Modular Robotics Market by Robot Type (Articulated Modular Robots, SCARA Modular Robots and Collaborative Modular Robots), Industry (Automotive, Electrical and Electronic, Plastic, Rubber and Chemicals) and Geography - Global Forecast 2035

The Clean in Place market is witnessing significant transformation driven by technological advancements, increasing emphasis on hygiene, and regulatory mandates across industries such as food, dairy, and pharmaceuticals. Clean in Place systems are designed to automatically clean and sanitize equipment and process pipelines without the need for manual disassembly. These systems are essential in industries that require stringent cleaning protocols to prevent contamination and ensure product quality. Over the forecast period from 2024 to 2036, the Clean in Place market is projected to grow steadily as manufacturers adopt more advanced systems to enhance operational efficiency and comply with global hygiene standards.

The market is segmented by system type into single use and reuse systems, by offering into single tank systems, two tank systems, and multi tank systems, by end user industry into food, dairy, and pharmaceuticals, and by geography. Each of these segments plays a critical role in shaping the future trajectory of the Clean in Place market.

Market Overview and Growth Drivers

The global Clean in Place market is experiencing robust growth due to a combination of regulatory pressure, technological innovation, and the need for efficient cleaning processes in production environments. As manufacturing facilities expand and automation becomes a central component of modern production, Clean in Place systems are increasingly preferred over manual cleaning methods. These systems reduce downtime, ensure consistent cleaning performance, and minimize the risk of contamination.

One of the primary growth drivers is the increasing focus on food safety and hygiene. Regulatory agencies across the world are implementing stricter norms for cleanliness in production facilities, particularly in sectors like food and pharmaceuticals where contamination can have serious consequences. Manufacturers are investing in advanced Clean in Place systems to meet these standards and maintain certifications.

Technological advancements in sensors, flow control, and data analytics are also driving market growth. Modern Clean in Place systems can be integrated with control systems to provide real time monitoring, automated cleaning cycles, and data logging for compliance purposes. These innovations improve efficiency, reduce water and chemical usage, and lower operational costs, making Clean in Place systems more attractive to end users.

Additionally, sustainability concerns are encouraging companies to adopt systems that reduce water and energy consumption. Reuse systems, in particular, allow manufacturers to recycle cleaning solutions, leading to significant cost savings and environmental benefits. This focus on resource efficiency is expected to boost demand across industries.

Market Segmentation by System Type

Single Use Systems

Single use Clean in Place systems are designed to use cleaning solutions once and then discard them. These systems are relatively simple and cost effective, making them ideal for smaller facilities or applications where cleaning requirements are not highly complex. They are commonly used in industries where batch production is prevalent and where the risk of cross contamination between product runs is low.

Single use systems are valued for their ease of installation and low upfront cost. They require minimal infrastructure and can be integrated into existing production lines with relative ease. However, the drawback of single use systems lies in their higher operating costs over time due to the continuous need for fresh cleaning solutions and water. In addition, the environmental impact of disposing of cleaning chemicals after each use is a concern in regions with strict waste disposal regulations.

Reuse Systems

Reuse Clean in Place systems, on the other hand, are designed to collect, filter, and reuse cleaning solutions multiple times. These systems are more complex and require larger infrastructure investments, but they offer significant long term savings. Reuse systems are particularly advantageous in large production facilities where cleaning cycles are frequent and water and chemical consumption can be substantial.

The ability to recycle cleaning solutions makes reuse systems highly sustainable. They are equipped with filtration and treatment mechanisms to ensure the cleaning solution remains effective over multiple cycles. This reduces both water consumption and chemical waste, aligning with sustainability goals and regulatory standards. Industries such as dairy and pharmaceuticals, where hygiene standards are extremely high, often prefer reuse systems due to their reliability, cost efficiency, and environmental benefits.

As global industries increasingly prioritize sustainability, reuse systems are expected to capture a larger share of the market over the forecast period.

