Multispectral Camera Market by Application (Defense, Commercial), End Use (Man-portable, Payloads), Cooling Technology (Cooled, Uncooled), Spectrum and Region - Global Forecast to 2028

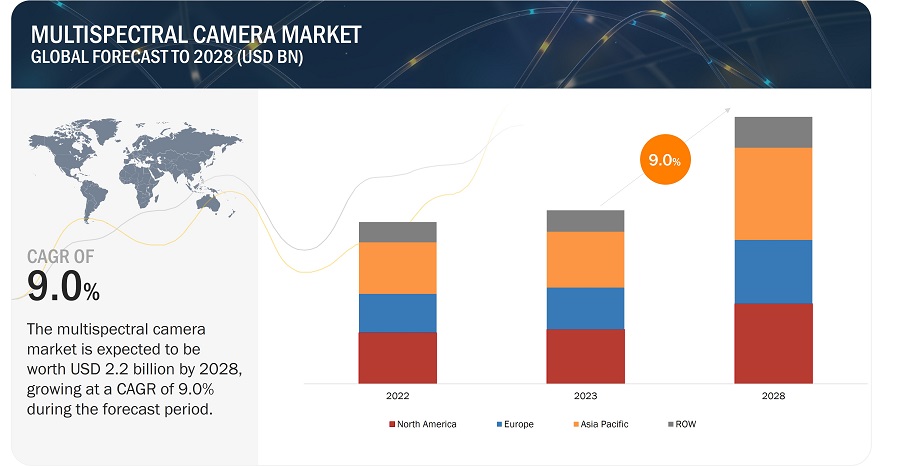

The Multispectral Camera Market size is estimated to be USD 1.4 billion in 2023 and is projected to reach USD 2.2 billion by 2028, at a CAGR of 9.0% from 2023 to 2038. The growing use and application of multispectral cameras worldwide can be attributed to their ability to capture and analyse data across multiple spectral bands, providing valuable insights for various fields.

The increasing popularity of multispectral cameras globally is driven by their diverse range of applications and the valuable information they provide through capturing and analysing data across multiple wavelengths.

Multispectral Camera Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Multispectral Camera Market Dynamics:

Drivers: Increasing demand for precision agriculture

In 2020, The projection that the global population will reach 9.7 billion by 2050 comes from the United Nations Department of Economic and Social Affairs, there is a growing need to improve agricultural productivity and efficiency. Precision agriculture is an approach that involves using technology to collect and analyse data about crops, soil, and weather conditions, enabling farmers to make data-driven decisions about planting, fertilizing, and harvesting. Multispectral cameras are a key technology in precision agriculture, providing farmers with detailed information about crop health, nutrient levels, and water usage. This information can help farmers optimize their operations, reduce costs, and increase yields.

Multispectral cameras can capture images in different spectral bands, providing information about the amount and distribution of chlorophyll in plants, as well as other indicators of plant health. This information can help farmers identify areas of their fields that require additional irrigation or fertilization and can also help them detect early signs of disease or pest infestations. Multispectral cameras can be mounted on drones or other agricultural equipment, enabling rapid and efficient data collection over large areas. The use of multispectral cameras in precision agriculture has been shown to improve crop yields and reduce costs, making it an increasingly important technology for farmers around the world.

Restraints: Competition from Alternative Technologies

The Multispectral Camera Industry faces competition from various alternative technologies that offer similar or complementary capabilities. These technologies include hyperspectral cameras, LiDAR, and radar.

Hyperspectral cameras are a type of imaging system that captures data across many narrow, contiguous spectral bands, typically spanning the visible and near-infrared (NIR) regions of the electromagnetic spectrum. Hyperspectral cameras provide high spectral resolution, allowing for detailed analysis of the chemical and physical properties of objects or environments. They are commonly used in applications such as precision agriculture, mineral exploration, and environmental monitoring. Compared to multispectral cameras, hyperspectral cameras offer more spectral resolution, which allows for more precise detection and identification of materials. However, they also tend to be more complex and expensive, which can limit their adoption in some applications. Additionally, hyperspectral cameras may not be suitable for applications that require broader spectral coverage or faster imaging speeds.

LiDAR, or Light Detection and Ranging, is another technology that can capture detailed 3D information about an environment. LiDAR systems emit laser pulses and measure the time it takes for the pulses to reflect back from objects in the environment, allowing for the creation of highly accurate 3D maps. LiDAR is commonly used in applications such as autonomous vehicles, robotics, and mapping. Compared to multispectral cameras, LiDAR offers the advantage of capturing 3D information, which can be useful for many applications. However, LiDAR is typically more expensive and less sensitive to certain materials, such as vegetation, than multispectral cameras. Additionally, LiDAR may not be suitable for applications that require spectral information, such as monitoring plant health or detecting chemical leaks.

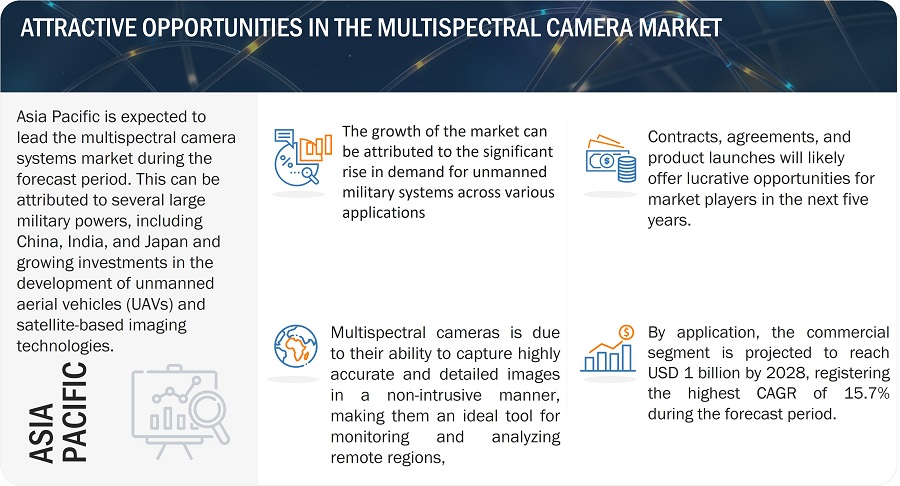

Opportunities: Expand multispectral camera applications through industry partnerships

To expand the applications of multispectral cameras, companies in the industry can seek out strategic partnerships with other industries. For example, partnering with technology companies could lead to the development of new applications for multispectral cameras in areas such as autonomous vehicles, medical imaging, and virtual reality. Partnering with companies in the agriculture industry could lead to the development of new precision agriculture applications for multispectral cameras. By working with farmers, agronomists, and other experts, multispectral camera companies can develop new tools to monitor crop health, detect nutrient deficiencies, and identify pests and diseases. These tools can help farmers to optimize crop production, minimize waste, and reduce environmental impact.

