Naval Communication Market by Platform (Ships, Submarines, Unmanned Systems)), System Technology (Naval Satcom Systems, Naval Radio Systems, Naval Security Systems, and Communication Management Systems), Application and Region - Global Forecast to 2028

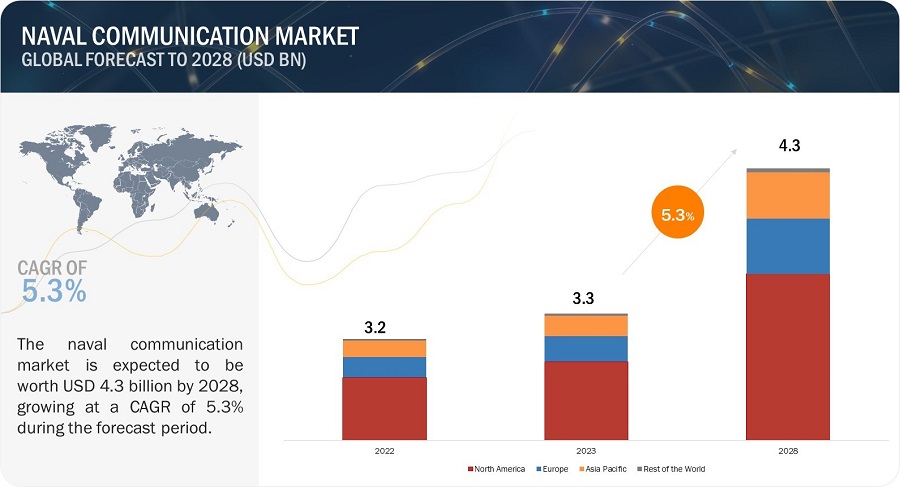

The Global Naval Communication Market is estimated to be USD 3.3 Billion in 2023 and expected to reach USD 4.3 Billion by 2028 at a CAGR of 5.3% from 2023 to 2028. The Naval Communication Industry is experiencing significant growth and development driven by various factors. The market is characterized by the increasing demand for advanced communication systems in naval operations, driven by the focus on maritime security, naval modernization programs, and the need for enhanced command and control capabilities.

The market is witnessing the rise of key segments, such as ships, command and control, and naval satellite communication (SATCOM) systems. Ships, being the backbone of naval operations, require robust communication systems to ensure effective coordination and information exchange. The command and control segment is crucial for enabling seamless coordination, real-time situational awareness, and streamlined decision-making processes. The naval SATCOM segment is growing rapidly due to the need for secure and reliable communication links in remote or geographically dispersed areas.

Geopolitical factors, defense budgets of nations, and advancements in communication technologies are major drivers shaping the market. Additionally, North America, with its advanced naval capabilities and presence of major defense contractors, is expected to have the largest market share.

Overall, the naval communication market is witnessing substantial developments, with the adoption of advanced technologies, focus on cybersecurity, integration of COTS solutions, and advancements in SATCOM systems, all aimed at enhancing operational effectiveness and ensuring secure communication for naval forces worldwide.

Naval Communication Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Naval communication Market Dynamics

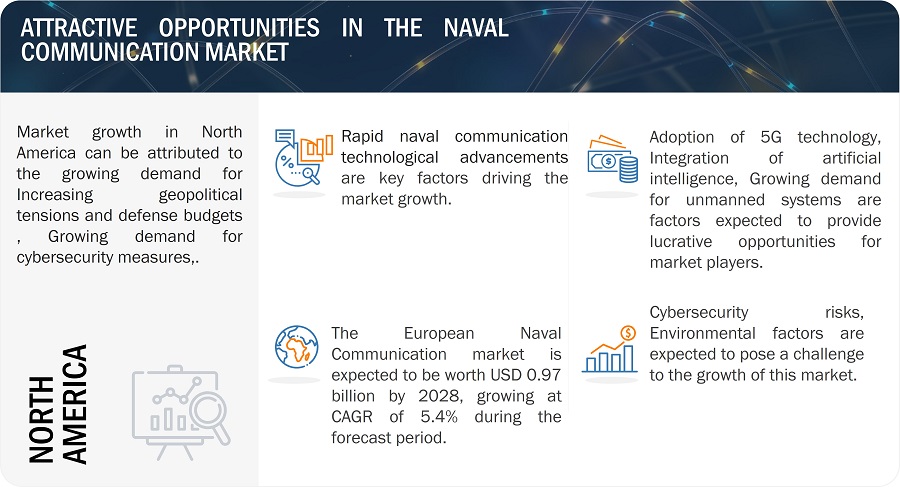

Driver: Increasing geopolitical tensions and defense budgets

The naval communication market experiences a strong driver in the form of escalating geopolitical tensions and the subsequent rise in defense budgets across the globe. As countries strive to bolster their naval capabilities and modernize their naval fleets, the demand for advanced communication systems becomes paramount. Seamless communication and real-time data exchange are essential for maintaining situational awareness, coordinating operations, and ensuring effective command and control. The need for reliable naval communication solutions to support these critical functions drives the market growth. The increasing geopolitical tensions and regional conflicts drive governments to allocate significant funds towards defense expenditure, with a particular focus on naval forces. This surge in defense budgets enables naval forces to invest in advanced communication technologies that enhance their operational capabilities. The market benefits from the increased demand for communication systems that can facilitate secure and efficient data exchange, both within naval vessels and between allied forces.

Restraints: Spectrum management

Spectrum management is a critical aspect of naval communication, and it poses several challenges that need to be addressed for efficient and reliable communication systems. The limited radio frequency spectrum available for communication purposes, coupled with the increasing number of communication systems and devices operating within the spectrum, creates a complex environment that requires effective management strategies.