Market Segmentation by Offering

Single Tank Systems

Single tank Clean in Place systems are the simplest configuration, consisting of a single tank that stores the cleaning solution. They are typically used in applications with basic cleaning requirements where a single cleaning solution is sufficient for the entire cycle. Single tank systems are compact, easy to maintain, and well suited for small production facilities or specific cleaning tasks within larger operations.

The growing number of small and medium sized enterprises in the food and beverage industry is contributing to the demand for single tank systems. These businesses require reliable cleaning solutions without the complexity or cost of multi tank configurations.

Two Tank Systems

Two tank Clean in Place systems include separate tanks for cleaning solutions and rinse water. This allows for more efficient cleaning cycles as the system can switch between cleaning and rinsing phases without the need for manual intervention. Two tank systems provide improved cleaning performance compared to single tank systems and are suitable for medium sized facilities with moderate cleaning requirements.

The use of two tank systems is increasing in dairy and food processing plants where thorough rinsing is essential to prevent residue buildup and contamination. These systems strike a balance between cost, performance, and operational flexibility, making them a popular choice for many manufacturers.

Multi Tank Systems

Multi tank Clean in Place systems represent the most advanced configuration. They include multiple tanks for various cleaning agents, rinse water, and sometimes recovery solutions. These systems allow for highly efficient and automated cleaning cycles tailored to specific equipment and product types. Multi tank systems are commonly used in large scale production facilities with complex cleaning requirements, such as pharmaceutical manufacturing plants and large dairy processing facilities.

The advantage of multi tank systems lies in their ability to handle different cleaning solutions for different stages of the cleaning process, resulting in thorough and consistent cleaning. They also support advanced features such as solution recovery and reconditioning, further reducing water and chemical usage. Although the initial investment is higher, the operational savings and performance benefits often justify the cost for large operations.

Market Segmentation by End User Industry

Food Industry

The food industry is one of the largest end users of Clean in Place systems. Ensuring hygiene and preventing contamination are critical in food processing, where even minor lapses can lead to product recalls, regulatory action, and damage to brand reputation. Clean in Place systems allow food manufacturers to automate their cleaning processes, ensuring consistent results and compliance with food safety standards.

Rising consumer awareness about food safety, combined with regulatory pressure from agencies such as the Food and Drug Administration and European Food Safety Authority, is driving investments in advanced cleaning technologies. The expansion of the processed food sector in emerging economies is also boosting demand for Clean in Place systems as new facilities adopt modern hygiene practices from the outset.

Dairy Industry

The dairy industry has some of the most stringent hygiene requirements due to the perishable nature of its products. Contamination can quickly lead to spoilage, making thorough cleaning essential. Clean in Place systems are integral to dairy processing operations, ensuring that equipment such as pasteurizers, storage tanks, and pipelines remain free of residue and bacteria.

Reuse systems and multi tank configurations are particularly common in the dairy industry because of their ability to handle frequent cleaning cycles efficiently. As dairy production expands globally, especially in regions like Asia Pacific and Latin America, the adoption of modern Clean in Place systems is expected to accelerate.

Pharmaceutical Industry

The pharmaceutical industry requires an exceptionally high level of cleanliness to ensure product safety and efficacy. Any contamination in pharmaceutical manufacturing can compromise product quality and lead to severe regulatory consequences. Clean in Place systems are widely used in pharmaceutical plants to clean reactors, fermenters, and other process equipment between production runs.

Pharmaceutical companies typically invest in advanced multi tank and reuse systems that offer precise control over cleaning parameters and full validation capabilities. Integration with automation systems and compliance with Good Manufacturing Practices are critical factors in the design and implementation of pharmaceutical Clean in Place systems.

The increasing production of biologics and sterile products is further driving the need for sophisticated cleaning solutions in the pharmaceutical sector.

Market Segmentation by Geography

The Clean in Place market is geographically diverse, with varying adoption rates and growth drivers across regions.

