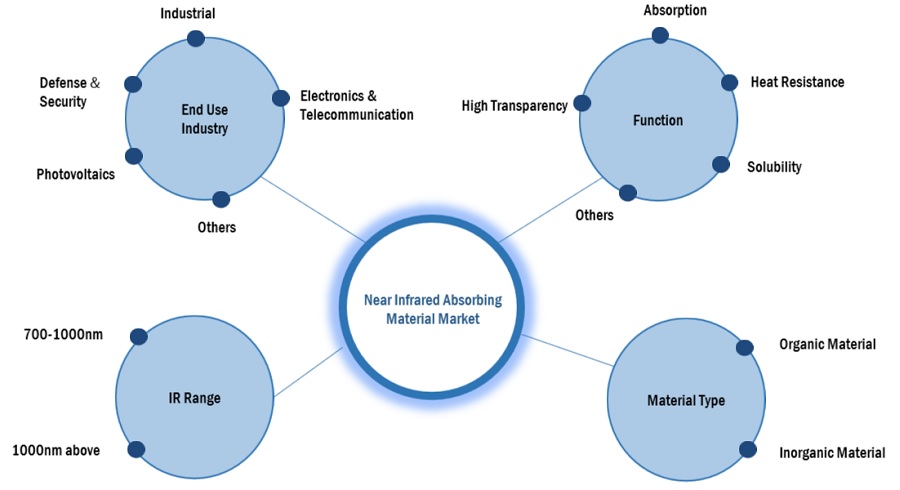

Near Infrared Absorbing Materials Market by Material (Organic Materials, Inorganic Materials), Function (High Transparency, Absorption, Heat Resistance), Absorption Range (700-1000nm, 1000nm), End Use Industry, Region - Global Forecast to 2028

Updated on : December 17, 2024

Near Infrared Absorbing Materials Market

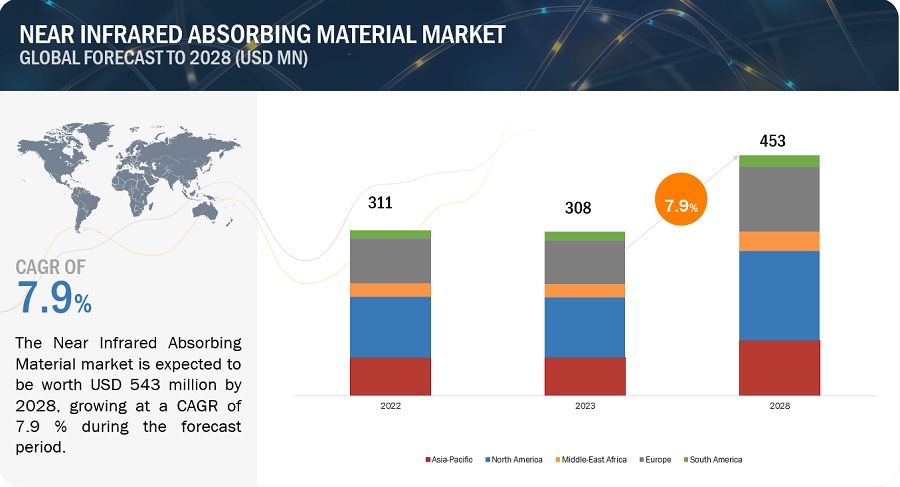

Near Infrared Absorbing Materials Market size was valued at USD 308 million in 2023 and is projected to reach USD 453 million by 2028, growing at 7.9% cagr from 2023 to 2028. The market is mainly led by the significant usage of near infrared absorbing material in various end-use industries. The growing demand from the electronics & telecommunication sector, rising demand for industrial sector, driving the market for near infrared absorbing market.

Near Infrared Absorbing Materials Market Size Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Near Infrared Absorbing Materials Market Dynamics

Driver: Increasing demand for advanced technologies.

Advancements in technology have been a significant driver for the development and adoption of near-infrared absorbing materials. These materials have gained prominence due to their unique ability to selectively absorb and manipulate near-infrared light, opening new possibilities for a wide range of applications. Advancements in characterization and measurement techniques have played a vital role in driving the adoption of near-infrared absorbing materials. Sophisticated instruments and tools enable accurate evaluation of material properties, including absorption spectra, transmittance, and reflectance. This level of characterization allows researchers and engineers to fine-tune the materials' performance and optimize their integration into specific applications. For example, Optical Filters: Near-infrared absorbing materials are used in optical filters to selectively block or transmit specific wavelengths of light. For example, in digital cameras and imaging devices, near-infrared absorbing filters are employed to enhance image quality by reducing unwanted infrared interference and improving color accuracy.

Restraint: Integration challenges

Integration challenges serve as restraints to the widespread adoption and implementation of near-infrared absorbing materials. While these materials offer promising benefits, certain barriers and complexities must be overcome to effectively integrate them into various applications.

