Neurosurgery Devices Market by Product (Neuromodulation(Spinal Cord Stimulation, Deep Brain Stimulation) Neuroendoscopy), Application (Chronic Pain, Depression, Parkinsons, Ischemia, Transnasal Neuroendoscopy), Region - Global Forecast to 2024

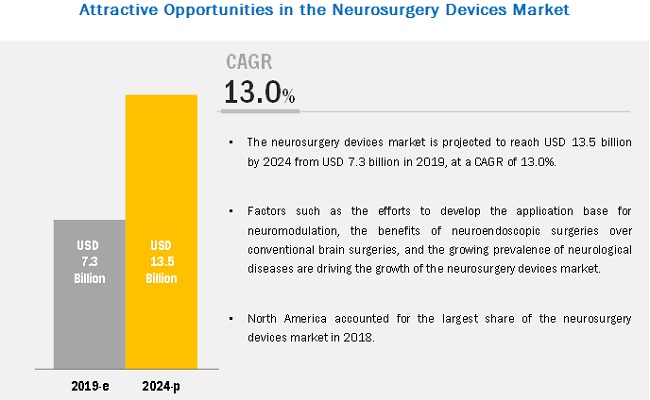

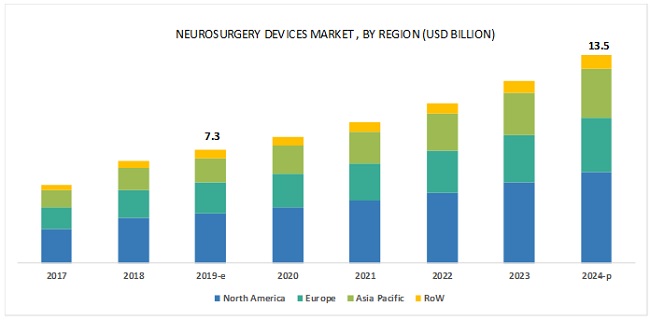

[120 Pages Report] The neurosurgery devices market is expected to grow from USD 7.3 billion in 2019 to USD 13.5 billion in 2024, at a CAGR of 13.0% during the forecast period. The growing prevalence of neurological diseases, efforts to develop the application base for neuromodulation, and the benefits of neuroendoscopic surgeries over conventional brain surgeries are driving the growth of the neurosurgery devices market.

By product, the neuromodulation devices segment is expected to grow at the highest CAGR during the forecast period.

On the basis of product, the neurosurgery instruments market is segmented into neuromodulation devices and neuroendoscopy devices. The neuromodulation devices segment is projected to register the highest growth during the forecast period. The rising prevalence of neurological disorders and the increasing number of brain surgeries are driving the growth of the neuromodulation devices market.

Parkinson's disease segment accounted for the largest share of the deep brain stimulation (DBS) applications market in 2018

On the basis of application, the market is segmented into spinal cord stimulation, deep brain stimulation, and neuroendoscopy applications. The deep brain stimulation applications market is further segmented into Parkinson's disease, tremor, depression, and other DBS applications (Alzheimer’s disease, dystonia, and Tourette syndrome). Parkinson's disease segment accounted for the largest share of the deep brain stimulation applications market in 2018. The large share of this segment can be attributed to the rising incidence of Parkinson’s, along with the growing number of researches conducted in this field.

North America accounted for the largest share of the neurosurgery devices market in 2018, while the Asia Pacific market is expected to register the highest growth during the forecast period

In 2018, North America accounted for the largest share of the market. Factors such as the high prevalence of neurological disorders, large number of neurosurgical procedures performed, and the presence of a favorable reimbursement structure are supporting the growth of the North American neurosurgery devices market. However, the Asia Pacific market is projected to register the highest CAGR of 14.8% during the forecast period, primarily due to the growing geriatric population in Japan and China and healthcare reforms and government initiatives & investments in several APAC countries.