North America

North America holds a significant share of the Clean in Place market, driven by strict regulatory frameworks and advanced manufacturing practices. The food, dairy, and pharmaceutical industries in the region are mature and highly automated, creating strong demand for efficient cleaning systems. Additionally, the presence of leading equipment manufacturers and technological innovators contributes to the growth of the market in this region.

Europe

Europe is another major market for Clean in Place systems, supported by stringent hygiene regulations and a strong focus on sustainability. European manufacturers are increasingly adopting reuse systems and multi tank configurations to minimize water and chemical consumption. The dairy and food processing sectors are particularly influential in driving demand.

Asia Pacific

The Asia Pacific region is expected to witness the fastest growth during the forecast period. Rapid industrialization, expanding food and beverage production, and increasing regulatory emphasis on hygiene are driving the adoption of Clean in Place systems. Countries such as China, India, and Southeast Asian nations are investing in modern manufacturing facilities equipped with advanced cleaning technologies.

The growing pharmaceutical industry in the region also presents significant opportunities for Clean in Place system suppliers, as companies upgrade their facilities to meet international standards.

Latin America and Middle East and Africa

Latin America and the Middle East and Africa are emerging markets for Clean in Place systems. Growth in these regions is driven by expanding food and dairy industries and increasing awareness of hygiene standards. While adoption rates are currently lower compared to developed regions, rising investments in manufacturing infrastructure are expected to fuel steady growth in the coming years.

Competitive Landscape

The Clean in Place market is competitive, with numerous global and regional players offering a wide range of systems and solutions. Leading companies are focusing on innovation, sustainability, and integration capabilities to differentiate their offerings. Key strategies include the development of energy efficient and water saving systems, integration with digital monitoring platforms, and customization to meet specific industry requirements.

Mergers and acquisitions, strategic partnerships, and expansion into emerging markets are common strategies as companies seek to strengthen their market positions. The growing emphasis on smart manufacturing and the Industrial Internet of Things is also leading to the development of intelligent Clean in Place systems capable of predictive maintenance and performance optimization.

Future Outlook

The future of the Clean in Place market looks promising as industries continue to prioritize hygiene, efficiency, and sustainability. Technological innovations will play a crucial role in shaping the next generation of systems. Developments in sensors, data analytics, and control systems will enable more precise and automated cleaning processes.

Sustainability will remain a central theme, with manufacturers focusing on reducing water and chemical usage through advanced reuse systems and recovery technologies. Regulatory frameworks are expected to become even more stringent, further driving demand for reliable and compliant cleaning solutions.

Emerging markets will offer significant growth opportunities as industries modernize their facilities and adopt global hygiene standards. Companies that can provide cost effective, scalable, and sustainable Clean in Place solutions will be well positioned to capitalize on these opportunities.

Scope of the Report:

This report categorizes the modular robotics market based on robot type, industry, and region.

By Robot Type:

- Articulated modular robots

- Cartesian modular robots

- SCARA modular robots

- Parallel modular robots

- Collaborative modular robots

-

Other modular robots

- Spherical robots

- Cylindrical robots

By Industry:

- Automotive

- Electrical and Electronics

- Plastic, Rubber, and Chemicals

- Metals and Machinery

- Food & Beverages

- Precision Engineering and Optics

- Pharmaceuticals and Cosmetics

- Others(oil & gas; paper and printing; foundry and forging; ceramics and stone; construction; textiles and clothing; supply chain management; and wood industries.)