Opportunities: Adoption of 5G technology

The adoption of 5G technology presents significant opportunities for the naval communication market. 5G offers high-speed data transfer, low latency, and massive connectivity capabilities, which can revolutionize naval operations. The implementation of 5G networks in naval communication infrastructure unlocks new possibilities for enhanced situational awareness, improved command, and control capabilities, and streamlined decision-making processes. With 5G, naval forces can leverage real-time communication, support the exchange of large volumes of data, and facilitate the integration of advanced technologies such as autonomous vehicles and Internet of Things (IoT) devices. The higher data transfer speeds and reduced latency enable faster and more accurate information exchange, enhancing operational efficiency and mission success. Furthermore, 5G's ultra-reliable and low-latency communication (URLLC) capabilities enable precise and time-critical communication, making it ideal for applications such as remote-controlled vehicles, unmanned systems, and mission-critical operations. This opens up opportunities for naval forces to leverage the benefits of 5G in areas such as remote surveillance, autonomous maritime operations, and real-time decision-making.

Challenges: Cybersecurity risks

Cybersecurity risks pose a significant challenge to naval communication systems. As digital communication technologies become more prevalent, naval networks and infrastructure are increasingly vulnerable to cyber threats. Malicious actors may attempt to disrupt communication channels, compromise data integrity, or gain unauthorized access to sensitive information. The consequences of successful cyberattacks can be severe, leading to operational disruptions, compromised mission-critical systems, and compromised national security. To mitigate cybersecurity risks, robust and comprehensive cybersecurity measures are necessary. This includes implementing multi-layered security protocols, encryption mechanisms, intrusion detection systems, and advanced firewalls. Continuous monitoring, threat intelligence sharing, and regular vulnerability assessments are crucial to identify and address potential vulnerabilities. Additionally, comprehensive cybersecurity training and awareness programs for naval personnel help build a strong security culture and minimize the risk of human error.

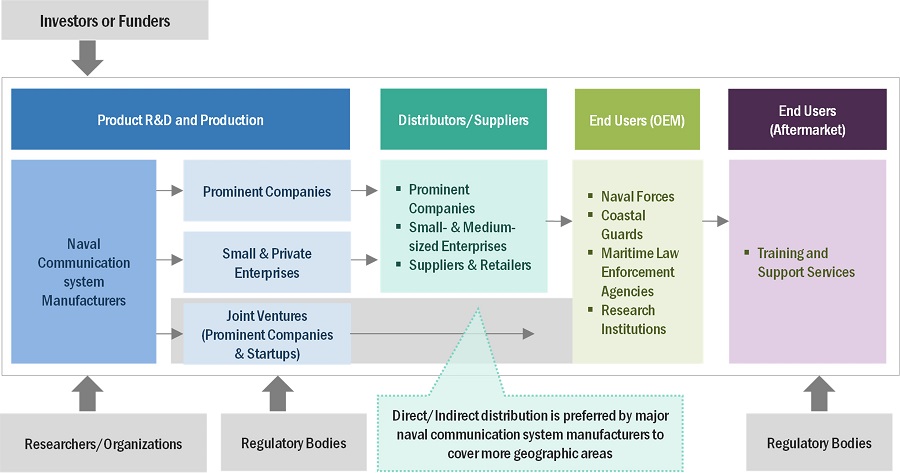

Naval Communication Market Ecosystem

The naval communication market ecosystem is comprised of various stakeholders and components that contribute to the overall functioning of the industry. This ecosystem includes manufacturers, suppliers of naval communication solutions, government bodies, research organizations, and end-users such as defense organizations. Manufacturers design, produce, and certify, while suppliers provide raw materials and specialized components. End-users play a vital role by specifying and purchasing solutions for ships and submarines or retrofitting existing ones. Collaboration and coordination among these stakeholders are essential for the smooth operation and growth of the naval communication market ecosystem. Prominent companies in this market Honeywell International Inc. (US), General Dynamics Corporation (US), Lockheed Martin Corporation (US), BAE Systems plc (UK), and Elbit Systems Ltd.(Israel) among others.

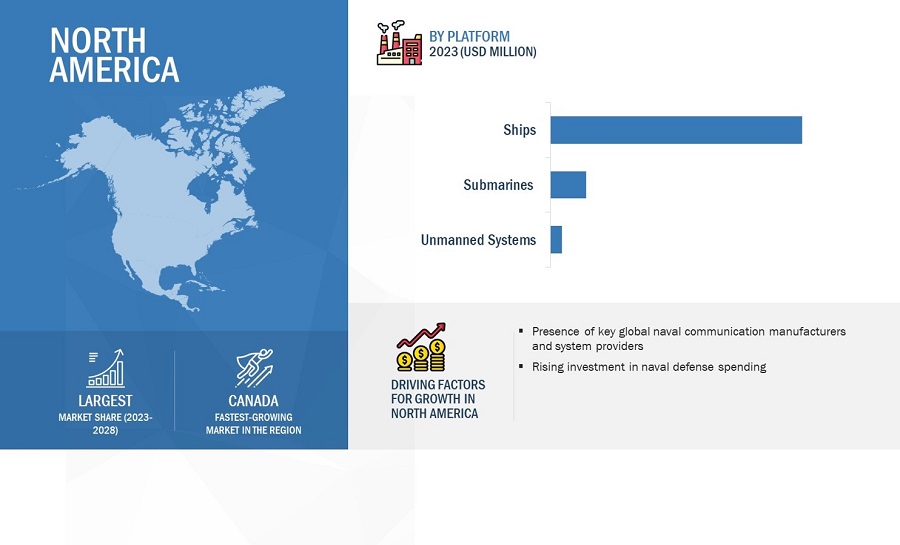

Based on platform, ships segment is estimated to account for the largest market share of the naval communication market

The increasing focus on maritime security and the need to address evolving threats have driven the demand for advanced communication solutions in the ships segment. Naval modernization programs aimed at enhancing operational capabilities further contribute to the demand for efficient and reliable communication systems.

