North America Electromagnetic NDT Market by Method (Eddy Current Testing, Remote Field Testing, Magnetic Flux Leakage Testing), by Vertical (Oil & Gas, Power Generation, Automotive, Aerospace), by Country (The U.S., Canada, Mexico) - Trends & Forecast to 2015 - 2020

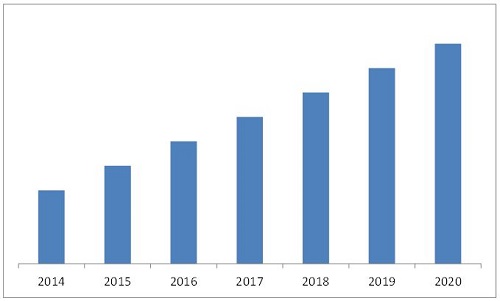

The non-destructive testing (NDT) method involves inspecting, testing, and evaluating assemblies, materials, or components to identify any discontinuities or differences in their characteristics, without hampering the work performed by the component or system. In other words, an NDT inspection can be performed on the component or system without affecting its current working condition. Modern non-destructive testing methods such as electromagnetic NDT are now being used by various industrial verticals such as oil & gas, power generation, aerospace, automotive, foundries, and process industries to ensure product quality and reliability, to optimize the manufacturing process, lower the cost of production, and avoid machine failures and damages. The North American magnetic & electromagnetic NDT market is expected to grow $223.76 million at a CAGR of 8.84% during the forecast period between 2015 and 2020.

Key Take-Aways

- Analysis of the North American electromagnetic NDT market, with focus on high-growth sub-segments such as oil & gas, power generation, aerospace, automotive, and process industries

- Impact analysis of market dynamics that include the factors currently driving and restraining the growth of the market; along with the projection of future trends in the North American electromagnetic NDT market

- The Porters Five Forces framework has been applied and explained in detail along with the value chain analysis for the North American electromagnetic NDT market

- The competitive landscape has been detailed by identifying the key players along with an in-depth market share analysis including the company revenue and market share

There are various types of h America Electromagnetic NDT Market inspection methods such as eddy-current testing (ECT), remote field testing (RFT), and alternating current field measurement (ACFM) testing, which are used by several industry verticals. All these types of electromagnetic NDT equipment possess unique characteristics according to which they are selected to carry out the inspection tasks. Among all electromagnetic NDT testing methods, eddy-current testing is the most commonly used to inspect non-ferromagnetic materials. On the other hand, remote field testing is used for the inspection of carbonsteel and other ferromagnetic materials. The demand for electromagnetic NDT equipment used in inspections and quality has significantly grown, and is expected to grow further during the forecast period due to the increasing emphasis on quality control among industry players across various industry verticals. Government safety regulations, the prominently growing automotive and aerospace sectors, and the new power generation projects in the U.S. are some of the significant drivers for the growth of the North American electromagnetic NDT equipment market. However, the high cost of equipment and the lack of qualified technicians are the key factors that are restraining the growth of the North American electromagnetic NDT equipment market.

The North American electromagnetic NDT market is expected to grow at a CAGR of 8.84% between 2015 and 2020. The electromagnetic NDT equipment present a huge scope in various industry verticals for increasing their operational efficiency and providing quality products. However, the major factor restraining the growth of the h America Electromagnetic NDT Market is the high cost of equipment. Since the use of NDT inspection is not very frequent in the industries and requires specialized workforce to carry out the inspection, many industry players prefer to rent rather than buy the equipment. The stringent government safety regulations and growing demand from the automotive and aerospace segments are the key factors driving the North American electromagnetic NDT equipment market. The development of infrastructure, increasing industrial development, and the strict regulations of the governments regarding safety and environmental issues are boosting the growth opportunities for the North American electromagnetic NDT market. The key players in the North American electromagnetic NDT equipment market included in the report are GE (U.S.), Olympus Corporation (Japan), Foerster (U.S.), Zetec, Inc. (U.S.), and Magnetic Analysis Corp. (U.S.), and others.

