Multilayer Ceramic Capacitor Market Size, Share & Trends

Multilayer Ceramic Capacitor Market by General Capacitor, Array, Serial Construction, Mega Cap, Dielectric Type, Rated Voltage (Low Voltage, Mid Voltage, High Voltage), End Use, Application, Package, Capacitance Range - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global multilayer ceramic capacitor market is projected to rise from USD 15.00 billion in 2025 to USD 21.93 billion by 2030, registering a CAGR of 7.9%. A key factor fueling this growth is the rapid rollout of 5G networks, which is driving substantial demand for MLCCs within the telecommunications sector. 5G infrastructure such as base stations and small cells requires significantly more MLCCs than 4G LTE systems to enable high-frequency signal filtering, decoupling, and energy storage, ensuring stable and efficient operation. These capacitors must be compact yet capable of withstanding higher frequencies and elevated temperatures, making them indispensable for modern high-density telecom circuit boards. For instance, SAMSUNG ELECTRO-MECHANICS has developed specialized MLCCs tailored for 5G base stations, meeting the stringent performance standards of next-generation networks. As global 5G deployment accelerates, the demand for advanced, high-performance MLCCs is expected to grow, reinforcing their critical role in the telecommunications industry.

KEY TAKEAWAYS

-

BY TYPEThe type segment includes general capacitor, array, serial construction, maga cap, and other types. General-purpose MLCCs hold the largest market share due to their versatility and cost-effectiveness. They are widely used across consumer electronics, automotive, telecom, and industrial applications for decoupling, filtering, and energy storage. Their compatibility with high-density circuit boards and standard performance requirements drives broad adoption globally.

-

BY DIELECTRIC TYPEThe dielectric type segment includes Class I, Class II, and Class III MLCCs. Class I MLCCs dominate the market owing to their excellent stability, low dielectric loss, and minimal temperature coefficient. They are preferred for precision applications in telecom, automotive, medical, and industrial sectors, where consistent performance and reliability are critical.

-

BY RATED VOLTAGEthe rated voltage segment includes low voltage (≤16 V), mid voltage (25–200 V), and high voltage (>200 V). Low-voltage MLCCs account for the largest market share as most electronic devices operate within lower voltage ranges. They are widely employed in smartphones, wearables, and consumer electronics for filtering, decoupling, and signal stabilization, supporting compact and cost-efficient designs.

-

BY END USEThe end use segment includes consumer electronics, automotive, telecom, industrial, healthcare & medical, aerospace & defense, and other end uses. The consumer electronics segment leads the marekt due to rapidly growing demand for smartphones, tablets, laptops, and wearables. High-density and miniaturized circuit boards in these devices require MLCCs for power management, signal integrity, and energy storage, driving continuous adoption.

-

BY APPLICATIONThe application includes decoupling capacitors, filtering capacitors, bypass capacitors, resonant/timing capacitors, coupling/decoupling capacitors in RF, and powertrain HV capacitors. Decoupling MLCCs dominate the market because they prevent voltage fluctuations and reduce noise in electronic circuits. They are essential in smartphones, computers, automotive electronics, and telecom equipment, ensuring stable performance of integrated circuits and processors.

-

BY PACKAGEPackage type includes ultra-miniature, small, medium, and large. Ultra-miniature MLCC packages are projected to hold the largest market share, driven by device miniaturization and high-density PCB requirements. These compact capacitors enable designers to save space without compromising performance, especially in mobile devices and IoT applications.

-

BY CAPACITANCE RANGEThe capacitace range includes the following segments: <100 pF, 100 pF–1 nF, 1–100 nF, 0.1–1 µF, 1–100 µF, and >100 µF. MLCCs in the 0.1–1 µF range dominate due to their balanced capacitance and voltage handling capacity, suitable for a wide array of applications such as decoupling, filtering, and energy storage. This range meets the requirements of consumer electronics, automotive, and industrial devices efficiently.