Partnering with companies in the environmental monitoring industry could lead to the development of new applications for multispectral cameras in areas such as climate change research, water quality monitoring, and wildlife conservation. By working with environmental scientists and conservationists, multispectral camera companies can develop new tools to track changes in the environment and identify potential problems.

In summary, expanding multispectral camera applications through industry partnerships can help to drive innovation, create new market base, and deliver unique benefits to customers. By collaborating with companies in other industries, multispectral camera companies can expand the reach and impact of their technology and create new opportunities for growth and development.

Challenges: Complexity and data management

The complexity of multispectral cameras refers to the challenges associated with collecting and analysing the large amounts of data generated by these cameras. Multispectral cameras capture images across multiple wavelengths, resulting in a wealth of information that must be analysed and interpreted to be useful. The challenge lies in extracting meaningful insights from this data, which can be time-consuming and difficult. Multispectral cameras generate data that includes information about the reflectance and absorption of light in different wavelengths. This data can be used to identify features such as vegetation, water, and minerals, but the process of analysing this data can be complex. Multispectral data analysis requires specialized knowledge and expertise, and the sheer volume of data generated can make it difficult to identify and analyse relevant information.

To address this challenge, companies in the multispectral camera market are investing in user-friendly software that simplifies the process of data analysis. This software can automate image processing, use machine learning algorithms to identify relevant features, and provide easy-to-use interfaces that enable users to interpret the data. In addition to software solutions, there are other strategies that companies can use to simplify the process of data analysis. For example, companies can develop standardized calibration procedures that ensure consistency across different cameras and datasets. They can also provide training and support to users to help them better understand how to analyse multispectral data.

The complexity of multispectral cameras presents a significant challenge to their adoption and use. However, by investing in user-friendly software and other solutions, companies can simplify the process of data analysis and make multispectral cameras more accessible to users across a variety of industries.

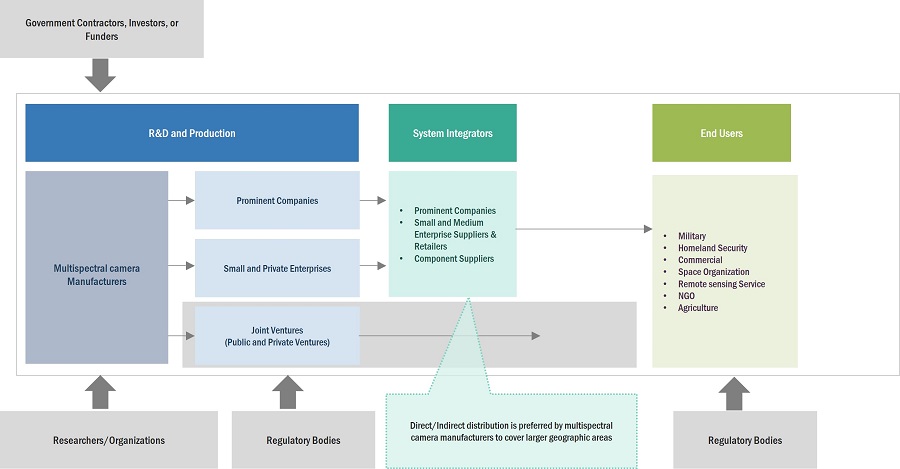

Multispectral Camera Market Ecosystem

The Multispectral Camera Companies are dominated by a few globally established players such as Teledyne FLIR (US), Leonardo DRS (US), Collins Aerospace (US), Hensoldt (Germany), JAI (Denmark), TetraCam Inc. (US), Telops Inc. (Canada), DJI (China), Paras Aerospace (India), Cubert GMBH (Germany) and HGH Group (France).

Based on End Use, the payloads segment is projected to grow at the highest CAGR in the multispectral camera market during the forecast period

Multispectral cameras in payloads are experiencing significant growth due to several factors. Firstly, there is an increasing demand for detailed and accurate remote sensing data in various industries, including agriculture, forestry, environmental monitoring, and infrastructure inspection. Multispectral cameras provide valuable insights by capturing images in multiple spectral bands, enabling precise analysis of vegetation health, land cover, and other parameters. Secondly, advancements in technology have made multispectral cameras more compact, lightweight, and affordable, making them suitable for integration into aerial platforms such as drones and satellites. This has opened new possibilities for efficient and cost-effective data collection over large areas. Lastly, the availability of powerful image processing and analysis techniques has further enhanced the value of multispectral data, enabling better decision-making and resource management. The combination of these factors has contributed to the highest growth of multispectral cameras in payloads, catering to diverse applications and industries.

Based on Application, the defense segment is highest market share the multispectral camera during the forecast period

Multispectral cameras in defense applications are witnessing rapid growth due to their ability to enhance situational awareness and improve operational capabilities. Defense forces require comprehensive and accurate information about their surroundings to effectively monitor and respond to threats. Multispectral cameras offer an advantage by capturing images across multiple spectral bands, including visible, near infrared, and thermal infrared. Moreover, multispectral cameras provide crucial data for target acquisition, tracking, and intelligence gathering. They can detect heat signatures, identify chemical or biological agents, and differentiate between objects based on their spectral characteristics. This information allows defense personnel to make informed decisions, allocate resources efficiently, and respond effectively to potential threats.

Based on End Use, the payload segment is highest market share the multispectral camera during the forecast period

Multispectral cameras are seeing considerable market share increase in payloads for Unmanned Aerial Vehicles (UAVs), satellites, and vehicles for a number of reasons. First off, multispectral camera technology has advanced to the point that it can now be easily integrated into tiny and medium-sized platforms, like unmanned aerial vehicles (UAVs) and compact satellites. As a result, multispectral imaging systems now have a larger market potential and are more widely available. Second, multispectral cameras provide useful capabilities for imaging applications that use satellites and the air. They make it possible to collect images in a variety of spectral bands, facilitating in-depth data analysis and interpretation. Multispectral cameras installed on UAVs or satellites, for instance, give farmers practical information on the health of their crops, nutrient deficits, and pest infestations. As a result, crop management is enhanced, and yields rise.

