Nerve Monitoring System Market by Product (Nerve Monitor, Electrode, Probe, Accessories), Technology (EEG, EMG, EP, ECOG), Application (Neurosurgery, ENT Surgery, Spine Surgery, Cardiovascular Surgery), End User (Hospital, ASC) - Global Forecasts to 2022

[127 Pages Report] Rising use of nerve monitoring in trauma cases to drive the market demand for nerve monitoring system to reach USD 1.45 billion by 2022

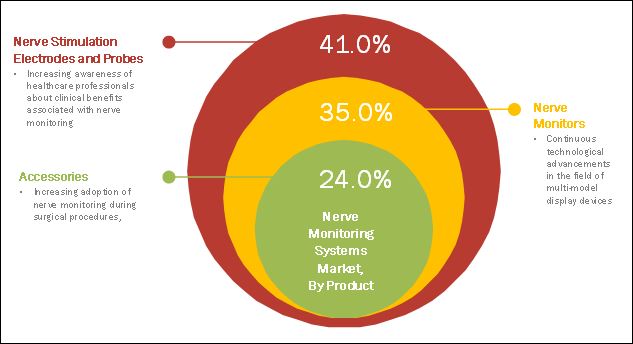

The global nerve monitoring systems market has been segmented on the basis of product, technology, application, end user, and region. Based on product, the nerve stimulation electrodes and probes segment commanded the largest share of the global nerve monitoring system market in 2017. This large market share is mainly attributed to factors such as increasing awareness of healthcare professionals about clinical benefits associated with nerve monitoring, increasing number of complex & critical surgeries worldwide, and ongoing technological advancements in the field of nerve stimulation & monitoring.

The global nerve monitoring systems market is estimated to reach USD 1.45 billion by 2022; growing at a CAGR of 4.9% during the forecast period. The expansion in target patient population, growing availability of medical reimbursement for nerve monitoring procedures, and rising demand for surgical intervention among trauma cases across the globe are some key factors propelling the growth of nerve monitoring systems industry.

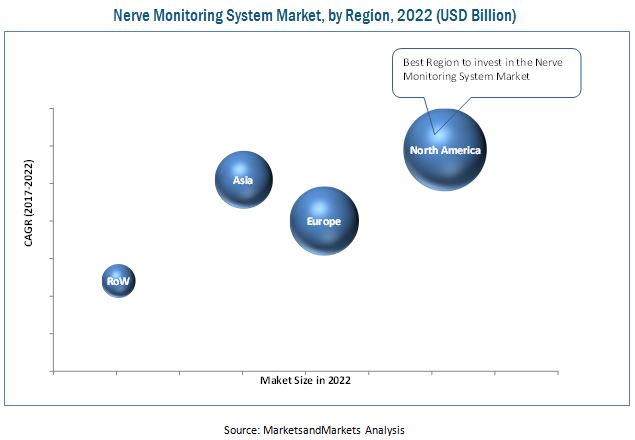

In 2016, North America held the largest share of the market and registers the highest growth rate during the forecast period. The growth of this North America market is attributed to the significant adoption of nerve monitoring owing to the growing number of clinical trials that have proved its therapeutic efficacy in surgeries and the availability of medical reimbursement in the US. Furthermore, the market growth is attributed to large patient population for target diseases, strong presence of device manufacturers in the region, and the availability of significant R&D investments to support nerve monitoring product development.

In 2016, Medtronic (Ireland) held the leading position in the market. Over the past three years, the company has focused on the R&D activities for the product innovation and increased its R&D expenditure for further growth in the industry. NuVasive (US), Nihon Kohden (Japan), Bovie Medical (US), Natus Medical (US), Checkpoint Surgical (US), Magstim (UK), Inomed (Germany), Erbe Elektromedizin (Germany), Dr. Langer Medical (Germany), EMS Handels (Austria), Neurovision Medical (US), and Halyard Health (Georgia), were few other key players operating in the market.

