Nonwoven Filtration Market by Filter type (Synthetic, Natural), Layer (Single layer, Multi-layer), Technology (Spunbond, Meltblown, Wetlaid, Airlaid, Thermobond, Needlepunch, spunlace), End-use Industry and Region - Global Forecast to 2027

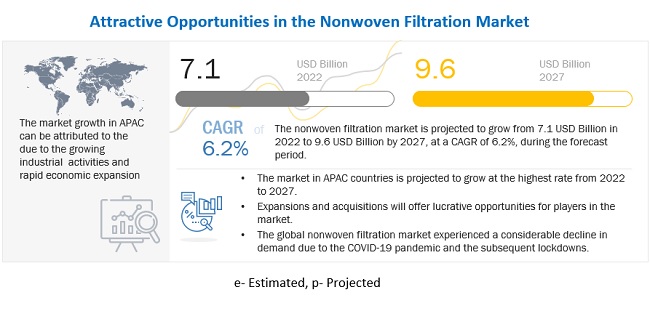

[280 Pages Report] The Nonwoven filtration market size is estimated to be USD 7.1 Billion in 2022 and is projected to reach USD 9.6 Billion by 2027, at a CAGR of 6.2%. Nonwoven filtration. Nonwoven filtration material are porous sheets or web structures formed by bonding of entangling fiber or filaments together through mechanically, thermally, or chemically processed. The increasing demand for nonwoven filtration material from end use industries such as the water treatment, healthcare and automotive industries is driving the growth of nonwoven filtration market, especially in developing economies such as India, Japan, and China. The adoption of the latest technologies and production processes in various industry segments are the key factor that are fueling the demand for nonwoven filters in the emerging economies. Easy availability of raw materials, technologies, and innovative product design helps to provide cost efficiency for the end products manufactured using nonwoven filtration.

The rising awareness regarding clean environment and The increasing demand for nonwoven filter from end-use industries (such as transportation, HVAC, water treatment, medical & healthcare, food & beverage, and others) are generating new opportunities for nonwoven filtration market. The nonwoven filtration materials are cost effective, durable and can penetrate a wide range of markets which led to increase in the demand of nonwoven filters.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 pandemic Impact

Due to COVID-19 pandemic, the suspension of manufacturing operation, disruption of supply chain, and declining demand from end use industries had significant impact on the demand of nonwoven filtration market. However, due to COVID-19 pandemic, the demand from pharmaceutical and healthcare industry increased, which, in turn, support for the growth of nonwoven filtration market. Also, with changing lifestyle, and awareness regarding the clean air and water quality index as increased the use of nonwoven filtration in several industrial and non-industrial sectors. However, the end use industries such food and beverages, automotive, and HVAC systems were severely affected by the pandemic.

Nonwoven Filtration Market Dynamics

Driver: The increasing demand for water treatment across the globe to drive the market.

Due to economic limitations related to water treatment and lack of proper regulations, the growth of water treatment industry is mostly witnessed in the emerging economies such as China, India, Brazil, and ASEAN countries. The governments in these countries are highly investing in wastewater treatment to improve quality of water. With growing concern and stringent government regulations regarding water quality in the developed and in developing regions, government and manufacturing industries are emphasizing on water treatment. Therefore, several countries are spending on the expansion of new water treatment plants and increasing capacity of present ones which, in turn, is will going to drive the nonwoven filtration market.

Out of total water resources globally only 2.5 % are freshwater resources, which makes water availability for the supply of industrial and domestic usage is a tough challenge. Industrial water consumption accounts for around 25% of the total water consumption. Water is used in several application of industrial processes such as in the oil & gas, mining, agriculture & irrigation, construction, food & beverage, life sciences, and pharma & biopharma industries. It is become important to efficiently recycle and reuse water with the use of water treatment because of the increasing gap between the demand and supply of water for the industrial use. The environmental regulations regarding wastewater discharge has played an vital role in driving the demand of the nonwoven filters for industrial water & wastewater treatment.

The rising industrial expansions is increasing the need for fresh and clean water for domestic, agricultural, and industrial purposes significantly in the developing economies. Due to this the demand for water treatment is expected to be higher in emerging economies such as China, Brazil, India, Indonesia, Malaysia, Argentina, Chile, and Vietnam, than that in the developed countries. The growth in the power, oil & gas, mining, and chemical industries, especially in developing economies drives the nonwoven filtration market during the forecast period.

Restraint: Availability of low-cost and inferior quality filtration products

The are various type of industrial filters available in the market. These filters are differentiated on the basis of product type, technology, and filter media. Also, to maintain air and water quality there are various standards set for manufacturing of filter products. Industrial filters are used across several end-use industries for the removal contamination, reducing maintenance costs, and preserving natural resources and increase operation efficiency of industrial processes. These factors contribute to the higher demand and prices of nonwoven filters that are used in industrial applications.

However, there are inferior-quality and low-cost maintenance alternatives and maintenance provided by gray market pose serious challenges to brand owners. Emerging economies are price sensible markets which plays an important role during purchasing of products, which provides opportunities for local players to offer alternative and provide similar products at a relatively lower price. This factor restricts global players to entry in the local market and presents a challenge for the Nonwoven filtration market

Opportunities: Profileration of advance technologies

Development of new technologies have led the textile industry to experience high growth in its several product segments, especially for nonwoven filtration materials. New technologies are expected to cut down the production costs, thereby making the supply & manufacturing of nonwoven textile commercially feasible. Enhancement in technologies, such as airlaid, wetlaid, spunbond process crabbing, calendaring, wrenching, creeping, pressing, spgrinding, singeing, washing, litting, printing, dyeing, and chemical finishing, have successfully made nonwoven textile fibers with functional properties required for nonwoven filtration. Also, filtration media suppliers are focusing on more value-added, high-performing solutions, filtration efficient, and cleaner energy solutions. Usage of nanofiber and high-performance material technologies have been used as alternatives to traditional membranes, and making new opportunities for nonwoven filtration materials manufacturers. The high-performance fibers are largely produced in technologically-advanced countries, such as the US, Japan, Canada, and some European countries, but it is also progressing in the developing countries, such as India, China, and South Korea.

