Oil and Gas Analytics Market by Software (Upstream, Midstream, and Downstream), by Deployment Model, by Services, and by Regions - Forecasts and Analysis (2014 - 2019)

[135 Pages Report] The Oil and Gas Analytics Market is estimated to grow from $4.29 billion in 2014 to $19.65 billion in 2019 at a Compound Annual Growth Rate (CAGR) of 35.5% from 2014 to 2019

The global oil and gas industry is at a crossroad over the depleting oil and gas reserves worldwide. New challenges arise and are addressed through conventional technologies. The rising global demand for fuel, increasing competition, financial capital and public scrutiny and regulations are a few of the severe challenges faced today. The falling crude oil reserves and the dynamic supply and demand are responsible for the price volatility of crude oil. New exploration and extraction techniques are on the rise for new types of hydrocarbons. The emerging technologies in the oil and gas industry generate a huge volume of operational and financial data. The use of various analytical engines helps to turn growing amounts of data into insights yielding profitability. The use of advanced business intelligence and analytics tools in the oil and gas industry would lead to efficient and effective operations. The Oil and Gas Analytics market thus shows a growing trend with many oil companies transforming their conventional practices into an analytical performance-powered approach.

Today, the oil and gas companies have swiftly turned towards the use of advanced information and communication technologies (ICT) to face the challenges gripping the industry. Huge data volumes (Big Data) are generated in the operations of the upstream, midstream and downstream segments of oil and gas companies. This data could be transformed into crucial information and insights yielding greater efficiency, productivity and profitability to the companies. The advanced solutions like business intelligence and big data management and analytics have transformed the conventional management into fact-based decision driven management. The oil companies face organizational data challenges like poor data quality, data integration, data irrelevancies, data ownership and limited visibility. The new-age big data analytics solutions have overcome the fragmented framework into unified data architecture to address the organizational data challenges.

The oil and gas analytics market shows a positive growth in the prospective years with more oil companies resolving to achieve lower operation and maintenance costs. Analytical framework systems such as SAP HANA and Apache Hadoop provide support for various analytical software and technologies. The oil and gas analytics spectrum provides various solutions for upstream, midstream and downstream operations. The geospatial and exploration analytics solutions help oil companies search new oil reserves in remote geographies. The infrastructure analytics solutions provide construction insights for extraction and drilling infrastructure and oil pipelines. It also provides data insights for predictive maintenance and repairs to avoid financial and ecological damages.

The midstream and downstream operations in the oil industry are extremely crucial due to the complex supply chain and retail of the combustible materials and products. Video analytics provides complete surveillance solution for the oil pipelines across the oil and gas supply chain. Product analytics solutions provide oil refineries with product analysis and standard chemical composition of the end products. The crude oil prices are one of the major influencers for the global stock markets. Various pricing analytics solutions process the financial big data of the company to forecast the market dynamics and price elasticity of supply and demand in the oil and gas analytics market. The social media market has for long remained untapped by the oil and gas companies. The oil companies could now enhance their customer relation management with the help of customer big data analytical tools.

The oil and gas analytics solutions provide the companies with demand forecasts of the current market. The drilling analytics indicates the feasible and appropriate production rates for the company. Big data analytical platforms have revolutionized modern-day oil companies by improving exploration and drilling practices, logistics and supply chain management and downstream marketing and trading.

The research report includes key market drivers, the current global trends adopted for oil and gas analytics, market size of the industry and the forecasts for the market segments and upcoming technologies. The report further analyzes the future potential growth of the market in the oil and gas sector, the competitive analysis of major market players, the opportunities prevailing before the key companies and the best market practices.