Near-infrared absorbing materials need to be compatible with existing technologies, substrates, and manufacturing processes. Ensuring proper adhesion, compatibility with different materials, and compatibility with deposition techniques can be challenging.

Opportunity: Growing renewable energy sector

The growing renewable energy sector presents significant opportunities for the utilization and advancement of near-infrared absorbing materials. As the world increasingly focuses on transitioning to clean and sustainable energy sources, these materials can play a crucial role in enhancing the efficiency and performance of renewable energy systems. Here is an overview of the opportunities presented by the growing renewable energy sector.

Near-infrared absorbing materials can enhance the efficiency of solar energy systems by capturing a broader range of the solar spectrum, including near-infrared wavelengths. Near-infrared absorbing materials have the potential to be utilized in photothermal applications, where they can absorb near-infrared radiation and convert it into heat. This heat can then be harnessed for various purposes, including water heating, space heating, or industrial processes, reducing the reliance on conventional energy sources

Challenge: High cost of Materials.

The high cost of materials poses a significant challenge in the development and widespread adoption of near-infrared absorbing materials. These materials often involve complex synthesis processes, specialized equipment, and rare or expensive components, leading to increased production costs.

The production of near-infrared absorbing materials can be expensive due to the requirement of sophisticated manufacturing techniques and stringent quality control processes. Some near-infrared absorbing materials rely on rare elements or components that are scarce and expensive to obtain. Limited availability of these materials can drive up their costs, making them less economically viable for large-scale applications.

MARKET ECOSYSTEM

The market ecosystem for near-infrared absorbing materials is composed of a diverse array of entities and stakeholders that collectively contribute to the development, implementation, and advancement of near infrared absorbing materials. At the core of this ecosystem are material providers who focus on research, development, and manufacturing of near infrared absorbing material and systems. They continuously innovate and produce novel materials and their applications to meet the evolving demands of the market.

Sumitomo Metal Mining Co., Ltd. (Japan), Nanophase Technologies Corporation (US), Heraeus Holding (Germany), Keeling & Walker (UK), Edmund Optics (US), Merck (US), 3M (US), (Japan), Resonac Holdings Corporation (Japan), Advanced nano products co ltd (South Korea), Nippon Shokubai Co., Ltd.(Japan).

Near Infrared Absorbing Materials Market Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"700-1000nm Infrared range type is the largest type near infrared absorbing materials market in 2023, in terms of value"

The 700-1000nm is the largest market share of near infrared range in the near infrared absorbing materials market in term of value in 2023. The 700-1000nm infrared (IR) range, also known as the short-wavelength near-infrared (SW-NIR) range, is a segment of the electromagnetic spectrum that encompasses wavelengths ranging from 700 nanometers (nm) to 1000 nm. This IR range is of particular interest in various fields due to its unique properties and applications.

In terms of optical properties, the 700-1000nm IR range offers a balance between absorption and transmission characteristics. This range is commonly referred to as the "therapeutic window" in medical applications because it allows for efficient penetration into biological tissues while minimizing adverse effects such as thermal damage.

“Inorganic material types accounted for the largest material share of the near infrared absorbing materials market in 2023” in terms of value.

Inorganic materials, including antimony tin oxide (ATO), indium tin oxide (ITO), quantum dots, doped tungsten oxide, and others, contribute significantly to the near-infrared absorbing material market. These materials possess unique properties that make them highly suitable for near-infrared absorption applications. ATO and ITO, for example, are widely used as transparent conductive coatings with near-infrared absorbing capabilities, making them ideal for applications such as smart windows and optoelectronic devices.

“Absorption function accounted for the largest share of the near infrared absorbing materials market in 2023” in terms of value.

Absorption is a fundamental function of near-infrared (NIR) absorbing materials, as it allows them to selectively absorb light within the NIR spectrum. This function plays a crucial role in numerous applications where targeted absorption of specific wavelengths is desired.

In the field of photovoltaics, absorption is of utmost importance for efficient energy conversion in solar cells. NIR absorbing materials are designed to absorb a specific range of NIR wavelengths, enabling them to harness a broader spectrum of solar radiation. By efficiently absorbing NIR light, these materials can convert a larger portion of the solar energy into electrical energy, enhancing the overall performance and efficiency of solar cells. In medical applications, NIR absorbing materials with strong absorption capabilities are utilized for targeted therapies and imaging.