Based on application, the command and control segment are anticipated to dominate the market

The dominance of the command and control segment can be attributed to several factors. First, the increasing emphasis on network-centric warfare concepts and interoperability among different naval assets drives the demand for robust command and control systems. These systems integrate various communication technologies, data analytics, and artificial intelligence (AI) capabilities, enabling faster data processing, predictive analysis, and enhanced decision-making.

The naval satcom systems segment of the naval communication market by system technology is projected to dominate the market.

The naval satcom system is expected to demonstrate the highest CAGR in the naval communication market. satcom systems play a vital role in facilitating secure and reliable communication, data exchange, and real-time information sharing for naval forces. The growing demand for maritime surveillance, remote sensing, and intelligence gathering drives the need for advanced satcom capabilities.

The North America is projected to lead the naval communication market.

North America possesses an extensive network of naval bases, command centers, and research institutions that foster innovation and drive the demand for naval communication systems. The region's emphasis on maritime security, protection of sea lanes, and projection of naval power further fuels market growth. While other regions, such as Europe and Asia-Pacific, also have significant naval capabilities and defense investments, North America is expected to hold the largest market share due to its advanced naval forces, defense industry expertise, and substantial resources dedicated to naval modernization. The strong presence of major defense contractors in the region further solidifies its market dominance.

Naval Communication Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Naval Communication Industry Companies: Top Key Market Players

The Naval Communication Compaines is dominated by a few globally established players such as Prominent companies include Honeywell International Inc. (US), General Dynamics Corporation (US), Lockheed Martin Corporation (US), BAE Systems plc (UK), and Elbit Systems Ltd.(Israel) among others are some of the leading players operating in the naval communication market, are the key manufacturers that secured naval communication contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements of naval forces across the world.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size

|

USD 3.3 Billion in 2023

|

|

Projected Market Size

|

USD 4.3 Billion by 2028

|

|

Growth Rate

|

CAGR of 5.3%

|

|

Market size available for years |

2020–2022 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Application, By Platform, By System Technology, and By Region |

|

Geographies covered |

North America, Europe, Asia Pacific and Rest of the World |

|

Companies covered |

Honeywell International Inc. (US), General Dynamics Corporation (US), Lockheed Martin Corporation (US), BAE Systems plc (UK), and Elbit Systems Ltd.(Israel), and among others. |

Naval Communication Market Highlights

The study categorizes the naval communication market based on Application, Platform, System Technology, and Region.

|

Segment |

Subsegment |

|

By Application |

|

|

By Platform |

|

|

By System Technology |

|

|

By Region |

|

Recent Developments

- In February 2022, The US Defense Advanced Research Projects Agency (DARPA) awarded BAE Systems a contract to develop management software that connects military sensors and land, air, and sea weapons. With a total value of USD 24.9 Million , the contract is part of the service’s Mission-Integrated Network Control (MINC) project to create a secure network overlay to support multi-domain kill webs. The software would ensure that critical data reaches the right user at the right time using secure control of any available communications or networking resources in contested environments.

- In April 2021, Lockheed Martin acquired Ultra Electronics' naval systems business, expanding naval communication and electronic warfare capabilities, offering advanced solutions for communication, surveillance, and electronic countermeasures in maritime domains..

- In November 2021, Honeywell announced the launch of two new resilient navigation systems: the Honeywell Compact Inertial Navigation System and the Honeywell Radar Velocity System.

Frequently Asked Questions (FAQ):

Which are the major companies in the Naval Communication Market? What are their major strategies to strengthen their market presence?

Some of the key players in the Naval Communication Market are Honeywell International Inc. (US), General Dynamics Corporation (US), Lockheed Martin Corporation (US), BAE Systems plc (UK), and Elbit Systems Ltd.(Israel) among others, are the key manufacturers that secured naval communication system contracts in the last few years.

What are the drivers and opportunities for the Naval Communication Market?

The Naval Communication Market is driven by various factors and presents lucrative opportunities for industry players. One of the key drivers of the market is the increasing focus on maritime security and the need for advanced communication capabilities to support naval operations. Rising geopolitical tensions, territorial disputes, and evolving security threats have heightened the demand for robust communication systems that enhance situational awareness, interoperability, and command and control capabilities. Additionally, naval modernization programs worldwide provide a significant growth opportunity for the market. Navies across the globe are investing in the development and integration of advanced communication technologies to upgrade their naval fleets. The deployment of advanced sensor systems, unmanned platforms, and surveillance equipment further fuels the demand for integrated communication solutions.

Which region is expected to grow at the highest rate in the next five years in Naval Communication Market?

The market in Asia-Pacific region is projected to grow at the highest CAGR of from 2023 to 2028, showcasing strong demand from naval communication in the region. Asia-Pacific is expected to lead the naval communication market, demonstrating significant growth and capturing a substantial market share. The region's leadership can be attributed to several factors, including the rising defense budgets of countries in the region, the modernization of naval forces, and the increasing geopolitical importance of the Asia-Pacific region. Countries like China, India, Japan, South Korea, and Australia are heavily investing in their naval capabilities, including advanced communication systems, to secure their maritime interests and strengthen their defense posture. These nations are actively pursuing naval modernization programs and developing indigenous technologies to enhance their naval communication capabilities.

Which platform of Naval Communication Market is expected to significantly lead in the coming years?

The ships segment is expected to experience significant growth in the naval communication market, characterized by a substantial CAGR. Ships play a vital role as platforms for naval operations and require robust communication systems to support their coordination and command functions. The increasing focus on maritime security and the need to address evolving threats have driven the demand for advanced communication solutions in the ships segment. Naval modernization programs aimed at enhancing operational capabilities further contribute to the demand for efficient and reliable communication systems.

Which application of Naval Communication Market is expected to significantly lead in the coming years?

