Network Devices Market by Connectivity (WiFi, Cellular, LoRa, ZigBee, Bluetooth), Device Type (Router, Gateway, Access Point), Application (Residential, Commercial, Enterprise, Industrial, Transportation) and Geography - Global Forecast to 2027

Updated on : October 22, 2024

Network Devices Market Size

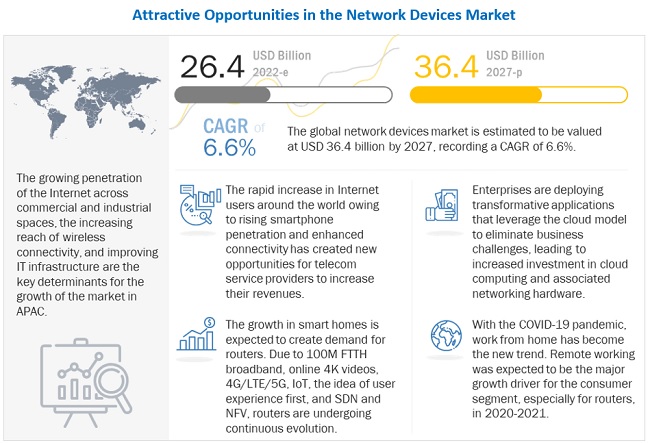

[230 Pages Report] the global network devices market is projected to grow from USD 26.4 billion in 2022 to USD 36.4 billion by 2027; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.6% from 2022 to 2027.

WiFi network deployment helps enterprises rapidly build and connect business applications. The WiFi network also provides greater flexibility, scalability, reliability, and cost-effective benefits in connecting mission-critical business applications. Core industry sectors are keen on automating and digitalizing their business processes to streamline business operations and drive new business revenue opportunities. As the number of Internet users is expected to continue to grow significantly in coming years, the demand for network devices including routers, gateways and access points is also expected to rise simultaneously. The network devices industry has been segmented based on device type, types, connectivity, application and geography. These market segments are further analyzed on the basis of market trends across the four regions considered in this study.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19

The emergence of the COVID-19 pandemic, a deadly respiratory disease that originated in China, is now become a worldwide issue and has also affected the network devices market. Many end-use verticals deploying network devices have been affected by this crisis. The market declined in 2020 due to government regulations regarding lockdown, temporary shutdown of manufacturing facilities, supply chain disruptions, limited production capacities, workforce shortage, and reduced demand in major end-use industries. By the end of 2020, the network devices market began to show signs of recovery, with R&D and expansion activities resuming throughout 2021. It was expected that these ongoing developments would help the market to recover by the end of 2021. Hence, as the overall market was expected to recover from 2021 onward, a realistic growth rate has been adopted.

Network Devices Market Dynamics

How is the worldwide growth in number of Internet users expected to change the market dynamics for network devices?

The number of internet users around the world is rapidly increasing owing to the growing smartphone penetration and enhanced connectivity. An increase in demand for connected devices that require a sophisticated Internet connection for seamless functionality is expected to boost the demand for network devices. While this is creating opportunities for broadband and telecom players, they face the continuing challenge of meeting customer expectations regarding network latency and bandwidth, and uptime in a competitive market. Players are investing heavily to capture these new opportunities with the help of enhanced network devices, which could provide the required connectivity bandwidth, security, and network reliability. Increasing investments by telecom players in wireless network infrastructure is expected to drive the growth of cellular-based network devices.

As the number of Internet users is expected to continue to grow significantly in coming years, the demand for network devices including routers, gateways and access points is also expected to rise simultaneously. The following infographic shows the number of internet users as a percentage of the regional population. Due to the gap in internet users in the population across APAC, South America, and Africa, these regions are expected to have higher growth as network accessibility improves.

According to the United States Telecomm Association, the global Internet Protocol traffic in 2021 was about 79,640 petabytes per month. The GSM Association states that global mobile data traffic reached record highs in 2020, with global data per user reaching more than 6 GB per month – double the data usage for 2018. Such developments are expected to boost the growth of the network devices market.

How has COVID-19 disrupted the network devices hardware supply chain?

Trade and mobility restrictions due to the COVID-19 pandemic have impacted global logistics and supply chain operations. Although essential items have been exempted from such restrictions, their availability has been impacted due to the lack of manpower to work on production lines, supply chains, and transportation.

Networking hardware is needed for the deployment of WiFi and cellular networks. The majority of devices and connectivity hardware used for wireless network deployment are sourced from China due to the region’s low-cost advantage; however, in the early days of the pandemic, most countries ceased their imports and export activities to some extent to avoid the spread of COVID-19. With a decline in the supply of networking modules and connectivity hardware, the enterprise sector witnessed a major hit in 2020. Several countries also reduced their reliance on China for the procurement of devices during this period. This led to a rise in lead times of enterprise-grade and industrial-grade networking hardware availability. This in turn had an impact on developing regions initiating the adoption of enterprise-grade and industrial-grade networking hardware.

What are the growing opportunities in wireless networking with advent of Industry 4.0 and IIoT?

The industrial Internet of Things (IIoT) is making the use of smart sensors and actuators to enhance manufacturing and industrial processes. Also known as the industrial Internet or Industry 4.0, IIoT uses the power of smart machines and real-time analytics to take advantage of the data generated by machines. Hence, industrial sensors are wirelessly connected to routers, gateways, and access points. The automotive industry extensively uses industrial robots, and IIoT helps to proactively maintain these systems and spot potential problems before they can disrupt production. ABB, a power and robotics firm, uses connected sensors to monitor the maintenance needs of its robots to prompt repairs before parts break. Airbus has launched its factory of the future, a digital manufacturing initiative to streamline operations and boost production. The company has integrated sensors into machines and tools on the shop floor and outfitted employees with wearable tech aimed at cutting down on errors and enhancing workplace safety. IIoT applications can also wirelessly connect machines and devices in the oil & gas and utilities industries.

