Offshore Drilling Rigs Market by Type (Jackup, Semi-Submersibles, Drillships), by Application (Shallow Water, Deepwater, Ultra-Deepwater) & Geography (North America, Latin America, Europe, the Middle East, Asia-Pacific, Africa, ROW) - Global Forecast to 2019

[199 Pages Report] The offshore drilling rigs market report includes the market size and estimation of the global drilling rigs industry in the offshore region. Primarily, offshore drilling rigs can be classified as jackup rigs, semi-submersible rigs, and drillships. The areas of application of drilling rigs in the offshore region are shallow water, deepwater, and ultra-deep water. Jackup rigs are used in the shallow water region, semi-submersible rigs are used in the deepwater region, and drillships are used in ultra-deep water regions of the offshore arena.

Jackup rigs are offshore rigs typically equipped with legs that can be lowered to the seabed such that a foundation is established to support the drilling platform. Once the foundation is installed, the drilling platform is further jacked up to the expected highest waves based on the leg length. Generally, jackup rigs can operate in water depths ranging from 350 to 450 feet.

Semi-submersibles are a type of offshore rigs that are submerged by means of a water ballast system, such that during drilling operations, the lower hull portion is below the water surface. These rigs float above the well through the use of an anchoring system or a computer-controlled DP thruster system. Most of the semi-submersibles are not mobile and are relocated with the help of tugs. Some semi-submersibles move between locations, using their own power when afloat on the pontoons. Semi-submersibles are typically employed in more challenging water conditions than drillships and in water depths ranging from 500 feet to 8,000+ feet.

Drillships are typically used in deepwater applications. These types of offshore rigs are generally self-propelled and are shaped like conventional ships. Drillships can be operated in a moored configuration or can be dynamically positioned (DP) without anchors utilizing their onboard propulsion and station keeping systems. Drillships generally possess a greater load capacity than semi-submersible rigs. This load capacity enables them to carry more supplies onboard, making them better suited for remote offshore drilling. However, operation of these rig types is limited to calmer water conditions than those in which semi-submersibles can operate.

The global offshore drilling rigs market value is expected to reach $102,473 million by 2019, growing at a CAGR of 9.27% from 2014 to 2019. Some of the factors responsible for this growth include increasing expenditure on exploration and production and the rising demand for energy from emerging economies like Africa, Brazil, and the U.S. Gulf of Mexico. The key concerns for the offshore drilling rigs industry include various environmental concerns and other related government regulations.

The offshore drilling rigs market is also analyzed with respect to Porter's Five Force model. Different market forces, namely, bargaining power of suppliers, bargaining power of buyers, degree of competition, threat of substitutes, and threat of new entrants, are analyzed with respect to the offshore drilling rigs industry. The report also presents the competitive landscape of major market players, including contract agreements, awards, mergers, acquisitions, and joint ventures, along with other developments. Some of the key players involved in these developments are Transocean Ltd. (Switzerland), Nabors Industries Ltd. (Bermuda), Ensco Plc. (U.K.), and Seadrill Ltd. (U.K.).

The report also provides a comprehensive review of major market drivers, restraints, opportunities, and challenges in the offshore drilling rigs market.

Scope of the Report:

The global offshore drilling rigs market is analyzed in terms of revenue ($Million) for the aforesaid applications, types, and by region.

By Geography

- North America

- Latin America

- Europe

- Asia-Pacific

- Middle East

- Africa

- Rest of the World (RoW)

By Application

- Shallow water

- Deepwater

- Ultra-Deep water

By Type

- Jackup Rigs

- Semi-Submersible Rigs

- Drillships

Offshore drilling rigs are used for drilling and exploration activities in the offshore arena. The high demand for crude oil, along with the maturing of onshore oil and gas wells is driving the market for offshore drilling rigs. The increase in the number of investments from operators, especially for deep and ultra-deep water activities, fuels the growth of the offshore drilling rigs market. Semi-submersibles and jackups dominate the global offshore drilling rigs market, owing to increasing shallow and deepwater explorations. The major regions of the offshore drilling rigs market are Latin America, the Gulf of Mexico, and Western Africa; most offshore explorations and drilling activities take place in these regions.

Growing demand for deepwater activities in the Asia-Pacific region and further drilling into mid ocean is driving the demand for mid and deep water floaters. Additionally, increasing investments with high E&P Capex in these regions are also propelling the growth of the deepwater market. Drillships currently have the largest market size because of increasing ultra-deep water activities in growing offshore regions across the world.

