Monitoring Tools Market by Offering (Software (by Deployment) & Services), Type (Infrastructure Monitoring, Application Performance Monitoring, Security Monitoring and End User Experience Monitoring), Vertical and Region - Global Forecast to 2028

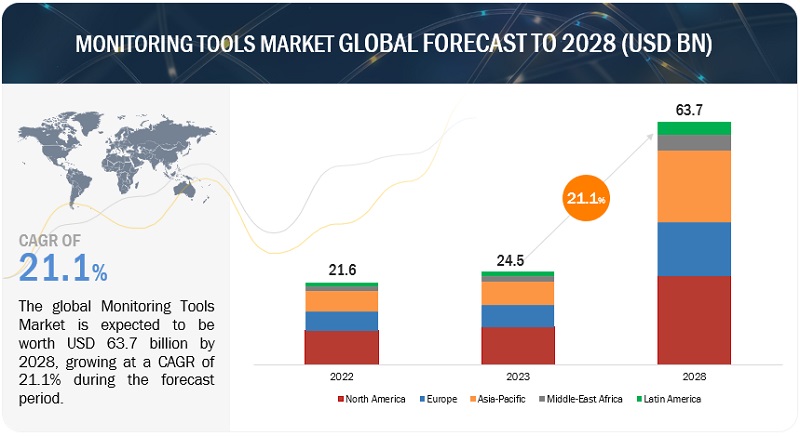

The global Monitoring Tools Market size was estimated at USD 24.5 billion in 2023 and is projected to reach USD 63.7 billion by 2028, at a CAGR of 21.1% during the forecast period.

Monitoring tools provide a comprehensive overview of IT infrastructure, making them indispensable for various industries. These tools encompass network monitoring to track devices and bandwidth, server monitoring to monitor resource usage, and application performance monitoring (APM) to analyze application health. Cloud monitoring ensures optimal performance and resource allocation in cloud environments, while log monitoring centralizes log data for efficient troubleshooting and security analysis. Security monitoring aids in detecting threats and breaches, and capacity planning tools predict resource needs for future growth. With real-time monitoring, alerts, and customizable dashboards, monitoring tools empower organizations to optimize performance, ensure reliability, and proactively address issues, fostering smooth operations and enhanced user experiences across their IT landscapes.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Rising demand for real-time monitoring and analytics

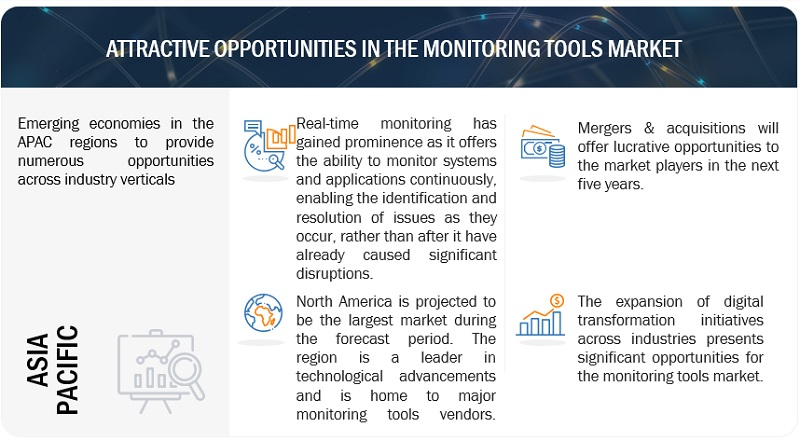

In today's business landscape, organizations heavily rely on their IT systems to drive operations, deliver services, and maintain customer satisfaction. Real-time monitoring has gained prominence as it offers the ability to monitor systems and applications continuously, enabling the identification and resolution of issues as they occur, rather than after they have already caused significant disruptions. Real-time monitoring meets the needs of businesses in several ways. It enables proactive issue detection, allowing organizations to identify potential bottlenecks, system failures, or security breaches in real-time. Real-time monitoring enhances system performance by providing insights into critical metrics. By closely monitoring performance indicators such as resource utilization and network traffic, organizations can identify areas of improvement and optimize their systems accordingly. Furthermore, real-time monitoring plays a crucial role in security and threat detection. By continuously monitoring network traffic, user activity, and system logs, organizations can promptly identify suspicious behavior, potential breaches, or unauthorized access attempts. Real-time monitoring also helps in optimizing the customer experience. By monitoring customer-facing applications and services in real-time, organizations can proactively identify and resolve issues that may affect the customer experience. This ensures high customer satisfaction levels, reduces customer churn, and fosters customer loyalty.

Restraint: High implementation and maintenance costs

High implementation and maintenance costs refer to the significant expenses associated with the initial setup and ongoing upkeep of a particular system, process, or technology within a business. This restraint can have a substantial impact on a company's financial resources and overall profitability. Implementing new technologies or systems often requires significant investments in hardware, software, training, and integration with existing infrastructure. For instance, when a manufacturing company decides to upgrade its production line with advanced robotics and automation, it needs to invest in purchasing the machinery, configuring it to the specific requirements, and training the employees to operate and maintain it effectively. All these activities come with substantial upfront costs that may strain the company's budget. Maintenance costs are another aspect that businesses must consider. After implementing a new system, there are ongoing expenses associated with monitoring, troubleshooting, upgrading, and repairing the technology. These costs can include software updates, equipment servicing, licensing fees, and the employment of skilled personnel to manage the system efficiently. Due to these high costs, businesses need to evaluate the potential return on investment (ROI) and consider the long-term benefits before committing to implementing or maintaining a particular system. It becomes essential to conduct a thorough cost-benefit analysis to ensure that the expected gains justify the financial outlay.

Opportunity: Emerging markets and untapped potential in developing regions

The emergence of new markets and untapped potential in developing regions presents significant opportunities for the monitoring tools market. As developing regions experience rapid economic growth and technological advancement, businesses in these areas are increasingly adopting digital solutions to drive their operations and improve productivity. This creates a demand for monitoring tools that can ensure the effective performance and reliability of their digital infrastructure. In emerging markets and developing regions, businesses are often in the early stages of digital transformation. They may be transitioning from manual or traditional processes to digital systems, making it crucial to have robust monitoring tools in place. These tools can help organizations monitor the performance of their newly implemented digital systems, identify areas for improvement, and ensure a smooth transition to digital workflows. Furthermore, developing regions often have unique market dynamics and regulatory environments. Monitoring tools that can adapt to these specific requirements have a competitive edge. The untapped potential in developing regions means that there is a significant market share waiting to be captured by monitoring tool providers. By establishing a presence in these regions and offering tailored solutions to local businesses, monitoring tool vendors can tap into new customer bases and drive revenue growth.

Challenge: Ensuring compatibility and interoperability with diverse IT environments

A significant challenge faced by the Monitoring Tools Market is ensuring compatibility and interoperability with diverse IT environments. As organizations adopt a wide range of technologies, systems, and infrastructure components, it becomes crucial for monitoring tools to seamlessly integrate with these diverse IT environments. The complexity of modern IT landscapes often results in a heterogeneous mix of technologies and vendor-specific solutions within an organization. Monitoring tools must be capable of capturing and analysing data from various sources and provide a unified view of the entire infrastructure. However, the lack of compatibility between monitoring tools and diverse IT environments can lead to limited coverage, data inconsistencies, and inefficient data collection processes. To address this challenge, monitoring tool providers should prioritize standardization and interoperability protocols. Adhering to widely accepted standards such as SNMP (Simple Network Management Protocol) and RESTful APIs (Application Programming Interfaces) can enable seamless integration with a variety of IT components. Additionally, monitoring tool providers should invest in comprehensive testing and certification processes to ensure compatibility with popular operating systems, databases, and applications. Moreover, monitoring tools should offer flexible deployment options to accommodate different IT architectures. Whether it is on-premises, cloud-based, or hybrid infrastructure, the tools should be designed to integrate seamlessly and capture data from any environment. This flexibility empowers organizations to monitor their entire IT ecosystem, regardless of its complexity or distribution.