The command and control segment is anticipated to have the largest market share in the naval communication market. Command and control systems are crucial for effective coordination, situational awareness, and decision-making in naval operations. As the complexity of naval missions increases, there is a growing demand for advanced command and control solutions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing geopolitical tensions and defense budgets- Advancements in satellite communication systems and integration of network centric solutions- Growing demand for cybersecurityRESTRAINTS- Spectrum management- Compatibility with legacy systemsOPPORTUNITIES- Adoption of 5G technology- Integration of artificial intelligence- Growing demand for unmanned systemsCHALLENGES- Cybersecurity risks- Environmental factors

-

5.3 DEVELOPMENTS IN NAVAL COMMUNICATION MARKET SINCE 1900MAJOR DEVELOPMENTS REVOLUTIONIZING NAVAL COMMUNICATION IN LAST 100 YEARS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSREVENUE SHIFTS AND NEW REVENUE POCKETS FOR NAVAL COMMUNICATION SOLUTION PROVIDERS

- 5.5 PRICING ANALYSIS

- 5.6 VOLUME DATA ANALYSIS

-

5.7 ECOSYSTEM ANALYSISPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.8 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSPARTS SUPPLIERSMANUFACTURERSEND USERS

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.11 TRADE DATA ANALYSIS

-

5.12 CASE STUDY ANALYSISIMPLEMENTATION OF ADVANCED COMMUNICATION SYSTEMS FOR NAVAL FLEETINTEGRATION OF UNDERWATER COMMUNICATION SYSTEMS INTO SUBMARINESDEVELOPMENT OF CYBERSECURITY SOLUTIONS FOR NAVAL COMMUNICATION SYSTEMS

-

5.13 TECHNOLOGY ANALYSISSOFTWARE-DEFINED NETWORKINGCOGNITIVE RADIOSATELLITE COMMUNICATION ADVANCEMENTSARTIFICIAL INTELLIGENCE AND MACHINE LEARNINGCYBERSECURITY ENHANCEMENTSINTEGRATION OF UNMANNED SYSTEMSQUANTUM COMMUNICATION

- 5.14 REGULATORY LANDSCAPE

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDS IMPACTING NAVAL COMMUNICATION MARKET5G- 5G connectivity for naval communicationQUANTUM COMMUNICATION- Safeguarding naval communication with quantum technologyARTIFICIAL INTELLIGENCE AND MACHINE LEARNING- Artificial intelligence and machine learning to be future of naval communicationAUGMENTED REALITY AND VIRTUAL REALITY- Augmented reality and virtual reality integration into naval communication systemsSOFTWARE-DEFINED NETWORKING- Software-defined networking to empower naval communicationSATELLITE COMMUNICATION SYSTEMS- Satellite communication systems to enhance naval communicationSOUNDING DEPTH- Adoption of underwater acoustic communication technology for naval communicationINTRA-VESSEL WIRELESS NETWORKS- Intra-vessel wireless networks to transform naval communicationCOGNITIVE RADIO TECHNOLOGY- Cognitive radio technology to enable integration of spectrum technology into naval communicationADVANCED RADAR AND SONAR COMMUNICATION SYSTEMS- Advanced radar and sonar communication systems to enhance situational awareness in naval operationsMULTI-FUNCTIONAL ANTENNA ARRAYS- Multi-functional antenna arrays to enhance naval communication capabilitiesUNDERWATER OPTICAL COMMUNICATION- Underwater optical communication to enable high-speed data transfer in naval operations

- 7.1 INTRODUCTION

-

7.2 SHIPSCRITICALITY OF INTEGRATED COMMUNICATION NETWORKS IN NAVAL SHIPS TO DRIVE MARKET- Combat vessels- COMBAT SUPPORT VESSELS

-

7.3 SUBMARINESINCREASING DEPENDENCY OF SUBMARINES ON COMMUNICATION TECHNOLOGIES FOR CONDUCTING STEALTHY UNDERWATER OPERATIONS TO DRIVE MARKET

-

7.4 UNMANNED SYSTEMSCRITICALITY OF UNMANNED SYSTEMS TO CONDUCT CRUCIAL OPERATIONS EFFICIENTLY TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 NAVAL SATCOM SYSTEMSRESPONSIBLE FOR PROVIDING SHIPS AND SUBMARINES WITH RELIABLE AND SECURE COMMUNICATION CAPABILITIES IN DIVERSE MARITIME ENVIRONMENTS- Antennas- Tactical data links

-

8.3 NAVAL RADIO SYSTEMSRESPONSIBLE FOR PROVIDING RELIABLE AND EFFECTIVE MEANS OF COMMUNICATION FOR SHIPS, SUBMARINES, AND NAVAL AVIATION- High frequency- Ultra high frequency- Very high frequency

-

8.4 NAVAL SECURITY SYSTEMSPLAY VITAL ROLE IN SAFEGUARDING NAVAL ASSETS, PERSONNEL, AND OPERATIONS FROM THREATS- Data encryption systems

-

8.5 COMMUNICATION MANAGEMENT SYSTEMSHAVE ABILITY TO INTEGRATE VARIOUS COMMUNICATION CHANNELS INTO CENTRALIZED PLATFORM- Communication network infrastructure

- 9.1 INTRODUCTION

-

9.2 COMMAND & CONTROLNEED FOR RAPID TRANSMISSION OF CRITICAL INFORMATION SUCH AS TARGET DATA AND THREAT ASSESSMENTS TO DRIVE MARKET

-

9.3 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCEINCREASING USE OF HIGH-BANDWIDTH DATA LINKS AND SECURE NETWORK ARCHITECTURES TO DRIVE MARKET