In 2014, several technology companies including AT&T, Cisco, General Electric, IBM, and Intel came together to form the Industrial Internet Consortium (IIC). Of these, Cisco is a major networking hardware manufacturer.

The emergence of 5G will likely affect the use of IIoT devices. The high throughput and low latency of 5G makes it possible for devices to share data in real time. This real-time connectivity will support the use of 5G enabled, rugged routers and gateways in the market.

What are thye challenges posed by data security and privacy concerns in open networks?

Data privacy is one of the major concerns of several organizations. Due to the tremendous rise in data volumes, enterprises seek better security and privacy options that will protect the network and secure it from online threats, such as corporate surveillance, data breaches, and data espionage. The growing number of systems has resulted in many security and privacy issues, and every endpoint, gateway, sensor, and smartphone has become a potential target for hackers. Since the WLAN network provides access to various smart devices, security is a major factor that needs to be considered while deploying Wi-Fi networks. Wi-Fi solutions and associated services, in the scenario, offer secure, reliable, and high-speed Internet access. Any disruption to enterprise processes can have a significant effect on the entire business. As a result, several enterprises are reluctant to adopt Wi-Fi solutions and services. Therefore, proper security and privacy are needed for Wi-Fi solutions and associated services to be successfully deployed. Such challenges are expected to affect the growth of the market.

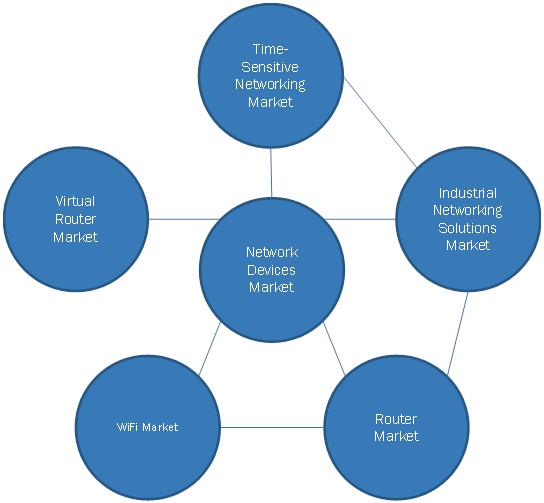

Market Interconnections

Routers to account for the largest share of the network devices market in 2022.

The routers segment is expected to lead the network devices market, by type, during the forecast period. The growing need for high-speed Internet connectivity and the rising adoption of smart devices such as smartphones, tablets, and smart TVs are driving the demand for wireless routers with effective connectivity in the residential sector. The increasing demand for Internet-based devices, expansion of cloud networking, and rising adoption of virtualized technologies, are expected to propel the growth of the routers market for industrial, enterprise, and commercial applications during the forecast period. Industrial routers provide the communications backbone for manufacturing and utilities applications that run in both indoor and outdoor environments. Cellular based industrial routers also need to be certified for connection compatibility by cellular service providers such as AT&T, Verizion and Vodafone. Some industrial routers also have SCADA compatibility for use with industrial equipment and machinery that use standardized SCADA communication. Industrial routers also feature unlicensed wireless bands that are not found in residential or commercial routers.

Indoor network devices segment to dominate network devices market during the forecast period.

The indoor segment held the larger share of the network devices market. The signal range of any given access point indoors varies significantly from device to device. Factors that determine the range of an access point include the specific wireless protocol it runs on, the strength of its device transmitter, and the nature of physical obstructions and radio interference in the surrounding area. Physical obstructions, such as brick walls and metal frames or siding, can reduce the range of a WiFi network by 25% or more. A wireless signal weakens every time it encounters an obstruction; this happens frequently indoors, due to walls, floors, and even the electronic interference caused by appliances.

WiFi-based network devices to register the highest share for network devices market in 2022.

WiFi enables devices to connect directly to each other or to broad networks to deliver information. It is a key technology driving the IoT concept, and mainly operates in the frequency band of around 2.4 GHz and 5.0 GHz. WiFi is expected to be the leading segment, by connectivity, in the network devices market during the forecast period. From WiFi 5 to new WiFi 6 and 6E routers, gateways, and access points, WiFi connectivity provides the ideal performance, range and overall value. A WiFi router connects directly to a modem through a cable. This allows it to receive information from and transmit information to the Internet. The router then creates and communicates with the home WiFi network using built in antennas, thus allowing all the devices on the home network Internet access. The wireless nature of WiFi networks allows users to access network resources from nearly any convenient location within their primary networking environment across commercial, industrial, and enterprise applications.

Enterprise network devices to have highest share in 2022.

An enterprise network is usually deployed across large organizations and offices. it comprises the IT infrastructure that midsize and large organizations use to provide connectivity among users, devices, and applications. An enterprise network consists of physical and virtual networks and protocols that serve the dual purpose of connecting all users and systems on a local area network (LAN) to applications in the data center and cloud as well as facilitating access to network data and analytics. The market for enterprise networking is expected to be the leading segment in the network devices market during the forecast period. The increasing demand for Internet-based devices, expansion of cloud networking, and rising adoption of virtualized technologies are expected to propel the growth of the network devices market for enterprise applications during the forecast period. Favorable government initiatives to promote the digitalization and industrialization of developing economies will positively influence the enterprise market.

Market in North America estimated to have the largest share during the forecast period.