Target Audience

- Nerve monitoring product manufacturers

- Nerve monitoring product suppliers and distributors

- Contract manufacturers

- Healthcare service providers [including hospitals, surgical centers, and ambulatory surgical centers (ASCs)]

- Research laboratories and academic institutes

- Clinical research organizations (CROs)

- Government regulatory authorities

- Independent associations and non-government organizations

- National and international regulatory authorities

- Market research firms

Scope of the report

This research report categorizes the nerve monitoring systems market into the following segments:

Nerve Monitoring Systems Market, by Product

- Nerve Monitors

- Nerve Stimulation Electrodes and Probes

- Accessories

Nerve Monitoring Systems Market, by Technology

- Electromyography (EMG)

- Electroencephalography (EEG)

- Electrocorticography (ECOG)

- Evoked Potential (EP)

Nerve Monitoring Systems Market, by Application

- Neurosurgery

- Spine Surgery

- ENT Surgery

- Cardiovascular Applications

- Other Applications

Nerve Monitoring Systems Market, by Application

- Hospitals and Surgical Centers

- Ambulatory Surgical Centers

Nerve Monitoring Systems Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Rest of Europe (RoE)

- Asia-Pacific

- Japan

- China

- India

- Rest of Asia Pacific (RoAPAC)

- Rest of the World

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for nerve monitoring systems market report:

Geographical Analysis

- Further breakdown of Rest of Europe market into Italy, Spain, Russia, and other European Countries

- Further breakdown of the Rest of the World (RoW) nerve monitoring systems market into Latin America, the Middle East, and Africa

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growing demand of nerve stimulation electrodes and probes to drive the global nerve monitoring systems market to reach USD 1.45 billion by 2022<

Nerve monitoring procedures utilize dedicated stimulation probes or electrodes; those are hand-held, single-use devices to locate and/or stimulate local nerve endings. These devices provide an electrical impulse to stimulate motor nerves or muscle to evaluate nerve integrity. Moreover, nerve stimulation electrodes & probes are used during various surgeries, such as parotid surgeries, orthopedic trauma surgeries, head & neck surgeries, and neurosurgery.

The nerve stimulation electrodes and probes market is projected to reach 42.4% of overall nerve monitoring systems market by 2022, largely due to the increasing awareness of healthcare professionals about clinical benefits associated with nerve monitoring (such as improved patient safety & surgical accuracy, decreased post-operative trauma, and early patient recovery), increasing number of complex & critical surgeries worldwide (coupled with growing number of target patient population base). Rising spinal cord injuries across the world, ongoing technological advancements in the field of nerve stimulation & monitoring, and rising adoption of intraoperative nerve monitoring during surgeries are likely to propel further growth of the nerve monitoring systems during the forecast period.

Market Dynamics

Increasing number of complex surgical procedures to drive the nerve monitoring systems industry across developed countries during the forecast period

Hospitals & Surgical Centres

With increasing number of complex diagnostic and surgical procedures performed in hospitals coupled with growing number of hospitals and surgical centers across developing countries, nerve monitoring systems are increasingly being utilized. The number of nerve monitoring procedures performed in hospitals and surgical centers is growing is further attributed to evolving reimbursement scenario for nerve monitoring procedures across developed countries

Ambulatory Surgical Centres

Ambulatory surgical centers (ASCs) are healthcare facilities wherein selected surgical and medical services are provided outside the hospital setting. Positive demand growth of nerve monitoring systems in ASCs is driven by the increasing number of reimbursed medical procedures under the ASC payment system in the US and rising number of minimally invasive surgeries performed among ASCs.

Key Questions

- What are the business growth strategies adopted by key market players to maintain their market position across key geographies?

- What is the existing developmental pipeline of major nerve monitoring systems among Medtech manufacturers as well as academia?

