MVNO Market by Operational Model (Reseller, Service Operator, Full MVNO), Subscriber (Consumer, Enterprise), Service Type (Postpaid, Prepaid), Business Model (Discount, Ethnic, Business, Youth/Media) and Region - Global Forecast to 2028

Updated on : Feb 02, 2026

Mobile Virtual Network Operator (MVNO) Market - Worldwide | Future Scope & Trends

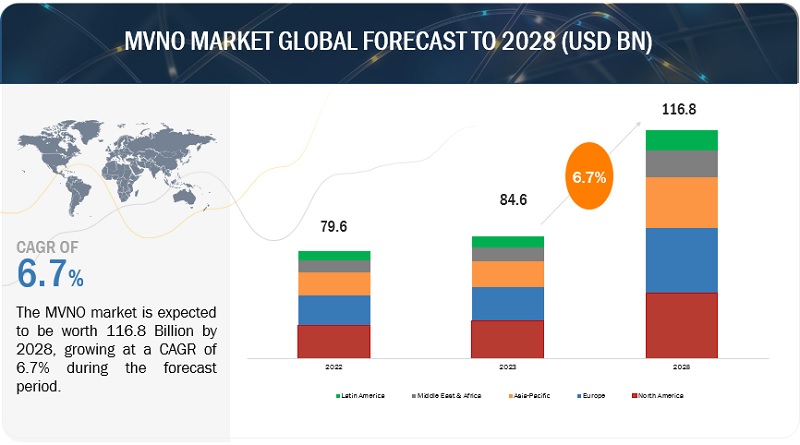

The global MVNO Market is projected to grow significantly, increasing from USD 84.6 billion in 2023 to USD 116.8 billion by 2028, with a robust CAGR of 6.7%. Many countries, such as US, China, UK, Brazil, Germany and Japan, are industrial automation and digital manufacturing leaders. The deployment of IoT devices and connectivity solutions in the automotive, electronics, and robotics industries drives the demand for MVNO services that enable seamless connectivity and data transmission.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Mobile Virtual Network Operator (MVNO) Market Dynamics

Driver: Profit maximization opportunity for both MNOs and MVNOs.

A promising avenue for profit maximization that can benefit both MVNOs and MNOs centers around infrastructure sharing. By strategically entering into agreements that allow MVNOs to utilize MNOs' network infrastructure, both parties can unlock substantial financial advantages. MVNOs gain access to a reliable and extensive network without the massive capital expenditure required for network deployment, significantly reducing operating costs. Simultaneously, MNOs capitalize on underutilized network capacity, effectively monetizing their infrastructure investments. This sharing model can stimulate revenue growth for MNOs while allowing MVNOs to operate competitively, offering more cost-effective services to consumers. Moreover, it fosters a collaborative ecosystem where both entities can explore additional opportunities for revenue generation, such as joint marketing efforts and the development of innovative service packages, ultimately driving profit maximization for both MVNOs and MNOs in an increasingly dynamic telecommunications landscape. On the other hand, MVNOs do not own the network infrastructure as it requires high Capital Expenditure (CAPEX). Instead, they opt for an agreement with MNOs to use MNO networks for specific geography and time periods. Hence, small and innovative companies can enter this market without having large CAPEX and OPEX.

Restraint: MNOs giving low priority to MVNO customers

The practice of mobile network operators (MNOs) giving low priority to mobile virtual network operator (MVNO) customers has been a contentious issue in the telecommunications industry. Often, MNOs operate their networks with a tiered quality of service model, where their retail customers are given higher priority over MVNO customers who rely on their infrastructure. During network congestion or high traffic, MVNO customers may experience slower data speeds or lower call quality than the MNO's subscribers. From the MNOs’ perspective, this prioritization is often justified to protect the quality of service for their direct customers who pay premium rates. However, it can be perceived as unfair treatment by MVNOs and their customers, as MVNOs are essentially reselling the MNOs’ services to their customer base. The consequences of this practice can include frustrated MVNO customers, decreased customer satisfaction, and potential churn from the MVNO's side. To address this issue and ensure fairness, regulatory bodies in some regions have imposed rules and regulations on MNOs, mandating equal treatment of MVNO and MNO customers regarding network priority during congestion. Such regulations aim to create a level playing field in the telecommunications market, ensuring that MVNOs can provide competitive and reliable services to their customers while also allowing MNOs to maintain network quality for all users. In conclusion, the prioritization of MNO customers over MVNO customers during times of network congestion has been a contentious issue, highlighting the need for regulatory oversight to ensure fair treatment and service quality for all consumers in the telecommunications industry.