Growing Offshore CAPEX: A driver of the offshore drilling rigs market

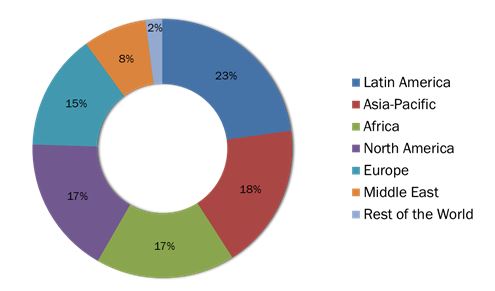

The global offshore drilling rigs market has witnessed decent growth, precipitated by the increasing global demand for energy and rising number of investments from operators in deepwater drilling activities. The largest markets for offshore drilling rigs are Latin America, Asia-Pacific, and Africa.

Offshore Drilling Rigs: Market Share, by Geography, 2014

Source: MarketsandMarkets Analysis

The Latin American region has abundant high offshore potential reserves of oil and gas. Furthermore, factors such as increasing investments in E&P CAPEX in the region are leading to growing offshore exploration and production activities, thereby increasing the demand for drilling equipment and offshore rigs.

The progress of the offshore rigs market largely depends on growing exploration activities across the globe. The recent discoveries of oil and gas reserves in remote areas, along with increasing technological advancements in terms of equipment have made drilling operations more feasible and cost-effective.

COSL (China), Nabors (Bermuda), Ensco plc. (U.K.), Diamond Offshore Drilling (U.S.), KCA Deutag (U.K.), and Maersk Drilling (Denmark), are the major players that constitute a significant share of the global offshore drilling rigs market. These players are concentrating on growing markets and are investing heavily to meet the demand from these markets and to reduce contract backlogs. KCA Deutag and Noble Corporation, two of the oldest players, have been gaining traction in this market owing to their vast experience and expanding product portfolios, and through providing drilling services to emerging markets.

Contracts and Agreements: Key strategy

Most of these companies rely mainly on availing contracts for drilling from operators. This is done in order to gain maximum revenue and avail of niche opportunities in the market. To meet the demand for offshore drilling activities and to enhance oil productivity, drilling contractors have opted for contract extensions and agreements as their key strategy.

The major offshore drilling rig types include jackups, semi-submersibles, and drillships. Semi-submersibles are the largest in terms of market value and jackups are the most widely employed rigs for offshore drilling.

Table of Contents

1 Introduction (Page No.- 13)

1.1 Objectives

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No.- 16)

2.1 Market Size Estimation

2.2 Market Share Estimation

2.2.1 Secondary Data

2.2.1.1 Key Data Points Taken From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data Points Taken From Primary Sources