Challenges: Frequent replacement of industrial filters

The frequent disposable and replacement of industrial filters is an increasing environmental concern as they have toxic substances. For instance, the filters in the pharmaceuticals industry contains few types of pathogens, which can survive for a long period on the air filters in humid environments. Hence, the proper disposal of that filters is an important factor as it can be harmful to the environment.

However, with the advent of ISO 14001, filter manufacturers are now have their environmental policies and are frequently striving to reduce industrial waste. Also, many companies specifically focus on the disposal of nonwoven filters used in several industrial applications.

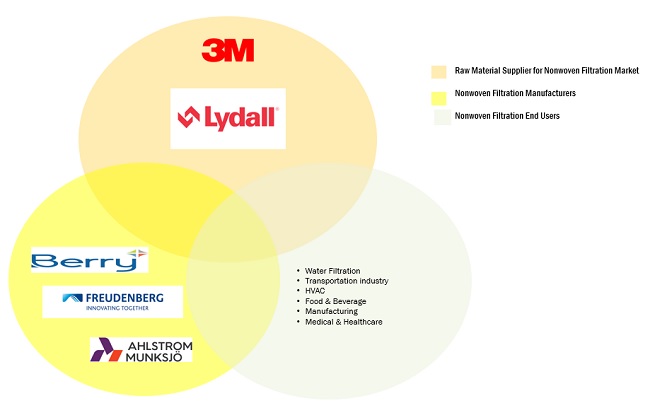

Ecosystem Diagram

By End Use Industry, Water filtration segment accounted for the largest share in 2021

Water Filtration has the largest share to be the overall nonwoven filtration market. The rising concern related to water treatment, and significant investment from the government and industrial sector for the expansion of existing water filtration plant capacities and development of new water treatment plants will supports the growth of nonwoven filtration market.

By Type, Synthetic segment accounted for the largest share in 2021

Synthetic segment is estimated to be the largest market for nonwoven filtration market. The growth synthetic nonwoven filters are driven by several factors such as high performance charactertics, availability of raw material, ease of formulation & application, and low cost. Synthetic filter medias employed both mechanical and electrostatically charged methods, which improves initial filtration effectiveness without altering airflow resistance.

By Layer, Multi-layer segment accounted for the largest share in 2021

The multi-layer nonwoven filter segment is estimated to be the largest market for nonwoven filtration. Multilayer nonwoven filter fabrics provides various physical and filtration characteristics which are improved by the structural anisotropy of the different fibers. In gas turbine applications, multi-layer nonwoven textiles filters were utilized, and they performed better than single layer filters.

By Technology, Spunbond segment accounted for the largest share in 2021

Spunbond has the largest share in the overall nonwoven filtration market, followed by the melt blow segment. The spunbond filtration technology used to provide better filtration efficiency and durability. These factors are driving the demand of spunbond technology in nonwoven filtration market.

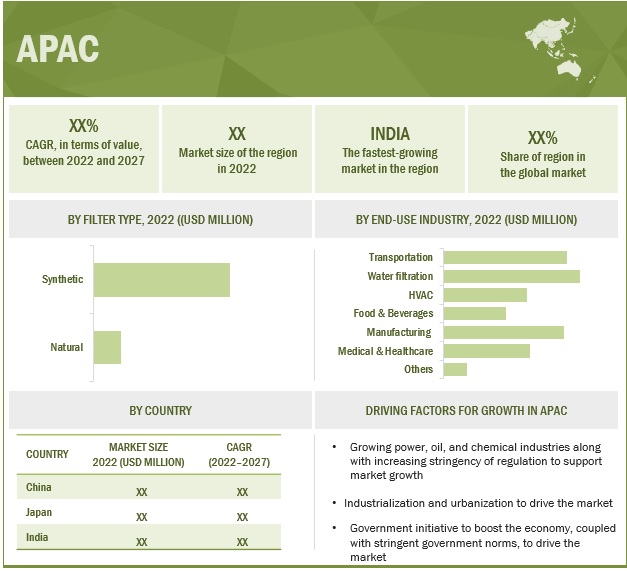

APAC account for the largest share of the nonwoven filtration market during the forecast period

APAC holds the largest share in the global nonwoven filtration market. The growing investment in end use industries such as manufacturing sector, and healthy growth of medical & healthcare and food & beverage industries will drive the demand of nonwoven filtration in APAC region. Increasing govement regulations, rising awareness, and industrial initiative for sustainable development will support the growth of the market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The nonwoven filtration market comprises major manufacturers such as Ahlstrom-Munksjo Holdings (Finland), Berry Global Group, Inc. (US), Freudenberg Group (Germany), Alkegen (US), and Sandler AG (US) are the key players operating in the nonwoven filtration market. The companies adopted several organic and inorganic strategies such as expansions, acquisitions, joint ventures, and new product developments to enhance their positions in the nonwoven filtration market.

Scope of the report:

|

Report Metric |

Details |

|

Years Considered |

20202027 |

|

Base year |

2021 |

|

Forecast period |

20222027 |

|

Unit considered |

Value (USD Billion) |

|

Segments |

Type, Layer, Technology, End Use Industry, and Region |

|

Regions |

North America, Europe, Asia-Pacific, Middle East & Africa and South America |

|

Companies |

The major players are as Ahlstrom-Munksjo Holdings (Finland), Berry Global Group, Inc. (US), Freudenberg Group (Germany), Alkegen (US), Sandler AG (US) and others are covered in the nonwoven filtration market. |

This research report categorizes the global nonwoven filtration market on the basis of Type, Material, Application, and Region.

Nonwoven Filtration market, By Type

- Natural

- Synthetic

Nonwoven Filtration market, By Layer

- Single

- Multi-layer

Nonwoven Filtration market, By Technology

- Spunbond

- Meltblow

- Wetlaid

- Airlaid

- Thermobond

- Needlepunch

- Spunlace

- Others

Nonwoven Filtration market, By End Use Industry

- Transportation

- Water Filtration

- Food & Beverage

- HVAC

- Manufacturing

- Medical & Healthcare

- Others

Nonwoven Filtration market, By Region

- North America

- Europe

- Asia Pacific (APAC)

- South America

- Middle East & Africa (MEA)

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In April 2022, Ahlstrom-Munksjφ has started additional capacity in both filtration and energy storage materials at its plant in Turin, Italy.

