Natural Disaster Detection IoT Market by Component (Hardware, Solutions, Services), Application (Flood Detection, Drought Detection), Communication System (First Responder Tools, Vehicle-ready Gateways), End User and Region - Global Forecast to 2027

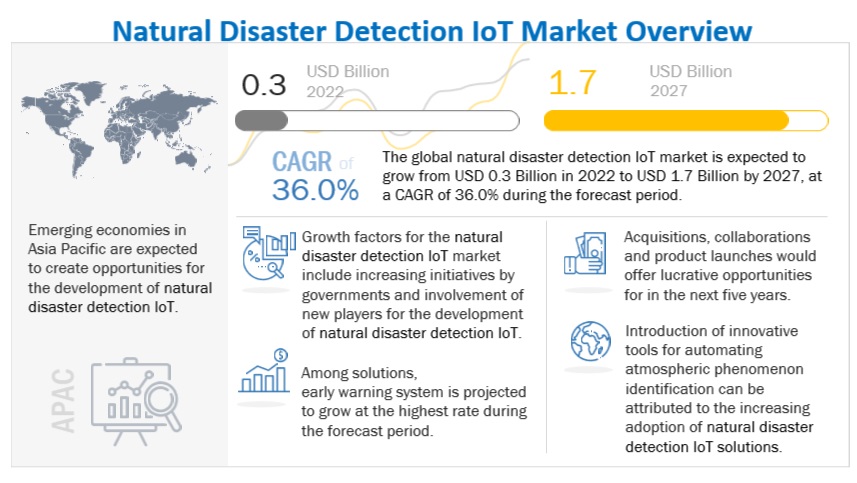

[261 Pages Report] The global natural disaster detection IoT market size is projected to grow from USD 0.3 billion in 2022 to USD 1.7 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 36.0% during the forecast period. Predicting possibilities of upcoming disasters with sensors, AI, and deep learning technologies is driving market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Use of IoT devices and sensors to predict disasters in advance

Preparing for a natural disaster is a continuous process. With the assistance of technology, it is crucial that natural hazards need not become catastrophes to support the general public and the government with protective measures. The near-real-time data is collected by the IoT devices and by the sensors, such as volcanic activity, water levels, and barometric readings. Wildfires, tornadoes, volcanic activities, cloudbursts, and earthquakes are detected by the sensors, and they deliver early warnings. Also, predictive maintenance can protect critical infrastructure or any infrastructure. Sensors enable relief from hazards by monitoring pollutants and contaminants, also consisting of radioactive situations. Lately, scientists have been employing sensors to gather vast amounts of seismic data and analyzing it with AI to assess the size and patterns of earthquakes. This data facilitates prediction more accurately when earthquakes will occur. The precision of the IoT-based system is considerably greater than that of traditional prediction methods.

Restraint: Vulnerabilities of IoT devices

With the advancements in the IoT industry, there is an increment in the variety and quantity of IoT devices. IoT devices have been widely used in smart wear, smart homes, smart cars, smart manufacturing, smart medical care, and many other life-related fields. Every internet-connected device, such as smartphones, laptops, and wearables, acts as a node within a global hazard-tracking system. Each IoT device could act as a sensor that detects surrounding atmospheric conditions and transmits vital data to natural disaster researchers. With it, security vulnerabilities of IoT devices are continually emerging. The rise in security vulnerabilities will bring severe risks if it fails.

Opportunity: Growing adoption of satellite remote sensing and GIS for disaster risk minimization and prevention

Satellite remote sensing consists of wide-ranging areas, and it functions 24/7 and in all types of weather. It is used to examine the earth's surface and atmosphere to monitor disasters and explore resources. Human factors, such as system users and operators working in disaster management and response and technical factors, are crucial in applying satellite remote sensing to disaster management support. The combination of different kinds of data using models is allowed by GIS. The combination of the different kinds of spatial data with non-spatial data is made possible with GIS, and attribute data and use them as useful information in the different stages of disaster management. GIS lets emergency management requirements are identified before an incident. Disaster events, such as tsunamis, wildfires, floods, earthquakes, hurricanes, chemical cloud dispersion, and oil spills, can be modeled and displayed in GIS. This helps in disaster risk minimization and prevention.

Challenge: Communication gets hampered in the disaster region

In situations where natural disasters have occurred, the efficiency of disaster response operations is very vital in saving human life. However, there are challenges in the efficiency of communication systems, consisting of cellular networks, that usually crash due to numerous causes making the coordination among many disordered disaster response workers extremely difficult. By breaking the communication blockage, the survival rate can be greatly increased. At the site, the sensor and satellite collect data that must be communicated to the Disaster Management Unit (DMU) so that required actions can be taken as quickly as possible. The challenge may arise that the internet services may be disrupted due to the disaster. In such a situation, the DMU shall make preliminary decisions on the basis of the last received data.

Rescue personnel segment is projected to grow at the fastest rate during the forecast period.

Enhanced communications systems assist in rescue work. IoT devices can help in search and rescue operations, as well as monitor post-disaster conditions and levels of essential resource stockpiles. IoT can continue to be used to distribute information to the public while normal communications are still being repaired. Search and rescue, emergency relief, and minimizing hazards created by the disaster. IoT devices are efficient in saving lives and minimizing the costs spent on relief measures. They can also make rescue operations easier for emergency services personnel. Therefore, IoT technology is highly adopted by rescue personnel.