Opportunity: Adoption of IoT, M2M, and BYOD by MVNOs to attract new customers

IoT refers to connected devices in the network that include everything from personal to business appliances that use Wi-Fi , ZigBee, Bluetooth, or Low Power Wide Area Network (LPWAN) radio standards for communicating with each other. IoT and M2M are changing every aspect of business as compared to any other technology. As per Statista Research Department, approximately 30 billion devices will be connected by 2020. The connected device would generate huge traffic on the network, creating opportunities for MVNOs. By understanding the ecosystem of IoT and how things or objects are connected and interact, the MVNO service provider can develop tailored services that help enterprises and customers run their IoT devices and manage network traffic smoothly. In addition, BYOD is also gaining momentum across the globe. The proliferation of smartphones and tablets across enterprises fueled the growth of the BYOD trend in businesses. BYOD helps MVNOs increase workforce productivity and overall business efficiency. However, they would face challenges while integrating their services on different devices as all the devices have different architecture and hardware. BYOD would significantly reduce the setup cost for enterprises and customers.

Challenge: Stringent government rules and regulations for MNOs and MVNOs

Regulatory bodies such as the Federal Communications Commission (FCC) of the US, General Data Protection Regulation (GDPR) of Europe, Telecom Regulatory Authority of India (TRAI) of India, National Broadcasting and Telecommunications Commission (NBTC) of Thailand, and Agência Nacional de Telecomunicações (Anatel) of Brazil have stringent rules to which all the MVNOs must adhere. The EU GDPR focuses on safeguarding the Personally Identifiable Information (PII) of citizens. The GDPR compliance solutions are used extensively in Europe and North America compared to other regions, where the adoption rate of GDPR compliance solutions and services is slow. GDPR provides companies with an opportunity to build customer trust in their business, which could improve sales and business performance. It would contribute to raising business standards, becoming central to business operations, and resonating with brand values. It would help drive consistent practice across borders, creating a more secure environment for transferring data, which, in turn, would increase opportunities for doing business. It provides greater legal harmonization, removing some of the complexities of geographical variations in law.