-

9.4 ROUTINE OPERATIONSINCREASING NEED TO ESTABLISH SECURE AND RELIABLE COMMUNICATION LINKS TO DRIVE MARKET

- 9.5 OTHERS

-

10.1 INTRODUCTIONREGIONAL RECESSION IMPACT ANALYSIS

-

10.2 NORTH AMERICAINTRODUCTIONPESTLE ANALYSISUS- Technological advancements to drive marketCANADA- Collaborative R&D and indigenous innovation to drive market

-

10.3 EUROPEINTRODUCTIONPESTLE ANALYSISUK- Innovations and presence of prominent players to drive marketGERMANY- Increasing collaborations between government and private companies to drive marketFRANCE- Technological innovations to drive marketRUSSIA- Innovations and strategic investments to drive marketITALY- Focus on R&D to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICINTRODUCTIONPESTLE ANALYSISCHINA- Investments in advanced communication systems to drive marketINDIA- Modernization of naval fleet to drive marketJAPAN- Presence of key players to drive marketAUSTRALIA- Upgrade of naval communication systems to drive marketSOUTH KOREA- Increasing investments in advanced technologies to drive marketREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLDINTRODUCTIONPESTLE ANALYSISMIDDLE EAST & AFRICA- Advancements in naval command and control capabilities to drive marketLATIN AMERICA- Increasing focus on enhancing naval capabilities to drive market

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET RANKING ANALYSIS

- 11.5 COMPANY FOOTPRINT

-

11.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSHONEYWELL INTERNATIONAL INC.- Business overview- Products offered- Recent developments- MnM viewGENERAL DYNAMICS CORPORATION- Business overview- Products offered- Recent developments- MnM viewLOCKHEED MARTIN CORPORATION- Business overview- Products offered- Recent developments- MnM viewBAE SYSTEMS PLC- Business overview- Products offered- Recent developments- MnM viewELBIT SYSTEMS LTD.- Business overview- Products offered- Recent developments- MnM viewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products offered- Recent developmentsL3HARRIS TECHNOLOGIES, INC.- Business overview- Products offered- Recent developmentsNORTHROP GRUMMAN CORPORATION- Business overview- Products offered- Recent developmentsSAAB AB- Business overview- Products offered- Recent developmentsTHALES GROUP- Business overview- Products offered- Recent developmentsLEONARDO S.P.A.- Business overview- Products offered- Recent developmentsCURTISS-WRIGHT CORPORATION- Business overview- Products offered- Recent developmentsCOBHAM LIMITED- Business overview- Products offered- Recent developmentsRAFAEL ADVANCED DEFENSE SYSTEMS LTD.- Business overview- Products offered- Recent developmentsASELSAN A.S.- Business overview- Products offeredGARMIN LTD.- Business overview- Products offered- Recent developmentsVIASAT INC.- Business overview- Products offered- Recent developmentsIRIDIUM COMMUNICATIONS INC.- Business overview- Products offered- Recent developments

-

12.3 OTHER PLAYERSRHODE & SCHWARZDATA LINK SOLUTIONSULTRA ELECTRONICSFURUNO ELECTRIC CO., LTD.ICOM INC.KONGSBERGJAPAN RADIO COMPANY

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 NAVAL COMMUNICATION MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- TABLE 4 AVERAGE VALUE OF NAVAL COMMUNICATION COMPONENTS

- TABLE 5 NAVAL COMMUNICATION MARKET: DELIVERIES (IN UNITS)

- TABLE 6 RAW MATERIAL SUPPLIERS

- TABLE 7 PARTS SUPPLIERS

- TABLE 8 MANUFACTURERS

- TABLE 9 END USERS

- TABLE 10 NAVAL COMMUNICATION MARKET: IMPACT OF PORTER’S FIVE FORCES

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF NAVAL COMMUNICATION SYSTEMS (%)

- TABLE 12 KEY BUYING CRITERIA FOR NAVAL COMMUNICATION SYSTEMS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 18 NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 19 NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 20 NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 21 NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 22 NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 23 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 24 NAVAL COMMUNICATION MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 25 NAVAL COMMUNICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 27 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 29 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 31 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 34 US: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 35 US: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 36 US: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 37 US: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 CANADA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 39 CANADA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 40 CANADA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 41 CANADA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 42 EUROPE: NAVAL COMMUNICATION MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 43 EUROPE: NAVAL COMMUNICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 44 EUROPE: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 45 EUROPE: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 46 EUROPE: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 47 EUROPE: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 48 EUROPE: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 49 EUROPE: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 50 UK: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 51 UK: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 52 UK: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 53 UK: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 54 GERMANY: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 55 GERMANY: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 56 GERMANY: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 57 GERMANY: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 58 FRANCE: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 59 FRANCE: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 60 FRANCE: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 61 FRANCE: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 62 RUSSIA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 63 RUSSIA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 64 RUSSIA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 65 RUSSIA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 66 ITALY: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 67 ITALY: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 68 ITALY: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 69 ITALY: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 70 REST OF EUROPE: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 71 REST OF EUROPE: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 72 REST OF EUROPE: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 73 REST OF EUROPE: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 75 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 77 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 79 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 81 ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 CHINA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 83 CHINA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 84 CHINA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 85 CHINA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 86 INDIA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 87 INDIA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 88 INDIA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 89 INDIA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 90 JAPAN: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 91 JAPAN: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 92 JAPAN: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 93 JAPAN: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 AUSTRALIA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 95 AUSTRALIA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 96 AUSTRALIA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 97 AUSTRALIA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 98 SOUTH KOREA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 99 SOUTH KOREA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 100 SOUTH KOREA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 101 SOUTH KOREA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 107 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 108 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 109 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 110 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2020–2022 (USD MILLION)

- TABLE 111 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY SYSTEM TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 112 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 113 REST OF THE WORLD: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 118 LATIN AMERICA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2020–2022 (USD MILLION)

- TABLE 119 LATIN AMERICA: NAVAL COMMUNICATION MARKET, BY PLATFORM, 2023–2028 (USD MILLION)

