Pet Insurance Market Size, Growth, Share & Trends Analysis

Pet Insurance Market by Policy Coverage (Accident Only, Illness Only, Comprehensive Plans, Preventive Care), Animal Type (Dog, Cat), Provider Type (Public, Private), Sales Channel (Broker, Direct, Agency, Bancassurance) & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

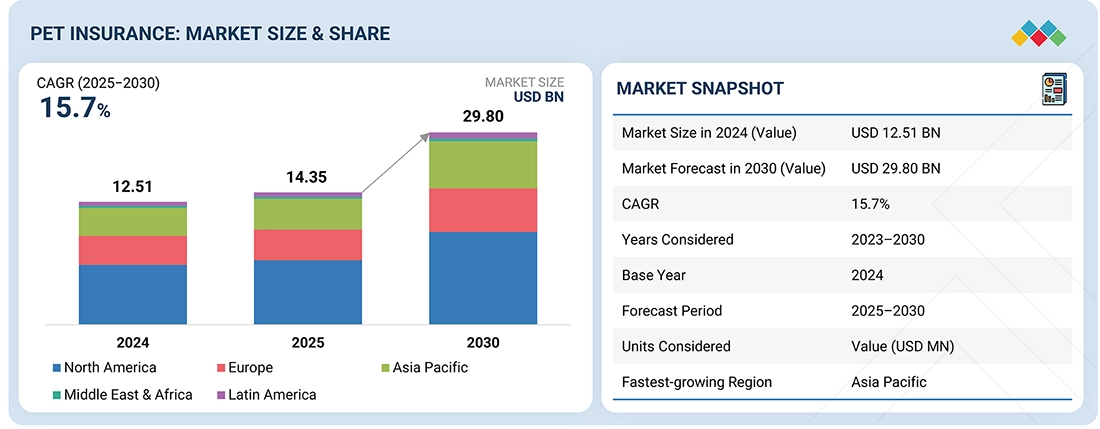

The pet insurance market is projected to reach USD 29.80 billion by 2030 from USD 14.35 billion in 2025, at a CAGR of 15.7% from 2025 to 2030. The pet insurance market covers policies designed to provide financial coverage for veterinary care, including illness, accidents, preventive treatments, and in some cases, routine check-ups. Market growth is primarily driven by the rising rate of pet ownership and the increasing humanization of pets, leading to higher spending on animal healthcare. Growing awareness about the financial risks associated with unexpected veterinary expenses and the benefits of insurance protection is further boosting adoption. Additionally, expanding coverage options (such as multi-pet policies, wellness add-ons, and chronic condition coverage) and the digitalization of insurance platforms are enhancing customer accessibility and convenience. Supportive regulatory frameworks and insurer–veterinary collaborations are also contributing to market expansion. Moreover, the demand for comprehensive, affordable, and customized plans, coupled with increasing partnerships between insurers and veterinary hospitals, is expected to accelerate the growth of the pet insurance industry in the coming years.