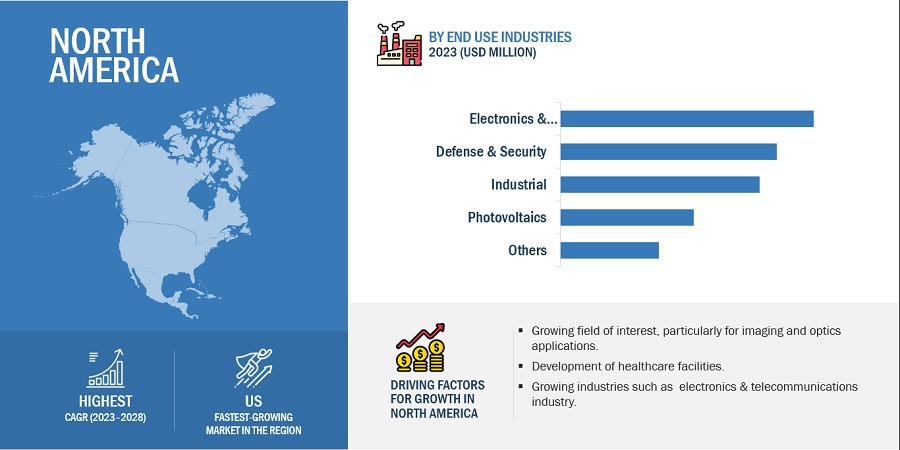

" Electronics & Telecommunications was largest end-use industry for near infrared absorbing materials market in 2023, in terms of value"

The Electronics & Telecommunications by end use, accounted for the largest market share in the for near infrared absorbing materials market, in terms of value, in 2023. However, the Electronics & Telecommunications is projected to grow at the highest CAGR in value during the forecast period. The electronics and telecommunications industry is a dynamic and rapidly evolving sector that relies on advanced technologies and materials to meet the demands of an interconnected world. Near-infrared absorbing materials play a crucial role in this industry, enabling various applications that enhance performance, functionality, and user experience.

In the field of electronics, near-infrared absorbing materials find application in optical filters, which are used to selectively transmit or block specific wavelengths of light. These filters help improve image quality, reduce glare, and enhance the clarity of displays and imaging devices. For example, organic dyes and polymers can be used as color filters in liquid crystal displays (LCDs) to achieve vibrant and accurate color reproduction.

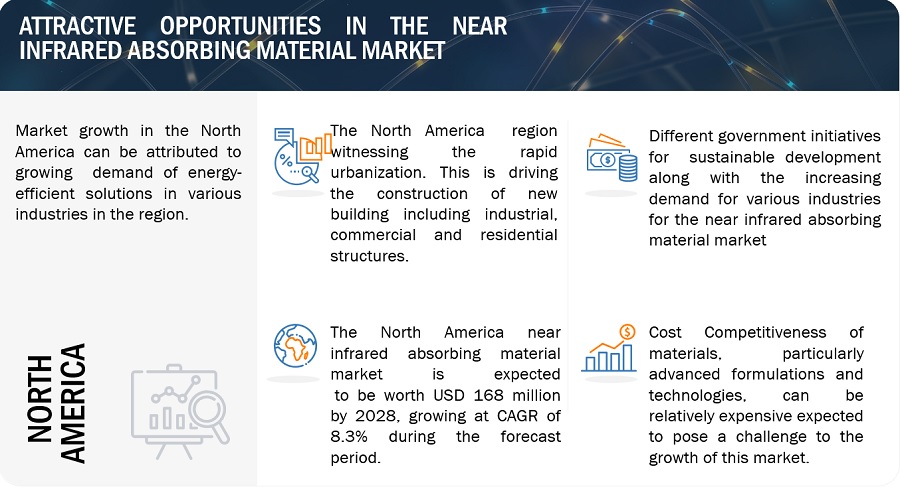

" North America was the largest market for Near infrared Absorbing Material Market in 2023, in terms of value."

The Near infrared Absorbing Material Market in North America is anticipated to register a highest CAGR between 2023 and 2028. The Near IR Absorbing Material Market in North America comprises the US, Mexico, and Canada. It was the largest market of The Near IR Absorbing Material Market in 2022. The energy-efficient solutions fuels the demand for NIR absorbing materials. North America places a strong emphasis on energy efficiency and sustainability. NIR absorbing materials can be used in various applications, such as smart windows or solar control films, to reduce solar heat gain and improve energy efficiency in buildings. The major players operating in the North America region include Inframat Advanced Materials LLC , Epolin LLC, American elements among others.

To know about the assumptions considered for the study, download the pdf brochure

Near Infrared Absorbing Materials Market Players

The key players in this market Sumitomo Metal Mining Co., Ltd. (Japan), Nanophase Technologies Corporation (US), Heraeus Holding (Germany), Keeling & Walker (UK), Edmund Optics (US), Merck (US), 3M (US), (Japan), Resonac Holdings Corporation (Japan), Advanced nano products co ltd (South Korea), Nippon Shokubai Co., Ltd.(Japan). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of near infrared absorbing material have opted for new product launches to sustain their market position.