North America Electromagnetic NDT Equipment Market

Source: MarketsandMarkets Analysis

This report on the North American electromagnetic NDT equipment market covers various types of Non-Destructive Testing (NDT) inspection methods such as eddy-current testing (ECT), remote field testing (RFT), and alternating current field measurement (ACFM) testing, which are used by the industry verticals. The report also describes the industry trends, drivers, restraints, and opportunities of the magnetic & electromagnetic NDT market and forecasts the market to 2020, segmented on the basis of methods, verticals, and geography. It covers the key verticals of the magnetic and electromagnetic NDT equipment market including the oil & gas, power generation, aerospace, automotive, foundries, process industries, and others (medical and healthcare, infrastructure, and mining). Among all the verticals, power generation is expected to be the largest contributor to the overall magnetic and electromagnetic NDT equipment market in North America. This vertical accounted for 24% of the market share and its market size is expected to reach $48.65 million by 2020, at a CAGR of 7.59% between 2015 and 2020. For this analysis, the Electromagnetic NDT Market has been segmented into countries such as the U.S., Mexico, and Canada.

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 North America Electromagnetic NDT Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Demand-Side Variables

2.2.1 Introduction

2.2.1.1 Growing Investments in the Old and Deteriorating Infrastructure

2.2.1.2 Increase in Demand From the Automotive Sector

2.3 America Electromagnetic NDT Market Size Estimation

2.4 America Electromagnetic NDT Market Breakdown & Data Triangulation

2.5 Research Assumptions and Limitations

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Opportunities in the North American Magnetic and Electromagnetic NDT Market

4.2 Top Three Segments in the North American Magnetic & Electromagnetic NDT Market

4.3 North America Electromagnetic NDT Market, By Country

4.4 North America Electromagnetic NDT Market: Industry Verticals

4.5 the U.S Magnetic & Electromagnetic NDT Vertical Market: Methods of NDT Testing (2020)

4.6 the U.S. Magnetic & Electromagnetic NDT Equipment Shipment

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Evolution of the NDT Technology

5.3 America Electromagnetic NDT Market Segmentation

5.3.1 By Method

5.3.2 By Vertical

5.3.3 By Country

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Prominently Growing Automotive and Aerospace Sector in the North American Region

5.4.1.2 Government Safety Regulations

5.4.1.3 New Power Generation Projects in the U.S.

5.4.2 Restraints

5.4.2.1 Lack of Qualified Technicians

5.4.2.2 High Costs of Equipment

5.4.3 Opportunities

5.4.3.1 Technological Advancements

5.4.3.2 Demand for Third-Party Inspection Service Providers

5.4.4 Challenge

5.4.4.1 Lack of Awareness About New NDT Inspection Methods

5.4.5 Burning Issue

5.4.5.1 Rapid Industrial Transformation

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Recent Trends

6.4 Porters Five Forces Analysis

6.4.1 Bargaining Power of Suppliers

6.4.2 Bargaining Power of Buyers

6.4.3 Threat of New Entrants

6.4.4 Threat of Substitutes

6.4.5 Intensity of Competitive Rivalry

7 the North American Magnetic and Electromagnetic NDT Equipment Market, By Method (Page No. - 48)

7.1 Introduction

7.1.1 Market Trends of Magnetic and Electromagnetic NDT Methods and Applications

7.2 EDDY-Current NDT Equipment

7.2.1 North America Electromagnetic NDT Market and Technology Trends

7.2.2 Key Application Areas

7.3 Remote Field Testing Equipment

7.3.1 Market and Technology Trends

7.3.2 Key Application Areas

7.4 Magnetic Flux Leakage Testing Equipment

7.4.1 North America Electromagnetic NDT Market and Technology Trends

7.4.2 Key Application Areas

7.5 Alternating Current Field Measurement Equipment

7.5.1 Market and Technology Trends

7.5.2 Key Application Areas

8 the North American Magnetic and Electromagnetic NDT Equipment Market, By Vertical (Page No. - 59)

8.1 Introduction

8.2 Oil & Gas

8.3 Power Generation

8.4 Aerospace

8.5 Process Industry

8.6 Automotive

8.7 Foundry

8.8 Others

9 the North American Magnetic and Electromagnetic NDT Equipment Market, By Country (Page No. - 70)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

