Network API Market Size, Share, Growth & Latest Trends

Network API Market by API Type (Device Status, Identity, Location, Network Performance), Application (IoT, Priority Communication, Anti-fraud, Entertainment & Content Distribution, Enterprise IT, Autonomous Vehicles), Vertical - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The network API market is projected to expand from USD 1.96 billion in 2025 to USD 6.13 billion by 2030, at a CAGR of 25.7% during the forecast period. The market is evolving into one of the most powerful enablers of digital transformation, bridging telecom infrastructure with enterprise applications through standardized programmability.

KEY TAKEAWAYS

-

BY VERTICALBFSI is the largest vertical in the network API market, driven by the demand for robust identity verification, transaction security, real-time payment processing, and compliance with stringent regulatory requirements such as KYC (Know Your Customer), AML (Anti-Money Laundering), and PSD2 (Payment Services Directive) mandates.

-

BY REGIONAsia Pacific is expected to grow fastest, with a CAGR of 28.7%, driven by rapid mobile internet adoption, rising 5G penetration, and the push for digital services across developing economies. Japan, South Korea, India, China, and Australia are actively engaging in trials and commercial rollouts of next-generation network APIs, particularly those aligned with the GSMA Open Gateway framework.

-

COMPETITIVE LANDSCAPEThe major market players have adopted organic and inorganic strategies, including partnerships, collaborations, and investments. For instance, Ericsson officially launched Aduna as the industry's largest network API joint venture platform, combining network capabilities from twelve global operators to provide unified, standardized access to network functions worldwide, representing a paradigm shift in operator collaboration.

The network API market by API type categorizes offerings according to the network functionalities they expose via APIs. These API types include device status, edge, identity, location, network performance, and other API types (policy control, security, analytics). These offer insights into the different API Types used to deploy network API functionality

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The network API market is shifting from legacy, service-led revenue toward API-first, edge-enabled offerings. As operators and platform players adopt programmable APIs, low-latency routing, monetization, and observability, customers gain faster time-to-market, new usage-based revenues, stronger partner ecosystems, and measurable QoE improvements. This shift delivers secure, context-aware experiences, lower operating costs, and verifiable SLAs that drive adoption and growth

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing shift toward cloud and digital transformation

-

5G and IoT expansion

Level

-

Stringent privacy and compliance regulations

-

Integration complexity and cost barriers

Level

-

Growing demand for real-time data and services

-

Monetization of Network-as-a-Service

Level

-

Scalability & SLA assurance

-

Rising complexity of API security and cyber threats

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rise of SDN/NFV technologies

The rise of Software Defined Networking (SDN) and Network Functions Virtualization (NFV) is one of the drivers for the network API market. These technologies decouple hardware from software, allowing operators to deliver programmable, cloud-native infrastructure that supports API exposure at scale. APIs for policy control, analytics, and performance are becoming viable only because of SDN/NFV’s flexibility, enabling operators to abstract complex network functions and present them to developers as easily consumable APIs. This shift is already evident in deployments where operators are leveraging SDN-based cores and virtualized edge nodes to launch CAMARA-compliant APIs for enterprises in IoT, autonomous mobility, and media distribution. As more networks transition to cloud-native architectures, the programmability unlocked by SDN/NFV will accelerate API adoption across all verticals

Restraint: Integration complexity and cost barriers

Enterprise-grade network APIs must interoperate with existing OSS/BSS systems, cloud platforms, and legacy hardware. This integration is non-trivial: each API often requires custom adapters, detailed documentation, and backend changes. The Ericsson white paper notes that even if a uniform API existed, developers would still face technical integration with each service provider and would need to establish separate commercial relationships with them. These hurdles indicate that building a solution using multiple network APIs can involve months of engineering work per operator. This complexity translates into higher development costs. In practice, carriers launching network APIs often need to build extensive developer portals and support systems. Small and medium enterprises may find the resource requirements prohibitive. Even large telecoms partner with API aggregators or join standards bodies such as GSMA Open Gateway to reduce friction. Furthermore, a shortage of skilled developers adds to the restraint, considering the complexity of telecom protocols. This talent gap can delay projects and increase costs. All these factors, including technical integration overhead, tooling costs, and staffing, make API initiatives expensive.