KEY TAKEAWAYS

-

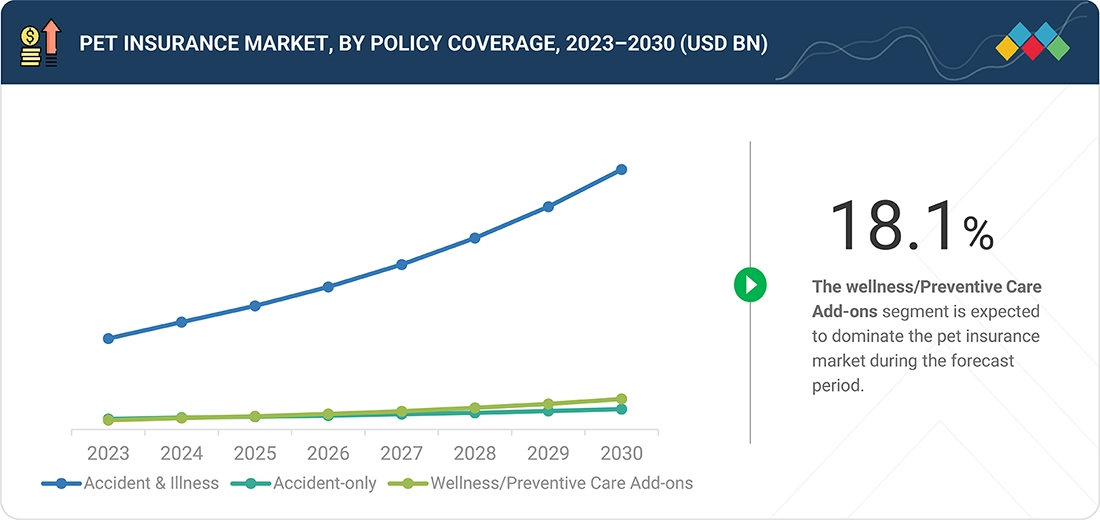

BY POLICY COVERAGEAccident & illness policies dominate the pet insurance market as they provide comprehensive coverage, while accident-only policies serve as cost-effective alternatives. Wellness/Preventive care add-ons are increasingly popular, driven by pet owners’ focus on routine care and early disease detection.

-

BY SALES CHANNELDirect sales channels remain significant due to digital adoption and insurer–customer interaction, while agencies and brokers continue to expand reach through personalized guidance. Bancassurance and other sales channels are emerging, enhancing accessibility and market penetration.

-

BY PROVIDER TYPEPrivate providers lead the market, offering flexible plans and tailored services, while public providers contribute to affordability and accessibility in certain regions. Competitive dynamics between these provider types influence innovation and customer engagement.

-

BY ANIMAL TYPEDogs account for the majority share of the market due to higher adoption rates and healthcare expenditure, followed by cats. Coverage for other animals is gradually rising, reflecting growing awareness and demand for diverse pet species.

-

BY REGIONThe Asia Pacific is expected to grow at the highest rate, at a CAGR of 17.0% driven by rising pet adoption, growing awareness of pet health, increasing disposable incomes, and expanding veterinary care infrastructure in countries such as China, India, and Japan.

-

COMPETITIVE LANDSCAPELeading market players are pursuing both organic and inorganic strategies, including new product launches, partnerships, and acquisitions, to strengthen their market presence. For example, key companies such as Trupanion, Pet Plan Limited, Nationwide, and Anicom Holdings, Inc. are expanding coverage offerings, enhancing digital platforms for policy management, and entering strategic collaborations to improve accessibility and customer engagement.

The pet insurance market is projected to experience robust growth over the next decade, fueled by rising pet ownership, growing humanization of pets, and increasing expenditure on veterinary care. Pet owners are seeking financial protection against the rising costs of treatments, surgeries, and chronic disease management, which is driving the demand for comprehensive insurance policies. Coverage options such as accident & illness plans, accident-only policies, and wellness/preventive care add-ons are gaining traction as owners prioritize both emergency and routine healthcare. The market is further supported by the expansion of veterinary clinics, hospitals, and specialty care facilities, alongside growing partnerships between insurers and veterinary service providers. Advancements in digital platforms, mobile apps, and online claims processing are improving policy accessibility and customer experience. Moreover, the introduction of customized, affordable, and multi-pet insurance plans is widening adoption across diverse demographics. With a rising global companion animal population, increasing awareness of preventive healthcare, and the need for financial security against unforeseen medical expenses, the pet insurance industry is set to play a critical role in shaping the future of animal healthcare management worldwide.