Monitoring Tool Market Ecosystem

By infrastructure monitoring, Network Monitoring to account for the largest market size during the forecast period

Network monitoring involves the use of software to continuously monitor the health and reliability of a computer network. By collecting and analyzing performance data, network performance monitoring (NPM) systems generate topology maps and provide actionable insights to IT teams. These insights offer complete visibility into network components, application performance, and related IT infrastructure, allowing organizations to monitor network health, identify issues, and optimize data flow. NPM systems are capable of monitoring network resources across various environments, including on-premises, data centers, cloud services, and hybrid ecosystems. They detect malfunctioning network devices, overloaded resources, and anomalies in network traffic. One of the key features of NPM software is its ability to alert network administrators when performance issues arise. These systems collect and analyze data to measure traffic flow, performance, and availability. They can also establish thresholds and leverage machine learning algorithms to determine baseline performance and generate more accurate alerts. By implementing network monitoring, organizations can proactively manage their networks, ensure optimal performance, and maintain service availability. This enables businesses to detect and address performance issues efficiently, resulting in improved network reliability, enhanced user experiences, and optimized data transmission.

By deployment, on-premises to account for the largest market size during the forecast period

While the market for on-premises monitoring tools still holds relevance, it has been impacted by the rising popularity of cloud-based alternatives. On-premises solutions are favored by businesses relying on legacy systems and those with stringent compliance and security requirements. The ability to customize and control the monitoring environment, lower latency for real-time applications, and the management of hybrid environments are factors driving the continued demand for on-premises tools. However, the overall trend in the monitoring tools market is shifting towards cloud-based solutions due to their scalability, cost-effectiveness, accessibility, and advanced features.

By application monitoring, Database Monitoring to account for the largest market size during the forecast period

Database monitoring is the practice of tracking the performance and health of databases to ensure optimal performance. It involves collecting and analyzing performance metrics to identify issues and optimize resource allocation. Database monitoring is crucial for businesses that rely on databases for their daily operations, as it helps maintain optimal performance, minimize downtime, and ensure a positive user experience. Database monitoring tools provide real-time insights into the performance of databases, allowing IT teams to proactively address potential issues. These tools offer features such as dashboards, metrics collection, and event monitoring to help identify issues, trends, and patterns. Some of the key metrics tracked by database monitoring tools include resource usage, response time, throughput, error rate, and bandwidth utilization. Effective database monitoring ensures that applications can run properly without crashes or performance degradation due to database downtime.

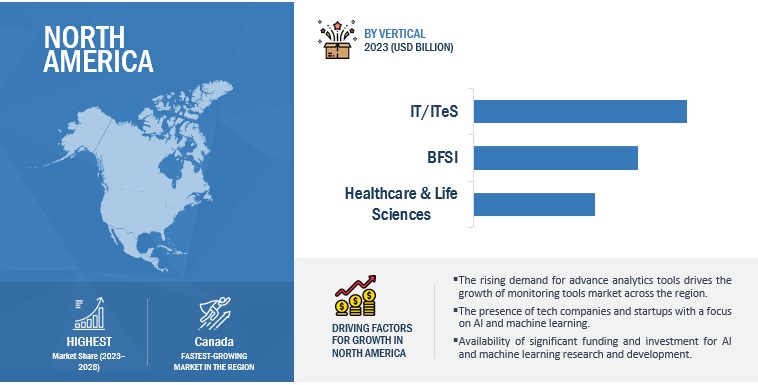

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in Monitoring tools. North America has been a major contributor to the development and growth of the Monitoring tools market. In recent years, North America has witnessed a significant surge in the adoption of monitoring tools across various industries. The region's IT sector, including the United States and Canada, has been at the forefront of this growth, with companies investing heavily in advanced monitoring solutions to optimize their IT infrastructure. Network monitoring, server monitoring, and application performance monitoring (APM) have seen substantial uptake as organizations prioritize seamless operations and enhanced user experiences. Cloud monitoring and security monitoring have gained traction, driven by the rising popularity of cloud services and the increasing need to safeguard digital assets from cyber threats.

Key Market Players

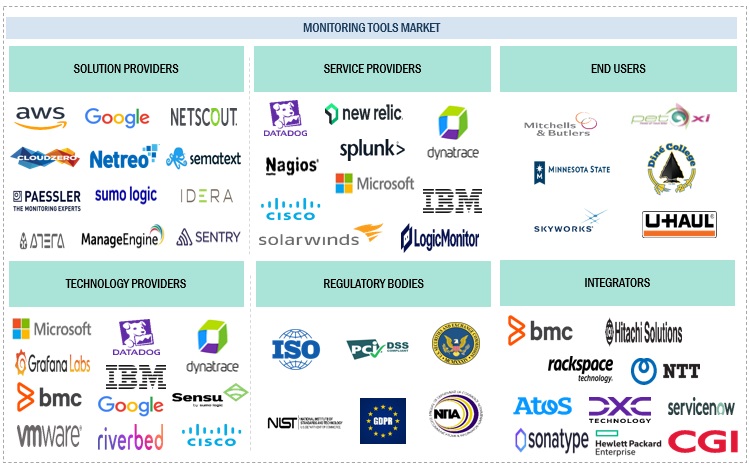

The Monitoring tools vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global market for Monitoring tools Microsoft (US), Google (US), AWS (US), IBM (US), Cisco (US), Dynatrace (US), Splunk (US), Solarwinds (US), Netscout (US), New Relic (US), Logic Monitor (US), Paessler AG (Germany), Netreo (US), ManageEngine (US), Idera (US), Sematext (US), Datadog (US), Icinga (Germany), Nagios (US), Zabbix (Latvia), Sentry (US), UptimeRobot (Malta), Atera (Israel), Better Stack (Czech Republic), Sumo Logic (US), Checkmk (Germany), Exporise (US), ITRS (UK), Riverbed Technology (US), Nlyte Software (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Million/Billion |

|

Segments covered |

Offering, Type, Infrastructure Monitoring, Application Performance Monitoring (APM), Security Monitoring, End User Experience Monitoring, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

|

Companies covered |

Microsoft (US), Google (US), AWS (US), IBM (US), Cisco (US), Dynatrace (US), Splunk (US), Solarwinds (US), Netscout (US), New Relic (US), Logic Monitor (US), Paessler AG (Germany), Netreo (US), ManageEngine (US), Idera (US), Sematext (US), Datadog (US), Icinga (Germany), Nagios (US), Zabbix (Latvia), Sentry (US), UptimeRobot (Malta), Atera (Israel), Better Stack (Czech Republic), Sumo Logic (US), Checkmk (Germany), Exporise (US), ITRS (UK), Riverbed Technology (US), Nlyte Software (US) |

This research report categorizes the Monitoring tools market based on Offering, Type, Infrastructure Monitoring, Application Performance Monitoring (APM), Security Monitoring, End User Experience Monitoring, Vertical, and Region.

By Offering

-

Software

- Cloud

- On-premises

-

Services

-

Professional Service

- Consulting Services

- Deployment & Integration

- Training, Support, and Maintenance

- Managed Service

-

Professional Service

By Type:

- Infrastructure Monitoring Tools

- Application Performance Monitoring (APM) Tools

- Security Monitoring Tools

- End-User Experience Monitoring Tools

By Infrastructure Monitoring:

- Network Monitoring

- Storage Monitoring

- Server Monitoring

- Cloud Infrastructure Monitoring

- Other Infrastructure Monitoring

By Application Performance Monitoring (APM):

- Database Monitoring

- Web Application Monitoring

- Mobile Application Monitoring

- Code-Level Monitoring

- Other Application Performance Monitoring

By Security Monitoring:

- Intrusion Detection and Prevention Systems (IDPS)

- Log Monitoring and Analysis

- Vulnerability Assessment and Management

- Other Security Monitoring

By End User Experience Monitoring:

- Synthetic Monitoring

- Real User Monitoring (RUM)

- Other End User Experience Monitoring

By Vertical:

- Banking, Financial Services, and Insurance

- Retail & eCommerce

- Healthcare & Life Sciences

- IT/ITeS

- Media & Entertainment

- Manufacturing

- Automotive, Transportation and Logistics

- Telecom

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Nordic

- Benelux

- Rest of Europe

-

Asia Pacific

- China

- Japan

- ASEAN

- South Korea

- ANZ

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- United Arab Emirates

- Israel

- Qatar

- Turkey

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In June 2023, IBM acquired Apptio, this acquisition to advance IBM's existing resource optimization, observability, and application management offerings, maximize value for clients and drive significant synergies across several IBM growth areas.