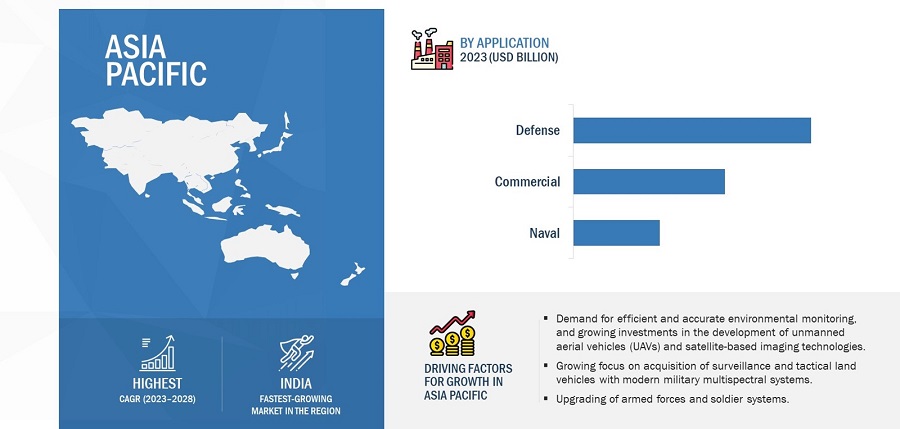

Asia Pacific is expected to account for the highest CAGR in the forecasted period and largest share in 2023.

Multispectral cameras in the Asia-Pacific region are experiencing significant growth due to several key factors. Firstly, the region has a diverse range of industries, including agriculture, environmental monitoring, forestry, and urban planning, which can benefit from the capabilities of multispectral imaging. Multispectral cameras provide valuable data for crop monitoring, disease detection, land cover analysis, and environmental assessments. Secondly, the rapid technological advancements in the region have led to increased availability and affordability of multispectral camera systems. This has made them more accessible to industries and organizations of varying sizes, including small and medium enterprises, research institutions, and government agencies.

Multispectral Camera Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Teledyne FLIR (US), Leonardo DRS (US), Collins Aerospace (US), Hensoldt (Germany), JAI (Denmark), TetraCam Inc. (US), Telops Inc. (Canada), DJI (China), Paras Aerospace (India), Cubert GMBH (Germany), HGH Group (France), Ocean Insight (US), Sepctral Devices (UK), Silios technology (France), Unispectral (Israel), Opgal Optronics Industries Ltd. (Israel) are some of the leading companies in the multispectral camera market. These companies have well-equipped manufacturing facilities and strong distribution networks across North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Scope of the Report

|

Report Metric |

Details |

|

Growth Rate |

9.0% |

|

Estimated Market Size in 2023 |

USD 1.4 Billion |

|

Projected Market Size in 2028 |

USD 2.2 Billion |

|

Market Size Available for Years |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD billion) |

|

Segments Covered |

Cooling Technology, Application, End Use, Spectrum & Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies Covered |

Teledyne FLIR (US), Leonardo DRS (US), Collins Aerospace (US), Hensoldt (Germany), JAI (Denmark), TetraCam Inc. (US), Telops Inc. (Canada), DJI (China), Paras Aerospace (India), Cubert GMBH (Germany), HGH Group (France), Ocean Insight (US), Sepctral Devices (UK), Silios technology (France), Unispectral (Israel), Opgal Optronics Industries Ltd. (Israel), Wingtra AG (Switzerland), Headwall Photonics (US), Photon etc. (Canada) |

Multispectral Camera Market Highlights

This research report categorizes the military multispectral camera based on Cooling Technology, Application, End Use, Spectrum & Region.

|

Segment |

Subsegment |

|

By Cooling Technology: |

|

|

By Application: |

|

|

By End Use: |

|

|

By Imaging Spectrum: |

|

|

By Region: |

|

Recent Developments

- In July 2020, The Aurora infrared camera is also a product of Leonardo DRS and is used for night vision and other low-light applications. It features a high-resolution sensor that can detect even the slightest differences in temperature, allowing users to see in complete darkness. The camera is designed to be rugged and durable, making it suitable for use in harsh environments such as military operations and law enforcement.

- In March 2019, Teledyne FLIR has been awarded numerous contracts by various organizations for its imaging systems, including multispectral cameras. One notable example is a contract awarded by the US Army in 2019 for Teledyne FLIR's Black Hornet 3 nano drone, which incorporates multispectral imaging capabilities. This contract was worth up to USD 39.6 million and was aimed at enhancing situational awareness for soldiers on the battlefield.

- In June 2019, Hensoldt has been awarded several contracts for its multispectral imaging systems. For example, in 2019, Hensoldt was awarded a contract by the German armed forces for the delivery of six Pegasus-NIR systems, which are multispectral reconnaissance systems used for surveillance and reconnaissance missions. The contract was worth over USD 5.4 million.

Frequently Asked Questions (FAQ):

What is the current size of the multispectral cameras market?

The multispectral cameras market is projected to grow from an estimated USD 1.4 billion in 2023 to USD 2.2 billion by 2028, at a CAGR of 9.0% from 2023 to 2028.

What are the key sustainability strategies adopted by leading players operating in the military EO/IR system market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the multispectral cameras. Teledyne FLIR (US), Leonardo DRS (US), Collins Aerospace (US), Hensoldt (Germany), JAI (Denmark), TetraCam Inc. (US), Telops Inc. (Canada), DJI (China), Paras Aerospace (India), Cubert GMBH (Germany), HGH Group (France), Ocean Insight (US), Sepctral Devices (UK), Silios technology (France), Unispectral (Israel), Opgal Optronics Industries Ltd. (Israel) are some of the leading companies in the multispectral camera market.

What new emerging technologies and use cases disrupt the multispectral camera market?

Response: Some of the major emerging technologies and use cases disrupting the market include the development of unmanned system for agriculture, survey & mapping, remote sensing, military ISR activity.

Who are the key players and innovators in the ecosystem of the multispectral camera market?

Response: . Teledyne FLIR (US), Leonardo DRS (US), Collins Aerospace (US), Hensoldt (Germany), JAI (Denmark), TetraCam Inc. (US), Telops Inc. (Canada), DJI (China), Paras Aerospace (India).

Which region is expected to hold the highest market share in the multispectral camera market?