North America is estimated to lead the network devices market. The market in North America is mainly driven by the increasing adoption of integrated enterprise and business solutions for more flexible and agile business processes and operations. The demand for wireless hotspots and Wi-Fi solutions and services is expected to increase due to the rise in wireless technology investments by the major companies in this region. The key players in the network devices market in the US and Canada are making efforts to offer the largest suite of networking products and solutions, thereby providing a great opportunity for regional companies to increase their business footprint. The presence of the major networking solution and service providers, including Cisco Systems, Aruba, Juniper Networks, and Extreme Networks, in this region is a major factor responsible for the growth of the North American market. To strengthen their market presence, these networking solution and service providers are launching new products and services in the market. This is expected to foster the growth of the network devices market in North America.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The network devices companies such as Cisco Systems (US), Cradlepoint (US), Juniper Networks (US), Huawei (China), HP Enterprise (US), Digi International (US), Sierra Wireless (Canada), Nokia (Finland), Inseego (US), Teltokina Networks (Lithuania), Extreme Networks (US), D-Link (Taiwan), TP-LINK (China), Moxa (Taiwan), Adtran (US), Schneider Electric (France), General Electric (US), Siemens (Germany), Multitech (US), Casa Systems (US), Advantech (Taiwan), Robustel (China), Lantronix (US), HMS Networks (Sweden), ASUSTek Computer (Taiwan), and Belkin International (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Network Devices Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2022 | USD 26.4 Billion |

| Revenue Forecast in 2027 | USD 36.4 Billion |

| Growth Rate | 6.6% CAGR |

|

Market size available for years |

2018—2027 |

|

Base year |

2021 |

|

Forecast period |

2022—2027 |

|

Units |

Value (USD Billion), Volume (Million Units) |

|

Segments covered |

|

|

Regions covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Largest Growing Region | North America |

| Largest Market Share Segment | Indoor network devices |

This report categorizes the network devices market based on device type, type, connectivity, application, and geography.

Network Devices Market, by Device Type:

- Routers

- Gateways

- Access Points

Network Devices Market, by Type:

- Indoor

- Outdoor

Network Devices Market, by Connectivity:

- WiFi

- Cellular

- WiFi + Others

- LoRa

- Others

Network Devices Market, by Application:

- Residential Networking

- Commercial Networking

- Enterprise Networking

- Industrial Networking

- Transportation Networking

Network Devices Market, by Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- Rest of APAC

-

RoW

- South America

- Middle East & Africa

Recent Developments

- In January 2022, Sierra Wireless (Canada) announced its AirLink RV50X router certified by FCC for use on the Anterix 900 MHz spectrum, enabling industrial, energy and utility customers to connect critical infrastructure and utilize the Anterix 900 MHz spectrum for Private LTE.

- In November 2021, Juniper Networks (US) announced two new 6 GHz access points that leverage Mist AI to maximize Wi-Fi performance and capacity while simplifying IT operations. In addition, Juniper introduced a new IoT Assurance service that streamlines and scales the onboarding and securing of IoT devices without Network Access Control (NAC). These enhancements to the Juniper, wireless access portfolio, furthered the company’s experience-first networking mission.

- In June 2021, Cisco (US) announced a new portfolio of Catalyst industrial routers for enterprise networks. These include the Catalyst 5G Industrial Routers and Cisco IoT Gateway Series. Featuring 5G capabilities, they enable organizations to run connected operations at scale with a choice of management tools suited for both IT and operations

Frequently Asked Questions (FAQ):

What will be the dynamics for the adoption of network devices based on WiFi connectivity?

WiFi is a key technology driving the IoT concept, and mainly operates in the frequency band of around 2.4 GHz and 5.0 GHz; there are slight modifications in the operating frequencies and standards in various countries. WiFi can be accessed over various devices, such as smartphones, digital cameras, personal computers, tablet computers, and digital audio players. In utilities, WiFI is utilized for wireless ridging, which involves deployment of ‘point to point’ wireless connectivity. WiFI is also utilized as a connectivity technology for SCADA communications including video surveillance, injection layer communications, remote field operations, and instrumentation data.

Which network device is expected to have high market value by 2027?

Routers are expected to lead the network devices market in 2027. The growing need for high-speed Internet connectivity and the rising adoption of smart devices such as smartphones, tablets, and smart TVs are driving the demand for wireless routers with effective connectivity in the residential sector. The increasing demand for Internet-based devices, expansion of cloud networking, and rising adoption of virtualized technologies, are expected to propel the growth of the routers market for industrial, enterprise, and commercial applications

How will WiFI protocol developments in change the market landscape in the future?

In 2020, WiFi 6E was announced for devices that offer the higher performance, lower latency, and faster data rates of WiFi 6 extended into the 6 GHz frequency band. An unlicensed spectrum within the 6GHz unlicensed spectrum is expected to be made available for industrial use by regulators around the world. WiFi 6E is expected to become the preferred WiFi protocol for mission critical applications such as electric power grid systems and first responder communications systems. The development framework of WiFi 7 (802.11BE) started in 2021.

How will 5G enabled network devices change the networking landscape?

The 5th generation (5G) mobile network is likely to be the next telecommunication standard. 5G exhibits a higher capacity than 4G and is more secure and industry-centric than preceding technologies. It will ensure user experience continuity in challenging situations, such as high mobility and thickly populated areas. 5G network is expected to offer a high data transfer rate, greater device connection density, and minimum latency. As the adoption of 5G increases and its enabling technology ecosystem matures, industry and supply chain use cases for 5G will become increasingly prevalent.

What are the key players influencing market ecosystem? How do they contribute to the companies operating in the market space?