Flood detection segment is set to account for the largest market share during the forecast period

To detect and avoid natural disasters, such as floods in a timely manner, evolving technology plays a vital role. With the support of an IoT-based early flood-related parameter monitoring and detection system, it is possible to prevent natural disasters caused by flooding. This model is proposed and is utilized for monitoring the water level, variations in flow, humidity, and temperature variation in the river, and the same can be used at dams or reservoirs. Then the assessed values are consistently updated on the web server, which is used to send flood alerts to authorities and people for faster action.

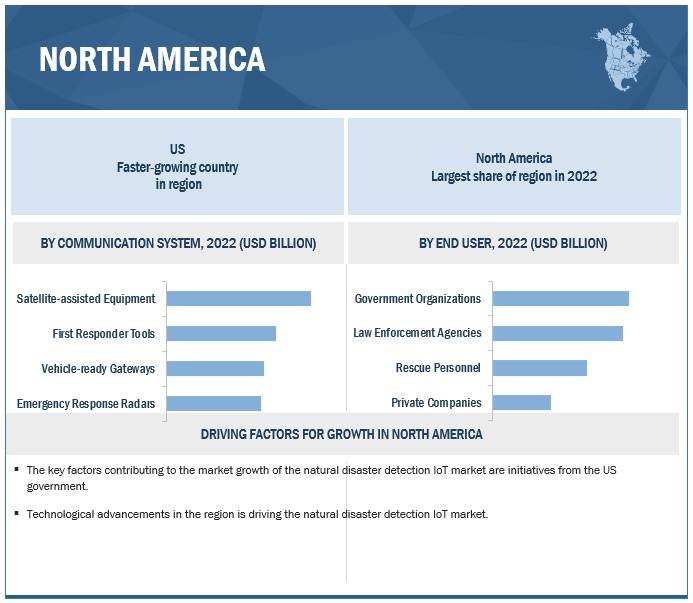

North America to account for the largest market share during the forecast period

North America has faced various types of natural disasters, such as earthquakes, droughts, mudslides, flooding, hurricanes, tornadoes, and tsunamis. These situations severely affect human life, and also, there is a major effect on finance due to the smashing of expensive infrastructure, homes, and the environment. The leaders in the region are expected to adopt IoT solutions for natural disaster detection, such as satellite IoT solutions, to decrease the loss of life and damage to property and infrastructure.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The natural disaster detection IoT market vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global natural disaster detection IoT market are NEC Corporation (Japan), BlackBerry (Canada), Semtech (US), SAP (Germany), Sony (Japan), Nokia (Finland), Sadeem Technology (Saudi Arabia), Lumineye (US), Venti LLC (US), SimpliSafe (India), One Concern (US), OnSolve (US), Trinity Mobility (India), SkyAlert (Mexico), Serinus (Germany), Knowx Innovations (India), OgoXe (France), Aplicaciones Tecnológicas SA (Spain), Earth Networks (US), Responscity Systems (India), Sensoterra (Netherlands), Intel (US), Grillo (Brazil), Bulfro Monitech (India), and Green Stream Technologies (US). The study includes an in-depth competitive analysis of these key players in the natural disaster detection IoT market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By component, application, communication system, end user, and region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

NEC Corporation (Japan), BlackBerry (Canada), Semtech (US), SAP (Germany), Sony (Japan), Nokia (Finland), Sadeem Technology (Saudi Arabia), Lumineye (US), Venti LLC (US), SimpliSafe (India), One Concern (US), OnSolve (US), Trinity Mobility (India), SkyAlert (Mexico), Serinus (Germany), Knowx Innovations (India), OgoXe (France), Aplicaciones Tecnológicas SA (Spain), Earth Networks (US), Responscity Systems (India), Sensoterra (Netherlands), Intel (US), Grillo (Brazil), Bulfro Monitech (India), and Green Stream Technologies (US) |

This research report categorizes the natural disaster detection IoT market to forecast revenues and analyze trends in each of the following subsegments:

By Component

- Hardware

-

Solutions

- Beacon

- Floating Sensor Network

- Lightning Detector System

- Acoustic Real-Time Monitoring System

- Early Warning System

- Other Solutions

-

Services

-

Professional Services

- Consulting

- Deployment and Integration

- Support and Maintenance

- Training and Simulation

- Managed Services

-

Professional Services

By Application

- Flood Detection

- Drought Detection

- Wildfire Detection

- Landslide Detection

- Earthquake Detection

- Weather Monitoring

- Other Applications

By Communication System

- First Responder Tools

- Satellite-Assisted Equipment

- Vehicle-Ready Gateways

- Emergency Response Radars

By End User

- Government Organizations

- Private Companies

- Law Enforcement Agencies

- Rescue Personnel

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Nordic Region

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia and New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East and Africa

-

Middle East

- UAE

- KSA

- Rest of Middle East

-

Africa

- South Africa

- Egypt

- Nigeria

- Rest of Africa

-

Middle East

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2022, NEC signed an agreement with the City of Kawasaki, Kanagawa Prefecture, regarding their cooperation and partnership in disaster-proof urban development based on digital technology. It was an unprecedented initiative involving a municipality in Japan.