Key Market Players

Major players in this neurosurgery instruments market include B. Braun Melsungen (Germany), Medtronic (US), Boston Scientific Corporation (US), Nevro Corporation (US), KARL STORZ (Germany), Abbott (US), Ackermann Instrumente (Germany), Hawk (China), Machida Endoscope (Japan), and adeor Medical (Germany).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast unit |

Value (USD) |

|

Segments covered |

Product, Application, and Region |

|

Geographies covered |

North America (US & Canada), Europe (Germany, France, the UK, and the RoE), Asia Pacific, and the RoW |

|

Companies covered |

Major 10 players covered, including Medtronic (US), Boston Scientific Corporation (US), and Abbott (US) |

This research report categorizes the market based on product, application, and region.

Neurosurgery Devices Market, by Product

- Neuromodulation Devices

- Internal Neuromodulation Devices

- Spinal Cord Stimulation Devices

- Deep Brain Stimulation Devices

- Other Internal Neuromodulation Devices

- External Neuromodulation Devices

- Internal Neuromodulation Devices

- Neuroendoscopy Devices

Neurosurgery Devices Market, by Application

- Spinal Cord Stimulation

- Chronic Pain

- Failed Back Surgery Syndrome

- Ischemia

- Deep Brain Stimulation

- Parkinson's Disease

- Tremor

- Depression

- Other DBS Applications

- Neuroendoscopy

- Transnasal Neuroendoscopy

- Intraventricular Neuroendoscopy

- Transcranial Neuroendoscopy

Neurosurgery Devices Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Rest of Europe (RoE)

- Asia Pacific

- RoW

Recent Developments:

- In 2019, Boston Scientific Corporation (US) launched Vercise PC and Vercise Gevia Deep Brain Stimulation (DBS) Systems, featuring the Vercise Cartesia Directional Lead.

- In 2018, Nevro Corporation (US) received the US FDA approval for its next-generation Senza II Spinal Cord Stimulation (SCS) System.

Key Questions Addressed by the Report

- Which product segment will dominate the market in the future?

- Emerging countries offer immense opportunities for the growth and adoption of neurosurgery devices; will this scenario continue in the coming five years?

- Where will all the advancements in technology offered by various companies take the industry in the mid- to long-term?

- What are the upcoming devices in the neurosurgery instruments market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Design

2.2 Research Approach

2.2.1 Research Methodology Steps

2.2.2 Secondary and Primary Research Methodology

2.2.2.1 Secondary Research

2.2.2.2 Secondary Sources

2.2.2.3 Primary Research

2.2.2.4 Primary Sources

2.2.2.5 Key Insights From Primary Sources

2.3 Neurosurgery Instruments Market Size Estimation Methodology

2.4 Market Data Estimation and Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Neurosurgery Devices: Market Overview

4.2 Neurosurgery Devices Market for Spinal Cord Stimulation, By Type, 2019 vs 2024 (USD Million)

4.3 Deep Brain Stimulation Applications Market, By Type, 2019 vs 2024 (USD Million)

4.4 Market: Geographic Growth Opportunities

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Research Into Expanding Applications of Neuromodulation

5.2.1.2 Benefits of Neuroendoscopic Surgery Over Conventional Brain Surgery

5.2.1.3 Rising Prevalence of Neurological Diseases

5.2.2 Restraints

5.2.2.1 High Cost of Neuroendoscopy Procedures and Equipment

5.2.3 Opportunities

5.2.3.1 Emerging Economies

5.2.4 Challenges

5.2.4.1 Dearth of Trained Professionals

6 Neurosurgery Devices Market, By Product (Page No. - 37)

6.1 Introduction

6.2 Neuromodulation Devices

6.2.1 Internal Neuromodulation Devices

6.2.2 Spinal Cord Stimulation Devices

6.2.2.1 SCS Devices Dominate the Internal Neuromodulation Devices Market as They are Cost-Efficient

6.2.3 Deep Brain Stimulation Devices

6.2.3.1 Growing Prevalence of Parkinson’s Disease and Other Neurological Disorders to Fuel Market Growth

6.2.4 Other Internal Neuromodulation Devices

6.3 External Neuromodulation Devices

6.3.1 Rising Demand for Noninvasive Neuromodulation Techniques to Drive the Adoption of External Neuromodulation Devices

6.4 Neuroendoscopy Devices

6.4.1 Low Cost, Smaller Incisions, and Reduced Hospital Stay are Some of the Advantages Associated With Neuroendoscopy Devices

