Near infrared Imaging Market: Growth, Size, Share, and Trends

Near-infrared Imaging Market by Product (Imaging System, Probe, Dye (Organic, Nanoparticle)), Procedure (Cancer, Cardio, GI, OBGYN), Application (Preclinical, Clinical, Medical), End User (Hospital, Pharma, Research Lab) & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The near-infrared imaging market is projected to reach USD 2.08 billion by 2030 from USD 1.25 billion in 2025, at a CAGR of 10.6% from 2025 to 2030. The Near-Infrared (NIR) Imaging Market is experiencing significant acceleration as healthcare systems transition toward precision and image-guided care. NIR imaging, operating typically in the 650–900 nm range, enables superior tissue penetration and minimal background interference compared to visible light imaging—making it indispensable in intraoperative visualization, tumor detection, and preclinical pharmacokinetic studies. Market growth is driven by the expanding use of fluorescence-guided surgery, increasing deployment of hybrid NIR/visible cameras, and rapid integration of real-time analytics and AI-based quantification software. With wider acceptance in oncology, cardiovascular, and neurological procedures, NIR imaging has evolved from a research tool to a mainstream clinical adjunct supporting decision-making during complex surgeries.

KEY TAKEAWAYS

- The North America NIR market accounted for a 42.8% revenue share in 2024.

- By product type, the devices segment accounted for the largest share of 55.0% in 2024.

- By Procedure type, the cancer surgeries segment accounted for a 25.7% revenue share in 2024.

- By Application, the clinical imaging segment accounted for the largest share of 47.6% in 2024.

- By end-user, the hospitals & surgical clinics segment accounted for a 41.1% revenue share in 2024.

- Company Stryker (US), KARL STORZ SE & Co. KG (Germany), Carl Zeiss Meditec AG (Germany), and PerkinElmer, Inc. (US). were identified as some of the star players in the XYZ market (global), given their strong market share and product footprint.

- Companies EXOSENS (France) , NIRX Medical Technologies, LLC (US) , and Biotium (US), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Several macro- and micro-level trends are converging to transform the NIR imaging landscape. AI-enabled image quantification and machine learning-based segmentation are enhancing intraoperative accuracy and enabling automated identification of anatomical boundaries. Dual-channel NIR fluorescence systems capable of simultaneous visible and NIR visualization are improving surgical precision. Furthermore, advancements in targeted fluorophores—such as ICG derivatives, IRDye 800CW, and tumor-specific probes—are allowing molecular differentiation of malignant and healthy tissues. Miniaturized NIR sensors are enabling point-of-care (POC) and handheld devices for vascular imaging and reconstructive procedures. On the research side, multi-spectral NIR imaging is being combined with PET, MRI, and CT to create high-fidelity hybrid imaging data for drug discovery and translational medicine.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Healthcare providers are witnessing a paradigm shift toward data-driven, preventive, and minimally invasive care—a transition strongly supported by NIR imaging technologies. For hospitals and ambulatory facilities, AI-enabled screening programs are improving early disease detection and surgical planning. Multi-cancer early detection initiatives are increasingly leveraging NIR-based biomarkers for high-risk patient screening. In research and pharma ecosystems, fluorescence lifetime imaging microscopy (FLIM) and molecular tomography using NIR dyes are shortening the drug development cycle by enabling real-time tracking of drug distribution and efficacy. Meanwhile, technological disruptions such as AI-assisted intraoperative visualization, spectral unmixing algorithms, and AI-based noise correction are redefining imaging workflows, allowing clinicians to extract quantitative data for precision therapeutics.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Technological advancements in near-infrared imaging modalities

-

Increasing number of surgical procedures globally

Level

-

High initial capital and operational costs of near-infrared systems

-

Lengthy approval process of near-infrared fluorophores

Level

-

Growth potential for major players in emerging economies

-

Use of blockchain for distribution and storage of medical images

Level

-

Hospital budget cuts

-

Dearth of trained professionals in emerging economies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Technological advancements in near-infrared imaging modalities

The primary growth drivers include the rising incidence of cancer and cardiovascular diseases, the growing preference for image-guided surgeries, and the increasing demand for non-invasive diagnostic techniques. The technological evolution of fluorescence dyes & cameras and government-funded initiatives supporting preclinical and translational research are further propelling market expansion.

Restraint: High initial capital and operational costs of near-infrared systems

The market faces headwinds from high capital costs of NIR imaging systems and limited reimbursement frameworks for fluorescence-guided procedures. Regulatory complexity in approving new contrast agents—due to safety and pharmacokinetic variability—also delays commercialization. In developing markets, low clinician awareness and a lack of standardized training slow adoption. Furthermore, inter-device calibration inconsistencies and software interoperability issues between imaging platforms pose operational challenges for healthcare facilities.