10 Competitive Landscape (Page No. - 105)

10.1 Overview

10.2 Market Share Analysis: the North American Magnetic & Electromagnetic NDT Market

10.3 Competitive Situation and Trends

10.4 New Product Launches

10.5 Agreements, Partnerships, Expansion and Contracts

10.6 Others

11 Company Profile (Page No. - 110)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 Introduction

11.2 General Electric Company

11.3 Olympus Corporation

11.4 Dr. Foerster GmbH & Co. KG

11.5 Zetec, Inc.

11.6 Magnetic Analysis Corporation

11.7 Mistras Group, Inc.

11.8 Eddyfi

11.9 Ashtead Technology

11.10 Russell NDE Systems, Inc.

11.11 TSC Inspection Systems

11.12 United Western Technologies

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 137)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (78 Tables)

Table 1 North America Electromagnetic NDT Market: Analysis of Drivers

Table 2 North America Electromagnetic NDT Market: Analysis of Restraints

Table 3 North America Electromagnetic NDT Market: Analysis of Opportunities

Table 4 North America Electromagnetic NDT Market: Analysis of Challenges

Table 5 North America Magnetic and Electromagnetic NDT Equipment Market Size, By Method, 20142020 ($Million)

Table 6 North American Magnetic and Electromagnetic NDT Equipment Market Size, By Method, 20142020 (Units)

Table 7 Technical Trends in EDDY-Current Testing

Table 8 Industries With Testing Requirements

Table 9 North America Magnetic and Electromagnetic NDT Equipment Market Size, By Vertical, 20142020 ($Million)

Table 10 North America Magnetic and Electromagnetic NDT Equipment Market Size, By Vertical, 20142020 (Units )

Table 11 Different NDT Methods and Solutions Offered in the Oil & Gas Industry

Table 12 Different NDT Methods and Solutions Offered in Power Generation

Table 13 Different NDT Methods and Solutions Offered in Nuclear Power Generation

Table 14 Different NDT Methods and Solutions Offered in Renewable Power Generation

Table 15 NDT Technologies Used in Aerospace Industry

Table 16 Different Other Modern NDT Methods Used in the Aerospace Industry

Table 17 NDT Essentials for Aircraft Maintenance

Table 18 NDT Technologies in the Automotive Vertical

Table 19 NDT Technologies Used in Foundry Industry

Table 20 North America Magnetic and Electromagnetic NDT Equipment Market Size, By Country, 20142020 ($Million)

Table 21 North America Magnetic and Electromagnetic NDT Equipment Market Size, By Country, 20142020 (Units)

Table 22 U.S. EDDY-Current NDT Equipment Market Size, By Vertical,20142020 ($Million)

Table 23 U.S. EDDY-Current NDT Equipment Market Size, By Vertical,20142020 (Units)

Table 24 U.S. Remote Field Testing Equipment Market, By Vertical,20142020 ($Million)

Table 25 U.S. Remote Field Testing Equipment Market, By Vertical,20142020 (Units)

Table 26 Magnetic Flux Leakage Testing Equipment Market Size in the U.S.,By Vertical, 20142020 ($Million)

Table 27 U.S. Magnetic Flux Leakage Testing Equipment Market, By Vertical,20142020 (Units)

Table 28 Alternating Current Field Measurement Equipment Market Size InThe U.S., By Vertical, 20142020 ($Million)

Table 29 Alternating Current Field Measurement Equipment Market Size InThe U.S., By Vertical, 20142020 (Units)

Table 30 U.S. Magnetic and Electromagnetic NDT Equipment Market Size,By Vertical, 20142020 ($Million)

Table 31 U.S. Magnetic and Electromagnetic NDT Equipment Market, By Vertical, 20142020 (Units)

Table 32 U.S. Oil & Gas Vertical Market Size, By Method, 20142020 ($Million)

Table 33 U.S. Oil & Gas Market Size, By Method, 20142020 (Units)

Table 34 U.S. Power Generation Market Size, By Method, 20142020 ($Million)

Table 35 U.S. Power Generation Vertical Market Size, By Method,20142020 (Units)