- Growing number of trauma based surgical procedures is a key trend in clinical management. What impact trauma based surgical procedures will have on nerve monitoring systems market during the forecast period?

- What alternative technologies/therapies are currently being used for nerve monitoring worldwide? What competition they pose for key nerve monitoring systems market players.

The global nerve monitoring system market is projected to reach USD 1.45 Billion by 2022 from USD 1.14 Billion in 2017, at a CAGR of 4.9% during the forecast period. Increased target patient population, clinical benefits associated with nerve monitoring procedures, and the rising use of nerve monitoring in trauma cases are factors expected to drive the demand for nerve monitoring products during the study period.

This report broadly segments the nerve monitoring system market into product, technology, application, and end user.

On the basis of product, the market is categorized into nerve stimulation electrodes and probes, nerve monitors, and accessories. In 2017, nerve stimulation electrodes and probes segment is expected to account for the largest share. The large share of this segment is attributed to the increasing awareness about the clinical benefits associated with nerve monitoring, increasing number of complex & critical surgeries worldwide, rising spinal cord injuries across the world, and ongoing technological advancements in the field of nerve stimulation & monitoring.

Based on technology, the market is segmented into electromyography, electroencephalography, electrocorticography, and evoked potential. Electromyography (EMG) segment is expected to be the fastest-growing segment of the market during the forecast period. Electromyography is used for analysis, evaluation, and recording of electrical activity of skeletal muscles and motor nerve cells associated with them. Growing availability of reimbursements for EMG-assisted surgical procedures in developed countries and the significant use of EMG nerve monitoring for intraoperative applications are expected to drive the growth of the electromyography segment during the forecast period.

Based on application, the nerve monitoring system market is segmented into cardiovascular, neurosurgery, spine surgery, ENT surgery, and other applications. The ENT surgery segment is expected to grow at the highest CAGR in the nerve monitoring system market. The rising number of target ENT surgeries across the globe (coupled with the growing awareness of healthcare professionals), increasing clinical data for nerve monitoring procedures for thyroid surgeries, and availability of reimbursement are expected to drive the growth of this segment during the forecast period.

Based on end user, the nerve monitoring systems market is segmented into hospitals and surgical centers, and ambulatory surgical centers. The hospitals and surgical centers segment is projected to be the fastest-growing end-user segment of the nerve monitoring system market. High growth rate of the hospitals and surgical centers segment can be attributed to factors such as increasing number of complex surgical procedures performed there, rising number of diagnostic and surgical procedures carried out at hospitals, and growing number of hospitals and surgical centers across developing countries (such as India, China, Poland, Mexico, and South Africa)

The report covers the nerve monitoring systems market across four major geographies, namely, North America, Europe, Asia, and the Rest of the World (RoW). North America is expected to command the largest share of the market in 2017 due to the significant adoption of nerve monitoring owing to the growing number of clinical trials that have proved its therapeutic efficacy in surgeries.

The major players of the market are Medtronic (Ireland), NuVasive (US), Nihon Kohden (Japan), Bovie Medical (US), and Natus Medical (US), Checkpoint Surgical (US), Magstim (UK), Inomed (Germany), Erbe Elektromedizin (Germany), Dr. Langer Medical (Germany), EMS Handels (Austria), Neurovision Medical (US), and Halyard Health (Georgia).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation Methodology

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Nerve Monitoring Systems: Market Overview