By Region:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (Belgium, Sweden, Poland, and the Czech Republic among others)

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC (Taiwan, Thailand, Malaysia, Indonesia, Australia, and New Zealand among others)

-

Rest of the World (RoW)

- The Middle East and Africa

- South America

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Years Considered

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

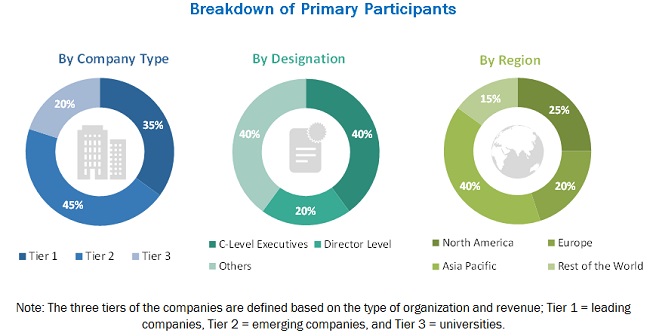

2.1.2.2 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in Modular Robotics Market

4.2 Market, By Robot Type

4.3 Market, By Industry

4.4 Market in APAC, Country vs Industry

4.5 Market, By Country

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics: Overview

5.2.1 Drivers

5.2.1.1 Growing Investments in Industrial Automation

5.2.1.2 Increasing Adoption of Collaborative Modular Robots Owing to Their Benefits and Features

5.2.2 Restraints

5.2.2.1 Complexity of Modular Robots With Respect to Their Designs and Controlling Electronics

5.2.3 Opportunities

5.2.3.1 Rising Adoption of Robotics-As-A-Service Model

5.2.4 Challenges

5.2.4.1 Interoperability Issues and Difficulty in Integration of Different Robotic Frameworks Into Existing Facilities

5.2.4.2 Address the Need for Safe Handling of Industrial-Grade Operations

5.3 Value Chain Analysis

6 Architecture of Modular Robots (Page No. - 40)

6.1 Introduction

6.2 Chain Type

6.3 Lattice Type

6.4 Hybrid Type

7 Modular Robotics Market, By Robot Type (Page No. - 42)

7.1 Introduction

7.2 Articulated Modular Robots

7.2.1 Articulated Modular Robots to Hold Largest Share of Market By 2018

7.3 Cartesian Modular Robots

7.3.1 Cartesian Modular Robots to Hold Second-Largest Share of Market By 2018.

7.4 Scara Modular Robots

7.4.1 Best Price-To-Performance Ratio Offered By Scara Modular Robots for High-Speed Applications to Drive Market During Forecast Period

7.5 Parallel Modular Robots

7.5.1 High Adoption Rate for Pick-And-Place Applications in Food & Beverages Industry to Drive Market for Parallel Modular Robots

7.6 Collaborative Modular Robots

7.6.1 Ability to Work Safely Alongside Humans Expected to Fuel Growth of Market for Collaborative Modular Robots

7.7 Other Modular Robots

7.7.1 Spherical Robots

7.7.1.1 Ability to Optimally Perform Tasks Involving Low-Weight Payloads Drives Market for Spherical Modular Robots

7.7.2 Cylindrical Robots

7.7.2.1 Adoption of Cylindrical Modular Robots in Manufacturing Industries for Welding Applications is Key Factor Driving Factor

8 Modular Robotics Market, By Industry (Page No. - 53)

8.1 Introduction

8.2 Automotive

8.2.1 Adoption of Modular Robots for Automatizing Assembly Lines is Key Factor Driving Growth of Market for Automotive Industry

8.3 Electrical and Electronics

8.3.1 Ability of Modular Robotics Systems to Enable Efficient Automation and Systematic Manufacturing Processes to Boost Their Adoption in Electrical and Electronics Industry

8.4 Plastics, Rubber, and Chemicals

8.4.1 Capability to Handle Hazardous Explosive Substances Boosts Adoption of Modular Robots in Plastics, Rubber, and Chemicals Industry

8.5 Metals and Machinery

8.5.1 High Rate of Adoption of Modular Robots for Applications Such as Welding and Pick-And-Place to Drive Market for Metals and Machinery Industry

8.6 Food & Beverages

8.6.1 Adoption of Parallel Modular Robots for Pick-And-Place Application is Key Trend Observed in Food & Beverages Industry

