NLP in Defense Market - Global Forecast to 2029

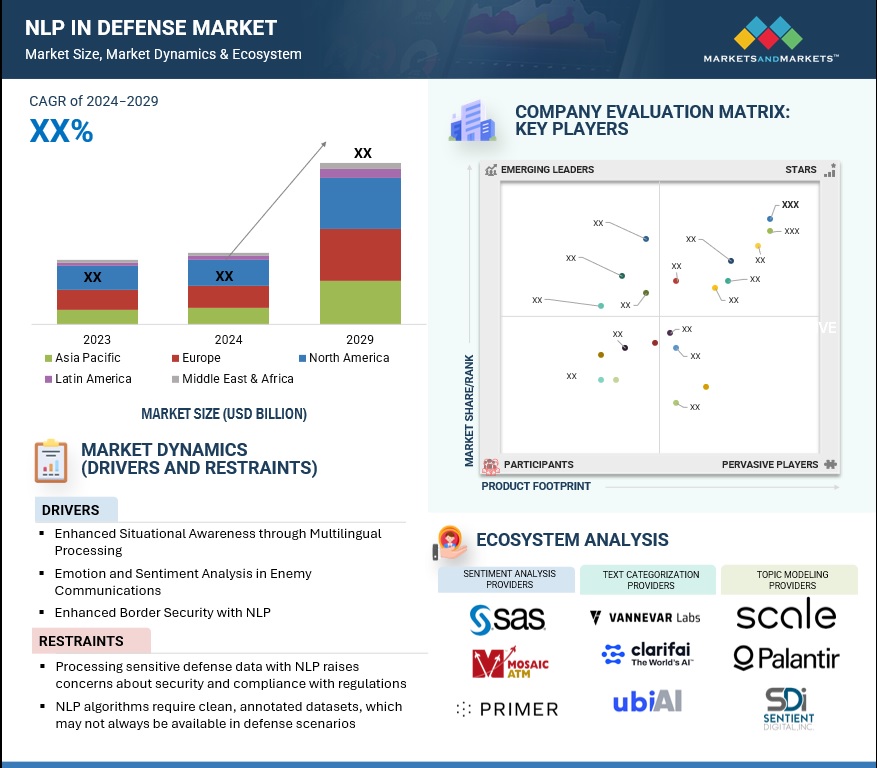

The NLP in defense market is expected to increase from USD XX billion in 2024 to USD XX billion in 2029, at a CAGR of XX% during the forecast period. Natural language processing (NLP) assists defense organizations in assessing sentiment within adversarial communications, enabling them to anticipate hostile motives, organize psychological operations, and enhance counter-strategies efficiently. Virtual assistants and chatbots powered by NLP recreate real-world combat situations, improving soldiers’ training and equipping them for different battlefield environments. The NLP-based defense tools are facilitated by the immediate translation and analysis of multilingual information from captured communications, intelligence resources, and local communities, which enhances situational understanding during global operations.

Significant trends, such as the increasing demand for sentiment evaluation and behavioral forecasting, assist agencies in taking measures against threats and accomplishing immersive training experiences, allowing staff to rehearse decision-making in extremely realistic combat situations. These advancements are revolutionizing defense tactics and activities, enhancing their intelligence and flexibility in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Generative AI on NLP in defense Market

Generative AI is transforming NLP application in defense sector by facilitating the development of exceptionally flexible language models capable of instantly analyzing and generating large quantities of intricate data. It improves intelligence collection by producing comprehensive insights from unstructured text, including intercepted messages or publicly available information. Generative AI further enables the swift creation of authentic training simulations, permitting soldiers to interact with dynamic, AI-created situations replicating actual threats. Moreover, it facilitates the automation of generating multilingual reports and strategic summaries, enhancing decision-making processes. Generative AI-driven NLP systems enhance coordination in critical situations by enabling more intuitive human-machine interfaces, providing an advantage in defensive and offensive strategies. This groundbreaking technology changes how defense agencies analyze and respond to vital information.

NLP in Defense Market Dynamics

Driver: Customizable NLP models in Military Decisions Making

The rising demand for high-performance tires is expected to drive the demand for advanced tire modeling software. Many luxury, sports, and electric vehicles use performance tires that require engineering precision in durability, grip, efficiency, and environmental standards.

Customizable NLP models have driven the development of new NLP solutions with enhanced characteristics tailored to enable multiple operations in the defense industry. These models help defense agencies to cope with data related to regional languages, military terminology, and coded text for intelligence and decision-making. For instance, the U.S. Department of Defense (DoD) invested significantly in Artificial Intelligence and NLP initiatives, concentrating on adaptive systems for essential mission tasks. Adjustable models enhance battlefield communication by providing immediate insights in fast-paced scenarios. Moreover, these models facilitate the automation of multilingual intelligence reports and strategic planning, improving response times and increasing operational accuracy. Their ability to adjust to distinct defense situations has positioned them as a key force, promoting innovation and the use of NLP technologies in defense worldwide.

Restraint: Processing sensitive defense data with NLP raises concerns about security and compliance

TOne main restraint of using NLP to process defense data is its slow adoption due to security and compliance issues in the defense market. NLP systems need to have highly elevated levels of access to the classified data, which brings explicit risks of unauthorized access, other people getting into databases without permission, and spying. For instance, the U.S. Government Accountability Office prepared a report in February 2022 demonstrating how AI, including NLP, has weak points that threaten national security. However, strict data protection laws such as the GDPR make applying NLP in cross-border activities even more challenging. These concerns restrict the extent of cloud-based NLP solutions, require costly on-site systems, and slow the adoption of NLP solutions.

Opportunity: NLP enables autonomous vehicles and drones to process spoken or textual commands

The possibility of self-driving vehicles and drones' ability to understand voice or text-based instructions is one opportunity for technology vendors in the defense industry. Nonlinear analysis of commands is necessary when using autonomous systems in modern warfare to avoid mistranslation issues. A study by the U.S. Department of Defense suggests increasing procurement of automated systems that demand NLP, a recent trend that is progressively exhibited. This opportunity creates pathways for providers to develop flexible, multilingual NLP solutions for various combat situations. Thanks to progress in real-time processing and contextual comprehension, technology providers can significantly improve autonomy, efficiency, and decision-making in defense operations.

Challenge: Existing biases in training data can lead to skewed analyses

The challenge with bias in training data has impeded advancement in NLP within the defense market due to a lack of verifiable analysis and insights. The bias in datasets, whether cultural, linguistic, or demographic differences, can result in distortion of critical intelligence, which is essential in the decisions made. For instance, in a 2023 report by the National Institute of Standards and Technology, it was established that AI systems trained with bias had serious challenges and mistakenly misclassified languages from the nonwestern world, which was not right, which was bad for international Military operations. Operational failure or failure to detect threats can come from poor sentiment analysis or threat detection, resulting from poorly designed training data. To mitigate this bias, a lot of time will be spent on data curation and retraining, which translates to increased costs and delays in adoption.

NLP in Defense Market Ecosystem

The NLP in defense market ecosystem comprises a diverse range of stakeholders. Key players include sentiment analysis providers, text categorization providers, information extraction providers, topic modeling providers, and technology partners. This collaborative ecosystem is critical in enhancing the capabilities of defense operations through advanced NLP solutions.

To know about the assumptions considered for the study, download the pdf brochure

By service type, the training and consulting segment to grow at highest CAGR during the forecast period.

The NLP in defense market is expected to see the training and consulting segment grow at the highest CAGR during forecast period. Initially, the growing intricacy of defense operations requires advanced NLP training to improve personnel capabilities in data analysis and decision-making. As companies embrace AI-based technologies, customized training initiatives are crucial for successfully deploying and using NLP solutions. Additionally, the need for tailored consulting services is increasing as defense organizations aim to enhance their operational effectiveness and incorporate NLP into their current systems. The increasing focus on data-driven insights for strategic planning heightens the demand for tailored training and consulting, guaranteeing that defense staff are prepared to utilize NLP capabilities effectively.

BBy end user, strategic planning and policy makers segment will register the highest CAGR during the forecast period.

The segment for strategic planning and policymakers in the NLP in defense market is anticipated to have the highest CAGR driven by various important factors. Government programs highlighting data-informed decision-making are becoming more common. For instance, Department of Defense (DoD) emphasizes the significance of utilizing AI and NLP technologies to improve operational efficiency and strategic understanding. Also, the National Defense Strategy of 2022 pointed out the importance of advanced analytics in policy-making and resource distribution. With defense institutions striving to have more sophisticated NLP applications that can sift through large volumes of data problems, there will be substantial growth in the demand for decision-support solutions assisting strategic planning. This endorsement by the government makes it clear that the NLP technologies will be crucial in formulating future defense policies and strategies.

By solution type, the information extraction segment will hold largest market share during the forecast period.

The information extraction segment within the NLP in defense market is expected to gain the maximum market share during the forecast period owing to a number of promising factors. Reports from governments specify that there is a dire need to improve data processing capabilities for security purposes. For instance, the U.S. Department of Defense has made it a primary goal to adopt new information extraction technologies targeting the large volumes of unstructured data as raised in their AI Strategy, which seeks to assist in making better decisions and improve efficiency in defense scenarios. Moreover, the onset of various data-producing circumstances, such as intelligence reports, social media, and surveillance, necessitates sound tools for information extraction. These tools assist defense agencies in changing unstructured data into useful information, thereby improving situational understanding and strategic planning. The combination of government policies and increased need for efficient data analysis affirms the response of the information extraction segment to the demand of the NLP defense market.

By region, North America region to hold largest market share in NLP in defense market during the forecast period.

North American region is expected to dominate the global NLP in defense market due to the high technology integration and significant defense budgets. Specific trends include adaptation of Al and NLP into autonomous entities, such as drones and monitoring systems, shift towards using real-time translation tools for intelligence-gathering purposes. Advancements in cybersecurity are additionally using NLP to identify and combat complex threats. Furthermore, the emergence of cloud-based NLP services also improves the adoption and deployment of defense organizations, considering data processed operations. Further market expansion is attributable to the growth of AI-linked applications during conflict such as automated threat detection and improved situational awareness. With approximately 300 million+ social media users in the US, there is a growing need for sentiment analysis and real-time data processing, thus explaining North America’s dominance of the NLP market for defense applications.

Key Market Players

- IBM

- HENSOLDT

- Scale AI

- Vennevar Labs

- Systematic

- Primer.AI

- Eldr.AI

- Plantir

- Mosaic ATM

- BOOZ ALLEN

Recent Developments:

- In 12-2024, Anduril and Palantir joined forces to create a new partnership to combine their technologies for national security. This collaboration will use Anduril’s Lattice software and Palantir’s AI Platform to solve readiness and data processing scale issues.

- In 11-2024, Scale AI introduced Defense Llama, a unique large language model designed specifically for U.S. military and national security purposes. Developed from Meta's Llama 3, this model seeks to improve functionality in combat planning and intelligence activities. Presently under evaluation by military personnel in secure settings, Defense Llama aims to deliver pertinent and practical answers while following ethical standards, representing a notable advancement in incorporating generative AI into defense mechanisms.

- In 11-2024, The Australian Army effectively utilized Systematic's SitaWare software in its Captains Course, improving training and operational efficiency. This integration enables officers to leverage advanced situational awareness tools, enhancing decision-making and teamwork in complicated situations. The implementation represents a dedication to strengthening military training via technology, guaranteeing that upcoming leaders possess the essential abilities for today's challenges.

- In 11-2024, Avathon has teamed up with the McChrystal Group to improve access to its Industrial AI platform in the aerospace and defense industries. It intends to provide Warfighters and national security specialists with the AI tools that help optimize their readiness, manage assets, and supply chains. The partnership aims to use AI to predict dependencies for other resources, especially during the conflict hence improving the military strength and flexibility.

- In October 2024, Primer AI released the latest version of its AI platform, containing a feature, near-zero hallucination. This improvement is supposed to enhance the use and reliability of AI results in its conversation and responses especially in defending systems. Reducing wrong output means significant improvement in the quality and reliability of the information that users receive, and, therefore, support of the decision-making process in critical defense contexts.

Frequently Asked Questions (FAQ):

What are the opportunities for the NLP in defense market?

Define the NLP in defense market.

Which are the major market players covered in the report?

How big is the global NLP in defense market today?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in NLP in Defense Market