2.2.2.2 Key Industry Insights

2.2.3 Assumptions

3 Executive Summary (Page No.- 22)

4 Premium Insights (Page No.- 25)

4.1 Attractive Market Opportunities in offshore Rigs

4.2 Regional Life Cycle Analysis, By Geography

4.3 Future Demand for Drillships

4.4 South American Deep-Water Discoveries Constitute Almost Half of the Global Offshore Discoveries

4.5 Potential Growth of Offshore Operations Across All the Regions in the Next Five Years

4.6 Growth for Mid and Deep Water Floaters to Be Seen By the Year 2019

5 Market Overview (Page No.- 30)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Geography

5.2.2 By Application

5.2.3 By Type

5.3 Market Dynamics

5.3.1 Market Drivers

5.3.1.1 Increasing E&P Expenditures

5.3.1.2 Rising Energy Demand From Emerging Countries

5.3.1.2.1 Demand for Crude Oil

5.3.1.2.2 Demand for Natural Gas

5.3.1.3 Price Regulations of Oil Drive Offshore Exploration Activities

5.3.2 Restraints

5.3.2.1 Environmental Concerns and Related Government Regulations

5.3.3 Opportunities

5.3.3.1 Consolidations & Collaborations Are the Key Opportunities for Offshore Drilling Explorations

5.3.4 Challenges

5.3.4.1 Increase in Offshore Mishaps

6 Industry Trends (Page No.- 40)

6.1 Value Chain Analysis

6.1.1 Rig Equipment Suppliers

6.1.2 Drilling Rig Manufacturers

6.1.3 Contract Drilling Service

6.1.4 End-Users

6.2 Porters Five Forces Analysis

6.2.1 Threat of New Entrants

6.2.2 Threat of Substitutes

6.2.3 Bargaining Power of Buyers

6.2.4 Bargaining Power of Suppliers

6.2.5 Intensity of Rivalry

7 Offshore Drilling Rig Industry: an Overview (Page No.- 44)

7.1 Introduction

7.2 Jackups

7.3 Semi-Submersibles

7.4 Drillships

7.5 Platform Rigs

7.6 Tender Assist Rig

7.7 Offshore Rig Supply Overview

7.8 Offshore Drillers Market

7.8.1 Offshore Rig Count, By Company and Type

7.8.2 Jackups Newbuilds, By Company

7.8.3 Floaters Newbuilds, By Company

7.8.4 Offshore Rig Demand Growth

7.8.4.1 Jackup Demand Growth

7.8.4.2 Floater Demand Growth

7.9 Offshore Newbuild Deliveries

7.9.1 Jackup: Newbuild Deliveries

7.9.1.1 Jackups Newbuild Deliveries, 2014

7.9.1.2 Jackup Newbuild Deliveries, 2015

7.9.1.3 Jackup Newbuild Deliveries, 2016+

7.9.2 Semi-Submersibles: Newbuild Deliveries

7.9.2.1 Semi-Submersibles New Build Deliveries, 2014

7.9.2.2 Semi-Submersibles Newbuild Deliveries, 2015

7.9.2.3 Semi-Submersibles Newbuild Deliveries, 2016

7.9.2.4 Semi-Submersibles Newbuild Deliveries, 2017+

7.9.3 Drillships: Newbuild Deliveries

7.9.3.1 Drillships Newbuild Deliveries, 2014

7.9.3.2 Drillships Newbuild Deliveries, 2015

7.9.3.3 Drillships Newbuild Deliveries, 2016

7.9.3.4 Drillships Newbuild Deliveries, 2017+

7.10 Offshore Rig Utilization Rate

8 Offshore Drilling Rigs Market Analysis, By Type (Page No.- 61)

8.1 Introduction

8.2 Global Offshore Drilling Rigs, By Type

8.2.1 Global Offshore Drilling Rigs, By Sub-Type

8.3 Jackup Rigs Market, By Region

8.4 Semi-Submersible Rigs Market, By Region

8.5 Drillships Market, By Region

9 Offshore Drilling Rigs Market Analysis, By Region (Page No.- 69)

9.1 Introduction

9.2 Offshore Rigs Market, By Region

9.3 North America

9.3.1 By Type

9.3.2 By Application

9.4 Latin America

9.4.1 By Type

9.4.2 By Application

9.5 Europe

9.5.1 By Type

9.5.2 By Application

9.6 The Middle East

9.6.1 By Type

9.6.2 By Application

9.7 Asia-Pacific

9.7.1 By Type

9.7.2 By Application

9.8 Africa

9.8.1 By Type

9.8.2 By Application

9.9 Rest of The World (ROW)

9.9.1 By Type

9.9.2 By Application

10 Offshore Drilling Rigs Market Analysis, By Application (Page No.- 86)

10.1 Introduction

10.2 Offshore Rigs Market, By Application

10.3 Shallow Water Rigs Market

10.3.1 By Region

10.3.2 By Type

10.3.2.1 Premium Jackup Rigs Market

10.3.2.2 Commodity Jackup Rigs Market

10.4 Deep Water Rigs Market

10.4.1 By Region

10.4.2 By Type

10.4.2.1 Midwater Floaters Market

10.4.2.2 Deepwater Floaters Market

10.5 Ultra-Deep Water Rigs Market

10.5.1 By Region

11 Competitive Landscape (Page No.- 98)

11.1 Overview

11.2 Market Share Analysis

11.3 Contract Agreements

11.4 Contract Awards

11.5 Mergers, Acquisitions and Joint Ventures

11.6 Other Developments

12 Company Profiles (Page No.- 126)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Aban Offshore Limited

12.3 Atwood Oceanics

12.4 China Oilfield Services Limited.

12.5 Diamond Offshore Drilling Inc.

12.6 Ensco PLC

12.7 Hercules Offshore Inc.

12.8 KCA Deutag

12.9 Maersk Drilling

12.10 Nabors Industries Ltd.

12.11 Noble Corporation

12.12 Pacific Drilling

12.13 Rowan Companies PLC

12.14 Seadrill Limited

12.15 Transocean Ltd.

12.16 Vantage Drilling

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of

Unlisted Companies.