- In March 2023, Cisco and Lightspin are aligned with a common goal to help customers modernize their cloud environments with end-to-end security and observability from build to runtime.

- In February 2022, Netscout announced the availability of nGeniusEDGE Server, a comprehensive, plug-and-play solution that provides customers with the visibility and insights they need to ensure a high-quality end-user experience regardless of where employees work..

- In April 2021, ManageEngine launched RMM CENTRAL WHICH is a unified remote monitoring and management solution for managed service providers.

- In November 2020, Datadog and Google will grow a relationship with Datadog’s first European Google Cloud data center to now include new regions, making it even easier for organizations to access and implement Datadog’s monitoring and security platform.

Frequently Asked Questions (FAQ):

What is Monitoring tools?

Monitoring tools are software applications that track and analyze the performance, health, and availability of IT infrastructure components. They offer specialized functionalities like network monitoring, server monitoring, application performance monitoring (APM), cloud monitoring, log monitoring, security monitoring, and capacity planning.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Spain, Nordic, Benelux and Italy in the European region.

Which are key verticals adopting Monitoring tools software and services?

Key verticals adopting Monitoring tools include Banking, Financial Services, and Insurance, Retail & eCommerce,

Which are the key drivers supporting the market growth for Monitoring tools?

The key drivers supporting the market growth for Monitoring tools include Rising demand for real-time monitoring and analytics, Increasing emphasis on security and compliance, Growing adoption of cloud-based monitoring solutions, Escalating complexity in the IT infrastructure and network ecosystem.

Who are the key vendors in the market for Monitoring tools?

The key vendors in the global Monitoring tools market include Microsoft (US), Google (US), AWS (US), IBM (US), Cisco (US), Dynatrace (US), Splunk (US), Solarwinds (US), Netscout (US), New Relic (US), Logic Monitor (US), Paessler AG (Germany), Netreo (US), ManageEngine (US), Idera (US), Sematext (US), Datadog (US), Icinga (Germany), Nagios (US), Zabbix (Latvia), Sentry (US), UptimeRobot (Malta), Atera (Israel), Better Stack (Czech Republic), Sumo Logic (US), Checkmk (Germany), Exporise (US), ITRS (UK), Riverbed Technology (US), Nlyte Software (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising demand for real-time monitoring and analytics- Increasing emphasis on security and compliance- Growing adoption of cloud-based monitoring solutions- Escalating complexity in IT infrastructure and network ecosystemRESTRAINTS- High implementation and maintenance cost- Lack of skilled professionals- Differences in infrastructure, data formats, security protocols, and connectivity requirementsOPPORTUNITIES- Expansion of digital transformation initiatives across industries- Emerging markets and untapped potential in emerging economies- Increasing adoption of IoT devices and need to monitor their performanceCHALLENGES- Managing volume and velocity of data- Ensuring compatibility and interoperability with diverse IT environment- Addressing scalability and flexibility requirements of large-scale monitoring deployments

-

5.3 CASE STUDY ANALYSISMANUFACTURING- Improving manufacturing app performance in remote factories with NETSCOUT- Skyworks stays ahead of global demand for connectivity with Dynatrace- Major manufacturer ensures reliable WAN connectivity and quality user experiences with NETSCOUTENERGY AND UTILITY- NETSCOUT smart edge monitoring validates quality performance of new SD-WAN- Energy utility assures cost-effective design strategy with NETSCOUT propagation modelingAUTOMOTIVE & TRANSPORTATION- U-Haul gets automatic and intelligent observability with DynatraceEDUCATION- Improved and enhanced IT infrastructure with Paessler AG- Diné selects Netreo to increase quality and reduce downtime and costHEALTHCARE & LIFESCIENCES- Major healthcare organization reduces monitoring footprint by 97% through NetreoGOVERNMENT- State of Minnesota boosts citizen trust and workforce retention with DynatraceHOSPITALITY- Mitchells & Butlers creates new digital revenue streams with Dynatrace

-

5.4 BRIEF HISTORY OF EVOLUTION OF MONITORING TOOLSMONITORING TOOLS: DESKTOP WORLDMONITORING TOOLS: NETWORK MONITORINGMONITORING TOOLS: INTERNET ERAMONITORING TOOLS: ONLINE COMMERCEMONITORING TOOLS: SHIFT TO BUSINESS-ORIENTED PRIORITIESMONITORING TOOLS: CLOUDMONITORING TOOLS: DEALING WITH DATA

-

5.5 ECOSYSTEM ANALYSIS

-

5.6 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENTSOFTWARE DEVELOPMENTSOLUTION PROVIDERSSYSTEM INTEGRATIONDISTRIBUTORS AND SUPPLIERSEND USERS

- 5.7 PRICING MODEL ANALYSIS

-

5.8 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATION AND PATENT APPLICATIONS- Top applicants

-

5.9 TECHNOLOGY ANALYSISRELATED TECHNOLOGIES- Artificial Intelligence (AI)- Machine learning (ML)- Cloud Computing- Big Data Analytics- Edge Computing- Internet of Things (IoT)- Containers and Microservices- Automation and Orchestration- Chatbots and Virtual Assistance

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY CONFERENCES & EVENTS, 2023–2024

-

5.12 BUSINESS MODELS OF MONITORING TOOLSSUBSCRIPTION MODELFREEMIUM MODELPAY-PER-USE MODELON-DEMAND MODELWHITE-LABEL MODELOEM MODELFREE TRIAL MODEL

-

5.13 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 BEST PRACTICES IN MONITORING TOOLS MARKET

- 5.15 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN MARKET

- 5.16 FUTURE DIRECTION OF MARKET

- 5.17 COMPARISON OF AGENT-BASED AND AGENTLESS MONITORING TOOLS

-

5.18 STAGES IN MARKETSYSTEM CONFIGURATION- Data SourcesMONITORING SYSTEMSDATA COLLECTORSANALYSIS ENGINESDECISION ENGINES

- 5.19 COMPARISON OF OPEN-SOURCE & CLOSED-SOURCE MONITORING TOOLS, BY TYPE

- 5.20 PRICING OF OPEN-SOURCE MONITORING TOOLS

-

6.1 INTRODUCTIONOFFERING: MARKET DRIVERS

-

6.2 SOFTWARESOFTWARE: MARKET, BY DEPLOYMENT- On-premises- Cloud

-

6.3 SERVICESPROFESSIONAL SERVICES- Ability to help businesses effectively adopt and utilize monitoring tools to fuel demand for professional services- Consulting Services- Deployment & Integration- Training, Support, and MaintenanceMANAGED SERVICES- Demand for continuous performance optimization, resource utilization, and operational efficiency to drive market growth

-

7.1 INTRODUCTIONTYPE: MARKET DRIVERS

-

7.2 INFRASTRUCTURE MONITORING TOOLSSCALABILITY AND ADAPTABILITY SUITED FOR MODERN IT ENVIRONMENTS TO DRIVE MARKET GROWTH

-

7.3 APPLICATION PERFORMANCE MONITORING TOOLSNEED TO ENHANCE USER EXPERIENCE BY CAPTURING DATA TO DRIVE MARKET GROWTH

-

7.4 SECURITY MONITORING TOOLSNEED TO MAINTAIN ROBUST SECURITY INFRASTRUCTURE TO FUEL MARKET

-

7.5 END-USER EXPERIENCE MONITORING TOOLSDEMAND FOR END-USER EXPERIENCE MONITORING TOOLS TO RISE

-

8.1 INTRODUCTIONINFRASTRUCTURE MONITORING: MARKET DRIVERS

-

8.2 NETWORK MONITORINGIMPLEMENTING NETWORK MONITORING TO ENABLE ORGANIZATIONS MANAGE NETWORKS, ENSURE OPTIMAL PERFORMANCE, AND MAINTAIN SERVICE AVAILABILITYNETWORK TRAFFIC MONITORINGNETWORK BANDWIDTH MONITORINGNETWORK SECURITY MONITORINGNETWORK DEVICE MONITORINGOTHERS