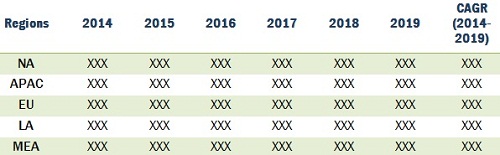

The report gives a comprehensive study about the current global market and their in-depth analysis with respect to regional market space, revenue flows, future prospects and evolving industry verticals. The report encompasses the business potentials of regions such as North America (NA), Europe, Asia-Pacific (APAC), Latin America (LA) and Middle-East and Africa (MEA). The major global providers included in the report are Accenture, Cisco Systems, EMC Corporation, Hewlett-Packard, IBM Corporation, Microsoft Corporation, Oracle, SAP AG, SAS Institute and Teradata.

The human advancements in the fields of lifestyle, travel and transportation are responsible for the resultant need of greater oil consumption. The staggering oil productions in the previous century have intensified the global issue of exhaustion of fossil fuels. The rapid depletion of oil and gas reserves has brought the global oil and gas authorities to a crossroad. The oil companies have to transmute their current operational techniques to tackle the productivity losses from the limited oil resources. The field of oil and gas analytics provides a solution to alchemize the organizational data into the most valuable assets for the company. The market shows a tremendous future potential for global oil companies offering a visionary solution

World economy is driven by the exchange of goods and services. Exchange of goods heavily depends on the intermodal transportation service. The immense growth in the transportation sector is an outcome of the expanding world economies. The global transportation machinery and fleet urges for a colossal demand for oil and gas.

The global oil demand is on an exponential rise due to rapid globalization and industrial growth. The developed economies in the west show very high per capita oil consumptions. The BRICS economies excluding Russia import large quantities of crude oil due to low domestic oil and gas production and huge demand in the country. The exhausting oil and gas reserves have aggravated the oil demands forcing oil companies to maintain higher production volumes from aging oil fields. This fact drives solutions and systems available in the market on global level.

The oil companies have undertaken exploration drives to discover new oil reserves in order to supply greater production volumes to meet the global demand. These production and operational expansions of the oil and gas industry have led to new explorations into the remote regions with adverse frontiers across the globe. The extraction units have to sustain the harsh conditions and environment in deserts and deep ocean waters. The maintenance costs of the oil companies are sky rocketing in order to sustain environmental challenges. Billions of dollars are spent annually over the repairs and maintenance of offshore and deepwater oilrigs. The aging production infrastructure often results in oil explosions and oil spills which is responsible for hazardous ecological consequences like loss of marine wealth and acid rains.

The global production of oil and gas swings across every day and it is under heavy political scrutiny and influence. The oil and gas market is an oligopoly where a few strong players control the entire market space. The rising oil demand and the fluctuating supply have made the crude oil prices very volatile. The heavy rise and falls in the oil market have kept away hefty investments for the technological advancements of the oil fields. The oil industry thus operates inefficiently with low oil production by conventional techniques resulting in heavy operational losses. The oil and gas analytics market is estimated to grow from $4.29 billion in 2014 to $19.65 billion in 2019 at a Compound Annual Growth Rate (CAGR) of 35.5% from 2014 to 2019.

Oil and Gas Analytics: Market, by Region ($Million)

Source: Press Releases, Expert Interviews, and MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Market Scope

2 Research Methodology (Page No. - 19)

2.1 Market Size Estimation

2.2 Market Share Estimation

2.2.1 Key Data Points Taken From Secondary Sources

2.2.2 Key Data Points from Primary Sources

2.2.3 Key Industry Insights

2.2.4 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities In Oil And Gas Analytics Market

4.2 Market Top Three Analytics Software Used In Upstream Operations

4.3 Market across Various Regions

4.4 Oil and Gas Analytics Software Type Market across Various Regions

4.5 Life Cycle Analysis, By Geography

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 Oil and Gas Analytics Market By Software

5.3.2 Market By Deployment Platform

5.3.3 Market By Services

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Global Demand for Oil And Gas

