Nanofiltration Membrane Market by Type (Polymeric, Ceramic, Hybrid), Module (Spiral Wound, Tubular, Hollow Fiber, Flat Sheet), Application (Municipal, Industrial), And Region (North America, Europe, Apac, South America, MEA) - Global Forecast to 2028

Nanofiltration Membrane Market

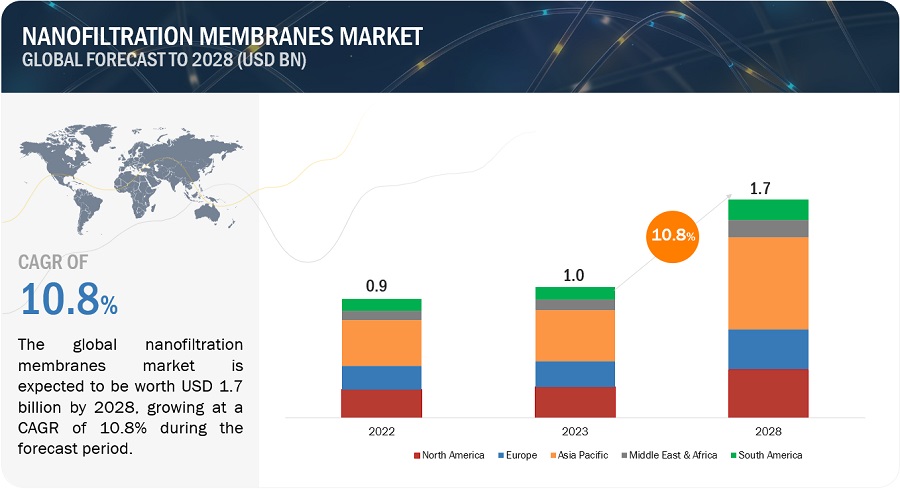

The global nanofiltration membrane market is valued at USD 1.0 billion in 2023 and is projected to reach USD 1.7 billion by 2028, growing at 10.8% cagr during the forecast period. The nanofiltration membrane market is projected to grow significantly in the coming years. Nanofiltration is an energy-efficient separation technique that is becoming increasingly important as companies seek to reduce their energy consumption and carbon footprint. In addition, nanofiltration membranes can be regenerated, which can lead to cost savings in the long run.

Global Nanofiltration Membrane Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Nanofiltration Membrane Market Dynamics

Driver: Rising industrialization and urbanization

Industrialization is gaining momentum, and various sectors, such as manufacturing, chemicals, pharmaceuticals, and textiles, are expanding their operations, resulting in a substantial surge in water demand. These industries require copious amounts of water for processes like cooling, cleaning, and product manufacturing. Simultaneously, urbanization is leading to the concentrated growth of populations in cities, driving up domestic water usage for households, sanitation, and urban infrastructure. This combined effect amplifies the pressure on freshwater resources, prompting the need for innovative water treatment technologies like nanofiltration to ensure a reliable and sustainable supply. However, recently, the growth has come from the emerging/developing economies in the Asia Pacific region (China and India). In these regions, water scarcity and poor water quality are significant challenges, and access to safe and clean water is a pressing need. This was primarily due to the increasing population and the increasing demand for clean, fresh water for agricultural and industrial purposes and rapid industrialization.

Restraint: Fouling in nanofiltration membrane

Fouling in nanofiltration membranes is a critical phenomenon that can significantly impact the efficiency and effectiveness of water treatment processes. It refers to the gradual accumulation of particles, contaminants, and substances on the surface or within the pores of nanofiltration membranes during the filtration process. This accumulation forms a layer that can impede the flow of water and alter the membrane's separation properties. As a result, fouling has substantial implications for operational performance, maintenance costs, and the overall quality of treated water.

Opportunity: Rising advancements in nanofiltration membrane

Advancements in filtration technology not only enhance the capabilities of nanofiltration but also expand its horizons, enabling it to tackle multifaceted challenges across a spectrum of industries. The convergence of cutting-edge techniques with nanofiltration membranes introduces transformative possibilities that underscore their importance in modern water treatment and separation processes. Advancements in filtration technology also facilitate energy-efficient nanofiltration processes. The optimization of membrane configurations and innovative engineering approaches can reduce the energy required for water separation. Lower operating pressures and optimized flow dynamics not only decrease the operational costs associated with energy consumption but also align nanofiltration with sustainability objectives. This energy efficiency is particularly pertinent in sectors where energy costs constitute a substantial portion of the overall operational budget.

