Modular Chillers Market by Type (Air-Cooled, Water-Cooled), Application (Commercial, Industrial, Residential), and Region (North America, Europe, APAC, the Middle East & Africa, and South America) - Global Forecast to 2024

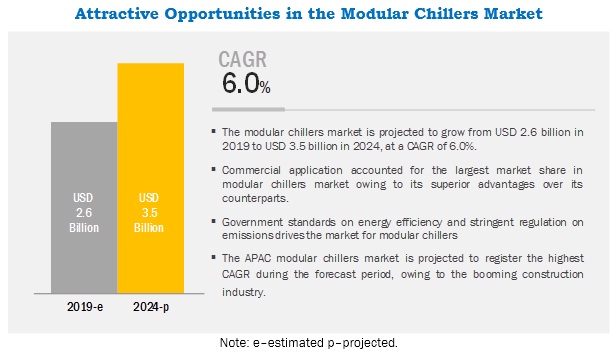

[108 Pages Report] The modular chillers market size is estimated to be USD 2.6 billion in 2019 and is projected to reach USD 3.5 billion by 2024, at a CAGR of 6.0%. The growth in global commercial construction industry along with the competitive advantages of modular chillers is a major driving factor of the modular chillers market.

The water-cooled modular chillers dominates the market; whereas air-cooled modular chillers is expected to be the faster -growing segment during the forecast period.

The water-cooled type segment accounted for the largest share of the market, owing to its superior performance compared to the air cooled systems. The water-cooled modular chillers are ideal for cooling at large commercial places, such as corporate offices, schools, shopping malls, and hospitals. On the other hand, the air cooled segment is projected to register the higher growth, owing to its low operating cost and compact design.

The commercial application accounted for largest market share and is also projected to register the highest CAGR during the forecast period.

The commercial application segment is accounted for the largest market share and is projected to register the highest growth rate during the forecast period. The high demand from commercial applications is attributed to its high demand in the HVAC systems. Commercial applications includes air conditioning in commercial infrastructures, such as commercial offices, government buildings, schools, hospitals, shopping malls, and hotels. Population growth is expected to create demand for these commercial construction projects, which would, in turn, create the demand for modular chillers.

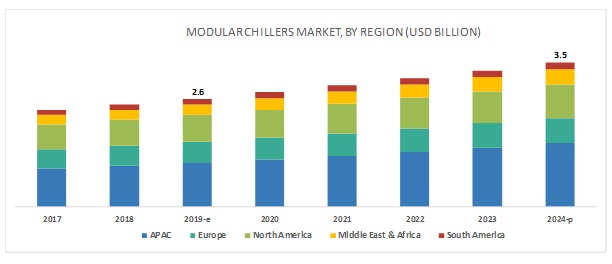

APAC is projected to be the largest market during the forecast period.

APAC has the most populous countries, namely, China and India. China, Japan, South Korea, and India are the key markets for modular chillers in APAC. In 2018, China accounted for the largest share of the APAC market, owing to the presence of huge HVAC and construction industries. According to the World Bank, India is expected to be one of the worlds fastest-growing economies with an estimated annual GDP expansion rate of more than 7.0% during the forecast period. In addition, the overall demand for ACs across APAC countries witnessed high growth in 2018. Thus, the overall economic scenario in APAC is favorable for the growth of the modular chillers market.

Key Market Players

Carrier Corporation (US), McQuay Air-Conditioning (Hong Kong), Johnson Controls- Hitachi Air Conditioning (Japan), Midea Group (China), Ingersoll Rand (Ireland), Gree Electric Appliances (China), Frigel Firenze (Italy), Mitsubishi Electric Corporation (Japan), Multistack (US), and Haier Group (China) are the key players operating in the modular chillers market.

These companies have adopted various organic as well as inorganic growth strategies between 2015 and 2019 to strengthen their positions in the market. Acquisition is the key growth strategy adopted by these leading players to enhance regional presence and product portfolios to meet the growing demand for modular chillers from emerging economies.

Scope of the Report:

|

Report Metric |

Details |

|

Years considered for the study |

20172024 |

|

Base year |

2018 |

|

Forecast period |

20192024 |

|

Units considered |

Value (USD Million) |

|

Segments |

Type, Application, and Region |

|

Regions |

North America, APAC, Europe, the Middle East & Africa, and South America |

|

Companies |

Carrier Corporation (US), McQuay Air-Conditioning Ltd., (Hong Kong), Johnson Controls- Hitachi Air Conditioning (Japan), Midea Group (China), Ingersoll Rand (Ireland), Gree Electric Appliances, Inc. (China), Frigel Firenze S.p.A. (Italy), Mitsubishi Electric Corporation (Japan), Multistack, LLC. (US), and Haier Group (China). |

This research report categorizes the modular chillers market based on type, application, and region.