- January 2022, Ahlstrom-Munksjφ has signed the contracts for civil works and machinery to build a new glass fiber tissue line facility located in Madisonville, Kentucky, US.

- In December 2021, Freudenberg acquired RPS Products, this acquisition will help the company in expanding their business in North America while investing in a new business field.

- In October 2021, Ahlstrom-Munksjφ developed new testing capabilities, helping to accelerate its position in markets of Electric Vehicles and Industrial Filtration in their Pont-Evκque R&D center in France.

- In October 2021, Freudenberg Filtration Technologies (FFT) has opened a new manufacturing facility in Shunde (Foshan City), China.

- In October 2021, Unifrax a high-performance specialty materials and filtration technology provider has acquired Lydall, Inc. a leader in the production of specialty filtration materials and advance material solutions. They rebranded company as Alkegen.

- In May 2021, Ahlstrom-Munksjφ Launche FiltEV, its platform of high-performance filtration materials for electric vehicles.

- In February 2021, Ahlstrom-Munksjφ has launched TenderGuard product portfolio consists of soft, comfortable, and protective fabrics

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the Nonwoven Filtration Market?

The major drivers influencing the growth of nonwoven filtration market are increasing demand for water filtration activities across the globe.

What are the major challenges in the Nonwoven Filtration Market?

The major challenges in nonwoven filtration market is the frequent disposable and replacement of the industrial filters.

What are the restraining factors in Nonwoven Filtration Market?

The major restraining factor faced by nonwoven filtration market is the availability of low-cost and inferior quality filtration materials.

What is the key opportunity in Nonwoven Filtration Market?

The advancement of filtration technologies will provide several new opportunities to nonwoven filtration market.

What is the impact of COVID-19 pandemic on the Nonwoven Filtration Market?

There was a mixed impact on the Nonwoven Filtration Market across the globe due to COVID-19. Owing to COVID-19, demand from the Medical & Healthcare industry has increased whereas in transportation, Manufacturing plants (other than healthcare) and in others the demand for nonwoven filtration was declined. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

TABLE 1 EXAMPLES OF NONWOVEN APPLICATIONS IN FILTRATION

1.2.1 INCLUSIONS AND EXCLUSIONS

TABLE 2 INCLUSION AND EXCLUSION

1.3 MARKET SCOPE

FIGURE 1 NONWOVEN FILTRATION MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 2 NONWOVEN FILTRATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Critical secondary inputs

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Critical primary inputs

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP MARKET SIZE ESTIMATION: ASCERTAINING MARKET SIZE AND SHARE OF SEVERAL COUNTRIES TO ESTIMATE OVERALL DEMAND

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP ANALYSIS

2.2.2 SUPPLY-SIDE MARKET SIZE ESTIMATION: ASCERTAINING MARKET SIZE AND SHARE OF US IN GLOBAL MARKET

FIGURE 4 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 5 NONWOVEN FILTRATION MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 RESEARCH ASSUMPTIONS

2.4.2 RESEARCH LIMITATIONS

2.4.3 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 53)

TABLE 3 NONWOVEN FILTRATION MARKET SNAPSHOT

FIGURE 6 WATER FILTRATION SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2021

FIGURE 7 SYNTHETIC SEGMENT ACCOUNTED FOR LARGER SHARE IN 2021

FIGURE 8 MULTI-LAYER ACCOUNTED FOR LARGER SHARE IN 2021

FIGURE 9 SPUNBOND SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2021

FIGURE 10 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN NONWOVEN FILTRATION MARKET

FIGURE 11 INCREASING DEMAND FOR WATER FILTRATION OFFERS MARKET GROWTH OPPORTUNITIES

4.2 ASIA PACIFIC NONWOVEN FILTRATION MARKET, BY FILTER TYPE AND COUNTRY, 2021

FIGURE 12 CHINA ACCOUNTED FOR LARGEST SHARE IN ASIA PACIFIC

4.3 NONWOVEN FILTRATION MARKET, BY TECHNOLOGY

FIGURE 13 SPUNBOND SEGMENT TO DOMINATE OVERALL NONWOVEN FILTRATION MARKET

4.4 NONWOVEN FILTRATION MARKET, BY COUNTRY

FIGURE 14 INDIA TO BE FASTEST-GROWING MARKET FOR NONWOVEN FILTRATION, IN TERMS OF VOLUME

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN NONWOVEN FILTRATION MARKET

5.2.1 DRIVERS

5.2.1.1 Growing demand in HVAC systems, coupled with growing awareness pertaining to air intake quality, supports market growth

FIGURE 16 GLOBAL HVAC SYSTEMS MARKET SIZE IN VALUE (USD BILLION) AND Y-O-Y GROWTH (%) ANALYSIS, 20172026

5.2.1.2 Increasing global demand for water treatment to drive market

5.2.1.3 Increasing use in healthcare and manufacture of medical personal protective items to boost demand

5.2.1.4 Industrial development in major countries

TABLE 4 YEAR-OVER-YEAR GROWTH PROJECTIONS (%) OF EMERGING COUNTRIES, 20222023

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

FIGURE 17 CRUDE OIL PRICES, 2019JUNE 2022 (USD/BARREL)

5.2.2.2 Availability of low-cost and inferior-quality filtration products

5.2.3 OPPORTUNITIES

5.2.3.1 Proliferation of new technologies

5.2.4 CHALLENGES

5.2.4.1 Frequent replacement and disposal of industrial filters

5.3 PORTERS FIVE FORCES ANALYSIS

FIGURE 18 NONWOVEN FILTRATION MARKET: PORTERS FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 5 INDUSTRIAL FILTRATION MARKET: PORTERS FIVE FORCES ANALYSIS