Opportunity: Growth opportunities in emerging countries

Emerging economies like India, China, Brazil, South Korea, Turkey, Russia, and South Africa present significant growth prospects for key players in the near-infrared imaging sector. While cost remains a concern in these developing nations, their vast populations—particularly in India and China—create a sustainable market for imaging devices. With over half of the world’s population living in these countries, they host a large patient demographic. As per GLOBOCAN 2018, Asia reported 8,750,932 cancer cases.

Challenges: Hospital budget cuts

The industry’s key challenges include short half-life and photobleaching of conventional dyes, quantification variability due to tissue scattering, and limited availability of standardized protocols for NIR quantitation. The clinical translation of preclinical imaging data is hindered by interspecies differences in biodistribution, rendering regulatory validation complex. The absence of universal AI-imaging interoperability frameworks and data privacy restrictions further limits scalability. Additionally, procurement cost sensitivity in mid-tier hospitals and the maintenance complexity of NIR platforms restrict penetration outside tertiary centers.

Near Infrared Imaging Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Developing / validating chemical imaging (which often uses NIR) for monitoring the uniformity of blends of active and inactive ingredients during powder mixing (pre-tablet stage) | Detecting issues in blending | Content uniformity early reduces rejects and rework |

|

Build a large database of NIR spectral signatures of its oral medicine tablets, and uses NIR spectra for identification of their tablet product | The ability to test tablets without destroying them, through packaging, quickly | Reduces cost and improves throughput in QC and anti-fraud efforts |

|

Integrates AI-powered imaging with near-infrared imaging navigation systems | Improved tumor resection precision in cancer surgery |

|

Preclinical and translational research integrating imaging modalities with robotics | Acceleration of precision medicine and minimally invasive approaches |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The NIR imaging ecosystem comprises device manufacturers, fluorescent probe developers, AI analytics solution providers, research labs, and clinical end-users. Academic and translational research centers form the innovation hub, developing NIR dyes and quantification algorithms. Hospitals and surgical centers serve as primary adopters, utilizing NIR systems for intraoperative visualization, while pharmaceutical and biotech companies leverage them in drug efficacy and biodistribution studies. Collaborations between imaging OEMs, AI firms, and pharmaceutical companies are increasingly driving ecosystem convergence.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Near IR Imaging Market, By Product

Devices account for over 70% of total market revenue, driven by the widespread use of NIR camera systems, handheld probes, and fluorescence-guided imaging platforms. Hospitals prefer integrated NIR camera systems in laparoscopic and robotic setups for tumor resection, sentinel node mapping, and perfusion assessment. Continuous product launches—such as Stryker’s SPY Elite System or Hamamatsu’s ORCA Flash camera series—underscore the intensity of innovation. Accessory products such as illumination sources, filters, and optics modules form secondary revenue streams supporting OEM expansion.

Near IR Imaging Market, By Procedure

Oncology applications lead the NIR imaging market, accounting for over 45% of total usage, supported by the critical role of fluorescence guidance in breast, colorectal, head & neck, and gynecological surgeries. Adoption of multi-cancer early detection programs is growing through the use of biomarker-based imaging agents. Cardiovascular imaging using NIR for graft patency and perfusion monitoring is a fast-growing secondary segment, while neurology and orthopedics are emerging domains driven by functional and molecular imaging innovations.

Near IR Imaging Market, By Application

The clinical imaging segment dominates the market due to rising adoption in cancer, cardiovascular, and reconstructive surgeries. Surgeons increasingly rely on real-time NIR visualization for lymphatic mapping, vascular patency assessment, and tumor margin identification. Preclinical procedures, though smaller in revenue, are gaining traction in biodistribution studies and drug delivery monitoring, with a high CAGR driven by biopharma R&D investment. The clinical-to-preclinical synergy is enabling translational validation, making the ecosystem increasingly collaborative.

Near IR Imaging Market, By End User

Hospitals and surgical centers dominate the market due to their high procedural volumes and rapid adoption of hybrid visualization systems. Integration of NIR into robotic surgery platforms and operating room automation systems is a key accelerator. Meanwhile, research laboratories and pharmaceutical companies are leveraging NIR imaging in drug screening, biodistribution, and efficacy studies, often using preclinical models. This dual demand—from clinical and research ends—continues to strengthen industry innovation cycles.

REGION

North America to be largest region in global near-infrared imaging market during forecast period

North America commands the largest share of the global market, anchored by strong clinical adoption in the US and Canada, extensive NIH and NSF funding for molecular imaging, and the presence of leading OEMs and probe manufacturers. Regulatory flexibility for fluorescence dyes and robust hospital digital infrastructure facilitate faster clinical translation. The region’s expanding AI-surgery ecosystem, advanced robotic programs, and increasing prevalence of cancer further consolidate its dominance. Europe follows, driven by investments in translational research and favorable reimbursement for oncology-based imaging procedures.