Opportunity: Monetization of Network-as-a-Service

The growing adoption of Network-as-a-Service (NaaS) presents a significant opportunity in the network API market, particularly as enterprises demand agile, programmable access to network functionalities. NaaS enables service providers to expose network resources, such as bandwidth, latency control, and security policies, through APIs on a pay-per-use or subscription basis. This shift from static, hardware-defined infrastructure to API-driven network services allows telecom operators and hyperscalers to diversify revenue streams by offering on-demand, customizable network capabilities to developers, cloud-native businesses, and vertical enterprises.

Challenge: Rising complexity of API security and cyber threats

As network APIs expose more sensitive network functions, they increasingly attract attention from cyber attackers. Securing these APIs is no longer a secondary concern but a central challenge. Unlike traditional APIs, network APIs facilitate real-time data exchange, control signaling, and session persistence, making them highly attractive attack vectors. Implementing robust security protocols is complex, as it involves authentication tokens, encrypted communications, intrusion detection, and rate-limiting mechanisms. The threat landscape is highly dynamic, with new vulnerabilities constantly emerging, requiring operators to maintain an evolving security posture. This is further complicated by the distributed nature of modern networks, which often span on-premises telecom infrastructure, cloud environments, and edge platforms. Each integration point introduces potential risks. Ensuring end-to-end protection across such environments is difficult, particularly for smaller operators who may lack resources to deploy enterprise-grade defenses. Moreover, every API release demands extensive security audits, delaying product timelines

Network API Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Development of programmable network APIs for SD-WAN orchestration, enabling multi-vendor policy automation, dynamic path selection, and real-time telemetry. | Faster deployment cycles, centralized policy control, improved application performance, reduced operational complexity |

|

Deployment of MagentaBusiness API platform for enterprise customers focusing on Quality-on-Demand services for teleoperated driving, device location tracking for logistics optimization, and roaming status verification for fraud prevention | Enhanced supply chain resilience, reduced operational costs, improved sustainability outcomes through precise location tracking, fraud mitigation, and guaranteed low-latency performance for safety-critical applications |

|

Establishment of Network-as-a-Platform (NaaP) through centralized API catalog offering SIM swap detection for financial institutions, identity verification services, and network performance monitoring for industrial automation applications | Stronger competitive positioning, improved productivity through API reuse, reduced operational risks via automated fraud detection, enhanced supply chain resilience, and measurable ROI from automation initiatives |

|

Integration of NetAware Platform with 5G network APIs for manufacturing clients, enabling real-time equipment monitoring, predictive maintenance automation, and enhanced security protocols across industrial IoT networks and private 5G infrastructure | Enhanced supply chain resilience, reduced operational costs through predictive maintenance, improved sustainability outcomes via automated optimization, and stronger security posture for industrial operations |

|

Development of CAMARA-compliant API marketplace through Aduna joint venture offering standardized location services for fintech applications, quality-of-service APIs for healthcare applications, and edge computing capabilities for autonomous vehicle systems | Increased R&D efficiency through standardized APIs, transparent idea evaluation across partners, faster commercialization of innovative services, and enhanced customer engagement through personalized location-based applications |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The network API market is highly competitive and comprises many vendors who offer solutions to a specific or niche market segment. Several changes have occurred in the market in recent years. The vendors are involved in various partnerships and collaborations to develop comprehensive solutions that address a wide range of requirements.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Network API Market, By API Type

The identity API type constitutes a critical category within the network API ecosystem, focusing on authentication, verification, and identity management capabilities that ensure secure access and protect against fraudulent activities across digital platforms and services. This comprehensive API segment includes number verification APIs that validate phone numbers and mobile identities without requiring SMS-based two-factor authentication, KYC (Know Your Customer) match APIs that streamline identity verification processes by cross-referencing user-provided information with authoritative databases, digital identity verification APIs that authenticate users through government-issued documents and biometric verification, and multi-factor authentication APIs that enhance security through layered verification mechanisms. These APIs are driving significant growth in the network API market by addressing the escalating challenges of digital fraud, identity theft, and security breaches that cost organizations billions of dollars annually while simultaneously improving user experience through streamlined authentication processes. The increasing digitization of financial services, the expansion of e-commerce platforms, and the growing sophistication of cyber threats have created substantial demand for robust identity verification solutions that can operate in real-time without compromising user convenience.