Challenges: Lack of awareness about the advantages of membrane filtration

A majority of processed water, food, and beverage manufacturers utilize conventional purification and filtration methods such as biological or chemical treatment. Nanofiltration membrane provides high efficiency and requires less preparation in food, beverage, or water processing. Desalination, fractionation, standardization, concentration, and clarifying or separation are some of the main functions of membrane technologies in the food industry. The emulsified oils in foods and beverages are also separated using membrane filtration systems. Membrane filtration has fewer processing stages, allowing for greater levels of purity as well as higher total yields. The technology is employed in numerous industrial large-scale applications, making it possible for industries to run cleaner, more cost-effective, and legal operations free of contaminants and harmful particles. Additionally, it consumes less energy than traditional methods and reduces the total production cost. These are some key advantages that make this technology a vital investment. Yet, due to the lack of awareness regarding the above-mentioned advantages, most food, beverage, and processed water manufacturers still utilize conventional filtration technologies and methods.

Nanofiltration Membrane Market Ecosystem

By type, polymeric will be the largest in the nanofiltration membrane market in 2022.

Polymeric membranes are easy to produce and process. They are porous and semi-permeable, and their use depends on the application. The majority of industrial and municipal water treatment applications employ polymeric membranes. Polymeric membranes have low mechanical stability and fouling problems, which limit their use in electrochemical processes in solid-state batteries and solvent dehydration. The applications of polymeric nanofiltration are extensive and impactful. In the realm of water treatment, these membranes are deployed to remove organic matter, color, and problematic divalent ions from both potable water sources and wastewater streams.

By module, the spiral wound module will be the largest in the nanofiltration membrane market in 2022.

Spiral wound nanofiltration membrane modules are used in various applications, including wastewater treatment, food and beverage processing, and the pharmaceutical industry. They are ideal for applications where total suspended solids can be largely removed via prefiltration. These nanofiltration membrane modules can be made of various materials, including ceramic and polymeric nanofiltration membranes. Spiral wound nanofiltration membrane modules have a molecular weight cutoff between 150-500Da, which makes them effective in removing small contaminants. They have high anti-fouling properties, which make them effective in highly polluted wastewater.

By application, industrial accounts for the largest share of the nanofiltration membrane market in 2022.

Industrial treatment is an important application of nanofiltration membranes. Various industries considered in this segment include food & beverage, chemical & petrochemical, pharmaceutical & medical, textile, power, and pulp & paper, among others. Nanofiltration membrane filtration is employed by food industries owing to their high barrier properties against bacteria and other pollutants. Efficient nanofiltration membrane solutions help food & beverage manufacturers to concentrate, clarify, and purify products, including bottled water, juice, and wine. They are also used for enzyme recovery, processing of cheese whey, and removal of pathogens from milk.

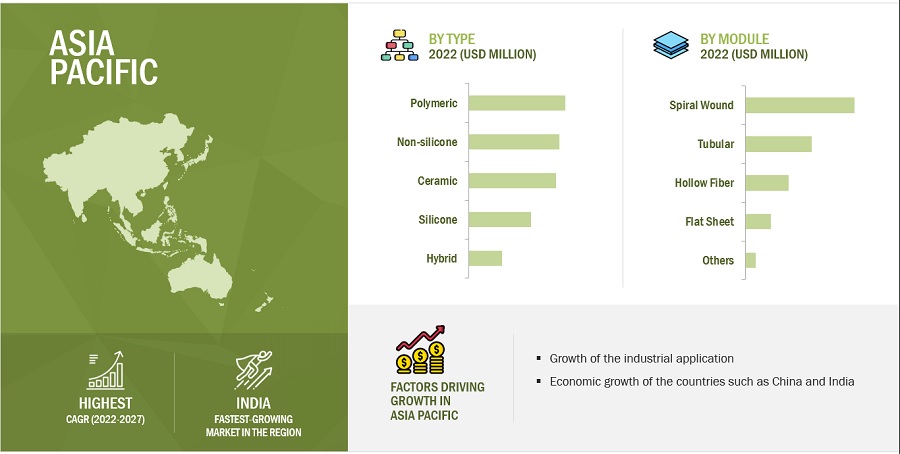

Asia Pacific is projected to be fastest growing amongst other regions in the nanofiltration membrane market in terms of value.

Based on the region, the nanofiltration membrane market is segmented into Asia Pacific, North America, Europe, South America, and the Middle East & Africa. Currently, Asia Pacific is the fastest-growing market for nanofiltration membranes. Rising population, urbanization, and rapid industrial and infrastructural development are increasing the demand for wastewater treatment plants and membranes. The ease of availability of labor at lower prices makes Asia Pacific an attractive destination for investors to set up manufacturing facilities. It has witnessed significant growth in manufacturing activities due to low manufacturing costs and the support of the local governments. An increase in investments in R&D is also one of the factors driving the market in Asia Pacific.

To know about the assumptions considered for the study, download the pdf brochure

Nanofiltration Membrane Market Players

Some of the key players operating in the nanofiltration membrane market include DuPont Water Solutions (US), Toray Industries, Inc. (Japan), Veolia Environnement S.A. (France), Alfa Laval AB (Sweden), GEA Group AG (Germany), Hydranautics (US), NX Filtration (Netherlands), Pall Corporation (US), Vontron Technology Co., Ltd. (China), and Pentair (US) among others.

