Multi-Vendor Support Services Market by Service Type (Hardware and Software Support Services), Business Application (Sales and Marketing, Financial and Accounting, Supply Chain, and IT Operations), Vertical, and Region - Global Forecast to 2023

[148 Pages Report] The global Multi-Vendor Support Services (MVSS) market size is expected to grow from USD 51.46 billion in 2017 to USD 60.14 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 2.52% during the forecast period. The base year considered for the study is 2017 and the forecast period is from 2018 to 2023.

Multi-Vendor Support Services (MVSS) enable companies to provide support services to more than one product of other manufacturers as well as their own products. For example, system vendors, such as IBM, independently provide support services for products they do not manufacture, whereas Dell and HP provide support services for their own products, as well as, for other companies’ products. These companies are classified as MVSS providers.

Market Dynamics

Drivers

-

Rapid changes in the IT infrastructure

-

Rising maintenance costs of OEM services

-

MVSS reduce IT support and maintenance complexities

-

Regain control of infrastructure support from OEMs

Restraints

-

Loss of control over IT assets

-

Concerns over sharing of proprietary data, and privacy and security issues

Opportunities

-

Increasing need for new levels of support services

-

Growing use of centralized support services

Challenges

-

Lack of technical expertise

-

Lack of new service offerings in accordance with changes in the IT infrastructure

Rapid changes in the IT infrastructure drives the global Multi-Vendor Support Services Market

IT infrastructure’s size and complexities are increasing rapidly, due to increased computing needs that are met by a bigger and better network, and server and storage equipment. Organizations are increasingly digitalizing their operations using cloud, container, IoT, and other technologies to meet the new demands of business functions. For instance, as per Cisco’s Cloud Index released in September 2016, about 68% of organizations used some form of cloud. Owing to the changing technological landscape, organizations are rapidly adopting MVSS to manage and maintain their infrastructure. Additionally, with the increasing complexities of technology solutions, companies are looking to automate or outsource their non-core activities. MVSS providers help organizations focus on their core business activities, as they offer services and solutions such as continuous monitoring of hardware and software, audit of the existing support contracts, equipment, and inventory management. MVSS help improve uptime, increase efficiency, and smooth transition from old equipment to new systems.

The following are the major objectives of the study.

- To define, describe, and forecast the Multi-Vendor Support Services (MVSS) market by service type, business application, organization size, vertical, and region

- To provide detailed information regarding the major factors, such as drivers, opportunities, industry-specific challenges, and restraints, influencing the growth of the market

- To analyze the micromarkets1 with respect to the individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market and details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To profile key players and comprehensively analyze their market shares and core competencies

- To analyze the competitive developments, such as mergers and acquisitions, partnerships, new contracts, and product developments in the multi-vendor support services market

