Nutritional Yeast Market

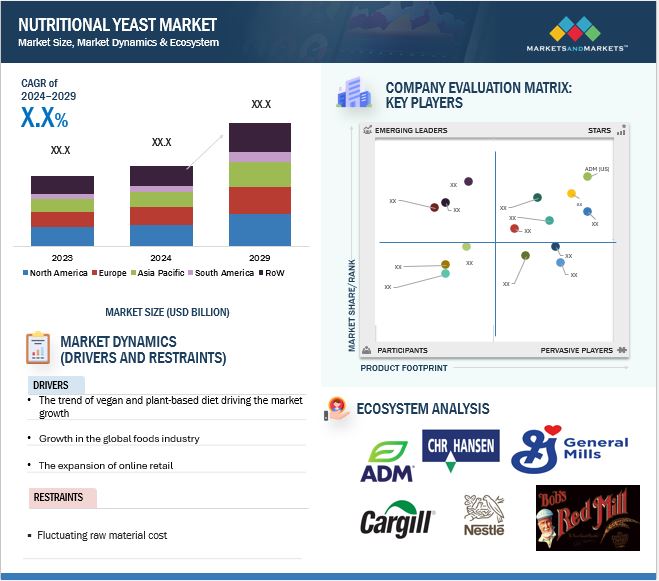

The nutritional yeast market is estimated at USD XX.XX billion in 2024 and is projected to reach USD XX.XX billion by 2029, at a CAGR of X.X% from 2024 to 2029. The global nutritional yeast market has experienced robust growth, fueled by increasing consumer demand for plant-based, protein-rich, and clean-label food products.

Nutritional yeast is highly valued for its health benefits, including being a source of complete protein, vitamins (especially B-complex), and minerals, which align with evolving dietary preferences and lifestyles. As of 2024, the Asia-Pacific region is anticipated to be the fastest-growing market, driven by the rising vegan population, heightened health awareness, and the expansion of plant-based food industries.

This growth aligns with broader trends in food spending, as highlighted by the USDA’s October 2024 report. Spending at foodservice outlets (FAFH) has consistently outpaced food-at-home (FAH) expenditures since 2009. In 2023, foodservice facilities contributed USD 1.5 trillion to the USD 2.6 trillion U.S. food industry total, with full-service and limited-service establishments accounting for USD 513.3 billion and USD 521.0 billion, respectively. The FAFH share reached a record 58.5% in 2023, reflecting consumer preferences for convenient, health-conscious dining options.

The correlation lies in how nutritional yeast fits seamlessly into both FAH and FAFH applications. Its versatility as a flavor enhancer and nutrient-dense ingredient positions it as a sought-after product in restaurants and home kitchens alike, supporting its market expansion.

Market Dynamics

Drivers: The trend of vegan and plant-based diet driving the market growth

One significant driver of the nutritional yeast industry is the rising consumer preference for plant-based and vegan diets, driven by increasing health consciousness and environmental sustainability awareness. Nutritional yeast is a nutrient-dense product, offering complete protein, B vitamins, and trace minerals, making it a popular alternative to dairy-based products in vegan diets. Additionally, its rich, umami flavor serves as a versatile seasoning in food applications, appealing to consumers seeking healthier and flavorful ingredients. The trend is further fueled by innovations in the foodservice sector, which integrates nutritional yeast into diverse menus, catering to growing demands for functional, clean-label food options. These factors collectively boost its adoption across global markets, with significant traction observed in the Asia-Pacific and North American regions.

Restraint: Fluctuating raw material cost

One significant restraint in the nutritional yeast industry is its susceptibility to fluctuating raw material costs and supply chain disruptions. Since nutritional yeast is derived from specific strains of Saccharomyces cerevisiae, its production requires consistent sourcing of sugar or molasses as a substrate. Variability in the availability and prices of these agricultural inputs can impact production costs. Additionally, nutritional yeast is a niche product, and its relatively high cost compared to conventional protein or flavoring options can limit its appeal, particularly in price-sensitive markets. Furthermore, a lack of consumer awareness about nutritional yeast’s benefits in certain regions poses challenges for market penetration, slowing the pace of growth despite rising demand for vegan and plant-based food options globally.