-

BY REGIONThe multilayer ceramic capacitor market covers North America, Europe, Asia Pacific, and RoW. Asia Pacific held the largest market share in 2024, driven by strong electronics manufacturing hubs in China, Japan, South Korea, and Taiwan. High demand from consumer electronics, automotive, and telecom sectors, along with local production capabilities, underpins the region’s market dominance.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Murata Manufacturing Co., Ltd., SAMSUNG ELECTRO-MECHANICS, and YAGEO Group have entered into a number of agreements and partnerships to cater to the growing demand for MLCCs across industries.

The growing adoption of electric and hybrid vehicles is boosting demand for high-performance MLCCs in power electronics, battery management systems, and infotainment modules. These capacitors are critical for voltage regulation, high-frequency filtering, and energy storage while ensuring reliability under high voltages and extreme temperatures. MLCCs are also increasingly used in ADAS, sensors, and connectivity systems, supporting compact, high-density circuit designs. As EVs become more widespread, the need for robust, miniaturized, and high-capacitance MLCCs is expected to rise significantly, presenting major growth opportunities for manufacturers.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

MLCC customers are adapting to rapid industry changes driven by smaller, more advanced electronics, electrification in vehicles, and the rollout of 5G and 6G networks, all of which push demand for high-capacitance, high-frequency, and automotive-grade components. At the same time, persistent supply chain disruptions, material shortages, and the threat of counterfeits are forcing buyers to adopt stricter sourcing and testing practices. Environmental regulations and emerging alternatives such as polymer capacitors further complicate sourcing and design, making it essential for customers to balance innovation, cost, reliability, and supply security.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increased circuit complexity in consumer electronics due to miniaturization

-

Rising incorporation of MLCCs in smartphones, smart wearables, and other electronic devices

Level

-

Price volatility in raw materials

-

Environmental and regulatory compliance costs

Level

-

Elevating demand for circular sourcing and recycling services for MLCCs

-

Surging use of medium- and high-voltage MLCCs in industrial, medical, and automotive applications

Level

-

Availability of counterfeit and substandard MLCCs

-

High capital expenditure required for capacity expansion

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased circuit complexity in consumer electronics due to miniaturization

The increased circuit complexity in consumer electronics due to miniaturization is the major driver accelerating the growth of the multilayer ceramic capacitor market. As modern devices such as smartphones, wearables, laptops, and IoT gadgets become increasingly compact yet more functionally dense-with added features such as 5G connectivity, high-speed processors, Al modules, and multiple sensors-the demand for compact and high-capacitance MLCCs has surged. Manufacturers are responding by developing capacitors with ultra-thin dielectric layers and higher layer counts to deliver greater capacitance in smaller packages.

Restraint: Price volatility in raw materials

Price volatility in raw materials is one of the most critical factors hindering the growth of the multilayer ceramic capacitor market, as the production process heavily depends on materials like nickel, palladium, and ceramic dielectric powders (mainly barium titanate). These materials are essential for forming the electrode and dielectric layers in MLCCS, and their prices are highly sensitive to global supply-demand dynamics, mining output, and geopolitical tensions. For example, nickel, a key element for internal electrodes, has seen sharp price swings in recent years due to supply disruptions from major producers such as Russia and Indonesia and growing demand from the EV battery industry.

Opportunity: Elevating demand for circular sourcing and recycling services for MLCCs

As OEMs and electronics manufacturers push harder on sustainability targets and extended producer responsibility, recycling and closed-loop sourcing for MLCCs is a growing commercial opportunity: MLCCs contain recoverable ceramic dielectric materials (barium titanate and related oxides) and electrode metals (nickel, palladium, silver) whose value and environmental footprint make recovery economically and reputationally attractive. Building a recycling/circular-economy offering can take several forms-collection and reverse-logistics from OEMs (original equipment manufacturer) and EMS (electronics manufacturing services) partners, mechanical and chemical processing to separate, purify, and reconstitute ceramic powders and electrode metals, refurbishment and re-qualification of salvaged components for non-critical applications, and finally supplying certified recycled materials back to MLCC manufacturers or PCB/substrate producers.