-

8.3 STORAGE MONITORINGSTORAGE MONITORING TO ENHANCE RESOURCE EFFICIENCY AND OPTIMIZE END-USER EXPERIENCESTORAGE CAPACITY MONITORINGSTORAGE UTILIZATION MONITORINGDISK PERFORMANCE MONITORINGRAID HEALTH MONITORINGOTHERS

-

8.4 SERVER MONITORINGGROWING DEMAND TO IDENTIFY POTENTIAL BOTTLENECKS AFFECTING PERFORMANCE IN SERVER MONITORING TO DRIVE MARKETCPU USAGE MONITORINGMEMORY USAGE MONITORINGDISK SPACE MONITORINGOTHERS

-

8.5 CLOUD INFRASTRUCTURE MONITORINGPROVIDING REAL-TIME INSIGHTS INTO AVAILABILITY AND PERFORMANCE OF CLOUD INFRASTRUCTURE TO BOOST MARKETCLOUD RESOURCE AVAILABILITY MONITORINGCLOUD RESOURCE UTILIZATION MONITORINGCLOUD SERVICE PERFORMANCE MONITORINGOTHERS

- 8.6 OTHER INFRASTRUCTURE MONITORING

-

9.1 INTRODUCTIONAPPLICATION PERFORMANCE MONITORING: MARKET DRIVERS

-

9.2 DATABASE MONITORINGGROWING NEED FOR DATABASE MONITORING TO ENSURE OPTIMAL PERFORMANCE AND USER EXPERIENCE TO DRIVE MARKETQUERY PERFORMANCE ANALYSISDATABASE RESPONSE TIME MONITORINGRESOURCE UTILIZATION TRACKINGOTHERS

-

9.3 WEB APPLICATION MONITORINGRISING DEMAND FOR REAL-TIME INSIGHTS TO DRIVE MARKET GROWTHPERFORMANCE MONITORINGINTERNAL NETWORK MONITORINGSERVICE-LEVEL AGREEMENT (SLA) MONITORINGOTHERS

-

9.4 MOBILE APPLICATION MONITORINGGROWING DEMAND FOR OPTIMAL PERFORMANCE OF BUSINESSES TO DRIVE MARKETAPP STORE MONITORINGBATTERY MONITORING SYSTEMSDEVICE COMPATIBILITY TESTINGPUSH NOTIFICATION MONITORINGOTHERS

-

9.5 CODE-LEVEL MONITORINGGROWING DEMAND FOR SEAMLESS INTEGRATION OF DIVERSE GEOSPATIAL DATASETS TO DRIVE MARKETDEEP CODE-LEVEL DIAGNOSTICSCODE PROFILING AND ANALYSISEXCEPTION TRACKING AND ANALYSISOTHERS

- 9.6 OTHER APPLICATION PERFORMANCE MONITORING

-

10.1 INTRODUCTIONSECURITY MONITORING: MARKET DRIVERS

-

10.2 INTRUSION DETECTION AND PREVENTION SYSTEMS (IDPS)GROWING NEED TO DETECT AND PREVENT UNAUTHORIZED ACCESS TO DRIVE MARKET GROWTHNETWORK-BASED IDPSHOST-BASED IDPSBEHAVIOR-BASED IDPSSIGNATURE-BASED IDPSOTHERS

-

10.3 LOG MONITORING AND ANALYSISLOG MONITORING AND ANALYSIS TO DRIVE MARKET BY PROVIDING SECURITY AND OPERATIONAL EFFICIENCYSECURITY EVENT LOG MONITORINGSECURITY INFORMATION AND EVENT MANAGEMENT (SIEM)LOG CORRELATION AND ANALYSISTHREAT INTELLIGENCE INTEGRATIONOTHERS

-

10.4 VULNERABILITY ASSESSMENT AND MANAGEMENTGROWING DEMAND FOR VALUABLE INSIGHTS INTO SECURITY POSTURE OF ORGANIZATIONS TO PROPEL MARKET GROWTHVULNERABILITY SCANNINGVULNERABILITY PRIORITIZATIONPATCH MANAGEMENTVULNERABILITY REMEDIATION TRACKINGOTHERS

- 10.5 OTHER SECURITY MONITORING

-

11.1 INTRODUCTIONEND-USER EXPERIENCE MONITORING: MARKET DRIVERS

-

11.2 SYNTHETIC MONITORINGGROWING NEED FOR SYNTHETIC MONITORING FOR IDENTIFICATION AND RESOLUTION OF POTENTIAL ISSUES TO BOOST MARKET GROWTHTRANSACTION MONITORINGGEO-DISTRIBUTED MONITORINGSYNTHETIC USER BEHAVIOR SIMULATIONBROWSER COMPATIBILITY TESTINGTHIRD-PARTY SERVICES MONITORINGOTHERS

-

11.3 REAL USER MONITORINGUSAGE OF REAL USER MONITORING TO GATHER DATA OF DIFFERENT METRICS TO BOOST MARKETUSER BEHAVIOR TRACKINGCONVERSION FUNNEL ANALYSISUSER FLOW VISUALIZATIONUSER EXPERIENCE METRICSPERFORMANCE METRICSOTHERS

- 11.4 OTHER END-USER EXPERIENCE MONITORING

-

12.1 INTRODUCTIONVERTICALS: MARKET DRIVERS

-

12.2 BFSIINCREASING COMPLEXITY OF BANKING AND FINANCIAL PROCESSES IN BFSI TO DRIVE MARKETFRAUD DETECTION AND PREVENTIONANOMALY DETECTION AND FORECASTINGBUDGETING AND EXPENSE TRACKINGINCIDENT RESPONSE REMEDIATIONRISK ASSESSMENT AND MANAGEMENTOTHER APPLICATIONS

-

12.3 RETAIL & ECOMMERCENEED TO RESOLVE ISSUES AND REDUCE REVENUE LOSS & DOWNTIME IN EXPANDING RETAIL & ECOMMERCE INDUSTRY TO BOOST MARKET DEMANDCUSTOMER SERVICE MONITORINGWEBSITE UPTIME MONITORINGAPPLICATION PERFORMANCE MONITORINGTRANSACTION MONITORINGORDER TRACKING AND DELIVERY MONITORINGCOMPETITOR MONITORINGOTHER APPLICATIONS

-

12.4 HEALTHCARE & LIFESCIENCESPROVIDING EFFICIENT PATIENT CARE, OPTIMIZING PROCESSES, AND ENHANCING OVERALL OPERATIONAL EFFECTIVENESS IN HEALTHCARE & LIFE SCIENCES TO BOOST MARKETELECTRONIC HEALTH RECORD (EHR) MONITORINGPATIENT MONITORING SYSTEMSCLINICAL DECISION SUPPORT SYSTEM (CDSS) MONITORINGDRUG DISPENSING SYSTEM MONITORINGOTHER APPLICATIONS

-

12.5 IT/ITESGROWING COMPLEXITY OF IT ENVIRONMENT TO DRIVE MARKETSERVER MONITORINGIT INFRASTRUCTURE MONITORINGDATABASE MONITORINGLOG MONITORING AND ANALYSISBACKUP AND RECOVERY MONITORINGOTHER APPLICATIONS

-

12.6 MEDIA & ENTERTAINMENTINDUSTRY’S ACCEPTANCE OF MONITORING TOOLS FOR OPTIMIZING CONTENT DELIVERY AND ENHANCING USER EXPERIENCE TO DRIVE MARKETREAL-TIME ANALYTICSASSET AND CONTENT MANAGEMENTRISK AND COMPLIANCECONTENT MANAGEMENTOTHER APPLICATIONS

-

12.7 MANUFACTURINGOPTIMIZING PERFORMANCE, ENHANCING SECURITY, AND LEVERAGING EMERGING TECHNOLOGIES FOR IMPROVED EFFICIENCY AND PRODUCTIVITY TO DRIVE MARKETPROCESS CONTROL MONITORINGREAL-TIME DATA ANALYTICSSUPPLY CHAIN MANAGEMENTINVENTORY OPTIMIZATIONQUALITY CONTROL MONITORINGPRODUCTION MONITORINGOTHER APPLICATIONS

-

12.8 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICSINCREASING ADOPTION OF AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS TO DRIVE MARKETROUTE OPTIMIZATIONFLEET MONITORINGFUEL MONITORINGSHIPMENT TRACKING AND DELIVERY MONITORINGCOMPLIANCE MONITORINGOTHER APPLICATIONS