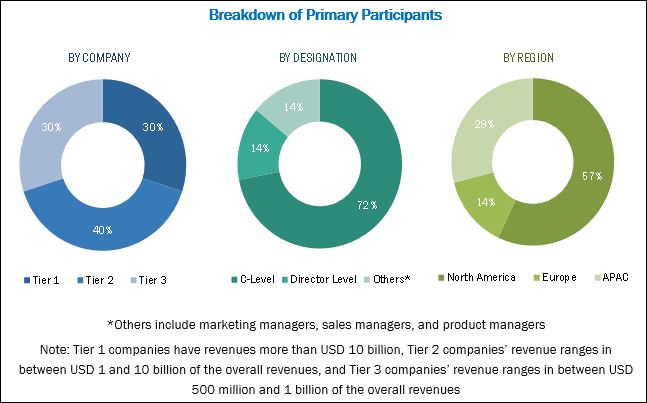

The research methodology used to estimate and forecast the Multi Vendor Support Services Market size was initiated with the collection and analysis of data on the key vendors’ revenues through secondary sources, such as annual reports and press releases, investor presentations, conferences and associations, such as ITSMA; CompTIA; Institute of Electrical and Electronics Engineers (IEEE); Communications Society (ComSoc); and Information Theory Society (ITS). In addition to this, the vendor offerings were taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the multi-vendor support services market from the revenues of key players (companies) and their shares in the market. This calculation was done on the basis of estimation, and by verifying the revenues of key players through extensive primary interviews. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of the primary participants is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The Multi Vendor Support Services Market includes various vendors providing associated support services to their commercial clients across the globe. Major companies such as IBM (US), Dell (US), HP (US), Symantec (US), Oracle (US), Fujitsu (Japan), NEC (Japan), Lenovo (China), and Hitachi (Japan) have adopted partnerships, agreements, and collaborations as the key growth strategies to enhance their market reach.

Major Market Developments

- In December 2017, Symantec partnered with British Telecommunication, a provider of communication services and solutions, and announced the availability of a new endpoint protection solution for BT’s business customers.

- In November 2016, IBM acquired Sanovi Technologies a company that provides hybrid cloud recovery, cloud migration, and business continuity software for enterprise data centers and cloud infrastructure. The acquisition would allow IBM to provide business continuity and disaster recovery services to its client base.

- In June 2017, Lenovo launched PC as a Service, designed to eliminate the burden of buying, deploying, and managing computing assets. Lenovo does this by offering the latest equipment, upgrades, and service without any upfront capital costs. The company’s premier support, and hardware and software monitoring services are included in the multi-vendor services.

Key Target Audience Of Multi-Vendor Support Services Market

- Original Equipment Manufacturers (OEMs)

- Third-Party Maintenance (TPM) service providers

- Value-Added Resellers (VARs)

- System Integrators (SIs)

- TPM resellers

- Managed Service Providers (MSPs)

- TPM aggregators

- MVSS providers

The study answers several questions for stakeholders, primarily which market segments to focus in the next 2 to 5 years to prioritize their efforts and investments.

Scope of the Multi-Vendor Support Services Market Research Report

The research report segments the Multi Vendor Support Services Market into the following submarkets:

By Service Type:

- Hardware Support Services

- Software Support Services

By Business Application

- Financial and Accounting

- Human Resource

- Supply Chain

- IT Operations

- Sales and Marketing

- Production

- Others(Research and Development [R&D] and legal services)

By Organization Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Retail and Consumer goods

- Manufacturing

- Travel and Logistics

- Telecom and IT

- Government and Defense

- Media and Entertainment

- Energy and Utilities

- Others (automotive, construction and recreational services, and education)

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Asia (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American market into the US and Canada

- Further breakdown of the European market into the UK, Germany, and France

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecasts the global Multi-Vendor Support Services (MVSS) market size to grow from USD 53.09 billion in 2018 to USD 60.14 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 2.52% during the forecast period. Major growth factors for the Multi-Vendor Support Services Market include the rapidly increasing changes in the IT infrastructure, rising maintenance costs of OEM services, reducing IT support and maintenance complexities, and regaining control of infrastructure support from OEMs. In addition to this, the increasing need for new levels of support services and growing use of centralized support services are other driving forces for the market. The global Multi Vendor Support Services Market is segmented by service type, business application, organization size, vertical, and region.

The hardware support services segment is expected to account for a higher market share. Hardware support services help organizations stay on top of the support and maintenance of their equipment through providing post warranty services, extending life of devices, and offering system upgrades and patches. The hardware support services include preventive and remedial services, such as contract maintenance and per-incident repair online, telephonic technical troubleshooting and assistance for setup, and hardware warranty upgrades. Additionally, the increase in demand for a new level of services is expected to drive the growth of this market.