These companies have adopted various organic as well as inorganic growth strategies between 2018 and 2022 to strengthen their positions in the market. The new product launch is the key growth strategy adopted by these leading players to enhance regional presence and develop product portfolios to meet the growing demand for nanofiltration membranes from emerging economies.

Nanofiltration Membrane Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 1.0 billion |

|

Revenue Forecast in 2028 |

USD 1.7 billion |

|

CAGR |

10.8% |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million), Volume (Million Square Meter) |

|

Segments |

Type, Module, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

DuPont Water Solutions (US), Toray Industries, Inc. (Japan), Veolia Environnement S.A. (France), Alfa Laval AB (Sweden), GEA Group AG (Germany), Hydranautics (US), NX Filtration (Netherlands), Pall Corporation (US), Vontron Technology Co., Ltd. (China), and Pentair (US) among others. |

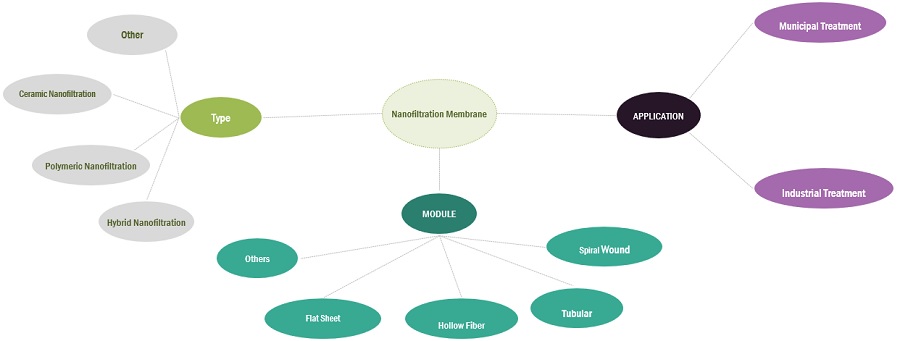

This report categorizes the global nanofiltration membranes market based on type, module, application, and region.

On the basis of type, the nanofiltration membranes market has been segmented as follows:

On the basis of module, the nanofiltration membranes market has been segmented as follows:

- Spiral wound

- Tubular

- Hollow fiber

- Flat sheet

- Others

On the basis of application, the nanofiltration membranes market has been segmented as follows:

- Municipal

- Industrial

On the basis of region, the nanofiltration membranes market has been segmented as follows:

- North America

- Asia Pacific

- Europe

- South America

- Middle East & Africa

The nanofiltration membranes market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In March 2022, Toray Industries, Inc. launched the TBW-HR Series of ultralow-pressure reverse osmosis membrane elements that enhance neutral molecule rejection. This product helped the company to strengthen its product portfolio in reverse osmosis membrane elements.

- In April 2022, Veolia Water Technologies launched the Barrel, a technology for desalination and water reuse in Asia Pacific. The Barrel is a multi-RO element vessel that is designed to be a plug-and-play system. It is used in place of existing RO membranes and nanofiltration skids. The Barrel helped the company meet the challenges and expectations of the desalination market by producing fresh water and complying with all water quality standards.

- In March 2022, Hydranautics launched the PRO-X series membranes to provide improved performance and efficiency in various applications, including seawater desalination, brackish water treatment, and industrial process water treatment.

- In January 2022, Alfa Laval acquired Sandymount, a US-based company specializing in beverage technologies, and uses a novel, patented membrane technique to concentrate beer. Alfa Laval’s wide array of products and technologies helps beer makers distribute high-quality beer in concentrated forms, create new business prospects, and enable a more sustainable beer delivery supply chain. It is incorporated into the food systems business unit of Alfa Laval’s food & water division.

- In October 2019, DuPont acquired a membrane business from Evoqua Water Technologies Corp. to increase DuPont’s product portfolio in filtration technology. This acquisition helped DuPont to strengthen its product portfolio by offering Evoqua’s ultrafiltration and membrane biofiltration.

Frequently Asked Questions (FAQ):

What is the current size of the global nanofiltration membrane market?

The global nanofiltration membrane market size is estimated to reach USD 1.7 billion by 2028 from USD 1.0 billion in 2023, at a CAGR of 10.8% during the forecast period.

Who are the winners in the global nanofiltration membrane market?

Companies such as include DuPont Water Solutions (US), Toray Industries, Inc. (Japan), Veolia Environnement S.A. (France), Alfa Laval AB (Sweden), GEA Group AG (Germany), Hydranautics (US), NX Filtration (Netherlands), Pall Corporation (US), Vontron Technology Co., Ltd. (China), and Pentair (US) among others. They have the potential to broaden their product portfolio and compete with other key market players.

What are some of the drivers in the market?

Rising industrialization and urbanization, Declining freshwater resources, and Low energy consumption in nanofiltration.

What are the various types of nanofiltration membranes?

Polymeric, ceramic, and hybrid are the major types of nanofiltration membranes.