-

12.9 TELECOMLEVERAGING MONITORING TOOLS FOR ENHANCED PERFORMANCE AND SECURITY TO DRIVE MARKETSERVICE QUALITY MONITORINGNETWORK CONFIGURATION MONITORINGCAPACITY PLANNINGNETWORK OUTAGE MONITORINGOTHER APPLICATIONS

- 12.10 OTHER VERTICALS

- 13.1 INTRODUCTION

-

13.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Investment in AI and automation technologies to spur market growthCANADA- Rising adoption of cloud infrastructures in different realms to drive market

-

13.3 EUROPEEUROPE: MONITORING TOOLS MARKET DRIVERSEUROPE: IMPACT OF RECESSIONUK- Government support to strengthen cybersecurity, promote digital transformation, and foster innovation to drive market growthGERMANY- Rising focus on IT efficiency and security to drive market growthFRANCE- Strong position of France in transportation and construction sectors to drive marketITALY- Evolution of advanced technologies and incentives to promote market growthSPAIN- Rising technology advancements to drive marketBENELUX- Growing adoption of monitoring tools to drive marketNORDIC COUNTRIES- Proactive stance toward harnessing technology to drive market growthREST OF EUROPE

-

13.4 ASIA PACIFICASIA PACIFIC: MONITORING TOOLS MARKET DRIVERSASIA PACIFIC: IMPACT OF RECESSIONCHINA- China to witness substantial growth and transformation through digitalization and technological advancementsJAPAN- Rising demand for data security and compliance to drive market growthINDIA- Increasing use of IoT devices, big data, and AI-powered applications to drive marketANZ- Increasing importance of real-time insights to fuel market growthSOUTH KOREA- Seamless integration of monitoring data in cloud-based solutions to drive marketASEAN- Increasing shift towards cloud-based infrastructure to fuel market growthREST OF ASIA PACIFIC

-

13.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MONITORING TOOLS MARKET DRIVERSMIDDLE EAST & AFRICA: IMPACT OF RECESSIONKINGDOM OF SAUDI ARABIA- Active investment in IT and infrastructure to drive marketUAE- Adopting innovative technologies promoted by government to drive marketISRAEL- Government support for technological innovations to drive marketTURKEY- Increasing adoption of cloud services to drive market growthQATAR- Strong emphasis on technological advancements to drive marketSOUTH AFRICA- Growing adoption of cloud services to manage and secure cloud-based infrastructures and applications to propel marketREST OF MIDDLE EAST AND AFRICA

-

13.6 LATIN AMERICALATIN AMERICA: MONITORING TOOLS MARKET DRIVERSLATIN AMERICA: IMPACT OF RECESSIONBRAZIL- Government incentives and support to encourage adoption of technology solutions to drive marketMEXICO- Rapid adoption of monitoring tools for security-related concerns to drive marketARGENTINA- Growing use of tools to analyze data in various sectors to fuel market growthREST OF LATIN AMERICA

- 14.1 OVERVIEW

- 14.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 14.3 REVENUE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS

-

14.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

14.6 COMPANY EVALUATION MATRIX FOR SMES/STARTUPSPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 14.7 COMPETITIVE BENCHMARKING

-

14.8 MONITORING TOOLS: PRODUCT LANDSCAPECOMPARATIVE ANALYSIS OF MONITORING TOOL PRODUCTS

-

14.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

- 14.10 VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 14.11 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY VENDORS

- 15.1 INTRODUCTION

-

15.2 KEY PLAYERSMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAWS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCISCO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDYNATRACE- Business overview- Products/Solutions/Services offered- Recent developmentsSPLUNK- Business overview- Products/Solutions/Services offered- Recent developmentsSOLARWINDS- Business overview- Products/Solutions/Services offered- Recent developmentsNETSCOUT- Business overview- Products/Solutions/Services offered- Recent developmentsNEW RELIC- Business overview- Products/Solutions/Services offered- Recent developmentsLOGICMONITOR- Business overview- Products/Solutions/Services offered- Recent developmentsPAESSLER AG- Business overview- Products/Solutions/Services offered- Recent developmentsNETREO- Business overview- Products/Solutions/Services offered- Recent developmentsMANAGEENGINE- Business overview- Products/Solutions/Services offered- Recent developmentsIDERA- Business overview- Products/Solutions/Services offered- Recent developmentsSEMATEXT- Business overview- Products/Solutions/Services offered- Recent developmentsDATADOGICINGANAGIOSZABBIX

-

15.3 OTHER PLAYERSSENTRYUPTIMEROBOTATERABETTER STACKSUMO LOGICCHECKMKEXOPRISEITRSRIVERBED TECHNOLOGYNLYTE SOFTWARE

-

16.1 NETWORK MONITORING MARKET—GLOBAL FORECAST TO 2027MARKET DEFINITIONMARKET OVERVIEWNETWORK MONITORING MARKET, BY OFFERINGNETWORK MONITORING MARKET, BY BANDWIDTHNETWORK MONITORING MARKET, BY TECHNOLOGYNETWORK MONITORING MARKET, BY END USERNETWORK MONITORING MARKET, BY REGION

-

16.2 PREDICTIVE ANALYTICS MARKET—GLOBAL FORECAST TO 2026MARKET DEFINITIONMARKET OVERVIEWPREDICTIVE ANALYTICS MARKET, BY COMPONENTPREDICTIVE ANALYTICS MARKET, BY DEPLOYMENT MODEPREDICTIVE ANALYTICS MARKET, BY ORGANIZATION SIZEPREDICTIVE ANALYTICS MARKET, BY VERTICALPREDICTIVE ANALYTICS MARKET, BY REGION

-

16.3 END-USER EXPERIENCE MONITORING MARKET—GLOBAL FORECAST TO 2023MARKET DEFINITIONMARKET OVERVIEWEND-USER EXPERIENCE MONITORING MARKET, BY COMPONENTEND-USER EXPERIENCE MONITORING MARKET, BY ACCESS TYPEEND-USER EXPERIENCE MONITORING MARKET, BY ORGANIZATION SIZEEND-USER EXPERIENCE MONITORING MARKET, BY DEPLOYMENT TYPEEND-USER EXPERIENCE MONITORING MARKET, BY VERTICALEND-USER EXPERIENCE MONITORING MARKET, GEOGRAPHIC ANALYSIS

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 RECESSION IMPACT ON MONITORING TOOLS MARKET

- TABLE 4 MARKET SIZE AND GROWTH RATE, 2017–2022 (USD MILLION, Y-O-Y%)

- TABLE 5 MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y%)

- TABLE 6 MARKET: SOLUTION PROVIDERS

- TABLE 7 MARKET: SERVICE PROVIDERS

- TABLE 8 MARKET: TECHNOLOGY PROVIDERS

- TABLE 9 MARKET: INTEGRATORS

- TABLE 10 MARKET: REGULATORY BODIES

- TABLE 11 MARKET: END USERS

- TABLE 12 MONITORING TOOLS MARKET: PRICING LEVELS

- TABLE 13 PATENTS FILED, 2013–2023

- TABLE 14 TOP 20 PATENT OWNERS, 2013–2023

- TABLE 15 LIST OF PATENTS ASSOCIATED WITH MARKET, 2021–2023

- TABLE 16 PORTER’S FIVE FORCES ANALYSIS

- TABLE 17 DETAILED LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 20 BEST PRACTICES IN MARKETS

- TABLE 21 SHORT-TERM ROADMAP, 2023–2025

- TABLE 22 MID-TERM ROADMAP, 2026–2028

- TABLE 23 LONG-TERM ROADMAP, 2029–2030

- TABLE 24 COMPARISON OF AGENT-BASED AND AGENTLESS MONITORING TOOLS

- TABLE 25 COMPARISON OF OPEN-SOURCE & CLOSED-SOURCE MONITORING TOOLS BY TYPE

- TABLE 26 PRICING OF OPEN-SOURCE MONITORING TOOLS

- TABLE 27 MONITORING TOOLS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 28 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 29 SOFTWARE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 SOFTWARE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 32 MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 33 ON-PREMISES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 ON-PREMISES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 CLOUD: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 CLOUD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 38 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 39 SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 42 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 43 PROFESSIONAL SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 CONSULTING SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 CONSULTING SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 DEPLOYMENT & INTEGRATION: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 DEPLOYMENT & INTEGRATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 TRAINING, SUPPORT, AND MAINTENANCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 50 TRAINING, SUPPORT, AND MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 MANAGED SERVICES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 54 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 55 INFRASTRUCTURE MONITORING TOOLS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 INFRASTRUCTURE MONITORING TOOLS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 APPLICATION PERFORMANCE MONITORING TOOLS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 58 APPLICATION PERFORMANCE MONITORING TOOLS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 SECURITY MONITORING TOOLS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 60 SECURITY MONITORING TOOLS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 END-USER EXPERIENCE MONITORING TOOLS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 62 END-USER EXPERIENCE MONITORING TOOLS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2017–2022 (USD MILLION)