The supply chain business application is expected to hold significant market size during the forecast period. Supply chain is the management of materials and information as they move across the value chain. There is an increasing need for visibility at every stage of the supply chain, Companies are deploying technologies that enable increased visibility from distribution centers to shipping processes. This has led to the use of cloud-based options to improve efficiency within the distribution centers and warehouses. Furthermore, the technologies such as Radio Frequency Identification (RFID) and Near Field Communication (NFC) are being used to track, trace, maintain, repair and overhaul, and manage crew. Support services are required to ensure the smooth functioning of this business application. MVSS help maintain and manage hardware and software infrastructure by providing support services.

The Small and Medium-sized Enterprises (SMEs) segment is expected to grow at a higher CAGR during the forecast period. These enterprises face greater resource crisis than large enterprises, owing to the fact that SMEs have a lower rate of adoption in the current market scenario. However, MVSS offer a comprehensive set of services that help customers optimize their investments, manage labor costs, and provide advanced IT infrastructure and technologies; these factors are expected to increase the adoption of MVSS among SMEs. Hence, the SMEs segment is expected to adopt MVSS at a higher rate than large enterprises.

Applications areas in sales and marketing, financial and accounting, supply chain, IT operations, production, and human resources drive growth in multi-vendor support services market.

Sales and Marketing

IT applications help optimize the enterprises’ marketing and sales distribution activities. Organizations are using Customer Relationship Management (CRM) software solutions and other associated services with it to manage customers and prospects, send emails, make calls, and manage pipeline among others. Furthermore, marketing activities have changed considerably over the last decade with organizations focusing on digital marketing and use of advanced analytics to find customer preferences and market trends. Enterprises are digitizing this business application and MVSS are helpful to increase the efficiency of these organizations by reducing the downtime, increasing the life of devices, software updates and patches, and maintaining the IT infrastructure by offering services such as proactive reporting and analytics, remote advisory, and proactive maintenance services.

Financial and Accounting

Financial and accounting business application helps manage the revenues and costs of the organization. The finance application helps raise the money required for business operations, treasury management, budgeting, taxation, inventory management and control, managing cash flows and liquidity among others. IT has helped companies to track and use a computerized system to record transactions. Furthermore, it has reduced the time required to prepare financial information for the management. Organizations are increasingly using advanced computing to manage and simplify the finance and accounting application. MVSS provider helps maintain and manage the hardware and software required by this business application and help improve the efficiency of the systems by offering patches and upgrades, and end of warranty and life services.

Supply Chain

The supply chain is the management of materials and information as they move across the value chain. There is an increasing need for visibility at every stage of the supply chain. From distribution centers through the shipping process, technologies which enable increased visibility are being deployed. This has led to the use of cloud-based options to improve efficiency within distribution centers and warehouses. Furthermore, technologies such as Radio Frequency Identification (RFID) and Near Field Communication (NFC) are being used to track; trace; maintain, repair, and overhaul; compliance; and crew management. Support services are required to ensure smooth functioning of this business application. MVSS help maintain and manage the hardware and software infrastructure by providing support services.

IT Operations

Traditional IT Operations Management (ITOM) is changing rapidly with organizations using technologies such as AI, cloud, and IoT. Organizations are increasingly using AI to automate routine tasks, predict issues, do root cause analysis, and incident management. Furthermore, organizations are increasingly deploying IT operations solutions on the cloud. With the increase in the use of these technologies, this business application has become more complex. Additionally, with this increased complexity, management of the IT infrastructure is outsourced to MVSS provider. These service providers help optimize, maintain, and manage the IT infrastructure by providing services such as remote desktop support, remote server and network support, onsite server, and network support services.

Critical questions the report answers:

-

Where will all these developments take the industry in the mid to long term?

-

What are the upcoming industry applications catered by IoT operating systems?

Loss of control over IT assets, concerns over sharing of proprietary data, and privacy and security issues are the major restraining factors for the growth of the multi-vendor support services market. However, the recent developments such as new service launches and acquisitions undertaken by the major market players are expected to boost the market growth.