What are the various module of nanofiltration membranes?

Spiral wound, tubular, hollow fiber, and flat sheet are the major modules of nanofiltration membrane. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 RECESSION IMPACT ANALYSIS

-

5.3 MARKET DYNAMICSDRIVERS- Rapid industrialization and urbanization- Declining freshwater resources- Low energy consumptionRESTRAINTS- Fouling in nanofiltration membranesOPPORTUNITIES- Technological advancements in nanofiltration- Expansion into emerging marketsCHALLENGES- Low performance at high temperatures

-

5.4 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND USERS

-

5.5 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.6 MACROECONOMIC INDICATORSGLOBAL GDP TRENDS

-

5.7 REGULATORY LANDSCAPEREGULATIONSNORTH AMERICA- Clean Water Act- Safe Drinking Water ActASIA PACIFIC- Environmental Protection Law- Water Resources Law- Water Pollution Prevention and Control Law- Water Prevention and Control of Pollution ActEUROPE- Urban Wastewater Treatment Directive- Drinking Water Directive- Water Framework DirectiveREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.8 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

- 5.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.10 CASE STUDY ANALYSISTORAY INDUSTRIES, INC.: NANOFILTRATION MEMBRANES FOR WATER TREATMENTKOCH SEPARATION SOLUTIONS: NANOFILTRATION MEMBRANES FOR DAIRY INDUSTRY

- 5.11 TECHNOLOGY ANALYSIS

-

5.12 ECOSYSTEM MAPPING

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAQUALITYSERVICE

-

5.15 PATENT ANALYSISINTRODUCTIONDOCUMENT TYPESPUBLICATION TRENDS IN LAST 10 YEARSINSIGHTSJURISDICTION ANALYSISTOP APPLICANTS

- 6.1 INTRODUCTION

-

6.2 POLYMERICPOROSITY AND PERMEABILITY OF POLYMERIC MEMBRANES TO DRIVE MARKETPOLYAMIDEPOLYSULFONE AND POLYETHERSULFONEOTHERS

-

6.3 CERAMICRESISTANCE TO CONCENTRATED ACIDS AND CAUSTIC SOLUTIONS TO FUEL MARKETZIRCONIAALUMINATITANIAOTHERS

-

6.4 HYBRIDHYDROPHILICITY AND CHEMICAL STABILITY TO DRIVE MARKET

- 6.5 OTHER TYPES

- 7.1 INTRODUCTION

-

7.2 SPIRAL WOUNDOPTIMAL PERFORMANCE AND COST-EFFECTIVENESS TO DRIVE MARKET

-

7.3 TUBULAREFFICIENT SEPARATION OF PARTICLES AND SOLUTES TO DRIVE MARKET

-

7.4 HOLLOW FIBERHIGH SURFACE AREA AND EFFECTIVE REMOVAL OF CONTAMINANTS TO FUEL MARKET

-

7.5 FLAT SHEETINCREASING FILTRATION REQUIREMENTS FROM VARIOUS INDUSTRIES TO DRIVE MARKET

- 7.6 OTHER MODULES

- 8.1 INTRODUCTION

-

8.2 MUNICIPAL TREATMENTNEED FOR WATER TREATMENT AND REUSE TO DRIVE MARKETDESALINATIONUTILITY WATER TREATMENTWASTEWATER REUSE

-

8.3 INDUSTRIAL TREATMENTSELECTIVE SEPARATION OF IONS AND MOLECULES TO DRIVE MARKETFOOD & BEVERAGE- Dairy processing- Food processing- Beverage processingCHEMICAL & PETROCHEMICALPHARMACEUTICAL & MEDICALOTHERS

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Implementing clean-up strategies and water pollution prevention laws to drive marketJAPAN- Development of advanced technologies and industrial sector to fuel marketINDIA- Growing demand from end-use industries to drive marketSOUTH KOREA- Rising demand from food & beverage industry to boost marketREST OF ASIA PACIFIC

-

9.3 EUROPERECESSION IMPACT ON EUROPEGERMANY- Highest EU standards for wastewater treatment to drive growthUK- Rapid urbanization and industrialization to drive marketFRANCE- Advancements in water treatment infrastructure to boost marketITALY- Rising demand from pharmaceutical sector to drive marketSPAIN- High production of desalinated water to fuel demand for nanofiltration membranesNETHERLANDS- Well-organized water supply system and sewage facilities to drive growthREST OF EUROPE

-

9.4 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAUS- Various government initiatives for wastewater treatment to drive marketCANADA- State- and national-level municipal regulations to drive growthMEXICO- High demand from manufacturing and agriculture sector to fuel market

-

9.5 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICASAUDI ARABIA- Growth of tourism and chemical industry to drive marketUAE- New water treatment infrastructure and sustainable practices to drive marketQATAR- Reuse of treated wastewater for industrial and irrigation purposes to drive marketOMAN- Increasing domestic and industrial water requirements to fuel marketREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICABRAZIL- Smart water management techniques and foreign investments to drive growthCHILE- Well-developed water supply channels and use of sustainable resources to drive marketREST OF SOUTH AMERICA

