North American Radiation Protection Apron Market by Type (Front Protection, Vest & Skirt, Full Wrap, Pregnancy Lead Apron), Material (Lead Apron, Light Lead Composite Apron, Lead Free Apron), Country (US, Canada) - Forecast to 2026

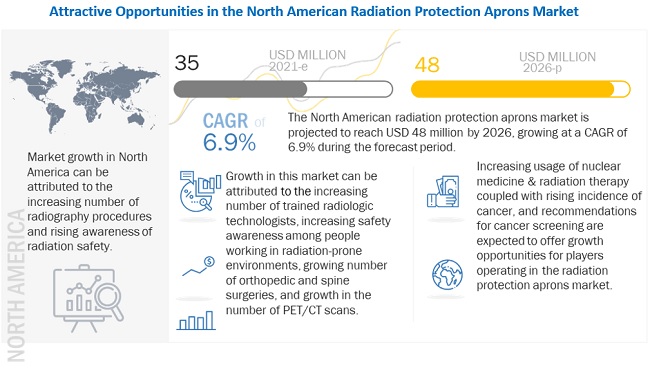

[106 Pages Report] The North American radiation protection aprons market is projected to reach USD 48 million by 2026 from USD 35 million in 2021, at a CAGR of 6.9% during the forecast period. The growth of the North American radiation protection aprons market is being driven by factors such as increasing number of trained radiologic technologists, increasing safety awareness, the growing number of orthopedic and spine surgeries, and growth in the number of PET/CT scans. Lead aprons are deemed no longer necessary for adult patients in dental X-ray procedures in the US is expected to restrain North American radiation protection market growth. Increasing usage of nuclear medicine & radiation therapy coupled with the rising incidence of cancer, and recommendations for cancer screening are expected to offer strong growth opportunities for players in the market. In contrast, discomfort and pain due to the weight of lead aprons, and high and growing cost of lead may challenge market growth to a certain extent. The North American radiation protection aprons market is segmented based on type, material, and country.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the North American radiation protection aprons market

Healthcare policies have recommended pausing elective and routine medical services, particularly surgical procedures and imaging examinations. The public is also hesitant to visit any healthcare facility for fear of being exposed to the disease. Financial hardships faced by radiology centers also contribute to the decline in imaging case volumes. This decline would lead to lesser radiology procedures conducted in the coming few months, which will lead to lesser demand for radiation protection aprons.

The COVID-19 pandemic has also impacted nuclear power and the nuclear fuel industry on both the supply and demand sides. According to the International Association for Energy Economics, the demand for electricity in the US will decline by 3% in 2020. These factors have negatively impacted the radiation protection aprons market during the pandemic. Many companies operating in the market have also faced disruptions in the supply chain and a decline in sales during the COVID-19 pandemic.

North American radiation protection aprons Market Dynamics

DRIVER: Increasing number of trained radiologic technologists

Trained radiologic technologists are required to effectively operate medical imaging equipment, such as X-ray and computed tomography (CT), which are widely used for diagnostic and treatment applications in hospitals and other healthcare facilities. Radiologic technologists use personal protective equipment (PPE), such as clothing or other special equipment (including aprons), to protect themselves against exposure to ionizing radiations during the use of this medical imaging equipment. As a result, the growth in the number of radiologic technologists is expected to directly impact the medical radiation protection aprons market

RESTRAINT: No mandate for using lead aprons during dental x-ray procedures in the US

Conventionally, in dental clinics across the US, the use of lead aprons was mandated for patients to protect themselves from excessive radiation during dental X-ray procedures. However, according to the Center for Health Protection, Radiation Protection Services (RPS), as of 2016, lead aprons in dental are not mandatory for adult patients. Though the RPS has recommended providing lead aprons for patients who want to wear them during treatment procedures voluntarily, this policy change is expected to affect the demand for medical radiation protection aprons in dental clinics. Similarly, according to a report from the American Academy of Oral and Maxillofacial Radiology, the benefits of lead aprons for patients in dental radiography are minimal as compared to the benefits offered by E-speed films and rectangular collimation (rectangular collimation is used in dental clinics to reduce radiation doses for patients). With the availability of alternatives for lead aprons in dental clinics, the demand for adult medical radiation protection aprons is expected to decrease among these end users during the forecast period.