The study measures and evaluates the major offerings and key strategies of the key market vendors, such as IBM (US), Dell (US), HP (US), Oracle (US), Fujitsu (Japan), NEC (Japan), Lenovo (China), Symantec (US), and Hitachi (Japan). These major companies have been offering reliable MVSS to their commercial clients across diverse locations and are increasingly undertaking mergers and acquisitions, and partnerships to develop and introduce new services in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Break-Up of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Multi-Vendor Support Services Market

4.2 Market Top 3 Business Applications and Regions

4.3 Market By Service Type, 2018–2023

4.4 Market By Organization Size, 2018

4.5 Market By Region, 2018–2023

4.6 Market Investment Scenario

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rapid Changes in the IT Infrastructure

5.2.1.2 Rising Maintenance Cost of Oem Services

5.2.1.3 Mvss Reduce IT Support and Maintenance Complexities

5.2.1.4 Regain Control of Infrastructure Support From OEMs

5.2.2 Restraints

5.2.2.1 Loss of Control Over IT Assets

5.2.2.2 Concerns Over Sharing of Proprietary Data, Privacy, and Security Issues

5.2.3 Opportunities

5.2.3.1 Increasing Need for New Levels of Support Services

5.2.3.2 Growing Use of Centralized Support Services

5.2.4 Challenges

5.2.4.1 Lack of Technical Expertise

5.2.4.2 Lack of New Service Offerings in Accordance With Changes in the IT Infrastructure

5.3 Use Cases

5.4 Multi-Vendor Support Services Ecosystem

6 Multi-Vendor Support Services Market, By Service Type (Page No. - 41)

6.1 Introduction

6.2 Hardware Support Services

6.3 Software Support Services

7 Multi-Vendor Support Services Market, By Business Application (Page No. - 45)

7.1 Introduction

7.2 Financial and Accounting

7.3 Sales and Marketing

7.4 Supply Chain

7.5 IT Operations

7.6 Production

7.7 Human Resource

7.8 Others

8 Multi-Vendor Support Services Market, By Organization Size (Page No. - 53)

8.1 Introduction

8.2 Small and Medium-Sized Enterprises

8.3 Large Enterprises

9 Multi-Vendor Support Services Market, By Vertical (Page No. - 57)

9.1 Introduction

9.2 Banking, Financial Services, and Insurance

9.3 Government and Defense

9.4 Retail and Consumer Goods

9.5 Telecom and IT

9.6 Healthcare and Life Sciences

9.7 Manufacturing

9.8 Media and Entertainment

9.9 Energy and Utilities

9.10 Travel and Logistics

9.11 Others

10 Multi-Vendor Support Services Market, By Region (Page No. - 70)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia Pacific

10.5 Middle East and Africa

10.6 Latin America

11 Competitive Landscape (Page No. - 93)

11.1 Overview

11.2 Market Ranking

11.3 Competitive Scenario

11.3.1 New Service Launches and Enhancements

11.3.2 Partnerships, Collaborations, and Agreements

11.3.3 Mergers and Acquisitions

12 Company Profiles (Page No. - 97)

12.1 Oracle

(Business Overview, Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.2 Dell

12.3 IBM

12.4 HP

12.5 Microsoft

12.6 Fujitsu

12.7 NEC

12.8 Symantec

12.9 Hitachi

12.10 Lenovo

12.11 Abtech Technologies

12.12 Netapp

12.13 ONX

12.14 Ensure Services

12.15 MCSA Group

12.16 Zensar Technologies

12.17 Citrix

12.18 Computer Data Source (CDS)

12.19 Evernex

12.20 Terix Computer Service

12.21 XS International

12.22 Park Place Technologies

12.23 Curvature

12.24 Citycomp

12.25 Service Express

*Details on Business Overview, Services, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13 Appendix (Page No. - 138)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (57 Tables)

Table 1 Multi-Vendor Support Services Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Table 2 Enterprise Use Cases, By Vertical

