS: COMPANY OVERVIEW

- TABLE 150 CROMPTON GREAVES POWER AND INDUSTRIAL SOLUTIONS: PRODUCTS OFFERED

- TABLE 151 CROMPTON GREAVES POWER AND INDUSTRIAL SOLUTIONS: OTHERS

- TABLE 152 NISSIN ELECTRIC: COMPANY OVERVIEW

- TABLE 153 NISSIN ELECTRIC: PRODUCTS OFFERED

- TABLE 154 ALFANAR GROUP: COMPANY OVERVIEW

- TABLE 155 ALFANAR GROUP: PRODUCTS OFFERED

- TABLE 156 ALFANAR GROUP: DEALS

- TABLE 157 JIANGSHAN SCOTECH ELECTRICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 158 JIANGSHAN SCOTECH ELECTRICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: COMPANY OVERVIEW

- TABLE 160 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: PRODUCTS OFFERED

- FIGURE 1 OIL-IMMERSED POWER TRANSFORMER MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

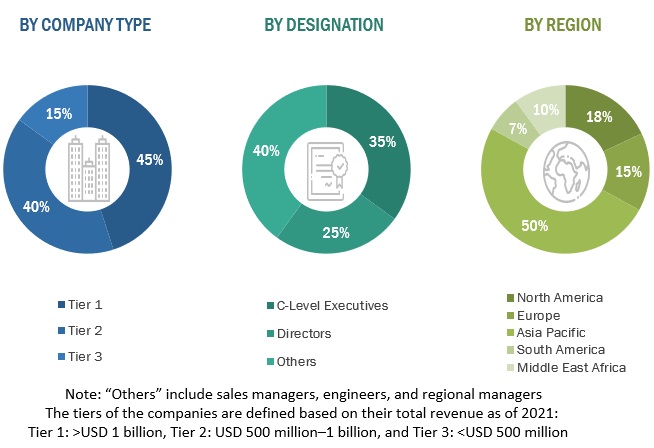

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR OIL-IMMERSED POWER TRANSFORMERS

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF OIL-IMMERSED POWER TRANSFORMERS

- FIGURE 8 SUPPLY-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 ASIA PACIFIC DOMINATED MARKET IN 2022

- FIGURE 11 PAD-MOUNTED SEGMENT TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 THREE PHASE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 HIGH VOLTAGE SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 TRANSMISSION SEGMENT TO EXHIBIT LARGEST MARKET SHARE (2023–2028)

- FIGURE 15 UTILITIES SEGMENT TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 GROWING ENVIRONMENTAL CONCERNS AND URBANIZATION TO DRIVE MARKET

- FIGURE 17 ASIA PACIFIC MARKET TO SHOWCASE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 OUTDOOR SEGMENT AND CHINA ACCOUNTED FOR LARGEST MARKET SHARES IN ASIA PACIFIC, 2022

- FIGURE 19 PAD-MOUNTED SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 20 THREE PHASE SEGMENT TO HAVE LARGEST MARKET SHARE IN 2022

- FIGURE 21 MEDIUM VOLTAGE SEGMENT TO HAVE HIGHEST SHARE IN 2022

- FIGURE 22 UTILITIES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 23 OIL-IMMERSED POWER TRANSFORMER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 EXPANSION OF ELECTRIC VEHICLE MARKET, 2016–2023

- FIGURE 25 RENEWABLE CAPACITY ADDITIONS, BY REGION, 2019–2021

- FIGURE 26 CHANGE IN ELECTRICITY DEMAND, BY REGION, 2019–2025

- FIGURE 27 GLOBAL GDP GROWTH, 2010–2022

- FIGURE 28 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 VALUE CHAIN ANALYSIS

