Nanomechanical Testing Market by Offering (Hardware, Services), Application (Material Development, Life Sciences, Industrial Manufacturing, and Semiconductor Manufacturing), Instrument Type (SEM, TEM, & Dual-Beam), and Geography - Global Forecast to 2023

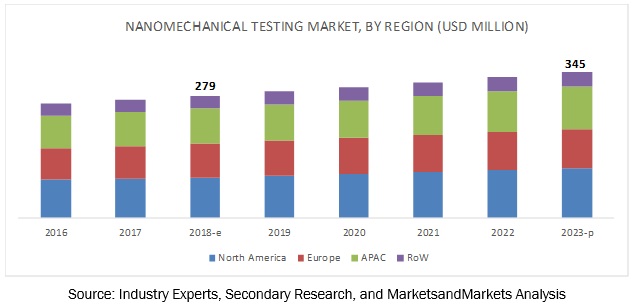

[98 Pages Report] According to MarketsandMarkets, the global nanomechanical testing market is expected to grow from USD 279 million in 2018 to USD 345 million by 2023, at a CAGR of 3.65% during the forecast period. The increasing demand for testing various materials to understand its properties on a nanoscale would increase the market for nanomechanical testing services for several applications, such as life sciences, industrial manufacturing, and material development.

Material Development Application to Account for Largest Size of Nanomechanical Testing Market From 2018 to 2023

Metamaterials are those engineered structures that are designed to interact with electromagnetic radiation in a pre-defined manner. Metamaterials usually comprise an array of structures called meta-atoms that can interact with magnetic and electric components; hence, metamaterials create promising opportunities for the players in the market. Metamaterials attain desired results by incorporating structural elements of sub-wavelength sizes in the original design, i.e., features that are smaller than the wavelength of the electromagnetic waves that they affect. Metamaterials enable extreme miniaturization of existing optical devices, and they can be customized to support novel properties that currently are not accessible with existing optical hardware, leading to entirely new optical systems. Similar to the development of classical electromagnetism, metamaterial developments are expected to fundamentally alter the way the world works today.

Hardware Segment to Account for Larger Size of Nanomechanical Testing Market, Based on Offering, By 2023

The market for hardware will continue to dominate the overall market for nanomechanical testing in the near future due to increasing advancements by key players toward product innovation leading to the development of systems with higher accuracy. The increasing demand for testing various materials to understand their properties on a nanoscale would increase the market for nanomechanical testing services for several applications, such as life sciences, industrial manufacturing, and material development.

North America to account for largest market size during forecast period

North America is expected to account for the largest size of the overall market in 2018. North America is also expected to be the fastest-growing region during the forecast period. The rapid industrialization and high demand for nanomechanical testing instruments for several R&D activities performed by many engineering institutions in this region propel the market growth in North America. However, the market in APAC for nanomechanical testing is estimated to grow at an expedited CAGR during the forecast period due to the dynamic changes in the adoption of new technologies and advancements in organizations across industries, as well as increased use of connected devices. This region has become a global focal point for major investments and business expansion opportunities. The market in Asia Pacific is expected to show significant growth in all sectors.

Key Market Players

Bruker Corporation (US), Micro Materials Limited (UK), Alemnis GmbH (Switzerland), MTS Systems Corporation (MTS Systems) (US), Quad Group, Inc. (Quad Group) (US), Illinois Tool Works Inc. (US), Nanoscience Instruments (Nanoscience) (US), Biomomentum Inc. (Canada), Micro Materials Limited (UK), Nanomechanics Inc. (US) and Testometric Co. Ltd. (UK) are the major players in the nanomechanical testing market.

Bruker

Bruker offers nanomechanical testing solutions that offer both semi- and fully automated test sequencing to meet high-throughput process characterization requirements of the evolving industry. Bruker is among the pioneers in technologies for elemental analysis. Recently, the company adopted acquisition as an inorganic growth strategy. Bruker offers a variety of hybrid nanomechanical test instrumentation and characterization techniques, allowing researchers to stretch the limits of traditional materials and design entirely new material systems. Testing solutions offered by Bruker can be used for understanding the relationship of microstructures, alloying, surface treatments, and temperature on mechanical and tribological properties in the case of metals, whereas in the case of composites, nanomechanical testing enables discovery of properties of individual constituents and interfaces for particulate-reinforced, fiber-reinforced, and laminate composite structures.

Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2016–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Offering, instrument type, application, and region |

|

Regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Bruker Corporation (US), Micro Materials Limited (UK), Alemnis GmbH (Switzerland), MTS Systems Corporation (US), Quad Group, Inc. (US), Illinois Tool Works Inc.(US), Nanoscience Instruments (US), Biomomentum Inc. (Canada), Micro Materials Limited (UK), Nanomechanics Inc.(US), and Testometric Co., Ltd. (UK) |

Nanomechanical Testing Market Segmentation:

In this report, the market has been segmented into the following categories:

Nanomechanical Testing Market, by Instrument Type:

- Transmission Electron Microscopes

- Scanning Electron Microscopes

- Dual-Beam (FIB/SEM) Systems

- Spectroscopes

Nanomechanical Testing Market, by Offering:

- Hardware

- Services

Nanomechanical Testing Market, by Application:

- Industrial Manufacturing

- Life Sciences

- Material Development

- Semiconductor manufacturing

Nanomechanical Testing Market, by Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In February 2018, Bruker announced the acquisition of IRM2, a developer of high-speed infrared (IR) imaging microscopes based on quantum cascade laser (QCL) technology. Innovative, fast QCL microscopy expands Bruker’s technology portfolio and market opportunities for infrared microscopy, with applications in biological tissue analysis and materials science, and future potential in tissue diagnostics.

- In December 2016, Micro Materials announced the launch of the CORE range, 5 new instruments that cover key experimental techniques in nano and micro-mechanical testing. The new product range includes CORE nanoindentation system, CORE microindentation system, CORE nano-scratch tester, CORE micro-scratch tester, and CORE nano-impact tester.

Key Questions Addressed in the Report:

- What could be the potential industrial applications of nanomechanical testing solutions?

- What is the importance of nanomechanical testing in the industrial sector?

- What are the drivers, challenges, restraints, and opportunities pertaining to the growth of the market?

- What are the opportunities for advances in micro-electro-mechanical systems (MEMS) technology providers?

- Which regions will showcase the growth of the market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 11)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 26)

4.1 Attractive Market Opportunities in Market

4.2 Market, By Application

4.3 Snapshot of Market Based on Instrument Type and Region

4.4 Market, By Country & Region

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Value Chain Analysis

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Advances in Micro-Electro-Mechanical Systems (MEMS)Technology

5.3.1.2 Accurate and Quick Test Results Achieved By Nanomechanical Testing

5.3.1.3 Negligible Thermal Drift Offered By Nanomechanical Testing Instruments

5.3.2 Restraints

5.3.2.1 Occurrence of Strain Hardening-Softening Oscillations While Testing Bulk Solids

5.3.3 Opportunities

5.3.3.1 Evolution of Metamaterials

5.3.4 Challenges

5.3.4.1 Limitations of Scanning Electron Microscopes

6 Nanomechanical Testing Market, By Offering (Page No. - 37)

6.1 Introduction

6.2 Hardware

6.2.1 Standalone and In-Situ Instruments are Used Extensively for Nanomechanical Testing

6.3 Services

6.3.1 Support, Maintenance, Repair, and Training Services are Offered By All Key Players in the Market

7 Nanomechanical Testing Market, By Instrument Type (Page No. - 41)

7.1 Introduction

7.2 Transmission Electron Microscope (TEM)

7.2.1 Easy Integration of TEM Into Existing Testing Equipment Drives Market Growth

7.3 Scanning Electron Microscope (SEM)

7.3.1 High-Resolution Micrographs of Nanoscale Architecture is Possible With the Use of SEM

7.4 Dual-Beam (FIB/SEM) System

7.4.1 Manufacturing Based on High Technology Will Shape the Market for FIB/SEM Systems

7.5 Spectroscope

7.5.1 Extraction of 2d Spectra for Studying Mechanical Properties Made the Usage of Spectroscopes Possible

7.5.2 Raman Spectrometer

7.5.3 Fluorescence Spectrometer

7.5.4 Surface Acoustic Wave (SAW) Spectrometer

7.5.5 Others

8 Nanomechanical Testing Market, By Application (Page No. - 49)

8.1 Introduction

8.2 Industrial Manufacturing

8.2.1 Process Metrology, Failure Analysis, and Product Quality Control in Industrial Manufacturing is Possible With the Use of Nanomechanical Testing