The network devices market is a huge ecosystem with several vendors delivering solutions at every stage. The market has a few vendors that offer the entire spectrum of solutions and services for household enterprises. Integrators play a major role in deploying complete network systems for enterprises. Regulatory authorities play a vital role in the network devices market. They are present at the country, regional, and global levels. Each country has regulatory bodies that authorize rules and policies for the telecommunication network. Solution providers offer networking solutions in the market. These solutions are needed for managing the devices, network performance, network security, and control of the deployed wireless network. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 NETWORK DEVICES MARKET: SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY & PRICING

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 2 NETWORK DEVICES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 List of key secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Breakdown of primary interviews

2.1.3.2 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

2.2.1.1 Approach for obtaining market size using bottom-up analysis (supply side)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY SIDE (TOP-DOWN APPROACH)

2.2.2 BOTTOM-UP APPROACH

2.2.2.1 Approach to arrive at the market size using bottom-up analysis (demand side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND SIDE (BOTTOM-UP APPROACH)

2.2.3 MARKET PROJECTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 37)

FIGURE 8 GROWTH PROJECTIONS OF NETWORK DEVICES MARKET IN REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

FIGURE 9 INDOOR NETWORK DEVICES TO HAVE LARGER MARKET SHARE IN 2021

FIGURE 10 ROUTERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 11 ENTERPRISE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 12 MARKET IN NORTH AMERICA TO HAVE HIGHEST SHARE IN 2022

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE OPPORTUNITIES IN NETWORK DEVICES MARKET

FIGURE 13 INCREASED FOCUS ON DIGITAL TRANSFORMATION ACROSS SECTORS DRIVING GROWTH OF NETWORK DEVICES MARKET

4.2 NETWORK DEVICES MARKET, BY DEVICE TYPE

FIGURE 14 ROUTERS TO HOLD LARGEST SHARE OF MARKET IN 2027

4.3 MARKET, BY CONNECTIVITY

FIGURE 15 NETWORK DEVICES WITH WIFI CONNECTIVITY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY APPLICATION

FIGURE 16 ENTERPRISE APPLICATION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET, BY COUNTRY

FIGURE 17 CHINA TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 IMPACT OF DRIVERS AND OPPORTUNITIES ON NETWORK DEVICES MARKET

FIGURE 19 IMPACT OF RESTRAINTS AND CHALLENGES ON MARKET

5.2.1 DRIVERS

5.2.1.1 Increased focus on digital transformation across various sectors

5.2.1.2 Worldwide growth in number of Internet users

FIGURE 20 INTERNET USERS AS A PERCENTAGE OF REGIONAL POPULATION, 2018 VS. 2023

5.2.1.3 Rising adoption of CYOD trend due to COVID-19 pandemic

5.2.1.4 Continuous development of WiFi standards

5.2.2 RESTRAINTS

5.2.2.1 Contention loss and co-channel interference in WiFi access points

5.2.2.2 Disruption in network devices hardware supply chain due to

COVID-19 49

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for carrier WiFi

5.2.3.2 Growing wireless networking with advent of Industry 4.0 and IIoT

5.2.3.3 Increasing emergence of connectivity for smart homes

5.2.3.4 Rising adoption of connected devices in hospitality and education sectors

5.2.4 CHALLENGES

5.2.4.1 Poor user experience in high-density environments

5.2.4.2 Data security and privacy concerns in open networks

5.3 TARIFFS AND REGULATIONS

5.3.1 TARIFFS RELATED TO NETWORK DEVICES

5.3.2 REGULATIONS

5.3.3 NORTH AMERICA

5.3.3.1 Federal Communications Commission (FCC)

5.3.4 EUROPE

5.3.4.1 Body of European Regulators for Electronic Communications (BEREC)

5.3.4.2 CE

5.3.4.3 Restriction of Hazardous Substances in Electrical and Electronic Equipment (RoHS)

5.3.4.4 International Special Committee on Radio Interference (CISPR)

5.3.5 APAC

5.3.5.1 Voluntary Control Council for Interference (VCCI)

5.3.5.2 Infocomm Media Development Authority (IMDA)

5.4 STANDARDS

5.4.1 STANDARDS

TABLE 1 HISTORY OF WIFI STANDARDS

5.4.2 IEEE 802.11

5.4.3 IEEE 802.11A

5.4.4 IEEE 802.11B

5.4.5 IEEE 802.11G

5.4.6 IEEE 802.11N

5.4.7 IEEE 802.11AC

5.4.8 IEEE 802.11AX

5.5 CASE STUDIES

5.5.1 NTTPC COMMUNICATIONS DEPLOYS CISCO INTEGRATED SERVICE ROUTERS WITH IOS EMBEDDED EVENT MANAGER TO REDUCE OVERALL OPERATIONS COST

5.5.2 D-LINK HELPS FOOD PROCESSING COMPANY IN WASHINGTON ELIMINATE NETWORK DOWNTIME AND ENABLE ROUND-THE-CLOCK EFFICIENCY

5.5.3 TP-LINK ASSISTS CHASE GRAMMAR SCHOOL WITH WIRELESS OPTIMIZATION FOR INTERNET CONNECTIVITY

5.5.4 CISCO HELPS TOKIO MARINE & NICHIDO FIRE INSURANCE TO REVOLUTIONIZE WORKING STYLE

5.5.5 SOUTHSTAR DRUG DEPLOYS HUAWEI WIFI 6 SOLUTION FOR SMOOTH WIRELESS NETWORK EXPERIENCE

5.6 PRICING ANALYSIS

TABLE 2 PRICING ANALYSIS

TABLE 3 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP 3 APPLICATIONS (USD)

5.7 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS OF NETWORK DEVICE ECOSYSTEM

5.8 ECOSYSTEM/MARKET MAP

FIGURE 22 NETWORK DEVICE MARKET ECOSYSTEM

TABLE 4 NETWORK DEVICES MARKET: SUPPLY CHAIN

5.9 TECHNOLOGY ANALYSIS

5.9.1 KEY EMERGING TECHNOLOGIES

5.9.1.1 WiFi 6

5.9.2 ADJACENT TECHNOLOGIES

5.9.2.1 Software-based Routing

5.10 WIFI AND CELLULAR TECHNOLOGY TRENDS

5.10.1 WIMAX

5.10.2 LONG-TERM EVOLUTION (LTE)

5.10.3 5G

5.11 PATENT ANALYSIS

TABLE 5 LIST OF MAJOR PATENTS (2019–2021)