5.4 KEY CONFERENCES & EVENTS IN 20222023

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS BUSINESSES

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN NONWOVEN FILTRATION MARKET

FIGURE 19 REVENUE SHIFT OF NONWOVEN FILTRATION PROVIDERS

5.6 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING RAW MATERIAL SUPPLIERS PHASE

5.7 CASE STUDY

5.7.1 SHIFT IN BUSINESS OF NONWOVEN FILTRATION MANUFACTURERS DURING COVID-19 PANDEMIC

TABLE 6 UPDATE ON OPERATIONS BY MANUFACTURERS IN RESPONSE TO COVID-19

5.8 MACROECONOMIC INDICATORS

5.8.1 GLOBAL GDP OUTLOOK

TABLE 7 WORLD GDP GROWTH PROJECTION (USD BILLION), 20192026

5.9 AVERAGE PRICING ANALYSIS

FIGURE 21 WEIGHTED AVERAGE PRICING ANALYSIS (USD/TON) OF NONWOVEN FILTRATION, BY REGION, 2021

TABLE 8 AVERAGE SELLING PRICES OF NONWOVEN FILTRATIONS, BY TECHNOLOGY (USD/TON)

5.10 FORECASTING FACTORS IMPACT ANALYSIS

5.11 KEY STAKEHOLDERS & BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS

TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

5.11.2 BUYING CRITERIA

FIGURE 23 KEY BUYING CRITERIA FOR DIFFERENT NONWOVEN FILTRATIONS

TABLE 10 KEY BUYING CRITERIA FOR DIFFERENT GRADES

5.12 ADJACENT AND RELATED MARKETS

5.12.1 INTRODUCTION

5.12.2 LIMITATIONS

5.12.3 NONWOVEN FABRICS MARKET

5.12.3.1 Market definition

5.12.3.2 Nonwoven fabrics market size, by application

TABLE 11 NONWOVEN FABRICS MARKET SIZE, BY APPLICATION, 20182025 (USD MILLION)

TABLE 12 NONWOVEN FABRICS MARKET SIZE, BY APPLICATION, 20182025 (KILOTON)

5.12.4 HVAC SYSTEM MARKET

5.12.4.1 Market definition

5.12.4.2 HVAC system market, by cooling equipment

TABLE 13 HVAC SYSTEM MARKET, BY COOLING EQUIPMENT, 20172020 (USD BILLION)

TABLE 14 HVAC SYSTEM MARKET, BY COOLING EQUIPMENT, 20212026 (USD BILLION)

5.12.4.3 HVAC system market, by heating equipment

TABLE 15 HVAC SYSTEM MARKET, BY HEATING EQUIPMENT, 20172020 (USD BILLION)

TABLE 16 HVAC SYSTEM MARKET, BY HEATING EQUIPMENT, 20212026 (USD BILLION)

5.12.4.4 HVAC system market, by ventilation equipment

TABLE 17 HVAC SYSTEM MARKET, BY VENTILATION EQUIPMENT, 20172020 (USD BILLION)

TABLE 18 HVAC SYSTEM MARKET, BY VENTILATION EQUIPMENT, 20212026 (USD BILLION)

5.12.4.5 HVAC system market, by implementation type

TABLE 19 HVAC SYSTEM MARKET, BY IMPLEMENTATION TYPE, 20172020 (USD BILLION)

TABLE 20 HVAC SYSTEM MARKET, BY IMPLEMENTATION TYPE, 20212026 (USD BILLION)

5.12.4.6 HVAC system market, by application

TABLE 21 HVAC SYSTEM MARKET, BY APPLICATION, 20172020 (USD BILLION)

TABLE 22 HVAC SYSTEM MARKET, BY APPLICATION, 20212026 (USD BILLION)

5.12.4.7 HVAC system market, by region

TABLE 23 HVAC SYSTEM MARKET, BY REGION, 20172020 (USD BILLION)

TABLE 24 HVAC SYSTEM MARKET, BY REGION, 20212026 (USD BILLION)

5.13 ECOSYSTEM MAP

FIGURE 24 ECOSYSTEM OF PANEL FILTERS MARKET

5.14 TRADE SCENARIO: KEY EXPORTING AND IMPORTING COUNTRIES

TABLE 25 INTENSITY OF TRADE, BY KEY COUNTRY

5.15 REGULATORY LANDSCAPE

TABLE 26 AIR FILTRATION STANDARDS AND NORMS

TABLE 27 REGULATIONS PERTAINING TO AIR & LIQUID FILTRATION THAT SUPPORT NONWOVEN FILTRATION MARKET

5.16 NONWOVEN FILTRATION PATENT ANALYSIS

5.16.1 INTRODUCTION

5.16.2 METHODOLOGY

5.16.3 DOCUMENT TYPE

FIGURE 25 PATENT STATUS TILL JULY-2022

FIGURE 26 PUBLICATION TRENDS - LAST 10 YEARS

5.16.4 INSIGHT

5.16.5 LEGAL STATUS OF THE PATENTS

FIGURE 27 LEGAL STATUS

FIGURE 28 JURISDICTION ANALYSIS

5.16.6 TOP COMPANIES/APPLICANTS

FIGURE 29 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NO. OF PATENTS

TABLE 28 LIST OF PATENTS BY 3M INNOVATIVE PROPERTIES CO.