8.7 Precision Engineering and Optics

8.7.1 Adoption of Modular Robotics System for Error-Proofing Processes in Precision Engineering and Optics Industry to Fuel Growth of Modular Robotics Market During Forecast Period

8.8 Pharmaceuticals and Cosmetics

8.8.1 Use of Modular Robots in Pharmaceuticals and Cosmetics Industries to Handle Hazardous Biologicals and Radioactive Substances to Drive Growth of Market

8.9 Others

8.9.1 Adoption of Modular Robots in Other Industries to Perform Tasks Such as Material Removal Increasing Adoption of Modular Robotic Systems in Industries Such as Wood and Glass to Fuel Growth of Market for Other Industries

9 Geographic Analysis (Page No. - 85)

9.1 Introduction

9.2 North America

9.2.1 Us

9.2.1.1 US Held Largest Share of Modular Robotics Market in 2017

9.2.2 Canada

9.2.2.1 Increasing Adoption of Modular Robots in Electrical and Electronics Industry to Drive Market in Canada During Forecast Period

9.2.3 Mexico

9.2.3.1 Increasing Adoption of Modular Robotic Systems in Automotive Industry to Fuel Growth of Market in Mexico

9.3 Europe

9.3.1 Germany

9.3.1.1 Automotive Industry Was Largest Contributor to Market in Germany in 2017

9.3.2 France

9.3.2.1 Adoption of Modular Robotics Systems in Electrical and Electronics Industry to Automate Integration Process to Fuel Growth of Market in France

9.3.3 Uk

9.3.3.1 Food & Beverages Industry to Drive Market in the UK During Forecast Period

9.3.4 Italy

9.3.4.1 High Rate of Adoption of Modular Robots for Applications Such as Welding, Pick and Place, and Packing is Key Driver for Market in Italy

9.3.5 Spain

9.3.5.1 Increasing Adoption of Modular Robotic Systems for Applications Such as Handling and Painting Drives Market in Spain

9.3.6 Rest of Europe

9.3.6.1 Shortage of Skilled Labors is Key Factor Driving Market in Rest of European Countries

9.4 APAC

9.4.1 China

9.4.1.1 Automotive Industry Held Largest Share of Modular Robotics Market in China in 2017

9.4.2 Japan

9.4.2.1 Various Government Polices Promoting Utilization of Robots in Various Industries Fuel Implementation of Modular Robotics in Japan

9.4.3 South Korea

9.4.3.1 Increasing Adoption of Modular Robotic Systems in Electrical and Electronics Industry to Contribute to Growth of Market in South Korea

9.4.4 India

9.4.4.1 Rising Labor Cost is Key Factor Driving Growth of Market in India

9.4.5 Rest of APAC

9.4.5.1 Increasing Penetration Rate of Modular Robotic Systems in Automotive Industry to Drive Market in Rest of APAC

9.5 RoW

9.5.1 South America

9.5.1.1 Increasing Focus on Manufacturing By Global Players is Key Factor Driving Market in South America

9.5.2 Middle East and Africa

9.5.2.1 Rising Adoption of Automation Services is Leading to Steady Growth of Market in Middle East and Africa

10 Competitive Landscape (Page No. - 97)

10.1 Introduction

10.2 Modular Robotics Market Ranking Analysis, 2017

10.3 Competitive Situations and Trends

10.3.1 Product Launches

10.3.2 Partnerships and Collaborations

10.3.3 Expansions

10.3.4 Contracts and Agreements

10.3.5 Acquisitions

11 Company Profiles (Page No. - 103)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Key Players

11.1.1 ABB

11.1.2 Fanuc

11.1.3 Kuka

11.1.4 Yaskawa

11.1.5 Kawasaki Heavy Industries

11.1.6 Mitsubishi Electric

11.1.7 Denso

11.1.8 Nachi-Fujikoshi

11.1.9 Universal Robots A/S

11.1.10 Rethink Robotics

11.2 Other Key Players

11.2.1 Stäubli International

11.2.2 Daihen

11.2.3 Cma Robotics Spa

11.2.4 Yamaha Motor

11.2.5 Engel

11.2.6 Comau S.P.A

11.2.7 Aurotek

11.2.8 Toshiba Machine

11.2.9 Acmi Spa

11.2.10 Cassioli Srl

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 133)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (68 Tables)