5.4.1.2 Untapped Value of Big Data In The Oil And Gas Industry

5.4.1.3 Asset-Intensive Oil and Gas Industry

5.4.2 Restraints

5.4.2.1 Price Volatility in The Oil And Gas Market

5.4.2.2 Harsh Climatic Conditions and Communication Links

5.4.2.3 Stringent Regulations and Compliances over The Oil And Gas Industry

5.4.3 Opportunities

5.4.3.1 Cloud Analytics

5.4.3.2 Evolutions of Digital Oilfields

5.4.4 Challenges

5.4.4.1 Depleting Oil and Gas Reserves

5.4.4.2 Aging Workforce In The Oil And Gas Industry

6 Industry Trends (Page No. - 42)

6.1 Value Chain Analysis

6.2 Porters Five Forces Analysis

6.2.1 Threat from New Entrants

6.2.2 Threat of Substitutes

6.2.3 Bargaining Power of Suppliers

6.2.4 Bargaining Power of Buyers

6.2.5 Intensity of Competitive Rivalry

7 Oil And Gas Analytics Market, By Software Used In Upstream Operations (Page No. - 46)

7.1 Introduction

7.2 Exploration and Drilling Analytics

7.3 Production Planning and Forecasting Analytics

7.4 Field Surveillance and Monitoring Analytics

7.5 Equipment Maintenance Management Analytics

7.6 Workforce Management Analytics

7.7 Asset Performance Analytics

8 Oil And Gas Analytics, By Software Used In Midstream Operations (Page No. - 54)

8.1 Introduction

8.2 Fleet Analytics

8.3 Pipeline SCADA Analytics

8.4 Storage Optimization Analytics

9 Oil and Gas Analytics, By Software Used In Downstream Operations 58 (Page No. - 58)

9.1 Introduction

9.2 Pricing Analytics

9.3 Commodity Trading Analytics

9.4 Refining Analytics

9.5 Demand Forecasting Analytics

10 Oil And Gas Analytics, By Deployment Platform (Page No. - 62)

10.1 Introduction

10.2 On-Premise

10.3 Hosted

11 Oil And Gas Analytics, By Services (Page No. - 66)

11.1 Introduction

11.2 Professional Services

11.3 Integration Services

11.4 Cloud Services

12 Geographical Analysis (Page No. - 70)

12.1 Introduction

12.1.1 Oil And Gas Analytics, By Region

12.2 North America

12.2.1 Type Market

12.2.2 Software Market

12.2.3 Software Used In Upstream Operations Market

12.2.4 Software Used In Midstream Operations Market

12.2.5 Software Used In Downstream Operations Market

12.2.6 Deployment Platform Market

12.2.7 Services Market

12.3 Europe

12.3.1 Type Market

12.3.2 Software Market

12.3.3 Software Used In Upstream Operations Market

12.3.4 Software Used In Midstream Operations Market

12.3.5 Software Used In Downstream Operations Market

12.3.6 Deployment Platform Market

12.3.7 Services Market

12.4APAC

12.4.1 Type Market

12.4.2 Software Market

12.4.3 Software Used In Upstream Operations Market

12.4.4 Software Used In Midstream Operations Market

12.4.5 Software Used In Downstream Operations Market

12.4.6 Deployment Platform Market

12.4.7 Services Market

12.5 MEA

12.5.1 Type Market

12.5.2 Software Market

12.5.3 Software Used In Upstream Operations Market

12.5.4 Software Used In Midstream Operations Market

12.5.5 Software Used In Downstream Operations Market

12.5.6 Deployment Platform Market

12.5.7 Services Market

12.6 Latin America

12.6.1 Type Market

12.6.2 Software Market

12.6.3 Software Used In Upstream Operations Market

12.6.4 Software Used In Midstream Operations Market

12.6.5 Software Used In Downstream Operations Market

12.6.6 Deployment Platform Market

12.6.7 Services Market

13 Competitive Landscape (Page No. - 88)

13.1 Overview

13.2 Market Share Analysis, Oil and Gas Analytics Market

13.3 Competitive Situation and Trends

