Non Crimp Fabric Market by Fiber Type (Carbon Fiber, Glass Fiber, Other Fibers), Type (Unidirectional, Multiaxial), End-Use Industry (Aerospace & Defense, Automotive, Wind Energy, Marine, Other Industries), and Region - Forecast to 2029

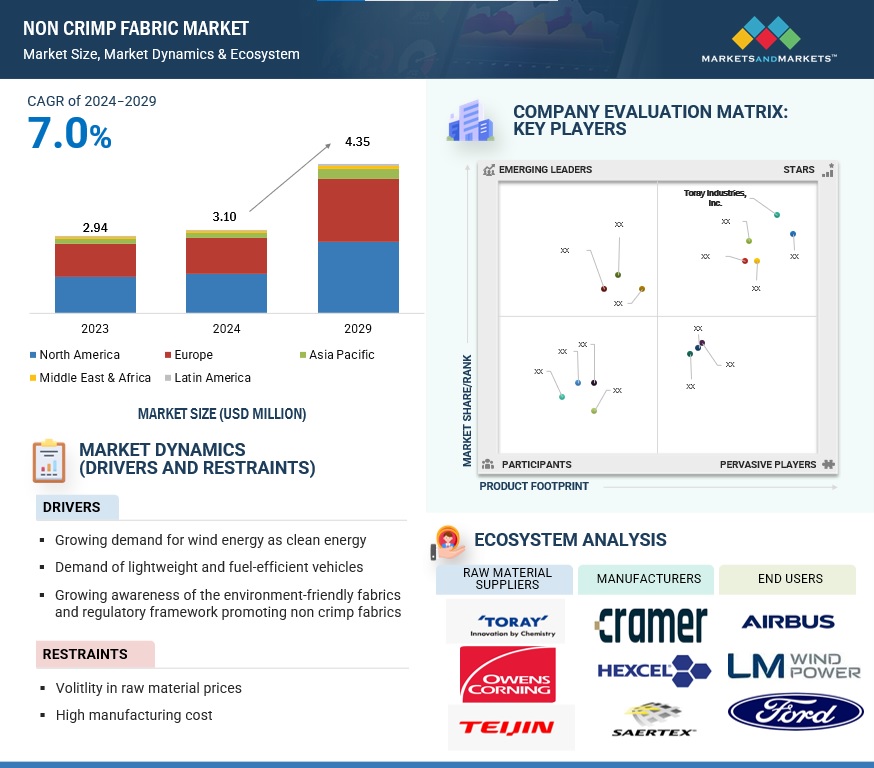

The non crimp fabric market is estimated to be around USD 3.10 billion in 2024 and is projected to reach USD 4.35 billion by 2029, at a CAGR of 7.0% from 2024 to 2029. Non-crimp fabrics (NCF) provide key advantages such as high strength, lightweight design, and exceptional durability, making them highly suitable for sectors like aerospace, automotive, and wind energy. Their multi-directional fiber alignment ensures superior mechanical properties, resulting in reduced weight and enhanced performance. However, challenges such as high production costs, intricate manufacturing processes, and limited raw material supply can hinder their widespread use. Furthermore, the need for specialized equipment and expertise in handling NCF poses additional barriers to growth, slowing its adoption in certain industries despite its performance advantages.

ATTRACTIVE OPPORTUNITIES IN THE NON CRIMP FABRIC MARKET

To know about the assumptions considered for the study, Request for Free Sample Report

Non Crimp Fabric Market Dynamics

Driver: Growing Demand for wind energy as clean energy

The growth of wind energy as a clean energy source is driving the demand for non-crimp fabrics, particularly in the production of large, high-performance wind turbine blades. As the global shift towards renewable energy intensifies, wind power is increasingly seen as a reliable solution for reducing carbon emissions. Non-crimp fabrics are essential in manufacturing larger, lighter, and more durable turbine blades due to their multi-directional fiber orientation, which provides superior strength and flexibility. According to Global Wind Energy Council, global wind power capacity could reach 2,000 gigawatts by 2030with countries like China, the U.S., and Germany leading investments in wind power infrastructure. The growing demand for efficient, long-lasting wind turbines is fueling the adoption of non-crimp fabrics, making them a key material in the wind energy industry's expansion.

Restraints: High material and manufacturing cost

The high material and manufacturing costs of non-crimp fabrics present a key challenge to their broader adoption. Producing NCF involves intricate processes, including precise fiber alignment and advanced composite handling, which demand specialized equipment and skilled labor. The cost of premium raw materials, such as high-strength fibers, further increases the overall price, making NCF more expensive compared to conventional fabrics. This higher cost can restrict its use, particularly in cost-sensitive sectors or regions, limiting the potential for growth in industries like automotive, sporting goods, and renewable energy, despite its performance benefits.