- In September 2022, Semtech and Sierra Wireless entered into an agreement to create a comprehensive IoT platform and enable the transformation to a smarter, more sustainable planet.

- In August 2021, BlackBerry built a new flood risk and clean water monitoring solution to provide autonomous early warnings before any flood strikes. It is based on BlackBerry's AtHoc critical event management platform developed in partnership with the University of Windsor..

Frequently Asked Questions (FAQ):

What is natural disaster detection IoT?

According to Pantech eLearning, IoT devices help collect data and identify different types of natural disasters. Disasters such as landslides, forest fires, and earthquakes need a decentralized and personalized alerting system. The solutions help in broadcasting the location of the disaster-detected area and use that location to identify all the people stranded in that area based on their phone location and send them alerts regarding the disaster before the situation gets dire. This serves as an early warning system in the most unexpected situations and uses IoT and LoRa.

Which countries are considered in Europe?

The report includes an analysis of the UK, France, Germany, Italy, Spain, and the Nordic region in Europe.

Which are the key drivers supporting the growth of the natural disaster detection IoT market?

The key driver supporting the growth of the natural disaster detection IoT market includes the use of IoT devices and sensors to predict disasters in advance, reduction in damage and economic loss with disaster warnings, and increasing government initiatives to introduce IoT in emergency planning in upcoming years.

Who are the key vendors in the natural disaster detection IoT market?

The key vendors operating in the natural disaster detection IoT market include NEC Corporation (Japan), BlackBerry (Canada), Semtech (US), SAP (Germany), Sony (Japan), Nokia (Finland), Sadeem Technology (Saudi Arabia), Lumineye (US), Venti LLC (US), SimpliSafe (India), One Concern (US), OnSolve (US), Trinity Mobility (India), SkyAlert (Mexico), Serinus (Germany), Knowx Innovations (India), OgoXe (France), Aplicaciones Tecnológicas SA (Spain), Earth Networks (US), Responscity Systems (India), Sensoterra (Netherlands), Intel (US), Grillo (Brazil), Bulfro Monitech (India), and Green Stream Technologies (US).

What are some of the technological advancements in the market?

Natural disaster detection technologies, solutions, and services are achievable with sensors combined with networking technologies. IoT helps monitor weather remotely and automate, thus reducing complexity in the accurate early warning notification systems by improving communication performance, reducing operational costs, and low energy sensors

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Use of IoT devices and sensors to predict disasters in advance- Reduction in damage and economic loss with disaster warnings- Increasing government initiatives to use IoT in emergency planningRESTRAINTS- Vulnerabilities of IoT devices- Inaccurate data entering AI systemOPPORTUNITIES- Growing adoption of satellite remote sensing and GIS for disaster risk minimization and prevention- Predictive analysis with AI and data analytics toolsCHALLENGES- Hampered communications at area of disaster

-

5.3 INDUSTRY TRENDSVALUE CHAIN ANALYSISECOSYSTEM ANALYSISDISRUPTIONS IMPACTING BUYERS/CLIENTS IN NATURAL DISASTER DETECTION IOT MARKETCASE STUDY ANALYSIS- Case study 1: Contra Costa County protects people from earthquakes and other calamities- Case study 2: NEC tests simulation technology in Rio de Janeiro that enables accurate warning of natural disasters- Case study 3: Early flood warning solution by Intel- Case study 4: IoT-enabled flood monitoring system and public safety monitoring using Semtech’s LoRa and IoT- Case study 5: Nokia’s drone solution for tsunami preparedness and response in Sendai City- Case study 6: Mississippi Emergency Management Agency (MEMA) coordinates to respond to crisesPRICING ANALYSIS- Average selling price, by key player- Average selling price trendPORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryTECHNOLOGY ANALYSIS- IoT- Artificial intelligence/machine learning- 5G network- Cloud computing- Big dataPATENT ANALYSIS- Methodology- Document types- Innovation and patent applicationsKEY STAKEHOLDERS AND BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaKEY CONFERENCES AND EVENTS IN 2022–2023

-

5.4 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- Middle East and Africa- Latin America

-

6.1 INTRODUCTIONCOMPONENTS: NATURAL DISASTER DETECTION IOT MARKET DRIVERS

-

6.2 HARDWAREWIRELESS SENSOR NETWORKS TO DETECT NATURAL DISASTERS

-

6.3 SOLUTIONSRISE IN ADOPTION OF NATURAL DISASTER DETECTION IOT SOLUTIONS FOR REAL-TIME DATA COLLECTIONBEACONFLOATING SENSOR NETWORKLIGHTNING DETECTOR SYSTEMACOUSTIC REAL-TIME MONITORING SYSTEMEARLY WARNING SYSTEMOTHER SOLUTIONS

-

6.4 SERVICESPROFESSIONAL SERVICES- Professional services to minimize risk caused by natural disasters and help in integration of proper IoT devices- Consulting- Deployment and integration- Support and maintenance- Training and simulationMANAGED SERVICES- Streamline process of deploying devices globally