Modular Chillers Market, by Type:

- Water-cooled modular chillers

- Air-cooled modular chillers

Modular Chillers Market, by Application:

- Commercial

- Corporate Offices

- Data Centers

- Public Buildings

- Residential

- Multifamily and Hospitality

- Industrial

- Cold storages

- Others

Modular Chillers Market, by Region:

- North America

- APAC

- Europe

- Middle East & Africa

- South America

The modular chillers market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In May 2019, Frigel Firenze launched new modular chillers; 3FX chillers. These chillers are available in 12 models. Seven models come with screw compressors and the remaining five come with scroll compressors. These chillers cater to industrial applications.

- In March 2018, Mitsubishi Electric Hydronics & IT Cooling Systems acquired chillers distributor Topclima of Climaveneta in Spain. This acquisition of Topclima helps the company to use the assets efficiently for business development.

- In January 2018, Ingersoll Rand acquired ICS Group Holdings Ltd (UK), a leading HVAC solution provider in Europe. This acquisition enables the company to cater to a broad range of customers and strengthen its growth in the European market.

- In June 2016, Midea Group acquired 80.0% stake in Clivet S.p.A. (Italy). The company is a leading manufacturer of air conditioning and heating systems for residential, commercial, and industrial applications. This acquisition will complement the companys existing product portfolio and reinforce its presence in the European HVAC market

- In April 2015, Carrier Corporation acquired minority stakes in Chongqing Midea General Refrigeration Equipment Co. Ltd. (CQ Midea). This strategic joint venture boosts the growth of the companies in the APAC market.

Critical questions the report answers:

- What are the upcoming hot bets for the modular chillers market?

- What are the market dynamics for different types of modular chillers?

- What are the major applications of modular chillers?

- Who are the major manufacturers of modular chillers?

- What are the factors driving the modular chillers market in each region?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Limitations

2.4.1 Methodology Limitations

2.5 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Modular Chillers Market

4.2 Modular Chillers Market, By Type

4.3 Modular Chillers Market, By Application

4.4 APAC Modular Chillers Market, By Application and Country

4.5 Modular Chillers Market, By Key Countries

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in the Number of Commercial Construction Projects

5.2.1.2 Advantages of Modular Chillers Over Traditional Chillers

5.2.2 Restraint

5.2.2.1 High Setup Cost of Modular Chillers

5.2.3 Opportunity

5.2.3.1 Growing Industrial Applications

5.2.3.2 Replacement of Currently Installed Chillers

5.2.4 Challenge

5.2.4.1 High Electricity Consumption

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Buyers

5.3.4 Bargaining Power of Suppliers

5.3.5 Intensity of Competitive Rivalry

6 Macroeconomic Overview (Page No. - 37)

6.1 Introduction

6.1.1 Real GDP Growth Rate and Per Capita GDP of Major Economies

6.2 Trends of HVAC Industry

6.2.1 Ac Units Demand in North America

6.2.2 Ac Units Demand in Europe

6.2.3 Ac Units Demand in APAC

7 Modular Chillers Market, By Type (Page No. - 40)

7.1 Introduction

7.1.1 Water-Cooled Modular Chillers

7.1.1.1 Water-Cooled Modular Chillers Have High Demand Owing to the High Efficiency

7.1.2 Air-Cooled Modular Chillers

7.1.2.1 Low Operating Cost and Environmental Footprint is Driving the Demand for Air-Cooled Modular Chillers

8 Modular Chillers Market, By Application (Page No. - 43)

8.1 Introduction

8.2 Commercial

8.2.1 Corporate Offices

8.2.1.1 Transformation of Suburban Cities to Urban Cities is Majorly Driving the Number of Corporate Offices

8.2.2 Data Centers

8.2.2.1 Data Centers are One of the Largest Consumers of Modular Chillers System

8.2.3 Public Buildings

8.2.3.1 Growth in the Population is Driving the Number of Public Buildings

8.3 Residential

8.3.1 Multifamily Building and Hospitality

8.3.1.1 Growing Demand for Luxury Apartment is Expected to Drive the Modular Chillers Market in the Multifamily and Hospitality Segment

8.4 Industrial

8.4.1 Cold Storages

8.4.1.1 Use of Ac in Food Storage Facilities is Likely to Create A Huge Demand for Modular Chillers

8.5 Others

9 Modular Chillers Market, By Region (Page No. - 47)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.1.1 China is the Largest Producer and Consumer of Ac Units