TABLE 29 OTHER LIST OF PATENTS

TABLE 30 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6 NONWOVEN FILTRATION MARKET, BY FILTER TYPE (Page No. - 98)

6.1 INTRODUCTION

FIGURE 30 NONWOVEN FILTRATION MARKET, BY FILTER TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 31 NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 32 NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

6.2 SYNTHETIC

6.2.1 SYNTHETIC MATERIAL TO MAINTAIN DOMINANCE THROUGHOUT FORECAST PERIOD

TABLE 33 SYNTHETIC NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (USD MILLION)

TABLE 34 SYNTHETIC NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (KILOTON)

6.3 NATURAL

6.3.1 GROWING ENVIRONMENTAL CONCERN AND SUSTAINABLE DEVELOPMENT TO SUPPORT MARKET GROWTH

TABLE 35 NATURAL NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (USD MILLION)

TABLE 36 NATURAL NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (KILOTON)

7 NONWOVEN FILTRATION MARKET, BY LAYER (Page No. - 103)

7.1 INTRODUCTION

FIGURE 31 NONWOVEN FILTRATION MARKET, BY LAYER, 2022 VS. 2027 (USD MILLION)

TABLE 37 NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 38 NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

7.2 SINGLE LAYER

7.2.1 INCREASING USAGE IN AIR FILTER APPLICATIONS TO BOOST DEMAND

TABLE 39 SINGLE-LAYERED NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (USD MILLION)

TABLE 40 SINGLE-LAYERED NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (KILOTON)

7.3 MULTI-LAYER

7.3.1 STRONG DEMAND FROM INDUSTRIAL APPLICATIONS TO SUPPORT MARKET GROWTH

TABLE 41 MULTI-LAYERED NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (USD MILLION)

TABLE 42 MULTI-LAYERED NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (KILOTON)

8 NONWOVEN FILTRATION MARKET, BY TECHNOLOGY (Page No. - 108)

8.1 INTRODUCTION

FIGURE 32 SPUNLACE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

TABLE 43 NONWOVEN FILTRATION MARKET SIZE, BY TECHNOLOGY, 20202027 (USD MILLION)

TABLE 44 NONWOVEN FILTRATION MARKET SIZE, BY TECHNOLOGY, 20202027 (KILOTON)

8.2 SPUNBOND

8.2.1 SUPERIOR TENSILE QUALITIES TO DRIVE MARKET

TABLE 45 SPUNBOND: NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (USD MILLION)

TABLE 46 SPUNBOND: NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (KILOTON)

8.3 MELTBLOWN

8.3.1 FINE, HIGHLY EFFECTIVE FILTER MEDIA FOR HVAC, MEDICAL & HEALTHCARE, AND AUTOMOTIVE INDUSTRIES TO DRIVE MARKET

TABLE 47 MELTBLOWN: NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (USD MILLION)

TABLE 48 MELTBLOWN: NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (KILOTON)

8.4 WETLAID

8.4.1 HIGH LEVEL OF VERSATILITY IN BLENDING OF VARIOUS FIBER TYPES TO DRIVE MARKET

TABLE 49 WETLAID: NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (USD MILLION)

TABLE 50 WETLAID: NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (KILOTON)

8.5 AIRLAID

8.5.1 CREATION OF HOMOGENEOUS AIR-FIBER MIXTURE TO DRIVE MARKET

TABLE 51 AIRLAID: NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (USD MILLION)

TABLE 52 AIRLAID: NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (KILOTON)

8.6 THERMOBOND

8.6.1 USE IN AUTOMOTIVE INDUSTRY TO DRIVE MARKET

TABLE 53 THERMOBOND: NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (USD MILLION)

TABLE 54 THERMOBOND: NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (KILOTON)

8.7 NEEDLEPUNCH

8.7.1 DEMAND FROM BUILDING & CONSTRUCTION AND TRANSPORTATION INDUSTRIES TO DRIVE MARKET

TABLE 55 NEEDLEPUNCH: NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (USD MILLION)

TABLE 56 NEEDLEPUNCH: NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (KILOTON)

8.8 SPUNLACE

8.8.1 USE IN PERSONAL CARE & HYGIENE SECTOR TO DRIVE MARKET

TABLE 57 SPUNLACE: NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (USD MILLION)

TABLE 58 SPUNLACE: NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (KILOTON)

9 NONWOVEN FILTRATION MARKET, BY END-USE INDUSTRY (Page No. - 118)

9.1 INTRODUCTION

FIGURE 33 MEDICAL & HEALTHCARE TO BE FASTEST- GROWING END-USE INDUSTRY DURING FORECAST PERIOD

TABLE 59 NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 60 NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

9.2 TRANSPORTATION

9.2.1 INCREASING VEHICLE PRODUCTION TO PROPEL DEMAND FOR AIR AND OIL FILTERS

TABLE 61 NONWOVEN FILTRATION MARKET SIZE IN TRANSPORTATION, BY REGION, 20202027 (USD MILLION)

TABLE 62 NONWOVEN FILTRATION MARKET SIZE IN TRANSPORTATION, BY REGION, 20202027 (KILOTON)

9.3 WATER FILTRATION

9.3.1 INCREASING SIGNIFICANCE OF FILTRATION IN MUNICIPAL AND INDUSTRIAL TREATMENT PROCESSES TO DRIVE MARKET

TABLE 63 NONWOVEN FILTRATION MARKET SIZE IN WATER FILTRATION, BY REGION, 20202027 (USD MILLION)

TABLE 64 NONWOVEN FILTRATION MARKET SIZE IN WATER FILTRATION, BY REGION, 20202027 (KILOTON)

9.4 FOOD & BEVERAGE

9.4.1 STRONG EMPHASIS ON FOOD SAFETY WILL DRIVE MARKET GROWTH

TABLE 65 NONWOVEN FILTRATION MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 20202027 (USD MILLION)

TABLE 66 NONWOVEN FILTRATION MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 20202027 (KILOTON)

9.5 HVAC

9.5.1 INCREASING ENVIRONMENTAL NORMS PERTAINING TO IMPROVING AIR QUALITY TO AUGMENT MARKET GROWTH

TABLE 67 NONWOVEN FILTRATION MARKET SIZE IN HVAC, BY REGION, 20202027 (USD MILLION)

TABLE 68 NONWOVEN FILTRATION MARKET SIZE IN HVAC, BY REGION, 20202027 (KILOTON)

9.6 MANUFACTURING

9.6.1 STRINGENT ENVIRONMENTAL REGULATIONS REGARDING HUMAN HEALTH & ENVIRONMENT TO BOOST MARKET

FIGURE 34 GLOBAL CRUDE OIL PRODUCTION, 20182021 (MILLION BARRELS PER DAY)

TABLE 69 NONWOVEN FILTRATION MARKET SIZE IN MANUFACTURING, BY REGION, 20202027 (USD MILLION)