4.2 Nerve Monitoring Systems Market Size, By Product

4.3 Geographic Analysis: Nerve Monitoring Systems Market in APAC, By Technology and Country

4.4 Nerve Monitoring Systems Market, By Application

4.5 Nerve Monitoring Systems Market, By End User

4.6 Geographic Snapshot of the Nerve Monitoring Systems Market

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Market Drivers

5.2.1.1 Expansion of Target Patient Base

5.2.1.2 Clinical Benefits Associated With Nerve Monitoring Procedures

5.2.1.3 Rising Use of Nerve Monitoring in Trauma Cases

5.2.1.4 Growing Availability of Medical Reimbursements for Nerve Monitoring

5.2.2 Market Restraints

5.2.2.1 Limited Awareness About Nerve Monitoring Among Healthcare Professionals

5.2.3 Market Opportunities

5.2.3.1 Increased Clinical Studies in the Field of Nerve Monitoring

5.2.3.2 Emerging Markets

6 Nerve Monitoring Systems Market, By Product (Page No. - 40)

6.1 Introduction

6.2 Nerve Monitors

6.3 Nerve Stimulation Electrodes and Probes

6.4 Accessories

7 Nerve Monitoring System Market, By Technology (Page No. - 50)

7.1 Introduction

7.2 Electromyography (EMG)

7.3 Electroencephalography (EEG)

7.4 Electrocorticography (ECOG)

7.5 Evoked Potential (EP)

8 Nerve Monitoring Systems Market, By Application (Page No. - 56)

8.1 Introduction

8.2 Neurosurgery

8.3 Spine Surgery

8.4 ENT Surgery

8.5 Cardiovascular Applications

8.6 Other Applications

9 Global Nerve Monitoring System Market, By End User (Page No. - 64)

9.1 Introduction

9.2 Hospitals and Surgical Centers

9.3 Ambulatory Surgical Centers

10 Nerve Monitoring Systems Market, By Region (Page No. - 70)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 UK

10.3.3 France

10.3.4 Rest of Europe (RoE)

10.4 Asia Pacific (APAC)

10.4.1 Japan

10.4.2 China

10.4.3 India

10.4.4 Rest of Asia Pacific (RoAPAC)

10.5 Rest of the World

11 Competitive Landscape (Page No. - 93)

11.1 Overview

11.2 Nerve Monitoring Systems Market Share , By Key Players

11.3 Competitive Scenario

11.3.1 Product Launches

11.3.2 Mergers and Acquisitions

11.3.3 Expansions

11.3.4 Relocation

12 Company Profiles (Page No. - 97)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.1 Medtronic

12.2 Nuvasive

12.3 Nihon Kohden

12.4 Bovie Medical

12.5 Natus Medical

12.6 Checkpoint Surgical

12.7 Magstim

12.8 Inomed

12.9 ERBE Elektromedizin

12.10 Neurovision Medical

12.11 Halyard Health

12.12 EMS Handels Gesellschaft

12.13 Dr. Langer Medical

12.14 Xavant Technology

12.15 Axon Healthcare

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 118)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (60 Tables)

Table 1 Key Reimbursement Codes for Nerve Monitoring During Surgical Intervention

Table 2 Global Nerve Monitoring Systems Market, By Product, 20152022 (USD Million)

Table 3 Nerve Monitoring Systems Market for Nerve Monitors, By Region, 20152022 (USD Million)

Table 4 North America: Nerve Monitoring System Market for Nerve Monitors, By Country, 20152022 (USD Million)

Table 5 Europe: Nerve Monitoring Systems Market for Nerve Monitors, By Country/Region, 20152022 (USD Million)

Table 6 Asia Pacific: Nerve Monitoring Systems Market for Nerve Monitors, By Country/Region, 20152022 (USD Million)

Table 7 Nerve Monitoring Market for Nerve Stimulation Electrodes and Probes, By Region, 20152022 (USD Million)

Table 8 North America: Nerve Monitoring Systems Market for Nerve Stimulation Electrodes and Probes, By Country, 20152022 (USD Million)

Table 9 Europe: Nerve Monitoring Systems Market for Nerve Stimulation Electrodes and Probes, By Country/Region, 20152022 (USD Million)

Table 10 Asia Pacific: Nerve Monitoring Systems Market for Nerve Stimulation Electrodes and Probes, By Country/Region, 20152022 (USD Million)

Table 11 Nerve Monitoring Market for Accessories, By Region, 20152022 (USD Million)