-

7.1 INTRODUCTIONAPPLICATIONS: NATURAL DISASTER DETECTION IOT MARKET DRIVERS

-

7.2 FLOOD DETECTIONPREVENTING FLOODS USING IOT-BASED MONITORING AND DETECTION SYSTEMS

-

7.3 DROUGHT DETECTIONPROVIDE DETAILED UPDATES ABOUT ENVIRONMENT-RELATED COMPONENTS USING IOT

-

7.4 WILDFIRE DETECTIONDETECTION OF WILDFIRE IN REMOTE AND UNMANAGED AREAS USING SENSORS

-

7.5 LANDSLIDE DETECTIONUSAGE OF NATURAL DISASTER DETECTION IOT SOLUTIONS TO REDUCE FATALITIES

-

7.6 EARTHQUAKE DETECTIONEARLY WARNING SYSTEM WITH IOT TO PREVENT DAMAGE DUE TO SEISMIC EVENTS

-

7.7 WEATHER MONITORINGIOT SYSTEM TO MONITOR CLIMATE CHANGE AND WEATHER CONDITIONS CONTINUOUSLY

-

7.8 OTHER APPLICATIONSDUAL SENSOR TECHNOLOGY FOR STORM DETECTION

-

8.1 INTRODUCTIONCOMMUNICATION SYSTEMS: NATURAL DISASTER DETECTION IOT MARKET DRIVERS

-

8.2 FIRST RESPONDER TOOLSUSAGE OF IOT, SMART DEVICES, AND AI TECHNOLOGIES FOR VICTIM DETECTION

-

8.3 SATELLITE-ASSISTED EQUIPMENTAI AND SATELLITE MAPPING TECHNIQUES TO SPEED UP PROCESS OF DISASTER MANAGEMENT

-

8.4 VEHICLE-READY GATEWAYSFAST CONNECTION BY DEPLOYING IOT SENSORS IN VEHICLE-READY GATEWAYS

-

8.5 EMERGENCY RESPONSE RADARSSYNTHETIC APERTURE RADAR TO BE USEFUL FOR MAPPING AND MONITORING SEVERAL NATURAL AND MAN-MADE DISASTERS

-

9.1 INTRODUCTIONEND USERS: NATURAL DISASTER DETECTION IOT MARKET DRIVERS

-

9.2 GOVERNMENT ORGANIZATIONSGOVERNMENT ORGANIZATIONS TO USE IOT FOR EMERGENCY PLANNING

-

9.3 PRIVATE COMPANIESADOPTION OF IOT, AI, AND SENSOR TECHNOLOGY TO MONITOR DISASTERS

-

9.4 LAW ENFORCEMENT AGENCIESUSE OF AI, IOT, AND SENSORY APPLICATIONS TRANSFORMING NATURAL DISASTER DETECTION AND MANAGEMENT

-

9.5 RESCUE PERSONNELIOT DEVICES TO HELP IN SEARCH AND RESCUE OPERATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: PESTLE ANALYSISNORTH AMERICA: RECESSION IMPACTUS- Preparedness for natural disasters with satellite IoTCANADA- IoT solutions to predict occurrence of new disasters

-

10.3 EUROPEEUROPE: PESTLE ANALYSISEUROPE: RECESSION IMPACTUK- Use of sensor technology in detection of earthquakesGERMANY- Increasing adoption of IoT solutions to detect natural disastersFRANCE- Favorable French policy on handling major hazardsITALY- Increasing use of IoT technology for wildfire detectionSPAIN- Increasing government funding for early detection of floodsNORDIC REGION- Stable welfare society helps to be least vulnerable to natural hazardsREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: PESTLE ANALYSISASIA PACIFIC: RECESSION IMPACTCHINA- Use of seismic monitoring and early warning system for natural disaster detectionINDIA- Focus on prevention, mitigation, and disaster preparednessJAPAN- JMA monitors earthquakes and operates earthquake observation networkAUSTRALIA AND NEW ZEALAND- Heavy economic losses faced by Australia due to natural disastersSOUTHEAST ASIA- Applications of big data for disaster management in Southeast AsiaREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST AND AFRICAMIDDLE EAST AND AFRICA: PESTLE ANALYSISMIDDLE EAST AND AFRICA: RECESSION IMPACTMIDDLE EAST- Ongoing developments for disaster risk reductionAFRICA- Need to enhance disaster risk financing

-

10.6 LATIN AMERICALATIN AMERICA: PESTLE ANALYSISLATIN AMERICA: RECESSION IMPACTBRAZIL- Government initiatives to adopt warning systemsMEXICO- National risk atlas helps in decision-making and disaster preventionREST OF LATIN AMERICA

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

- 11.4 HISTORICAL REVENUE ANALYSIS

- 11.5 COMPETITIVE BENCHMARKING

-

11.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

12.1 MAJOR PLAYERSNEC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBLACKBERRY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSEMTECH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSONY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNOKIA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAP- Business overview- Products/Solutions/Services offered- Recent developmentsINTEL- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 STARTUP/SMESGREEN STREAM TECHNOLOGIESSENSOTERRAEARTH NETWORKSRESPONSCITY SYSTEMSGRILLOBULFRO MONITECHSADEEM TECHNOLOGYLUMINEYEVENTI LLCSIMPLISAFEONE CONCERNONSOLVETRINITY MOBILITYSKYALERTSERINUSKNOWX INNOVATIONS PVT. LTD.OGOXEAPLICACIONES TECHNOLÓGICAS SA