Near Infrared Absorbing Materials Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 308 Million |

|

Revenue Forecast in 2028 |

USD 453 Million |

|

CAGR |

7.9% |

|

Years considered for the study |

2023-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion/Million) |

|

Segments |

IR Range, Material type, functions, End Use, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Sumitomo Metal Mining Co., Ltd. (Japan), Nanophase Technologies Corporation (US), Heraeus Holding (Germany), Keeling & Walker (UK), Edmund Optics (US), Merck (US), 3M (US), (Japan), Resonac Holdings Corporation (Japan), Advanced nano products co ltd (South Korea), Nippon Shokubai Co., Ltd.(Japan) |

Near Infrared Absorbing Materials Market Segmentation

This report categorizes the global near Infrared absorbing material market based on IR Range, Material type, functions, end use industry and region.

On the basis of IR range, the near infrared absorbing material market has been segmented as follows:

- 700-1000nm

- 1000nm above

On the basis of Material type, the near infrared absorbing material market has been segmented as follows:

- Organic Material

- Inorganic Materials

On the basis of Function type, the near infrared absorbing material market has been segmented as follows:

- High Transparency

- Absorption

- Heat Resistance,

- Solubility

- Others.

On the basis of End use industry, the near infrared absorbing material market has been segmented as follows:

- Electronics and Telecommunications

- Industrial

- Defense and security

- Photovoltaics

- Others.

On the basis of region, the near infrared absorbing material market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In 2023 Edmund Optics®, a renowned supplier of optical components for diverse applications, has teamed up with ISP Optics to provide worldwide availability of ISP Optics' extensive collection of high-quality optical components in over 15 infrared (IR) materials. Through this partnership, Edmund Optics becomes a global ecommerce distributor for ISP Optics.

- In 2023, AGEO, the world's leading supplier of passive electronic components, acquires Heraeus' platinum temperature sensor business.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the near infrared absorbing material market?

This study's forecast period for the near infrared absorbing material market is 2023-2028. The market is expected to grow at a CAGR of 7.9%, in terms of value, during the forecast period.

Who are the major key players in the near infrared absorbing material market?

market Sumitomo Metal Mining Co., Ltd. (Japan), Nanophase Technologies Corporation (US), Heraeus Holding (Germany), Keeling & Walker (UK), Edmund Optics (US), Merck (US), 3M (US), (Japan), Resonac Holdings Corporation (Japan), Advanced nano products co ltd (South Korea), Nippon Shokubai Co., Ltd.(Japan) are the leading manufacturers and service provider of near infrared absorbing material market.

What are the emerging trends in Near Infrared absorbing material market ?

Nanotechnology is playing a crucial role in the development of near infrared absorbing materials. Innovations in nanomaterials and nanocomposites are enabling the production of materials with enhanced properties, such as improved light absorption, higher thermal stability, and greater durability.

What are the drivers and opportunities for the near infrared absorbing material market?

The Increasing demand for advanced technologies in the near infrared absorbing material drive the infrared absorbing material market. The growing renewable energy sector presents significant opportunities for the utilization and advancement of near-infrared absorbing materials.

What are the restraining factors in the near infrared absorbing material market.

Integration challenges serve as restraints to the widespread adoption and implementation of near-infrared absorbing materials. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for advanced technologies- Energy efficiency and sustainabilityRESTRAINTS- Integration challengesOPPORTUNITIES- Growing renewable energy sector- Advancements in electronics and optoelectronicsCHALLENGES- High cost of materials- Performance limitations

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREATS OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.1 RECESSION IMPACT

-

6.2 VALUE CHAIN ANALYSISRAW MATERIALSMANUFACTURINGDISTRIBUTORSEND USERS

-

6.3 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

-

6.4 MARKET REGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.5 TRADE ANALYSISIMPORT SCENARIO FOR HS CODE 900211EXPORT SCENARIO FOR HS CODE 900211IMPORT SCENARIO FOR HS CODE 900590EXPORT SCENARIO FOR HS CODE 900590

-

6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN NEAR-INFRARED ABSORBING MATERIALS MARKET

-

6.7 ECOSYSTEM/MARKET MAP

- 6.8 TECHNOLOGY ANALYSIS

-

6.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.10 PATENT ANALYSISINTRODUCTIONAPPROACHDOCUMENT TYPEPATENT STATUSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANTSTOP 10 PATENT OWNERS (US) IN LAST FIVE YEARS

