Nutritional Analysis Market by Parameter, Product Type (Beverages, Bakery & Confectionery, Snacks, Dairy & Desserts, Meat & Poultry, Sauces, Dressings, Condiments, Fruits & Vegetables, Baby Food), Objectives and Region - Forecast Year 2026

Nutritional Analysis Market Overview

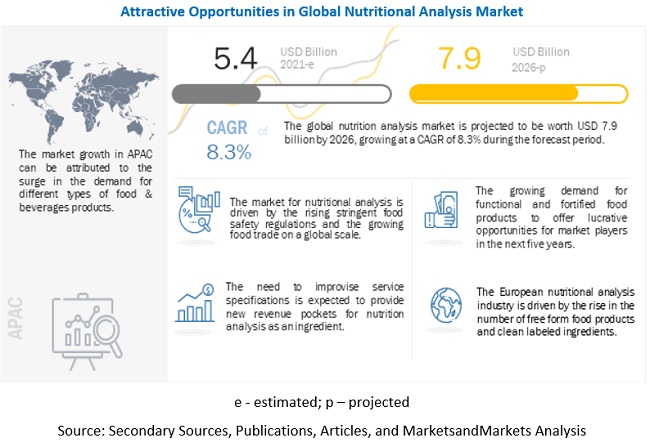

Nutritional analysis market size was valued at USD 5.4 billion in 2021. Nutritional analysis industry is projected to reach USD 7.9 billion by 2026, growing at a CAGR of 8.3% during the forecast period 2021-2026.

Nutritional analyses are performed on food products to assess their ingredients to formulate a product. Understanding a product's rheology and its characteristics depends on the ingredient composition. Thus, Food analysis testing will aid the formulators in determining the composition of the end product. The Food regulatory authorities such as the FDA, Codex Alimentarius, FAO, FSSAI, and others have enforced labeling restrictions on food products, encouraging manufacturers to offer accurate information on the calorific value and composition of food products per serving size. The authorities' rigorous laws increase the demand for nutritional analysis. Other opportunities for the market include trends like low-calorie products, health, and wellbeing, food ingredient & composition transparency, and food safety.

To know about the assumptions considered for the study, Request for Free Sample Report

Nutritional Analysis Market Dynamics

Driver: Increasing consumer awareness related to food nutrition and increasing health consciousness among consumers

Consumer buying behavior for food & grocery products has always been influenced by several economic, cultural, psychological, and lifestyle factors. Consumers are becoming aware of the vital relationship between diet, health, and disease. They need detailed, precise, and reliable information related to the food they consume. Food labels provide them with this information. Food labeling is a medium through which consumers can acquire knowledge about the food they are considering buying. However, to be useful, the information must deal with aspects of most concern to consumers, and it should be formulated so that consumers can understand and use it. Consumers use different sources of information to know about food labels. Television commercials can be a major source of information for consumers. Government nutritional labeling regulations are usually based on consumer surveys related to consumer understanding and the use of nutritional labeling. Hence, the nutritional analysis market is also affected by consumer understanding and the use of nutritional labeling, as it may help consumers buy the right product.

Increasing consumer awareness related to food nutrition is also one of the drivers of the market. Nutritional analysis laboratories provide food product testing services for new product development, thereby assisting companies in meeting the required nutritional value in their new products. During the past few years, several nutrition information formats and various terms expressing health-related benefits have appeared on food packages to support consumer choices. Various research studies have been conducted to study the impact of nutritional information on product labels and consumer purchase decisions for each product. These findings may help the food industry to enhance nutrition labeling and governments to create a coherent & unique framework for the mandatory use of nutrition information to help consumers.

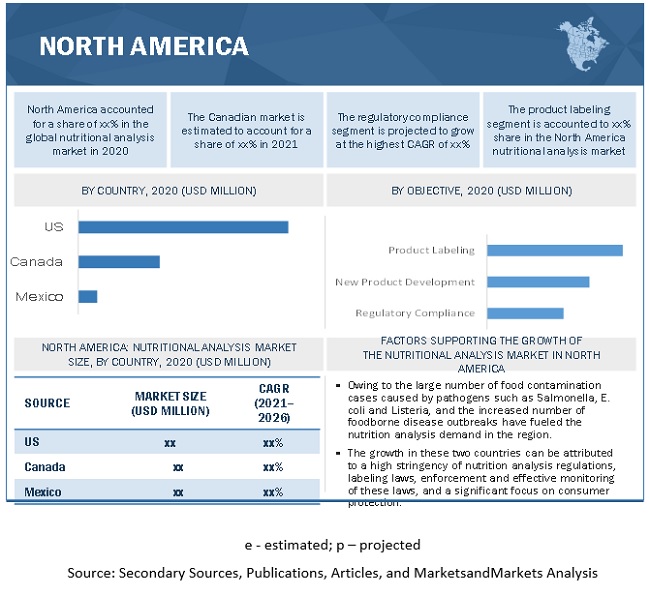

In the recent past, there has been an increase in the number of health-conscious consumers, specifically in North America, Europe, and the Asia Pacific. It is attributable to the rise in awareness of various health benefits associated with consuming healthy food products. As a result, consumers are being conscious and always seek transparency on food products that they consume on a daily basis. Considering this consumer perception, food manufacturers have taken the necessary steps to adopt several key procedures such as food testing, certification, and nutrition analysis. The process serves the purpose of nutrition labeling, facilitating target customers to have clear pictures of ingredients processed in the food they consume daily. Hence, the consumer perception of transparency in food products helps bolster the demand for food nutrition analysis.

Restraint: Lack of food control infrastructure & resources in developing countries

Developing regions lack organizations, sophistication, and the required technologies for food nutrition testing. The infrastructure of food analysis laboratories in developing countries is expected to be scant due to limited resources, restricted technology, and poor management. Issues such as the lack of institutional coordination, outdated technology, and the absence of expertise to execute regulations at low levels, equipment, and updated standards have been constraining the nutritional analysis market. Food control laboratories are poorly equipped and lack suitable trained analytical staff, especially in countries such as Ethiopia, Cuba, and Bangladesh.

On the other hand, countries such as India and China receive government assistance as finance and incentives to develop new technologies. These developing countries need to apply their resources for the required development of infrastructure, food control capacities, and technology enhancement. Authorities are not completely focusing on R&D expenses in updating technology and laboratories. These developing countries also lack support from international agencies such as the FAO, WHO, and the World Bank. Hence, the lack of food control infrastructure and resources inhibits the growth of the market.

The market is majorly dependent on the presence and enforcement of laws and policies related to nutritional labeling on products. The importance and implementation of such laws and policies depend on political willingness. Countries such as the US, Canada, Germany, France, China, Japan, and India, have adopted and strictly implemented nutritional labeling regulations. Hence, nutritional analysis testing companies are performing well in such countries. On the other end, countries such as Venezuela, Turkey, Switzerland, Morocco, Lebanon, and Jordan either do not have nutritional labeling regulations or do not implement them strictly. In such countries, nutritional analysis testing companies do not perform well, as food manufacturers do not willingly invest time and money in such tests since labeling is not mandatory.

Opportunity: Increasing stringent regulations for food and beverages by regulatory bodies

Consumers demand fresh, pure-quality water enriched with minerals and vitamins due to growing health concerns. As a result, water hardness test strips will increase significantly in the coming years. Environmental Protection Agency (EPA) has developed the National Primary Drinking Water Regulations with enforceable standards on the number of contaminants allowed in drinking water. These standards protect consumers from contaminants that may pose a risk to human health. All public water providers (municipal and civil bodies) must comply with these requirements while supplying water to their consumers. EPA has a set of standards known as the National Secondary Drinking Water Regulations. The government recommends these standards and guidelines to the water providers, which must be strictly followed.