OPPORTUNITY: Recommendations for cancer screening

Governments in developed countries and primary care doctors recommend cancer screening tests for patients to detect cancer in the early stages and decrease the mortality rate. The US Preventive Services Task Force (USPSTF) recommends screening for colorectal cancer starting at 50 years of age to 75 years of age in the US as a means of preventing disease incidence and ensuring early-stage treatment. Canada has also implemented biennial colorectal cancer screening guidelines for people aged 50–74 years.

These recommendations are expected to increase the number of tests conducted in diagnostic labs. This will drive the demand for radiation protection aprons products in the coming years.

CHALLENGE: High and growing cost of lead

Lead is the most important raw material required to manufacture radiation safety accessories such as gloves, aprons, and eyewear. However, it is extensively used for other purposes such as fire protection and manufacturing lead storage batteries. Due to its increasing use in other industries, its cost is projected to increase soon. This brings up the need to develop novel raw materials. Hence, the increasing cost of lead will challenge the North American radiation protection aprons market during the forecast period.

Front protection aprons segment dominated the North American radiation protection aprons market in 2020.

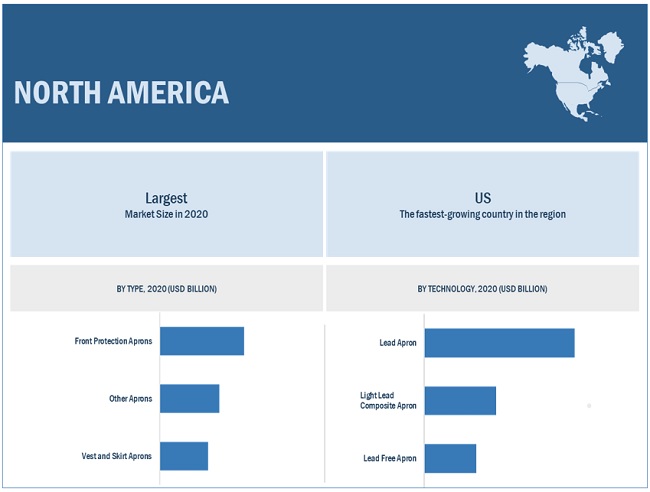

Based on type, the North American radiation protection aprons market is segmented into front protection aprons, vest & skirt aprons, and other aprons. In 2020, the front protection aprons segment accounted for the largest share of this market primarily due to the wide availability and high usage of these aprons in dental clinics and hospital settings.

The lead aprons segment to witness the highest market share during the forecast period.

Based on material, the North American radiation protection aprons market is segmented into lead aprons, light lead composite aprons, and lead-free aprons. The lead aprons segment accounted for the largest share of the North American medial radiation protection aprons market in 2020. The large share of this segment can be attributed to the durability of these aprons and their efficiency in blocking radiation and protecting the body.

US was the largest regional market for North American radiation protection aprons market in 2020.

Based on country, the North American radiation protection aprons market is segmented into the US and Canada. The growth of the North American market can be attributed to increasing awareness of radiation safety, the increasing number of radiography procedures performed, and ongoing research aimed at the development of new and advanced radiation protection products. In 2020, the US accounted for the largest share of the North American radiation protection aprons market. The large share can be attributed to the increasing number of radiography procedures performed and the rising number of healthcare professionals that use radiography equipment.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The prominent players operating in this market include Infab Corporation (US), Bar-ray Products (US), AliMed, Inc. (US) Burlington Medical (US) and Shielding International, Inc. (US).

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2019 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Material and Region |

|

Geographies covered |

US and Canada |

|

Companies covered |

Infab Corporation (US), Bar-Ray Products (US), AliMed, Inc. (US), Burlington Medical (US), Shielding International, Inc. (US) Protech Medical (US), AADCO Medical, Inc. (US), Lite Tech (US), Barrier Technologies (US), BLOXR Solutions (US), Techo-Aide (US), Kiran (India), Kemper Medical, Inc. (US), Z&Z Medical (US), MXR Imaging Inc. (US), Wolf X-ray Corporation (US), and Universal Medical, Inc. (US). |

This report categorizes the North American radiation protection aprons market into the following segments and subsegments:

By Type

- Front Protection Aprons

- Vest & Skirt Aprons

- Other Aprons

By Material

- Lead Aprons

- Light Lead Composite Aprons

- Lead-free Aprons

By Country

- US

- Canada

Recent Developments

- In 2021, Infab Corporation acquired MediDrapes Inc. (US), a provider of disposable protective drapes used in medical imaging equipment such as mini-C-arms, fluoroscopes, and ultrasound machines, added to the company’s portfolio.