- TABLE 64 MARKET, BY INFRASTRUCTURE MONITORING, 2023–2028 (USD MILLION)

- TABLE 65 INFRASTRUCTURE MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 66 INFRASTRUCTURE MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 NETWORK MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 68 NETWORK MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 STORAGE MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 70 STORAGE MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 SERVER MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 72 SERVER MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 CLOUD INFRASTRUCTURE MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 74 CLOUD INFRASTRUCTURE MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 OTHER INFRASTRUCTURE MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 76 OTHER INFRASTRUCTURE MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 MARKET, BY APPLICATION PERFORMANCE MONITORING, 2017–2022 (USD MILLION)

- TABLE 78 MONITORING TOOLS MARKET, BY APPLICATION PERFORMANCE MONITORING, 2023–2028 (USD MILLION)

- TABLE 79 APPLICATION PERFORMANCE MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 80 APPLICATION PERFORMANCE MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 DATABASE MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 82 DATABASE MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 WEB APPLICATION MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 84 WEB APPLICATION MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 MOBILE APPLICATION MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 86 MOBILE APPLICATION MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 CODE-LEVEL MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 88 CODE-LEVEL MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 OTHER APPLICATION PERFORMANCE MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 90 OTHER APPLICATION PERFORMANCE MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 MARKET, BY SECURITY MONITORING, 2017–2022 (USD MILLION)

- TABLE 92 MARKET, BY SECURITY MONITORING, 2023–2028 (USD MILLION)

- TABLE 93 SECURITY MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 94 SECURITY MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 INTRUSION DETECTION AND PREVENTION SYSTEMS (IDPS): MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 96 INTRUSION DETECTION AND PREVENTION SYSTEMS (IDPS): MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 LOG MONITORING AND ANALYSIS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 98 LOG MONITORING AND ANALYSIS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 99 VULNERABILITY ASSESSMENT AND MANAGEMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 100 VULNERABILITY ASSESSMENT AND MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 OTHER SECURITY MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 102 OTHER SECURITY MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 MONITORING TOOLS MARKET, BY END-USER EXPERIENCE MONITORING, 2017–2022 (USD MILLION)

- TABLE 104 MARKET, BY END-USER EXPERIENCE MONITORING, 2023–2028 (USD MILLION)

- TABLE 105 END-USER EXPERIENCE MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 106 END-USER EXPERIENCE MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 SYNTHETIC MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 108 SYNTHETIC MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 109 REAL USER MONITORING (RUM): MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 110 REAL USER MONITORING (RUM): MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 111 OTHER END-USER EXPERIENCE MONITORING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 112 OTHER END-USER EXPERIENCE MONITORING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 113 MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 114 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 115 BFSI: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 116 BFSI: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 117 MONITORING TOOLS MARKET IN BFSI VERTICAL, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 118 MARKET IN BFSI VERTICAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 RETAIL & ECOMMERCE: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 120 RETAIL & ECOMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 121 MARKET IN RETAIL & ECOMMERCE VERTICAL, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 122 MARKET IN RETAIL & ECOMMERCE VERTICAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 124 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 125 MARKET IN HEALTHCARE & LIFE SCIENCES VERTICAL, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 126 MARKET IN HEALTHCARE & LIFE SCIENCES VERTICAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 IT/ITES: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 128 IT/ITES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 129 MARKET IN IT/ITES VERTICAL, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 130 MARKET IN IT/ITES VERTICAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 131 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 132 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 133 MONITORING TOOLS MARKET IN MEDIA & ENTERTAINMENT VERTICAL, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 134 MARKET IN MEDIA & ENTERTAINMENT VERTICAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 135 MANUFACTURING: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 136 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 137 MARKET IN MANUFACTURING VERTICAL, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 138 MARKET IN MANUFACTURING VERTICAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 140 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 141 MARKET IN AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS VERTICALS, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 142 MARKET IN AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS VERTICALS, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 143 TELECOM: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 144 TELECOM: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 145 MARKET IN TELECOM VERTICAL, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 146 MARKET IN TELECOM VERTICAL, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 147 OTHER VERTICALS: MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 148 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 149 MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 150 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 151 NORTH AMERICA: MONITORING TOOLS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 152 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 153 NORTH AMERICA: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 154 NORTH AMERICA: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 155 NORTH AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 156 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 157 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 158 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 159 NORTH AMERICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 160 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 161 NORTH AMERICA: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2017–2022 (USD MILLION)

- TABLE 162 NORTH AMERICA: MARKET, BY INFRASTRUCTURE MONITORING, 2023–2028 (USD MILLION)

- TABLE 163 NORTH AMERICA: MARKET, BY APPLICATION PERFORMANCE MONITORING, 2017–2022 (USD MILLION)

- TABLE 164 NORTH AMERICA: MARKET, BY APPLICATION PERFORMANCE MONITORING, 2023–2028 (USD MILLION)

- TABLE 165 NORTH AMERICA: MARKET, BY SECURITY MONITORING, 2017–2022 (USD MILLION)

- TABLE 166 NORTH AMERICA: MARKET, BY SECURITY MONITORING, 2023–2028 (USD MILLION)

- TABLE 167 NORTH AMERICA: MARKET, BY EXPERIENCE, 2017–2022 (USD MILLION)

- TABLE 168 NORTH AMERICA: MARKET, BY END-USER EXPERIENCE MONITORING, 2023–2028 (USD MILLION)

- TABLE 169 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 170 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 171 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 172 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 173 US: MONITORING TOOLS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 174 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 175 US: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 176 US: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 177 US: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 178 US: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 179 US: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 180 US: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 181 US: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 182 US: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 183 EUROPE: MONITORING TOOLS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 184 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 185 EUROPE: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 186 EUROPE: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 187 EUROPE: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 188 EUROPE: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 189 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 190 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 191 EUROPE: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 192 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 193 EUROPE: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2017–2022 (USD MILLION)

- TABLE 194 EUROPE: MARKET, BY INFRASTRUCTURE MONITORING, 2023–2028 (USD MILLION)

- TABLE 195 EUROPE: MARKET, BY APPLICATION PERFORMANCE MONITORING, 2017–2022 (USD MILLION)

- TABLE 196 EUROPE: MARKET, BY APPLICATION PERFORMANCE MONITORING, 2023–2028 (USD MILLION)

- TABLE 197 EUROPE: MARKET, BY SECURITY MONITORING, 2017–2022 (USD MILLION)

- TABLE 198 EUROPE: MARKET, BY SECURITY MONITORING, 2023–2028 (USD MILLION)

- TABLE 199 EUROPE: MARKET, BY EXPERIENCE, 2017–2022 (USD MILLION)

- TABLE 200 EUROPE: MARKET, BY END-USER EXPERIENCE MONITORING, 2023–2028 (USD MILLION)

- TABLE 201 EUROPE: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 202 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 203 EUROPE: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 204 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 205 UK: MONITORING TOOLS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 206 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 207 UK: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 208 UK: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 209 UK: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 210 UK: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 211 UK: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 212 UK: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 213 UK: MONITORING TOOLS SOLUTIONS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 214 UK: MONITORING TOOLS SOLUTIONS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 215 ASIA PACIFIC: MONITORING TOOLS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 216 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 217 ASIA PACIFIC: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 218 ASIA PACIFIC: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 219 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 220 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 221 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 222 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 223 ASIA PACIFIC: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 224 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 225 ASIA PACIFIC: MARKET, BY INFRASTRUCTURE MONITORING, 2017–2022 (USD MILLION)