- 6.11 KEY CONFERENCES AND EVENTS, 2023–2024

- 7.1 INTRODUCTION

- 7.2 HIGH TRANSPARENCY

- 7.3 ABSORPTION

- 7.4 HEAT RESISTANCE

- 7.5 SOLUBILITY

- 7.6 OTHERS

- 8.1 INTRODUCTION

-

8.2 ORGANIC MATERIALSDYESPOLYMERSOLIGOMERSOTHERS

-

8.3 INORGANIC MATERIALSANTIMONY TIN OXIDEINDIUM TIN OXIDEQUANTUM DOTSDOPED TUNGSTEN OXIDEOTHER INORGANIC MATERIALS

- 9.1 INTRODUCTION

- 9.2 700-1,000 NM

- 9.3 ABOVE 1,000 NM

- 10.1 INTRODUCTION

- 10.2 ELECTRONICS & TELECOMMUNICATIONS

- 10.3 INDUSTRIAL SECTOR

- 10.4 DEFENSE & SECURITY

- 10.5 PHOTOVOLTAICS

- 10.6 OTHERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICARECESSION IMPACTUS- Demand for renewable energy sources, particularly solar power, to drive marketCANADA- Government initiatives and projects on advanced materials to support marketMEXICO- Consumer demand for advanced devices to boost market

-

11.3 EUROPERECESSION IMPACTGERMANY- Increasing adoption of solar power to bolster demand for near-infrared absorbing materialsFRANCE- Increased focus on conservation and sustainability to drive marketSPAIN- Resurgence in photovoltaic installations to drive marketITALY- Need for advanced healthcare solutions to drive marketUK- Increasing investments in defense sector to contribute to market growthREST OF EUROPE

-

11.4 ASIA PACIFICRECESSION IMPACTCHINA- Increasing need for electronic manufacturing of near-infrared absorbing materials to drive marketINDIA- Increasing focus on aerospace & defense sector to drive demand for near-infrared absorbing materialsJAPAN- Increasing awareness of sustainability goals to drive demandSOUTH KOREA- Highly advanced electronics industry to drive marketREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Digital initiatives to drive need for near-infrared absorbing materialsSOUTH AFRICA- Extensive photovoltaics applications to drive demandREST OF MIDDLE EAST & AFRICA

-

11.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Expected to hold largest share of market during forecast periodARGENTINA- Precision agriculture practices and desire for optimized crop management to drive marketPERU- Government initiatives to promote mining to drive marketREST OF SOUTH AMERICA

- 12.1 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2022

- 12.3 COMPANY REVENUE ANALYSIS

-

12.4 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

12.5 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.6 COMPETITIVE BENCHMARKING

- 12.7 NEAR-INFRARED ABSORBING MATERIALS MARKET: COMPANY FOOTPRINT

-

12.8 COMPETITIVE SCENARIO AND TRENDS (2020–2023)DEALSOTHERS

-

13.1 KEY PLAYERSSUMITOMO METAL MINING CO. LTD.- Business overview- Products/Services/Solutions offered- MnM viewNANOPHASE TECHNOLOGIES CORPORATION- Business overview- Products/Services/Solutions offered- MnM viewKEELING & WALKER LIMITED- Business overview- Products/Services/Solutions offered- MnM viewEDMUND OPTICS INC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNIPPON SHOKUBAI CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTHE HERAEUS GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM view3M- Business overview- Products/Services/Solutions offered- MnM viewMERCK KGAA- Business overview- Products/Services/Solutions offered- MnM viewADVANCED NANO PRODUCTS CO., LTD.- Business overviewRESONAC HOLDINGS CORPORATION- Business overview- Products/Services/Solutions offered- MnM view

-

13.2 OTHER PLAYERSYAMADA CHEMICAL CO., LTD.TOYO VISUAL SOLUTIONS CO., LTD.AMERICAN DYE SOURCE, INC.EPOLIN LLCVIAVI SOLUTIONS INC.AMERICAN ELEMENTSEKSMA OPTICSTOKYO CHEMICAL INDUSTRY PVT. LTD (TCI)UBIQUITOUS ENERGY, INC.FUJI PIGMENT CO., LTDNANOCO GROUP PLCINFRAMAT ADVANCED MATERIALS, LLCKRIYA MATERIALS B.V.FEW CHEMICALS GMBHDELTACHEM (QINGDAO) CO. LTD.

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 NEAR-INFRARED ABSORBING MATERIALS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NEAR-INFRARED ABSORBING MATERIALS MARKET: ECOSYSTEM

- TABLE 7 ADVANTAGES OF TECHNOLOGY

- TABLE 8 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR TOP-THREE END-USE INDUSTRIES

- TABLE 9 KEY BUYING CRITERIA FOR TOP-THREE END-USE INDUSTRIES

- TABLE 10 TOTAL NUMBER OF PATENTS (2017–2022)

- TABLE 11 PATENTS BY HEWLETT-PACKARD DEVELOPMENT COMPANY, LP

- TABLE 12 PATENTS BY SUMITOMO METAL MINING CO.