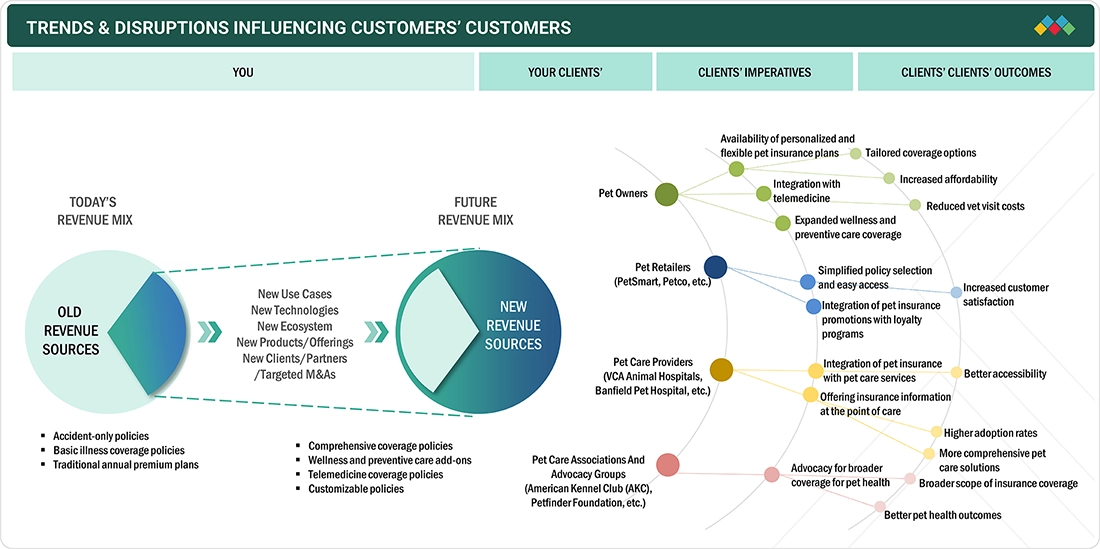

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on the pet insurance market arises from evolving pet ownership patterns and shifts in animal healthcare economics. Veterinary clinics, hospitals, and pet owners serve as the primary stakeholders, with applications spanning routine care, emergency treatments, chronic disease management, and preventive wellness programs. Trends such as the rising cost of veterinary services, increasing humanization of pets, greater adoption of digital platforms for claims and policy management, and stricter regulatory frameworks are transforming how insurers design and deliver products. These changes influence pet owners’ demand for flexible and affordable coverage options, thereby directly shaping revenue streams, innovation, and long-term competitiveness for pet insurance providers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rise in pet ownership

-

Increasing pet expenditure

Level

-

High pet insurance premium costs

-

Regulatory inconsistencies across jurisdictions

Level

-

Customizable plans and & wellness add-ons

-

Embedded insurance models

Level

-

Inefficiencies in insurance claims processing

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rise in pet ownership

The rise in global pet ownership is a key driver of the pet insurance market, as more households adopt dogs, cats, and other companion animals. With growing attachment to pets and increasing demand for quality veterinary care, owners are seeking financial protection against rising treatment costs. Pet insurance enables access to better healthcare while easing the burden of unexpected expenses, making it an attractive option. This trend is especially strong in North America and Europe, while adoption is accelerating in the Asia Pacific and Latin America with rising incomes and changing lifestyles.

Restraint: High pet insurance premium costs

The high cost of pet insurance premiums significantly restrains market growth, particularly in price-sensitive regions. While comprehensive policies covering accidents, illnesses, and preventive care offer valuable protection, their affordability remains a concern for many pet owners. Rising veterinary treatment costs and the inclusion of advanced care options often translate into higher premiums, discouraging adoption. This challenge is more pronounced in emerging markets, where awareness is growing but disposable incomes are comparatively lower, limiting the overall penetration of pet insurance.

Opportunity: Customizable plans & wellness add-ons

The growing demand for customizable insurance plans and wellness add-ons presents a major opportunity in the pet insurance market. Pet owners are increasingly seeking policies that align with their pets’ specific health needs, ranging from preventive care and vaccinations to chronic condition management. Wellness add-ons, such as coverage for routine check-ups, dental care, and nutrition, not only enhance value but also promote long-term pet health. By offering flexible, tailored policies and multi-pet coverage options, insurers can attract a broader customer base, improve affordability, and strengthen customer loyalty, thereby driving market expansion.