Opportunity: Growing adoption of non crimp fabric in protective clothing

The growth of non-crimp fabrics in protective clothing is fueled by their exceptional strength, durability, and lightweight characteristics. When combined with high-performance fibers like aramid, NCF becomes even more effective for use in military, firefighting, and industrial safety gear. Aramid fibers enhance the fabric’s resistance to heat, abrasion, and impact, making it ideal for environments requiring extreme protection. NCF’s multi-layered design improves overall mechanical performance, offering superior resistance to wear and tear. As safety standards evolve and the demand for advanced protective gear rises, NCF reinforced with aramid fibers is increasingly favored for its ability to meet stringent requirements while ensuring comfort and mobility, driving sector growth.

Challenges: Recycling Issues

Recycling non-crimp fabrics is challenging due to their complex structure and the use of composite materials like carbon, glass, or aramid fibers, which are bonded with resins or polymers. These resin systems are difficult to break down with conventional recycling methods. Additionally, the multi-layered construction of NCF complicates the separation of fibers from the matrix, making recycling inefficient. The absence of standardized recycling processes and infrastructure for composites further limits recycling efforts. As a result, much NCF waste ends up in landfills. Developing chemical recycling techniques and improving waste management are essential for enhancing NCF sustainability.

Non Crimp Fabric Market Ecosystem Analysis

The non crimp fabric market ecosystem is characterized by a dynamic interplay of key players, including manufacturers, suppliers, and regulatory bodies, all driven by the increasing demand for lightweight and environment friendly materials in various end-use industries. Major aerospace manufacturers like Boeing and Airbus lead the market, utilizing advanced composite materials to enhance structural integrity and reduce emissions, while suppliers such as Teijin and Toray provide essential raw materials like carbon fibers and resins. The market is further supported by technological advancements in manufacturing processes, such as automated fiber placement, which improve production efficiency and precision. Additionally, stringent environmental regulations and a growing emphasis on sustainability are pushing the industry towards greater adoption of composites across various applications. This ecosystem is marked by collaboration between companies and research institutions to innovate and meet the evolving needs of the end-use industries, ensuring robust growth in the coming years.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

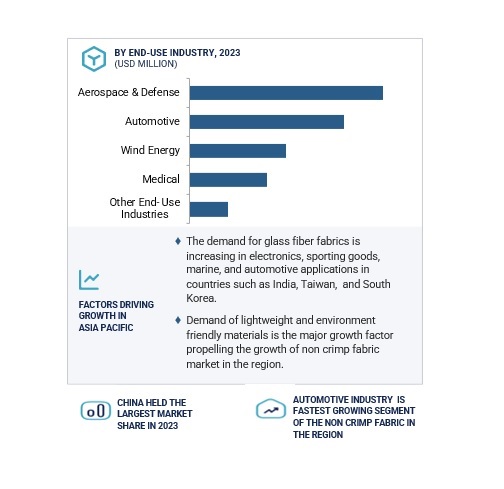

Based on the end use industry, aerospace & defense industry accounted for the largest market share in the non crimp fabric market, in 2023.

Non-crimp fabrics are driving significant growth in the aerospace industry due to their exceptional strength, lightweight properties, and superior durability. These fabrics are ideal for manufacturing composite components like aircraft wings, fuselage parts, and rocket structures, where reducing weight while maintaining performance is crucial. The use of NCF enhances fuel efficiency and overall structural integrity, making it a preferred choice for next-generation aircraft, as seen with companies like Boeing and Airbus. Additionally, NCF’s ability to improve durability without adding weight makes it vital for defense applications, including military vehicles and unmanned aerial systems (UAS), boosting safety and performance.

Based on the type, multiaxial segment is expected to register highest growth rate during the forecast period, in the non crimp fabric market.

Multiaxial non-crimp fabrics are gaining traction due to their exceptional properties, including superior strength, durability, and flexibility. The multi-directional fiber orientation of these fabrics provides enhanced mechanical performance, making them ideal for demanding applications in industries like automotive, aerospace, and wind energy. In the automotive sector, multiaxial NCF helps reduce vehicle weight while maintaining structural integrity. In aerospace, companies like Airbus leverage these fabrics for advanced composite structures that require high strength-to-weight ratios. Moreover, the growing wind energy sector is driving the adoption of multiaxial NCF for the production of larger, more efficient turbine blades that enhance energy generation capabilities.