TABLE 70 NONWOVEN FILTRATION MARKET SIZE IN MANUFACTURING, BY REGION, 20202027 (KILOTON)

9.7 MEDICAL & HEALTHCARE

9.7.1 RISING HEALTHCARE SPENDING BY DEVELOPED COUNTRIES WILL DRIVE MARKET

TABLE 71 NONWOVEN FILTRATION MARKET SIZE IN MEDICAL & HEALTHCARE, BY REGION, 20202027 (USD MILLION)

TABLE 72 NONWOVEN FILTRATION MARKET SIZE IN MEDICAL & HEALTHCARE, BY REGION, 20202027 (KILOTON)

9.8 OTHERS

TABLE 73 NONWOVEN FILTRATION MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 20202027 (USD MILLION)

TABLE 74 NONWOVEN FILTRATION MARKET SIZE IN OTHER INDUSTRIES, BY REGION, 20202027 (KILOTON)

10 NONWOVEN FILTRATION MARKET, BY REGION (Page No. - 130)

10.1 INTRODUCTION

FIGURE 35 RAPIDLY GROWING MARKETS IN EMERGING ECONOMIES ACT AS NEW HOTSPOTS

TABLE 75 NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (USD MILLION)

TABLE 76 NONWOVEN FILTRATION MARKET SIZE, BY REGION, 20202027 (KILOTON)

10.2 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: NONWOVEN FILTRATION MARKET SNAPSHOT

TABLE 77 ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY COUNTRY, 20202027 (USD MILLION)

TABLE 78 ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY COUNTRY, 20202027 (KILOTON)

TABLE 79 ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 80 ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 81 ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 82 ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 83 ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY TECHNOLOGY, 20202027 (USD MILLION)

TABLE 84 ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY TECHNOLOGY, 20202027 (KILOTON)

TABLE 85 ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 86 ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.2.1 CHINA

10.2.1.1 Growth in transportation, water treatment, and manufacturing sectors to drive market

FIGURE 37 CHINA: AUTOMOTIVE PRODUCTION DATA, 20192021 (MILLION UNIT)

TABLE 87 CHINA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 88 CHINA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 89 CHINA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 90 CHINA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 91 CHINA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 92 CHINA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.2.2 INDIA

10.2.2.1 Rising investments in automotive and manufacturing sectors to drive market

FIGURE 38 INDIA: AUTOMOTIVE PRODUCTION DATA, 20192021 (MILLION UNIT)

TABLE 93 INDIA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 94 INDIA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 95 INDIA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 96 INDIA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 97 INDIA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 98 INDIA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.2.3 JAPAN

10.2.3.1 Rising demand in pharmaceutical, food & beverage, and water treatment to drive market

FIGURE 39 JAPAN: AUTOMOTIVE PRODUCTION DATA, 20192021 (MILLION UNIT)

TABLE 99 JAPAN: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 100 JAPAN: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 101 JAPAN: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 102 JAPAN: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 103 JAPAN: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 104 JAPAN: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.2.4 SOUTH KOREA

10.2.4.1 Increased demand for air filters in automotive industry to drive market

TABLE 105 SOUTH KOREA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 106 SOUTH KOREA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 107 SOUTH KOREA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 108 SOUTH KOREA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 109 SOUTH KOREA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 110 SOUTH KOREA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.2.5 AUSTRALIA & NEW ZEALAND

10.2.5.1 Increasing demand in manufacturing sector to drive market

TABLE 111 AUSTRALIA & NEW ZEALAND: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 112 AUSTRALIA & NEW ZEALAND: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 113 AUSTRALIA & NEW ZEALAND: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 114 AUSTRALIA & NEW ZEALAND: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 115 AUSTRALIA & NEW ZEALAND: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 116 AUSTRALIA & NEW ZEALAND: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.2.6 REST OF ASIA PACIFIC

TABLE 117 REST OF ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 118 REST OF ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 119 REST OF ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 120 REST OF ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 121 REST OF ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 122 REST OF ASIA PACIFIC: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.3 NORTH AMERICA

FIGURE 40 NORTH AMERICA: NONWOVEN FILTRATION MARKET SNAPSHOT

TABLE 123 NORTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY COUNTRY, 20202027 (USD MILLION)

TABLE 124 NORTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY COUNTRY, 20202027 (KILOTON)

TABLE 125 NORTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 126 NORTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 127 NORTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 128 NORTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 129 NORTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY TECHNOLOGY, 20202027 (USD MILLION)

TABLE 130 NORTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY TECHNOLOGY, 20202027 (KILOTON)

TABLE 131 NORTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 132 NORTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.3.1 US

10.3.1.1 Stringent government regulations and industrial growth support market

FIGURE 41 US AUTOMOTIVE PRODUCTION AND SALES, 20192021 (THOUSAND UNIT)

TABLE 133 US: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 134 US: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 135 US: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 136 US: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 137 US: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 138 US: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.3.2 CANADA

10.3.2.1 Increasing government spending on water treatment, along with manufacturing growth, to drive market

TABLE 139 CANADA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 140 CANADA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 141 CANADA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 142 CANADA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 143 CANADA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 144 CANADA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.3.3 MEXICO

10.3.3.1 Increasing demand from automotive industry to drive market

TABLE 145 MEXICO: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 146 MEXICO: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 147 MEXICO: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 148 MEXICO: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 149 MEXICO: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 150 MEXICO: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.4 EUROPE

TABLE 151 EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY COUNTRY, 20202027 (USD MILLION)

TABLE 152 EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY COUNTRY, 20202027 (KILOTON)

TABLE 153 EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 154 EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 155 EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 156 EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 157 EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY TECHNOLOGY, 20202027 (USD MILLION)

TABLE 158 EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY TECHNOLOGY, 20202027 (KILOTON)

TABLE 159 EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 160 EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.4.1 GERMANY

10.4.1.1 Steady growth in transportation, manufacturing, pharmaceuticals, and food & beverage industries propelling market