- TABLE 120 LATIN AMERICA: NAVAL COMMUNICATION MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 121 LATIN AMERICA: NAVAL COMMUNICATION MARKET, BY APPLICATION 2023–2028 (USD MILLION)

- TABLE 122 NAVAL COMMUNICATION MARKET: DEGREE OF COMPETITION

- TABLE 123 NAVAL COMMUNICATION MARKET: COMPANY FOOTPRINT

- TABLE 124 NAVAL COMMUNICATION MARKET: APPLICATION FOOTPRINT

- TABLE 125 NAVAL COMMUNICATION MARKET: REGION FOOTPRINT

- TABLE 126 NAVAL COMMUNICATION MARKET: KEY STARTUPS/SMES

- TABLE 127 NAVAL COMMUNICATION MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 128 NAVAL COMMUNICATION MARKET: PRODUCT LAUNCHES, JUNE 2019– NOVEMBER 2021

- TABLE 129 NAVAL COMMUNICATION MARKET: DEALS, DECEMBER 2020

- TABLE 130 NAVAL COMMUNICATION MARKET: OTHER DEVELOPMENTS, APRIL 2021

- TABLE 131 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 132 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 133 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 134 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 135 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 136 GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

- TABLE 137 GENERAL DYNAMICS CORPORATION: PRODUCT LAUNCHES

- TABLE 138 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 139 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- TABLE 140 LOCKHEED MARTIN CORPORATION: PRODUCTS OFFERED

- TABLE 141 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 142 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 143 BAE SYSTEMS PLC: COMPANY OVERVIEW

- TABLE 144 BAE SYSTEMS PLC: PRODUCTS OFFERED

- TABLE 145 BAE SYSTEMS PLC: PRODUCT LAUNCHES

- TABLE 146 BAE SYSTEMS PLC: DEALS

- TABLE 147 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 148 ELBIT SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 149 ELBIT SYSTEMS LTD.: PRODUCT LAUNCHES

- TABLE 150 ELBIT SYSTEMS LTD.: DEALS

- TABLE 151 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 152 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS OFFERED

- TABLE 153 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 154 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 155 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 156 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 157 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 158 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 159 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- TABLE 160 NORTHROP GRUMMAN CORPORATION: PRODUCTS OFFERED

- TABLE 161 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 162 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 163 SAAB AB: COMPANY OVERVIEW

- TABLE 164 SAAB AB: PRODUCTS OFFERED

- TABLE 165 SAAB AB: PRODUCT LAUNCHES

- TABLE 166 SAAB AB: DEALS

- TABLE 167 THALES GROUP: COMPANY OVERVIEW

- TABLE 168 THALES GROUP: PRODUCTS OFFERED

- TABLE 169 THALES GROUP: PRODUCT LAUNCHES

- TABLE 170 THALES GROUP: DEALS

- TABLE 171 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 172 LEONARDO S.P.A.: PRODUCTS OFFERED

- TABLE 173 LEONARDO S.P.A.: PRODUCT LAUNCHES

- TABLE 174 LEONARDO S.P.A.: DEALS

- TABLE 175 CURTISS-WRIGHT CORPORATION: COMPANY OVERVIEW

- TABLE 176 CURTISS-WRIGHT CORPORATION: PRODUCTS OFFERED

- TABLE 177 CURTISS-WRIGHT CORPORATION: DEALS

- TABLE 178 COBHAM LIMITED: COMPANY OVERVIEW

- TABLE 179 COBHAM LIMITED: PRODUCTS OFFERED

- TABLE 180 COBHAM LIMITED: PRODUCT LAUNCHES

- TABLE 181 COBHAM LIMITED: DEALS

- TABLE 182 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 183 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: PRODUCTS OFFERED

- TABLE 184 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: PRODUCT LAUNCHES

- TABLE 185 ASELSAN A.S.: COMPANY OVERVIEW

- TABLE 186 ASELSAN A.S.: PRODUCTS OFFERED

- TABLE 187 GARMIN LTD.: COMPANY OVERVIEW

- TABLE 188 GARMIN LTD.: PRODUCTS OFFERED

- TABLE 189 GARMIN LTD.: DEALS

- TABLE 190 VIASAT INC.: COMPANY OVERVIEW

- TABLE 191 VIASAT INC.: PRODUCTS OFFERED

- TABLE 192 VIASAT INC.: PRODUCT LAUNCHES

- TABLE 193 VIASAT INC.: DEALS

- TABLE 194 IRIDIUM COMMUNICATIONS INC.: COMPANY OVERVIEW

- TABLE 195 IRIDIUM COMMUNICATIONS INC.: PRODUCTS OFFERED

- TABLE 196 IRIDIUM COMMUNICATIONS INC.: PRODUCT LAUNCHES

- TABLE 197 RHODE & SCHWARZ: COMPANY OVERVIEW

- TABLE 198 DATA LINK SOLUTIONS: COMPANY OVERVIEW

- TABLE 199 ULTRA ELECTRONICS: COMPANY OVERVIEW

- TABLE 200 FURUNO ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 201 ICOM INC.: COMPANY OVERVIEW

- TABLE 202 KONGSBERG: COMPANY OVERVIEW

- TABLE 203 JAPAN RADIO COMPANY: COMPANY OVERVIEW

- FIGURE 1 RESEARCH METHODOLOGY MODEL

- FIGURE 2 NAVAL COMMUNICATION MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM PRIMARY SOURCES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 NAVAL COMMUNICATION MARKET: DATA TRIANGULATION

- FIGURE 7 SHIPS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 NAVAL SATCOM SYSTEMS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 COMMAND & CONTROL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 ADVANCEMENTS IN NAVAL COMMUNICATION SYSTEMS TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 12 NAVAL SATCOM SYSTEMS SEGMENT TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 UNMANNED SYSTEMS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 COMMAND & CONTROL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 16 NAVAL COMMUNICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 NAVAL COMMUNICATION MARKET: KEY DEVELOPMENTS