Table 36 U.S. Aerospace Vertical Market Size, By Method, 20142020 ($Million)

Table 37 U.S. Aerospace Vertical Market Size, By Method, 20142020 (Units)

Table 38 U.S. Process Industries Vertical Market Size, By Method,20142020 ($Million)

Table 39 U.S. Process Industries Vertical Market Size, By Method,20142020 (Units)

Table 40 U.S. Automotive Vertical Market Size, By Method, 20142020 ($Million)

Table 41 U.S. Automotive Vertical Market Size, By Method, 20142020 (Units)

Table 42 U.S. Foundries Vertical Market Size, By Method, 20142020 ($Million)

Table 43 U.S. Foundries Vertical Market Size, By Method, 20142020 (Units)

Table 44 U.S. Others Vertical Market Size, By Method, 20142020 ($Million)

Table 45 U.S. Others Vertical Market Size, By Method, 20142020 (Units)

Table 46 Canadian Magnetic and Electromagnetic NDT Equipment Market Size,By Method, 20142020 ($Million)

Table 47 Canadian Magnetic and Electromagnetic NDT Equipment Market Size,By Method, 20142020 (Units)

Table 48 Canadian Magnetic and Electromagnetic NDT Equipment Market Size,By Vertical, 20142020 ($Million)

Table 49 Canadian Magnetic and Electromagnetic NDT Equipment Market Size,By Vertical, 20142020 ($Million)

Table 50 Canadian EDDY Current NDT Equipment Market Size, By Vertical,20142020 ($Million)

Table 51 Canadian Remote Field Testing Equipment Market Size, By Vertical,20142020 ($Million)

Table 52 Canadian Magnetic Flux Leakage Testing Equipment Market Size,By Vertical, 20142020 ($Million)

Table 53 Canadian Alternating Current Field Measurement Equipment Market Size, By Vertical, 20142020 ($Million)

Table 54 Canadian Oil & Gas Vertical Market Size, By Method, 20142020 ($Million)

Table 55 Canadian Power Generation Vertical Market Size, By Method,20142020 ($Million)

Table 56 Canadian Aerospace Vertical Market Size, By Method,20142020 ($Million)

Table 57 Canadian Automotive Vertical Market Size, By Method,20142020 ($Million)

Table 58 Canadian Foundries Vertical Market Size, By Method,20142020 ($Million)

Table 59 Canadian Process Industries Vertical Market Size, By Method,20142020 ($Million)

Table 60 Canadian Others Vertical Market Size, By Method, 20142020 ($Million)

Table 61 Mexico Magnetic and Electromagnetic NDT Equipment Market Size,By Method, 20142020 ($Million)

Table 62 Mexico Electromagnetic NDT Equipment Market Size,By Method, 20142020 (Units)

Table 63 Mexico Electromagnetic NDT Equipment Market Size,By Vertical, 20142020 ($Million)

Table 64 Mexico Electromagnetic NDT Equipment Market Size,By Vertical, 20142020 (Units)

Table 65 Mexico EDDY Current NDT Equipment Market Size, By Vertical,20142020 ($Million)

Table 66 Mexico Remote Field Testing Equipment Market Size, By Vertical,20142020 ($Million)

Table 67 Mexico Magnetic Flux Leakage Testing Equipment Market Size,By Vertical, 20142020 ($Million)

Table 68 Mexico Alternating Current Field Measurement Equipment Market Size, By Vertical, 20142020 ($Million)

Table 69 Mexico Oil & Gas Vertical Market Size, By Method, 20142020 ($Million)

Table 70 Mexico Power Generation Vertical Market Size, By Method,20142020 ($Million)

Table 71 Mexico Aerospace Vertical Market Size, By Method, 20142020 ($Million)

Table 72 Mexico Automotive Vertical Market Size, By Method,20142020 ($Million)

Table 73 Mexico Foundries Vertical Market Size, By Method, 20142020 ($Million)

Table 74 Mexico Process Industries Vertical Market Size, By Method,20142020 ($Million)

Table 75 Mexico Others Vertical Market Size, By Method, 20142020 ($Million)