8.3 Life Sciences

8.3.1 Developments in Bioimplant Devices Generate New Market Opportunities for Nanomechanical Testing Equipment

8.4 Material Development

8.4.1 Nanomechanical Testing Instruments Enable Ease of Study of Material Science and Low-Dimensional Materials

8.5 SEMiconductor Manufacturing

8.5.1 Shrinking Sizes of Devices Along With Improved Performance Will Boost the Market for Nanomechanical Testing Equipment

9 Geographic Analysis (Page No. - 57)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 Increasing Demand for Nanomechanical Testing in Life Sciences and Material Development to Boost Market Growth in the Us

9.2.2 Canada

9.2.2.1 Growing Focus of Medical Device Manufacturers on R&D to Positively Impact the Market in Canada

9.2.3 Mexico

9.2.3.1 Increasing Investments in the Healthcare Sector in Mexico Would Create the Demand for Nanomechanical Testing

9.3 Europe

9.3.1 UK

9.3.1.1 Continuously Evolving Electronics Industry Across the UK Will Need Improved Nanomechanical Testing Equipment

9.3.2 Germany

9.3.2.1 Use of Nanomechanical Testing Equipment in Electronics and Life Sciences Will Drive Market Growth Across Germany

9.3.3 France

9.3.3.1 Investments in Life Sciences, Majorly on Drug Solutions and Biomedical Devices, Will Bring New Market Opportunities in France

9.3.4 Italy

9.3.4.1 Automotive Sector Will Drive the Market for Nanomechanical Testing in Italy

9.3.5 Rest of Europe

9.4 Asia Pacific

9.4.1 Japan

9.4.1.1 Advanced Manufacturing Capabilities of Japan Will Bring New Market Opportunities for Nanomechanical Testing

9.4.2 China

9.4.2.1 Availability of Low-Cost Labor and Presence of Several Leading Consumer Electronics Manufacturing Companies Will Create High Demand for Nanomechanical Testing in the Near Future

9.4.3 South Korea

9.4.3.1 Automotive and Semiconductor Markets Will Drive the Need for Nanomechanical Testing in South Korea

9.4.4 Taiwan

9.4.4.1 Government Initiatives in the Life Sciences Sector to Positively Impact the Market

9.4.5 Rest of APAC

9.5 RoW

9.5.1 Middle East & Africa

9.5.2 South America

10 Competitive Landscape (Page No. - 73)

10.1 Introduction

10.2 Ranking Analysis of Key Players in Market

10.3 Competitive Scenario

10.3.1 Acquisitions

10.3.2 Product Launches

11 Company Profiles (Page No. - 76)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Key Players

11.1.1 Bruker

11.1.2 MTS Systems Corporation

11.1.3 Micro Materials Limited

11.1.4 Alemnis GmbH

11.1.5 Instron

11.1.6 Biomomentum Inc.

11.1.7 Quad Group Inc.

11.1.8 Nanomechanics Inc.

11.1.9 Testometric

11.1.10 Nanoscience Instruments

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 92)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (23 Tables)

Table 1 Comparative Analysis of Different Types of Tests

Table 2 Nanomechanical Testing Market, By Offering, 2016–2023 (USD Million)

Table 3 Market, By Hardware, 2016–2023 (USD Million)

Table 4 Market, By Instrument Type, 2016–2023 (USD Million)

Table 5 Market for TEM, By Application, 2016–2023 (USD Million)

Table 6 Market for SEM, By Application, 2016–2023 (USD Million)

Table 7 Market for Dual-Beam (FIB/SEM) System, By Application, 2016–2023 (USD Million)

Table 8 Market for Spectroscope, By Application, 2016–2023 (USD Million)

Table 9 Market, By Application, 2016–2023 (USD Million)

Table 10 Market for Industrial Manufacturing, By Region, 2016–2023 (USD Million)

Table 11 Market for Life Sciences, By Region, 2016–2023 (USD Million)

Table 12 Market for Material Development, By Region, 2016–2023 (USD Million)

Table 13 Market for Semiconductor Manufacturing, By Region, 2016–2023 (USD Million)

Table 14 Market, By Region, 2016–2023 (USD Million)

Table 15 Market in North America, By Country, 2016–2023 (USD Million)

Table 16 Market in North America, By Application, 2016–2023 (USD Million)

Table 17 Market in Europe, By Country, 2016–2023 (USD Million)

Table 18 Market in Europe, By Application,2016–2023 (USD Million)

Table 19 Market in Asia Pacific, By Country, 2016–2023 (USD Million)

Table 20 Market in Asia Pacific, By Application, 2016–2023 (USD Million)