FIGURE 23 NETWORK DEVICE PATENTS PUBLISHED, BY COUNTRY, 2015–2020

FIGURE 24 NUMBER OF PATENTS GRANTED ANNUALLY OVER THE LAST TEN YEARS

FIGURE 25 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 6 TOP 20 NETWORK DEVICE APPLICANT COMPANIES DURING 2015-2020

5.12 TRADE DATA

5.12.1 IMPORT SCENARIO

FIGURE 26 IMPORT DATA FOR HS CODE 851762, BY COUNTRY, 2016–2020

TABLE 7 IMPORT DATA FOR HS CODE 851762, BY COUNTRY, 2016–2020 (USD THOUSAND)

5.12.2 EXPORT SCENARIO

FIGURE 27 EXPORT DATA FOR HS CODE 851762, BY COUNTRY, 2016–2020

TABLE 8 EXPORT DATA FOR HS CODE 851762, BY COUNTRY, 2016–2020 (USD THOUSAND)

5.13 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 PORTER’S FIVE FORCES IMPACT ON THE NETWORK DEVICES MARKET

5.13.1 THREAT OF NEW ENTRANTS

5.13.2 THREAT OF SUBSTITUTES

5.13.3 BARGAINING POWER OF SUPPLIERS

5.13.4 BARGAINING POWER OF BUYERS

5.13.5 INTENSITY OF COMPETITIVE RIVALRY

5.14 KEY STAKEHOLDERS & BUYING CRITERIA

5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

5.14.2 BUYING CRITERIA

FIGURE 29 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 11 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 30 YC-YCC SHIFT FOR MARKET

5.16 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 12 MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6 NETWORK DEVICES MARKET, BY DEVICE TYPE (Page No. - 72)

6.1 INTRODUCTION

FIGURE 31 ROUTERS SEGMENT TO HOLD LARGEST SHARE OF NETWORK DEVICES MARKET DURING FORECAST PERIOD

TABLE 13 MARKET, BY DEVICE TYPE, 2018–2021 (USD BILLION)

TABLE 14 NETWORK DEVICES MARKET, BY DEVICE TYPE, 2022–2027 (USD BILLION)

TABLE 15 MARKET, BY DEVICE TYPE, 2018–2021 (MILLION UNITS)

TABLE 16 MARKET, BY DEVICE TYPE, 2022–2027 (MILLION UNITS)

6.2 ROUTERS

6.2.1 WIDESPREAD USE OF INDUSTRIAL ROUTERS FOR MANUFACTURING AND UTILITIES APPLICATIONS IN INDOOR AND OUTDOOR ENVIRONMENTS

TABLE 17 ROUTERS MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 18 ROUTERS MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 19 ROUTERS MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 20 ROUTERS MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

6.3 GATEWAYS

6.3.1 RUGGEDIZED INDUSTRIAL GATEWAYS SUITED TO SEVERE AND REMOTE ENVIRONMENTS

TABLE 21 GATEWAYS MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 22 GATEWAYS MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 23 GATEWAYS MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 24 GATEWAYS MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

6.4 ACCESS POINTS

6.4.1 DESIGNED TO CONNECT WIRELESS DEVICES IN VARIOUS ENVIRONMENTS

TABLE 25 ACCESS POINTS MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 26 ACCESS POINTS MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 27 ACCESS POINTS MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 28 ACCESS POINTS MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

7 NETWORK DEVICES MARKET, BY TYPE (Page No. - 83)

7.1 INTRODUCTION

FIGURE 32 INDOOR SEGMENT TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

TABLE 29 MARKET, BY TYPE, 2018–2021 (USD BILLION)

TABLE 30 MARKET, BY TYPE, 2022–2027 (USD BILLION)

7.2 INDOOR

7.2.1 SUITED TO SEVERAL APPLICATIONS DESPITE LIMITED WIFI RANGE

7.2.2 INDOOR: MARKET DRIVERS

7.2.3 INDOOR: COVID-19 IMPACT

7.3 OUTDOOR

7.3.1 OUTDOOR DEVICES HELP EXTEND INTERNAL WIRELESS NETWORKS

7.3.2 OUTDOOR: MARKET DRIVERS

7.3.3 OUTDOOR: COVID-19 IMPACT

8 NETWORK DEVICES MARKET, BY CONNECTIVITY (Page No. - 88)

8.1 INTRODUCTION

FIGURE 33 WIFI CONNECTIVITY TO HOLD LARGEST SHARE OF NETWORK DEVICES MARKET DURING FORECAST PERIOD

TABLE 31 MARKET, BY CONNECTIVITY, 2018–2021 (MILLION UNITS)

TABLE 32 MARKET, BY CONNECTIVITY, 2022–2027 (MILLION UNITS)

8.2 WIFI

8.2.1 OPERATES IN FREQUENCY BAND OF AROUND 2.4 GHZ AND 5.0 GHZ

8.3 CELLULAR

8.3.1 WIDE USE OF EVOLVING CELLULAR-BASED TECHNOLOGIES IN NETWORK DEVICES

8.4 WIFI+OTHERS

8.4.1 WIFI+OTHERS ENCOMPASSES WIFI ALONG WITH BLUETOOTH, ZIGBEE, AND/OR LORA

8.5 LORA

8.5.1 EXPLICITLY DESIGNED FOR LONG-RANGE, LOW-POWER COMMUNICATIONS

8.6 OTHERS

8.6.1 BLUETOOTH AND ZIGBEE CONNECTIVITY

9 NETWORK DEVICES MARKET, BY APPLICATION (Page No. - 97)

9.1 INTRODUCTION

FIGURE 34 ENTERPRISE NETWORKING TO HOLD LARGEST SHARE OF NETWORK DEVICES MARKET DURING FORECAST PERIOD

TABLE 33 MARKET, BY APPLICATION, 2018–2021 (USD BILLION)