- In 2021, MXR Imagng Inc. entered into partnership with Konica Minolta (Tokyo) to expand its product portfolio, including medical imaging solutions across multiple departments, modalities, and imaging applications for healthcare facilities.

- In 2020, Burlington Medical launched lightweight advanced material for its Enviro-Lite and Burlite products used for radiation protection

Frequently Asked Questions (FAQ):

What is the impact of COVID-19 on the North American radiation protection aprons market?

The COVID-19 pandemic has a negative impact on North American radiation protection aprons. The reduced use of North American radiation protection aprons due to the pausing elective and routine medical services, particularly surgical procedures and imaging examinations. The public is also hesitant to visit any healthcare facility for fear of being exposed to the disease. Financial hardships faced by radiology centers also contribute to the decline in imaging case volumes.

Who are the key players in the North American radiation protection aprons market?

The prominent players operating in this market include Infab Corporation (US), Bar-ray Products (US), AliMed, Inc. (US) Burlington Medical (US) and Shielding International, Inc. (US).

Which product type dominates the North American radiation protection aprons market?

In 2020, the front protection aprons segment accounted for the largest share of this market primarily due to the wide availability and high usage of these aprons in dental clinics and hospital settings.

What factors are driving the North American radiation protection aprons market?

Market growth is largely driven by factors such as the increasing number of trained radiologic technologists, increasing safety awareness, the growing number of orthopedic and spine surgeries, and growth in the number of PET/CT scans.

What is the market for North American radiation protection aprons?

The North American radiation protection aprons market is projected to reach USD 48 million by 2026 from USD 35 million in 2021, at a CAGR of 6.9% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 14)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

FIGURE 1 RADIATION PROTECTION APRONS MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 18)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY DESIGNATION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.1 GROWTH FORECAST

FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 7 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.5.1 COVID-19-SPECIFIC ASSUMPTIONS

2.6 LIMITATIONS

2.7 RISK ASSESSMENT

2.8 COVID-19 ECONOMIC ASSESSMENT

2.9 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 9 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 10 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 33)

FIGURE 11 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 12 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY MATERIAL, 2021 VS. 2026 (USD MILLION)

FIGURE 13 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY COUNTRY, 2021 VS. 2026 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 36)

4.1 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET OVERVIEW

FIGURE 14 INCREASING NUMBER OF RADIOGRAPHY PROCEDURES TO DRIVE MARKET GROWTH

4.2 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY MATERIAL (2021–2026)

FIGURE 15 LEAD-FREE APRONS SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 NORTH AMERICA: NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY TYPE AND COUNTRY (2020)

FIGURE 16 US ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2020

4.4 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 17 US TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 RADIATION PROTECTION APRONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing number of trained radiologic technologists

TABLE 1 METROPOLITAN AREAS IN THE US WITH HIGH EMPLOYMENT LEVELS AMONG RADIOLOGY TECHNOLOGISTS AND TECHNICIANS

5.2.1.2 Increasing safety awareness among people working in radiation-prone environments

5.2.1.3 Growing number of orthopedic and spine surgeries

5.2.1.4 Growth in the number of PET/CT scans

TABLE 2 CT SCANNERS INSTALLED, BY COUNTRY, 2017 VS. 2019 (PER MILLION INHABITANTS)

TABLE 3 CT SCAN PROCEDURAL VOLUME, BY COUNTRY, 2017 VS. 2019 (PER 1,000 INHABITANTS)

5.2.2 RESTRAINTS

5.2.2.1 No mandate for using lead aprons during dental X-ray procedures in the US

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing usage of nuclear medicine & radiation therapy coupled with the rising incidence of cancer

TABLE 4 NUMBER OF NEW CANCER CASES FROM 2020 TO 2040

TABLE 5 WORLDWIDE INSTALLATION BASE OF RADIOTHERAPY EQUIPMENT, 2017–2019

5.2.3.2 Recommendations for cancer screening

5.2.4 CHALLENGES

5.2.4.1 Discomfort and pain due to the weight of lead aprons

5.2.4.2 High and growing cost of lead

5.3 COVID-19 IMPACT ON THE RADIATION PROTECTION APRONS MARKET

5.4 AVERAGE SELLING PRICE FOR MEDICAL RADIATION PROTECTION APRONS

TABLE 6 PRICING ANALYSIS FOR RADIATION PROTECTION APRONS, NORTH AMERICA

5.5 USAGE AND PURCHASE PATTERNS

6 NORTH AMERICA RADIATION PROTECTION APRONS MARKET, BY TYPE (Page No. - 48)

6.1 INTRODUCTION

TABLE 7 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 8 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY TYPE, 2020–2026 (USD MILLION)