The International Bottled Water Association (IBWA) has provided a code of practice to guide the bottled water industry stakeholders with technical and federal regulations. All bottlers are required to comply with state or local agency regulatory requirements in areas where their bottles are sold or distributed. FDA regulations mandate that every bottled water be processed to undergo physical, chemical, and hardness tests.

The convenience and safety attributes of the consumption of tested water have been driving the market due to the lower chances of contamination compared to tap and unprocessed water. The higher the consumption of quality water, the more regular and stringent the water hardness tests conducted, ultimately leading to the growth of the nutritional analysis market.

Another factor is the rapid industrialization of the food & beverages sector, leading to increased nutrition analysis demand. The nutrition analysis market in emerging economies is linked to rapid industrialization, booming food trade with Europe (free trade agreements) and North America, increasing need for better quality water, and the growing regulatory focus on protecting consumer wellbeing. These have led to the increasingly stringent enforcement of laws on food & water safety and the environment (USDA, FDA). An increase in industrialization in regions such as the Asia Pacific and Africa has increased awareness among people related to food contamination. It, in turn, has resulted in the implementation of numerous food safety acts, which are key opportunities for the market.

Challenge: Time-consuming testing methods and lack of harmonization of food nutritional labeling regulations

Food nutritional analysis testing has been witnessing improvements in technology, with the time taken now being one to three weeks for nutritional analysis through advanced and rapid testing. Sample preparation, which involves the extraction of analyses and separation of potential analyses, takes approximately 60% of the sample's total time. The preparation of the report is estimated to account for 20%–25% of the total time. The results obtained after comprehensive testing are used to direct the food manufacturing cycle. Nutritional analysis services are mostly used for new product development and nutritional labeling purposes. The delays in reports being generated result in delays in further processing of product development or product launch in the market.

The growing number of national standards for food safety management has led to ambiguity, and there is a need to harmonize these food nutritional labeling standards.

Leading industries in the food sector have increasingly recognized the cost and inefficiencies resulting from the development of multiple food nutritional labeling standards. Industrial experts have often suggested uniform and harmonized food nutritional labeling standards to reduce the multiplicity of food laws to make the process more efficient. Governments and private-sector stakeholders should work together to eliminate the duplication and overlap among multiple standards and create transparent & uniform food certification standards. As not all countries have mandatory nutritional labeling regulations, it restricts the business of several nutritional analysis service providers.

The fat profile segment is projected to grow at a higher rate during the Nutritional Analysis market during the forecast period.

Fat is a component that impacts product rheologic behavior, shelf life, and pricing. Fat content also determines a product's calorific value as 1 gram of fat contains 9 calories. Fat is an essential component as it provides both energy and nutritional benefits. The regulatory agencies have mandated that trans-fat and saturated-fat information must be profiled in product labeling since this information would provide the nutritional benefit of the fat in the product. Another factor driving their market expansion is increased public knowledge of the benefits of a low-fat diet. As a result, mentioning the fat percentage became one of the buying decision factors. Hence, the growth rate is projected to be higher in the market.

The baby food, by product type, is projected to have a higher growth rate during the forecast period.

Regulatory authorities have imposed stringent measures on baby foods to maintain infant food safety. Because nutrition is vital for infant growth, giving nutritional information will influence purchase decisions of that product. Infant foods are also usually screened for purity and adulterations. Thus, these factors have been driving higher growth rates in themarket.

The new product development, by objective segment, is estimated to have a higher growth rate in the nutritional analysis market during the forecast period.

Creating a product involves ingredient composition and cost estimation, and determining the ingredient composition requires multiple lab analyses. A product's nutritional information will also affect the consumer's purchase decision. Thus, formulators have relied on nutritional analysis for trial samples while formulating a food product.

To know about the assumptions considered for the study, download the pdf brochure

The Asia Pacific is estimated to account for the largest market share in terms of value and volume in the global nutritional analysis market.

Government agencies in the Asia Pacific are addressing malnutrition and poor nutritional health habits. To enhance awareness, the government has been working on establishing and publicizing nutritional information on the food they consume. The Asia Pacific's increasing population boosts the demand for food, hence the increase in demand for nutritional analysis. Many developing countries in APAC are becoming more aware of nutritional and health issues. Therefore, the Asia Pacific accounts for a large global nutritional analysis market share.

Key Market Players

The key players in this market include SGS SA (Switzerland), Intertek Group Plc (UK), Eurofins Scientific (Luxembourg), Bureau Veritas (France), ALS Limited (Australia), Mérieux NutriSciences (US), Thermo Fisher Scientific (US), AsureQuality Limited (New Zealand), TÜV Nord Group (Germany), and DTS Food Laboratories (France). The other players include Qiagen Inc (Germany), Covance Inc. (US), Hill Laboratories (New Zealand), Microbac Laboratories Inc. (US), Romer Labs (Austria), Symbio Laboratories (Poland), Premier Analytical Services (UK), Agrolab GmbH (Germany), Campden BRI (UK), and Nova Biologicals (US). Strategic deals were the dominant strategy adopted by the key players, followed by new service launches. These strategies have helped them to increase their presence in different regions and industrial segments. These companies have a strong presence in North America, Asia Pacific, and Europe.

Scope of the Report

|

Report Metric |

Details |

|

Market Value in 2021 |

USD 5.4 Billion |

|

Revenue Forecast in 2026 |

USD 7.9 Billion |

|

Growth Rate |

CAGR of 8.3% |

|

Forecast period considered |

2021–2026 |

|

Units considered |

Value (USD) |

|

Segments Covered |

|

|

Regions covered |

|

|

Companies studied |

SGS SA (Switzerland), Intertek Group (UK), Eurofins Scientific (Luxembourg), Thermo Fisher Scientific (US), Bureau Vieritas (France), ALS (Australia), Mérieux NutriSciences (US), AsureQuality (New Zealand), TÜV Nord Group (Germany), Food Lab, Inc. (US), Compu-Food Analysis (US), NutriData (US), Certified Laboratories (US), Premier Analytical Services (UK), Microbac Laboratories (US) |

This research report categorizes the nutritional analysis market based on parameter, product type, objective, and region.

|

Segment |

Subsegment |

|

Market By Parameter |

|

|

Market By Product Type |

|

|

Market By Objective |

|

|

Market By Region |

|

Frequently Asked Questions (FAQ):

How big is the nutritional analysis market?

The global nutritional analysis market is expected to grow at a compound annual growth rate of 8.3% from 2021 to 2026 to reach USD 7.9 billion by 2026.

Which players are involved in manufacturing of nutritional analysis market?

The key players in this market include SGS SA (Switzerland), Intertek Group Plc (UK), Eurofins Scientific (Luxembourg), Bureau Veritas (France), ALS Limited (Australia), Mérieux NutriSciences (US), Thermo Fisher Scientific (US), AsureQuality Limited (New Zealand), TÜV Nord Group (Germany), and DTS Food Laboratories (France).

What are the potential challenges to the nutritional analysis market?

Nutritional analysis services are mostly used for new product development and nutritional labeling purposes. The delays in reports being generated result in delays in further processing of product development or product launch in the market. Sample preparation, which involves the extraction of analyses and separation of potential analyses, takes approximately 60% of the sample's total time. The preparation of the report is estimated to account for 20%–25% of the total time. Thus, time for determining a parameter consumes time and is accounted as one of the challenges faced by the market.

What are the key market trends in the nutritional analysis market?