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE ANALYSIS

- 10.4 RANKING OF KEY PLAYERS

- 10.5 MARKET SHARE ANALYSIS

-

10.6 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

10.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 10.8 COMPETITIVE BENCHMARKING

-

10.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

11.1 KEY PLAYERSDUPONT- Business overview- Products offered- Recent developments- MnM viewTORAY INDUSTRIES, INC.- Business overview- Products offered- Recent developments- MnM viewVEOLIA- Business overview- Products offered- Recent developments- MnM viewALFA LAVAL- Business overview- Products offered- Recent developments- MnM viewGEA GROUP- Business overview- Products offered- Recent developments- MnM viewHYDRANAUTICS- Business overview- Products offered- Recent developments- MnM viewNX FILTRATION BV- Business overview- Products offered- Recent developments- MnM viewPALL CORPORATION- Business overview- Products offered- Recent developments- MnM viewVONTRON TECHNOLOGY CO., LTD.- Business overview- Products offered- MnM viewPENTAIR- Business overview- Products offered- Recent developments- MnM viewKOCH MEMBRANE SYSTEMS- Business overview- Products offered- Recent developments- MnM viewINOPOR- Business overview- Products offered- MnM view

-

11.2 OTHER PLAYERSSYNDER FILTRATION, INC.SOLSEP BVRISINGSUN MEMBRANE TECHNOLOGY (BEIJING) CO., LTD.UNISOL MEMBRANE TECHNOLOGYMEMBRANIUMKEENSEN TECHNOLOGY CO., LTD.JOZZON MEMBRANE TECHNOLOGY CO., LTD.WAVE CYBER(SHANGHAI)CO., LTD.MANN+HUMMELAPPLIED MEMBRANES, INC.SPX FLOWORIGINWATERNOVASEP

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 NANOFILTRATION MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 NANOFILTRATION MARKET: VALUE CHAIN STAKEHOLDERS

- TABLE 3 NANOFILTRATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 PER CAPITA GDP TRENDS (USD), 2020–2022

- TABLE 5 GDP GROWTH ESTIMATE AND PROJECTION OF KEY COUNTRIES, 2023–2027

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REGION-WISE IMPORT TRADE DATA (USD THOUSAND)

- TABLE 10 REGION-WISE EXPORT TRADE DATA (USD THOUSAND)

- TABLE 11 NANOFILTRATION MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 12 PATENTS BY EVONIK OPERATIONS GMBH

- TABLE 13 PATENTS BY ECOLAB INC.

- TABLE 14 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 15 NANOFILTRATION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 16 NANOFILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 17 NANOFILTRATION MARKET, BY TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 18 NANOFILTRATION MARKET, BY TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 19 NANOFILTRATION MARKET, BY MODULE, 2019–2022 (USD MILLION)

- TABLE 20 NANOFILTRATION MARKET, BY MODULE, 2023–2028 (USD MILLION)

- TABLE 21 NANOFILTRATION MARKET, BY MODULE, 2019–2022 (MILLION SQUARE METER)

- TABLE 22 NANOFILTRATION MARKET, BY MODULE, 2023–2028 (MILLION SQUARE METER)

- TABLE 23 NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 24 NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 25 NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 26 NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 27 NANOFILTRATION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 28 NANOFILTRATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 NANOFILTRATION MARKET, BY REGION, 2019–2022 (MILLION SQUARE METER)

- TABLE 30 NANOFILTRATION MARKET, BY REGION, 2023–2028 (MILLION SQUARE METER)

- TABLE 31 ASIA PACIFIC: NANOFILTRATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 32 ASIA PACIFIC: NANOFILTRATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: NANOFILTRATION MARKET, BY COUNTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 34 ASIA PACIFIC: NANOFILTRATION MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 35 ASIA PACIFIC: NANOFILTRATION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 36 ASIA PACIFIC: NANOFILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: NANOFILTRATION MARKET, BY TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 38 ASIA PACIFIC: NANOFILTRATION MARKET, BY TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 39 ASIA PACIFIC: NANOFILTRATION MARKET, BY MODULE, 2019–2022 (USD MILLION)

- TABLE 40 ASIA PACIFIC: NANOFILTRATION MARKET, BY MODULE, 2023–2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: NANOFILTRATION MARKET, BY MODULE, 2019–2022 (MILLION SQUARE METER)

- TABLE 42 ASIA PACIFIC: NANOFILTRATION MARKET, BY MODULE, 2023–2028 (MILLION SQUARE METER)