7 Neurosurgery Devices Market, By Application (Page No. - 46)

7.1 Introduction

7.2 Spinal Cord Stimulation Market

7.2.1 Chronic Pain

7.2.1.1 Spinal Cord Stimulation is the Standard Procedure for Patients With Chronic Pain

7.2.2 Failed Back Surgery Syndrome (FBSS)

7.2.2.1 Treatments Such as Chiropractic and Acupressure are Expected to Hamper the Growth of the Market for FBSS

7.2.3 Ischemia

7.2.3.1 High Incidence of Ischemia to Drive the Demand for Neurosurgery Devices

7.3 Deep Brain Stimulation Market

7.3.1 Parkinson’s Disease

7.3.1.1 Rising Incidence of Parkinson’s and the Growing Number of Researches Conducted in This Field to Drive Market Growth

7.3.2 Tremor

7.3.2.1 Rising Geriatric Population and the High Efficacy of DBS to Support Market Growth

7.3.3 Depression

7.3.3.1 DBS Therapies to Treat Depression Involve Activating the Brain Directly With Magnets, Implants, and Electricity

7.3.4 Other DBS Applications

7.4 Neuroendoscopy

7.4.1 Transnasal Neuroendoscopy

7.4.1.1 Transnasal Neuroendoscopy is Indicated for Biopsies, Removal of Cysts, and Removal of Pituitary Gland Tumors

7.4.2 Intraventricular Neuroendoscopy

7.4.2.1 Ease of Use, Increased Visibility, and Treatment of A Large Number of Neurological Conditions—Key Advantages of Intraventricular Neuroendoscopy

7.4.3 Transcranial Neuroendoscopy

7.4.3.1 Transcranial Approach is More Invasive as Compared to the Transnasal Neuroendoscopic Approach

8 Neurosurgery Devices Market, By Region (Page No. - 58)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 The US Dominates the North American Neurosurgery Devices Market Due to the High Prevalence of Traumatic Brain Injuries

8.2.2 Canada

8.2.2.1 Favorable Government Initiatives to Support Market Growth in Canada

8.3 Europe

8.3.1 Germany

8.3.1.1 The Strong Presence of Key Neurosurgery Equipment Manufacturers to Support Market Growth

8.3.2 UK

8.3.2.1 High Burden of Brain Tumors to Fuel Market Growth

8.3.3 France

8.3.3.1 Rising Geriatric Population and the Associated Increase in the Prevalence of Neurological Disorders to Drive the Demand for Neurosurgery Devices

8.3.4 RoE

8.4 Asia Pacific

8.5 Rest of the World

9 Competitive Landscape (Page No. - 91)

9.1 Overview

9.2 Neurosurgery Instruments Market Share Analysis

9.2.1 Introduction

9.3 Competitive Leadership Mapping

9.3.1 Visionary Leaders

9.3.2 Innovators

9.3.3 Dynamic Differentiators

9.3.4 Emerging Companies

9.4 Competitive Scenario

9.4.1 Product Launches

9.4.2 Expansions

9.4.3 Acquisitions

9.4.4 Joint Ventures

10 Company Profiles (Page No. - 99)

10.1 B. Braun Melsungen

10.2 Medtronic

10.3 Boston Scientific Corporation

10.4 Nevro Corporation

10.5 Karl Storz

10.6 Abbott

10.7 Ackermann Instrumente

10.8 Adeor Medical

10.9 Hangzhou Hawk Optical Electronic Instruments

10.10 Machida Endoscope Co., Ltd.

11 Appendix (Page No. - 114)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (89 Tables)

Table 1 Indicative List of Neuromodulation Clinical Trials

Table 2 Neurosurgery Devices Market, By Product, 2017–2024 (USD Million)