13.3.1 New Product Launches

13.3.2 Agreements, Partnerships, Collaborations, & Joint Ventures

13.3.3 Mergers and Acquisitions

14 Company Profiles (Page No. - 95)

14.1 Introduction

14.2 Hewlett-Packard

14.2.1 Business Overview

14.2.2 Products & Services

14.2.3 Key Strategy

14.2.4 Recent Developments

14.2.5 SWOT Analysis

14.2.6 MNM View

14.3 Hitachi

14.3.1 Business Overview

14.3.2 Products & Services

14.3.3 Key Strategy

14.3.4 Recent Developments

14.3.5 MNM View

14.4 IBM

14.4.1 Business Overview

14.4.2 Products & Services

14.4.3 Key Strategy

14.4.4 Recent Developments

14.4.5 SWOT Analysis

14.4.6 MNM View

14.5 Northwest Analytics

14.5.1 Business Overview

14.5.2 Products & Services

14.5.3 Key Strategy

14.5.4 Recent Developments

14.5.5 MNM View

14.6 Oracle

14.6.1 Business Overview

14.6.2 Products & Services

14.6.3 Key Strategy

14.6.4 Recent Developments

14.6.5 SWOT Analysis

14.6.6 MNM View

14.7 Sap Ag

14.7.1 Business Overview

14.7.2 Products & Services

14.7.3 Key Strategy

14.7.4 Recent Developments

14.7.5 SWOT Analysis

14.7.6 MNM View

14.8 SAS Institute

14.8.1 Business Overview

14.8.2 Products & Services

14.8.3 Key Strategy

14.8.4 Recent Developments

14.8.5 MNM View

14.9 Tableau Software

14.9.1 Business Overview

14.9.2 Products & Services

14.9.3 Key Strategy

14.9.4 Recent Developments

14.9.5 MNM View

14.10 Teradata

14.10.1 Business Overview

14.10.2 Products & Services

14.10.3 Key Strategy

14.10.4 Recent Developments

14.10.5 MNM View

14.11 Tibco Software

14.11.1 Business Overview

14.11.2 Products & Services

14.11.3 Key Strategy

14.11.4 Recent Developments

14.11.5 SWOT Analysis

14.11.6 MNM View

15 Appendix (Page No. - 128)

15.1 Discussion Guide

15.2 Introducing RT: Real-Time Market Intelligence

15.3 Available Customizations

15.4 Related Reports

List of Tables (69 Tables)

Table 1 Oil and Gas Analytics Market: Assumptions

Table 2 Global Demand for Oil and Gas Is Propelling the Growth of Market

Table 3 Price Volatility in Oil and Gas Market Is Restraining the Growth of Market

Table 4 Evolution of Digital Oilfields in Oil and Gas Market Is Propelling the Growth of Market

Table 5 Depleting Oil and Gas Reserves Is the Major Challenge Faced In Market

Table 6 Oil and Gas Analytics Market, By Software Used In Upstream Operations, 20132019 ($Million)

Table 7 Exploration and Drilling Analytics Market, By Region, 20132019 ($Million)

Table 8 Production Planning and Forecasting Analytics Market, By Region, 20132019 ($Million)

Table 9 Field Surveillance And Monitoring Analytics Market, By Region, 20132019 ($Million)

Table 10 Equipment Maintenance Management Analytics Market, By Region, 20132019 ($Million)

Table 11 Workforce Management Analytics Market, By Region, 20132019 ($Million)

Table 12 Asset Performance Analytics Market, By Region, 20132019 ($Million)

Table 13 Oil and Gas Analytics Market, By Software Used In Midstream Operations, 20132019 ($Million)

Table 14 Fleet Analytics Market, By Region, 20132019 ($Million)

Table 15 Pipeline SCADA Analytics Market, By Region, 20132019 ($Million)

Table 16 Storage Optimization Analytics Market, By Region, 20132019 ($Million)

Table 17 Oil and Gas Analytics Market, By Software Used In Downstream Operations, 20132019 ($Million)

Table 18 Pricing Analytics Market, By Region, 20132019 ($Million)

Table 19 Commodity Trading Analytics Market, By Region, 20132019 ($Million)