Opportunity: Flavorings and seasoning industry offer high growth potential of nutritional yeast market

An emerging opportunity in the nutritional yeast industry lies in its application as a natural flavor enhancer and seasoning in the processed food sector. With increasing consumer demand for clean-label and healthier alternatives to artificial flavorings, nutritional yeast offers a savory, umami-rich profile that enhances the taste of snacks, sauces, and ready-to-eat meals. This aligns with the growing focus on reducing sodium and artificial additives in processed foods. Additionally, its rich vitamin B content and complete protein profile make it appealing in fortified foods aimed at health-conscious consumers. Companies can leverage this opportunity by targeting convenience foods and meal kits, tapping into a market segment projected to grow alongside rising urbanization and busy lifestyles globally.

Challenge: Limited awareness of nutritional yeast restricts market growth

One significant challenge in the nutritional yeast industry is limited consumer awareness and misconceptions about its uses and benefits. While nutritional yeast is gaining traction among health-conscious consumers and vegans, a considerable portion of the general population remains unfamiliar with its advantages, such as being a rich source of protein, B-complex vitamins, and dietary fiber. Furthermore, some perceive it as solely a vegan or niche product, hindering its broader acceptance in mainstream diets. This limited awareness restricts market growth, particularly in regions where plant-based trends are less developed. Overcoming this challenge requires targeted educational campaigns, clear labeling, and innovative product formulations that demonstrate its versatility, appealing to a wider audience and encouraging adoption in everyday cooking and foodservice applications.

Market Ecosystem

Flake nutritional yeast holds largest market share in by form segment in the Nutritional yeast market.

In the nutritional yeast market, flakes hold the largest market share due to their versatile application in food products and their ease of use. Nutritional yeast flakes are popular for adding flavor, texture, and nutritional value to a wide range of dishes such as sauces, soups, salads, and snacks. Their rich cheesy and nutty flavor makes them a preferred choice among consumers, especially those following vegan and plant-based diets. Additionally, the flake form is more consumer-friendly as it blends well into recipes and is easier to sprinkle over foods compared to powder, tablets, or capsules. The growing demand for clean-label and functional food products further boosts the dominance of nutritional yeast flakes in the market.

The food industry application segment holds the largest share in the Nutritional yeast market.

The food industry segment holds the largest market share in the nutritional yeast market, driven by the increasing demand for plant-based products, clean-label ingredients, and vegan proteins. Nutritional yeast is widely used in food products such as vegan cheese, snacks, sauces, and seasonings due to its rich nutrient profile, including vitamins B12, B6, and complete protein. The rise of veganism, health-conscious eating, and plant-based diets is pushing its popularity as a flavoring and fortification agent in a variety of food products. Additionally, its use in gluten-free and dairy-free foods further strengthens its position in the food industry. The growing trend of functional foods also contributes to the segment's dominance, with nutritional yeast offering both flavor and nutritional benefit.