Challenge: Inefficiencies in insurance claims processing

Inefficiencies in insurance claims processing remain a key challenge for the pet insurance market, often leading to delays, complex paperwork, and customer dissatisfaction. Lengthy reimbursement timelines and a lack of standardized procedures discourage pet owners from adopting or renewing policies. In some cases, disputes over coverage eligibility further reduce trust in insurers. These inefficiencies highlight the need for greater digitalization, automation, and transparent communication to improve claims management and enhance customer experience.

Pet Insurance Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers comprehensive accident & illness insurance for dogs and cats | Covers congenital and breed-specific issues | No annual or per-condition payout limits | Direct payment to vets is available | No payout caps | Direct vet payment | Broad coverage for accidents, illnesses, and hereditary conditions | Customizable deductibles | Fast claims | Excludes wellness/routine care |

|

Provides a wide range of accident, illness, and wellness/preventive care options | The only US insurer covering exotic pets (birds, reptiles, etc.) | Multiple plan levels available | Broad portfolio | Strong brand reputation | Flexible coverage for dogs, cats, and exotic animals | Wellness/preventive care optional | High trust among pet owners |

|

Covers accidents, illnesses, dental, behavioral therapy, and alternative treatments | Optional wellness rewards for preventive care | Flexible deductibles and reimbursement options | Comprehensive care | Customizable plans | Wellness and routine care add-ons | Covers alternative treatments | Higher flexibility on costs and coverage |

|

Single accident & illness plan for dogs and cats | Unlimited lifetime payouts | Fast claims processing | No cap on payout amounts | Unlimited benefits | Fast digital claims | Simple coverage | Broad acceptance | Does not cover routine/preventive care | Clarity and ease-of-use |

|

Major Japanese insurer exclusively handling pets | Works directly with clinics/hospitals | Covers illnesses and accidents | Tailored to local cost structures and market needs | Leading market share in Japan | Deep local expertise | Strong clinic partnerships | Tailored regional coverage and pricing | Wellbeing initiatives |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The pet insurance market ecosystem comprises a network of insurance providers, intermediaries (brokers, agencies, bancassurance partners), veterinary clinics & hospitals, pet owners, and regulatory bodies working together to deliver financial protection and improved healthcare access for companion animals. Insurance providers design and underwrite policies, while intermediaries and digital platforms expand distribution and awareness. Veterinary clinics & hospitals play a critical role by guiding owners on policy benefits and facilitating claims, ensuring seamless integration between medical services and insurance coverage. Pet owners remain the central stakeholders, driving demand through rising adoption and willingness to invest in animal health. Regulatory authorities and industry associations support the ecosystem by establishing compliance, transparency, and consumer protection standards. Furthermore, strategic collaborations, partnerships with veterinary networks, and digital innovations in policy management and claims processing are strengthening connectivity across the ecosystem, enabling wider adoption and ensuring accessible, affordable, and reliable pet healthcare financing.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Pet Insurance Market, By Policy Coverage

The accident & illness segment holds the largest share of the pet insurance market as it provides the most comprehensive coverage, protecting against unexpected injuries, chronic conditions, hereditary diseases, and major medical expenses. Pet owners increasingly prefer these policies because they offer greater financial security and peace of mind compared to accident-only or limited coverage plans. With rising veterinary costs and growing awareness of advanced treatments, accident & illness insurance is becoming the most attractive option, driving its dominance in the market.

Pet Insurance Market, By Sales Channel

The direct sales segment accounts for the largest share of the pet insurance market as consumers increasingly prefer purchasing policies online or directly from insurers for convenience, transparency, and cost-effectiveness. Digital platforms and mobile apps make it easier for pet owners to compare plans, customize coverage, and manage claims without relying on intermediaries. In addition, direct channels allow insurers to build stronger customer relationships and offer personalized solutions, further reinforcing their dominance in the market.