- TABLE 13 PATENTS BY NIPPON KAYAKU KK

- TABLE 14 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY FUNCTION, 2019–2022 (USD MILLION)

- TABLE 15 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 16 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 17 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY MATERIAL, 2023–2028 (USD MILLION)

- TABLE 18 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY INFRARED RANGE, 2019–2022 (USD MILLION)

- TABLE 19 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY INFRARED RANGE, 2023–2028 (USD MILLION)

- TABLE 20 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 21 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 22 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 NORTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 25 NORTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 26 NORTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 27 NORTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 28 US: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 29 US: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 30 CANADA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 31 CANADA: NEAR-INFRARED ABSORBING MATERIALS MARKET, END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 32 MEXICO: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 33 MEXICO: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 34 EUROPE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 35 EUROPE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 36 EUROPE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 37 EUROPE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 38 GERMANY: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 39 GERMANY: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 40 FRANCE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 41 FRANCE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 42 SPAIN: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 43 SPAIN: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 44 ITALY: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 45 ITALY: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 46 UK: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 47 UK: NEAR-INFRARED ABSORBING MATERIALS MARKET BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 48 REST OF EUROPE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 49 REST OF EUROPE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 51 ASIA PACIFIC: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 52 ASIA PACIFIC: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 53 ASIA PACIFIC: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 54 CHINA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 55 CHINA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 56 INDIA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 57 INDIA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 58 JAPAN: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 59 JAPAN: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 60 SOUTH KOREA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 61 SOUTH KOREA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 63 REST OF ASIA PACIFIC: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 64 MIDDLE EAST & AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 65 MIDDLE EAST & AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 66 MIDDLE EAST & AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 67 MIDDLE EAST & AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 68 SAUDI ARABIA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 69 SAUDI ARABIA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY 2023–2028 (USD MILLION)

- TABLE 70 SOUTH AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 71 SOUTH AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 72 REST OF MIDDLE EAST & AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 73 REST OF MIDDLE EAST & AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY 2023–2028 (USD MILLION)

- TABLE 74 SOUTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 75 SOUTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 76 SOUTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 77 SOUTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY 2023–2028 (USD MILLION)

- TABLE 78 BRAZIL: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 79 BRAZIL: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 80 ARGENTINA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 81 ARGENTINA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 82 PERU: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 83 PERU: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 84 REST OF SOUTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 85 REST OF SOUTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 86 STRATEGIES ADOPTED BY KEY MANUFACTURERS

- TABLE 87 NEAR-INFRARED ABSORBING MATERIALS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 88 NEAR–INFRARED ABSORBING MATERIALS MARKET: LIST OF KEY STARTUP/SMES

- TABLE 89 NEAR-INFRARED ABSORBING MATERIALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 90 END-USE INDUSTRY: COMPANY FOOTPRINT

- TABLE 91 FUNCTION: COMPANY FOOTPRINT

- TABLE 92 MATERIAL: COMPANY FOOTPRINT

- TABLE 93 REGION: COMPANY FOOTPRINT

- TABLE 94 COMPANY FOOTPRINT

- TABLE 95 DEALS, JANUARY 2020–JULY 2023

- TABLE 96 OTHERS, JANUARY 2020-JULY 2023

- TABLE 97 SUMITOMO METAL MINING CO. LTD: COMPANY OVERVIEW

- TABLE 98 SUMITOMO METAL MINING CO. LTD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 99 SUMITOMO METAL MINING CO. LTD: DEALS

- TABLE 100 NANOPHASE TECHNOLOGIES CORPORATION.: COMPANY OVERVIEW

- TABLE 101 NANOPHASE TECHNOLOGIES CORPORATION.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 102 KEELING & WALKER LIMITED: COMPANY OVERVIEW

- TABLE 103 KEELING & WALKER LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 104 EDMUND OPTICS INC: COMPANY OVERVIEW

- TABLE 105 EDMUND OPTICS INC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 106 EDMUND OPTICS INC: PRODUCT LAUNCHES

- TABLE 107 EDMUND OPTICS INC: DEALS

- TABLE 108 NIPPON SHOKUBAI CO., LTD: COMPANY OVERVIEW

- TABLE 109 NIPPON SHOKUBAI CO., LTD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 110 NIPPON SHOKUBAI CO., LTD: DEALS

- TABLE 111 THE HERAEUS GROUP: COMPANY OVERVIEW

- TABLE 112 THE HERAEUS GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 113 THE HERAEUS GROUP: DEALS

- TABLE 114 3M: COMPANY OVERVIEW

- TABLE 115 3M: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 116 MERCK KGAA: COMPANY OVERVIEW

- TABLE 117 MERCK KGAA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 118 ADVANCED NANO PRODUCTS CO., LTD: COMPANY OVERVIEW

- TABLE 119 ADVANCED NANO PRODUCTS CO., LTD: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 120 RESONAC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 121 RESONAC HOLDINGS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 122 YAMADA CHEMICAL CO., LTD: COMPANY OVERVIEW