6.2 FRONT PROTECTION APRONS

6.2.1 FRONT APRONS ARE WIDELY USED FOR SHORT-DURATION PROCEDURES

TABLE 9 NORTH AMERICAN FRONT PROTECTION APRONS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 10 NORTH AMERICAN FRONT PROTECTION APRONS MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

6.3 VEST & SKIRT APRONS

6.3.1 COMPANY INITIATIVES TOWARD PRODUCT DEVELOPMENT SUPPORT MARKET GROWTH

TABLE 11 NORTH AMERICAN VEST & SKIRT APRONS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 12 NORTH AMERICAN VEST & SKIRT APRONS MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

6.4 OTHER APRONS

TABLE 13 NORTH AMERICAN OTHER APRONS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 14 NORTH AMERICAN OTHER APRONS MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

7 NORTH AMERICA RADIATION PROTECTION APRONS MARKET, BY MATERIAL (Page No. - 53)

7.1 INTRODUCTION

TABLE 15 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY MATERIAL, 2016–2019 (USD MILLION)

TABLE 16 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY MATERIAL, 2020–2026 (USD MILLION)

7.2 LEAD APRONS

7.2.1 INCREASE IN MEDICAL IMAGING PROCEDURES DRIVES DEMAND FOR LEAD APRONS

FIGURE 19 PREVALENCE OF BACK PAIN AMONG LEAD APRON USERS

FIGURE 20 PREVALENCE OF BACK PAIN DUE TO LEAD APRON

TABLE 17 NORTH AMERICAN LEAD APRONS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 18 NORTH AMERICAN LEAD APRONS MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

7.3 LIGHT LEAD COMPOSITE APRONS

7.3.1 LOW WEIGHT AND EASE OF USE HAVE MADE LIGHT LEAD COMPOSITE APRONS POPULAR

TABLE 19 NORTH AMERICAN LIGHT LEAD COMPOSITE APRONS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 20 NORTH AMERICAN LIGHT LEAD COMPOSITE APRONS MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

7.4 LEAD-FREE APRONS

7.4.1 LOW WEIGHT AND EASE OF RECYCLING HAS DRAWN ATTENTION TO LEAD-FREE APRONS

TABLE 21 NORTH AMERICAN LEAD-FREE APRONS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 22 NORTH AMERICAN LEAD-FREE APRONS MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

8 NORTH AMERICA RADIATION PROTECTION APRONS MARKET, BY COUNTRY (Page No. - 59)

8.1 INTRODUCTION

TABLE 23 INSTALLED BASE OF CT SCANNERS AND MRI SYSTEMS IN NORTH AMERICA, 2017 VS. 2018

TABLE 24 CT PROCEDURAL AND MRI PROCEDURAL VOLUMES IN NORTH AMERICA, 2017 VS. 2018 (MILLION)

FIGURE 21 NORTH AMERICA: RADIATION PROTECTION APRONS MARKET SNAPSHOT

TABLE 25 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 26 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 27 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 28 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 29 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY MATERIAL, 2016–2019 (USD MILLION)

TABLE 30 NORTH AMERICAN RADIATION PROTECTION APRONS MARKET, BY MATERIAL, 2020–2026 (USD MILLION)

8.2 US

8.2.1 THE US DOMINATED THE NORTH AMERICAN MARKET IN 2020

FIGURE 22 NUMBER OF MRI AND CT EXAMS PER 1,000 PEOPLE IN THE US

TABLE 31 US: KEY MACROINDICATORS

TABLE 32 US: RADIATION PROTECTION APRONS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 33 US: RADIATION PROTECTION APRONS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 34 US: RADIATION PROTECTION APRONS MARKET, BY MATERIAL, 2016–2019 (USD MILLION)

TABLE 35 US: RADIATION PROTECTION APRONS MARKET, BY MATERIAL, 2020–2026 (USD MILLION)