- TABLE 43 ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 44 ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 46 ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 47 CHINA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 48 CHINA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 49 CHINA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 50 CHINA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 51 JAPAN: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 52 JAPAN: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 53 JAPAN: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 54 JAPAN: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 55 INDIA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 56 INDIA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 57 INDIA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 58 INDIA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 59 SOUTH KOREA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 60 SOUTH KOREA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 61 SOUTH KOREA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 62 SOUTH KOREA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 63 REST OF ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 64 REST OF ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 65 REST OF ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 66 REST OF ASIA PACIFIC: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 67 EUROPE: NANOFILTRATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 68 EUROPE: NANOFILTRATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 69 EUROPE: NANOFILTRATION MARKET, BY COUNTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 70 EUROPE: NANOFILTRATION MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 71 EUROPE: NANOFILTRATION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 72 EUROPE: NANOFILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 73 EUROPE: NANOFILTRATION MARKET, BY TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 74 EUROPE: NANOFILTRATION MARKET, BY TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 75 EUROPE: NANOFILTRATION MARKET, BY MODULE, 2019–2022 (USD MILLION)

- TABLE 76 EUROPE: NANOFILTRATION MARKET, BY MODULE, 2023–2028 (USD MILLION)

- TABLE 77 EUROPE: NANOFILTRATION MARKET, BY MODULE, 2019–2022 (MILLION SQUARE METER)

- TABLE 78 EUROPE: NANOFILTRATION MARKET, BY MODULE, 2023–2028 (MILLION SQUARE METER)

- TABLE 79 EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 80 EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 81 EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 82 EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 83 GERMANY: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 84 GERMANY: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 85 GERMANY: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 86 GERMANY: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 87 UK: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 88 UK: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 89 UK: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 90 UK: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 91 FRANCE: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 92 FRANCE: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 93 FRANCE: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 94 FRANCE: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 95 ITALY: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 96 ITALY: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 97 ITALY: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 98 ITALY: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 99 SPAIN: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 100 SPAIN: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 SPAIN: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 102 SPAIN: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 103 NETHERLANDS: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 104 NETHERLANDS: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 105 NETHERLANDS: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 106 NETHERLANDS: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 107 REST OF EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 108 REST OF EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 REST OF EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 110 REST OF EUROPE: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 111 NORTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 114 NORTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 115 NORTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 116 NORTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 117 NORTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 118 NORTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 119 NORTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2019–2022 (USD MILLION)

- TABLE 120 NORTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2023–2028 (USD MILLION)

- TABLE 121 NORTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2019–2022 (MILLION SQUARE METER)

- TABLE 122 NORTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2023–2028 (MILLION SQUARE METER)

- TABLE 123 NORTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 124 NORTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 125 NORTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 126 NORTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 127 US: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 128 US: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 129 US: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 130 US: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 131 CANADA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 132 CANADA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 133 CANADA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 134 CANADA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 135 MEXICO: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 136 MEXICO: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 137 MEXICO: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 138 MEXICO: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 139 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY COUNTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 142 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 143 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 146 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 147 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY MODULE, 2019–2022 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY MODULE, 2023–2028 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY MODULE, 2019–2022 (MILLION SQUARE METER)

- TABLE 150 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY MODULE, 2023–2028 (MILLION SQUARE METER)

- TABLE 151 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 154 MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 155 SAUDI ARABIA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 156 SAUDI ARABIA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 SAUDI ARABIA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 158 SAUDI ARABIA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 159 UAE: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 160 UAE: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 161 UAE: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 162 UAE: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 163 QATAR: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 164 QATAR: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 165 QATAR: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 166 QATAR: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 167 OMAN: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 168 OMAN: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 169 OMAN: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 170 OMAN: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 171 REST OF MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 174 REST OF MIDDLE EAST & AFRICA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 175 SOUTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 176 SOUTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 177 SOUTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2019–2022 (MILLION SQUARE METER)

- TABLE 178 SOUTH AMERICA: NANOFILTRATION MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE METER)

- TABLE 179 SOUTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 180 SOUTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 181 SOUTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2019–2022 (MILLION SQUARE METER)

- TABLE 182 SOUTH AMERICA: NANOFILTRATION MARKET, BY TYPE, 2023–2028 (MILLION SQUARE METER)

- TABLE 183 SOUTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2019–2022 (USD MILLION)

- TABLE 184 SOUTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2023–2028 (USD MILLION)

- TABLE 185 SOUTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2019–2022 (MILLION SQUARE METER)

- TABLE 186 SOUTH AMERICA: NANOFILTRATION MARKET, BY MODULE, 2023–2028 (MILLION SQUARE METER)

- TABLE 187 SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 188 SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 189 SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 190 SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 191 BRAZIL: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 192 BRAZIL: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 193 BRAZIL: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 194 BRAZIL: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 195 CHILE: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 196 CHILE: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 197 CHILE: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 198 CHILE: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 199 REST OF SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 200 REST OF SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 201 REST OF SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE METER)

- TABLE 202 REST OF SOUTH AMERICA: NANOFILTRATION MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE METER)