FIGURE 42 GERMANY: AUTOMOTIVE PRODUCTION & SALES, 20192021 (MILLION UNIT)

TABLE 161 GERMANY: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 162 GERMANY: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 163 GERMANY: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 164 GERMANY: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 165 GERMANY: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 166 GERMANY: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.4.2 FRANCE

10.4.2.1 Major investments in automotive industry to drive market

TABLE 167 FRANCE: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 168 FRANCE: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 169 FRANCE: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 170 FRANCE: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 171 FRANCE: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 172 FRANCE: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.4.3 UK

10.4.3.1 Growth in FDI to enhance recovery of automotive sector

TABLE 173 UK: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 174 UK: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 175 UK: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 176 UK: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 177 UK: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 178 UK: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.4.4 ITALY

10.4.4.1 Market growth supported by strict regulations in water treatment industry

TABLE 179 ITALY: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 180 ITALY: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 181 ITALY: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 182 ITALY: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 183 ITALY: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 184 ITALY: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.4.5 SPAIN

10.4.5.1 High demand for wastewater treatment to drive market

TABLE 185 SPAIN: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 186 SPAIN: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 187 SPAIN: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 188 SPAIN: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 189 SPAIN: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 190 SPAIN: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.4.6 RUSSIA

10.4.6.1 Strong demand for water-treatment products to drive market

TABLE 191 RUSSIA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 192 RUSSIA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 193 RUSSIA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 194 RUSSIA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 195 RUSSIA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 196 RUSSIA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.4.7 REST OF EUROPE

TABLE 197 REST OF EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 198 REST OF EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 199 REST OF EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 200 REST OF EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 201 REST OF EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 202 REST OF EUROPE: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.5 MIDDLE EAST & AFRICA

TABLE 203 MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY COUNTRY, 20202027 (USD MILLION)

TABLE 204 MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY COUNTRY, 20202027 (KILOTON)

TABLE 205 MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 206 MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 207 MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 208 MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 209 MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY TECHNOLOGY, 20202027 (USD MILLION)

TABLE 210 MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY TECHNOLOGY, 20202027 (KILOTON)

TABLE 211 MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 212 MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.5.1 UAE

10.5.1.1 Government investment in water treatment industry to drive market

TABLE 213 UAE: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 214 UAE: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 215 UAE: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 216 UAE: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 217 UAE: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 218 UAE: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.5.2 SAUDI ARABIA

10.5.2.1 Increasing manufacturing sector output and spending on water treatment to spur demand

TABLE 219 TOP CHEMICAL COMPANIES IN SAUDI ARABIA

TABLE 220 SAUDI ARABIA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 221 SAUDI ARABIA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 222 SAUDI ARABIA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 223 SAUDI ARABIA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 224 SAUDI ARABIA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 225 SAUDI ARABIA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.5.3 TURKEY

10.5.3.1 Increasing demand for automobile products to drive market

TABLE 226 TURKEY: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 227 TURKEY: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 228 TURKEY: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 229 TURKEY: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 230 TURKEY: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 231 TURKEY: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.5.4 SOUTH AFRICA

10.5.4.1 Industrial sector growth to boost market demand

TABLE 232 SOUTH AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 233 SOUTH AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 234 SOUTH AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 235 SOUTH AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 236 SOUTH AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 237 SOUTH AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 238 REST OF MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 239 REST OF MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 240 REST OF MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 241 REST OF MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 242 REST OF MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 243 REST OF MIDDLE EAST & AFRICA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.6 SOUTH AMERICA

TABLE 244 SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY COUNTRY, 20202027 (USD MILLION)

TABLE 245 SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY COUNTRY, 20202027 (KILOTON)

TABLE 246 SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 247 SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 248 SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 249 SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 250 SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY TECHNOLOGY, 20202027 (USD MILLION)

TABLE 251 SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY TECHNOLOGY, 20202027 (KILOTON)

TABLE 252 SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 253 SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.6.1 BRAZIL

10.6.1.1 Growing demand from automotive sector fueling market

FIGURE 43 BRAZILIAN FOOD SERVICE INDUSTRY MARKET SIZE, 2019 VS. 2020 (USD BILLION)

TABLE 254 BRAZIL: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 255 BRAZIL: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 256 BRAZIL: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 257 BRAZIL: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 258 BRAZIL: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 259 BRAZIL: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.6.2 ARGENTINA

10.6.2.1 Government investments to boost manufacturing sector to drive market

TABLE 260 ARGENTINA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 261 ARGENTINA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 262 ARGENTINA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 263 ARGENTINA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 264 ARGENTINA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 265 ARGENTINA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

10.6.3 REST OF SOUTH AMERICA

TABLE 266 REST OF SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (USD MILLION)

TABLE 267 REST OF SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY FILTER TYPE, 20202027 (KILOTON)

TABLE 268 REST OF SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (USD MILLION)

TABLE 269 REST OF SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY LAYER, 20202027 (KILOTON)

TABLE 270 REST OF SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (USD MILLION)

TABLE 271 REST OF SOUTH AMERICA: NONWOVEN FILTRATION MARKET SIZE, BY END-USE INDUSTRY, 20202027 (KILOTON)

11 COMPETITIVE LANDSCAPE (Page No. - 212)

11.1 INTRODUCTION

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 272 OVERVIEW OF STRATEGIES ADOPTED BY NONWOVEN FILTRATION MANUFACTURERS

11.3 MARKET SHARE ANALYSIS

FIGURE 44 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 273 NONWOVEN FILTRATION MARKET: DEGREE OF COMPETITION

11.4 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 274 STRATEGIC POSITIONING OF KEY PLAYERS

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 PERVASIVE PLAYERS

11.5.3 EMERGING LEADERS

11.5.4 PARTICIPANTS

FIGURE 45 NONWOVEN FILTRATION MARKET: COMPANY EVALUATION QUADRANT, 2021

11.6 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 STARTING BLOCKS

11.6.4 DYNAMIC COMPANIES

FIGURE 46 START-UPS/SMES EVALUATION QUADRANT FOR NONWOVEN FILTRATION MARKET

11.7 REVENUE ANALYSIS OF TOP PLAYERS

FIGURE 47 REVENUE ANALYSIS FOR KEY COMPANIES IN THE LAST 3 YEARS

11.8 COMPETITIVE BENCHMARKING

TABLE 275 NONWOVEN FILTRATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 276 NONWOVEN FILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