- FIGURE 18 NAVAL COMMUNICATION MARKET: REVENUE SHIFTS FOR KEY PLAYERS

- FIGURE 19 NAVAL COMMUNICATION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 20 NAVAL COMMUNICATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 NAVAL COMMUNICATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF NAVAL COMMUNICATION SYSTEMS

- FIGURE 23 KEY BUYING CRITERIA FOR NAVAL COMMUNICATION SYSTEMS

- FIGURE 24 SHIPS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 25 NAVAL SATCOM SYSTEMS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 26 COMMAND & CONTROL TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 27 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN NAVAL COMMUNICATION MARKET DURING FORECAST PERIOD

- FIGURE 28 RECESSION IMPACT: GLOBAL PESSIMISTIC AND REALISTIC SCENARIOS

- FIGURE 29 NORTH AMERICA: NAVAL COMMUNICATION MARKET SNAPSHOT

- FIGURE 30 EUROPE: NAVAL COMMUNICATION MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: NAVAL COMMUNICATION MARKET SNAPSHOT

- FIGURE 32 MARKET SHARE ANALYSIS, 2022

- FIGURE 33 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2018–2022

- FIGURE 34 RANKING ANALYSIS OF TOP FIVE PLAYERS, 2022

- FIGURE 35 NAVAL COMMUNICATION MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 36 NAVAL COMMUNICATION MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 37 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 38 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 40 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 41 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 42 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 43 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 44 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 SAAB AB: COMPANY SNAPSHOT

- FIGURE 46 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 47 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 48 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT

- FIGURE 49 COBHAM LIMITED: COMPANY SNAPSHOT

- FIGURE 50 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 51 ASELSAN A.S.: COMPANY SNAPSHOT

- FIGURE 52 GARMIN LTD.: COMPANY SNAPSHOT

- FIGURE 53 VIASAT INC.: COMPANY SNAPSHOT

- FIGURE 54 IRIDIUM COMMUNICATIONS INC.: COMPANY SNAPSHOT

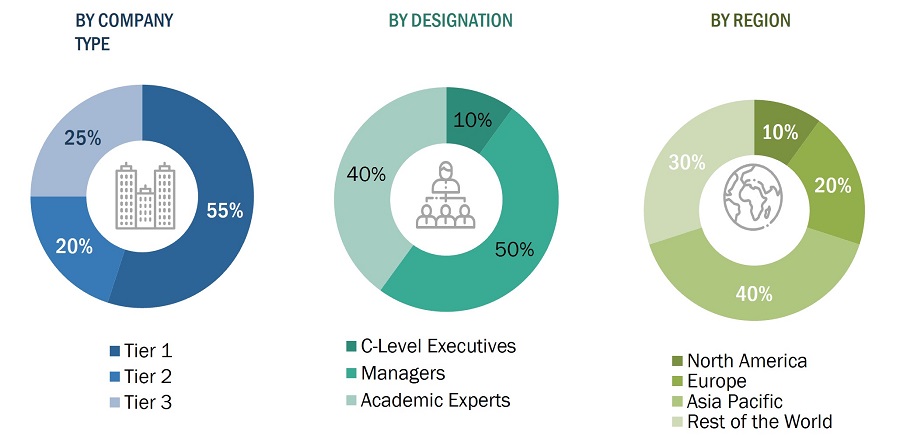

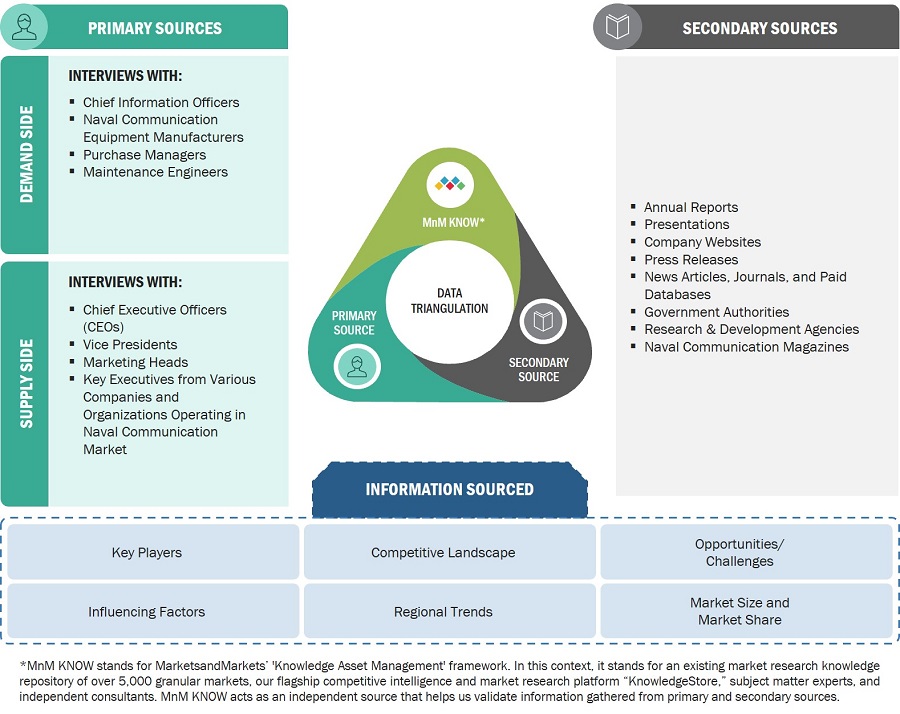

The study involved four major activities in estimating the current size of the naval communication market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The ranking analysis of companies in the naval communication market was carried out using secondary data from paid and unpaid sources, as well as by analyzing the product portfolios and service offerings of key companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. These included government sources, corporate filings, such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles by recognized authors, directories, and databases.