Table 3 Multi-Vendor Support Services Market Size, By Service Type, 2016–2023 (USD Million)

Table 4 Hardware Support Services: Market Size By Region, 2016–2023 (USD Million)

Table 5 Software Support Services: Market Size By Region, 2016–2023 (USD Million)

Table 6 Market Size By Business Application, 2016–2023 (USD Million)

Table 7 Financial and Accounting: Market Size By Region, 2016–2023 (USD Million)

Table 8 Sales and Marketing: Market Size By Region, 2016–2023 (USD Million)

Table 9 Supply Chain: Market Size By Region, 2016–2023 (USD Million)

Table 10 IT Operations: Market Size By Region, 2016–2023 (USD Million)

Table 11 Production: Market Size By Region, 2016–2023 (USD Million)

Table 12 Human Resource: Market Size By Region, 2016–2023 (USD Million)

Table 13 Others: Market Size By Region, 2016–2023 (USD Million)

Table 14 Multi-Vendor Support Services Market Size, By Organization Size, 2016–2023 (USD Million)

Table 15 Small and Medium-Sized Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 16 Large Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 17 Multi-Vendor Support Services Market Size, By Vertical, 2016–2023 (USD Million)

Table 18 Banking, Financial Services, and Insurance: Market Size By Region, 2016–2023 (USD Million)

Table 19 Government and Defense: Market Size By Region, 2016–2023 (USD Million)

Table 20 Retail and Consumer Goods: Market Size By Region, 2016–2023 (USD Million)

Table 21 Telecom and It: Market Size By Region, 2016–2023 (USD Million)

Table 22 Healthcare and Life Sciences: Market Size By Region, 2016–2023 (USD Million)

Table 23 Manufacturing: Market Size By Region, 2016–2023 (USD Million)

Table 24 Media and Entertainment: Multi-Vendor Support Services Market Size, By Region, 2016–2023 (USD Million)

Table 25 Energy and Utilities: Market Size By Region, 2016–2023 (USD Million)

Table 26 Travel and Logistics: Market Size, By Region, 2016–2023 (USD Million)

Table 27 Others: Market Size, By Region, 2016–2023 (USD Million)

Table 28 Market Size By Region, 2016–2023 (USD Million)

Table 29 North America: Multi-Vendor Support Services Market Size, By Service Type, 2016–2023 (USD Million)

Table 30 North America: Market Size By Business Application, 2016–2023 (USD Million)

Table 31 North America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 32 North America: Market Size By Vertical, 2016–2023 (USD Million)

Table 33 North America: Market Size By Country, 2016–2023 (USD Million)

Table 34 Europe: Multi-Vendor Support Services Market Size, By Service Type, 2016–2023 (USD Million)

Table 35 Europe: Market Size By Business Application, 2016–2023 (USD Million)

Table 36 Europe: Market Size By Organization Size, 2016–2023 (USD Million)

Table 37 Europe: Market Size By Vertical, 2016–2023 (USD Million)

Table 38 Europe: Market Size By Country, 2016–2023 (USD Million)

Table 39 Asia Pacific: Multi-Vendor Support Services Market Size, By Service Type, 2016–2023 (USD Million)

Table 40 Asia Pacific: Market Size By Business Application, 2016–2023 (USD Million)

Table 41 Asia Pacific: Market Size By Organization Size, 2016–2023 (USD Million)

Table 42 Asia Pacific: Market Size By Vertical, 2016–2023 (USD Million)

Table 43 Asia Pacific: Market Size By Country, 2016–2023 (USD Million)

Table 44 Middle East and Africa: Multi-Vendor Support Services Market Size, By Service Type, 2016–2023 (USD Million)

Table 45 Middle East and Africa: Market Size By Business Application, 2016–2023 (USD Million)

Table 46 Middle East and Africa: Market Size By Organization Size, 2016–2023 (USD Million)

Table 47 Middle East and Africa: Market Size By Vertical, 2016–2023 (USD Million)