- TABLE 226 ASIA PACIFIC: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2023–2028 (USD MILLION)

- TABLE 227 ASIA PACIFIC: MARKET, BY APPLICATION PERFORMANCE MONITORING, 2017–2022 (USD MILLION)

- TABLE 228 ASIA PACIFIC: MARKET, BY APPLICATION PERFORMANCE MONITORING, 2023–2028 (USD MILLION)

- TABLE 229 ASIA PACIFIC: MARKET, BY SECURITY MONITORING, 2017–2022 (USD MILLION)

- TABLE 230 ASIA PACIFIC: MARKET, BY SECURITY MONITORING, 2023–2028 (USD MILLION)

- TABLE 231 ASIA PACIFIC: MARKET, BY EXPERIENCE, 2017–2022 (USD MILLION)

- TABLE 232 ASIA PACIFIC: MARKET, BY END-USER EXPERIENCE MONITORING, 2023–2028 (USD MILLION)

- TABLE 233 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 234 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 235 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 236 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 237 CHINA: MONITORING TOOLS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 238 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 239 CHINA: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 240 CHINA: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 241 CHINA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 242 CHINA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 243 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 244 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 245 CHINA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 246 CHINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 252 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 253 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 254 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: MARKET, BY INFRASTRUCTURE MONITORING, 2017–2022 (USD MILLION)

- TABLE 258 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2023–2028 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION PERFORMANCE MONITORING, 2017–2022 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION PERFORMANCE MONITORING, 2023–2028 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: MARKET, BY SECURITY MONITORING, 2017–2022 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: MARKET, BY SECURITY MONITORING, 2023–2028 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: MARKET, BY EXPERIENCE, 2017–2022 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: MARKET, BY END-USER EXPERIENCE MONITORING, 2023–2028 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 267 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 268 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 269 LATIN AMERICA: MONITORING TOOLS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 270 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 271 LATIN AMERICA: MARKET, BY DEPLOYMENT, 2017–2022 (USD MILLION)

- TABLE 272 LATIN AMERICA: MARKET, BY DEPLOYMENT, 2023–2028 (USD MILLION)

- TABLE 273 LATIN AMERICA: MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 274 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 275 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2017–2022 (USD MILLION)

- TABLE 276 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 277 LATIN AMERICA: MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 278 LATIN AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 279 LATIN AMERICA: MARKET, BY INFRASTRUCTURE MONITORING, 2017–2022 (USD MILLION)

- TABLE 280 LATIN AMERICA: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2023–2028 (USD MILLION)

- TABLE 281 LATIN AMERICA: MARKET, BY APPLICATION PERFORMANCE MONITORING, 2017–2022 (USD MILLION)

- TABLE 282 LATIN AMERICA: MARKET, BY APPLICATION PERFORMANCE MONITORING, 2023–2028 (USD MILLION)

- TABLE 283 LATIN AMERICA: MARKET, BY SECURITY MONITORING, 2017–2022 (USD MILLION)

- TABLE 284 LATIN AMERICA: MARKET, BY SECURITY MONITORING, 2023–2028 (USD MILLION)

- TABLE 285 LATIN AMERICA: MARKET, BY EXPERIENCE, 2017–2022 (USD MILLION)

- TABLE 286 LATIN AMERICA: MARKET, BY END-USER EXPERIENCE MONITORING, 2023–2028 (USD MILLION)

- TABLE 287 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 288 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 289 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 290 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 291 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 292 MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 293 COMPETITIVE BENCHMARKING FOR KEY PLAYERS, 2023

- TABLE 294 DETAILED LIST OF KEY SMES/STARTUPS

- TABLE 295 COMPETITIVE BENCHMARKING OF SMES/STARTUPS, 2023

- TABLE 296 COMPARATIVE ANALYSIS OF MONITORING TOOL PRODUCTS

- TABLE 297 MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 298 MARKET: DEALS, 2020–2023

- TABLE 299 MONITORING TOOLS MARKET: OTHERS, 2020–2022

- TABLE 300 MICROSOFT: BUSINESS OVERVIEW

- TABLE 301 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 MICROSOFT: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 303 MICROSOFT: DEALS

- TABLE 304 GOOGLE: BUSINESS OVERVIEW

- TABLE 305 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 GOOGLE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 307 GOOGLE: DEALS

- TABLE 308 AWS: BUSINESS OVERVIEW

- TABLE 309 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 AWS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 311 AWS: DEALS

- TABLE 312 IBM: BUSINESS OVERVIEW

- TABLE 313 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 314 IBM: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 315 IBM: DEALS

- TABLE 316 CISCO: BUSINESS OVERVIEW

- TABLE 317 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 318 CISCO: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 319 CISCO: DEALS

- TABLE 320 DYNATRACE: BUSINESS OVERVIEW

- TABLE 321 DYNATRACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 DYNATRACE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 323 DYNATRACE: DEALS

- TABLE 324 SPLUNK: BUSINESS OVERVIEW

- TABLE 325 SPLUNK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 SPLUNK: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 327 SPLUNK: DEALS

- TABLE 328 SOLARWINDS: BUSINESS OVERVIEW

- TABLE 329 SOLARWINDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 330 SOLARWINDS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 331 SOLARWINDS: DEALS

- TABLE 332 NETSCOUT: BUSINESS OVERVIEW

- TABLE 333 NETSCOUT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 NETSCOUT: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 335 NETSCOUT: DEALS

- TABLE 336 NEW RELIC: BUSINESS OVERVIEW

- TABLE 337 NEW RELIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 338 NEW RELIC: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 339 NEW RELIC: DEALS

- TABLE 340 LOGIC MONITOR: BUSINESS OVERVIEW

- TABLE 341 LOGIC MONITOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 342 LOGIC MONITOR: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 343 LOGIC MONITOR: DEALS

- TABLE 344 LOGIC MONITOR: OTHERS

- TABLE 345 PAESSLER AG: BUSINESS OVERVIEW

- TABLE 346 PAESSLER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 347 PAESSLER AG: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 348 PAESSLER AG: DEALS

- TABLE 349 NETREO: BUSINESS OVERVIEW

- TABLE 350 NETREO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 351 NETREO: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 352 NETREO: DEALS

- TABLE 353 MANAGEENGINE: BUSINESS OVERVIEW

- TABLE 354 MANAGEENGINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 355 MANAGEENGINE: PRODUCT LAUNCHES

- TABLE 356 MANAGEENGINE: DEALS

- TABLE 357 IDERA: BUSINESS OVERVIEW

- TABLE 358 IDERA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 359 IDERA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 360 SEMATEXT: BUSINESS OVERVIEW

- TABLE 361 SEMATEXT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 362 SEMATEXT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 363 NETWORK MONITORING MARKET, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 364 NETWORK MONITORING MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 365 NETWORK MONITORING MARKET, BY EQUIPMENT, 2018–2021 (USD MILLION)

- TABLE 366 NETWORK MONITORING MARKET, BY EQUIPMENT, 2022–2027 (USD MILLION)

- TABLE 367 NETWORK TAP: NETWORK MONITORING MARKET, BY TYPE, 2018–2021 (USD MILLION)

- TABLE 368 NETWORK TAP: NETWORK MONITORING MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 369 NETWORK MONITORING MARKET, BY BANDWIDTH, 2018–2021 (USD MILLION)

- TABLE 370 NETWORK MONITORING MARKET, BY BANDWIDTH, 2022–2027 (USD MILLION)

- TABLE 371 NETWORK MONITORING MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

- TABLE 372 NETWORK MONITORING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 373 NETWORK MONITORING MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 374 NETWORK MONITORING MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 375 NETWORK MONITORING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 376 NETWORK MONITORING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 377 PREDICTIVE ANALYTICS MARKET SIZE AND GROWTH RATE, 2015–2020 (USD MILLION, Y-O-Y%)

- TABLE 378 PREDICTIVE ANALYTICS MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y-O-Y%)

- TABLE 379 PREDICTIVE ANALYTICS MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

- TABLE 380 PREDICTIVE ANALYTICS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 381 PREDICTIVE ANALYTICS MARKET, BY SOLUTION, 2015–2020 (USD MILLION)