Table 12 North America: Nerve Monitoring Systems Market for Accessories, By Country, 20152022 (USD Million)

Table 13 Europe: Nerve Monitoring System Market for Accessories, By Country/Region, 20152022 (USD Million)

Table 14 Asia Pacific: Nerve Monitoring Systems Market for Accessories, By Country/Region, 20152022 (USD Million)

Table 15 Nerve Monitoring Systems Market, By Technology, 20152022 (USD Million)

Table 16 Nerve Monitoring Systems Market for Electromyography, By Region, 20152022 (USD Million)

Table 17 Nerve Monitoring System Market for Electroencephalography, By Region, 20152022 (USD Million)

Table 18 Nerve Monitoring Systems Market for Electrocorticography, By Region, 20152022 (USD Million)

Table 19 Nerve Monitoring Systems Market for Evoked Potential, By Region, 20152022 (USD Million)

Table 20 Global Nerve Monitoring System Market, By Application, 20152022 (USD Million)

Table 21 Nerve Monitoring Systems Market for Neurosurgery, By Region, 2015-2022 (USD Million)

Table 22 Nerve Monitoring Systems Market for Spinal Surgery, By Region, 2015-2022 (USD Million)

Table 23 Nerve Monitoring Systems Market for ENT Surgery, By Region, 2015-2022 (USD Million)

Table 24 Nerve Monitoring System Market for Cardiovascular Applications, By Region, 2015-2022 (USD Million)

Table 25 Nerve Monitoring Systems Market for Other Applications, By Region, 2015-2022 (USD Million)

Table 26 Nerve Monitoring Systems Market, By End User, 20152022 (USD Million)

Table 27 Nerve Monitoring Systems Market for Hospitals and Surgical Centers, By Region, 20152022 (USD Million)

Table 28 Nerve Monitoring System Market for Hospitals and Surgical Centers, By North America, 20152022 (USD Million)

Table 29 Nerve Monitoring Systems Market for Ambulatory Surgical Centers, By Region, 20152022 (USD Million)

Table 30 Nerve Monitoring Systems Market for Ambulatory Surgical Centers, By North America, 20152022 (USD Million)

Table 31 Nerve Monitoring Systems Market, By Region, 20152022 (USD Million)

Table 32 North America: Nerve Monitoring Systems Market, By Country, 20152022 (USD Million)

Table 33 North America: Nerve Monitoring Systems Market, By Product, 20152022 (USD Million)

Table 34 North America: Nerve Monitoring System Market, By Technology, 20152022 (USD Million)

Table 35 North America: Nerve Monitoring Systems Market, By Application, 20152022 (USD Million)

Table 36 North America: Nerve Monitoring Systems Market, By End User, 20152022 (USD Million)

Table 37 US: Nerve Monitoring Systems Market, By Product, 20152022 (USD Million)

Table 38 Canada: Nerve Monitoring Systems Market, By Product, 20152022 (USD Million)

Table 39 Europe: Nerve Monitoring Systems Market, By Country, 20152022 (USD Million)

Table 40 Europe: Nerve Monitoring Systems Market, By Product, 20152022 (USD Million)

Table 41 Europe: Nerve Monitoring Systems Market, By Technology, 20152022 (USD Million)

Table 42 Europe: Nerve Monitoring Systems Market, By Application, 20152022 (USD Million)

Table 43 Europe: Nerve Monitoring System Market, By End User, 20152022 (USD Million)

Table 44 Germany: Nerve Monitoring Systems Market, By Product, 20152022 (USD Million)

Table 45 UK: Nerve Monitoring Systems Market, By Product, 20152022 (USD Million)

Table 46 France: Nerve Monitoring Systems Market, By Product, 20152022 (USD Million)

Table 47 RoE: Nerve Monitoring Systems Market, By Product, 20152022 (USD Million)

Table 48 Asia Pacific: Nerve Monitoring System Market, By Country, 20152022 (USD Million)