Table 76 New Product Launches, 20122014

Table 77 Agreements, Partnerships, Expansions, & Contracts, 20132014

Table 78 Others, 20132014

List of Figures (47 Figures)

Figure 1 North America Electromagnetic NDT Market Covered

Figure 2 Research Design

Figure 3 U.S. Light Vehicle Production, 2010-2014

Figure 4 North America Electromagnetic NDT Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 North American Magnetic and Electromagnetic NDT Equipment Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 Limitations of the Research Study

Figure 9 Roadmap for the NDT Technology

Figure 10 Automotive Vertical for the Magnetic and Electromagnetic NDT Equipment Market in North America is Expected to Grow at A CAGR of 11.58% Between 2015 and 2020

Figure 11 North America Magnetic and Electromagnetic NDT Equipment Market Share, By Key Player, 2014

Figure 12 Lucrative Opportunities in the North American Magnetic and Electromagnetic NDT Market

Figure 13 Top Three Segments in the North American Magnetic and Electromagnetic NDT Market

Figure 14 The U.S. Magnetic & Electromagnetic NDT Market is Expected to Grow at the Highest CAGR in the Coming Years

Figure 15 Automotive & Aerospace to Grow at A Faster Rate in the Coming Years

Figure 16 EDDY-Current Testing NDT Method is Projected to Have Largest Market Share in 2020

Figure 17 Shipments for EDDY Current Testing Are Expected to Increase InThe Coming Years

Figure 18 Road Map for the NDT Technology

Figure 19 North America Magnetic and Electromagnetic NDT Equipment Market Segmentation, By Method

Figure 20 North America Electromagnetic NDT Market Segmentation, By Vertical

Figure 21 North America Electromagnetic NDT Market Segmentation, By Country

Figure 22 North America Magnetic and Electromagnetic NDT Equipment Market : Drivers, Restraints Opportunities and Challenges

Figure 23 North America Electromagnetic NDT Market Value Chain Analysis (2014): Major Value is Added During the Research & Development and Manufacturing Phases

Figure 24 Shift Toward Service Industry is the Leading Trend in the North American Magnetic and Electromagnetic NDT Market

Figure 25 Porters Five Forces Analysis

Figure 26 Magnetic and Electromagnetic Testing Methods

Figure 27 EDDY-Current Testing is the Most Preferred NDT Testing Method in the North American Magnetic and Electromagnetic NDT Equipment Market

Figure 28 North American Magnetic and Electromagnetic NDT Market Segmentation By Vertical

Figure 29 North America Electromagnetic NDT Market Snapshot: 2014

Figure 30 U.S. Magnetic and Electromagnetic NDT Market Snapshot

Figure 31 The U.S. Power Generation Market Size, By Method Snapshot

Figure 32 U.S. Others Magnetic & Electromagnetic NDT Equipment Market Snapshot

Figure 33 EDDY Current Testing Held Largest Share in Canadian Magnetic and Electromagnetic NDT Equipment Market

Figure 34 Automotive is A Dominant Vertical in Mexican Magnetic and Electromagnetic NDT Equipment Market

Figure 35 Companies Adopted Product Launch and Product Innovation as Key Growth Strategies From 2012 to 2014

Figure 36 North America Electromagnetic NDT Market Share, By Key Player, 2014

Figure 37 Market Evaluation Framework: New Product Developments Have Fueled Growth and Innovation in the NDT Market

Figure 38 Battle for Market Share: New Product Launches Was the Key Strategy Adopted By Companies to Expand Their Businesses

Figure 39 Geographic Revenue Mix of Key Market Players

Figure 40 General Electric: Company Snapshot

Figure 41 General Electric Company: SWOT Analysis

Figure 42 Olympus Corporation: Company Snapshot

Figure 43 Olympus Corporation: SWOT Analysis

Figure 44 Dr. Foerster GmbH & Co. KG: SWOT Analysis

Figure 45 Magnetic Analysis Corporation: SWOT Analysis

Figure 46 Mistras Group, Inc.: Company Snapshot

Figure 47 Mistras Group, Inc.:SWOT Analysis

Growth opportunities and latent adjacency in North America Electromagnetic NDT Market

Is this report provides the ultrasonic and visual inspection testing by Mexico country.