Table 20 Refining Analytics Market, By Region, 20132019 ($Million)

Table 21 Demand Forecasting Analytics Market, By Region, 20132019 ($Million)

Table 22 Oil and Gas Analytics Market, By Deployment Platform,20132019 ($Million)

Table 23 Market, By Deployment Platform,2014 & 2019, Y-O-Y (%)

Table 24 Oil and Gas Analytics On-Premise Market, By Region,20132019 ($Million)

Table 25 Oil and Gas Analytics Hosted Market, By Region, 20132019 ($Million)

Table 26 Oil and Gas Analytics Market, By Services, 20132019 ($Million)

Table 27 Market, By Services, 2014 & 2019, Y-O-Y (%)

Table 28 Oil and Gas Analytics Professional Services Market, By Region,20132019 ($Million)

Table 29 Oil and Gas Analytics Integration Services Market, By Region, 20132019 ($Million)

Table 30 Oil and Gas Analytics Cloud Services Market, By Region,20132019 ($Million)

Table 31 Oil and Gas Analytics, By Region, 20132019 ($Million)

Table 32 Oil and Gas Analytics, By Region, 2014 & 2019, Y-O-Y (%)

Table 33 Na, Oil and Gas Analytics Market, By Types, 20132019 ($Million)

Table 34 Na, Market, By Types, 2014 & 2019, Y-O-Y (%)

Table 35 Na, Market, By Software, 20132019 ($Million)

Table 36 Na, Market, By Software Used In Upstream Operations, 20132019 ($Million)

Table 37 Na, Market, By Software Used In Midstream Operations, 20132019 ($Million)

Table 38 Na, Market, By Software Used In Downstream Operations, 20132019 ($Million)

Table 39 Na, Market, By Deployment Platform,20132019 ($Million)

Table 40 Na, Market, By Services, 20132019 ($Million)

Table 41 Europe, Oil and Gas Analytics Market, By Types, 20132019 ($Million)

Table 42 Europe, Market, By Types, 2014 & 2019, Y-O-Y (%)

Table 43 Europe, Market, By Software,20132019 ($Million)

Table 44 Europe, Market, By Software Used In Upstream Operations, 20132019 ($Million)

Table 45 Europe, Market, By Software Used In Midstream Operations, 20132019 ($Million)

Table 46 Europe, Market, By Software Used In Downstream Operations, 20132019 ($Million)

Table 47 Europe, Market, By Deployment Platform,20132019 ($Million)

Table 48 Europe, Market, By Services,20132019 ($Million)

Table 49APAC, Oil and Gas Analytics Market, By Types, 20132019 ($Million)

Table 50APAC, Market, By Types, 2014 & 2019, Y-O-Y (%)

Table 51APAC, Market, By Software, 20132019 ($Million)

Table 52APAC, Market, By Software Used In Upstream Operations, 20132019 ($Million)

Table 53APAC, Market, By Software Used In Midstream Operations, 20132019 ($Million)

Table 54APAC, Market, By Software Used In Downstream Operations, 20132019 ($Million)

Table 55APAC, Market, By Deployment Platform,20132019 ($Million)

Table 56APAC, Market, By Services, 20132019 ($Million)

Table 57 Mea, Oil and Gas Analytics Market, By Types, 20132019 ($Million)

Table 58 Mea, Market, By Types, 2014 & 2019, Y-O-Y (%)

Table 59 Mea, Market, By Software, 20132019 ($Million)

Table 60 Mea, Market, By Software Used In Upstream Operations, 20132019 ($Million)

Table 61 Mea, Market, By Software Used In Midstream Operations, 20132019 ($Million)

Table 62 Mea, Market, By Software Used In Downstream Operations, 20132019 ($Million)

Table 63 Mea, Market, By Deployment Platform,20132019 ($Million)

Table 64 Mea, Market, By Services, 20132019 ($Million)

Table 65 La, Oil and Gas Analytics Market, By Types, 20132019 ($Million)