Table 1 Modular Robotics Market, By Robot Type, 2015–2023 (USD Million)

Table 2 Market, By Robot Type, 2015–2023 (Units)

Table 3 Market for Articulated Modular Robots, By Industry, 2015–2023 (USD Million)

Table 4 Market for Cartesian Modular Robots, By Industry, 2015–2023 (USD Million)

Table 5 Market for Scara Modular Robots, By Industry, 2015–2023 (USD Million)

Table 6 Market for Parallel Modular Robots, By Industry, 2015–2023 (USD Million)

Table 7 Market for Collaborative Modular Robots, By Industry, 2015–2023 (USD Million)

Table 8 Market for Other Modular Robots, By Industry, 2015–2023 (USD Million)

Table 9 Market, By Industry, 2015–2023 (USD Million)

Table 10 Market for Automotive, By Region, 2015–2023 (USD Million)

Table 11 Market for Automotive in North America, By Country, 2015–2023 (USD Million)

Table 12 Market for Automotive in Europe, By Country, 2015–2023 (USD Million)

Table 13 Market for Automotive in APAC, By Country, 2015–2023 (USD Million)

Table 14 Market for Automotive in RoW, By Region, 2015–2023 (USD Million)

Table 15 Market for Automotive, By Robot Type, 2015–2023 (USD Million)

Table 16 Market for Electrical and Electronics in North America, By Country, 2015–2023 (USD Million)

Table 17 Market for Electrical and Electronics, By Region, 2015–2023 (USD Million)

Table 18 Market for Electrical and Electronics in Europe, By Country, 2015–2023 (USD Million)

Table 19 Market for Electrical and Electronics Industry in APAC, By Country, 2015–2023 (USD Million)

Table 20 Market for Electrical and Electronics in RoW, By Region, 2015–2023 (USD Million)

Table 21 Market for Electrical and Electronics, By Robot Type, 2015–2023 (USD Million)

Table 22 Market for Plastics, Rubber, and Chemicals, By Region, 2015–2023 (USD Million)

Table 23 Market for Plastics, Rubber, and Chemicals Industries in North America, By Country, 2015–2023 (USD Million)

Table 24 Market for Plastics, Rubber, and Chemicals in Europe, By Country, 2015–2023 (USD Million)

Table 25 Market for Plastics, Rubber, and Chemicals in APAC, By Country, 2015–2023 (USD Million)

Table 26 Market for Plastics, Rubber, and Chemicals in RoW, By Region, 2015–2023 (USD Million)

Table 27 Market for Plastics, Rubber, and Chemicals, By Robot Type, 2015–2023 (USD Million)

Table 28 Market for Metals and Machinery, By Region, 2015–2023 (USD Million)

Table 29 Market for Metals and Machinery in North America, By Country, 2015–2023 (USD Million)

Table 30 Market for Metals and Machinery in Europe, By Country, 2015–2023 (USD Million)

Table 31 Market for Metals and Machinery in APAC, By Country, 2015–2023 (USD Million)

Table 32 Market for Metals and Machinery in RoW, By Region, 2015–2023 (USD Million)

Table 33 Market for Metal and Machinery, By Rob0t Type, 2015–2023 (USD Million)

Table 34 Market for Food & Beverages, By Region, 2015–2023 (USD Million)

Table 35 Market for Food & Beverages in North America, By Country, 2015–2023 (USD Million)

Table 36 Market for Food & Beverages in Europe, By Country, 2015–2023 (USD Million)

Table 37 Market for Food & Beverages in APAC, By Country, 2015–2023 (USD Million)