Challenges: Availability of counterfeit and substandard MLCCs

Counterfeit and substandard products pose a significant challenge to market players, particularly because MLCCs are crucial for device performance and reliability in applications spanning consumer electronics, automotive, aerospace, and medical devices. Counterfeit MLCCs often mimic authentic products in appearance but fail to meet the required electrical specifications, temperature tolerance, voltage ratings, or aging characteristics. Substandard capacitors can lead to premature failures, circuit malfunctions, or even safety hazards, which is especially risky in safety-critical applications, such as electric vehicles, medical devices, or avionics.

Multilayer Ceramic Capacitor Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Extensive MLCC range for smartphones, tablets, and wearables (decoupling, bypass, filtering); high-reliability automotive MLCCs for EVs, ADAS, and powertrain ECUs (CASE era); industrial control, robotics, and energy (high-voltage, robust MLCCs); telecom/5G base stations and network equipment; medical devices (miniature, high-grade capacitors); aerospace/defense (mission-critical, high-temp) | Highest reliability| Miniaturization | Extreme temp and voltage tolerance | Stable supply for automotive safety and telecom | Compliance (AEC-Q200, medical) |Quality Leadership |

|

MLCCs in smartphones, laptops, and wearables (ultra-thin, high-frequency); advanced automotive MLCCs for EVs, xEVs, ADAS, autonomous drive, infotainment, and AI server boards; telecom/data center equipment needing high-density integration; industrials (factory automation, PLCs); healthcare and medical devices (monitoring, portable diagnostics) | Cost-effective mass production | High capacity |AI/EV/ADAS-specific grades, leading in automotive and data center adoption| Thermal and vibration durability |

|

MLCCs for smartphones, IoT, white goods, consumer electronics (miniaturized, array capacitors); automotive (drive systems, charging, powertrain, ADAS, infotainment); telecom 5G routers, high-voltage/industrial (power modules, automation, renewables, EV charging, on-board chargers); medical (implantable, imaging) and aerospace/defense applications (with KEMET) | Broadest global range | Industrially certified |High-voltage segments |Best-in-class price/performance |Cross-industry application depth |

|

High-reliability MLCCs for smartphones (over 1,000 MLCCs per device), 5G mobile, infotainment, smart home, and IoT edge; automotive (EV battery, ADAS, e-mobility, power/motor control); industrial robotics, PLCs, and automation; high-frequency telecom modules; medical/healthcare (portable diagnostics, implantable, DC/DC modules); aerospace, defense, and transport | Advanced miniaturization | High-capacitance and reliability for >10-year life | Industry leadership in all major device categories ? |

|

Smartphones, wearables, home automation, and consumer electronics (thin/ultra-miniature MLCCs); automotive electronics (autonomous drive, powertrain inverters, sensor modules, high-voltage EVs); telecom (server, 5G base stations, power line filtering); industrial (energy, industrial controls, grid, renewables, EV charging); medical and aerospace/defense (high tolerance, harsh environment) | Reliability |Full range from miniature to power MLCCs | Automotive/industrial qualification | Global supply chain and engineering support |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The multilayer ceramic capacitor ecosystem analysis describes the interconnected network of manufacturers and end users. It encompasses leading MLCC producers such as Murata, SAMSUNG ELECTRO-MECHANICS, TDK, Yageo, Kyocera, and Taiyo Yuden, along with major end users from sectors such as consumer electronics (Apple, Samsung, Sony, HP, LG) and automotive (Volkswagen, GM, Tesla, Toyota). This analysis considers the flow of technology, supply chains, market demand, and value creation across these participants, highlighting their roles, dependencies, and the innovations shaping MLCC adoption in diverse electronic and automotive applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Multilayer Ceramic Capacitor Market, By Type

General capacitor held the largest market share of around 43% in 2024 due to their widespread use in consumer electronics, automotive, industrial, and telecom sectors. Their versatility and cost-effectiveness make them essential for applications ranging from smartphones and wearables to electric vehicles and 5G networks, maintaining their leading position as industries continue to demand high-capacitance, miniaturized solutions.