Near Infrared Imaging Market: COMPANY EVALUATION MATRIX

The competitive landscape is moderately consolidated. Stryker, LI-COR, Hamamatsu, Karl Storz, and PerkinElmer dominate the market with broad clinical portfolios, while niche innovators such as Quest Medical Imaging, Shimadzu, Fluoptics, Lumicell, and MediBeacon focus on developing contrast agents and intraoperative imaging platforms. Players are emphasizing multi-channel imaging systems, the expansion of NIR-II wavelength, and AI-powered fluorescence quantification. Strategic collaborations between device OEMs and pharmaceutical companies (e.g., Stryker–Novadaq, PerkinElmer–Bracco) are fostering an integrated ecosystem for the co-development of probes and devices. M&A activities remain strong as firms seek to combine imaging hardware expertise with digital and reagent capabilities.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.11 Billion |

| Market Forecast in 2030 (Value) | USD 2.07 Billion |

| Growth Rate | CAGR of 10.6% from 2025-2030 |

| Years Considered | 2023 - 2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: Near Infrared Imaging Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Medical Device OEM |

|

|

| Hospital Healthcare Provider |

|

|

| Imaging Software Manufacturer |

|

|

RECENT DEVELOPMENTS

- September 2024 : ZEISS Medical Technology unveiled its latest Robotic Visualization System at the Congress of Neurological Surgeons (CNS) for use in complex surgical procedures across neurosurgery and other surgical disciplines.

- April 2024 : LI-CORbio launched the Odyssey F Imaging Systems, next-generation biomolecular imagers designed for faster scans, high data fidelity, and expanded assay versatility. Available in 3- or 10-channel models, they support multiplexing in both visible and near-infrared (NIR) ranges, enabling reliable, quantitative research with unmatched speed and confidence.

- October 2022 : Carl Zeiss Meditec partnered with the European Association of Neurosurgical Societies (EANS) to seek support for the training and continued education of neurosurgical specialists, foster the exchange of knowledge between users and medical technology manufacturers, and drive scientific advancement in the field of neurosurgery.

Table of Contents

Methodology

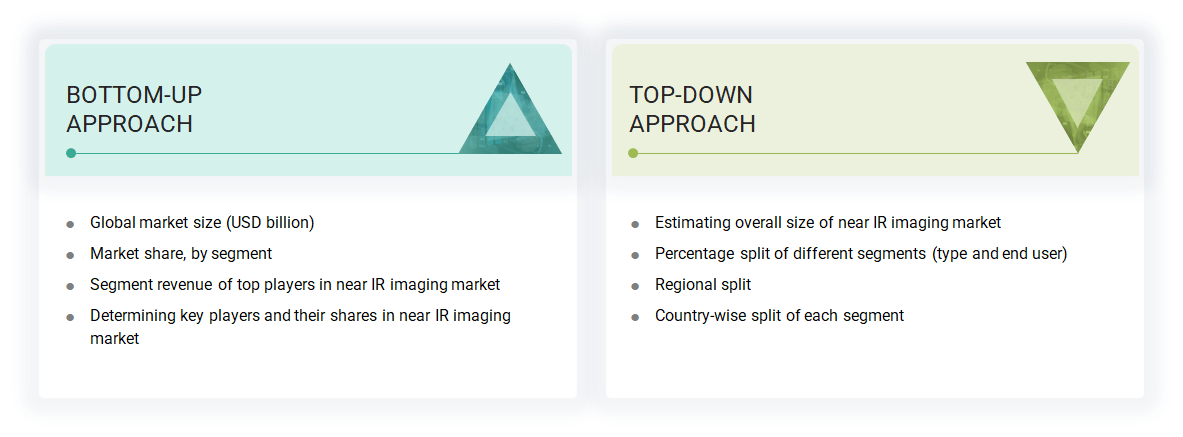

This study relied heavily on both primary and secondary sources. Extensive secondary research was conducted to gather information about near-infrared imaging. The next step involved validating these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Various approaches were employed to estimate the overall market size, including top-down and bottom-up methods. Subsequently, market segmentation and data triangulation procedures were applied to determine the market size of different segments and subsegments within the near-infrared imaging market. The research also examined various factors influencing the industry to identify segmentation types, industry trends, key players, the competitive landscape, essential market dynamics, and strategies employed by key market participants.