Response: In 2023, Asia Pacific held the greatest market share for multispectral cameras, and during the forecast period, India is anticipated to grow at the highest CAGR.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for precision agriculture- Advancements in sensor technology- Growing adoption of unmanned aerial vehicles- Increasing demand for medical imaging- Rising demand for security and surveillanceRESTRAINTS- Competition from alternative technologies- High cost and regulatory constraintsOPPORTUNITIES- Expansion of multispectral camera applications through industry partnerships- Surging development of user-friendly software for multispectral image analysis- Increasing investment in research and development of new multispectral camera technologyCHALLENGES- Complexity in analyzing and managing huge amounts of data- Integration challenges with platforms

-

5.3 TRENDS IMPACTING CUSTOMER BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR MULTISPECTRAL CAMERA MANUFACTURERS

-

5.4 RECESSION IMPACT ANALYSISIMPACT OF RECESSION ON MULTISPECTRAL CAMERA MARKET

-

5.5 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE TREND

-

5.6 MULTISPECTRAL CAMERA PROJECTED VOLUME, BY REGIONMULTISPECTRAL CAMERA PROJECTED VOLUME, BY REGION

-

5.7 MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.8 VALUE CHAIN ANALYSIS

-

5.9 USE CASE ANALYSISUSE CASE 1: CROP HEALTH MONITORING USING DRONE-MOUNTED MULTISPECTRAL SENSORSUSE CASE 2: LAND USE AND LAND COVER MAPPING USING CUBESAT MULTISPECTRAL SENSORS

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.13 KEY CONFERENCES AND EVENTS FROM JUNE 2023 TO JUNE 2024

- 6.1 INTRODUCTION

-

6.2 KEY TECHNOLOGICAL TRENDS IN MULTISPECTRAL CAMERA MARKETINTEGRATION WITH AI AND MACHINE LEARNINGADVANCED REMOTE SENSINGMINIATURIZATION AND COST REDUCTIONUAVS MULTISPECTRAL CAMERA

-

6.3 IMPACT OF MEGATRENDSDIGITALIZATION AND INTRODUCTION OF INTERNET OF THINGSREVOLUTIONIZING AGRICULTURAL AND HEALTHCARE INDUSTRIES

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 INNOVATION AND PATENT REGISTRATIONS

- 7.1 INTRODUCTION

-

7.2 COOLEDUTILIZING COOLED MULTISPECTRAL CAMERAS FOR MILITARY ISR AND TARGET TRACKING

-

7.3 UNCOOLEDUNCOOLED MULTISPECTRAL CAMERAS REVOLUTIONIZE PORTABLE MILITARY DEVICES

- 8.1 INTRODUCTION

-

8.2 DEFENSEMULTISPECTRAL CAMERAS ARE VERSATILE TOOLS FOR DEFENSE APPLICATIONSINTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE- Advanced multispectral camera systems for enhanced situational awareness in security operationsTARGET AND TRACKING- Capability to detect, identify, and track targets in several spectral bands using multispectral camerasIMAGING SYSTEMS- Precision tracking and imaging with multispectral camera scopes in military operations

-

8.3 COMMERCIALMULTISPECTRAL CAMERAS FOR CUTTING-EDGE COMMERCIAL APPLICATIONSSURVEY AND MAPPING- Revolutionizing survey and mapping with UAV-mounted multispectral camerasENVIRONMENTAL MONITORING- Rising demand for real-time environmental monitoring due to climate change and frequent natural disastersREMOTE SENSING- Growing use of multispectral cameras in remote sensing as researchers seek to understand Earth's surface and atmosphereLIFE SCIENCES & MEDICAL DIAGNOSTICS- Increasing use of multispectral cameras in medical applications as scientists seek to analyze vast amounts of dataOTHERS

- 9.1 INTRODUCTION

-

9.2 MAN-PORTABLEINTEGRATED EO/IR CAPABILITIES WITH SOLDIER SYSTEMS FOR INCREASED MISSION EFFECTIVENESS

-

9.3 PAYLOADSHIGH DEMAND FOR SMALL, LIGHTWEIGHT, AND COMBAT-PROVEN PRODUCTS

- 10.1 INTRODUCTION

-

10.2 VISIBLE LIGHTADVANCES IN VISIBLE LIGHT MULTISPECTRAL CAMERA TECHNOLOGY TO INCREASE POTENTIAL FOR NON-INVASIVE MEDICAL DIAGNOSTICS

-

10.3 NEAR-INFRAREDRISING NEED FOR NEAR-INFRARED MULTISPECTRAL CAMERAS IN AGRICULTURE INDUSTRY FOR ACCURATE CROP HEALTH ANALYSIS AND YIELD PREDICTION

-

10.4 SHORT-WAVE INFRARED (SWIR)GROWING DEMAND FOR SWIR MULTISPECTRAL CAMERAS IN DEFENSE AND SECURITY INDUSTRY TO IMPROVE TARGET DETECTION AND IDENTIFICATION

-

10.5 MID-WAVE INFRARED (MWIR)INCREASING REQUIREMENT FOR MWIR MULTISPECTRAL CAMERAS IN DEFENSE AND SECURITY INDUSTRY FOR ACCURATE THERMAL IMAGING

-

10.6 LONG-WAVE INFRARED (LWIR)DEVELOPMENT OF LOW-COST LWIR MULTISPECTRAL CAMERAS TO INCREASE POTENTIAL FOR COMMERCIAL APPLICATIONS

- 11.1 INTRODUCTION

- 11.2 REGIONAL RECESSION IMPACT ANALYSIS

-

11.3 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICARECESSION IMPACT ANALYSIS: NORTH AMERICAUS- Growing use of multispectral cameras in defense applications to drive marketCANADA- Increased integration of multispectral cameras in defense applications to fuel market

-

11.4 EUROPEPESTLE ANALYSIS: EUROPERECESSION IMPACT ANALYSIS: EUROPEUK- Growing deployment of multispectral cameras in research applications to drive marketFRANCE- Rising interest in expanding hyperspectral imaging applications to drive marketGERMANY- Rising adoption of advanced imaging technologies by industries to drive marketRUSSIA- Growing integration of multispectral cameras in defense applications to drive marketITALY- Robust presence of major defense players to drive marketREST OF EUROPE

-

11.5 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICRECESSION IMPACT ANALYSIS: ASIA PACIFICCHINA- Increasing demand for remote sensing applications and advancements in technology to drive marketINDIA- Increasing demand for remote sensing applications to drive marketJAPAN- Advancements in technology and supportive government and research environment to drive demandSOUTH KOREA- Development of new technologies and increased government investment to drive marketREST OF ASIA PACIFIC

-

11.6 REST OF THE WORLDRECESSION IMPACT ANALYSIS: REST OF THE WORLDMIDDLE EAST & AFRICA- Growing need for agricultural and environmental monitoring to drive marketLATIN AMERICA- Increasing adoption in agriculture for precision farming and crop monitoring to drive demand

- 12.1 INTRODUCTION

- 12.2 RANKING ANALYSIS, 2023

- 12.3 MARKET SHARE ANALYSIS, 2022

- 12.4 REVENUE ANALYSIS, 2022

- 12.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

12.6 COMPETITIVE EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSLEONARDO DRS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOLLINS AEROSPACE- Business overview- Products/Solutions/Services offered- MnM viewTELEDYNE FLIR- Business overview- Products/Solutions/Services offered- MnM viewHENSOLDT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJAI- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCUBERT GMBH- Business overview- Products/Solutions/Services offered- Recent developmentsOCEAN INSIGHT- Business overview- Products/Solutions/Services offered- Recent developmentsOPGAL OPTRONIC INDUSTRIES LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsSALVO COATINGS- Business overview- Products/Solutions/Services offeredTELOPS INC.- Business overview- Products/Solutions/Services offeredDJI- Business overview- Products/Solutions/Services offered- Recent developmentsRAPTOR PHOTONICS LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsHGH GROUP- Business overview- Products/Solutions/Services offeredUNISPECTRAL- Business overview- Products/Solutions/Services offered- Recent developmentsIBEROPTICS SISTEMAS- Business overview- Products/Solutions/Services offeredSILIOS TECHNOLOGIES- Business overview- Products/Solutions/Services offeredPARAS AEROSPACE- Business overview- Products/Solutions/Services offeredSPECTRAL DEVICES- Business overview- Products/Solutions/Services offered