Multilayer Ceramic Capacitor Market, By Dielectric Type

Class III MLCCs are projected to record at the highest CAGR among dielectric types. These capacitors are preferred in applications where maximum capacitance and small footprints are required, such as bulk capacitance in consumer electronics and power supply decoupling. Increasing miniaturization in electronics is accelerating adoption, particularly where size and capacitance outweigh precision.

Multilayer Ceramic Capacitor Market, By Rated Voltage

The mid voltage segment (typically 50–100 V) is expected to register the highest CAGR in the coming years. This growth is fueled by automotive electrification, industrial automation, and new 48 V vehicle architectures demanding capacitors that balance high capacitance, increased voltage tolerance, and reliability. The surge in electric vehicles, energy storage, and renewable infrastructure further propels demand for mid voltage MLCCs.

Multilayer Ceramic Capacitor Market, By End Use

The automotive segment is expected to record the highest CAGR in the market. Vehicle electrification, autonomous driving, and advanced driver assistance systems (ADAS) require a growing number of high-reliability capacitors for powertrain management, infotainment, and safety systems. As electric vehicle adoption increases, the demand for automotive-grade MLCCs also rises, leading to sustained market growth above the average in this sector.

REGION

Asia Pacific to be fastest-growing region in global multilayer ceramic capacitor market during forecast period

The Asia Pacific is projected to record the highest CAGR in the multilayer ceramic capacitor market due to its position as a global electronics manufacturing hub, strong demand in consumer electronics such as smartphones and wearables, and the rapid adoption of automotive electrification, particularly electric vehicles. The region's leadership in 5G infrastructure rollout and the rise of industrial automation further boost MLCC demand. Government incentives, heavy investments in R&D, and continuous innovation in miniaturization and performance enhance growth prospects. Together, these factors drive robust consumption and production of MLCCs, making Asia Pacific the fastest-growing region in this market.

Multilayer Ceramic Capacitor Market: COMPANY EVALUATION MATRIX

In the multilayer ceramic capacitor market matrix, Murata Manufacturing Co., Ltd. is positioned as a star due to its strong product footprint and dominant market share, reflecting its leadership in innovation and adoption across OEMs. KYOCERA Corporation, on the other hand, is seen as an emerging leader, holding a significant market share but with a comparatively smaller product footprint, indicating strong growth potential as it expands its multilayer ceramic capacitor offering.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 15.00 Billion |

| Market Forecast in 2030 (Value) | USD 21.93 Billion |

| Growth Rate | CAGR of 7.9% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Volume (Million Units) and Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Lndscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: Multilayer Ceramic Capacitor Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global Smartphone OEM | Customized high-density Class III MLCCs for ultra-thin mobile devices | Enabled device miniaturization, improved battery life, and supported faster processor speeds by reducing PCB area and enhancing power integrity |

| European EV Manufacturer | Automotive-grade MLCCs with high-rated voltage and enhanced thermal stability for drive inverters | Improved system reliability, extended component lifespan under harsh operating conditions, and enhanced vehicle safety |

| Telecom Infrastructure Provider | RF-optimized MLCCs for 5G base station filters and front-end modules | Achieved higher data rates, reduced signal loss, and improved network coverage and performance |

| Industrial Automation Solution Integrator | Ruggedized, high-capacitance MLCCs for factory automation controllers | Minimized equipment downtime, enhanced noise immunity, and increased system stability in high-electromagnetic-interference environments |

| Consumer Electronics Giant | Low-ESR MLCC arrays for fast-charging and power-efficient gadgets | Reduced device charging time, improved thermal management, and enabled thinner product designs with superior power delivery |

RECENT DEVELOPMENTS

- August 2025 : SAMSUNG ELECTRO-MECHANICS launched the CL03X475MS3CNW (Class II), an ultra–high–capacitance MLCC tailored for AI server ASIC GPU packages, offering a capacitance of 4.7 µF at a rated voltage of 2.5 V. Its X6S temperature characteristics (-55 to 125°C) ensure reliable performance in high-heat AI applications with low current leakage and slim profile.