Table 3 Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 4 Internal Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 5 Spinal Cord Stimulation Devices Market, By Region, 2017–2024 (USD Million)

Table 6 Deep Brain Stimulation Devices Market, By Region, 2017–2024 (USD Million)

Table 7 Other Internal Neuromodulation Devices Market, By Region, 2017–2024 (USD Million)

Table 8 External Neuromodulation Devices Market, By Region, 2017–2024 (USD Million)

Table 9 Neuroendoscopy Devices Market, By Region, 2017–2024 (USD Million)

Table 10 Spinal Cord Stimulation Applications Market, By Type, 2017–2024 (USD Million)

Table 11 Chronic Pain Applications Market, By Region, 2017–2024 (USD Million)

Table 12 Failed Back Surgery Syndrome Applications Market, By Region, 2017–2024 (USD Million)

Table 13 Ischemia Applications Market, By Region, 2017–2024 (USD Million)

Table 14 Deep Brain Stimulation Applications Market, By Type, 2017–2024 (USD Million)

Table 15 Parkinson’s Disease Applications Market, By Region, 2017–2024 (USD Million)

Table 16 Tremor Applications Market, By Region, 2017–2024 (USD Million)

Table 17 Depression Applications Market, By Region, 2017–2024 (USD Million)

Table 18 Other Deep Brain Stimulation Applications Market, By Region, 2017–2024 (USD Million)

Table 19 Neuroendoscopy Applications Market, By Type, 2017–2024 (USD Million)

Table 20 Transnasal Neuroendoscopy Applications Market, By Region, 2017–2024 (USD Million)

Table 21 Intraventricular Neuroendoscopy Applications Market, By Region, 2017–2024 (USD Million)

Table 22 Transcranial Neuroendoscopy Applications Market, By Region, 2017–2024 (USD Million)

Table 23 Neurosurgery Devices Market, By Region, 2017–2024 (USD Million)

Table 24 North America: Market, By Country, 2017–2024 (USD Million)

Table 25 North America: Market, By Product, 2017–2024 (USD Million)

Table 26 North America: Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 27 North America: Internal Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 28 North America: Neurosurgery Devices Market for Spinal Cord Stimulation, By Type, 2017–2024 (USD Million)

Table 29 North America: Market for Deep Brain Stimulation, By Type, 2017–2024 (USD Million)

Table 30 North America: Market for Neuroendoscopy Applications, By Type, 2017–2024 (USD Million)

Table 31 US: Neurosurgery Instruments Market, By Product, 2017–2024 (USD Million)

Table 32 US: Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 33 US: Internal Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 34 US: Neurosurgery Devices Market for Spinal Cord Stimulation, By Type, 2017–2024 (USD Million)

Table 35 US: Market for Deep Brain Stimulation, By Type, 2017–2024 (USD Million)

Table 36 US: Neurosurgery Instruments Market for Neuroendoscopy Applications, By Type, 2017–2024 (USD Million)

Table 37 Canada: Neurosurgery Devices Market, By Product, 2017–2024 (USD Million)

Table 38 Canada: Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 39 Canada: Internal Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 40 Canada: Market for Spinal Cord Stimulation, By Type, 2017–2024 (USD Million)

Table 41 Canada: Market for Deep Brain Stimulation, By Type, 2017–2024 (USD Million)

Table 42 Canada: Neurosurgery Devices Market for Neuroendoscopy Applications, By Type, 2017–2024 (USD Million)

Table 43 Europe: Market, By Country, 2017–2024 (USD Million)