- 13.1 INTRODUCTION

-

13.2 PUBLIC SAFETY AND SECURITY MARKETMARKET DEFINITIONMARKET OVERVIEWPUBLIC SAFETY AND SECURITY MARKET, BY COMPONENTPUBLIC SAFETY AND SECURITY MARKET, BY SOLUTIONPUBLIC SAFETY AND SECURITY MARKET, BY SERVICEPUBLIC SAFETY AND SECURITY MARKET, BY VERTICALPUBLIC SAFETY AND SECURITY MARKET, BY REGION

-

13.3 INCIDENT AND EMERGENCY MANAGEMENT MARKETMARKET DEFINITIONMARKET OVERVIEWINCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMPONENTINCIDENT AND EMERGENCY MANAGEMENT MARKET, BY SOLUTIONINCIDENT AND EMERGENCY MANAGEMENT MARKET, BY SERVICEINCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMMUNICATION SYSTEMINCIDENT AND EMERGENCY MANAGEMENT MARKET, BY VERTICALINCIDENT AND EMERGENCY MANAGEMENT MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2019–2021

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 NATURAL DISASTER DETECTION IOT MARKET AND GROWTH RATE, 2017–2021 (USD MILLION, Y-O-Y %)

- TABLE 4 NATURAL DISASTER DETECTION IOT MARKET AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y %)

- TABLE 5 NATURAL DISASTER DETECTION IOT MARKET: ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE OF KEY PLAYERS

- TABLE 7 NATURAL DISASTER DETECTION IOT MARKET: PORTER’S FIVE FORCES MODEL ANALYSIS

- TABLE 8 PATENTS FILED, 2020–2022

- TABLE 9 LIST OF PATENTS IN NATURAL DISASTER DETECTION IOT MARKET, 2020–2022

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 11 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 12 NATURAL DISASTER DETECTION IOT MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 18 NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 19 HARDWARE: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 20 HARDWARE: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 21 SOLUTIONS: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 22 SOLUTIONS: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

- TABLE 24 NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 25 BEACON: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 26 BEACON: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 FLOATING SENSOR NETWORK: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 28 FLOATING SENSOR NETWORK: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 29 LIGHTNING DETECTOR SYSTEM: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 30 LIGHTNING DETECTOR SYSTEM: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 31 ACOUSTIC REAL-TIME MONITORING SYSTEM: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 32 ACOUSTIC REAL-TIME MONITORING SYSTEM: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 33 EARLY WARNING SYSTEM: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 34 EARLY WARNING SYSTEM: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 35 OTHER SOLUTIONS: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 36 OTHER SOLUTIONS: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 SERVICES: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 38 SERVICES: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 40 NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 41 NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

- TABLE 42 NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 43 PROFESSIONAL SERVICES: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 44 PROFESSIONAL SERVICES: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 45 CONSULTING: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 46 CONSULTING: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 DEPLOYMENT AND INTEGRATION: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 48 DEPLOYMENT AND INTEGRATION: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 49 SUPPORT AND MAINTENANCE: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 50 SUPPORT AND MAINTENANCE: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 51 TRAINING AND SIMULATION: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 52 TRAINING AND SIMULATION: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 53 MANAGED SERVICES: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 54 MANAGED SERVICES: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 55 NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 56 NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 57 FLOOD DETECTION: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 58 FLOOD DETECTION: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 59 DROUGHT DETECTION: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 60 DROUGHT DETECTION: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 61 WILDFIRE DETECTION: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 62 WILDFIRE DETECTION: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 63 LANDSLIDE DETECTION: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 64 LANDSLIDE DETECTION: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 65 EARTHQUAKE DETECTION: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 66 EARTHQUAKE DETECTION: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 67 WEATHER MONITORING: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 68 WEATHER MONITORING: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 69 OTHER APPLICATIONS: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 70 OTHER APPLICATIONS: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 71 NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2017–2021 (USD MILLION)

- TABLE 72 NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2022–2027 (USD MILLION)

- TABLE 73 FIRST RESPONDER TOOLS: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 74 FIRST RESPONDER TOOLS: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 75 SATELLITE-ASSISTED EQUIPMENT: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 76 SATELLITE-ASSISTED EQUIPMENT: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 77 VEHICLE-READY GATEWAYS: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 78 VEHICLE-READY GATEWAYS: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 79 EMERGENCY RESPONSE RADARS: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 80 EMERGENCY RESPONSE RADARS: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 81 NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2017–2021 (USD MILLION)

- TABLE 82 NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 83 GOVERNMENT ORGANIZATIONS: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 84 GOVERNMENT ORGANIZATIONS: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 85 PRIVATE COMPANIES: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 86 PRIVATE COMPANIES: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 87 LAW ENFORCEMENT AGENCIES: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 88 LAW ENFORCEMENT AGENCIES: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 89 RESCUE PERSONNEL: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 90 RESCUE PERSONNEL: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 91 NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 92 NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 93 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 94 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 95 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 96 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 97 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

- TABLE 98 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 99 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

- TABLE 100 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 101 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 102 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 103 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2017–2021 (USD MILLION)

- TABLE 104 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2022–2027 (USD MILLION)

- TABLE 105 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2017–2021 (USD MILLION)