Food transparency, increasing health & wellness awareness, and diets like low fat and calories are some recent trends influencing manufacturers to mention nutritional information on their product labels. These factors would all help to boost market growth, which are the main trends in the market.

What are the key development strategies companies undertake in the nutritional analysis market?

Strategies such as new service launches, investments into expansion and development, and research initiatives are the key strategies used by prominent players to achieve differential positioning in the global market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVE OF THE STUDY

1.1.1 NUTRITIONAL ANALYSIS MARKET DEFINITION

1.2 MARKET SCOPE

1.2.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION: NUTRITION ANALYSIS MARKET

1.2.2 INCLUSIONS AND EXCLUSIONS

1.2.3 GEOGRAPHIC SCOPE

1.3 PERIODIZATION CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED FOR THE STUDY, 2017–2020

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Primary insights

FIGURE 4 PRIMARY INSIGHTS

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.1 SUPPLY SIDE

FIGURE 7 NUTRITIONAL ANALYSIS MARKET: SUPPLY SIDE ANALYSIS

2.2.2 DEMAND SIDE

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS & RISK ASSESSMENT

2.5 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.5.1 SCENARIO-BASED MODELING

2.6 COVID-19 HEALTH ASSESSMENT

FIGURE 9 COVID-19: GLOBAL PROPAGATION

FIGURE 10 COVID-19 PROPAGATION: SELECT COUNTRIES

2.7 COVID-19 ECONOMIC ASSESSMENT

FIGURE 11 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.7.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 12 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 13 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 53)

FIGURE 14 NUTRITION ANALYSIS MARKET SIZE, BY PARAMETER, 2021 VS. 2026 (USD MILLION)

FIGURE 15 NUTRITION ANALYSIS MARKET SIZE, BY PRODUCT TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 16 NUTRITION ANALYSIS MARKET SIZE, BY OBJECTIVE, 2021 VS. 2026 (USD MILLION)

FIGURE 17 NUTRITION ANALYSIS MARKET SHARE, BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 OPPORTUNITIES IN THE NUTRITIONAL ANALYSIS MARKET

FIGURE 18 GROWING FOOD TRADE ON A GLOBAL SCALE TO DRIVE THE GROWTH OF THE MARKET

4.2 MARKET, BY PARAMETER, 2021 VS 2026 (USD MILLION)

FIGURE 19 THE VITAMIN PROFILE SEGMENT ACCOUNTS FOR THE LARGEST SHARE IN 2021

4.3 MARKET, BY OBJECTIVE & REGION

FIGURE 20 NORTH AMERICA DOMINATED THE MARKET ACROSS ALL OBJECTIVES IN 2020

4.4 MARKET, BY PRODUCT TYPE

FIGURE 21 THE BEVERAGES SEGMENT DOMINATED THE MARKET ACROSS ALL PRODUCT TYPES

4.5 NORTH AMERICA MARKET, BY OBJECTIVE & COUNTRY, 2017

FIGURE 22 IN NORTH AMERICA, THE PRODUCT LABELING SEGMENT ACCOUNTED FOR THE LARGEST SHARE, BY APPLICATION, IN 2020

4.6 COVID-19 IMPACT ON THE MARKET

FIGURE 23 GROWTH IN 2020 IS REDUCED IN THE POST-COVID-19 SCENARIO COMPARED TO THE PRE-COVID-19 SCENARIO

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 MARKET DYNAMICS: NUTRITIONAL ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Malnutrition and poor diets constitute the key driver for the global market

FIGURE 25 GLOBAL COMMITMENTS TO NUTRITION FOR 2025

5.2.1.2 Global implementation of nutrition labeling and claims regulations

5.2.1.2.1 Benefits to the food industry from nutritional labeling and claims

5.2.1.2.2 Benefits to companies providing nutritional analysis services

5.2.1.3 Growth of nutritional and dietary supplement industries has increased the demand for nutritional analysis services

FIGURE 26 CONSUMER SHARE OF THE UNITED STATES ADULT TAKING DIETARY SUPPLEMENTS, 2018

5.2.1.4 Changing consumer buying behavior due to nutritional labeling on products

5.2.1.4.1 Increasing consumer awareness related to food nutrition

5.2.1.5 Rise in trend of transparency in food products

5.2.2 RESTRAINTS

5.2.2.1 Lack of food control infrastructure & resources in developing countries

5.2.2.1.1 Absence of nutritional labeling regulations in several countries restrains the nutritional analysis business

5.2.2.2 Nutritional analysis and labeling are accountable to time constraints and expensive

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging nutritional analysis market service providers