- FIGURE 30 ECOSYSTEM MAPPING

- FIGURE 31 PATENT ANALYSIS

- FIGURE 32 AVERAGE SELLING PRICE OF OIL-IMMERSED POWER TRANSFORMERS, BY REGION

- FIGURE 33 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- FIGURE 35 KEY BUYING CRITERIA, BY END USER

- FIGURE 36 OIL-IMMERSED POWER TRANSFORMER MARKET, BY INSTALLATION, 2022

- FIGURE 37 OIL-IMMERSED POWER TRANSFORMER MARKET, BY PHASE, 2022

- FIGURE 38 OIL-IMMERSED POWER TRANSFORMER MARKET, BY VOLTAGE, 2022

- FIGURE 39 OIL-IMMERSED POWER TRANSFORMER MARKET, BY END USER, 2022

- FIGURE 40 OIL-IMMERSED POWER TRANSFORMER MARKET, BY REGION, 2022

- FIGURE 41 ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 42 ASIA PACIFIC: OIL-IMMERSED POWER TRANSFORMER MARKET SNAPSHOT

- FIGURE 43 EUROPE: OIL-IMMERSED POWER TRANSFORMER MARKET SNAPSHOT

- FIGURE 44 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 45 REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022

- FIGURE 46 COMPANY EVALUATION MATRIX, 2022

- FIGURE 47 STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 48 ABB: COMPANY SNAPSHOT

- FIGURE 49 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 50 GENERAL ELECTRIC: COMPANY SNAPSHOT

- FIGURE 51 SIEMENS: COMPANY SNAPSHOT

- FIGURE 52 EATON: COMPANY SNAPSHOT

- FIGURE 53 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

- FIGURE 54 HITACHI: COMPANY SNAPSHOT

- FIGURE 55 HYUNDAI ELECTRIC: COMPANY SNAPSHOT

- FIGURE 56 FUJI ELECTRIC: COMPANY SNAPSHOT

- FIGURE 57 CROMPTON GREAVES POWER AND INDUSTRIAL SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 58 NISSIN ELECTRIC: COMPANY SNAPSHOT

- FIGURE 59 TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION: COMPANY SNAPSHOT

This study involved extensive efforts to ascertain the current size of the oil immersed power transformer market. The process commenced with a meticulous secondary research phase aimed at collecting data pertaining to the market, analogous markets, and the broader industry landscape. Subsequently, the gathered findings, assumptions, and calculations of market size underwent rigorous validation through primary research, involving consultations with industry experts spanning the entire value chain. The assessment of the total market size was conducted through an analysis tailored to each country. Following this, a detailed dissection of the market took place, and the data was cross-referenced to derive estimations for the sizes of various segments and sub-segments within the market. This dual-phased approach, combining both secondary and primary research methodologies, enhances the reliability and accuracy of the study's findings.

Secondary Research

In the course of this research study, an extensive array of secondary sources was employed, incorporating directories, databases, and reputable references such as Hoover's, Bloomberg BusinessWeek, Factiva, World Bank, the US Department of Energy (DOE), and the International Energy Agency (IEA). These sources played a pivotal role in the collection of valuable data essential for conducting a comprehensive analysis of the global oil immersed power transformer market. Encompassing technical, market-oriented, and commercial aspects, these secondary sources contributed substantially to the depth and breadth of the study. Additional secondary sources included annual reports, press releases, investor presentations, whitepapers, authoritative publications, articles authored by well-respected experts, information from industry associations, trade directories, and various database resources. The diverse range of secondary sources utilized ensures a robust and well-informed foundation for the research study.

Primary Research

The market engages various stakeholders across its supply chain, encompassing component manufacturers, product manufacturers/assemblers, service providers, distributors, and end-users. The predominant driving force behind market demand stems from industrial end-users, and the increasing requisites of transmission and distribution utilities also contribute significantly to market growth. On the supply side, a discernible trend is observed with heightened demand for contracts from the industrial sector, accompanied by a notable prevalence of mergers and acquisitions among major industry players.

To gather a comprehensive understanding of the market, both qualitatively and quantitatively, a range of primary sources from both the supply and demand sides were interviewed. The breakdown below delineates the primary respondents who played a crucial role in providing insights for the research study.