- TABLE 106 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 107 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 108 NORTH AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 109 US: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 110 US: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 111 US: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 112 US: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 113 US: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

- TABLE 114 US: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 115 US: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

- TABLE 116 US: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 117 US: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 118 US: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 119 US: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2017–2021 (USD MILLION)

- TABLE 120 US: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2022–2027 (USD MILLION)

- TABLE 121 US: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2017–2021 (USD MILLION)

- TABLE 122 US: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 123 CANADA: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 124 CANADA: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 125 CANADA: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 126 CANADA: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 127 CANADA: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

- TABLE 128 CANADA: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 129 CANADA: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

- TABLE 130 CANADA: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 131 CANADA: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 132 CANADA: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 133 CANADA: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2017–2021 (USD MILLION)

- TABLE 134 CANADA: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2022–2027 (USD MILLION)

- TABLE 135 CANADA: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2017–2021 (USD MILLION)

- TABLE 136 CANADA: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 137 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 138 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 139 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 140 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 141 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

- TABLE 142 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 143 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

- TABLE 144 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 145 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 146 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 147 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2017–2021 (USD MILLION)

- TABLE 148 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2022–2027 (USD MILLION)

- TABLE 149 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2017–2021 (USD MILLION)

- TABLE 150 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 151 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 152 EUROPE: NATURAL DISASTER DETECTION IOT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 153 UK: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 154 UK: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 155 UK: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 156 UK: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 157 UK: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

- TABLE 158 UK: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 159 UK: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

- TABLE 160 UK: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 161 UK: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 162 UK: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 163 UK: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2017–2021 (USD MILLION)

- TABLE 164 UK: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2022–2027 (USD MILLION)

- TABLE 165 UK: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2017–2021 (USD MILLION)

- TABLE 166 UK: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 167 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 168 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 169 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 170 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 171 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICES, 2017–2021 (USD MILLION)

- TABLE 172 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICES, 2022–2027 (USD MILLION)

- TABLE 173 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

- TABLE 174 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 175 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 176 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 177 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2017–2021 (USD MILLION)

- TABLE 178 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2022–2027 (USD MILLION)

- TABLE 179 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2017–2021 (USD MILLION)

- TABLE 180 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 181 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 182 ASIA PACIFIC: NATURAL DISASTER DETECTION IOT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 183 CHINA: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 184 CHINA: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 185 CHINA: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 186 CHINA: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 187 CHINA: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

- TABLE 188 CHINA: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 189 CHINA: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

- TABLE 190 CHINA: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 191 CHINA: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 192 CHINA: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 193 CHINA: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2017–2021 (USD MILLION)

- TABLE 194 CHINA: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2022–2027 (USD MILLION)

- TABLE 195 CHINA: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2017–2021 (USD MILLION)

- TABLE 196 CHINA: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 197 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 198 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 199 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 200 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 201 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

- TABLE 202 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 203 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

- TABLE 204 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 205 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 206 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 207 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2017–2021 (USD MILLION)

- TABLE 208 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2022–2027 (USD MILLION)

- TABLE 209 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2017–2021 (USD MILLION)

- TABLE 210 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 211 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2017–2021 (USD MILLION)

- TABLE 212 MIDDLE EAST AND AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 213 MIDDLE EAST: NATURAL DISASTER DETECTION IOT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 214 MIDDLE EAST: NATURAL DISASTER DETECTION IOT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 215 KSA: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 216 KSA: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 217 KSA: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 218 KSA: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 219 KSA: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

- TABLE 220 KSA: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 221 KSA: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

- TABLE 222 KSA: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 223 KSA: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 224 KSA: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 225 KSA: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2017–2021 (USD MILLION)

- TABLE 226 KSA: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2022–2027 (USD MILLION)

- TABLE 227 KSA: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2017–2021 (USD MILLION)

- TABLE 228 KSA: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 229 AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 230 AFRICA: NATURAL DISASTER DETECTION IOT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 231 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 232 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 233 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 234 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 235 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

- TABLE 236 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 237 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

- TABLE 238 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 239 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 240 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 241 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2017–2021 (USD MILLION)

- TABLE 242 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2022–2027 (USD MILLION)

- TABLE 243 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2017–2021 (USD MILLION)

- TABLE 244 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 245 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

- TABLE 246 LATIN AMERICA: NATURAL DISASTER DETECTION IOT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 247 BRAZIL: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

- TABLE 248 BRAZIL: NATURAL DISASTER DETECTION IOT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 249 BRAZIL: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2017–2021 (USD MILLION)

- TABLE 250 BRAZIL: NATURAL DISASTER DETECTION IOT MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 251 BRAZIL: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2017–2021 (USD MILLION)

- TABLE 252 BRAZIL: NATURAL DISASTER DETECTION IOT MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

- TABLE 253 BRAZIL: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

- TABLE 254 BRAZIL: NATURAL DISASTER DETECTION IOT MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 255 BRAZIL: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2017–2021 (USD MILLION)

- TABLE 256 BRAZIL: NATURAL DISASTER DETECTION IOT MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 257 BRAZIL: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2017–2021 (USD MILLION)

- TABLE 258 BRAZIL: NATURAL DISASTER DETECTION IOT MARKET, BY COMMUNICATION SYSTEM, 2022–2027 (USD MILLION)