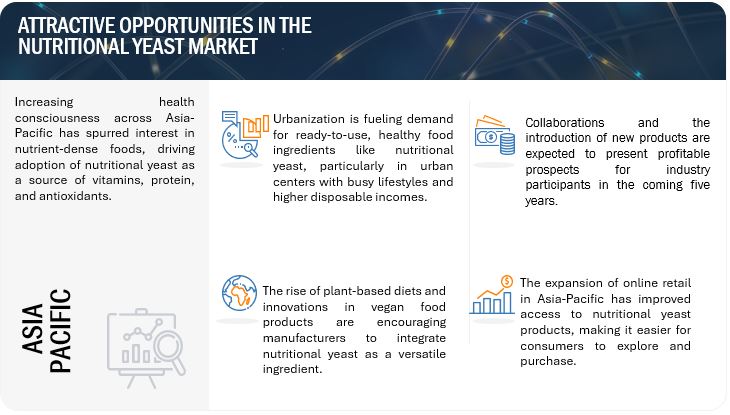

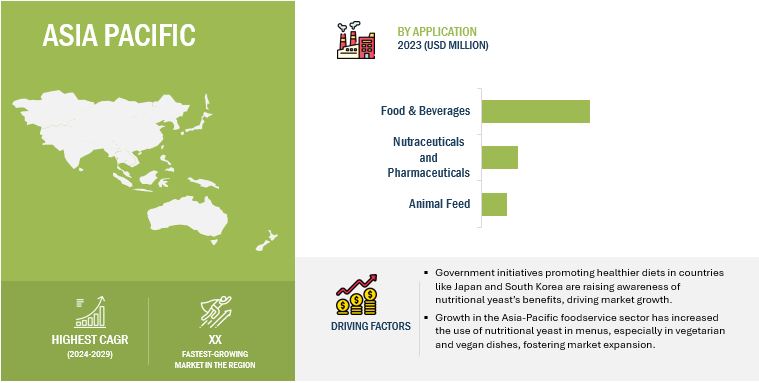

The Asia Pacific region is anticipated to experience the fastest growth between 2024 and 2029.

The Asia-Pacific region is poised to become the fastest-growing market for nutritional yeast, driven by an increasing preference for plant-based diets, particularly among health-conscious consumers. Rising awareness about the benefits of vegan proteins and nutritional yeast's rich content of essential nutrients, such as vitamins B6, B12, and protein, is further fueling this trend. Countries like India and China are witnessing significant growth in the vegan population, making them key markets for nutritional yeast. Additionally, the expanding food and beverage industry in this region is incorporating more plant-based products, further promoting the demand for nutritional yeast. The region’s growing health awareness, particularly regarding diet-related diseases and sustainable food sources, is propelling the rise of nutritional yeast as a popular ingredient.

Key Market Players

- Cargill, Incorporated (US)

- ADM (US)

- Chr. Hansen Holding A/S (Denmark)

- Lesaffre Group (France)

- Biomin (Austria)

- Kothari Fermentation and Biochem Ltd (India)

- ABF Ingredients (UK)

- Bob’s Red Mill (US)

- Nutreco (Netherlands)

- Alto Ingredients, Inc. (US)

- Angel Yeast (China)

- Alltech (US)

- AB Mauri (UK)

- Bragg Premium (US)

- AB Vista (UK)

- Bob’s Red Mill Natural Foods (US)

These market players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In July 2024, Cargill entered into an exclusive distribution agreement with Brenntag Specialties Nutrition for its EpiCor in Europe. This collaboration expands Cargill’s presence in the growing nutritional yeast and postbiotic market, enhancing its portfolio in immune and gut health functions. The deal strengthens Cargill’s ability to meet rising demand for innovative dietary supplements in key European markets, driving new product development opportunities.

- In November 2022, Nutreco launched a patented yeast-based livestock supplement designed to improve digestion and enhance feed efficiency, supporting sustainability in animal nutrition.

- In February 2022, Bragg Live Food Products introduced its Flavored Nutritional Yeast Seasonings in Roasted Garlic and Smoky BBQ flavors. This innovation, the first of its kind in the U.S. market, strengthens Bragg's leadership in the plant-based food sector. The new offerings align with growing consumer demand for plant-based proteins, increasing market share and expanding Bragg’s product appeal.

Frequently Asked Questions (FAQ):

What is the current size of the nutritional yeast market?

The nutritional yeast market is estimated at USD XX.XX billion in 2024 and is projected to reach USD XX.XX billion by 2029, at a CAGR of X.X% from 2024 to 2029.

Which are the key players in the Nutritional yeast market, and how intense is the competition?

Key players include ADM (US), Cargill, Incorporated (US), Chr. Hansen Holding A/S (Denmark), Lesaffre Group (France), and Biomin (Austria). The market competition is intense, with continuous R&D investments, mergers, acquisitions, and innovations in nutritional yeast market.

Which region is projected to account for the largest share of the nutritional yeast market?

North America holds the largest share of the nutritional yeast market, driven by increased consumer demand for plant-based products, health-conscious eating, and the growth of vegan and vegetarian diets, particularly in the U.S. and Canada.

What kind of information is provided in the company profiles section?

The company profiles cover comprehensive business overviews, financial data, geographic reach, product lines, strategic initiatives, and key innovations, offering detailed insights into the companies' market strategies.

What are the key factors driving the growth of the nutritional yeast market?

The nutritional yeast market is driven by rising plant-based dietary trends, growing vegan and vegetarian populations, increasing demand for protein-rich and sustainable food, and a shift toward clean-label products. Additionally, its health benefits, such as being a source of B vitamins and protein, further fuel market growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Nutritional Yeast Market