Table 44 Europe: Market, By Product, 2017–2024 (USD Million)

Table 45 Europe: Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 46 Europe: Internal Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 47 Europe: Neurosurgery Devices Market for Spinal Cord Stimulation, By Type, 2017–2024 (USD Million)

Table 48 Europe: Market for Deep Brain Stimulation, By Type, 2017–2024 (USD Million)

Table 49 Europe: Market for Neuroendoscopy Applications, By Type, 2017–2024 (USD Million)

Table 50 Germany: Neurosurgery Devices Market, By Product, 2017–2024 (USD Million)

Table 51 Germany: Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 52 Germany: Internal Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 53 Germany: Market for Spinal Cord Stimulation, By Type, 2017–2024 (USD Million)

Table 54 Germany: Neurosurgery Devices Market for Deep Brain Stimulation, By Type, 2017–2024 (USD Million)

Table 55 Germany: Market for Neuroendoscopy Applications, By Type, 2017–2024 (USD Million)

Table 56 UK: Neurosurgery Devices Market, By Product, 2017–2024 (USD Million)

Table 57 UK: Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 58 UK: Internal Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 59 UK: Market for Spinal Cord Stimulation, By Type, 2017–2024 (USD Million)

Table 60 UK: Neurosurgery Devices Market for Deep Brain Stimulation, By Type, 2017–2024 (USD Million)

Table 61 UK: Neurosurgery Instruments Market for Neuroendoscopy Applications, By Type, 2017–2024 (USD Million)

Table 62 France: Market, By Product, 2017–2024 (USD Million)

Table 63 France: Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 64 France: Internal Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 65 France: Market for Spinal Cord Stimulation, By Type, 2017–2024 (USD Million)

Table 66 France: Neurosurgery Instruments Market for Deep Brain Stimulation, By Type, 2017–2024 (USD Million)

Table 67 France: Neurosurgery Devices Market for Neuroendoscopy Applications, By Type, 2017–2024 (USD Million)

Table 68 RoE: Market, By Product, 2017–2024 (USD Million)

Table 69 RoE: Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 70 RoE: Internal Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 71 RoE: Table 72 RoE: Neurosurgery Devices Market for Deep Brain Stimulation, By Type, 2017–2024 (USD Million)

Table 73 RoE: Market for Neuroendoscopy Applications, By Type, 2017–2024 (USD Million)

Table 74 Asia Pacific: Market, By Product, 2017–2024 (USD Million)

Table 75 Asia Pacific: Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 76 Asia Pacific: Internal Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 77 Asia Pacific: Market for Spinal Cord Stimulation, By Type, 2017–2024 (USD Million)

Table 78 Asia Pacific: Market for Deep Brain Stimulation, By Type, 2017–2024 (USD Million)

Table 79 Asia Pacific: Market for Neuroendoscopy Applications, By Type, 2017–2024 (USD Million)

Table 80 RoW: Neurosurgery Devices Market, By Product, 2017–2024 (USD Million)

Table 81 RoW: Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 82 RoW: Internal Neuromodulation Devices Market, By Type, 2017–2024 (USD Million)

Table 83 RoW: Neurosurgery Instruments Market for Spinal Cord Stimulation, By Type, 2017–2024 (USD Million)

Table 84 RoW: Market for Deep Brain Stimulation, By Type, 2017–2024 (USD Million)

Table 85 RoW: Market for Neuroendoscopy Applications, By Type, 2017–2024 (USD Million)

Table 86 Product Launches (2017–2019)

Table 87 Expansions (2017–2019)

Table 88 Acquisitions (2017–2019)

Table 89 Joint Ventures (2017–2019)

List of Figures (33 Figures)

Figure 1 Research Design: Neurosurgery Devices Market

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market: Bottom-Up Approach

Figure 4 Neurosurgery Instruments Market : Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Market, By Product, 2019 vs 2024 (USD Million)