5.2.3.2 Increasing stringent regulations for edible beverages

5.2.3.3 Rapid industrialization of the food & beverages sector to fuel the demand for nutrition analysis

FIGURE 27 GLOBAL ANNUAL GROWTH RATE OF INDUSTRIES, 2014–2018

5.2.4 CHALLENGES

5.2.4.1 Time-consuming testing methods

5.2.4.2 Lack of harmonization of food nutritional labeling regulations

6 REGULATIONS FOR THE FOOD SAFETY TESTING MARKET (Page No. - 69)

6.1 INTRODUCTION

6.2 INTERNATIONAL BODY FOR FOOD SAFETY STANDARDS AND REGULATIONS

6.2.1 CODEX ALIMENTARIUS COMMISSION

6.2.2 GLOBAL FOOD SAFETY INITIATIVE

6.3 NORTH AMERICA

6.3.1 US REGULATIONS

6.3.1.1 Federal legislation

6.3.1.1.1 State legislation

6.3.1.1.2 Food safety in retail food

6.3.1.1.3 Food safety in trade

6.3.1.1.4 HACCP regulation in the US

6.3.1.1.5 US regulation for foodborne pathogens in poultry

6.3.1.1.6 Food safety regulations for fruit & vegetable growers

6.3.1.1.7 GMO regulations in the US

6.3.1.1.8 FDA Food Safety Modernization Act

6.3.1.1.9 Labeling of GM foods

TABLE 2 FEDERAL FOOD, DRUG, AND COSMETIC ACT, BY TOLERANCE OF RAW & PROCESSED FOOD

6.3.1.1.10 Regulatory guidance by the FDA for aflatoxins

6.3.1.1.11 Pesticide regulation in the US

6.3.2 CANADA

6.3.3 MEXICO

6.4 EUROPE

6.4.1 EUROPEAN UNION REGULATIONS

FIGURE 28 LEGISLATION PROCESS IN THE EU

6.4.1.1 Microbiological criteria regulation

6.4.1.2 Melamine legislation

TABLE 3 MAXIMUM LEVEL FOR MELAMINE & ITS STRUCTURAL ANALOGS

6.4.1.3 General food law for food safety

FIGURE 29 ROLE OF THE EFSA TO REDUCE CAMPYLOBACTERIOSIS

6.4.2 GERMANY

6.4.3 UNITED KINGDOM

6.4.4 FRANCE

6.4.5 ITALY

6.4.6 POLAND

6.5 ASIA PACIFIC

6.5.1 CHINA

6.5.1.1 Regulating bodies for food safety

6.5.1.2 Major efforts of China to standardize its food safety system

6.5.2 JAPAN

6.5.3 INDIA

6.5.3.1 Food safety standards amendment regulations, 2012

6.5.3.2 Food safety standards amendment regulations, 2011

6.5.3.3 Food Safety and Standards Act, 2006

6.5.4 AUSTRALIA

6.5.4.1 Food Standards Australia and New Zealand

6.5.5 NEW ZEALAND

6.5.5.1 GMOs labeling regulation in Asia Pacific

TABLE 4 GMOS LABELING IN ASIA PACIFIC COUNTRIES

6.5.6 INDONESIA

6.5.6.1 General law for food safety

6.5.7 CHEMICAL CONTAMINANTS

6.5.8 GENETICALLY ENGINEERED FOODS

6.5.9 ALLERGEN: REGULATIONS ON ALLERGEN LABELING IN FOOD

6.6 REST OF THE WORLD

6.6.1 SOUTH AFRICA

6.6.1.1 International vs. local standards & legislations

6.6.1.2 Private standards in South Africa and the requirements for product testing

6.6.2 BRAZIL

6.6.2.1 Ministry of Agriculture, Livestock, and Food Supply (MAPA)

6.6.2.2 Ministry of Health

6.6.3 ARGENTINA

7 INDUSTRY TRENDS (Page No. - 89)

7.1 INTRODUCTION

FIGURE 30 FOOD SAFETY MANAGEMENT SYSTEM

7.2 MACRO INDICATORS

FIGURE 31 MALNUTRITION: A GLOBAL PROBLEM, 2016

TABLE 5 GLOBAL ACTIVITIES TO DEAL WITH THE MALNUTRITION PROBLEM

7.3 FOOD AND NUTRITION LABELING FROM CONSUMER PERSPECTIVE

FIGURE 32 NUTRITIONAL LABEL USE AND CONSUMER UNDERSTANDING

7.4 FOOD AND NUTRITION LABELING: INDUSTRY TRENDS

7.4.1 GROWTH IN THE GLOBAL NUTRITION MARKET

FIGURE 33 GLOBAL NUTRITION MARKET, 2008–2017 (USD MILLION)

7.4.2 GROWTH IN THE FOOD CONTRACT LABORATORY INDUSTRY

FIGURE 34 FOOD CONTRACT LABORATORY MARKET SIZE, 2008–2020 (USD MILLION)

7.5 VALUE CHAIN ANALYSIS

7.5.1 INPUT NUTRITIONAL ANALYSIS MARKET

7.5.2 FOOD INDUSTRY

7.5.3 DISTRIBUTION

FIGURE 35 VALUE CHAIN ANALYSIS: FOOD DEALERS ADD TWO TO SEVEN PERCENT TO THE PRICE OF THE END PRODUCTS

7.6 ECOSYSTEM MAP

FIGURE 36 MARKET FOR NUTRITIONAL ANALYSIS: ECOSYSTEM VIEW

FIGURE 37 FOOD SAFETY TESTING MARKET: MARKET MAP

7.6.1 SUPPLY SIDE

7.6.2 DOWNSTREAM

7.7 SUPPLY CHAIN ANALYSIS

7.7.1 UPSTREAM PROCESS

7.7.1.1 R&D

7.7.1.2 Production

7.7.2 MIDSTREAM PROCESS

7.7.2.1 Processing & transforming

7.7.2.2 Transportation

7.7.3 DOWNSTREAM PROCESS

7.7.3.1 Final preparation

7.7.3.2 Distribution

FIGURE 38 SUPPLY CHAIN ANALYSIS

TABLE 6 FOOD SAFETY TESTING MARKET: SUPPLY CHAIN (ECOSYSTEM)

7.8 YC-YCC SHIFT

FIGURE 39 REVENUE SHIFT FOR FOOD NUTRITION ANALYSIS

7.9 TECHNOLOGY ANALYSIS: UPCOMING TECHNOLOGIES IN THE NUTRITIONAL ANALYSIS MARKET

7.9.1 MICROARRAY

7.9.2 PHAGES

7.9.3 BIOCHIP

7.9.4 FLOW CYTOMETRY

7.9.5 NUCLEAR MAGNETIC RESONANCE

7.9.6 INDUCTIVELY COUPLED PLASMA

7.10 PATENTS ANALYSIS

FIGURE 40 GLOBAL PATENT PUBLICATIONS, 2017–2020

FIGURE 41 MOST ACTIVE REGIONS FOR FILING PATENTS, 2017–2020

FIGURE 42 TOP PUBLISHERS OF PATENTS, 2017–2020

TABLE 7 KEY PATENTS FOR THE MARKET, 2020–2021

7.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 FOOD SAFETY TESTING MARKET: PORTER’S FIVE FORCES ANALYSIS

7.11.1 THREAT OF NEW ENTRANTS

7.11.2 THREAT OF SUBSTITUTES

7.11.3 BARGAINING POWER OF SUPPLIERS

7.11.4 BARGAINING POWER OF BUYERS

7.11.5 DEGREE OF COMPETITION

7.12 CASE STUDIES

7.12.1 ALLERGEN SENSORS FOR CONSUMER

7.12.2 FOOD TEST QUALITY, ACCURACY, AND TURN-AROUND TIME PLAY IS A CRUCIAL ROLE IN DETERMINING THE OVERALL FOOD SAFETY

8 NUTRITION ANALYSIS MARKET, BY PARAMETER (Page No. - 113)

8.1 INTRODUCTION

FIGURE 43 MARKET SIZE, BY PARAMETER, 2021 VS. 2026 (USD MILLION)

TABLE 9 MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 10 MARKET SIZE, BY PARAMETER, 2021–2026 (USD MILLION)

8.1.1 COVID-19 IMPACT ON NUTRITION ANALYSIS MARKET, BY PARAMETER (2018–2021)

8.1.1.1 Realistic scenario

TABLE 11 REALISTIC SCENARIO: COVID-19 IMPACT ON NUTRITION ANALYSIS MARKET SIZE, BY PARAMETER, 2018–2021 (USD MILLION)

8.1.1.2 Optimistic scenario

TABLE 12 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON MARKET, BY PARAMETER, 2018–2021 (USD MILLION)

8.1.1.3 Pessimistic scenario

TABLE 13 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON MARKET, BY PARAMETER, 2018–2021 (USD MILLION)

8.2 VITAMIN PROFILE

8.2.1 AN INCREASE IN THE DEMAND FOR VITAMIN SUPPLEMENTS STIRS THE NEED FOR VITAMIN PROFILE ANALYSIS

TABLE 14 VITAMIN PROFILE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 15 VITAMIN PROFILE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2021–2026 (USD MILLION)

8.3 PROTEINS

8.3.1 PROTEIN ANALYSIS ENSURES QUALITY CONTROL OF PACKED FOOD MATERIAL

TABLE 16 PROTEINS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 17 PROTEINS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.4 FAT PROFILE

8.4.1 FAT ANALYSIS IS IMPERATIVE TO ENSURE ACCURATE NUTRITIONAL BLENDING IN FOOD PRODUCTS

TABLE 18 FAT PROFILE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 19 FAT PROFILE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.5 SUGAR PROFILE

8.5.1 HIGH-PERFORMANCE LIQUID CHROMATOGRAPHY IS THE MOST WIDELY USED METHOD FOR SUGAR ANALYSIS

TABLE 20 SUGAR PROFILE: NUTRITIONAL ANALYSIS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 21 SUGAR PROFILE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.6 TOTAL DIETARY PROFILE

8.6.1 DIETARY FIBERS FORM AN INTEGRAL COMPONENT IN THE OVERALL NUTRITION PROFILE

TABLE 22 TOTAL DIETARY PROFILE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 23 TOTAL DIETARY PROFILE: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.7 MINERAL PROFILE

8.7.1 MINERAL ASSESSMENT HELPS IN REGULATING THE CONTENT IN FOOD PRODUCTS

TABLE 24 MINERAL PROFILE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 25 MINERAL PROFILE: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.8 CHOLESTEROL