- TABLE 123 TOYO VISUAL SOLUTIONS CO., LTD: COMPANY OVERVIEW

- TABLE 124 AMERICAN DYE SOURCE, INC: COMPANY OVERVIEW

- TABLE 125 EPOLIN LLC: COMPANY OVERVIEW

- TABLE 126 VIAVI SOLUTIONS INC: COMPANY OVERVIEW

- TABLE 127 AMERICAN ELEMENTS: COMPANY OVERVIEW

- TABLE 128 EKSMA OPTICS: COMPANY OVERVIEW

- TABLE 129 TOKYO CHEMICAL INDUSTRY PVT. LTD (TCI): COMPANY OVERVIEW

- TABLE 130 UBIQUITOUS ENERGY, INC.: COMPANY OVERVIEW

- TABLE 131 FUJI PIGMENT CO., LTD: COMPANY OVERVIEW

- TABLE 132 NANOCO GROUP PLC: COMPANY OVERVIEW

- TABLE 133 INFRAMAT ADVANCED MATERIALS, LLC: COMPANY OVERVIEW

- TABLE 134 KRIYA MATERIALS B.V.: COMPANY OVERVIEW

- TABLE 135 FEW CHEMICALS GMBH: COMPANY OVERVIEW

- TABLE 136 DELTACHEM (QINGDAO) CO. LTD: COMPANY OVERVIEW

- FIGURE 1 NEAR-INFRARED ABSORBING MATERIALS MARKET SEGMENTATION

- FIGURE 2 NEAR-INFRARED ABSORBING MATERIALS MARKET: RESEARCH DESIGN

- FIGURE 3 NEAR-INFRARED ABSORBING MATERIALS MARKET: DATA TRIANGULATION

- FIGURE 4 ELECTRONICS & TELECOMMUNICATIONS END-USE INDUSTRY ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 5 ABSORPTION FUNCTION ACCOUNTED FOR MAJOR MARKET SHARE IN 2022

- FIGURE 6 700 TO 1,000 NM IR RANGE SEGMENT ACCOUNTED FOR LARGER SHARE OF NEAR-INFRARED ABSORBING MATERIALS MARKET IN 2022

- FIGURE 7 INORGANIC MATERIALS ACCOUNTED FOR LARGER SHARE OF NEAR-INFRARED ABSORBING MATERIALS MARKET

- FIGURE 8 NORTH AMERICA TO REGISTER HIGHEST GROWTH IN NEAR-INFRARED ABSORBING MATERIALS MARKET

- FIGURE 9 EUROPE TO BE SECOND-LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 10 ABOVE 1000 NM ACCOUNTED FOR SIGNIFICANT SHARE IN 2022

- FIGURE 11 ORGANIC MATERIALS ACCOUNTED FOR SIGNIFICANT SHARE IN 2022

- FIGURE 12 HIGH TRANSPARENCY FUNCTION ACCOUNTED FOR SECOND-LARGEST SHARE IN 2022

- FIGURE 13 ELECTRONICS & TELECOMMUNICATIONS END-USE INDUSTRY ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 14 ELECTRONICS & TELECOMMUNICATIONS END-USE INDUSTRY AND US ACCOUNTED FOR LARGEST SHARES IN NORTH AMERICA

- FIGURE 15 US TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: NEAR-INFRARED ABSORBING MATERIALS MARKET

- FIGURE 17 NEAR-INFRARED ABSORBING MATERIALS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 18 VALUE CHAIN OF NEAR-INFRARED ABSORBING MATERIALS MARKET

- FIGURE 19 IMPORT SCENARIO FOR HS CODE 900211, BY KEY COUNTRY, 2019–2022

- FIGURE 20 EXPORT SCENARIO FOR HS CODE 900211, BY KEY COUNTRY, 2019–2022

- FIGURE 21 IMPORT SCENARIO FOR HS CODE 900590, BY KEY COUNTRY, 2019–2022

- FIGURE 22 EXPORT SCENARIO FOR HS CODE 900590, BY KEY COUNTRY, 2019–2022

- FIGURE 23 REVENUE SHIFT: NEAR-INFRARED ABSORBING MATERIALS MARKET

- FIGURE 24 NEAR-INFRARED ABSORBING MATERIALS MARKET: ECOSYSTEM

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 26 KEY BUYING CRITERIA FOR TOP-THREE END-USE INDUSTRIES

- FIGURE 27 PATENTS REGISTERED FOR NEAR-INFRARED ABSORBING MATERIAL, 2017–2022

- FIGURE 28 PATENT PUBLICATION TRENDS FOR NEAR-INFRARED ABSORBING MATERIAL, 2017–2022

- FIGURE 29 LEGAL STATUS OF PATENTS FILED FOR NEAR-INFRARED ABSORBING MATERIAL

- FIGURE 30 HIGHEST NUMBER OF PATENTS FILED IN CHINA

- FIGURE 31 HEWLETT-PACKARD DEVELOPMENT COMPANY, LP REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2017 AND 2022

- FIGURE 32 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY FUNCTION, 2022