Pet Insurance Market, By Provider Type

The private providers segment of the pet insurance market accounted for the largest share in 2024 as they offer a wide range of flexible and customized policies tailored to the diverse needs of pet owners. Unlike public providers, which are limited in scope and geography, private insurers actively expand coverage through accident & illness plans, wellness add-ons, and multi-pet options. Their strong presence in major markets, coupled with continuous innovation in digital platforms and claims processing, has enabled them to attract a larger customer base and maintain leadership in the industry.

Pet Insurance Market, By Animal Type

In 2024, dogs held the largest share of the pet insurance market because dogs are the most owned companion animals and often require higher veterinary care due to their size, activity levels, and susceptibility to accidents and chronic conditions. Pet owners are more willing to invest in comprehensive coverage, including accident & illness policies and wellness add-ons, to ensure timely treatment and financial protection. This strong demand for dog insurance drives the segment’s dominance in the market.

REGION

Asia Pacific to be fastest-growing region in global pet insurance market during forecast period

The Asia Pacific region is the fastest-growing market for pet insurance, driven by rising pet adoption, increasing disposable incomes, and growing awareness of animal healthcare. Rapid urbanization and the humanization of pets are encouraging owners to seek better medical care, while the expansion of digital insurance platforms is improving accessibility. Countries like China, Japan, and India are witnessing strong growth as veterinary costs rise and insurers introduce affordable, customized plans. Additionally, supportive regulatory initiatives and partnerships with veterinary networks are further accelerating adoption across the region.

Pet Insurance Market: COMPANY EVALUATION MATRIX

In the pet insurance market matrix, Trupanion (Star) leads with a strong market presence, extensive coverage options, and a well-established network of veterinary partnerships, driving widespread adoption across North America and expanding globally. Its focus on comprehensive accident & illness policies, digital claims processing, and customer-centric services reinforces its leadership position. Embrace Pet Insurance Agency, LLC (Emerging Leader) is gaining momentum with innovative offerings such as customizable plans, wellness rewards, and multi-pet coverage, appealing to a broader customer base. While Trupanion dominates with scale and brand recognition, Embrace demonstrates strong potential to advance toward the leaders’ quadrant through continued innovation and expansion.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Trupanion (US)

- Nationwide (US)

- Pet Plan Limited (UK)

- Anicom Holdings, Inc. (Japan)

- Healthy Paws (US)

- Pets Best Insurance Services, LLC (US)

- Pumpkin Insurance Services Inc. (US)

- Spot Pet Insurance Services, LLC (US)

- Figo Pet Insurance LLC (US)

- Agria Pet Insurance Ltd. (Sweden)

- PetPartners, Inc. (US)

- ASPCA (US)

- Pet Protect Limited (UK)

- Embrace Pet Insurance Agency, LLC (US)

- Getsafe (Germany)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 12.51 BN |

| Market Forecast in 2030 (Value) | USD 29.80 BN |

| CAGR | CAGR of 15.7% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD BN) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