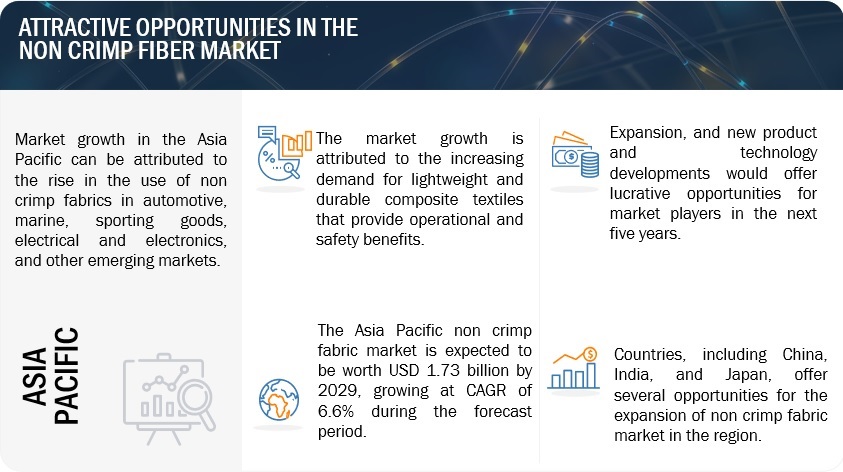

Asia Pacific region holds the largest share of the non crimp fabric market

The growth opportunities for non-crimp fabrics (NCF) in the Asia Pacific region are substantial, driven by the increasing demand for lightweight, durable, and high-performance materials across industries such as automotive, aerospace, and wind energy. The region's robust manufacturing infrastructure, coupled with the push for sustainable and efficient solutions, has fostered significant advancements. For instance, countries like China and India are expanding their production capabilities, utilizing NCF for both electric vehicles (EVs) and renewable energy sectors, where composite materials are critical for enhancing performance while reducing weight. In Japan, advancements in high-performance NCF applications for aerospace and automotive industries are particularly prominent, with companies like Toray Industries leading innovation in composite materials. Furthermore, the growing demand for wind turbine blades in countries like South Korea and Taiwan has led to an increased adoption of non-crimp fabrics for producing larger, more efficient turbines. These trends suggest a promising future for NCF in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Toray Industries, Inc. (Japan) Teijin Ltd. (Japan) SGL Carbon (Germany) Hexcel Coraporation (US) SAERTEX GmbH & Co. KG (Germany) Cramer Group (US) V2 Composites, Inc. (US) Vitrulan Holding GmbH (UK) Kümpers Composites (Germany) Chomarat (France) Tex Tech Industries (US) Isomatex (Belgium) Cathay Composites (Australia) R&G Faserverbundwerkstoffe GmbH (Germany) Selcom Multiaxial Fabrics (Italy)

Non Crimp Fabric Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2022-2029 |

|

Base Year Considered |

2023 |

|

Forecast period |

2024–2029 |

|

Units considered |

Value (USD Million) |

|

Segments Covered |

Fabric Type, Type, End-Use Industry, and Region |

|

Regions Covered |

North America, Europe, Asia Pacific, Middle East & Africa and Latin America |

Recent Developments in Non Crimp Fabric Market

- In April 2022, SAERTEX and Terre de Lin have formed a partnership to develop non-crimp fabrics using flax fibers for the marine, sports, and leisure sectors. This collaboration combines SAERTEX's expertise in reinforcement materials with the extensive production capacity of Terre de Lin, one of the largest global suppliers of sustainable flax fibers. The partnership aims to leverage both companies' strengths to create eco-friendly, high-performance materials tailored for these growing industries.

- In July 2020, Teijin's Tenax Dry Reinforcements (DR) carbon fiber materials have been approved for use in the Airbus A320neo wing spoilers, utilizing a Resin Transfer Molding (RTM) process developed by Spirit AeroSystems. This highly automated RTM solution incorporates Tenax Dry Reinforcements Non-Crimp Fabrics (DRNF) and Tenax Braided Fibers (DRBF) to create both skins and stiffeners, while preserving existing product interfaces. This innovation enables the direct replacement of all final spoiler components, enhancing production efficiency and performance.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQ):

What are the opportunities in the non crimp fabric market?

Growing adoption of electric vehicles, increasing demand for high-strength and lightweight materials in the automotive, aerospace, and sporting goods industries, the demand for wind turbines as the world shifts to renewable energy, and technological advancements are propelling the growth of the non crimp fabric market during the forecast period.

Define the non crimp fabric market.

Non-crimp fabrics (NCF) are made up of unidirectional layers sewn together, with each layer arranged in different orientations to provide strength and stiffness in multiple directions. These fabrics consist of several fiber layers knitted together, forming a multiaxial structure that ensures superior yarn alignment and minimizes layer-to-layer undulation. This results in parts and products with enhanced mechanical properties and a smooth, uniform surface. NCFs offer advantages such as high strength, low production costs, and ease of handling, as the stitching keeps the material intact. The multiaxial design also optimizes weight distribution, providing strength and stiffness tailored to the specific application.