9.2.2 Japan

9.2.2.1 Modular Chillers Demand is Majorly Driven By the Moderate Growth in the Commercial Infrastructure Sector

9.2.3 India

9.2.3.1 Growth in Commercial Construction is Likely to Influence the Demand for Modular Chillers Positively

9.2.4 South Korea

9.2.4.1 The Modular Chillers Market is Affected Positively By the Increasing Demand for Ac Systems

9.2.5 Rest of APAC

9.3 North America

9.3.1 US

9.3.1.1 Transformation of Suburban Cities Into Urban Cities is Providing A Boost to the Modular Chillers Market

9.3.2 Canada

9.3.2.1 Canadas Modular Chillers Market is Majorly Driven By Its Booming Construction Industry

9.3.3 Mexico

9.3.3.1 Growth in Commercial Construction Driven By Urbanization is Influencing the Market Positively

9.4 Europe

9.4.1 Italy

9.4.1.1 Ongoing Infrastructural Developments in Basilicata and Puglia Regions are Increasing the Demand for Modular Chillers

9.4.2 Germany

9.4.2.1 Governments Goal to Complete Climate-Neutral Infrastructure Across the Country By 2050 is A Major Opportunity for the Market

9.4.3 France

9.4.3.1 The Impressive Growth of the HVAC Industry in Recent Years is Promising for the Market

9.4.4 UK

9.4.4.1 The Recovering Construction Industry and Steady HVAC Systems Demand are Likely to Propel the Market

9.4.5 Russia

9.4.5.1 The Growing Demand for Ac Units in the HVAC Industry is Fueling the Market Growth

9.4.6 Spain

9.4.6.1 The Market is Driven By the Positive Scenario in the Residential Construction Sector, Which Includes New Building Permits Across the Country

9.4.7 Rest of Europe

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.1.1 Upcoming Infrastructural Development Projects in Various Sectors, Including Transportation, Will Generate Potential Growth Opportunities for the Market

9.5.2 UAE

9.5.2.1 Infrastructural Development in All the Major Cities of the Country is Propelling the Demand for Modular Chillers

9.5.3 South Africa

9.5.3.1 Increasing Population and Subsequent Growth in Residential and Commercial Construction are Driving the Market

9.5.4 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.1.1 Growing Residential and Non-Residential Construction is Driving the HVAC Industry Increasing the Demand for Modular Chillers

9.6.2 Rest of South America

10 Competitive Landscape (Page No. - 77)

10.1 Overview

10.2 Competitive Leadership Mapping, 2018

10.2.1 Terminology/Nomenclature

10.2.1.1 Visionary Leaders

10.2.1.2 Innovators

10.2.1.3 Dynamic Differentiators

10.2.1.4 Emerging Companies

10.2.2 Strength of Product Portfolio

10.2.3 Business Strategy Excellence

10.3 Market Ranking of Key Players, 2018

10.4 Competitive Scenario

10.4.1 New Product Launch

10.4.2 Expansion

10.4.3 Acquisition & Joint Venture

11 Company Profiles (Page No. - 86)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Ingersoll Rand

11.2 Gree Electric Appliances

11.3 Carrier Corporation

11.4 Frigel Firenze

11.5 Midea Group

11.6 Multistack

11.7 Mcquay Air-Conditioning

11.8 Johnson Controls-Hitachi Air Conditioning

11.9 Qingdao Haier

11.10 Mitsubishi Electric Hydronics & It Cooling Systems

11.11 Other Players

11.11.1 Aermec

11.11.2 Climacool

11.11.3 Kingair Machinery

11.11.4 LG Electronics

11.11.5 Suzhou Sujing Bush Refrigeration Equipment

11.11.6 Tica Climate Solutions

11.11.7 Withair Industries

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 103)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (68 Tables)

Table 1 Annual Percent Change of Real GDP Growth Rates (20162023)

Table 2 Trends and Forecast of GDP Per Capita, By Country, 20162020 (USD)

Table 3 Overall Ac Demand in North America, 20152017 (Thousand Units)

Table 4 Overall Ac Demand in Europe, 20152017 (Thousand Units)

Table 5 Overall Ac Demand in APAC, 20152017 (Thousand Units)

Table 6 Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 7 Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 8 Modular Chillers Market Size, By Region, 20172024 (USD Million)

Table 9 APAC: Modular Chillers Market Size, By Country, 20172024 (USD Million)

Table 10 APAC: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 11 APAC: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 12 China: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 13 China: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 14 Japan: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 15 Japan: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 16 India: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 17 India: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 18 South Korea: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 19 South Korea: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 20 Rest of APAC: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 21 Rest of APAC: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 22 North America: Modular Chillers Market Size, By Country, 20172024 (USD Million)

Table 23 North America: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 24 North America: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 25 US: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 26 US: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 27 Canada: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 28 Canada: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 29 Mexico: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 30 Mexico: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 31 Europe: Modular Chillers Market Size, By Country, 20172024 (USD Million)