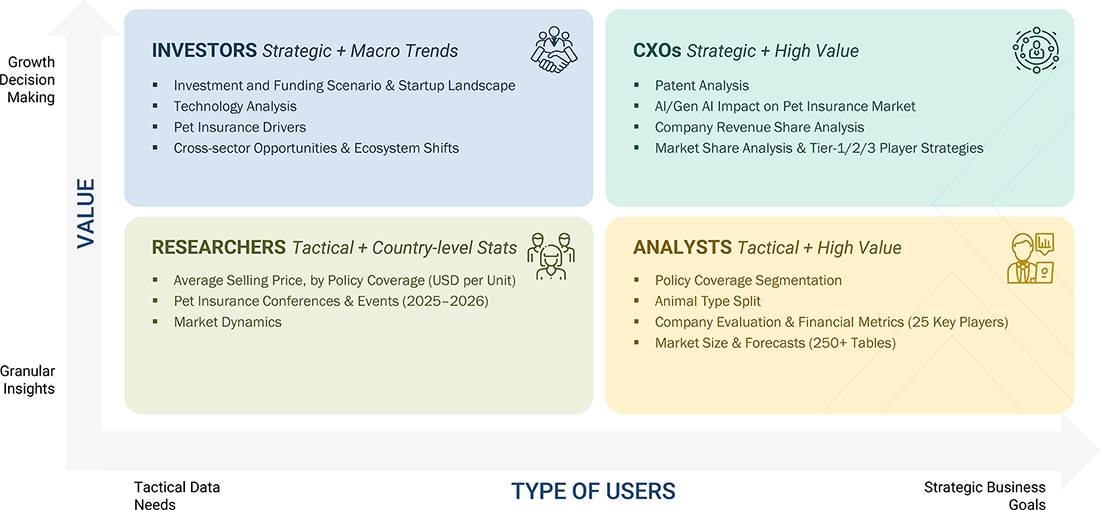

WHAT IS IN IT FOR YOU: Pet Insurance Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Product Analysis |

|

|

| Company Information |

|

|

| Geographic Analysis |

|

|

RECENT DEVELOPMENTS

- April 2025 : Pumpkin Insurance Services Inc. introduced PumpkinNow, an urgent pay feature that enables eligible customers to access up to 90% of covered veterinary costs within 15 minutes, even before settling the bill with the clinic. This service ensures quicker access to essential and high-cost treatments.

- February 2025 : Rate Insurance partnered with Spot Pet Insurance Services, LLC to provide its customers with comprehensive pet health coverage. The collaboration expands access to affordable insurance options, helping pet owners ensure quality care for their animals.

- October 2024 : Bindable has teamed up with Pets Best Insurance Services, LLC to integrate pet insurance into its digital platform. The partnership allows carriers, brokers, and affinity groups within Bindable’s network to seamlessly access Pets Best products through an online quoting system.

- September 2024 : Trupanion introduced its premium insurance service in Germany and Switzerland, aiming to provide coverage for more than 29 million pets across both markets.