TABLE 34 MARKET, BY APPLICATION, 2022–2027 (USD BILLION)

TABLE 35 MARKET, BY APPLICATION, 2018–2021 (MILLION UNITS)

TABLE 36 MARKET, BY APPLICATION, 2022–2027 (MILLION UNITS)

9.2 RESIDENTIAL NETWORKING

9.2.1 INCEASING DEMAND FOR WIRELESS NETWORKING TO CONTROL DOMESTIC DEVICES

TABLE 37 RESIDENTIAL NETWORK DEVICES MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 38 RESIDENTIAL MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 39 RESIDENTIAL MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 40 RESIDENTIAL MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 41 RESIDENTIAL MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 42 RESIDENTIAL MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 43 RESIDENTIAL MARKET IN APAC, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 44 RESIDENTIAL MARKET IN APAC, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 45 RESIDENTIAL MARKET IN ROW, BY REGION, 2018–2021 (USD BILLION)

TABLE 46 RESIDENTIAL MARKET IN ROW, BY REGION, 2022–2027 (USD BILLION)

9.3 COMMERCIAL NETWORKING

9.3.1 WIDE USE OF COMMERCIAL NETWORKS TO IMPROVE RETAIL OPERATIONS

TABLE 47 COMMERCIAL MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 48 COMMERCIAL MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 49 COMMERCIAL MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 50 COMMERCIAL MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 51 COMMERCIAL MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 52 COMMERCIAL MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 53 COMMERCIAL MARKET IN APAC, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 54 COMMERCIAL MARKET IN APAC, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 55 COMMERCIAL MARKET IN ROW, BY REGION, 2018–2021 (USD BILLION)

TABLE 56 COMMERCIAL MARKET IN ROW, BY REGION, 2022–2027 (USD BILLION)

9.4 ENTERPRISE NETWORKING

9.4.1 SIGNIFICANT INCREASE IN DEMAND DUE TO COVID-10 PANDEMIC

TABLE 57 ENTERPRISE NETWORK DEVICES MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 58 ENTERPRISE MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 59 ENTERPRISE MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 60 ENTERPRISE MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 61 ENTERPRISE MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 62 ENTERPRISE MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 63 ENTERPRISE MARKET IN APAC, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 64 ENTERPRISE MARKET IN APAC, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 65 ENTERPRISE MARKET IN ROW, BY REGION, 2018–2021 (USD BILLION)

TABLE 66 ENTERPRISE MARKET IN ROW, BY REGION, 2022–2027 (USD BILLION)

9.5 INDUSTRIAL NETWORKING

9.5.1 GROWING NEED FOR ADVANCED WIDE-AREA NETWORKING SOLUTIONS

TABLE 67 INDUSTRIAL NETWORK DEVICES MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 68 INDUSTRIAL MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 69 INDUSTRIAL MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 70 INDUSTRIAL MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 71 INDUSTRIAL MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 72 INDUSTRIAL MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 73 INDUSTRIAL MARKET IN APAC, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 74 INDUSTRIAL MARKET IN APAC, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 75 INDUSTRIAL MARKET IN ROW, BY REGION, 2018–2021 (USD BILLION)

TABLE 76 INDUSTRIAL MARKET IN ROW, BY REGION, 2022–2027 (USD BILLION)

9.6 TRANSPORTATION NETWORKING

9.6.1 RISING DEPLOYMENT IN PUBLIC ROAD TRANSPORTATION SYSTEMS AND RAILWAYS

TABLE 77 TRANSPORTATION MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 78 TRANSPORTATION MARKET, BY REGION, 2022–2027 (USD BILLION)

TABLE 79 TRANSPORTATION MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 80 TRANSPORTATION NETWORK DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 81 TRANSPORTATION MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 82 TRANSPORTATION MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 83 TRANSPORTATION MARKET IN APAC, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 84 TRANSPORTATION MARKET IN APAC, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 85 TRANSPORTATION MARKET IN ROW, BY REGION, 2018–2021 (USD BILLION)

TABLE 86 TRANSPORTATION MARKET IN ROW, BY REGION, 2022–2027 (USD BILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 122)

10.1 INTRODUCTION

FIGURE 35 NORTH AMERICA TO LEAD NETWORK DEVICES MARKET DURING FORECAST PERIOD

TABLE 87 MARKET, BY REGION, 2018–2021 (USD BILLION)

TABLE 88 MARKET, BY REGION, 2022–2027 (USD BILLION)

10.2 NORTH AMERICA

FIGURE 36 MARKET SNAPSHOT IN NORTH AMERICA

TABLE 89 NETWORK DEVICES MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 90 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 91 MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (USD BILLION)

TABLE 92 MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD BILLION)

10.2.1 US

10.2.1.1 Largest market in North America due to high number of router installations

TABLE 93 MARKET IN THE US, BY TYPE, 2018–2021 (USD BILLION)

TABLE 94 MARKET IN THE US, BY TYPE, 2022–2027 (USD BILLION)

10.2.2 CANADA

10.2.2.1 Increasing deployment of WiFi networks leading to market growth

TABLE 95 MARKET IN CANADA, BY TYPE, 2018–2021 (USD BILLION)

TABLE 96 MARKET IN CANADA, BY TYPE, 2022–2027 (USD BILLION)

10.2.3 MEXICO

10.2.3.1 Rapid industrialization to boost nascent market

TABLE 97 MARKET IN MEXICO, BY TYPE, 2018–2021 (USD BILLION)