Table 21 Market in RoW, By Region, 2016–2023 (USD Million)

Table 22 Market in RoW, By Application, 2016–2023 (USD Million)

Table 23 Ranking Analysis of Key Companies in Market (2017)

List of Figures (31 Figures)

Figure 1 Nanomechanical Testing Market Segmentation

Figure 2 Market: Process Flow of Market Size Estimation

Figure 3 Market: Research Design

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Hardware Segment to Account for Larger Size of Market, Based on Offering, By 2023

Figure 8 Life Sciences Application to Witness Highest CAGR in Market During 2018–2023

Figure 9 Market, By Instrument Type, 2018–2023

Figure 10 North America Accounted for Largest Market Share in 2017

Figure 11 Market Expected to Grow at Higher CAGR From 2018 to 2023 Because of Advances in Micro-Electro-Mechanical Systems (MEMS) Technology

Figure 12 Market for Life Sciences Applications Expected to Grow at the Highest CAGR From 2018 to 2023

Figure 13 SEM and North America Held Largest Share of Market, Based on Instrument Type and Region, Respectively, in 2017

Figure 14 US Held Largest Share of Market in 2017

Figure 15 Key Testing Approaches Used for Nanomechanical Characterization

Figure 16 Value Chain of Nanomechanical Testing Equipment

Figure 17 Market Dynamics: Overview

Figure 18 Market, By Offering

Figure 19 Service Offerings in Market

Figure 20 Market, By Instrument Type

Figure 21 Types of Spectrometers

Figure 22 Market, By Application

Figure 23 Applications of Nanomechanical Testing Instruments in Industrial Manufacturing

Figure 24 Use of Nanomechanical Testing in Material Development

Figure 25 Prominent Applications of Nanomechanical Testing in Semiconductor Industry

Figure 26 China Expected to Exhibit Highest CAGR in Market From 2018 to 2023

Figure 27 Snapshot of Market in North America

Figure 28 Snapshot of Market in Europe

Figure 29 Snapshot of Market in APAC

Figure 30 Bruker: Company Snapshot

Figure 31 MTS Systems Corporation: Company Snapshot

The study involved 4 major activities to estimate the current size of the nanomechanical test equipment market. Exhaustive secondary research was done to collect information on the market, including the peer market and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for the identification and collection of relevant information for this study databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the extensive technical, market-oriented, and commercial study of the nanomechanical testing market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research was conducted to obtain key information regarding the industry’s supply chain, market’s value chain, total pool of key players, market segmentation according to industry trends (to the bottom-most level), geographic markets, and key developments from both market- and technology-oriented perspectives. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

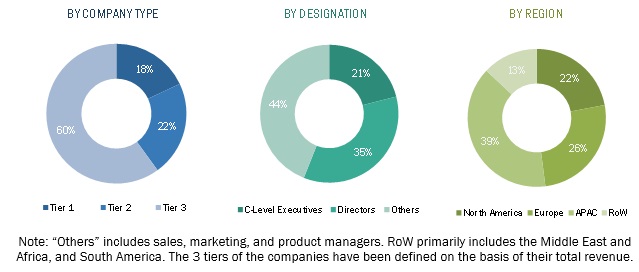

Primary Research

Extensive primary research has been conducted after understanding and analyzing the nanomechanical testing market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand-side and supply-side vendors across 4 major regions—North America, Europe, Asia Pacific, and Rest of the World (South America, and the Middle East and Africa). Approximately, 25% of the primary interviews have been conducted with the demand side and 75% with the supply side. These primary data has been collected mainly through telephonic interviews, which consists of 80% of the overall primary interviews; however, questionnaires and emails have also been used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were implemented to estimate and validate the total size of the nanomechanical testing market. These methods were also used extensively to estimate the size of the markets based on various subsegments. The research methodology used to estimate the market size includes the following steps:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides across different end-use applications.

Study Objectives

- To describe and forecast the nanomechanical testing market segmented on the basis of instrument type, offering, application, and geography

- To describe and forecast the market size of various segments with respect to 4 main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding major factors, namely, drivers, restraints, opportunities, and challenges influencing the growth of the nanomechanical testing market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market ranking, based on their revenue and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as acquisitions, product launches and developments, and research and developments carried out in the nanomechanical testing market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Company Information: Detailed analysis and profiling of additional 5 market players

- Country-level break-up for the market based on end-use applications and offerings

Growth opportunities and latent adjacency in Nanomechanical Testing Market