To know about the assumptions considered for the study, download the pdf brochure

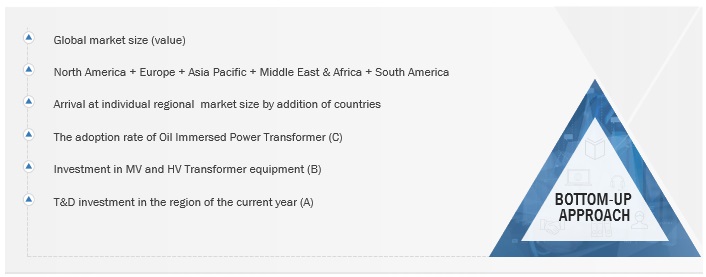

Market Size Estimation

The estimation and validation of the oil immersed power transformer market size have been meticulously conducted through a bottom-up approach. This method was rigorously employed to ascertain the dimensions of multiple subsegments within the market. The research process encompasses the following key stages.

- This approach has looked at production figures both nationally and regionally for every kind of oil immersed power transformer.

- Extensive secondary and primary research has been carried out to obtain a thorough comprehension of the worldwide market environment for different types of transformers.

- Several primary interviews have been conducted with prominent power transformer system development experts, including significant OEMs and Tier I suppliers.

- Qualitative aspects like market drivers, constraints, opportunities, and challenges have been considered when estimating and projecting the market size.

Global Oil Immersed Power Transformer Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The process of determining the overall market size incorporated the methodologies previously outlined, which included segmenting the market into various segments and subsegments. To conclude the comprehensive market analysis and attain precise statistics for each market segment and subsegment, data triangulation and market segmentation techniques were implemented as deemed appropriate. Data triangulation involved a thorough examination of various factors and trends from both the demand and supply perspectives within the ecosystem of the market.

Market Definition

An oil immersed power transformer refers to an electrical device designed for the transmission and distribution of electrical power. It operates by utilizing oil as a cooling and insulating medium within its core and windings. This type of transformer is crucial for stepping up or stepping down voltage levels, enabling efficient and safe power transfer across various applications. The market for oil immersed power transformers encompasses the manufacturing, distribution, and utilization of these transformers, serving diverse sectors such as industrial, residential, and commercial establishments. It involves the production and supply chain activities related to oil immersed transformers, addressing the demand for reliable and efficient power distribution solutions in the context of global energy infrastructure. The market definition extends to the various voltage classes, installation types, and end-users associated with oil immersed power transformers, reflecting the integral role these devices play in the broader electrical grid and power distribution systems.

Key Stakeholders

- Government Utility Providers

- Independent Power Producers

- Transformer manufacturers

- Power equipment and garden tool manufacturers

- Consulting companies in the energy & power sector

- Distribution utilities

- Government and research organizations

- Organizations, forums, and associations

- Raw material suppliers

- State and national regulatory authorities

- Transformer manufacturers, distributors, and suppliers

- Transformers original equipment manufacturers (OEMs)

Objectives of the Study

- The market for oil immersed power transformers will be outlined, characterized, segmented, and projected based on factors such as installation, phase, voltage, and end user.

- To project market sizes for the North American, South American, European, Asia Pacific, Middle Eastern, and African markets, along with the major nations in each of these five regions.

- To offer thorough insights into the factors propelling market drivers, restraints, opportunities, and challenges specific to the industry.

- To strategically examine each subsegment's growth trends, future potential, and share of the market as a whole.

- To assess market prospects for interested parties and the competitive environment for industry leaders.

- To carefully examine the market shares and core competencies of the major players and develop strategic profiles of them.

- To track and evaluate competitive developments, including partnerships, agreements, sales contracts, new product launches, acquisitions, joint ventures, contracts, expansions, and investments, in the market.

- The market for oil immersed power transformers is evaluated in this report.

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Oil Immersed Power Transformer Market