8.8.1 CHOLESTEROL ANALYSIS IS IMPORTANT TO PREVENT ADVERSE EFFECTS OF HIGH CHOLESTEROL LEVELS

TABLE 26 CHOLESTEROL: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 27 CHOLESTEROL: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.9 CALORIES

8.9.1 REGULATING CALORIE CONTENT IN FOOD PRODUCTS IS CRUCIAL TO MAINTAIN CONSISTENT NUTRITIONAL LEVELS

TABLE 28 CALORIES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 29 CALORIES: MARKET, BY REGION, 2021–2026 (USD MILLION)

8.10 MOISTURE

8.10.1 MOISTURE ANALYSIS PREVENTS SPOILAGE OF FOOD PRODUCTS

TABLE 30 MOISTURE: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 31 MOISTURE: MARKET FOR NUTRITIONAL ANALYSIS, BY REGION, 2021–2026 (USD MILLION)

8.11 OTHER PARAMETERS

8.11.1 ACID AND ASH CONTENT ANALYSIS IS NECESSARY TO ENSURE THE SAFETY OF FOOD PRODUCTS

TABLE 32 OTHER PARAMETERS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 33 OTHER PARAMETERS: MARKET, BY REGION, 2021–2026 (USD MILLION)

9 NUTRITION ANALYSIS MARKET, BY OBJECTIVE (Page No. - 130)

9.1 INTRODUCTION

FIGURE 44 NUTRITION ANALYSIS MARKET SIZE, BY OBJECTIVE, 2021 VS. 2026 (USD MILLION)

TABLE 34 NUTRITIONAL ANALYSIS MARKET SIZE, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 35 MARKET SIZE, BY OBJECTIVE, 2021–2026 (USD MILLION)

9.1.1 COVID-19 IMPACT ON NUTRITION ANALYSIS MARKET, BY OBJECTIVE (2018–2021)

9.1.1.1 Realistic scenario

TABLE 36 REALISTIC SCENARIO: COVID-19 IMPACT ON NUTRITION ANALYSIS MARKET SIZE, BY OBJECTIVE, 2018–2021 (USD MILLION)

9.1.1.2 Optimistic scenario

TABLE 37 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON NUTRITION ANALYSIS MARKET SIZE, BY OBJECTIVE, 2018–2021 (USD MILLION)

9.1.1.3 Pessimistic scenario

TABLE 38 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON NUTRITION ANALYSIS MARKET SIZE, BY OBJECTIVE, 2018–2021 (USD MILLION)

9.2 NEW PRODUCT DEVELOPMENT

9.2.1 NUTRITION ANALYSIS USING LABORATORY TESTS AND ANALYTICAL METHODS THAT PLAY A MAJOR ROLE IN NEW PRODUCT DEVELOPMENT

TABLE 39 NEW PRODUCT DEVELOPMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 40 NEW PRODUCT DEVELOPMENT: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2021–2026 (USD MILLION)

9.3 PRODUCT LABELING

9.3.1 HEALTH AND WELLNESS TRENDS TRIGGER THE DEMAND FOR ACCURATE NUTRITIONAL LABELING

TABLE 41 PRODUCT LABELING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 PRODUCT LABELING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 REGULATORY COMPLIANCE

9.4.1 REGULATORY COMPLIANCE REQUIRES ACCURATE NUTRITIONAL ANALYSIS IN ACCORDANCE WITH THE REGULATORY NORMS AND GUIDELINES

TABLE 43 REGULATORY COMPLIANCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 44 REGULATORY COMPLIANCE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2021–2026 (USD MILLION)

10 NUTRITION ANALYSIS MARKET, BY PRODUCT TYPE (Page No. - 137)

10.1 INTRODUCTION

FIGURE 45 MARKET SIZE, BY PRODUCT TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 45 MARKET SIZE, BY PRODUCT TYPE, 2016–2020 (USD MILLION)

TABLE 46 MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

10.1.1 COVID-19 IMPACT ON THE NUTRITION ANALYSIS MARKET, BY PRODUCT TYPE (2018–2021)

10.1.1.1 Realistic scenario

TABLE 47 REALISTIC SCENARIO: COVID-19 IMPACT ON NUTRITIONAL ANALYSIS MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

10.1.1.2 Optimistic scenario

TABLE 48 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON NUTRITION ANALYSIS MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

10.1.1.3 Pessimistic scenario

TABLE 49 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON NUTRITION ANALYSIS MARKET SIZE, BY PRODUCT TYPE, 2018–2021 (USD MILLION)

10.2 BEVERAGES

10.2.1 NUTRITION ANALYSIS OF BEVERAGES HELPS REGULATE CALORIE INTAKE AND ENSURE A BALANCED DIET

TABLE 50 BEVERAGES: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2016–2020 (USD MILLION)

TABLE 51 BEVERAGES: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2021–2026 (USD MILLION)

10.3 SNACKS

10.3.1 GROWING DEMAND FOR HEALTHIER SNACKS PROPELS THE NUTRITION ANALYSIS MARKET

TABLE 52 SNACKS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 53 SNACKS: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2021–2026 (USD MILLION)

10.4 BAKERY AND CONFECTIONERY

10.4.1 NUTRITION ANALYSIS OF BAKERY AND CONFECTIONERY PRODUCTS IS NECESSARY TO MONITOR ADULTERATION

TABLE 54 BAKERY AND CONFECTIONERY: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2016–2020 (USD MILLION)

TABLE 55 BAKERY AND CONFECTIONERY: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2021–2026 (USD MILLION)

10.5 MEAT AND POULTRY

10.5.1 MEAT AND POULTRY PRODUCTS REQUIRE THE MOST CAREFULLY DEVISED NUTRITION ANALYSIS TO ASSURE CONSUMERS OF THEIR SAFETY AND QUALITY

TABLE 56 MEAT AND POULTRY: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2016–2020 (USD MILLION)

TABLE 57 MEAT AND POULTRY: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2021–2026 (USD MILLION)

10.6 SAUCES, DRESSINGS, AND CONDIMENTS

10.6.1 HEALTH AND WELLNESS TREND FUELS THE DEMAND FOR QUALITY-ASSURED SAUCES AND DRESSINGS

TABLE 58 SAUCES, DRESSINGS, AND CONDIMENTS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 59 SAUCES, DRESSINGS, AND CONDIMENTS: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2021–2026 (USD MILLION)

10.7 DAIRY AND DESSERTS

10.7.1 NUTRITION ANALYSIS OF DAIRY PRODUCTS IS CRUCIAL IN DETERMINING THE QUALITY AND IDENTIFYING ADULTERATION

TABLE 60 DAIRY AND DESSERTS: NUTRITIONAL ANALYSIS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 61 DAIRY AND DESSERTS: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2021–2026 (USD MILLION)

10.8 FRUITS AND VEGETABLES

10.8.1 FRUITS AND VEGETABLES REQUIRE ADEQUATE NUTRITION ANALYSIS TO AVOID PESTICIDE-INDUCED DISEASES AMONG CONSUMERS

TABLE 62 FRUITS AND VEGETABLES: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2016–2020 (USD MILLION)

TABLE 63 FRUITS AND VEGETABLES: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2021–2026 (USD MILLION)

10.9 EDIBLE FATS AND OILS

10.9.1 HIGH-PERFORMANCE LIQUID CHROMATOGRAPHY IS WIDELY USED FOR NUTRITION ANALYSIS OF EDIBLE FATS AND OILS

TABLE 64 EDIBLE FATS AND OILS: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2016–2020 (USD MILLION)

TABLE 65 EDIBLE FATS AND OILS: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2021–2026 (USD MILLION)