TABLE 98 NETWORK DEVICES MARKET IN MEXICO, BY TYPE, 2022–2027 (USD BILLION)

10.3 EUROPE

FIGURE 37 MARKET SNAPSHOT IN EUROPE

TABLE 99 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 100 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD BILLION)

TABLE 101 MARKET IN EUROPE, BY TYPE, 2018–2021 (USD BILLION)

TABLE 102 MARKET IN EUROPE, BY TYPE, 2022–2027 (USD BILLION)

10.3.1 UK

10.3.1.1 Active government support for cloud-based projects to boost market

TABLE 103 MARKET IN THE UK, BY TYPE, 2018–2021 (USD BILLION)

TABLE 104 MARKET IN THE UK, BY TYPE, 2022–2027 (USD BILLION)

10.3.2 GERMANY

10.3.2.1 Widespread adoption of industrial networking to fuel market growth

TABLE 105 MARKET IN THE GERMANY, BY TYPE, 2018–2021 (USD BILLION)

TABLE 106 MARKET IN THE GERMANY, BY TYPE, 2022–2027 (USD BILLION)

10.3.3 FRANCE

10.3.3.1 Accelerated investments in 5G technology for industrial networking

TABLE 107 NETWORK DEVICES MARKET IN FRANCE, BY TYPE, 2018–2021 (USD BILLION)

TABLE 108 MARKET IN FRANCE, BY TYPE, 2022–2027 (USD BILLION)

10.3.4 REST OF EUROPE

TABLE 109 MARKET IN THE REST OF EUROPE, BY TYPE, 2018–2021 (USD BILLION)

TABLE 110 MARKET IN THE REST OF EUROPE, BY TYPE, 2022–2027 (USD BILLION)

10.4 APAC

FIGURE 38 MARKET SNAPSHOT IN APAC

TABLE 111 MARKET IN APAC, BY COUNTRY, 2018–2021 (USD BILLION)

TABLE 112 MARKET IN APAC, BY COUTRY, 2022–2027 (USD BILLION)

TABLE 113 NETWORK DEVICES MARKET IN APAC, BY TYPE, 2018–2021 (USD BILLION)

TABLE 114 MARKET IN APAC, BY TYPE, 2022–2027 (USD BILLION)

10.4.1 CHINA

10.4.1.1 Challenging market due to complex and difficult regulatory environments

TABLE 115 MARKET IN CHINA, BY TYPE, 2018–2021 (USD BILLION)

TABLE 116 NETWORK DEVICES MARKET IN CHINA, BY TYPE, 2022–2027 (USD BILLION)

10.4.2 JAPAN

10.4.2.1 Growing telecom industry to provide greater scope for networking

TABLE 117 MARKET IN JAPAN, BY TYPE, 2018–2021 (USD BILLION)

TABLE 118 MARKET IN JAPAN, BY TYPE, 2022–2027 (USD BILLION)

10.4.3 SOUTH KOREA

10.4.3.1 Rising government support for deployment of 5G network

TABLE 119 MARKET IN SOUTH KOREA, BY TYPE, 2018–2021 (USD BILLION)

TABLE 120 MARKET IN SOUTH KOREA, BY TYPE, 2022–2027 (USD BILLION)

10.4.4 REST OF APAC

TABLE 121 MARKET IN REST OF APAC, BY TYPE, 2018–2021 (USD BILLION)

TABLE 122 MARKET IN REST OF APAC, BY TYPE, 2022–2027 (USD BILLION)

10.5 ROW

FIGURE 39 MARKET IN MIDDLE EAST & AFRICA TO GROW AT SLIGHTLY HIGHER RATE DURING FORECAST PERIOD

TABLE 123 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 124 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 125 MARKET IN ROW, BY TYPE, 2018–2021 (USD MILLION)

TABLE 126 MARKET IN ROW, BY TYPE, 2022–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Increasing Internet penetration opening up new growth opportunities in residential sector

TABLE 127 MARKET IN SOUTH AMERICA, BY TYPE, 2018–2021 (USD BILLION)

TABLE 128 MARKET IN SOUTH AMERICA, BY TYPE, 2022–2027 (USD BILLION)

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 Growing adoption of WiFi in Middle East to boost market

TABLE 129 NETWORK DEVICES MARKET IN MIDDLE EAST & AFRICA, BY TYPE, 2018–2021 (USD BILLION)

TABLE 130 MARKET IN MIDDLE EAST & AFRICA, BY TYPE, 2022–2027 (USD BILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 146)

11.1 OVERVIEW

11.2 STRATEGIES OF KEY PLAYERS / MARKET EVALUATION FRAMEWORK

TABLE 131 OVERVIEW OF STRATEGIES ADOPTED BY TOP FIVE INDUSTRIAL NETWORK DEVICE MANUFACTURERS FROM 2019 TO 2021

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

11.3 MARKET SHARE ANALYSIS: NETWORK DEVICES MARKET, 2021

TABLE 132 DEGREE OF COMPETITION

11.4 HISTORICAL REVENUE ANALYSIS

FIGURE 40 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 41 NETWORK DEVICES COMPANY EVALUATION QUADRANT, 2021

11.6 COMPETITIVE BENCHMARKING

TABLE 133 OVERALL COMPANY FOOTPRINT (27 PLAYERS)

TABLE 134 COMPANY OFFERING FOOTPRINT (27 PLAYERS)

TABLE 135 FOOTPRINT OF DIFFERENT COMPANIES FOR VARIOUS APPLICATIONS (27 PLAYERS) 154

TABLE 136 FOOTPRINT OF DIFFERENT COMPANIES FOR VARIOUS REGIONS (27 PLAYERS) 155

11.7 START-UP/SME EVALUATION MATRIX

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 42 NETWORK DEVICES MARKET: START-UP/SME EVALUATION MATRIX, 2021

11.8 COMPETITIVE BENCHMARKING

TABLE 137 MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 138 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