-

13.3 OTHER PLAYERSWINGTRA AG- Business overviewSURFACE OPTICS CORPORATION- Business overviewBAYSPEC INC.- Business overviewHEADWALL PHOTONICS- Business overviewPHOTON ETC.- Business overviewXENICS NV- Business overviewNEO AS- Business overview

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN MULTISPECTRAL CAMERA MARKET

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 MARKET ESTIMATION PROCEDURE FOR DEFENSE APPLICATIONS

- TABLE 4 AVERAGE SELLING PRICE OF MULTISPECTRAL CAMERAS (USD

- TABLE 5 MULTISPECTRAL CAMERA PROJECTED VOLUME, BY REGION

- TABLE 6 MULTISPECTRAL CAMERA MARKET ECOSYSTEM

- TABLE 7 CROP HEALTH MONITORING USING DRONE-MOUNTED MULTISPECTRAL SENSORS

- TABLE 8 LAND USE AND LAND COVER MAPPING USING CUBESAT MULTISPECTRAL SENSORS

- TABLE 9 MULTISPECTRAL CAMERA MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TWO APPLICATIONS (%)

- TABLE 11 KEY BUYING CRITERIA FOR TWO APPLICATIONS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 15 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 16 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 17 MULTISPECTRAL CAMERA MARKET: KEY CONFERENCES AND EVENTS, 2023−2024

- TABLE 18 MULTISPECTRAL CAMERA STATION: KEY PATENTS, 2018

- TABLE 19 MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 20 MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 21 MULTISPECTRAL CAMERA MARKET, BY APPLICATION 2019–2022 (USD MILLION)

- TABLE 22 MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 23 MULTISPECTRAL CAMERA MARKET, BY DEFENSE APPLICATION, 2019–2022 (USD MILLION)

- TABLE 24 MULTISPECTRAL CAMERA MARKET, BY DEFENSE APPLICATION, 2023–2028 (USD MILLION)

- TABLE 25 MULTISPECTRAL CAMERA MARKET, BY COMMERCIAL APPLICATION, 2019–2022 (USD MILLION)

- TABLE 26 MULTISPECTRAL CAMERA MARKET, BY COMMERCIAL APPLICATION, 2023–2028 (USD MILLION)

- TABLE 27 MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 28 MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 29 MULTISPECTRAL CAMERA MARKET, BY SPECTRUM, 2019–2022 (USD MILLION)

- TABLE 30 MULTISPECTRAL CAMERA MARKET, BY SPECTRUM, 2023–2028 (USD MILLION)

- TABLE 31 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 32 MULTISPECTRAL CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 MULTISPECTRAL CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 35 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 37 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET, BY DEFENSE APPLICATION 2019–2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET, BY DEFENSE APPLICATION, 2023–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET, BY COMMERCIAL APPLICATION, 2019–2022 (USD MILLION)

- TABLE 41 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET, BY COMMERCIAL APPLICATION, 2023–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 43 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET, BY SPECTRUM, 2019–2022 (USD MILLION)

- TABLE 45 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET, BY SPECTRUM, 2023–2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 47 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 48 US: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 49 US: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 50 US: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 51 US: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 52 US: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 53 US: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 54 CANADA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 55 CANADA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 56 CANADA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 57 CANADA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 58 CANADA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 59 CANADA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 60 EUROPE: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 61 EUROPE: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 62 EUROPE: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 63 EUROPE: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 64 EUROPE: MULTISPECTRAL CAMERA MARKET, BY DEFENSE APPLICATION, 2019–2022 (USD MILLION)

- TABLE 65 EUROPE: MULTISPECTRAL CAMERA MARKET, BY DEFENSE APPLICATION, 2023–2028 (USD MILLION)

- TABLE 66 EUROPE: MULTISPECTRAL CAMERA MARKET, BY COMMERCIAL APPLICATION, 2019–2022 (USD MILLION)

- TABLE 67 EUROPE: MULTISPECTRAL CAMERA MARKET, BY COMMERCIAL APPLICATION, 2023–2028 (USD MILLION)

- TABLE 68 EUROPE: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 69 EUROPE: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 70 EUROPE: MULTISPECTRAL CAMERA MARKET, BY SPECTRUM, 2019–2022 (USD MILLION)

- TABLE 71 EUROPE: MULTISPECTRAL CAMERA MARKET, BY SPECTRUM, 2023–2028 (USD MILLION)

- TABLE 72 EUROPE: MULTISPECTRAL CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 73 EUROPE: MULTISPECTRAL CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 74 UK: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 75 UK: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 76 UK: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 77 UK: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 78 UK: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 79 UK: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 80 FRANCE: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 81 FRANCE: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 FRANCE: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 83 FRANCE: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 84 FRANCE: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 85 FRANCE: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 86 GERMANY: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 87 GERMANY: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 88 GERMANY: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 89 GERMANY: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 90 GERMANY: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 91 GERMANY: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 92 RUSSIA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 93 RUSSIA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 RUSSIA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 95 RUSSIA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 96 RUSSIA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 97 RUSSIA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 98 ITALY: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 99 ITALY: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 100 ITALY: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 101 ITALY: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 102 ITALY: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 103 ITALY: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 104 REST OF EUROPE: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 105 REST OF EUROPE: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 REST OF EUROPE: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 107 REST OF EUROPE: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 108 REST OF EUROPE: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 109 REST OF EUROPE: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY DEFENSE APPLICATION 2019–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY DEFENSE APPLICATION, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY COMMERCIAL APPLICATION, 2019–2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY COMMERCIAL APPLICATION, 2023–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY SPECTRUM, 2019–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY SPECTRUM, 2023–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 124 CHINA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 125 CHINA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 126 CHINA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 127 CHINA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 128 CHINA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 129 CHINA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 130 INDIA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 131 INDIA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 132 INDIA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 133 INDIA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 134 INDIA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 135 INDIA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 136 JAPAN: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 137 JAPAN: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 138 JAPAN: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 139 JAPAN: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 140 JAPAN: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 141 JAPAN: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 142 SOUTH KOREA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 143 SOUTH KOREA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 144 SOUTH KOREA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 145 SOUTH KOREA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 146 SOUTH KOREA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 147 SOUTH KOREA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 154 REST OF THE WORLD: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 155 REST OF THE WORLD: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 156 REST OF THE WORLD: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 157 REST OF THE WORLD: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 158 REST OF THE WORLD: MULTISPECTRAL CAMERA MARKET, BY DEFENSE APPLICATION 2019–2022 (USD MILLION)