11.9 COMPETITIVE SITUATION AND TRENDS

11.9.1 DEALS

TABLE 277 NONWOVEN FILTRATION MARKET: DEALS (2019 TO 2022)

11.9.2 PRODUCT LAUNCHES

TABLE 278 NONWOVEN FILTRATION MARKET: PRODUCT LAUNCHES (2019 TO 2022)

11.9.3 OTHER DEVELOPMENTS

TABLE 279 NONWOVEN FILTRATION MARKET: EXPANSIONS (2019 TO 2022)

12 COMPANY PROFILES (Page No. - 227)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 MAJOR PLAYERS

12.1.1 FREUDENBERG GROUP

TABLE 280 FREUDENBERG GROUP: COMPANY OVERVIEW

FIGURE 48 FREUDENBERG GROUP: COMPANY SNAPSHOT

TABLE 281 FREUDENBERG GROUP: DEALS

TABLE 282 FREUDENBERG GROUP: PRODUCT LAUNCHES

TABLE 283 FREUDENBERG GROUP: OTHERS

12.1.2 BERRY GLOBAL GROUP, INC.

TABLE 284 BERRY GLOBAL GROUP, INC.: COMPANY OVERVIEW

FIGURE 49 BERRY GLOBAL GROUP, INC.: COMPANY SNAPSHOT

TABLE 285 BERRY GLOBAL GROUP INC.: DEALS

12.1.3 GLATFELTER COMPANY

TABLE 286 GLATFELTER COMPANY: COMPANY OVERVIEW

FIGURE 50 GLATFELTER COMPANY: COMPANY SNAPSHOT

TABLE 287 GLATFELTER COMPANY: DEALS

12.1.4 ALKEGEN

TABLE 288 ALKEGEN: COMPANY OVERVIEW

TABLE 289 ALKEGEN: DEALS

12.1.5 AHLSTROM-MUNKSJΦ HOLDINGS

TABLE 290 AHLSTROM-MUNKSJΦ HOLDINGS: COMPANY OVERVIEW

FIGURE 51 AHLSTROM-MUNKSJΦ HOLDINGS: COMPANY SNAPSHOT

TABLE 291 AHLSTROM MUNKSJΦ: OTHERS

TABLE 292 AHLSTROM MUNKSJΦ: PRODUCT LAUNCHES

12.1.6 JOHNS MANVILLE

TABLE 293 JOHNS MANVILLE: COMPANY OVERVIEW

TABLE 294 JOHNS MANVILLE: DEALS

TABLE 295 JOHNS MANVILLE: PRODUCT LAUNCHES

12.1.7 FITESA

TABLE 296 FITESA: COMPANY OVERVIEW

12.1.8 ASAHI KASEI

TABLE 297 ASAHI KASEI: COMPANY OVERVIEW

52 ASAHI KASEI: COMPANY SNAPSHOT

TABLE 298 ASAHI KASEI: DEALS

12.1.9 BWF GROUP

TABLE 299 BWF GROUP: COMPANY OVERVIEW

TABLE 300 BWF GROUP: DEALS

12.1.10 SANDLER AG

TABLE 301 SANDLER AG: COMPANY OVERVIEW

TABLE 302 SANDLER AG: DEALS

12.1.11 TWE GROUP

TABLE 303 TWE GROUP: COMPANY OVERVIEW

TABLE 304 TWE GROUP: DEALS

TABLE 305 TWE GROUP: PRODUCT LAUNCHES

12.1.12 FIBERWEB (INDIA) LTD.

TABLE 306 FIBERWEB (INDIA) LTD.: COMPANY OVERVIEW

FIGURE 53 FIBERWEB (INDIA) LTD.: COMPANY SNAPSHOT

12.1.13 PARK NON-WOVEN PVT. LTD.

TABLE 307 PARK NON-WOVEN PVT. LTD.: COMPANY OVERVIEW

12.2 OTHER PLAYERS

12.2.1 HOLLINGSWORTH & VOSE

12.2.2 CEREX ADVANCED FABRICS INC.

12.2.3 SWM INTERNATIONAL

12.2.4 BONDEX, INC.

12.2.5 IREMA

12.2.6 GREAT LAKES FILTERS

12.2.7 TEX-TECH INDUSTRIES INC.

12.2.8 FIBERTEX NONWOVENS A/S

12.2.9 HYDROWEB GMBH

12.2.10 AUTOTECH NONWOVENS PVT. LTD.

12.2.11 MOGUL TEKSTIL

12.2.12 SUPERIOR FELT & FILTRATION LLC

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 272)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the nonwoven filtration market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

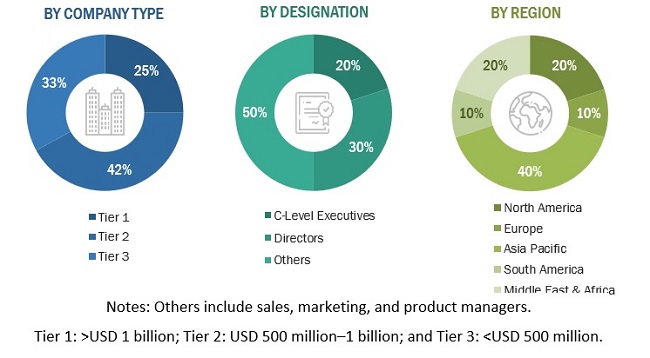

Primary Research

The nonwoven filtration market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the nonwoven filtration market. Primary sources from the supply side include associations and institutions involved in the nonwoven filtration industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global nonwoven filtration market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global nonwoven filtration market in terms of value

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on material, type, and application

- To forecast the market size, in terms of value, with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC nonwoven filtration market

- Further breakdown of Rest of Europe nonwoven filtration market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Nonwoven Filtration Market