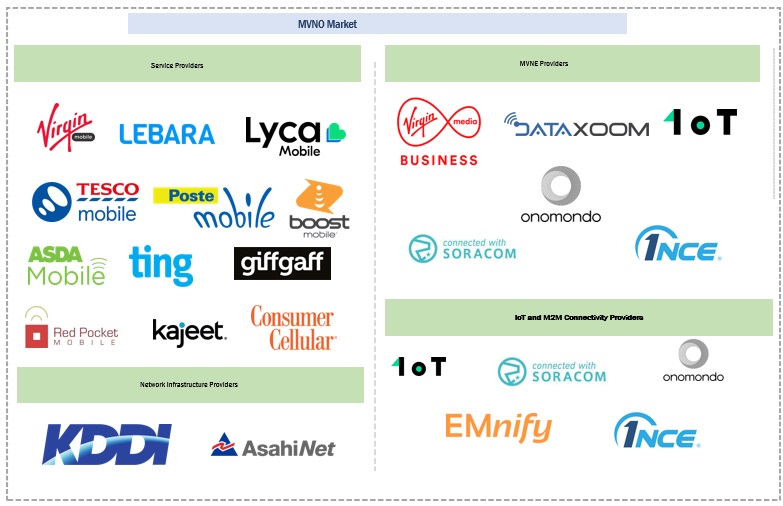

MVNO market Ecosystem

Prominent companies in this market include a well-established, financially stable provider of the MVNO market. These companies have innovated their offerings and possess a diversified product portfolio, state-of-the-art technologies, and marketing networks. Prominent companies in this market include as Virgin Media Business (UK), Dataxoom (US), Lebara (UK), KDDI (Japan), Asahi Net (Japan), Virgin Mobile (US), Tracfone Wireless (US), Boost Mobile (US), Lycamobile (UK), Tesco Mobile (UK).

By subscriber, the enterprise segment is expected to grow with the highest CAGR during the forecast period

MVNOs are exclusively hosted in secure cloud environments, making their services more scalable, faster to deploy, and less CAPEX-intensive to manage. This also makes the MVNO model more viable for medium and large enterprises. For example, under enterprise MVNOs, employees could bring their phones to work and get a branded SIM and associated number while retaining their number. Any data used on corporate apps could be charged to employers, while private app usage could be charged directly to employees, whether roaming or at home.

Based on region, Europe is expected to hold the largest market size during the forecast period

European MVNO market has several other driving factors, such as the rising demand for affordable data packs, BYOD device capabilities, and easy accessibility to MVNOs. The region is home to large telecom companies, such as Orange, Deutsche Telekom, Vodafone, Telefonica, and Telecom Italia, which help MVNOs with reliable networks. In Europe, the overall MVNO market is robust and is expected to develop and advance over the forecast period. The market offers massive opportunities for MVNO providers, as various enterprises are moving from traditional MNOs to MVNOs.

Market Players:

The major players in the mobile virtual network operator (MVNO) market are as Virgin Media Business (UK), Dataxoom (US), Lebara (UK), KDDI (Japan), Asahi Net (Japan). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the MVNO market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

Operational Model (Reseller, Service Operator and Full MVNO), Subscriber (Consumer and Enterprise), Service Type (Postpaid and Prepaid), Business Model (Discount, Specialist Data, Ethnic, Business, International/Roaming, Youth/Media, Bundled and Others), and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

Virgin Media Business (UK), Dataxoom (US), Lebara (UK), KDDI (Japan), Asahi Net (Japan), Virgin Mobile (US), Tracfone Wireless (US), Boost Mobile (US), Lycamobile (UK), Tesco Mobile (UK), Postemobile (UK), Airvoice Wireless (US), Asda Mobile (UK), Giffgaff (UK), Kajeet (US), Voiceworks (Netherlands), Ting (US), Red Pocket Mobile (US), Consumer Cellular (US), Hologram (US), 1oT (Estonia), Soracom (Japan), Onomondo (Denmark), Airlinq (US), EMnify (Germany), and 1NCE (Germany) |

This research report categorizes the mobile virtual network operator (MVNO) market based on offering, functions, deployment model, organization size, vertical, and region.

Based on Operational Model:

- Reseller

- Service Operator

- Full MVNO

Based on Subscriber:

- Consumer

- Enterprise

Based on Service Type:

- Postpaid

- Prepaid

Based on Business Model:

- Discount

- Specialist Data

- Ethnic

- Business

- International/Roaming

- Youth/Media

- Bundled

- Others

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand (ANZ)

- Rest of Asia Pacific

-

Middle East & Africa

- Middle East

- Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In March 2023, KDDI and Rakuten Mobile partnered to launch a new MVNO service for businesses. The service, KDDI Rakuten Mobile Business, was expected to offer mobile phone plans to businesses of all sizes.

- In February 2023, KDDI and NTT Docomo entered into a partnership to launch a new MVNO service for students. The service, called KDDI Docomo Student, was expected to offer mobile phone plans to students at participating universities.

- In January 2023, KDDI and China Mobile Japan partnered to launch a new MVNO service in Japan. The service, called KDDI China Mobile Japan, was launched to offer mobile phone plans to Chinese tourists visiting Japan.

