Ocular Implants Market by Product (Intraocular Lens, Glaucoma Implants, Orbital Implants), Application (Glaucoma surgery, Oculoplasty, Drug Delivery, Ocular Prosthesis), End User (Hospital, Specialty Eye Institutes) and Geography - Global Forecast to 2027

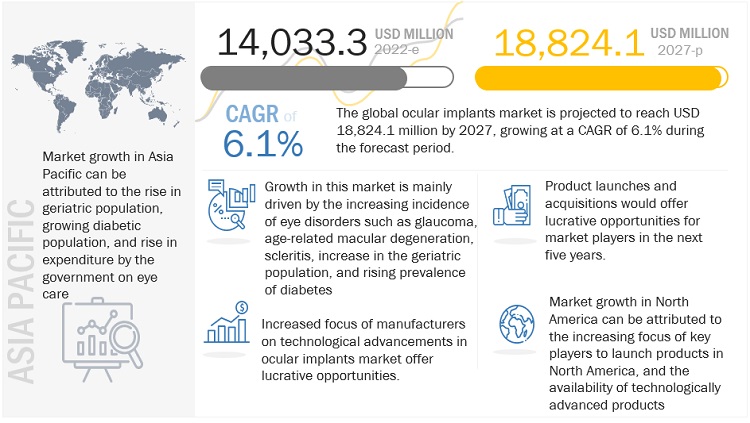

The global ocular implants market size is projected to reach USD 18,824.1 million by 2027 from USD 14,033.3 million in 2022, at a CAGR of 6.1% during the forecast period. Market is driven by factors such as increasing incidence of eye disorders such as age-related macular degeneration, glaucoma, corneal disease, and scleritis, increased time spent on virtual devices, and rising geriatric and diabetic population. Increasing adoption of a sedentary lifestyle and the rising prevalence of diabetes may lead to diabetic retinopathy, which is anticipated to boost the sales of ocular implants. According to the International Diabetes Federation, in 2021, approximately 537 million individuals were living with diabetes and it is anticipated to rise to 643 million by 2030.

However, stringent regulatory approvals combined with recent product recalls is expected is anticipated to hinder the market development.

To know about the assumptions considered for the study, Request for Free Sample Report

“The glaucoma implant accounted for the largest market share of the ocular implants market , in 2021”

The ocular implants market is segmented into introcular lenses, orbital impants, glaucoma implants, ocular prosthesis, and other implants. Glaucoma implants holds the largest share in the market and this is due to the rising incidence of glaucoma and it is one of the leading causes of blindness. According to a study by Bright Focus Foundation, about 20 million people across the globe had glaucoma in 2020 and is expected to exceed over 111 million by the end of 2040.

“Glaucoma surgery segment accounted for the largest market share in the ocular implants market, in 2021”

Based on application, the ocular implants market is segmented into glaucoma surgery, oculoplasty, drug delivery, age-related macular degeneration, and aesthetic purpose. The glaucoma surgery segment accounted for the largest market share in 2021 due to the rising incidence of glaucoma, growing awareness regarding the disease, and several organizations are focusing on creating awareness regarding glaucoma, which is helping to increase the treatment-seeking rate at an early stage. Age-related macular degeneration is expected to grow at the fastest rate, from 2021 to 2027. This can be attributed to the increasing geriatric population.

“Hospital segment accounted for the largest market share in the ocular implants market, by end user.”

The ocular implants market is segmented into hospitals, clinics, and speciality eye institutes. The hospital segment accounts for the largest share in the market and this is due to increasing number of patients opting for ophthalmic surgeries in hospitals as compared to clinics and specialty eye institutes and the increasing spending on healthcare infrastructure.

“North America held the largest market share of the market, in 2021”

The global ocular implants market is divided into five regions: North America, Asia-Pacific, Europe, Latin America, and the Middle East and Africa. According to the regional analysis, the North America region retained the largest market share in 2021. This is due to the increasing incidence of eye disorders, sedentary lifestyle, increasing focus of key players to launch products in North America, a favorable reimbursement scenario, and the availability of technologically advanced products. The region is likely to retain its lead during the forecast period.