Table 38 Market for Food & Beverages in RoW, By Region, 2015–2023 (USD Million)

Table 39 Market for Food & Beverages, By Robot Type, 2015–2023 (Million)

Table 40 Market for Precision Engineering and Optics, By Region, 2015–2023 (USD Million)

Table 41 Market for Precision Engineering and Optics in North America, By Country, 2015–2023 (USD Million)

Table 42 Market for Precision Engineering and Optics in Europe, By Country, 2015–2023 (USD Million)

Table 43 Market for Precision Engineering and Optics in APAC, By Country, 2015–2023 (USD Million)

Table 44 Market for Precision Engineering and Optics in RoW, By Region, 2015–2023 (USD Million)

Table 45 Market for Precision Engineering and Optics Industry, By Robot Type, 2015–2023 (Million)

Table 46 Market for Pharmaceuticals and Cosmetics, By Region, 2015–2023 (USD Million)

Table 47 Market for Pharmaceuticals and Cosmetics in North America, By Country, 2015–2023 (USD Million)

Table 48 Market for Pharmaceuticals and Cosmetics in Europe, By Country, 2015–2023 (Million)

Table 49 Market for Pharmaceuticals and Cosmetics in APAC, By Country, 2015–2023 (USD Million)

Table 50 Market for Pharmaceuticals and Cosmetics in RoW, By Region, 2015–2023 (USD Million)

Table 51 Market for Pharmaceuticals and Cosmetics, By Robot Type, 2015–2023 (USD Million)

Table 52 Market for Others, By Region, 2015–2023 (USD Million)

Table 53 Market for Others in North America, By Country, 2015–2023 (USD Million)

Table 54 Market for Others in Europe, By Country, 2015–2023 (USD Million)

Table 55 Market for Others in APAC, By Country, 2015–2023 (USD Million)

Table 56 Market for Others in RoW, By Region, 2015–2023 (USD Million)

Table 57 Market for Others, By Robot Type, 2015–2023 (USD Million)

Table 58 Market, By Region, 2015–2023 (USD Million)

Table 59 Market in North America, By Country, 2015–2023 (USD Million)

Table 60 Market in Europe, By Country, 2015–2023 (USD Million)

Table 61 Market in APAC, By Country, 2015–2023 (USD Million)

Table 62 Market in RoW, By Region, 2015–2023 (USD Milllion)

Table 63 Market Ranking, 2017

Table 64 Product Launches, 2015–2017

Table 65 Partnerships and Collaborations, 2015–2017

Table 66 Expansions, 2015–2017

Table 67 Contracts and Agreements, 2015–2017

Table 68 Acquisitions, 2015–2017

List of Figures (45 Figures)

Figure 1 Segmentation of Modular Robotics Market

Figure 2 Market: Research Design

Figure 3 Market: Bottom-Up Approach

Figure 4 Market: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Articulated Modular Robots to Hold Largest Share of Market Based on Robot Type By 2018

Figure 7 Automotive Industry to Hold Largest Share of Market By 2018

Figure 8 APAC to Hold Largest Share of Market By 2018

Figure 9 Growing Investments for Automation in Industries Drives Growth of Market

Figure 10 Articulated Modular Robots to Hold Largest Size of Market By 2018

Figure 11 Automotive Industry to Hold Largest Share of Market By 2018

Figure 12 China to Hold Largest Share of Market in APAC By 2018

Figure 13 China to Hold Largest Share of Market From 2018–2023

Figure 14 Growing Investments in Industrial Automation Drives Market

Figure 15 Modular Robotic Value Chain Analysis: Maximum Value Added During R&D Stage

Figure 16 Diagrammatic Representation of Chain Type Modular Robots

Figure 17 Diagrammatic Representation of Lattice Type Modular Robots

Figure 18 Market for Collaborative Robots to Grow at Highest CAGR During Forecast Period

Figure 19 Automotive to Hold Largest Share of Market for Articulated Modular Robots By 2018