- April 2025 : SAMSUNG ELECTRO-MECHANICS secured a major supply contract from Chinese EV giant BYD to deliver multilayer ceramic capacitors (MLCCs) for automotive applications, including powertrains and safety systems. The deal marks SEM's entry into supplying one of the world's largest EV manufacturers, leveraging its high-reliability automotive-grade MLCCs. This partnership is expected to boost SEM's market share in the EV sector, with initial shipments starting in 2025.

- March 2025 : TDK Corporation partnered with AM Batteries to advance energy-efficient battery manufacturing, focusing on scalability and sustainability for solid-state batteries. The collaboration combines TDK's expertise in electronic components, potentially including MLCCs for battery management systems, with AM Batteries' dry electrode technology. This initiative aims to accelerate US-based production and reduce environmental impact in EV battery supply chains.

- March 2025 : KYOCERA Corporation launched the KGM05 Series to deliver the industry's highest 47 μF capacitance in 0402-inch size (1.0×0.5 mm) for AI servers, smartphones, and miniaturized electronics, offering 2.1x the capacitance of previous 22 μF products with rated voltages of 2.5 V/4V and high reliability up to +105°C.

- Setember 2024 : YAGEO Group announced a new family of automotive-grade high-temperature multilayer ceramic capacitors tailored for electric vehicle powertrains and advanced driver-assistance systems, featuring superior thermal stability and durability to bolster performance in harsh automotive environments.

Table of Contents

Methodology

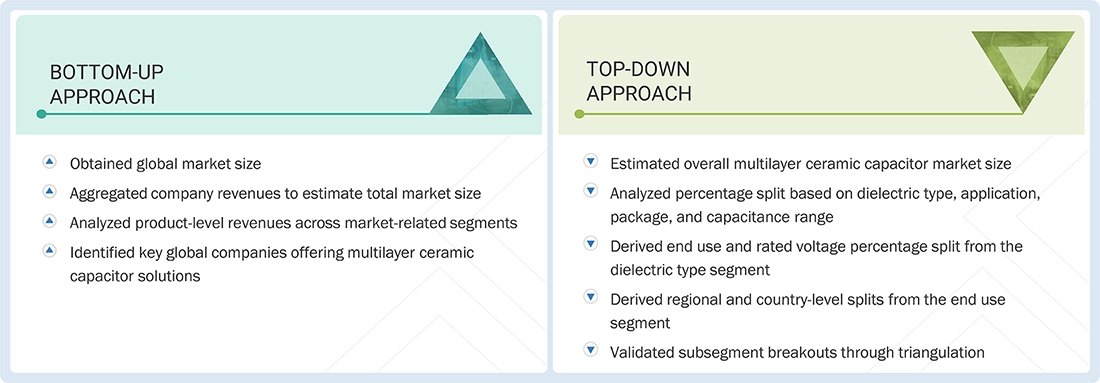

The study involved major activities in estimating the size of the multilayer ceramic capacitor market. Exhaustive secondary research was done to collect information on the multilayer ceramic capacitor industry. The next step was to validate these findings and assumptions with industry experts across the supply chain. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the size of the segments and subsegments of the multilayer ceramic capacitor market.

Secondary Research

Secondary research for this study involved gathering information from various credible sources, including company reports, white papers, academic journals, and industry publications. This process helps understand the supply and value chains, identify key players, analyze market segmentation and regional trends, and track major market and technology developments. The data collected was used to estimate the overall market size, which was later validated through primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge of the current market scenario for multilayer ceramic capacitors through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Notes: The market in the RoW region is further classified into the Middle East, Africa, and South America.

Other designations include product managers, sales managers, and marketing managers.

Tier 1 companies include market players with revenues exceeding USD 500 million; Tier 2 companies earn revenues between USD 100 million and USD 500 million; and Tier 3 companies earn up to USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A bottom-up approach has been employed to determine the overall size of the multilayer ceramic capacitor market.