List of Tables (84 Tables)

Table 1 Offshore Rig Count, By Company and Type, 2014

Table 2 Jackup Newbuilds, By Company, 20142017+

Table 3 Floater Newbuilds, By Company, 20142017+

Table 4 Jackup Demand, By Geography, 20132016

Table 5 Floater Demand, By Geography, 20132016

Table 6 Global Jackup Newbuild Deliveries, 20142016+

Table 7 Global Jackup Newbuild Deliveries, 2014

Table 8 Global Jackup Newbuild Deliveries, 2015

Table 9 Global Jackup Newbuild Deliveries, 2016+

Table 10 Global Semi-Submersibles Newbuild Deliveries, 20142017+

Table 11 Global Semi-Submersibles Newbuild Deliveries, 2014

Table 12 Global Semi-Submersibles Newbuild Deliveries, 2015

Table 13 Global Semi-Submersibles Newbuild Deliveries, 2016

Table 14 Global Semi-Submersibles Newbuild Deliveries, 2017

Table 15 Global Drillship Newbuild Deliveries, 20142017+

Table 16 Global Drillship Newbuild Deliveries, 2014

Table 17 Global Drillship Newbuild Deliveries, 2015

Table 18 Global Drillship Newbuild Deliveries, 2016

Table 19 Global Drillship Newbuild Deliveries, 2017+

Table 20 Offshore Rig Utilization Rate, By Type, Nov 2012Apr 2013

Table 21 Global Offshore Drilling Rigs Market, By Type, 20122019 ($Million)

Table 22 Global Offshore Drilling Rigs Market, By Type, 20122019 (Units)

Table 23 Global Offshore Drilling Rigs Market, By Sub-Type, 20122019 ($Million)

Table 24 Global Offshore Drilling Rigs Market, By Sub-Type, 20122019 (Units)

Table 25 Jackup Rigs Market, By Region, 20122019 ($Million)

Table 26 Jackup Rigs Market, By Region, 20122019 (Units)

Table 27 Semi-Submersible Rigs Market, By Region, 20122019 ($Million)

Table 28 Semi-Submersible Rigs Market, By Region, 20122019 (Units)

Table 29 Drillships Market, By Region, 20122019 ($Million)

Table 30 Drillships Market, By Region, 20122019 (Units)

Table 31 Global Offshore Drilling Rigs Market, By Region, 20122019 ($Million)

Table 32 Global Offshore Drilling Rigs Market, By Region, 20122019 (Units)

Table 33 North American Offshore Drilling Rigs Market, By Type, 20122019 ($Million)

Table 34 North American Offshore Drilling Rigs Market, By Type, 20122019 (Units)

Table 35 North American Offshore Drilling Rigs Market, By Application, 20122019 ($Million)

Table 36 North American Offshore Drilling Rigs Market, By Application, 20122019 (Units)

Table 37 Latin American Offshore Drilling Rigs Market, By Type, 20122019 ($Million)

Table 38 Latin American Offshore Drilling Rigs Market, By Type, 20122019 (Units)

Table 39 Latin American Offshore Drilling Rigs Market, By Application, 20122019 ($Million)

Table 40 Latin American Offshore Drilling Rigs Market, By Application, 20122019 (Units)

Table 41 European Offshore Drilling Rigs Market, By Type, 20122019 ($Million)

Table 42 European Offshore Drilling Rigs Market, By Type, 20122019 (Units)

Table 43 European Offshore Drilling Rigs Market, By Application, 20122019 ($Million)

Table 44 European Offshore Drilling Rigs Market, By Application, 20122019 (Units)

Table 45 The Middle East Offshore Drilling Rigs Market, By Type, 20122019 ($Million)

Table 46 The Middle East Offshore Drilling Rigs Market, By Type, 20122019 (Units)

Table 47 The Middle East Offshore Drilling Rigs Market, By Application, 20122019 ($Million)

Table 48 The Middle East Offshore Drilling Rigs Market, By Application, 20122019 (Units)

Table 49 The Asia-Pacific Offshore Drilling Rigs Market, By Type, 20122019 ($Million)

Table 50 The Asia-Pacific Offshore Drilling Rigs Market, By Type, 20122019 (Units)

Table 51 The Asia-Pacific Offshore Drilling Rigs Market, By Application, 20122019 ($Million)

Table 52 The Asia-Pacific Offshore Drilling Rigs Market, By Application, 20122019 (Units)

Table 53 African Offshore Drilling Rigs Market, By Type, 20122019 ($Million)

Table 54 African Offshore Drilling Rigs Market, By Type, 20122019 (Units)

Table 55 African Offshore Drilling Rigs Market, By Application, 20122019 ($Million)

Table 56 African Offshore Drilling Rigs Market, By Application, 20122019 (Units)