Table 48 Middle East and Africa: Market Size By Country, 2016–2023 (USD Million)

Table 49 Latin America: Multi-Vendor Support Services Market Size, By Service Type, 2016–2023 (USD Million)

Table 50 Latin America: Market Size By Business Application, 2016–2023 (USD Million)

Table 51 Latin America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 52 Latin America: Market Size By Vertical, 2016–2023 (USD Million)

Table 53 Latin America: Market Size By Country, 2016–2023 (USD Million)

Table 54 Market Ranking for the Market 2018

Table 55 New Service Launches and Enhancements, 2016–2018

Table 56 Partnerships, Collaborations, and Agreements, 2016–2017

Table 57 Mergers and Acquisitions, 2015–2016

List of Figures (56 Figures)

Figure 1 Multi-Vendor Support Services Market: Market Segmentation

Figure 2 Market Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Assumptions

Figure 7 Market Top 4 Segments, 2018

Figure 8 Market By Region, 2018

Figure 9 Growing Use of Centralized Support Services and Increasing Need for New Levels of Support Services are Expected to Drive the Market

Figure 10 Sales and Marketing, and North America are Estimated to Hold the Largest Market Shares in 2018

Figure 11 Hardware Support Services Segment is Expected to Hold the Larger Market Size During the Forecast Period

Figure 12 Large Enterprises Segment is Expected to Hold the Larger Market Share During the Forecast Period

Figure 13 North America is Expected to Hold the Largest Market Size During the Forecast Period

Figure 14 Asia Pacific is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 15 Multi-Vendor Support Services Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Hardware Support Services Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 17 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 18 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 19 Sales and Marketing Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 20 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 21 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 22 Large Enterprises Segment is Expected to Have the Larger Market Size During the Forecast Period

Figure 23 Europe is Expected to Have the Second Largest Market Size During the Forecast Period

Figure 24 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 25 Government and Defense Vertical is Expected to Have the Largest Market Size During the Forecast Period

Figure 26 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 28 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 29 Asia Pacific is Expected to Be an Attractive Destination for Investments

Figure 30 North America: Market Snapshot

Figure 31 Hardware Support Services Segment is Expected to Dominate the North American Multi-Vendor Support Services Market During the Forecast Period

Figure 32 Hardware Support Services Segment is Expected to Dominate the Market in Europe During the Forecast Period

Figure 33 Asia Pacific: Market Snapshot

Figure 34 Software Support Services Segment is Expected to Have the Higher CAGR in Asia Pacific During the Forecast Period

Figure 35 Hardware Support Services Segment is Expected to Dominate the Market in Middle East and Africa During the Forecast Period

Figure 36 Hardware Support Services Segment is Expected to Dominate the Market in Middle East and Africa During the Forecast Period

Figure 37 Key Developments By the Leading Players in the Multi-Vendor Support Services Market During 2015–2018

Figure 38 Oracle: Company Snapshot

Figure 39 Oracle: SWOT Analysis

Figure 40 Dell: Company Snapshot

Figure 41 Dell: SWOT Analysis

Figure 42 IBM: Company Snapshot

Figure 43 IBM: SWOT Analysis

Figure 44 HP: Company Snapshot

Figure 45 HP: SWOT Analysis

Figure 46 Microsoft: Company Snapshot

Figure 47 Microsoft: SWOT Analysis

Figure 48 Fujitsu: Company Snapshot

Figure 49 Fujitsu: SWOT Analysis

Figure 50 NEC: Company Snapshot

Figure 51 Symantec: Company Snapshot

Figure 52 Hitachi: Company Snapshot

Figure 53 Lenovo: Company Snapshot

Figure 54 Netapp: Company Snapshot

Figure 55 Zensar Technologies: Company Snapshot

Figure 56 Citrix: Company Snapshot

Growth opportunities and latent adjacency in Multi-Vendor Support Services Market