Table 32 Europe: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 33 Europe: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 34 Italy: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 35 Italy: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 36 Germany: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 37 Germany: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 38 France: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 39 France: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 40 UK: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 41 UK: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 42 Russia: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 43 Russia: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 44 Spain: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 45 Spain: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 46 Rest of Europe: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 47 Rest of Europe: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 48 Middle East & Africa: Modular Chillers Market Size, By Country, 20172024 (USD Million)

Table 49 Middle East & Africa: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 50 Middle East & Africa: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 51 Saudi Arabia: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 52 Saudi Arabia: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 53 UAE: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 54 UAE: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 55 South Africa: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 56 South Africa: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 57 Rest of Middle East & Africa: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 58 Rest of Middle East & Africa: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 59 South America: Modular Chillers Market Size, By Country, 20172024 (USD Million)

Table 60 South America: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 61 South America: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 62 Brazil: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 63 Brazil: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 64 Rest of South America: Modular Chillers Market Size, By Type, 20172024 (USD Million)

Table 65 Rest of South America: Modular Chillers Market Size, By Application, 20172024 (USD Million)

Table 66 New Product Launch, 20152019

Table 67 Expansion, 20152019

Table 68 Acquisition & Joint Venture, 20152019

List of Figures (32 Figures)

Figure 1 Modular Chillers Market: Research Design

Figure 2 Modular Chillers Market: Bottom-Up Approach

Figure 3 Modular Chillers Market: Top-Down Approach

Figure 4 Modular Chillers Market: Data Triangulation

Figure 5 Water-Cooled Type Accounted for the Larger Market Share in 2018

Figure 6 Commercial to Be the Fastest-Growing Application

Figure 7 APAC to Be the Fastest-Growing Modular Chillers Market

Figure 8 Increasing Demand for Space Cooling to Drive the Modular Chillers Market

Figure 9 Water-Cooled to Be the Larger Type Segment in the Modular Chillers Market

Figure 10 Commercial to Be the Largest Application of Modular Chillers By 2024

Figure 11 Commercial Was the Largest Application Segment and China the Largest Market in APAC in 2018

Figure 12 India to Register the Highest CAGR in the Market

Figure 13 Drivers, Restraints, Opportunities, and Challenges in the Modular Chillers Market

Figure 14 Porters Five Forces Analysis: Modular Chillers Market

Figure 15 Water-Cooled to Be the Larger Type Segment in the Modular Chillers Market

Figure 16 Commercial to Be the Largest Application Segment

Figure 17 APAC to Register the Highest CAGR in the Modular Chillers Market

Figure 18 APAC: Modular Chillers Market Snapshot

Figure 19 North America: Modular Chillers Market Snapshot

Figure 20 Europe: Modular Chillers Market Snapshot

Figure 21 Companies Adopted Acquisition as the Key Strategy Between 2015 and 2019

Figure 22 Modular Chillers Market: Competitive Leadership Mapping, 2018

Figure 23 Market Ranking, 2018

Figure 24 Ingersoll Rand: Company Snapshot

Figure 25 Ingersoll Rand: SWOT Analysis

Figure 26 Gree Electric Appliances: SWOT Analysis

Figure 27 Carrier Corporation: Company Snapshot

Figure 28 Carrier Corporation: SWOT Analysis

Figure 29 Frigel Firenze: SWOT Analysis

Figure 30 Midea Group: Company Snapshot

Figure 31 Midea Group: SWOT Analysis

Figure 32 Qingdao Haier: Company Snapshot

The study has involved four major activities in estimating the current market size for modular chillers. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain, through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. The market breakdown and data triangulation methodologies were then used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

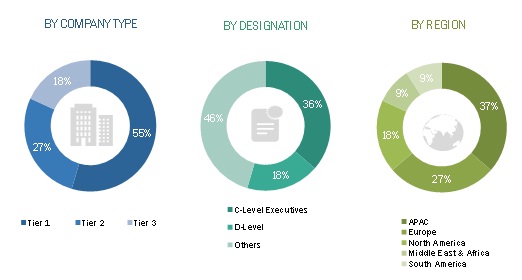

The modular chillers market comprises several stakeholders, such as raw material suppliers, distributors of modular chillers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of manufacturers and suppliers of the HVAC industry. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the modular chillers market. These methods were also used extensively to estimate the size of various sub segments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation process explained above-the market was split into several segments and sub segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply of modular chillers and their applications.

Objectives of the Study:

- To define, describe, and forecast the modular chillers market, in terms of value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market, by type and application

- To forecast the size of the market with respect to five regions, namely, APAC, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as new product launch, acquisition, joint venture, and expansion, undertaken in the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Notes: Micromarkets1 are the subsegments of the modular chillers market included in the report. Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Available Customizations:

MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the modular chillers market

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Modular Chillers Market