Table 57 ROW Offshore Drilling Rigs Market, By Type, 20122019 ($Million)

Table 58 ROW Offshore Drilling Rigs Market, By Type, 20122019 (Units)

Table 59 ROW Offshore Drilling Rigs Market, By Application, 20122019 ($Million)

Table 60 ROW Offshore Drilling Rigs Market, By Application, 20122019 (Units)

Table 61 Global Offshore Rigs Market Size, By Application, 20122019 ($Million)

Table 62 Global Offshore Rigs Market Size, By Application, 20122019 (Units)

Table 63 Shallow Water Rigs Market, By Region, 20122019 ($Million)

Table 64 Shallow Water Rigs Market, By Region, 20122019 (Units)

Table 65 Shallow Water Rigs Market, By Type, 20122019 ($Million)

Table 66 Shallow Water Rigs Market, By Type, 20122019 (Units)

Table 67 Premium Jackup Rigs Market, By Region, 20122019 ($Million)

Table 68 Premium Jackup Rigs Market, By Region, 20122019 (Units)

Table 69 Commodity Jackup Rigs Market, By Region, 20122019 ($Million)

Table 70 Commodity Jackup Rigs Market, By Region, 20122019 (Units)

Table 71 Deep Water Rigs Market, By Region, 20122019 ($Million)

Table 72 Deep Water Rigs Market, By Region, 20122019 (Units)

Table 73 Deep Water Rigs Market, By Type, 20122019 ($Million)

Table 74 Deepwater Rigs Market, By Type, 20122019 (Units)

Table 75 Midwater Floaters Market, By Region, 20122019 ($Million)

Table 76 Midwater Floaters Market, By Region, 20122019 (Units)

Table 77 Deepwater Floaters Market, By Region, 20122019 ($Million)

Table 78 Deepwater Floaters Market, By Region, 20122019 (Units)

Table 79 Ultra-Deep Water Rigs Market, By Region, 20122019 ($Million)

Table 80 Ultra-Deep Water Rigs Market, By Region, 20122019 (Units)

Table 81 Contract Agreements, 20102014

Table 82 Contract Awards, 2011-2014

Table 83 Mergers, Acquisitions and Joint Ventures, 2010-2014

Table 84 Other Developments, 2011-2014

List of Figures (29 Figures)

Figure 1 Markets Covered: Offshore Drilling Rigs Market

Figure 2 Offshore Drilling Rigs Market: Research Methodology

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation and Region

Figure 6 Offshore Rigs Market Snapshot (2014 vs. 2019): Market for Semi-Submersibles to Have Highest Growth Rate

Figure 7 Asia-Pacific to Drive the Growth of Market in the Coming Five Years

Figure 8 Attractive Market Opportunity, 2014 and 2019 ($Million)

Figure 9 Regional Cycle Analysis: Offshore Drilling Rigs Market

Figure 10 Market Comparison Between Jackups, Semi-Submersibles, and Drill ships, 2014 and 2019 ($ Million)

Figure 11 Global Deep-Water Discoveries, 2013

Figure 12 Regional Market Share, By Application, 2019 ($ Million)

Figure 13 Market Share Comparison of Offshore Drilling Rig, By Type, 2014 and 2019

Figure 14 Market Segmentation

Figure 15 Market Dynamics

Figure 16 Capital Spending in Subsea Market, 20122018 ($Million)

Figure 17 Changes in Natural Gas Consumption, 20092013 (Billion Cubic Meters)

Figure 18 Price Summary, WTI Crude & Brent Crude, 20112014 ($/Barrel)

Figure 19 E&P Spending (2009-2013)

Figure 20 Value Chain: Offshore Rigs Market

Figure 21 Porters Five Forces Analysis

Figure 22 Offshore Rigs Market Size, By Type, 2014-2019 ($Million)

Figure 23 Offshore Rigs Market Size, By Region, 2013 ($Billion)

Figure 24 Offshore Rigs Market Size, By Application, Market Size, 2014-2019 ($Million)

Figure 25 Companies Adopted Contract Agreements as the Key Growth Strategy Over the Last Three Years

Figure 26 Ensco and Sea drill Grew at the Fastest Rate Between 20112013

Figure 27 Battle for Market Share: Supply Contract Was the Key Strategy

Figure 28 Global Offshore Drilling Rigs Market Share, By Key Player, 2013

Figure 29 Geographic Revenue Mix of Top 5 Market Players

Growth opportunities and latent adjacency in Offshore Drilling Rigs Market