REGION

North America is estimated to account for the largest market share during the forecast period

The North American network API market is rapidly expanding, driven by enterprise adoption of edge computing and cloud-native architecture, and demand for secure API-based network programmability. The US leads the region, accounting for the majority of the spend on network APIs, with strong enterprise and hyperscale data centers integrating APIs to manage network visibility, load balancing, and network orchestration. A rising focus on integrating Wi-Fi, SD-WAN, and edge services through programmable APIs is boosting adoption. North America is a leading region in the network API market, driven by its advanced telecommunications infrastructure, particularly the maturity of 5G standalone (SA) core networks. The region benefits from a large developer community, with approximately 180,000 active API developers contributing to a 37% increase in API-based applications in 2023.

Network API Market: COMPANY EVALUATION MATRIX

In the network API market matrix, Ericsson (Star) leads with a strong market presence and wide product portfolio, helping organizations identify growth opportunities, build innovation roadmaps, and scale new business models. T-Mobile (Pervasive player) is gaining traction as it streamlines idea capture, evaluation, and execution, enabling organizations to accelerate innovation, reduce risks, and maximize ROI.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.46 Billion |

| Market Forecast in 2030 (value) | USD 21.67 Billion |

| Growth Rate | CAGR of 22.3% from 2025–2030 |

| Years Considered | 2019–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD) Million/Billion |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

WHAT IS IN IT FOR YOU: Network API Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|

RECENT DEVELOPMENTS

- June 2025 : Nokia signed a multi-year SD-WAN deal with Telefónica to transform enterprise connectivity using Nuage Networks. The deployment leverages Nuage SD-WAN to deliver scalable, policy-driven networking across Telefónica’s enterprise customer base.

- May 2025 : Fortinet expanded its collaboration with Google Cloud to offer secure SD-WAN connectivity via Google Distributed Cloud Edge, targeting high-compliance sectors. This allows Fortinet SD-WAN users to directly connect and secure edge workloads across distributed cloud environments.

- April 2025 : Aryaka partnered with Orange Business to deliver co-managed SD-WAN services across Europe and Asia, accelerating enterprise deployments. The partnership expands Aryaka’s SD-WAN reach and simplifies deployments for global enterprises seeking managed connectivity.

- March 2025 : HPE acquired Axis Security to integrate zero-trust capabilities into its Aruba SD-WAN solutions, strengthening its SASE strategy. This enhances Aruba’s SD-WAN by embedding secure remote access, critical for hybrid workforce models and distributed edge environments.

- February 2025 : Cato Networks raised USD 150 million to scale its global cloud-native SD-WAN and SASE backbone, with a focus on mid-market enterprises. The funding supports infrastructure expansion and product innovation in Cato’s all-in-one SD-WAN and security-as-a-service platform.

Table of Contents

Methodology

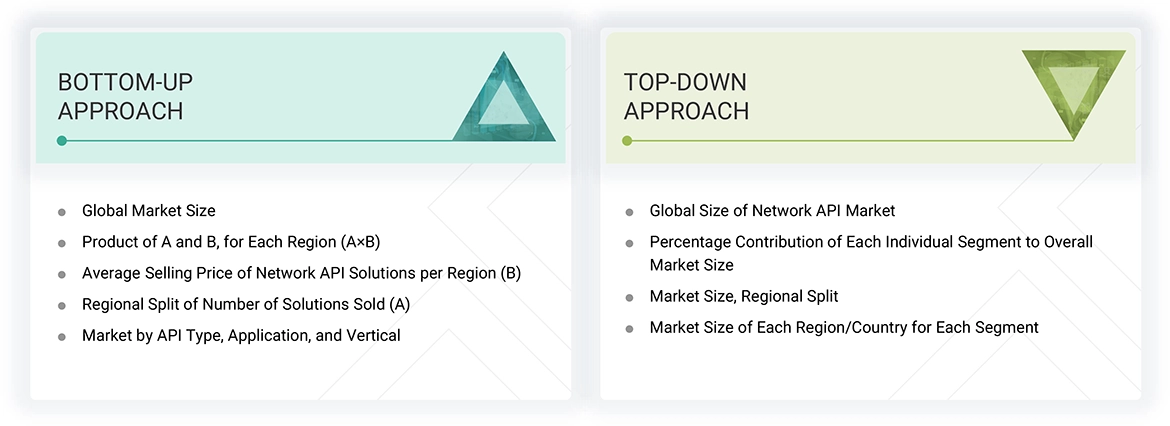

This research study involved four major activities in estimating the network API market size. Exhaustive secondary research was carried out to collect important information about the market and peer markets. The next step involved validating these findings and assumptions and sizing them with the help of primary research with industry experts across the value chain. The top-down and bottom-up approaches were used to estimate the market size. After the market breakdown, data triangulation was utilized to estimate the sizes of segments and sub-segments.