10.10 BABY FOODS

10.10.1 BABY FOODS REQUIRE STRINGENT AND ADEQUATE NUTRITION ANALYSIS TO ENSURE INFANTS’ SAFETY AND FOOD QUALITY

TABLE 66 BABY FOODS: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2016–2020 (USD MILLION)

TABLE 67 BABY FOODS: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2021–2026 (USD MILLION)

10.11 OTHER PRODUCT TYPES

10.11.1 NUTRITION ANALYSIS AND TESTING OF DRY FRUITS IS BECOMING INCREASINGLY POPULAR

TABLE 68 OTHER PRODUCT TYPES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 69 OTHER PRODUCT TYPES: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY REGION, 2021–2026 (USD MILLION)

11 NUTRITION ANALYSIS MARKET, BY REGION (Page No. - 153)

11.1 INTRODUCTION

TABLE 70 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 71 NUTRITION ANALYSIS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 72 REALISTIC SCENARIO: COVID-19 IMPACT ON THE NUTRITION ANALYSIS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 73 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

TABLE 74 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON NUTRITION ANALYSIS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

FIGURE 46 RUSSIA ESTIMATED TO GROW AT THE HIGHEST GROWTH RATE IN THE NUTRITION ANALYSIS MARKET, 2021–2026

11.2 NORTH AMERICA

FIGURE 47 NORTH AMERICA NUTRITIONAL ANALYSIS MARKET: SNAPSHOT

TABLE 75 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PRODUCT TYPE, 2016–2020 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

TABLE 83 NORTH AMERICA VITAMIN PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 84 NORTH AMERICA VITAMIN PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 85 NORTH AMERICA PROTEIN MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 86 NORTH AMERICA PROTEIN MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 87 NORTH AMERICA FAT PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 88 NORTH AMERICA FAT PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 89 NORTH AMERICA SUGAR MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 90 NORTH AMERICA SUGAR MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 91 NORTH AMERICA TOTAL DIETARY PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 92 NORTH AMERICA TOTAL DIETARY PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 93 NORTH AMERICA MINERAL PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 94 NORTH AMERICA MINERAL PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 95 NORTH AMERICA CHOLESTEROL MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 96 NORTH AMERICA CHOLESTEROL MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 97 NORTH AMERICA CALORIES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 98 NORTH AMERICA CALORIES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 99 NORTH AMERICA MOISTURE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 100 NORTH AMERICA MOISTURE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 101 NORTH AMERICA OTHER PARAMETERS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 102 NORTH AMERICA OTHER PARAMETER MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.2.1 UNITED STATES

11.2.1.1 Role of the regulatory bodies in enforcing food safety regulations and investigating foodborne outbreak illness

TABLE 103 UNITED STATES: NUTRITIONAL ANALYSIS MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 104 UNITED STATES: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 105 UNITED STATES: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 106 UNITED STATES: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Canada has one of the best regulation schemes for food safety and regulates food safety with high priority while exporting its goods globally

TABLE 107 CANADA: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 108 CANADA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 109 CANADA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 110 CANADA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Owing to the rise in the number of foodborne disease cases, more importance is being laid on food safety in the country

TABLE 111 MEXICO: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 112 MEXICO: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 113 MEXICO: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 114 MEXICO: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.3 EUROPE

TABLE 115 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PRODUCT TYPE, 2016–2020 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 122 EUROPE: NUTRITIONAL ANALYSIS MARKET SIZE, BY OBJECTIVE, 2021–2026 (USD MILLION)

TABLE 123 EUROPE VITAMIN PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 124 EUROPE VITAMIN PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 125 EUROPE PROTEIN PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 126 EUROPE PROTEIN PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 127 EUROPE FAT PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 128 EUROPE FAT PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 129 EUROPE SUGAR PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 130 EUROPE SUGAR PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 131 EUROPE TOTAL DIETARY PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 132 EUROPE TOTAL DIETARY PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 133 EUROPE MINERAL PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 134 EUROPE MINERAL PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 135 EUROPE CHOLESTEROL MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 136 EUROPE CHOLESTEROL MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 137 EUROPE CALORIES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 138 EUROPE CALORIES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 139 EUROPE MOISTURE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 140 EUROPE MOISTURE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 141 EUROPE OTHER PARAMETER MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 142 EUROPE OTHER PARAMETER MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.3.1 UNITED KINGDOM

11.3.1.1 Market growth is largely driven by tests conducted from the raw material stage to the final product distribution stage in the supply chain

TABLE 143 UNITED KINGDOM: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 144 UNITED KINGDOM: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 145 UNITED KINGDOM: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 146 UNITED KINGDOM: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.3.2 GERMANY

11.3.2.1 Concerns over mislabeling on packaged food products drive the demand for nutrition analysis in a much more organized manner

TABLE 147 GERMANY: NUTRITIONAL ANALYSIS MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 148 GERMANY: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 149 GERMANY: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 150 GERMANY: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Regulatory bodies in the country emphasizing food nutrition help grow the demand for the nutritional analysis services

TABLE 151 FRANCE: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 152 FRANCE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 153 FRANCE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 154 FRANCE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Increasing standard of living and health consciousness of consumers are driving the market growth

TABLE 155 ITALY: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 156 ITALY: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 157 ITALY: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 158 ITALY: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Consumer’s concern over the consumption of packaged food products help drive market growth for nutrition analysis

TABLE 159 SPAIN: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 160 SPAIN: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 161 SPAIN: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 162 SPAIN: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.3.6 RUSSIA

11.3.6.1 Government’s proactive steps leading to the increase in dependence on nutrition analysis in the food & beverages industry

TABLE 163 RUSSIA: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 164 RUSSIA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 165 RUSSIA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 166 RUSSIA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.3.7 POLAND

11.3.7.1 Increase in trade of raw fruits and vegetables bolstering demand for nutrition analysis

TABLE 167 POLAND: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 168 POLAND: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 169 POLAND: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 170 POLAND: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.3.8 REST OF EUROPE

11.3.8.1 Rise in awareness related to the health benefits associated with the consumption of healthy food products driving the market growth

TABLE 171 REST OF EUROPE: NUTRITIONAL ANALYSIS MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 172 REST OF EUROPE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 173 REST OF EUROPE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 174 REST OF EUROPE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 48 ASIA PACIFIC: MARKET: SNAPSHOT

TABLE 175 ASIA PACIFIC: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 177 ASIA PACIFIC: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 178 ASIA PACIFIC: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 179 ASIA PACIFIC: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PRODUCT TYPE, 2016–2020 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 181 ASIA PACIFIC: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET SIZE, BY OBJECTIVE, 2021–2026 (USD MILLION)

TABLE 183 ASIA PACIFIC VITAMIN PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 184 ASIA PACIFIC VITAMIN PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 185 ASIA PACIFIC PROTEIN PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 186 ASIA PACIFIC PROTEIN PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 187 ASIA PACIFIC FAT PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 188 ASIA PACIFIC FAT PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 189 ASIA PACIFIC SUGAR MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 190 ASIA PACIFIC SUGAR MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 191 ASIA PACIFIC TOTAL DIETARY PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 192 ASIA PACIFIC TOTAL DIETARY PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 193 ASIA PACIFIC MINERAL PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 194 ASIA PACIFIC MINERAL PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 195 ASIA PACIFIC CHOLESTEROL MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 196 ASIA PACIFIC CHOLESTEROL MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 197 ASIA PACIFIC CALORIES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 198 ASIA PACIFIC CALORIES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 199 ASIA PACIFIC MOISTURE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 200 ASIA PACIFIC MOISTURE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 201 ASIA PACIFIC OTHER PARAMETERS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 202 ASIA PACIFIC OTHER PARAMETERS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 A surging number of food safety regulations driving the growth of the market