Secondary Research

The secondary research process relies heavily on various secondary sources, including directories, databases such as Bloomberg Business, Factiva, and D&B Hoovers, white papers, annual reports, company documents, investor presentations, and SEC filings. This type of research was utilized to gather valuable information for a comprehensive, technical, market-oriented, and commercial analysis of the near-infrared imaging market. It also helped acquire crucial insights about key players and the market's classification and segmentation based on industry trends down to the most detailed level. Additionally, significant developments related to market and technology perspectives were identified. A database of the key industry leaders was created using this secondary research.

The market for companies offering near-infrared imaging is assessed through secondary data from paid and unpaid sources. This analysis involves examining the product portfolios of major companies and evaluating their performance and quality. Various sources were consulted during the secondary research process to gather comprehensive information for this study. The secondary research provided essential insights into the value chain, identified the key players, and facilitated market classification and segmentation from market and technology-oriented perspectives.

Primary Research

In the primary research process, various supply and demand sources were interviewed to gather qualitative and quantitative information for this report. The supply-side primary sources included industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and other key executives from prominent companies and organizations in the near-infrared imaging market. On the demand side, primary sources included OEMs, private and contract testing organizations, and service providers. This primary research validated market segmentation, identified key players, and gathered insights on significant industry trends and market dynamics.

After completing the market engineering process, which included calculations for market statistics, market breakdown, estimation, forecasting, and data triangulation, we conducted extensive primary research. This research aimed to gather information and verify the critical numbers obtained through initial calculations. Additionally, various segmentation types, industry trends, and the competitive landscape of near-infrared imaging devices offered by different market players were also identified. Key market dynamics such as drivers, restraints, opportunities, challenges, as well as industry trends and the strategies of major players in the market were also evaluated.

In the comprehensive market engineering process, top-down and bottom-up approaches and various data regulation methods were utilized to estimate and forecast the overall market segments and subsegments outlined in this report. Extensive qualitative and quantitative analyses were conducted throughout the market engineering process to highlight key information and insights presented in the report.

A breakdown of the primary respondents is provided below:

Note 1: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 2: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3 = < USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the near-infrared imaging market size. These methods were also used extensively to estimate the size of various segments in the market.

Revenue share analysis about the leading players was employed to determine the size of the global near-infrared imaging market. In this case, key players in the market have been identified, and their business revenues were determined through various insights gathered during the primary and secondary research phases. Secondary research included studying the annual and financial reports of top market players. On the other hand, primary research incorporated in-depth interviews with key opinion leaders, particularly chief executive officers, directors, and key marketing executives.

The research methodology used to estimate the market size includes the following:

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the global near-infrared imaging market was split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the near-infrared imaging market was validated using both top-down and bottom-up approaches.

Market Definition

Near-infrared imaging refers to the technique of capturing images in the near-infrared spectrum of light. This imaging technique utilizes wavelengths of light that are longer than those visible to the human eye but shorter than thermal radiation.

Stakeholders

- Near-infrared Imaging Solution Manufacturers, Suppliers, and Providers

- Near-infrared Imaging Equipment and Service Solution Providers

- Near-infrared Imaging Integrated Solution Providers

- Pharmaceutical Companies

- Biotechnology Companies

- Academic Institutions and Private Research Institutions

- Private & Public Hospitals and Clinics

- Diagnostic Centers

- CROs and CDMOs

- Consulting Firms

- Research Institutes

- Research Laboratories

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Report Objectives

- To define, describe, and forecast the near-infrared imaging market based on product, procedure, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth potential of the global near-infrared imaging market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the global near-infrared imaging market

- To analyze key growth opportunities in the global near-infrared imaging market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (GCC Countries and the rest of Middle East & Africa)

- To profile the key players in the global near-infrared imaging market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global near-infrared imaging market, such as agreements, expansions, and product launches

Frequently Asked Questions (FAQ)

What is the projected value of the global near IR imaging market during the forecast period?

The global near IR imaging market is projected to reach USD 2.07 billion by 2030 from USD 1.25 billion in 2025, at a CAGR of 10.6% during the forecast period.

By product, which segment accounted for the largest market share in 2024?

Based on product, the devices segment accounted for the largest share of the near IR imaging market in 2024. High-image resolution and real-time image guidance during surgeries provided through near IR devices are key factors driving market growth.

What strategies are adopted by the leading players in the market?

The leading players in the market have opted for launches, collaborations, partnerships, agreements, and expansions as critical growth strategies to expand their presence in the global near IR imaging market.

What are the primary factors expected to drive the growth of the near IR imaging market?

The advantages of near-infrared imaging over conventional visualization methods and the adoption of hybrid near-infrared imaging modalities for surgical guidance are the key factors driving market growth.

What are the specific challenges companies face in the near-infrared imaging market?

Hospital budget cuts and a dearth of trained professionals in emerging economies may challenge the growth of the market.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Near-infrared Imaging Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Near-infrared Imaging Market