Primary Research

Extensive primary research was conducted after obtaining information regarding the naval communication market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from naval communication vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using naval communication were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of naval communication and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

KEY PRIMARY SOURCES

|

COMPANY NAME |

DESIGNATION |

|

Honeywell International Inc. |

Saab AB |

|

Raytheon Technologies (Collins Aerospace) |

|

|

Leonardo S.p.A. |

|

|

Thales Group |

|

Market Size Estimation

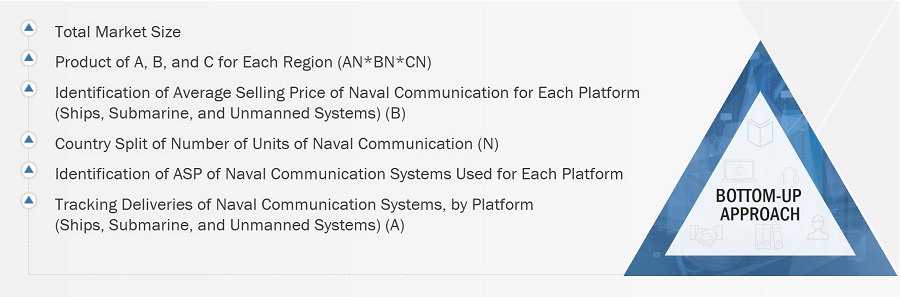

The research methodology used to estimate the size of the naval communication market includes the following details.

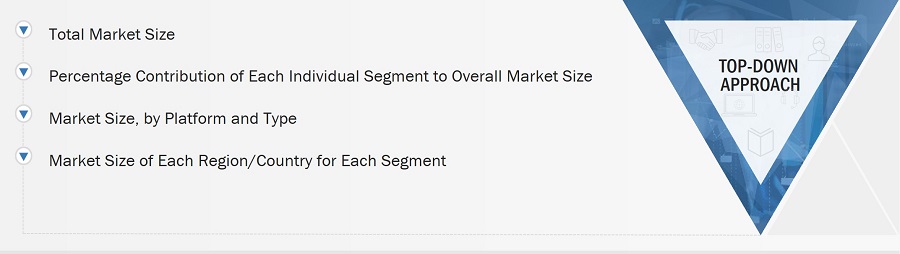

- The top-down and bottom-up approaches were used to estimate and validate the size of the naval communication market. The research methodology used to estimate the market size includes the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Global naval communication market size: Bottom-Up Approach

The naval communication market, by application and aircraft type, was used as a primary segment for estimating and projecting the global market size from 2023 to 2028.

The market size was calculated by adding the mass subsegments mentioned below, and the different methodologies adopted for each to arrive at the market numbers are delineated below:

- Naval communication Market = Volume * Average selling price of the naval communication components

Global naval communication market Size: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) acquired through percentage splits from secondary and primary research. The size of the immediate parent market was used to implement the top-down approach and calculate specific market segments. The bottom-up approach was also implemented to validate the revenues obtained for various market segments.

- Companies manufacturing naval communications and their subsystems are included in the report.

- The total revenue of these companies was identified through their annual reports and other authentic sources. In cases where annual reports were unavailable, the company revenue was estimated based on the number of employees, sources such as Factiva, ZoomInfo, press releases, and any publicly available data.

- Company revenue was calculated based on their operating segments.

- All publicly available company contracts related to naval communications were mapped and summed up.

Based on these parameters (contracts, agreements, partnerships, joint ventures, product matrix, secondary research), the share of naval communications in each segment was estimated

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the naval communication market based on application, system technology, platform, and region for the forecast period (2023 to 2028)

- To forecast the size of various segments of the market with respect to four major regions: North America, Europe, Asia Pacific, and the Rest of the World, along with the major countries in these regions

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify opportunities for stakeholders in the market by analyzing key market and technology trends

- To identify the current industry trends, market trends, and technology trends in the market

- To analyze competitive developments, such as contracts, agreements, acquisitions & partnerships, new product launches & developments, and R&D activities, in the market

- To estimate the procurement of naval communication by different countries to track technological advancements

- To identify the financial position, key products, and major developments of leading companies in the market

- To provide a comprehensive competitive landscape of the market, along with an overview of different strategies adopted by key players to strengthen their market position

Market Definition

In an era characterized by rapid technological advancements, efficient and reliable communication systems are essential for effective naval operations. Naval forces across the globe heavily rely on robust communication networks to maintain situational awareness, coordinate missions, and ensure seamless coordination between ships, submarines, aircraft, and onshore command centers. The naval communication market plays a critical role in providing the necessary infrastructure, equipment, and services to meet the unique communication needs of naval forces.

Communication is the lifeblood of any naval operation, enabling real-time information exchange, decision-making, and mission execution. Effective naval communication systems facilitate secure and uninterrupted voice, data, and video transmissions, enabling naval personnel to communicate across vast distances and in challenging maritime environments. These systems enhance operational efficiency, enable swift response to changing situations, and promote interoperability among different naval units and partner nations. The naval communication market operates within a dynamic technological landscape, constantly evolving to keep pace with emerging advancements. Modern naval forces are adopting cutting-edge technologies such as satellite communication, secure data networks, software-defined radios, and advanced encryption methods.

Market Stakeholders

- Raw Material Suppliers

- Naval communication Manufacturers

- Technology Support Providers

- Distributors

- Maintenance, Repair, and Overhaul (MRO) Companies

- System Integrators

- Government Agencies

- Investors and Financial Community Professionals

- Research Organizations

- Component Suppliers

- Technologists

- R&D Staff

Available Customizations

MarketsAndMarkets offers the following customizations for this market report:

- Additional country-level analysis of the naval communication market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the naval communication market

Growth opportunities and latent adjacency in Naval Communication Market