- TABLE 159 REST OF THE WORLD: MULTISPECTRAL CAMERA MARKET, BY DEFENSE APPLICATION, 2023–2028 (USD MILLION)

- TABLE 160 REST OF THE WORLD: MULTISPECTRAL CAMERA MARKET, BY COMMERCIAL APPLICATION, 2019–2022 (USD MILLION)

- TABLE 161 REST OF THE WORLD: MULTISPECTRAL CAMERA MARKET, BY COMMERCIAL APPLICATION, 2023–2028 (USD MILLION)

- TABLE 162 REST OF THE WORLD: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 163 REST OF THE WORLD: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 164 REST OF THE WORLD: MULTISPECTRAL CAMERA MARKET, BY SPECTRUM, 2019–2022 (USD MILLION)

- TABLE 165 REST OF THE WORLD: MULTISPECTRAL CAMERA MARKET, BY SPECTRUM, 2023–2028 (USD MILLION)

- TABLE 166 REST OF THE WORLD: MULTISPECTRAL CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 167 REST OF THE WORLD: MULTISPECTRAL CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 175 LATIN AMERICA: MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 176 LATIN AMERICA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 177 LATIN AMERICA: MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028 (USD MILLION)

- TABLE 178 LATIN AMERICA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 179 LATIN AMERICA: MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 180 KEY DEVELOPMENTS BY LEADING PLAYERS IN MULTISPECTRAL CAMERA MARKET, 2019–2022

- TABLE 181 MULTISPECTRAL CAMERA MARKET: DEGREE OF COMPETITION

- TABLE 182 COMPANY PRODUCTS FOOTPRINT

- TABLE 183 COMPANY APPLICATION FOOTPRINT ANALYSIS

- TABLE 184 COMPANY REGION FOOTPRINT ANALYSIS

- TABLE 185 MULTISPECTRAL CAMERA MARKET: PRODUCT LAUNCHES, JANUARY 2019–DECEMBER 2023

- TABLE 186 MULTISPECTRAL CAMERA MARKET: DEALS, JANUARY 2019–DECEMBER 2021

- TABLE 187 LEONARDO DRS: BUSINESS OVERVIEW

- TABLE 188 LEONARDO DRS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 LEONARDO DRS: PRODUCT LAUNCHES

- TABLE 190 LEONARDO DRS: DEALS

- TABLE 191 COLLINS AEROSPACE: BUSINESS OVERVIEW

- TABLE 192 COLLINS AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 TELEDYNE FLIR: BUSINESS OVERVIEW

- TABLE 194 TELEDYNE FLIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 TELEDYNE FLIR: DEALS

- TABLE 196 HENSOLDT: BUSINESS OVERVIEW

- TABLE 197 HENSOLDT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 HENSOLDT: PRODUCT LAUNCHES

- TABLE 199 HENSOLDT: DEALS

- TABLE 200 JAI: BUSINESS OVERVIEW

- TABLE 201 JAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 JAI: PRODUCT LAUNCHES

- TABLE 203 JAI: DEALS

- TABLE 204 CUBERT GMBH: BUSINESS OVERVIEW

- TABLE 205 CUBERT GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 CUBERT GMBH: PRODUCT LAUNCHES

- TABLE 207 OCEAN INSIGHT: BUSINESS OVERVIEW

- TABLE 208 OCEAN INSIGHT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 OCEAN INSIGHT: PRODUCT LAUNCHES

- TABLE 210 OPGAL OPTRONIC INDUSTRIES LTD.: BUSINESS OVERVIEW

- TABLE 211 OPGAL OPTRONIC INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 OPGAL OPTRONIC INDUSTRIES LTD.: PRODUCT LAUNCHES

- TABLE 213 OPGAL OPTRONIC INDUSTRIES LTD.: DEALS

- TABLE 214 SALVO COATINGS: BUSINESS OVERVIEW

- TABLE 215 SALVO COATINGS.: PRODUCTS OFFERED

- TABLE 216 TELOPS INC.: BUSINESS OVERVIEW

- TABLE 217 TELOPS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 DJI: BUSINESS OVERVIEW

- TABLE 219 DJI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 DJI: PRODUCT LAUNCHES

- TABLE 221 RAPTOR PHOTONICS LTD.: BUSINESS OVERVIEW

- TABLE 222 RAPTOR PHOTONICS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 RAPTOR PHOTONICS LTD.: PRODUCT LAUNCHES

- TABLE 224 HGH GROUP.: BUSINESS OVERVIEW

- TABLE 225 HGH GROUP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 UNISPECTRAL: BUSINESS OVERVIEW

- TABLE 227 UNISPECTRAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 UNISPECTRAL: PRODUCT LAUNCHES

- TABLE 229 IBEROPTICS SISTEMAS: BUSINESS OVERVIEW

- TABLE 230 IBEROPTICS SISTEMAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 SILIOS TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 232 SILIOS TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 PARAS AEROSPACE: BUSINESS OVERVIEW