Figure 20 Electrical & Electronics to Hold Largest Size of Market for Scara Modular Robots By 2023

Figure 21 Automotive Industry to Hold Largest Share of Market for Collaborative Modular Robots By 2023

Figure 22 Market for Metals & Machinery to Grow at Highest CAGR During Forecast Period

Figure 23 Modular Robotics Market for Automotive in APAC to Grow at Highest CAGR During Forecast Period

Figure 24 US to Hold Largest Size of Market for Electrical and Electronics in North America By 2018

Figure 25 China to Hold Largest Size of Market for Plastics, Rubber, and Chemicals in APAC in 2018

Figure 26 APAC to Hold Largest Size of Market for Metals and Machinery in 2023

Figure 27 Germany to Hold Largest Size of Market for Food and Beverages in 2018

Figure 28 Market for Precision Engineering and Optics in APAC to Grow at Highest CAGR During Forecast Period

Figure 29 Market for Pharmaceuticals and Cosmetics in Mexico to Grow at Highest CAGR During Forecast Period

Figure 30 US to Hold Largest Size of Market for Others During Forecast Period

Figure 31 Market in APAC to Grow at Significant CAGR During Forecast Period

Figure 32 North America: Market Snapshot

Figure 33 Europe: Market Snapshot

Figure 34 APAC: Market Snapshot

Figure 35 Market in South America to Grow at Higher CAGR During Forecast Period

Figure 36 Players in Market Adopted Product Launches as Their Key Growth Strategy From 2015 to 2017

Figure 37 Product Launches, Partnerships, and Collaborations as Key Business Strategies Adopted By Market Players During 2015–2017

Figure 38 ABB: Company Snapshot

Figure 39 Fanuc: Company Snapshot

Figure 40 Kuka: Company Snapshot

Figure 41 Yaskawa: Company Snapshot

Figure 42 Kawasaki Heavy Industries: Company Snapshot

Figure 43 Mitsubishi Electric: Company Snapshot

Figure 44 Denso: Company Snapshot

Figure 45 Nachi-Fujikoshi: Company Snapshot

The study involved four major activities in estimating the current size of the modular robotics market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the modular robotics market begins with capturing data on revenue of key vendors in the market through secondary research. This study incorporates the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the market. Vendor offerings have also been considered to determine the market segmentation. This entire research methodology includes the study of annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

The modular robotics market comprises several stakeholders, such as suppliers of raw material and manufacturing equipment; standard components, original equipment manufacturers (OEMs); original device manufacturers (ODMs) of modular robotics; solutions providers; vendors of assembly, testing, and packaging solutions; and system integrators in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the modular robotics market. These methods have also been used extensively to estimate the size of various market subsegments. The research methodology used to estimate the market size includes the following:

- Key players in major application areas and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Research Objective

- To define, describe, and forecast the overall modular robotics market, in terms of value, segmented based on robot type, industry, and geography

- To forecast the market size for various segments with regard to 4 regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To forecast the market based on robot type in terms of volume

- To provide qualitative information regarding various architectures of modular robotic systems

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To provide a detailed overview of modular robotics value chain

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments

- To strategically profile key players, comprehensively analyze their market rankings and core competencies, and detail the competitive landscape for market leaders

- To analyze competitive developments such as product launches and development; contracts and agreement; partnerships and collaboration; and acquisition in the overall modular robotics market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Market size for 2019 and 2021 for segments such as robot type, and vertical, geography.

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Critical questions would be;

- The modular robotics ecosystem faces the major challenge regarding the interoperability and integration with existing platforms. When will this scenario ease out?

- What are the approaches followed by the industry players to address this challenge?

Growth opportunities and latent adjacency in Modular Robotics Market

Why the modular robots emerging? People won't buy the modular robotic joints/gear, reconfigure their own robot at all. Robot is a robotic system. What's the potential of modular robotic joint/gear?