- TABLE 203 COMPANIES ADOPTED ACQUISITION AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2023

- TABLE 204 REVENUE ANALYSIS OF KEY COMPANIES, 2020–2022

- TABLE 205 NANOFILTRATION MARKET: DEGREE OF COMPETITION

- TABLE 206 COMPANIES IN NANOFILTRATION MARKET

- TABLE 207 NANOFILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY TYPE

- TABLE 208 NANOFILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY MODULE

- TABLE 209 NANOFILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY APPLICATION

- TABLE 210 NANOFILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY REGION

- TABLE 211 NANOFILTRATION: PRODUCT LAUNCHES/DEVELOPMENTS, 2018–2023

- TABLE 212 NANOFILTRATION: DEALS, 2018–2023

- TABLE 213 NANOFILTRATION: OTHERS, 2018–2023

- TABLE 214 DUPONT: COMPANY OVERVIEW

- TABLE 215 DUPONT: PRODUCTS OFFERED

- TABLE 216 DUPONT: DEALS

- TABLE 217 DUPONT: OTHER DEVELOPMENTS

- TABLE 218 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 219 TORAY INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 220 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 221 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 222 VEOLIA: COMPANY OVERVIEW

- TABLE 223 VEOLIA: PRODUCTS OFFERED

- TABLE 224 VEOLIA: DEALS

- TABLE 225 VEOLIA: PRODUCT LAUNCHES

- TABLE 226 VEOLIA: OTHER DEVELOPMENTS

- TABLE 227 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 228 ALFA LAVAL: PRODUCTS OFFERED

- TABLE 229 ALFA LAVAL: DEALS

- TABLE 230 GEA GROUP: COMPANY OVERVIEW

- TABLE 231 GEA GROUP: PRODUCTS OFFERED

- TABLE 232 GEA GROUP: PRODUCT LAUNCHES

- TABLE 233 HYDRANAUTICS: COMPANY OVERVIEW

- TABLE 234 HYDRANAUTICS: PRODUCTS OFFERED

- TABLE 235 HYDRANAUTICS: PRODUCT LAUNCHES

- TABLE 236 NX FILTRATION BV: COMPANY OVERVIEW

- TABLE 237 NX FILTRATION BV: PRODUCTS OFFERED

- TABLE 238 NX FILTRATION BV: OTHER DEVELOPMENTS

- TABLE 239 PALL CORPORATION: COMPANY OVERVIEW

- TABLE 240 PALL CORPORATION: PRODUCTS OFFERED

- TABLE 241 PALL CORPORATION: OTHER DEVELOPMENTS

- TABLE 242 VONTRON TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 243 VONTRON TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 244 PENTAIR: COMPANY OVERVIEW

- TABLE 245 PENTAIR: PRODUCTS OFFERED

- TABLE 246 PENTAIR: DEALS

- TABLE 247 KOCH MEMBRANE SYSTEMS: COMPANY OVERVIEW

- TABLE 248 KOCH MEMBRANE SYSTEMS: PRODUCTS OFFERED

- TABLE 249 KOCH MEMBRANE SYSTEMS: DEALS

- TABLE 250 KOCH MEMBRANE SYSTEMS: PRODUCT LAUNCHES

- TABLE 251 KOCH MEMBRANE SYSTEMS: OTHER DEVELOPMENTS

- TABLE 252 INOPOR: COMPANY OVERVIEW

- TABLE 253 INOPOR: PRODUCTS OFFERED

- FIGURE 1 NANOFILTRATION MARKET SEGMENTATION

- FIGURE 2 NANOFILTRATION MARKET: RESEARCH DESIGN

- FIGURE 3 NANOFILTRATION MARKET: MARKET SIZE ESTIMATION

- FIGURE 4 NANOFILTRATION MARKET: BOTTOM-UP APPROACH

- FIGURE 5 NANOFILTRATION MARKET: TOP-DOWN APPROACH

- FIGURE 6 NANOFILTRATION MARKET: DATA TRIANGULATION

- FIGURE 7 POLYMERIC SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 SPIRAL WOUND SEGMENT TO REGISTER HIGHEST GROWTH IN 2028

- FIGURE 9 INDUSTRIAL SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 11 ATTRACTIVE OPPORTUNITIES FOR NANOFILTRATION MANUFACTURERS DURING FORECAST PERIOD

- FIGURE 12 POLYMERIC SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 SPIRAL WOUND SEGMENT TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- FIGURE 14 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGER SHARE DURING FORECAST PERIOD

- FIGURE 15 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN NANOFILTRATION MARKET

- FIGURE 17 NANOFILTRATION MARKET: VALUE CHAIN

- FIGURE 18 NANOFILTRATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 REGION-WISE IMPORT TRADE DATA (USD THOUSAND)

- FIGURE 20 REGION-WISE EXPORT TRADE (USD THOUSAND)