- TABLE 259 BRAZIL: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2017–2021 (USD MILLION)

- TABLE 260 BRAZIL: NATURAL DISASTER DETECTION IOT MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 261 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN NATURAL DISASTER DETECTION IOT MARKET

- TABLE 262 NATURAL DISASTER DETECTION IOT MARKET: DEGREE OF COMPETITION

- TABLE 263 NATURAL DISASTER DETECTION IOT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 264 NATURAL DISASTER DETECTION IOT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY SOLUTION AND REGION

- TABLE 265 NATURAL DISASTER DETECTION IOT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY APPLICATION

- TABLE 266 NATURAL DISASTER DETECTION IOT MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS, BY SOLUTION AND REGION

- TABLE 267 NATURAL DISASTER DETECTION IOT MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS, BY APPLICATION

- TABLE 268 PRODUCT LAUNCHES, 2020–2022

- TABLE 269 DEALS, 2020–2022

- TABLE 270 NEC CORPORATION: BUSINESS OVERVIEW

- TABLE 271 NEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 NEC CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 273 NEC CORPORATION: DEALS

- TABLE 274 BLACKBERRY: BUSINESS OVERVIEW

- TABLE 275 BLACKBERRY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 BLACKBERRY: PRODUCT LAUNCHES

- TABLE 277 BLACKBERRY: DEALS

- TABLE 278 SEMTECH: BUSINESS OVERVIEW

- TABLE 279 SEMTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 SEMTECH: PRODUCT LAUNCHES

- TABLE 281 SEMTECH: DEALS

- TABLE 282 SONY: BUSINESS OVERVIEW

- TABLE 283 SONY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 SONY: PRODUCT LAUNCHES

- TABLE 285 SONY: DEALS

- TABLE 286 NOKIA: BUSINESS OVERVIEW

- TABLE 287 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 NOKIA: PRODUCT LAUNCHES

- TABLE 289 NOKIA: DEALS

- TABLE 290 SAP: BUSINESS OVERVIEW

- TABLE 291 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 SAP: PRODUCT LAUNCHES

- TABLE 293 SAP: DEALS

- TABLE 294 INTEL: BUSINESS OVERVIEW

- TABLE 295 INTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 INTEL: PRODUCT LAUNCHES

- TABLE 297 INTEL: DEALS

- TABLE 298 COMPONENTS: PUBLIC SAFETY AND SECURITY MARKET, 2015–2020 (USD MILLION)

- TABLE 299 COMPONENTS: PUBLIC SAFETY AND SECURITY MARKET, 2021–2027 (USD MILLION)

- TABLE 300 SOLUTIONS: PUBLIC SAFETY AND SECURITY MARKET, 2015–2020 (USD MILLION)

- TABLE 301 SOLUTIONS: PUBLIC SAFETY AND SECURITY MARKET, 2021–2027 (USD MILLION)

- TABLE 302 SERVICES: PUBLIC SAFETY AND SECURITY MARKET, 2015–2020 (USD MILLION)

- TABLE 303 SERVICES: PUBLIC SAFETY AND SECURITY MARKET, 2021–2027 (USD MILLION)

- TABLE 304 VERTICALS: PUBLIC SAFETY AND SECURITY MARKET, 2015–2020 (USD MILLION)

- TABLE 305 VERTICAL: PUBLIC SAFETY AND SECURITY MARKET, 2021–2027 (USD MILLION)

- TABLE 306 PUBLIC SAFETY AND SECURITY MARKET, BY REGION, 2015–2020 (USD MILLION)

- TABLE 307 PUBLIC SAFETY AND SECURITY MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 308 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

- TABLE 309 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 310 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY SOLUTION, 2016–2020 (USD MILLION)

- TABLE 311 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

- TABLE 312 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY SERVICE, 2016–2020 (USD MILLION)

- TABLE 313 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY SERVICE, 2021–2026 (USD MILLION)

- TABLE 314 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMMUNICATION SYSTEM, 2016–2020 (USD MILLION)

- TABLE 315 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY COMMUNICATION SYSTEM, 2021–2026 (USD MILLION)

- TABLE 316 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY VERTICAL, 2016–2020 (USD MILLION)

- TABLE 317 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 318 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 319 INCIDENT AND EMERGENCY MANAGEMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

- FIGURE 1 NATURAL DISASTER DETECTION IOT MARKET SEGMENTATION

- FIGURE 2 NATURAL DISASTER DETECTION IOT MARKET: GEOGRAPHIC SCOPE

- FIGURE 3 NATURAL DISASTER DETECTION IOT MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - REVENUE OF SOLUTIONS/SERVICES

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE FROM SOLUTIONS/SERVICES

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 NATURAL DISASTER DETECTION IOT MARKET TO WITNESS DECLINE IN Y-O-Y GROWTH IN 2022