- TABLE 234 PARAS AEROSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 SPECTRAL DEVICES: BUSINESS OVERVIEW

- TABLE 236 SPECTRAL DEVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 WINGTRA AG: BUSINESS OVERVIEW

- TABLE 238 SURFACE OPTICS CORPORATION: BUSINESS OVERVIEW

- TABLE 239 BAYSPEC INC.: BUSINESS OVERVIEW

- TABLE 240 HEADWALL PHOTONICS: BUSINESS OVERVIEW

- TABLE 241 PHOTON ETC.: BUSINESS OVERVIEW

- TABLE 242 XENICS NV: BUSINESS OVERVIEW

- TABLE 243 NEO AS: BUSINESS OVERVIEW

- FIGURE 1 MULTISPECTRAL CAMERA MARKET SEGMENTATION

- FIGURE 2 RESEARCH FLOW

- FIGURE 3 RESEARCH DESIGN

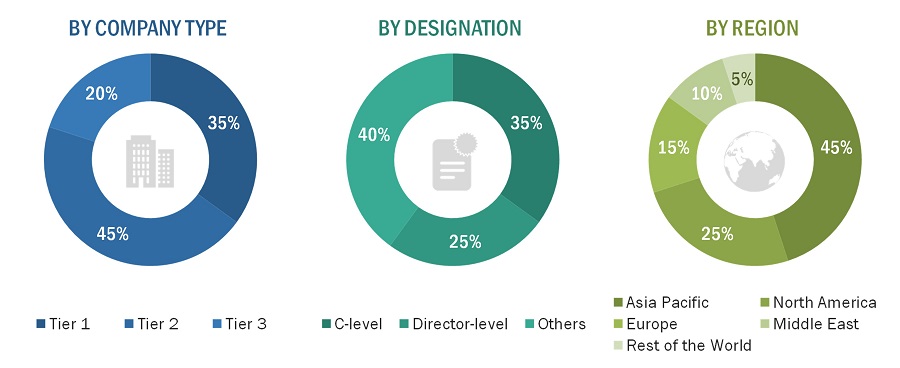

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

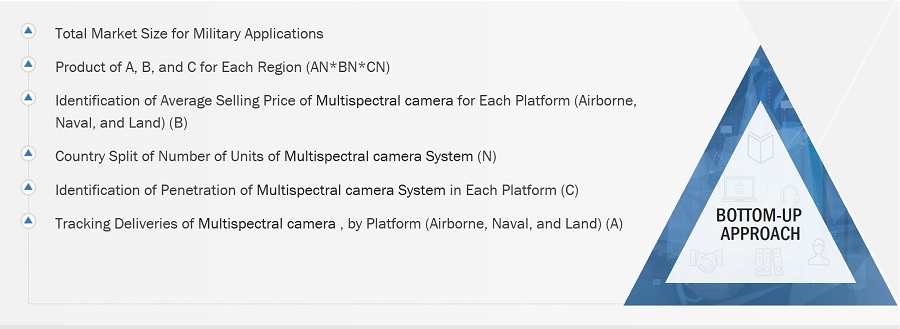

- FIGURE 5 BOTTOM-UP APPROACH

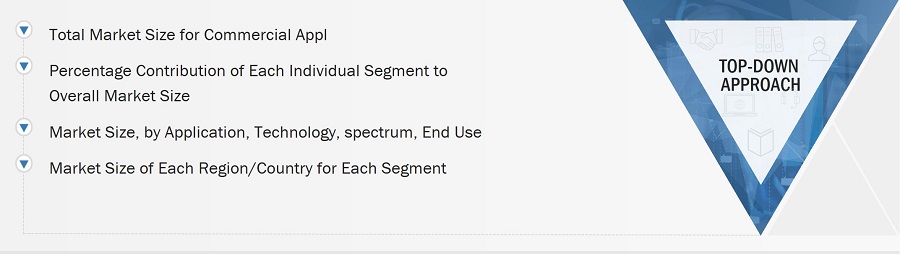

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 MILITARY EXPENDITURE, BY COUNTRY, 2019–2021 (USD BILLION)

- FIGURE 8 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 COMMERCIAL SEGMENT TO REGISTER HIGHER CAGR FROM 2023 TO 2028

- FIGURE 10 PAYLOADS SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 11 NEAR-INFRARED SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 12 COOLED SEGMENT TO ACQUIRE LARGEST MARKET SHARE BY 2028

- FIGURE 13 TARGET AND TRACKING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE BY 2028

- FIGURE 14 REMOTE SENSING SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 15 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 INCREASED ADOPTION OF UNMANNED SYSTEMS TO DRIVE MARKET

- FIGURE 17 SURVEY AND MAPPING SEGMENT TO SURPASS OTHER SEGMENTS BY 2028

- FIGURE 18 PAYLOADS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 TARGET AND TRACKING SEGMENT TO LEAD MARKET BY 2028

- FIGURE 20 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 21 INDIA TO BE FASTEST-GROWING MARKET FROM 2023 TO 2028

- FIGURE 22 MULTISPECTRAL CAMERA MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 REVENUE SHIFT IN MULTISPECTRAL CAMERA MARKET

- FIGURE 24 RECESSION IMPACT ANALYSIS ON MULTISPECTRAL CAMERA MARKET

- FIGURE 25 FACTORS IMPACTING MULTISPECTRAL CAMERA MARKET

- FIGURE 26 MULTISPECTRAL CAMERA MARKET ECOSYSTEM

- FIGURE 27 VALUE CHAIN ANALYSIS: MULTISPECTRAL CAMERA MARKET

- FIGURE 28 INTENSITY OF COMPETITIVE RIVALRY TO BE MODERATE IN MULTISPECTRAL CAMERA MARKET

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TWO APPLICATIONS

- FIGURE 30 KEY BUYING CRITERIA FOR TWO APPLICATIONS

- FIGURE 31 EVOLUTION OF MULTISPECTRAL CAMERA TECHNOLOGY: A ROADMAP FROM 1980 TO 2050

- FIGURE 32 SUPPLY CHAIN ANALYSIS

- FIGURE 33 MULTISPECTRAL CAMERA MARKET, BY COOLING TECHNOLOGY, 2023–2028

- FIGURE 34 MULTISPECTRAL CAMERA MARKET, BY APPLICATION, 2023–2028

- FIGURE 35 MULTISPECTRAL CAMERA MARKET, BY DEFENSE APPLICATION, 2023–2028

- FIGURE 36 MULTISPECTRAL CAMERA MARKET, BY COMMERCIAL APPLICATION, 2023–2028

- FIGURE 37 MULTISPECTRAL CAMERA MARKET, BY END USE, 2023–2028

- FIGURE 38 MULTISPECTRAL CAMERA MARKET, BY SPECTRUM, 2023–2028

- FIGURE 39 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET SNAPSHOT

- FIGURE 40 NORTH AMERICA: MULTISPECTRAL CAMERA MARKET SNAPSHOT

- FIGURE 41 EUROPE: MULTISPECTRAL CAMERA MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: MULTISPECTRAL CAMERA MARKET SNAPSHOT