Table of Contents

Methodology

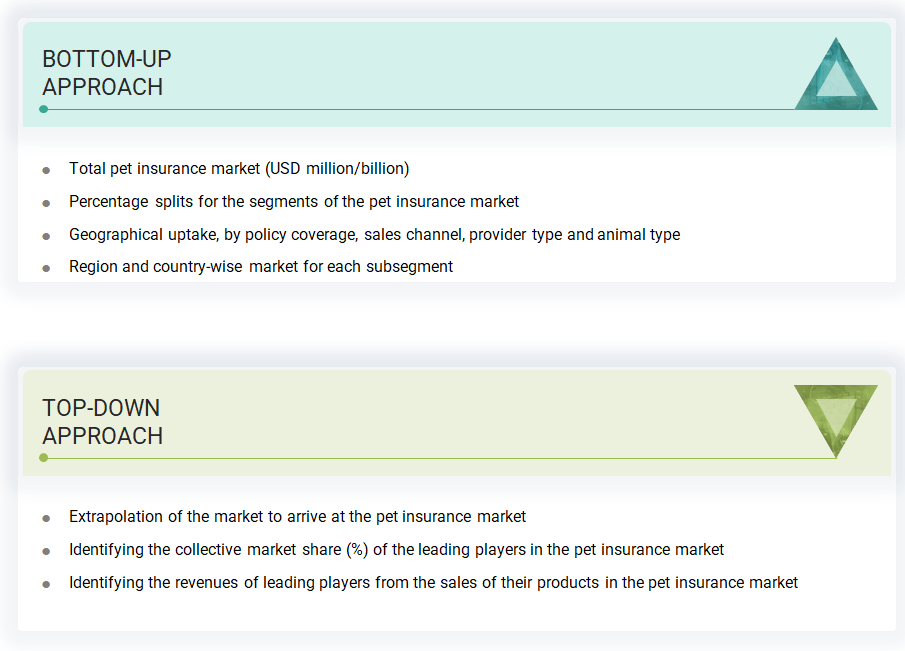

This research study extensively utilized both primary and secondary sources. It involved analyzing various factors influencing the industry to identify segmentation types, industry trends, key players, the competitive landscape, key market dynamics, and strategies employed by key players.

Secondary Research

This research study utilized a variety of comprehensive secondary sources, including directories, databases such as Bloomberg Business, Factiva, and Dun & Bradstreet, white papers, annual reports, company house documents, investor presentations, and SEC filings from various companies. Secondary research was employed to gather information crucial for an in-depth, technical, market-oriented, and commercial analysis of the pet insurance market. This approach also helped identify key players in the industry and allowed for classification and segmentation based on emerging trends at the most detailed level. Furthermore, significant developments pertaining to both market and technological perspectives were documented. A database of primary industry leaders was created as part of this secondary research.

Primary Research

In the primary research process, we interviewed a range of sources from both the supply and demand sides to gather qualitative and quantitative information for this report. On the supply side, we consulted individuals such as project, sales, marketing, and business development managers, as well as presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, and chief information officers, specifically related to the pet insurance market. On the demand side, we spoke with pet owners, veterinary practice managers, insurance sales professionals, and procurement/benefits managers.

The following is a breakdown of the primary respondents:

Note 1: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 2: Other designations include sales, marketing, and product managers.

Note 3: Tiers are defined based on a company’s total revenue. As of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the pet insurance market was determined after data triangulation from three approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

The pet insurance market refers to the part of the insurance industry that provides health coverage policies specifically created for domestic animals, mainly cats and dogs. These policies assist pet owners in managing veterinary costs by reimbursing expenses related to accidents, illnesses, surgeries, medications, and, in some cases, routine and preventive care. The market includes different types of coverage, such as accident-only, accident & illness, and wellness add-ons, offered through channels like direct-to-consumer platforms, brokers, and corporate partnerships. It involves various stakeholders, including private insurers, veterinary clinics, and regulatory agencies, all working together to protect companion animals' financial interests and overall health.

Stakeholders

- Pet Owners

- Insurance Providers

- Veterinary Clinics and Hospitals

- Brokers and Agents

- Technology Providers

- Regulatory Authorities

- Animal Welfare Organizations

- Distribution Partners

- Underwriters and Reinsurers

- Corporate Partners

Report Objectives

- To define, describe, segment, and forecast the pet insurance market by policy coverage, sales channel, provider type, animal type, and region

- To provide detailed information about the factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall pet insurance market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the pet insurance market in five central regions (along with their respective key countries): North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the pet insurance market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships

Key Questions Addressed by the Report

Who are the leading industry players in the pet insurance market?

The leading companies in the pet insurance industry include Trupanion (US), Nationwide (US), Pet Plan Limited (UK), Anicom Holdings, Inc. (Japan), and Healthy Paws (US).

Which geographic region is experiencing the highest growth rate in the pet insurance market?

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period.

Which policy coverage segment will dominate the market during the forecast period?

The accident and illness segment dominates the pet insurance market because it provides extensive coverage for the most common and expensive veterinary treatments, making it highly appealing to pet owners looking for financial protection against unexpected health problems.

What factors are expected to challenge market growth?

Limited coverage for pre-existing conditions, high premium costs, lack of standardized policy terms, and inefficiencies in claims processing and reimbursement are expected to hinder market growth.

What is the expected CAGR for the market during the forecast period?

The pet insurance market is projected to grow at a CAGR of 15.7% during the forecast period (2025−2030).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Pet Insurance Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Pet Insurance Market