Secondary Research

The revenue generated by companies providing network API solutions to different end users was evaluated using secondary data from both paid and unpaid sources. This process involved analyzing the product portfolios of major companies in the industry and assessing their performance and quality to rate them accordingly. In the secondary research process, various sources were referred to to identify and collect information for the study. These included annual reports, press releases, investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Secondary research was mainly used to obtain critical information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation based on the industry trends to the bottom-most level, regional markets, and key developments from market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from network API solutions vendors, system integrators, professional and managed service providers, industry associations, independent consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from platforms and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use network API solutions, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their use of network API solutions which is expected to affect the overall network API market growth.

Note: Tier 1 companies have revenues over USD 1 billion, Tier 2 companies have revenues between

USD 500 million and 1 billion, and Tier 3 companies have revenues less than USD 500 million. Other

designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the network API market. These methods were also used extensively to estimate the size of various subsegments in the market.

Network API Market : Top-Down and Bottom-Up Approach

Data Triangulation

The network API market was split into several segments and sub-segments after determining the overall market size from the above estimation process. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were used, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. The network API market size was validated using top-down and bottom-up approaches.

Market Definition

Network APIs are programming interfaces that allow developers and third-party applications to access and program the functions, data, and capabilities of network infrastructure. These APIs abstract the complexity of the underlying network, transforming it from a closed system into an open, programmable platform. This enables developers to build new applications and services that are deeply integrated with the network. The market includes a variety of API types that provide access to these capabilities, such as device status, edge, identity, location, network performance, and others (policy control, security, analytics, etc.).

Stakeholders

- Cloud Service Providers

- API Developers and Providers

- Edge & CDN Providers

- Security Vendors

- API Management Vendors

- Software Developers and Application Providers

- Managed Service Providers

- Regulatory Bodies

Report Objectives

- To determine and forecast the network API market by API type, application, vertical, and region from 2025 to 2030, and analyze various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa (MEA)

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key market players, provide a comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and research and development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Geographic Analysis as per Feasibility

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the Middle East & African market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What is the definition of network API?

Network APIs are programming interfaces that allow developers and third-party applications to access and program the functions, data, and capabilities of network infrastructure. These APIs abstract the complexity of the underlying network, transforming it from a closed system into an open, programmable platform. This enables developers to build new applications and services that are deeply integrated with the network.

What is the size of the network API market?

The network API market is projected to grow from USD 1.96 billion in 2025 to USD 6.13 billion by 2030, at a CAGR of 25.7% during the forecast period.

What are the major drivers of the network API market?

Major drivers of the network API market include the increasing shift toward cloud and digital transformation, 5G and IoT expansion, and the rise of SDN/NFV technologies.

Which are the key players operating in the network API market?

The major players in the network API market include Ericsson (Sweden), Nokia (Finland), Cisco (US), Microsoft (US), T-Mobile (US), AT&T (US), Orange (France), Deutsche Telekom (Germany), Vodafone (UK), Telefonica (Spain), Singtel (Singapore), Telstra (Australia), Huawei (China), Oracle (US), Bharti Airtel (India), Infobip (Croatia), Kentik (US), Obkio (Canada), NetBeez (US), Graphiant (US), Alkira (US), Shabodi (Canada), LotusFlare (US), and PhoenixNAP (US). These players have adopted various growth strategies, such as partnerships, agreements, and collaborations, product launches/enhancements, and acquisitions, to expand their footprint in the network API market.

What are the opportunities for new entrants in the network API market?

Opportunities in the network API market include monetization of 5G capabilities, enterprise adoption, edge computing integration, developer ecosystem, and cross-industry collaborations.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Network API Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Network API Market