- FIGURE 43 MARKET RANKING OF TOP FIVE PLAYERS, 2023

- FIGURE 44 MARKET SHARE OF TOP FIVE PLAYERS, 2022

- FIGURE 45 REVENUE OF TOP FIVE PLAYERS, 2023

- FIGURE 46 MULTISPECTRAL CAMERA MARKET: COMPETITIVE LEADERSHIP MAPPING, 2023

- FIGURE 47 MULTISPECTRAL CAMERA MARKET: STARTUP/SME COMPETITIVE LEADERSHIP MAPPING, 2023

- FIGURE 48 HENSOLDT: COMPANY SNAPSHOT

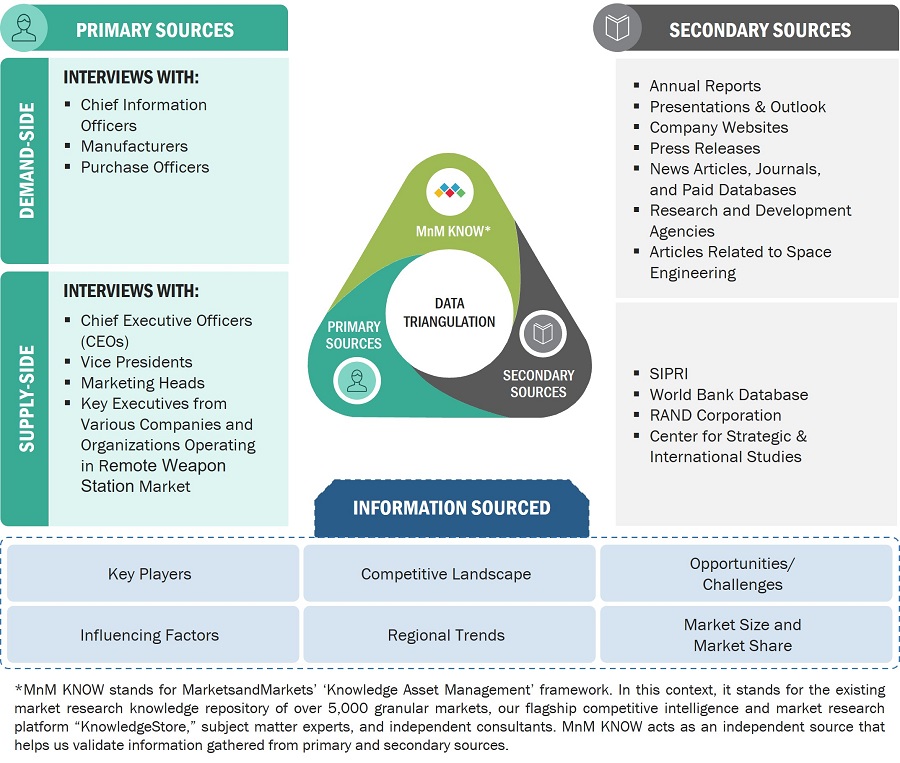

The research study conducted on the multispectral camera market involved extensive use of secondary sources, including directories, databases of articles, journals on multispectral camera, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the multispectral camera market. Primary sources are several industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of the multispectral camera market.

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess future prospects of the market.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for this study on the multispectral camera market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers and certified publications; articles from recognized authors; manufacturer's associations; directories; and databases. Secondary research was mainly used to obtain key information about the supply chain of the multispectral camera industry, the monetary chain of the market, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted to obtain qualitative and quantitative information for this report on the military multispectral camera market. Several primary interviews were conducted with the market experts from both demand- and supply-side across major regions, namely, North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa. Primary sources from the supply-side included industry experts such as business development managers, sales heads, technology and innovation directors, and related key executives from various key companies and organizations operating in the multispectral camera market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The multispectral camera market is an emerging one due to the growing demand for intelligence, surveillance and Reconnaissance and Commercial like survey & mapping, life science and medical diagnostic, remote sensing, environment monitoring and others. Both top-down and bottom-up approaches were used to estimate and validate the size of the multispectral camera market. The research methodology used to estimate the market size also included the following details:

Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up approach

The demand for advanced surveillance, target identification, and threat detection capabilities has made the defense industry a significant end-user segment for multispectral cameras. By recording images outside of the visible spectrum, multispectral cameras provide a clear advantage over conventional imaging systems. This allows for improved visibility in difficult conditions and the capacity to distinguish between different materials based on their distinctive spectral signatures.

The demand for cutting-edge sensor technology and the complexity of modern combat are driving the introduction of multispectral cameras in the defense industry. Modern imaging systems are being purchased by military organizations all over the world in order to acquire a tactical edge, enhance situational awareness, and guarantee the protection and safety of their employees.

Market size estimation methodology: Top-down approach

Top-down market size estimation for the multispectral camera market is that the increasing adoption of multispectral cameras in the agricultural sector, remote sensing, drone inspection, survey and mapping, life science and medical diagnostics is significantly contributing to the market's growth.

Given the growing population, the limited amount of arable land, and the shifting climatic patterns, the global agriculture sector is observing an increase in demand for effective and data-driven farming solutions. Farmers can use multispectral cameras as a useful tool to acquire a deeper understanding of their crops, allowing them to perform focused interventions and increase yields.

Data Triangulation

After arriving at the overall size of the multispectral camera market from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated sizes of different market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

A multispectral camera is a type of imaging device that captures images in several different spectral bands, or wavelengths of light. Unlike traditional cameras that capture images in the visible light spectrum, multispectral cameras can also capture images in the infrared, ultraviolet, and other non-visible parts of the electromagnetic spectrum. Multispectral cameras are often used in defense, remote sensing applications, such as environmental monitoring, crop management, and geological exploration. By capturing images in multiple spectral bands, these cameras can provide valuable information about the composition and health of various materials and surfaces.

In addition to remote sensing applications, multispectral cameras are also used in medical imaging, security and surveillance, and scientific research. These cameras can capture detailed images of biological tissues and structures, as well as detect hidden objects or substances that may be invisible to the naked eye. A multispectral camera is a type of imaging sensor used in EO/IR (Electro-Optical/Infrared) systems. EO/IR systems are used for a wide range of applications, including surveillance, target tracking, search and rescue, and environmental monitoring. By using multispectral cameras, these systems can provide more detailed information about the target or environment being monitored. In addition to visible light, multispectral cameras can capture images in infrared and ultraviolet bands, as well as other parts of the electromagnetic spectrum. This allows them to capture information about the temperature, chemical composition, and other physical properties of objects and environments.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

- Ministry of Defense

- Regulatory Bodies

- R&D Companies

- Providers of Weapons System and multispectral camera

- Providers of Active Protection Systems

- Commercial

- Space Organization

- Remote Sensing service provider

- Providers of multispectral camera Components and Sub-components

- Armed Forces

Report Objectives

- To define, describe, and forecast the size of the multispectral camera market based on cooling technology, application, end use, spectrum, and region from 2023 to 2028.

- To forecast the size of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), which comprises the Middle East & Africa, Latin America

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the multispectral camera market across the globe.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the multispectral camera market.

- To analyze opportunities for stakeholders in the market by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions and expansions, agreements, joint ventures and partnerships, new product launches, and Research & Development (R&D) activities in the multispectral camera market.

- To provide a detailed competitive landscape of the -market, in addition to an analysis of business and corporate strategies adopted by leading market players.

- To strategically profile key market players and comprehensively analyze their core competencies2.

1. Micro markets refer to further segments and subsegments of the military electro-optics & infrared (EO/IR) system market included in the report.

2. Core competencies of the companies were captured in terms of their key developments and strategies adopted by them to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Multispectral Camera Market