- TABLE 382 PREDICTIVE ANALYTICS MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

- TABLE 383 PREDICTIVE ANALYTICS MARKET, BY SERVICE, 2015–2020 (USD MILLION)

- TABLE 384 PREDICTIVE ANALYTICS MARKET, BY SERVICE, 2021–2026 (USD MILLION)

- TABLE 385 PREDICTIVE ANALYTICS MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

- TABLE 386 PREDICTIVE ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

- TABLE 387 PREDICTIVE ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

- TABLE 388 PREDICTIVE ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 389 PREDICTIVE ANALYTICS MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

- TABLE 390 PREDICTIVE ANALYTICS MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 391 PREDICTIVE ANALYTICS MARKET, BY REGION, 2015–2020 (USD MILLION)

- TABLE 392 PREDICTIVE ANALYTICS MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 393 END-USER EXPERIENCE MONITORING MARKET, BY COMPONENT, 2016–2023 (USD MILLION)

- TABLE 394 END-USER EXPERIENCE MONITORING MARKET, BY PRODUCT, 2016–2023 (USD MILLION)

- TABLE 395 END-USER EXPERIENCE MONITORING MARKET, BY SERVICE, 2016–2023 (USD MILLION)

- TABLE 396 END-USER EXPERIENCE MONITORING MARKET, BY ACCESS TYPE, 2016–2023 (USD MILLION)

- TABLE 397 END-USER EXPERIENCE MONITORING MARKET, BY ORGANIZATION SIZE, 2016–2023 (USD MILLION)

- TABLE 398 END-USER EXPERIENCE MONITORING MARKET, BY DEPLOYMENT TYPE, 2016–2023 (USD MILLION)

- TABLE 399 END-USER EXPERIENCE MONITORING MARKET, BY VERTICAL, 2016–2023 (USD MILLION)

- TABLE 400 END-USER EXPERIENCE MONITORING MARKET, BY REGION, 2016–2023 (USD MILLION)

- FIGURE 1 MONITORING TOOLS MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 3 APPROACH 1 (SUPPLY-SIDE): REVENUE FROM OFFERING OF MARKET

- FIGURE 4 APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM OFFERINGS OF MONITORING TOOLS PLAYERS

- FIGURE 5 APPROACH 3, BOTTOM-UP (SUPPLY SIDE): REVENUE AND SUBSEQUENT MARKET ESTIMATION FROM OFFERINGS OF MONITORING TOOLS

- FIGURE 6 APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF MONITORING TOOLS OFFERING THROUGH OVERALL MONITORING TOOLS SPENDING

- FIGURE 7 SOFTWARE SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 8 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 9 CONSULTING SERVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 10 INFRASTRUCTURE MONITORING SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 11 NETWORK MONITORING SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 12 DATABASE MONITORING SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 13 INTRUSION DETECTION AND PREVENTION SYSTEMS (IDPS) SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 14 SYNTHETIC MONITORING SEGMENT TO ACCOUNT FOR LARGEST SIZE IN 2023

- FIGURE 15 IT/ITES SEGMENT TO LEAD MARKET IN 2023

- FIGURE 16 NORTH AMERICA TO LEAD MARKET IN 2023

- FIGURE 17 INCREASE IN NUMBER OF AI- AND ML-BASED MONITORING TOOLS AND SOFTWARE TO DRIVE MARKET GROWTH

- FIGURE 18 SECURITY MONITORING TOOLS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 19 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE BY 2028

- FIGURE 20 SOFTWARE AND IT/ITES SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE BY 2023

- FIGURE 21 MONITORING TOOLS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 EVOLUTION OF MONITORING TOOLS

- FIGURE 23 ECOSYSTEM ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS

- FIGURE 25 TOTAL NUMBER OF PATENTS GRANTED, 2013–2023

- FIGURE 26 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013–2023

- FIGURE 27 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013–2023

- FIGURE 28 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 31 AUTOMATED MACHINE LEARNING MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 32 STAGES IN MARKET

- FIGURE 33 SOLUTIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 34 ON-PREMISES SEGMENT TO ACHIEVE HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 35 DEPLOYMENT & INTEGRATION SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 36 DEPLOYMENT & INTEGRATION SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 37 APPLICATION PERFORMANCE MONITORING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 38 NETWORK MONITORING TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 DATABASE MONITORING TOOLS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 INTRUSION DETECTION & PREVENTION SYSTEMS (IDPS) TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 SYNTHETIC MONITORING TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- FIGURE 42 IT/ITES SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 47 REVENUE ANALYSIS FOR KEY COMPANIES, 2018–2022

- FIGURE 48 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2022

- FIGURE 49 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS, 2023

- FIGURE 50 EVALUATION QUADRANT MATRIX FOR SMES/STARTUPS, 2023

- FIGURE 51 VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 52 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY VENDORS

- FIGURE 53 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 54 GOOGLE: COMPANY SNAPSHOT

- FIGURE 55 AWS: COMPANY SNAPSHOT

- FIGURE 56 IBM: COMPANY SNAPSHOT

- FIGURE 57 CISCO: COMPANY SNAPSHOT

- FIGURE 58 DYNATRACE: COMPANY SNAPSHOT

- FIGURE 59 SPLUNK: COMPANY SNAPSHOT

- FIGURE 60 SOLARWINDS: COMPANY SNAPSHOT

- FIGURE 61 NETSCOUT: COMPANY SNAPSHOT

- FIGURE 62 NEW RELIC: COMPANY SNAPSHOT

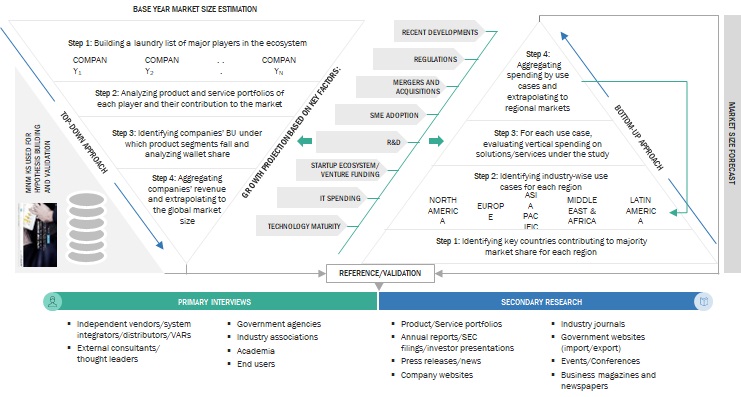

The research methodology for the global monitoring tools market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including key opinion leaders, subject matter experts, high-level executives of multiple companies offering monitoring tools offerings, and industry consultants to obtain and verify critical qualitative and quantitative information and assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources.

The secondary research was used to obtain key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from the supply and demand sides of the monitoring tools market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing Monitoring tools offerings; associated service providers; and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify and validate the segmentation types; industry trends; key players; the market's competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the critical information/insights throughout the report.

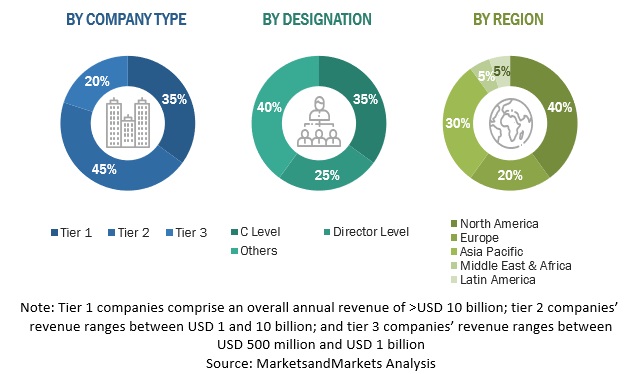

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the Monitoring tools market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global Monitoring tools market, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

The top-down approach prepared an exhaustive list of all the vendors offering Monitoring tools. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding and investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on the breadth of solution and service offerings, Applications, and verticals. The aggregate of all the companies’ revenues was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption rate of Monitoring tools solutions and services among different end-users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of monitoring tools solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on Monitoring tools solutions based on some of the key use cases. These factors for the Monitoring tools tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Top Down and Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation