Next-Generation Drug Conjugates (NDCs) Market - Global Forecast 2030

Next-generation drug conjugates (NDCs) are are an advanced class of targeted therapeutics designed to improve the specificity, efficacy, and safety of traditional drug conjugates. These drugs mainly use use non-antibody based targeting ligands delivering payloads to specific cells. The NDCs market is mainly driven by factors such as need for more effective, targeted, and safer treatments in oncology and other therapeutic areas, growing innovation in targeting technology, payloads, linkers, and drug delivery systems, along with strong regulatory and clinical support. Their ability to overcome challenges like drug resistance and systemic toxicity is one of the key factors attracting sponsors to focus on these drugs.

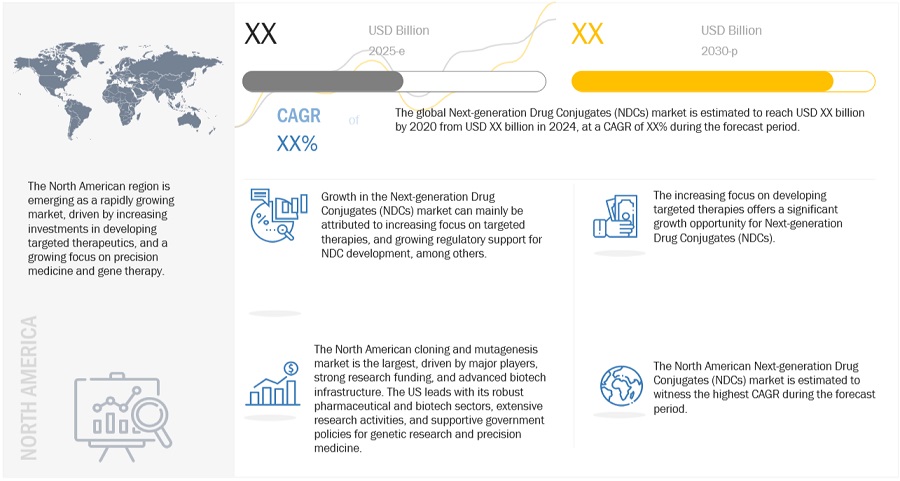

ATTRACTIVE OPPORTUNITIES IN THE NEXT-GENERATION DRUG CONJUGATES (NDCs) MARKET

Global Next-generation Drug Conjugates (NDCs) Market Dynamics

Driver: Growing advancements in targeted therapy development

Next-generation drug conjugates use more refined targeting strategies (e.g., monoclonal antibodies, peptides, small molecules) that increase specificity to tumor cells or disease sites. This improves therapeutic outcomes while minimizing off-target effects and systemic toxicity. Moreover, the rise of precision medicine, which tailors treatments based on individual genetic profiles, is driving the demand for highly targeted therapies like NDCs to provide better outcomes for patients with specific molecular characteristics.

Restraint: Development and manufacturing complexities

NDCs, especially those involving novel linkers, payloads, and targeting moieties, require sophisticated and often costly manufacturing processes. Producing high-quality drug conjugates with precise drug-to-antibody ratios (DAR) can be difficult and expensive, increasing their cost. The complexity of producing NDCs is a multifaceted challenge that involves advanced chemistry, biology, engineering, and manufacturing techniques. From designing stable linkers to ensuring consistent quality at scale, each step in the production process is critical to the success of the final product. The R&D required to design and optimize these conjugates is resource-intensive. As a result, the development of new NDCs may involve significant investment and longer timelines, making them less financially feasible for smaller biotech companies.

Recent Developments:

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- In January 2024, MediLink Therapeutics announced collaboration with Roche for the development of a next-generation antibody-drug conjugate candidate YL211, targeting c-Mesenchymal epithelial transition factor (c-Met) against solid tumors.

- In July 2023, ImmunoGen partnered with ImmunoBiochem for Next-Gen Antibody-Drug Conjugates. The partnership is a multi-target license and option agreement to research novel, first-in-class ADCs. The collaboration will combine ImmunoGen's proprietary linker-payload technology with ImmunoBiochem's antibodies directed against specific targets.

Next-Generation Drug Conjugates (NDCS) Market

Growth opportunities and latent adjacency in Next-Generation Drug Conjugates (NDCs) Market