11.9 COMPETITIVE SITUATIONS AND TRENDS

11.9.1 PRODUCT LAUNCHES

TABLE 139 PRODUCT LAUNCHES, 2019–2021

11.9.2 DEALS

TABLE 140 DEALS, 2019–2021

11.9.3 OTHERS

TABLE 141 EXPANSIONS, 2019–2021

12 COMPANY PROFILES (Page No. - 163)

(Business overview, Products offered, Recent developments & MnM View)*

12.1 KEY PLAYERS

12.1.1 CISCO SYSTEMS

TABLE 142 CISCO SYSTEMS: BUSINESS OVERVIEW

FIGURE 43 CISCO SYSTEMS: COMPANY SNAPSHOT

12.1.2 HUAWEI

TABLE 143 HUAWEI: BUSINESS OVERVIEW

FIGURE 44 HUAWEI: COMPANY SNAPSHOT

12.1.3 HP ENTERPRISE

TABLE 144 HP ENTERPRISE: BUSINESS OVERVIEW

FIGURE 45 HP ENTERPRISE: COMPANY SNAPSHOT

12.1.4 JUNIPER NETWORKS

TABLE 145 JUNIPER NETWORKS: BUSINESS OVERVIEW

FIGURE 46 JUNIPER NETWORKS: COMPANY SNAPSHOT

12.1.5 SIERRA WIRELESS

TABLE 146 SIERRA WIRELESS: BUSINESS OVERVIEW

FIGURE 47 SIERRA WIRELESS: COMPANY SNAPSHOT

12.1.6 CRADLEPOINT

TABLE 147 CRADLEPOINT: BUSINESS OVERVIEW

12.1.7 DIGI INTERNATIONAL

TABLE 148 DIGI INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 48 DIGI INTERNATIONAL: COMPANY SNAPSHOT

12.1.8 TELTONIKA

TABLE 149 TELTONIKA: BUSINESS OVERVIEW

12.1.9 MULTITECH

TABLE 150 MULTITECH: BUSINESS OVERVIEW

12.1.10 INSEEGO

TABLE 151 INSEEGO: BUSINESS OVERVIEW

FIGURE 49 INSEEGO: COMPANY SNAPSHOT

12.1.11 SCHNEIDER ELECTRIC

TABLE 152 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 50 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

12.1.12 GENERAL ELECTRIC

TABLE 153 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 51 GENERAL ELECTRIC: COMPANY SNAPSHOT

12.1.13 EXTREME NETWORKS

TABLE 154 EXTREME NETWORKS: BUSINESS OVERVIEW

FIGURE 52 EXTREME NETWORKS: COMPANY SNAPSHOT

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

12.2 OTHER KEY PLAYERS

12.2.1 SIEMENS

12.2.2 MOXA

12.2.3 ROBUSTEL

12.2.4 ADVANTECH

12.2.5 LYNX TECHNOLOGIES

12.2.6 LANTRONIX

12.2.7 D-LINK

12.2.8 TP-LINK TECHNOLOGIES

12.2.9 BELKIN INTERNATIONAL

12.2.10 ADTRAN

12.2.11 ASUSTEK COMPUTER

12.2.12 HMS NETWORKS

12.2.13 CASA SYSTEMS

12.2.14 NOKIA

13 APPENDIX (Page No. - 224)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

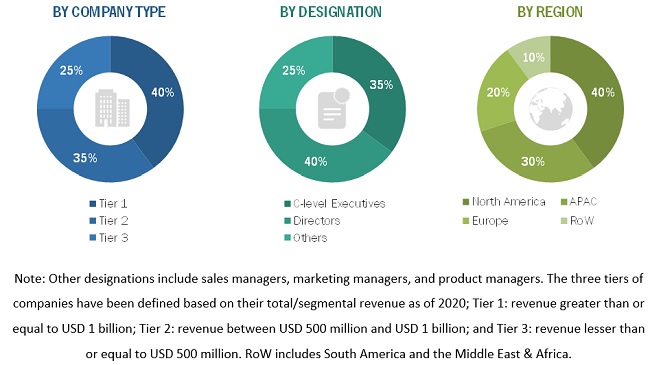

The study involved four major activities in estimating the size for the network devices market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, related journals, and certified publications; articles by recognized authors; gold and silver standard websites; directories; and databases like Factiva.

Secondary research was mainly conducted to obtain key information about the industry supply chain, the market value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both markets- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain the qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the network devices market.

Extensive primary research was conducted after obtaining information about the network devices market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides. Primary data has been mainly collected through telephonic interviews, which constitute approximately 80% of the overall primary interviews. Moreover, questionnaires and emails were also used to collect the data.

Breakdown of Primary Participants

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used, along with several data triangulation methods for estimating and forecasting the size of the network devices market and its segments and subsegments listed in this report. The key players in the market have been identified through secondary research, and their market share in the respective regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews of the industry experts, such as chief executive officers, vice presidents, directors, and marketing executives, for key insights.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Network Devices Market: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the network devices market from the estimation process explained above, the total market was split into several segments and subsegments. The market breakdown and data triangulation procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the network devices market, in terms of value and volume, segmented by device type, type, application, connectivity, and region

- To describe and forecast the market size, in terms of value, for four major regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information regarding the value chain, market and technology trends, product pricing, patents, use cases, and impact of COVID-19 on the network devices market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the network devices market

- To benchmark market players using the competitive leadership mapping framework, which analyzes market players based on various parameters within the broad categories of business strategy excellence, and strength of product portfolio

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with the competitive landscape of the market

- To analyze competitive developments, such as acquisitions, product launches, expansions, partnerships, agreements, and collaborations, in the network devices market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Network Devices Market