Competitive Landscape

Key Market Players to Propel Market Progress Due to Strategic Acquisitions

Primary players operating in the market utilize strategic acquisitions, partnerships, and product launches to broaden their product portfolio. For instance, in August 2021, Alcon, Inc., a subsidiary of Novartis, acquired Ivantis, Inc. and its HydrusMicrostent for surgical glaucoma. This acquisition supported Alcon’s commitment to further strengthen its industry-leading portfolio across refractive, retina, cataract, and glaucoma.

Key Industry Development

- In March 2022, Alcon, a global leader in eye care, introduced the Clareon family of intraocular lenses (IOLs) in the US. Clareon uses Alcon's most modern IOL material to provide consistent visual outcomes and long-lasting clarity.

- In May 2020, Bausch Health Companies, Inc. launched its first extended depth of focus (EDOF) IOL LuxSmart and a monofocal IOL LuxGood with preloaded delivery system and pure refractive optics (PRO) technology.

The primary interviews conducted for this report can be categorized as follows:

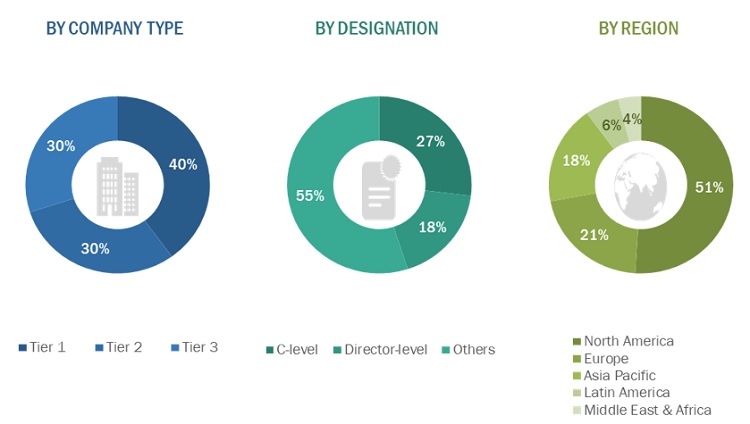

By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America – 6% , and the Middle East & Africa – 4%

Lits of Companies Profiled in the Report:

- ALCON (US)

- BAUSCH HEALTH COMPANIES, INC. (Canada)

- CARL ZEISS MEDITEC AG (Germany)

- JOHNSON & JOHNSON (US)

- HOYA CORPORATION (Japan)

- STAAR SURGICAL (US)

- MORCHER GMBH (Germany)

- GLAUKOS CORPORATION (US)

- ABBVIE INC. (US)

- SECOND SIGHT MEDICAL PRODUCTS INC. (US)

- NIDEK CO., LTD. (US)

- FCI OPHTHALMICS (US)

- NETWORK MEDICAL PRODUCTS LTD. (UK)

- GULDEN OPHTHALMICS (US)

- ORBTEX (US)

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Product, Application, and End User |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

|

Companies covered |

|

The research report categorizes the ocular implants market into the following segments and subsegments:

Product

- Intraocular Lenses

- Orbital Implants

- Glaucoma Implants

- Ocular Prosthesis

- Others

Application

- Glaucoma Surgery

- Oculoplasty

- Drug Delivery

- Age-Related Macular Degeneration

- Aesthetic Purpose

End User

- Hospitals

- Clinics

- Speciality Clinics

Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH APPROACH

2.1.1 SECONDARY SOURCES

2.1.1.1 KEY DATA FROM SECONDARY SOURCES

2.1.2 PRIMARY SOURCES

2.1.2.1 PRIMARY SOURCES

2.1.2.2 KEY DATA FROM PRIMARY SOURCES

2.1.2.3 BREAKDOWN OF PRIMARIES

2.2 MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION APPROACH

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

5.3 KEY CONFERECES & EVENTS

5.4 INDUSTRY TRENDS

5.5 REGULATORY ANALYSIS

5.6 ECOSYSTEM ANALYSIS

5.7 VALUE CHAIN ANALYSIS

5.8 PORTER’S FIVE FORCES ANALYSIS

5.9 PRICING ANALYSIS

5.10 PATENT ANALYSIS

6 OCULAR IMPLANTS MARKET, BY PRODUCT, 2020-2027 (USD MILLION)

6.1 INTRODUCTION

6.2 INTRAOCULAR LENS

6.3 ORBITAL IMPLANTS

6.4 GLAUCOMA IMPLANTS

6.5 OCULAR PROSTHESIS

6.6 OTHERS

7 OCULAR IMPLANTS MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

7.1 INTRODUCTION

7.2 GLAUCOMA SURGERY

7.3 OCULOPLASTY

7.4 DRUG DELIVERY

7.5 AGE-RELATED MACULAR DEGENERATION

7.6 AESTHETIC PURPOSE

8 OCULAR IMPLANTS MARKET, BY END USER, 2020-2027 (USD MILLION)

8.1 INTRODUCTION

8.2 HOSPITALS

8.3 CLINICS

8.4 SPECIALITY EYE INSTITUTES

9 OCULAR IMPLANTS MARKET, BY COUNTRY/REGION, 2020-2027 (USD MILLION)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.2 CANADA

9.3 EUROPE

9.3.1 GERMANY

9.3.2 UK

9.3.3 FRANCE

9.3.4 SPAIN

9.3.5 ITALY

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 JAPAN

9.4.2 CHINA

9.4.3 INDIA

9.4.4 REST OF ASIA PACIFIC

9.5 LATIN AMERICA

9.6 MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/ RIGHT-TO-WIN

10.2 REVENUE SHARE ANALYSIS OF KEY PLAYERS (2021)

10.3 MARKET SHARE ANALYSIS, BY KEY PLAYERS (2021)

10.4 COMPANY PRODUCT & GEOGRAPHICAL FOOTPRINT

10.5 COMPETITIVE LEADERSHIP MAPPING (2021)

10.5.1 STAR PLAYERS

10.5.2 EMERGING LEADERS

10.5.3 PARTICIPANTS

10.5.4 PERVASIVE PLAYERS

10.6 COMPETITIVE SCENARIO

10.6.1 PRODUCT LAUNCHES

10.6.2 DEALS

10.6.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

(Business Overview, Financials, Products Offered, Recent Developments, and MnM View)

11.1 ALCON

11.2 BAUSCH HEALTH COMPANIES, INC.

11.3 CARL ZEISS MEDITEC AG

11.4 JOHNSON & JOHNSON

11.5 HOYA CORPORATION

11.6 STAAR SURGICAL

11.7 MORCHER GMBH

11.8 GLAUKOS CORPORATION

11.9 ABBVIE INC.

11.10 SECOND SIGHT MEDICAL PRODUCTS INC.

11.11 NIDEK CO., LTD.

11.12 FCI OPHTHALMICS

11.13 NETWORK MEDICAL PRODUCTS LTD.

11.14 GULDEN OPHTHALMICS

11.15 ORBTEX

OTHER 5 EMERGING COMPANIES

12 APPENDIX

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

*The segmentation of the study can be updated during the course of the study based on primary insights and secondary research

*The list of companies mentioned above is indicative only and might change during the course of the study.

*Details on key financials might not be captured in case of unlisted companies.

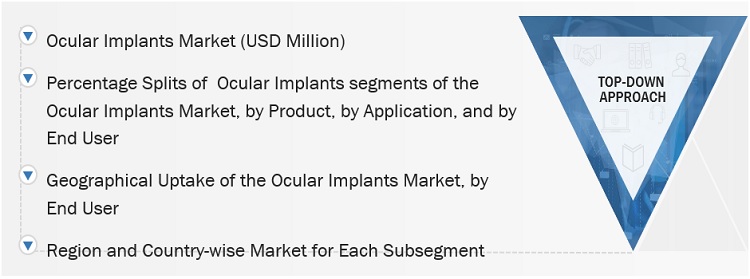

This study involved four major activities in estimating the current size of the ocular implants market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate segments and subsegments' market size.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources were mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the ocular implants market's total size. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research

- The revenues generated by leading players operating in the ocular implants market have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Ocular Implants Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size applying the process mentioned above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the ocular implants market by product, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To forecast the size of the ocular implants market with respect to five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle east & Africa

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile key players in the ocular implants market as well as comprehensively analyze their core competencies

- To track and analyze competitive developments such as product launches; acquisitions; expansions; as well as collaborations, agreements, and partnerships of the leading players in the ocular implants market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Europe ocular implants market into Switzerland, the Netherlands, and others.

- Further breakdown of the Asia Pacific ocular implants market into South Korea, Autralia, and others.

Growth opportunities and latent adjacency in Ocular Implants Market