TABLE 203 CHINA: NUTRITIONAL ANALYSIS MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 204 CHINA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 205 CHINA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 206 CHINA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.4.2 INDIA

11.4.2.1 Food laboratories are implementing new technologies and modern analytical instruments to detect foodborne pathogens and other contaminants

TABLE 207 INDIA: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 208 INDIA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 209 INDIA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 210 INDIA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Regulatory framework to meet the national standards to international levels to gain a leading market position for food products in the global market

TABLE 211 JAPAN: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 212 JAPAN: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 213 JAPAN: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 214 JAPAN: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.4.4 AUSTRALIA & NEW ZEALAND

11.4.4.1 Exports of various agricultural produce in the country requiring a rational food safety program

TABLE 215 AUSTRALIA & NEW ZEALAND: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 216 AUSTRALIA & NEW ZEALAND: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 217 AUSTRALIA & NEW ZEALAND: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 218 AUSTRALIA & NEW ZEALAND: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.4.5 REST OF ASIA PACIFIC

11.4.5.1 A rise in awareness related to the health benefits associated with the consumption of healthy food products is driving the market growth

TABLE 219 REST OF ASIA PACIFIC: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 220 REST OF ASIA PACIFIC: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 221 REST OF ASIA PACIFIC: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 222 REST OF ASIA PACIFIC: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 223 SOUTH AMERICA: NUTRITIONAL ANALYSIS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 224 SOUTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 225 SOUTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 226 SOUTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 227 SOUTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PRODUCT TYPE, 2016–2020 (USD MILLION)

TABLE 228 SOUTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 229 SOUTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 230 SOUTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

TABLE 231 SOUTH AMERICA VITAMIN PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 232 SOUTH AMERICA VITAMIN PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 233 SOUTH AMERICA PROTEIN PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 234 SOUTH AMERICA PROTEIN PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 235 SOUTH AMERICA FAT PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 236 SOUTH AMERICA FAT PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 237 SOUTH AMERICA SUGAR PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 238 SOUTH AMERICA SUGAR PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 239 SOUTH AMERICA TOTAL DIETARY PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 240 SOUTH AMERICA TOTAL DIETARY PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 241 SOUTH AMERICA MINERAL PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 242 SOUTH AMERICA MINERAL PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 243 SOUTH AMERICA CHOLESTEROL MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 244 SOUTH AMERICA CHOLESTEROL MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 245 SOUTH AMERICA CALORIES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 246 SOUTH AMERICA CALORIES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 247 SOUTH AMERICA MOISTURE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 248 SOUTH AMERICA MOISTURE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 249 SOUTH AMERICA OTHER PARAMETERS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 250 SOUTH AMERICA OTHER PARAMETERS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Regulations made by the Brazilian government to improve the health of the people drives the market

TABLE 251 BRAZIL: NUTRITIONAL ANALYSIS MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 252 BRAZIL: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 253 BRAZIL: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 254 BRAZIL: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Adoption of nutritional labeling to maintain the health of the population in the country to drive the market

TABLE 255 ARGENTINA: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 256 ARGENTINA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 257 ARGENTINA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 258 ARGENTINA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.5.3 CHILE

11.5.3.1 Increased demand for healthy food products in Chile has risen the trend of nutritional labeling, causing the growth of the market

TABLE 259 CHILE: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 260 CHILE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 261 CHILE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 262 CHILE: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.5.4 REST OF SOUTH AMERICA

TABLE 263 REST OF SOUTH AMERICA: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 264 REST OF SOUTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 265 REST OF SOUTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 266 REST OF SOUTH AMERICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.6 REST OF WORLD

TABLE 267 REST OF THE WORLD: NUTRITIONAL ANALYSIS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 268 REST OF THE WORLD: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 269 REST OF THE WORLD: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 270 REST OF THE WORLD: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 271 REST OF THE WORLD: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PRODUCT TYPE, 2016–2020 (USD MILLION)

TABLE 272 REST OF THE WORLD: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 273 REST OF THE WORLD: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 274 REST OF THE WORLD: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

TABLE 275 REST OF THE WORLD: VITAMIN PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 276 REST OF THE WORLD: VITAMIN PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 277 REST OF THE WORLD: PROTEIN PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 278 REST OF THE WORLD: PROTEIN PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 279 REST OF THE WORLD: FAT PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 280 REST OF THE WORLD: FAT PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 281 REST OF THE WORLD: SUGAR PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 282 REST OF THE WORLD: SUGAR PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 283 REST OF THE WORLD: TOTAL DIETARY PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 284 REST OF THE WORLD: TOTAL DIETARY PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 285 REST OF THE WORLD: MINERAL PROFILE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 286 REST OF THE WORLD: MINERAL PROFILE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 287 REST OF THE WORLD: CHOLESTEROL MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 288 REST OF THE WORLD: CHOLESTEROL MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 289 REST OF THE WORLD: CALORIES MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 290 REST OF THE WORLD: CALORIES MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 291 REST OF THE WORLD: MOISTURE MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 292 REST OF THE WORLD: MOISTURE MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 293 REST OF THE WORLD: OTHER PARAMETERS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 294 REST OF THE WORLD: OTHER PARAMETERS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

11.6.1 AFRICA

11.6.1.1 New food labeling regulations aimed at preventing misinformation driving the market in Africa

TABLE 295 AFRICA: NUTRITIONAL ANALYSIS MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 296 AFRICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 297 AFRICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 298 AFRICA: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.6.2 MIDDLE EAST

11.6.2.1 Increased demand for nutritional analysis for most food items due to the new nutrition labeling policy promoting healthy living

TABLE 299 MIDDLE EAST: MARKET SIZE, BY PARAMETER, 2016–2020 (USD MILLION)

TABLE 300 MIDDLE EAST: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY PARAMETER, 2021–2026 (USD MILLION)

TABLE 301 MIDDLE EAST: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 302 MIDDLE EAST: MARKET SIZE FOR NUTRITIONAL ANALYSIS, BY OBJECTIVE, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 264)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2019

TABLE 303 SGS SA DOMINATE THE MARKET IN 2020

FIGURE 49 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2018–2020 (USD MILLION)

12.3 COMPANY EVALUATION MATRIX: DEFINITION & METHODOLOGY

12.3.1 STAR

12.3.2 EMERGING LEADERS

12.3.3 PERVASIVE

12.3.4 PARTICIPANTS

FIGURE 50 MARKET: COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

12.4 COMPANY EVALUATION MATRIX: DEFINITION & METHODOLOGY (FOR START-UPS/SME’S)

12.4.1 PROGRESSIVE COMPANIES

12.4.2 STARTING BLOCKS

12.4.3 RESPONSIVE COMPANIES

12.4.4 10.4.4 DYNAMIC COMPANIES

FIGURE 51 NUTRITIONAL ANALYSIS MARKET: COMPANY EVALUATION QUADRANT FOR START-UPS/SME’S, 2020

12.5 PRODUCT FOOTPRINT

TABLE 304 MARKET: COMPANY TYPE FOOTPRINT (BY PARAMETER)

TABLE 305 MARKET: COMPANY REGION FOOTPRINT

TABLE 306 MARKET: PRODUCT FOOTPRINT (OVERALL)