- FIGURE 11 SUBSEGMENTS WITH HIGHEST GROWTH RATE IN GLOBAL NATURAL DISASTER DETECTION IOT MARKET FROM 2022 TO 2027

- FIGURE 12 NATURAL DISASTER DETECTION IOT MARKET, REGIONAL AND COUNTRY-WISE SHARE, 2022

- FIGURE 13 MAJOR DEVELOPMENTS BY LEADING VENDORS TO DRIVE NATURAL DISASTER DETECTION IOT MARKET DURING FORECAST PERIOD

- FIGURE 14 SOLUTIONS SEGMENT TO DOMINATE MARKET BY 2027

- FIGURE 15 EARLY WARNING SYSTEM TO HOLD HIGH GROWTH RATE DURING FORECAST PERIOD

- FIGURE 16 PROFESSIONAL SERVICES SEGMENT TO DOMINATE MARKET BY 2027

- FIGURE 17 TRAINING AND SIMULATION SEGMENT TO HOLD HIGH GROWTH RATE DURING FORECAST PERIOD

- FIGURE 18 FLOOD DETECTION SEGMENT TO DOMINATE MARKET BY 2027

- FIGURE 19 FIRST RESPONDER TOOLS SEGMENT TO HOLD HIGH GROWTH RATE DURING FORECAST PERIOD

- FIGURE 20 GOVERNMENT ORGANIZATIONS SEGMENT TO DOMINATE MARKET BY 2027

- FIGURE 21 SATELLITE-ASSISTED EQUIPMENT AND GOVERNMENT ORGANIZATIONS SEGMENT TO ACCOUNT FOR SIGNIFICANT MARKET SHARE IN 2022

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: NATURAL DISASTER DETECTION IOT MARKET

- FIGURE 23 NATURAL DISASTER DETECTION IOT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 NATURAL DISASTER DETECTION IOT MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 25 NUMBER OF PATENTS GRANTED ANNUALLY, 2020–2022

- FIGURE 26 TOP 10 PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2020–2022

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 29 SOLUTIONS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 EARLY WARNING SYSTEM SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 MANAGED SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 TRAINING AND SIMULATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 WEATHER MONITORING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 FIRST RESPONDER TOOLS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 RESCUE PERSONNEL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 38 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS, 2019–2021 (USD MILLION)

- FIGURE 39 NATURAL DISASTER DETECTION IOT MARKET KEY PLAYERS: COMPANY EVALUATION MATRIX, 2022

- FIGURE 40 NATURAL DISASTER DETECTION IOT MARKET STARTUP/SMES: COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 BLACKBERRY: COMPANY SNAPSHOT

- FIGURE 43 SEMTECH: COMPANY SNAPSHOT

- FIGURE 44 SONY: COMPANY SNAPSHOT

- FIGURE 45 NOKIA: COMPANY SNAPSHOT

- FIGURE 46 SAP: COMPANY SNAPSHOT

- FIGURE 47 INTEL: COMPANY SNAPSHOT

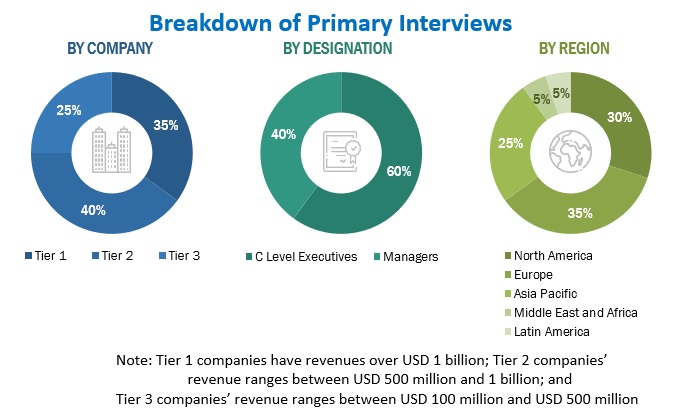

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the natural disaster detection IoT market. Primary sources were industry experts from core and related industries, preferred system developers, service providers, resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information, as well as to assess the market’s prospects. These included key industry participants, subject-matter experts, C-level executives of key companies, and industry consultants.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and various associations were also referred to, such as the Natural Hazards Center and The Scientist Magazine. Secondary research was used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides of the natural disaster detection IoT market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, related key executives from various vendors providing natural disaster detection IoT solutions, associated service providers, and system integrators operating in the targeted regions. All parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, both top-down and bottom-up approaches and several data triangulation methods were used to perform the market estimation and forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the market size of the natural disaster detection IoT market. The first approach involves the estimation of the market size by summing up the revenues of the companies generated through the sale of hardware, software, and services.

Natural disaster detection IoT Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The bottom-up approach was employed to arrive at the overall size of the natural disaster detection IoT market from the revenue of the key players and their share in this market. The revenue of the key players was analyzed to determine the overall size of the natural disaster detection IoT market.

Report Objectives

- To determine, segment, and forecast the global natural disaster detection IoT market by component, application, communication system, end user, and region in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the natural disaster detection IoT market

- To study the complete value chain and related industry segments and perform a value chain analysis of the natural disaster detection IoT market landscape

- To strategically analyze macro and micromarkets with respect to individual growth trends, prospects, and contributions to the total natural disaster detection IoT market

- To analyze industry trends, pricing data, and patents and innovations related to the natural disaster detection IoT market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the natural disaster detection IoT market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches and developments, partnerships, agreements, collaborations, business expansions, and Research and Development (R&D) activities

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Further breakdown of South Korean natural disaster detection IoT market

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Natural Disaster Detection IoT Market