Table 66 La, Market, By Types, 2014 & 2019, Y-O-Y (%)

Table 67 La, Market, By Software, 20132019 ($Million)

Table 68 La, Market, By Software Used In Upstream Operations, 20132019 ($Million)

Table 69 La, Market, By Software Used In Midstream Operations, 20132019 ($Million)

Table 70 La, Market, By Software Used In Downstream Operations, 20132019 ($Million)

Table 71 La, Market, By Deployment Platform,20132019 ($Million)

Table 72 La, Market, By Services, 20132019 ($Million)

Table 73 New Product Launches, 20132014

Table 74 Agreements, Partnerships, Collaborations, And Joint Ventures,20132014

Table 75 Mergers and Acquisitions, 20132014

List of Figures (20 Figures)

Figure 1 Oil and Gas Analytics Market: Stakeholders

Figure 2 Oil and Gas Analytics: Research Methodology

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Oil And Gas Analytics Market, By Software, 2014

Figure 6 Oil and Gas Analytics Software Market Snapshot (2014 Vs 2019): Exploration And Drilling Analytics Market Is Expected To Increase Five Times In The

Next Five Years

Figure 7 Attractive Market Opportunities In Oil And Gas Analytics

Figure 8 Exploration And Drilling Analytics Is Expected To Grow At The Fastest Rate Among The Top Three Analytical Software Used In Upstream Operations

Figure 9 Oil And Gas Analytics Market Share, 2014

Figure 10 Oil And Gas Analytics Software Type Market Share, 2014

Figure 11 Latin American Market Soon To Enter Exponential Growth Phase In Coming Years

Figure 12 Evolution Of Oil And Gas Analytics

Figure 13 Oil and Gas Analytics Market Segmentation: By Software

Figure 14 Market Segmentation: By Deployment Platform

Figure 15 Market Segmentation: By Services

Figure 16 Untapped Value Of Big Data In Oil And Gas Industry Will Spur The Demand Of Oil And Gas Analytics

Figure 17 Market: Drivers and Restraints

Figure 18 Value Chain Analysis (2014): Major Value Is Added During the Product Development Phase

Figure 19 Porters Five Forces Analysis Oil and Gas Analytics Market

Figure 20 More Than Half Of The Market Is Dominated By Exploration And Drilling Analytics

Figure 21 Oil and Gas Analytics Market, By Software

Figure 22 The Mea Region Is Expected To Grow With The Maximum CAGR, Owing To The Increased Adoption Of Oil And Gas Analytics Software In Developing Economies

Figure 23 On-Premises Market Set To Outpace Deployment Platform Segment In Growth

Figure 24 Hosted Deployment Platform Would Drive The Growth In Na Region By 2019 63

Figure 25 Companies Adopted Agreements, Partnerships, Collaborations, & Joint Ventures As The Key Growth Strategy Over The Last Four Years

Figure 26 Sap Ag and Oracle Grew At The Fastest Rate Between 20092013

Figure 27 Global Market Share, By Key Player, 2013

Figure 28 Battle for Market Share: Agreements, Partnerships, Collaborations, & Joint Ventures Was The Key Strategy

Figure 29 Geographic Revenue Mix of Top 5 Market Players

Figure 30 Hewlett-Packard: Business Overview

Figure 31 SWOT Analysis

Figure 32 Hitachi: Business Overview

Figure 33 IBM: Business Overview

Figure 34 SWOT Analysis

Figure 35 Northwest Analytics: Business Overview

Figure 36 Oracle: Business Overview

Figure 37 SWOT Analysis

Figure 38 Sap Ag: Business Overview

Figure 39 SWOT Analysis

Figure 40 SAS Institute: Business Overview

Figure 41 Tableau Software: Business Overview

Figure 42 Teradata: Business Overview

Figure 43 Tibco Software: Business Overview

Figure 44 SWOT Analysis

Growth opportunities and latent adjacency in Oil and Gas Analytics Market

"Gather insights into Oil and Gas (Upstream, Midstream, and Downstream) "