- FIGURE 21 REVENUE SHIFT AND NEW REVENUE POCKETS IN NANOFILTRATION MARKET

- FIGURE 22 NANOFILTRATION MARKET ECOSYSTEM

- FIGURE 23 SUPPLIER SELECTION CRITERION

- FIGURE 24 PATENTS REGISTERED (2012–2022)

- FIGURE 25 NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 26 TOP JURISDICTIONS

- FIGURE 27 TOP APPLICANTS’ ANALYSIS

- FIGURE 28 POLYMERIC MEMBRANES TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 29 SPIRAL WOUND SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 30 INDUSTRIAL TREATMENT TO GROW FASTER DURING FORECAST PERIOD

- FIGURE 31 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC: NANOFILTRATION MARKET SNAPSHOT

- FIGURE 33 SPIRAL WOUND TYPE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: NANOFILTRATION MARKET SNAPSHOT

- FIGURE 35 RANKING OF TOP FIVE PLAYERS IN NANOFILTRATION MARKET

- FIGURE 36 NANOFILTRATION MARKET SHARE, BY COMPANY (2022)

- FIGURE 37 NANOFILTRATION MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 38 NANOFILTRATION MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 39 DUPONT: COMPANY SNAPSHOT

- FIGURE 40 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 41 VEOLIA: COMPANY SNAPSHOT

- FIGURE 42 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 43 GEA GROUP: COMPANY SNAPSHOT

- FIGURE 44 NX FILTRATION BV: COMPANY SNAPSHOT

- FIGURE 45 PENTAIR: COMPANY SNAPSHOT

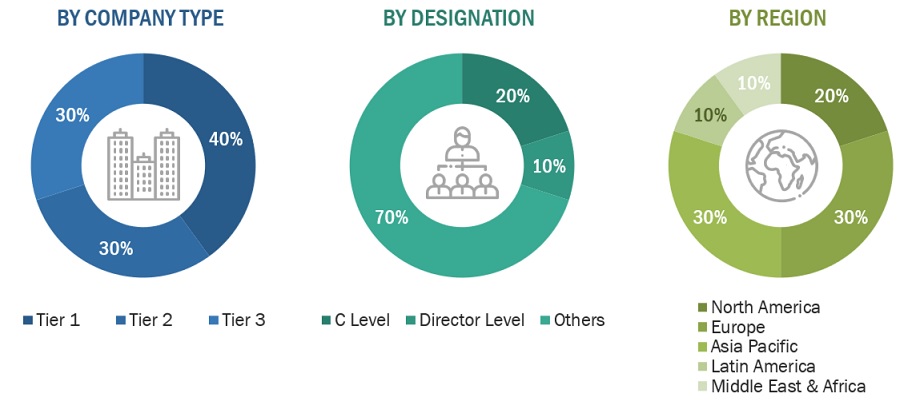

The study involved four major activities in estimating the current market size for nanofiltration membranes. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Factiva, Zauba, Hoovers, and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The nanofiltration membranes market comprises several stakeholders, such as membrane suppliers, distributors of nanofiltration membranes, system manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of applications such as municipal and industrial. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to this market. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of nanofiltration membranes and the future outlook of their business, which will affect the overall market.

Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the nanofiltration membranes market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Nanofiltration Membranes Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Nanofiltration Membranes Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both the demand and supply of nanofiltration membranes and their applications.

Market Definition

Nanofiltration (NF) is a membrane filtration process that falls between reverse osmosis (RO) and ultrafiltration (UF) in terms of the size of particles it can effectively separate. It is a type of liquid separation technology that utilizes a semi-permeable membrane to selectively allow certain substances to pass through while blocking others based on their size and molecular weight. These nanopores typically range from 1 to 10 nanometers in size, strategically designed to allow the passage of certain molecules and ions while blocking others based on their size and molecular weight.

Charge interactions on the membrane's surface contribute to the separation process. Functional groups present in the polymer material might impart a slight change to the membrane. Consequently, the membrane can either repel or attract ions based on their charge. For instance, negatively charged membranes may repulse similarly charged ions while permitting positively charged ones to permeate.

The applications of nanofiltration are diverse and impactful. It finds a pivotal role in water treatment, acting as a formidable tool to eliminate particles, bacteria, viruses, and specific ions from water sources. This enhances the taste, odor, and color of water, rendering it suitable for both domestic consumption and industrial utilization. Moreover, the food and beverage sector harnesses nanofiltration to process juices, dairy products, and concentrate liquids. By segregating compounds such as sugars, salts, and flavors, the technology contributes to enhancing the quality of consumables.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Objectives of the Study:

- To define, describe, and forecast the nanofiltration membranes market in terms of value and volume.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by type, module, and application.

- To forecast the size of the market for five regions, namely, Asia Pacific, Europe, North America, South America, and the Middle East & Africa along with their key countries

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To analyze competitive developments, such as new product launches, acquisitions, and expansion undertaken in the market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the nanofiltration membranes market

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Nanofiltration Membrane Market