Figure 7 Market for Spinal Cord Stimulation, By Type, 2019 vs 2024 (USD Million)

Figure 8 Neurosurgery Devices Market for Deep Brain Stimulation, By Type, 2019 vs 2024 (USD Million)

Figure 9 Geographical Snapshot of the Neurosurgery Devices Market

Figure 10 Growing Prevalence of Neurological Diseases to Drive Market Growth

Figure 11 Chronic Pain Segment Will Continue to Dominate the Spinal Cord Stimulation Applications Market in 2024

Figure 12 Parkinson's Disease Segment Accounted for the Largest Share of the Deep Brain Stimulation Applications Market in 2018

Figure 13 Asia Pacific Market to Register the Highest Growth in the Forecast Period

Figure 14 Neurosurgery Instruments Market : Drivers, Restraints, Opportunities, and Challenges

Figure 15 Neuromodulation Devices to Witness the Highest Growth in the Forecast Period

Figure 16 Spinal Cord Stimulation Devices Segment Dominates the Internal Neuromodulation Devices Market

Figure 17 Chronic Pain Segment Will Continue to Dominate the Spinal Cord Stimulation Applications Market in 2024

Figure 18 Parkinson's Disease Segment Accounted for the Largest Share of the Deep Brain Stimulation Applications Market in 2018

Figure 19 Transcranial Neuroendoscopy Segment to Witness the Highest Growth in the Neuroendoscopy Applications Market

Figure 20 North America Dominates the Neurosurgery Devices

Figure 21 North America: Neurosurgery Devices Market Snapshot

Figure 22 Europe: Market Snapshot

Figure 23 Asia Pacific: Market Snapshot

Figure 24 RoW: Neurosurgery Instruments Market Snapshot

Figure 25 Key Developments in the Market, 2017–2019

Figure 26 Neuroendoscopy: Market Share Ranking, By Key Player (2018)

Figure 27 Neuromodulation: Market Share Ranking, By Key Player (2018)

Figure 28 Neurosurgery Devices Market: Competitive Leadership Mapping (2018)

Figure 29 B. Braun Melsungen: Company Snapshot (2018)

Figure 30 Medtronic: Company Snapshot (2018)

Figure 31 Boston Scientific Corporation: Company Snapshot (2018)

Figure 32 Nevro Corporation: Company Snapshot (2018)

Figure 33 Abbott: Company Snapshot (2018)

The study involved four major activities in estimating the current market size for neurosurgery devices. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter market breakdown and data triangulation was used to estimate the market size of segments and subsegments

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases.

Primary Research

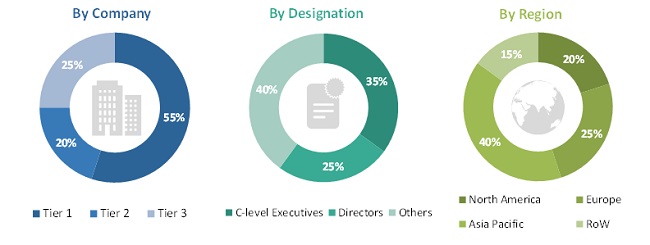

The neurosurgery devices market comprises several stakeholders such as neurosurgery device manufacturers and distributors, healthcare institutions (hospitals, medical schools, group practices, individual surgeons, and governing bodies), medical device vendors/service providers, research institutes, and research and consulting firms. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Mentioned below is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the neurosurgery devices market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and Neurosurgery Instruments Market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and to arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the neurosurgery industry.

Report Objectives

- To define, describe, and measure the neurosurgery devices market by product, application, and region

- To provide detailed information about the major factors influencing market growth (such as drivers, restraints, growth opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To strategically analyze the market structure and profile key players and their core competencies in the market

- To track and analyze competitive developments such as product launches, expansions, acquisitions, partnerships, and collaborations in the neurosurgery devices market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the software portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional neurosurgery instruments market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Neurosurgery Devices Market