12.6 MARKET EVALUATION FRAMEWORK

TABLE 307 OVERVIEW OF STRATEGIES DEPLOYED BY NUTRITIONAL ANALYSIS COMPANIES

12.6.1 NEW SERVICE LAUNCHES

TABLE 308 NUTRITIONAL ANALYSIS: NEW SERVICE LAUNCHES, JANUARY 2018–FEBRUARY 2021

12.6.2 DEALS

TABLE 309 NUTRITIONAL ANALYSIS: DEALS, JANUARY 2018–FEBRUARY 2021

13 COMPANY PROFILES (Page No. - 275)

13.1 KEY PLAYERS

(Business overview, Services offered, Recent developments, MnM view)*

13.1.1 SGS SA

TABLE 310 SGS SA: BUSINESS OVERVIEW

FIGURE 52 SGS SA: COMPANY SNAPSHOT

TABLE 311 SGS SA: OTHERS

13.1.2 INTERTEK GROUP PLC

TABLE 312 INTERTEK GROUP PLC: BUSINESS OVERVIEW

FIGURE 53 INTERTEK GROUP PLC: COMPANY SNAPSHOT

TABLE 313 INTERTEK GROUP PLC: NEW SERVICE LAUNCHES

TABLE 314 INTERTEK GROUP PLC: OTHERS

13.1.3 EUROFINS SCIENTIFIC

TABLE 315 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 54 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

TABLE 316 EUROFINS SCIENTIFIC: DEALS

TABLE 317 EUROFINS SCIENTIFIC: OTHERS

13.1.4 THERMO FISHER SCIENTIFIC, INC.

TABLE 318 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

FIGURE 55 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT

13.1.5 BUREAU VERITAS

TABLE 319 BUREAU VERITAS: BUSINESS OVERVIEW

FIGURE 56 BUREAU VERITAS: COMPANY SNAPSHOT

TABLE 320 BUREAU VERITAS: DEALS

13.1.6 ALS LTD

TABLE 321 ALS LTD: NUTRITIONAL ANALYSIS MARKET BUSINESS OVERVIEW

FIGURE 57 ALS LTD: COMPANY SNAPSHOT

13.1.7 MERIEUX NUTRISCIENCES CORP.

TABLE 322 MÉRIEUX NUTRISCIENCES CORPORATION: BUSINESS OVERVIEW

TABLE 323 MERIEUX NUTRISCIENCE CORP: DEALS

13.1.8 ASUREQUALITY LTD

TABLE 324 ASUREQUALITY LTD: BUSINESS OVERVIEW

FIGURE 58 ASUREQUALITY LTD: COMPANY SNAPSHOT

TABLE 325 ASUREQUALITY LTD: NEW SERVICE LAUNCHES

TABLE 326 ASUREQUALITY LTD: DEALS

13.1.9 TÜV NORD GROUP

TABLE 327 TUV NORD GROUP: BUSINESS OVERVIEW

FIGURE 59 TUV NORD GROUP: COMPANY SNAPSHOT

13.1.10 FOOD LAB INC.

TABLE 328 FOOD LAB INC.: BUSINESS OVERVIEW

13.1.11 COMPU-FOOD ANALYSIS, INC.

TABLE 329 COMPU-FOOD ANALYSIS, INC.: BUSINESS OVERVIEW

13.1.12 NUTRIDATA

TABLE 330 NUTRIDATA: BUSINESS OVERVIEW

13.1.13 CERTIFIED LABORATORIES

TABLE 331 CERTIFIED LABORATORIES: BUSINESS OVERVIEW

13.1.14 PREMIER ANALYTICAL SERVICES

TABLE 332 PREMIER ANALYTICAL SERVICE: BUSINESS OVERVIEW

13.1.15 MICROBAC LABORATORIES, INC.

TABLE 333 MICROBAC LABORATORIES, INC.: BUSINESS OVERVIEW

*Details on Business overview, Services offered, Recent developments, MnM view might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 OPAL RESEARCH AND ANALYTICAL SERVICES

13.2.2 MENUSANO

13.2.3 AWTA LTD

13.2.4 GUJARAT LABORATORIES

13.2.5 FOOD CONSULTING COMPANY

14 ADJACENT & RELATED MARKETS (Page No. - 315)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 FOOD DIAGNOSTICS MARKET

14.3.1 NUTRITIONAL ANALYSIS MARKET DEFINITION

14.3.2 MARKET OVERVIEW

FIGURE 60 FOOD DIAGNOSTICS TO WITNESS A STEADY GROWTH DURING THE FORECAST PERIOD

14.3.3 FOOD DIAGNOSTICS MARKET, BY FOOD TESTED

TABLE 334 FOOD DIAGNOSTICS MARKET, BY FOOD TESTED, 2018–2025 (USD MILLION)

14.4 GM FOOD SAFETY TESTING MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

FIGURE 61 GM FOOD SAFETY TESTING MARKET TO WITNESS A STEADY GROWTH DURING THE FORECAST PERIOD

14.4.3 GM FOOD SAFETY TESTING MARKET, BY CROP AND PROCESSED FOOD TESTED

TABLE 335 GM FOOD SAFETY TESTING MARKET SIZE, BY CROP AND PROCESSED FOOD TESTED, 2015–2022 (USD MILLION)

15 APPENDIX (Page No. - 320)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.3.1 SEGMENT ANALYSIS

15.3.1.1 Geographic Analysis

15.3.1.2 Company Information

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

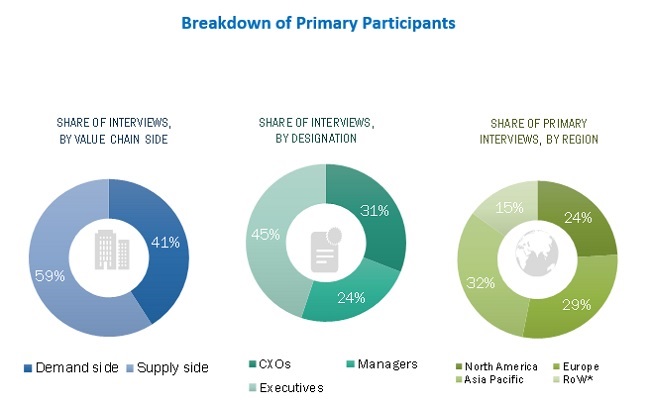

The study involved four major activities in estimating the nutritional analysis market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of the nutritional analysis market is characterized by the presence of manufacturing companies and government organizations, service providing company officials, government and research organizations, and research officers. The supply side is characterized by the presence of key CEOs and vice presidents, marketing directors, product innovation directors and related key executives from manufacturing companies and organizations operating in the market, and manufacturing and marketing companies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Nutritional Analysis Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the nutritional analysis market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary research.

- The COVID-19 impact on market size of nutritional analysis was determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- Determining and projecting the size of the nutritional analysis market, with respect to parameter, product type, objective, and regional markets, over a period, ranging from 2021 to 2026.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions.

- Providing detailed information about the impact of COVID-19 on nutritional analysis supply chain and its impact on various stakeholders such as suppliers, manufacturers, and retailers across the supply chain.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

- Identifying and profiling the key players in the nutrition analysis market and impact of COVID-19 on the key vendors.

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the value chain and products offered across key regions and their impact on the growth of the prominent market players

- Providing insights on key product innovations and investments in the nutrition analysis market.

Available Customizations

Geographical Analysis

- Further breakdown of the Rest of Europe nutritional analysis market, by key country

- Further breakdown of the Rest of Asia Pacific market, by key country

Segmentation Analysis

- Market segmentation analysis of other parameters of nutritional analysis

- Market segmentation by distribution channel as OTC and prescribed

Company Information

- Analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Nutritional Analysis Market