Which region is expected to have the largest market share in the non crimp fabric market?

Asia Pacific’s non crimp fabric market has been experiencing growth and significant industry demand. Asia Pacific is home to several prominent automotive and sporting goods manufacturing companies, and new wind energy projects, all contributing to the increasing adoption of non crimp fabric products.

What are the major market players covered in the report?

Some of the key players in the non crimp fabric market are Toray Industries, Inc. (Japan), Teijin Ltd. (Japan), SGL Carbon (Germany), Hexcel Corporation (US), SAERTEX GmbH & Co. KG (Germany), R&G Faserverbundwerkstoffe GmbH (Germany), Cramer Group (US), V2 Composites, Inc. (US), Vitrulan Holding GmbH (UK), Kümpers Composites (Germany), Chomarat (France), Tex Tech Industries (US), Isomatex (Belgium), Cathay Composites (Australia), and Selcom Multiaxial Fabrics (Italy). Partnerships and deals were the key strategies adopted by these companies to strengthen their position in the non crimp fabric market.

How big is the global non crimp fabric market today?

The non crimp fabric market is estimated to be around USD 3.10 billion in 2024 and is projected to reach USD 4.35 billion by 2029, at a CAGR of 7.0% from 2024 to 2029.

Summary

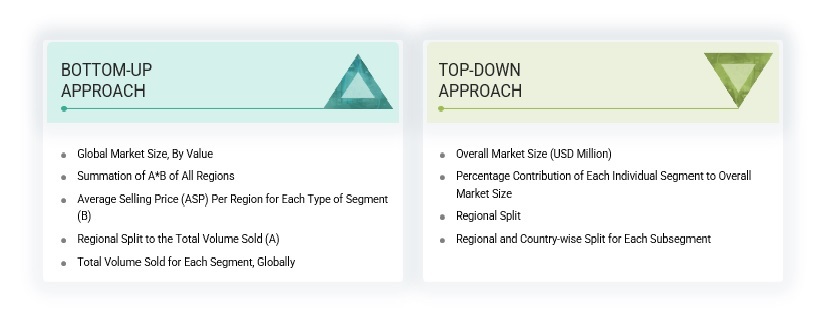

The study involved major activities in estimating the current market size for the non crimp fabric market. Exhaustive secondary research was done to collect information on the non crimp fabric industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the non crimp fabric market.

Secondary Research

The market for the companies offering non crimp fabric is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of non crimp fabric vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

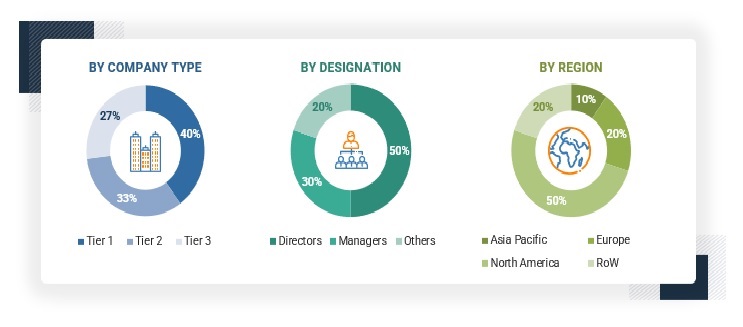

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the non crimp fabric market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of non crimp fabric offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Non Crimp Fabric Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the non crimp fabric market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Global Non Crimp Fabric Market Size: Bottom-Up Approach and Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Non-Crimp Fabrics (NCFs) are composed of unidirectional plies held together by stitching yarns, which are arranged in multiple orientations relative to the direction of fabric production. This unique structure creates a synergetic effect, combining exceptional material properties with excellent drape performance, making NCFs highly suitable for molding complex, three-dimensional composite components. The ability to effectively drape NCFs ensures optimal fiber alignment and material distribution, resulting in improved mechanical performance and material efficiency.

Key Stakeholder

- Fiber manufacturers and distributors

- Aerospace component manufacturers

- Automotive parts manufacturers

- Sporting goods manufacturers

- Composite and Fabric manufacturers and distributors

- Resin manufacturers

- Composite intermediate product producers

- Research and consulting firms

- R&D institutions

- Associations and government institutions

Report Objectives:

- To define, describe, and forecast the non crimp fabric market based on - fabric type, type, end-use industry, and region.

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze opportunities for stakeholders by identifying the high-growth segments of the market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players and comprehensively analyze their market sizes and core competencies

- To track and analyze competitive developments such as product enhancements and new product launches, acquisitions, and partnerships & collaborations in the market globally

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Growth opportunities and latent adjacency in Non Crimp Fabric Market