8.3 CANADA

8.3.1 THE SHORTAGE OF RADIOLOGISTS IS A MAJOR CHALLENGE IN THE CANADIAN MARKET

FIGURE 23 NUMBER OF MRI AND CT EXAMS PER 1,000 PEOPLE IN CANADA

TABLE 36 CANADA: KEY MACROINDICATORS

TABLE 37 CANADA: RADIATION PROTECTION APRONS MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 38 CANADA: RADIATION PROTECTION APRONS MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 39 CANADA: RADIATION PROTECTION APRONS MARKET, BY MATERIAL, 2016–2019 (USD MILLION)

TABLE 40 CANADA: RADIATION PROTECTION APRONS MARKET, BY MATERIAL, 2020–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 70)

9.1 OVERVIEW

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 41 OVERVIEW OF STRATEGIES ADOPTED BY KEY HEPATITIS TESTING MARKET PLAYERS

9.3 COMPANY RANKING ANALYSIS

FIGURE 24 TOP FIVE COMPANIES IN THE NORTH AMERICAN RADIATION PROTECTION APRONS MARKET

9.4 COMPETITIVE SCENARIO

FIGURE 25 MARKET EVALUATION MATRIX, 2018–2021

9.4.1 DEALS

TABLE 42 DEALS

9.4.2 PRODUCT LAUNCHES/APPROVALS

TABLE 43 PRODUCT LAUNCHES/APPROVALS

9.4.3 OTHER DEVELOPMENTS

TABLE 44 OTHER DEVELOPMENTS

10 COMPANY PROFILES (Page No. - 75)

10.1 KEY PLAYERS

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

10.1.1 INFAB CORPORATION

TABLE 45 INFAB CORPORATION: BUSINESS OVERVIEW

10.1.2 BAR-RAY PRODUCTS

TABLE 46 BAR-RAY PRODUCTS: BUSINESS OVERVIEW

10.1.3 ALIMED, INC.

TABLE 47 ALIMED, INC.: BUSINESS OVERVIEW

10.1.4 BURLINGTON MEDICAL

TABLE 48 BURLINGTON MEDICAL: BUSINESS OVERVIEW

10.1.5 SHIELDING INTERNATIONAL, INC.

TABLE 49 SHIELDING INTERNATIONAL, INC.: BUSINESS OVERVIEW

10.1.6 PROTECH MEDICAL

TABLE 50 PROTECH MEDICAL: BUSINESS OVERVIEW

10.1.7 AADCO MEDICAL, INC.

TABLE 51 AADCO MEDICAL INC.: BUSINESS OVERVIEW

10.1.8 LITE TECH

TABLE 52 LITE TECH: BUSINESS OVERVIEW

10.1.9 BARRIER TECHNOLOGIES

TABLE 53 BARRIER TECHNOLOGIES: BUSINESS OVERVIEW

10.1.10 BLOXR SOLUTIONS, LLC

TABLE 54 BLOXR SOLUTIONS, LLC: BUSINESS OVERVIEW

10.2 OTHER PLAYERS

10.2.1 TECHNO-AIDE

10.2.2 KIRAN

10.2.3 KEMPER MEDICAL, INC.

10.2.4 Z&Z MEDICAL, INC.

10.2.5 MXR IMAGING INC.

10.2.6 WOLF X-RAY CORPORATION

10.2.7 UNIVERSAL MEDICAL, INC.

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11 APPENDIX (Page No. - 100)

11.1 INSIGHTS FROM INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the North American radiation protection aprons market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the North American radiation protection aprons market. The secondary sources used for this study include World Health Organization, World Bank, Centers for Disease Control and Prevention, National Institutes of Health, Canadian Association of Radiologists, International Radiation Protection Association, Radiological Society of North America, Organisation for Economic Co-operation and Development (OECD), American Medical Association, Food and Drug Administration (FDA), Annual Reports, SEC Filings, Expert Interviews, and MarketsandMarkets Analysis. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

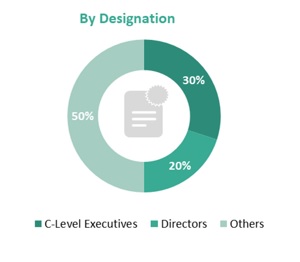

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the North American radiation protection aprons market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the North American radiation protection aprons business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the North American radiation protection aprons market based on type, material, and country.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges).

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies.

- To track and analyze competitive developments such as product launches, agreements, expansions, acquisitions, and other developments in the North American medical radiation protection aprons market.

- To benchmark players within the market using proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- An additional five company profiles

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in North American Radiation Protection Apron Market