- Collected company-level revenues from annual reports, investor presentations, and financial disclosures to understand individual contributions to the multilayer ceramic capacitor market

- Aggregated product-level revenues across the dielectric type segment to estimate market segments

- Summed up the company and segment-level revenues to calculate the total global market size of multilayer ceramic capacitors.

- Analyzed regional presence and deployment of multilayer ceramic capacitor solutions to validate revenue estimates and refine regional market size.

- Cross-verified data through secondary sources, industry reports, and industry experts to ensure accuracy and reliability of the market estimation.

The top-down approach was adopted to estimate and validate the total size of the multilayer ceramic capacitor market.

- Estimate the overall multilayer ceramic capacitor market size using comprehensive industry benchmarks and market data

- Analyze the percentage split of dielectric type, application, package, and capacitance range

- Derive percentage splits for the rated voltage and end use segment based on the dielectric type segmentation to understand industry-specific adoption

- Determine regional and county-level splits within each end use to capture geographic and technological nuances

- Validate all subsegment breakouts through triangulation of primary research, industry experts, and secondary literature to ensure accuracy and reliability.

Multilayer Ceramic Capacitor Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes explained above, the market has been segmented into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment. The data has been triangulated by studying various factors and trends from the demand and supply sides in the multilayer ceramic capacitor market.

Market Definition

A multilayer ceramic capacitor (MLCC) is a core component in electronic devices that controls the stable current flow within electronic circuits. MLCCs are made of ceramic dielectric film with printed electrodes (inner electrode) stacked in a misaligned manner, sintered at high temperature at one time to form a ceramic chip, and then sealed with a metal layer (outer electrode) at both ends of the chip to create a monolithic-like structure; hence, it is also called a monolithic capacitor. An MLCC is a crucial component in smartphones, home appliances, base stations, industrial equipment, and automobiles.

MLCCs facilitate the temporary storage of power, maintain stable voltage, and reduce noise in electronic components used in all types of electronic devices worldwide. The manufacturers of MLCCs possess various technologies and material-based development skills, enabling them to offer a diverse range of tiny, thin, and highly reliable MLCCs with varying capacitance, rated voltage, and temperature properties.

The MLCC ecosystem comprises material providers, manufacturers, associated technology patent holders, and distributors. Additionally, it represents the MLCC vendors offering a comprehensive range of products utilized by the electronics, automotive, telecom, industrial equipment, medical equipment, energy & power, military, and other end-use industries. The MLCC market is consolidated, with most key manufacturers of MLCCs based in the Asia Pacific region.

Key Stakeholders

- Government bodies and policymakers

- Industry organizations, forums, alliances, and associations

- Market research and consulting firms

- Raw material suppliers and distributors

- Research institutes and organizations

- Analysts and strategic business planners

- End uses of MLCCs across various industries, such as electronics, automotive, telecommunications, industrial equipment, and others (medical equipment, energy & power, and military)

Report Objectives

- To define, describe, and forecast the size of the multilayer ceramic capacitor market, by offering, technology, connectivity, application, vertical, and region, in terms of value

- To describe and forecast the size of the multilayer ceramic capacitor market, by dielectric type, in terms of volume

-

To forecast the market for various segments with respect to the central regions, namely,

North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value - To provide macroeconomic outlooks with respect to the main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the market’s growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To provide ecosystem analysis, supply chain, trends/disruptions impacting customer business, technology analysis, pricing analysis, key stakeholders & buying criteria, case study analysis, trade analysis, patent analysis, Porter’s five forces, key conferences & events, AI impact, impact of 2025 US tariff, and regulations related to the multilayer ceramic capacitor market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detailing the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings, core competencies, company valuation, and financial metrics, and product/brand comparison, along with detailing the competitive landscape for the market leaders

- To analyze the competitive developments, such as product launches, software launches, agreements, collaborations, and acquisitions, carried out by market players

- To map competitive intelligence based on company profiles, key player strategies, and game-changing developments, such as product developments, collaborations, and acquisitions

- To benchmark players within the market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio.

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company‘s specific needs. The following customization options are available for the report.

Country-wise Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Multilayer Ceramic Capacitor Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Multilayer Ceramic Capacitor Market