- FIGURE 33 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY MATERIAL, 2022

- FIGURE 34 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY INFRARED RANGE

- FIGURE 35 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2022

- FIGURE 36 NORTH AMERICA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET SNAPSHOT

- FIGURE 38 EUROPE: NEAR-INFRARED ABSORBING MATERIALS MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: NEAR-INFRARED ABSORBING MATERIALS MARKET SNAPSHOT

- FIGURE 40 MIDDLE EAST & AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET SNAPSHOT

- FIGURE 41 SOUTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET SNAPSHOT

- FIGURE 42 MARKET SHARE ANALYSIS OF TOP-FIVE PLAYERS IN NEAR-INFRARED ABSORBING MATERIALS MARKET, 2022

- FIGURE 43 MARKET SHARE ANALYSIS, 2022

- FIGURE 44 NEAR-INFRARED ABSORBING MATERIALS MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2022

- FIGURE 45 NEAR-INFRARED ABSORBING MATERIALS MARKET: STARTUP/ SME EVALUATION QUADRANT, 2022

- FIGURE 46 SUMITOMO METAL MINING CO. LTD: COMPANY SNAPSHOT

- FIGURE 47 NANOPHASE TECHNOLOGIES CORPORATION.: COMPANY SNAPSHOT

- FIGURE 48 NIPPON SHOKUBAI CO., LTD: COMPANY SNAPSHOT

- FIGURE 49 3M: COMPANY SNAPSHOT

- FIGURE 50 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 51 RESONAC HOLDINGS CORPORATION: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the Near Infrared absorbing material market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The Near Infrared absorbing material market comprises several stakeholders in the value chain, which include input suppliers, equipment manufacturers, technology providers, service providers, distribution and logistics, and end users. Various primary sources from the supply and demand sides of the Near Infrared absorbing material market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the Near Infrared absorbing material industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Near Infrared absorbing material and the outlook of their business, which will affect the overall market.

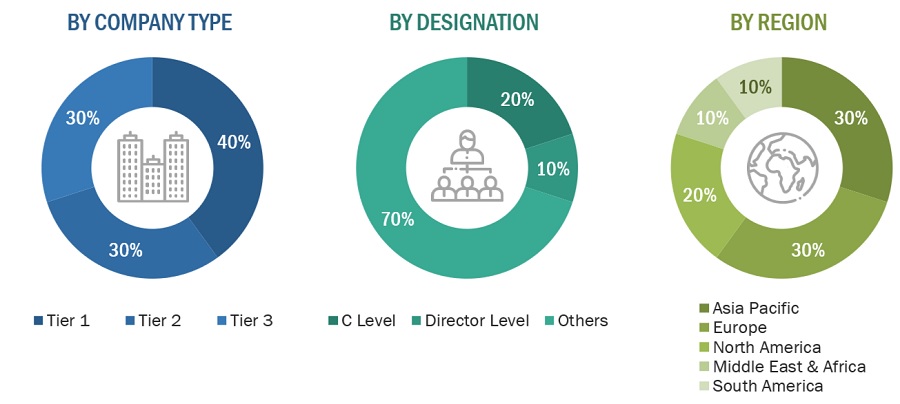

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Keeling & Walker |

Individual Industry Expert |

|

Nanophase Technologies Corporation |

Sales Manager |

|

American Elements |

Manager |

|

Edmund Optics |

Marketing Manager |

|

Evotech |

Senior Scientist |

|

|

|

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the Near Infrared absorbing material market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Near Infrared Absorbing Material Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Near Infrared Absorbing Material Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Near-infrared (NIR) absorbing materials, also known as NIR absorbers refer to substances or compounds that have the ability to absorb electromagnetic radiation in the near-infrared region of the electromagnetic spectrum. This region typically spans wavelengths ranging from approximately 700 nanometers (nm) to 2500 nm. NIR absorbing materials are designed to selectively absorb light within this wavelength range while allowing other wavelengths, such as visible light or longer infrared radiation, to pass through or remain unaffected. These materials find diverse applications in various industries such as electronics & telecommunications, industrial, photovoltaics etc.

Key Stakeholders

- Raw material suppliers.

- Near Infrared absorbing material manufacturers.

- Near Infrared absorbing material traders, distributors, and suppliers.

- End-use industry participants.

- Government and research organizations.

- Associations and industrial bodies.

- Research and consulting firms.

- Research & development (R&D) institutions.

- Environmental support agencies.

Report Objectives

- To define, describe, and forecast the size of the Near Infrared absorbing material market, in terms of value.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on technology, type, application and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Near Infrared Absorbing Materials Market