Table 49 Asia Pacific: Nerve Monitoring Systems Market, By Product, 20152022 (USD Million)

Table 50 Asia Pacific: Nerve Monitoring System Market, By Technology, 20152022 (USD Million)

Table 51 Asia Pacific: Nerve Monitoring Systems Market, By Application, 20152022 (USD Million)

Table 52 Asia Pacific: Nerve Monitoring Systems Market, By End User, 20152022 (USD Million)

Table 53 Japan: Nerve Monitoring Systems Market, By Product, 20152022 (USD Million)

Table 54 China: Nerve Monitoring Systems Market, By Product, 20152022 (USD Million)

Table 55 India: Nerve Monitoring Systems Market, By Product, 20152022 (USD Million)

Table 56 RoAPAC: Nerve Monitoring Systems Market, By Product, 20152022 (USD Million)

Table 57 RoW: Nerve Monitoring System Market, By Product, 20152022 (USD Million)

Table 58 RoW: Nerve Monitoring Systems Market, By Technology, 20152022 (USD Million)

Table 59 RoW: Nerve Monitoring Systems Market, By Application, 20152022 (USD Million)

Table 60 RoW: Nerve Monitoring System Market, By End User, 20152022 (USD Million)

List of Figures (34 Figures)

Figure 1 Global Nerve Monitoring Systems Market: Research Methodology Steps

Figure 2 Research Design

Figure 3 Breakdown of Primaries

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Nerve Monitoring Systems Market, By Product, 2017

Figure 8 Nerve Monitoring System Technology Market, By Region (USD Million), 2017

Figure 9 Nerve Monitoring Systems Market, By Application, 2017

Figure 10 Nerve Monitoring Systems Market, By End User, 2017

Figure 11 North America is Estimated to Account for the Largest Share in 2017

Figure 12 Growing Availability of Medical Reimbursements for Nerve Monitoring is Driving the Growth of the Market

Figure 13 Nerve Stimulation Electrodes and Probes Will Continue to Dominate the Market in 2022

Figure 14 Electroencephalography Segment to Dominate the APAC Market in 2017

Figure 15 Neurosurgery Segment to Dominate the Nerve Monitoring Systems Market During the Forecast Period

Figure 16 Hospitals and Surgical Centers to Dominate the Nerve Monitoring Systems Market, During the Forecast Period

Figure 17 North America to Register the Highest CAGR During the Forecast Period

Figure 18 Nerve Monitoring Market: Drivers, Restraints, & Opportunities

Figure 19 Annual Healthcare Expenditure (%GDP): Developed vs Developing Countries (20102015)

Figure 20 Nerve Stimulation Electrodes and Probes to Witness the Highest Growth During the Forecast Period

Figure 21 Electromyography Segment to Register the Highest CAGR in the Nerve Monitoring System Market During the Forecast Period

Figure 22 ENT Surgery Segment to Witness the Highest Growth in the Nerve Monitoring Systems Market During the Forecast Period

Figure 23 Hospitals and Surgical Centers to Witness the Highest Growth Rate in the Nerve Monitoring Systems Market During the Forecast Period

Figure 24 North America: Nerve Monitoring Systems Market Snapshot

Figure 25 Europe: Nerve Monitoring System Market Snapshot

Figure 26 Asia Pacific: Nerve Monitoring Systems Market Snapshot

Figure 27 Key Developments Adopted By Players in the Nerve Monitoring Systems Market Between 2014 and 2017

Figure 28 Nerve Monitoring Systems Market Share, By Players, 2016

Figure 29 Medtronic: Company Snapshot

Figure 30 Nuvasive: Company Snapshot

Figure 31 Nihon Kohden: Company Snapshot

Figure 32 Bovie Medical: Company Snapshot

Figure 33 Natus Medical: Company Snapshot

Figure 34 Halyard Health: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Nerve Monitoring System Market