Frequently Asked Questions (FAQ):

What is the definition of the MVNO market?

A mobile virtual network operator (MVNO) is a mobile device service provider who does not own wireless network infrastructure and spectrum on which its services operate. The MVNO leases wireless capacity from a third-party mobile network operator (MNO) at wholesale prices and resells it to consumers at reduced retail prices under its own business brand. MNOs such as Verizon Wireless, AT&T, Sprint, and T-Mobile chose to sell telecommunication services to MVNOs because MNO networks have extra capacity that would otherwise be unused. The MVNO may use its own customer service, billing support systems, marketing, and sales personnel, or it could employ the services of a Mobile Virtual Network Enabler (MVNE).

What is the market size of the MVNO market?

The MVNO market size is projected to grow from USD 84.6 billion in 2023 to USD 116.8 billion by 2028, at a CAGR of 6.7% during the forecast period.

What are the major drivers in the MVNO market?

The major drivers of the MVNO market are the provision of demographic-related customer services, and profit maximization opportunity for both MNOs and MVNOs.

Who are the key players operating in the MVNO market?

The major players in the MVNO market are Virgin Media Business (UK), Dataxoom (US), Lebara (UK), KDDI (Japan), Asahi Net (Japan), Virgin Mobile (US), Tracfone Wireless (US), Boost Mobile (US), Lycamobile (UK), Tesco Mobile (UK), Postemobile (UK), Airvoice Wireless (US), Asda Mobile (UK), Giffgaff (UK), Kajeet (US), Voiceworks (Netherlands), Ting (US), Red Pocket Mobile (US), Consumer Cellular (US), Hologram (US), 1oT (Estonia), Soracom (Japan), Onomondo (Denmark), Airlinq (US), EMnify (Germany), and 1NCE (Germany).

What are the opportunities for new market entrants in the MVNO market?

The major opportunities of the MVNO market is the adoption of IoT, M2M, and BYOD by MVNOs to attract new customers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Provision of demographic-related customer services- Profit maximization opportunity for both MNOs and MVNOsRESTRAINTS- MNOs giving low priority to MVNO customersOPPORTUNITIES- Adoption of IoT, M2M, and BYOD by MVNOs to attract new customersCHALLENGES- Fragmented nature of market- Stringent government rules and regulations for MNOs and MVNOs

-

5.3 INDUSTRY TRENDSBRIEF HISTORY OF MVNOECOSYSTEM ANALYSISTECHNOLOGY ROADMAP OF MVNO MARKET- Short-term roadmap (2023–2025)- Mid-term roadmap (2026–2028)- Long-term roadmap (2029–2030)CASE STUDY ANALYSIS- Case study 1: Telit provided stable connection for water monitoring to WaterSignal using cellular connectivity- Case study 2: SORACOM provided strong, consistent connection, real-time visualization, and secure pathway to Aurora Payments via SORACOM VPG- Case study 3: M2M Services implemented LTE-M Technology and Modules for Alarm Devices for Telit- Case study 4: Kajeet filtering enabled through Sentinel helped manage data consumption across active devices- Case study 5: SORACOM’s Napter service helped to maximize security by providing remote access to any EV charger on demandVALUE CHAIN ANALYSISREGULATORY LANDSCAPE- General Data Protection Regulation- Personal Information Protection and Electronic Documents Act- Cloud Security Alliance Security Trust Assurance and Risk- SOC 2- Digital Millennium Copyright Act- Anti-Cybersquatting Consumer Protection ActPATENT ANALYSISKEY CONFERENCES & EVENTS, 2022–2023PRICING ANALYSISPORTER’S FIVE FORCES MODEL- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalryKEY STAKEHOLDERS & BUYING CRITERIA- Key stakeholders in buying criteria- Buying criteriaMVNO IMPACT ON ADJACENT NICHE TECHNOLOGIES- Network function virtualization (NFV)- Software-defined network (SDN)- Artificial Intelligence- Edge computing- BlockchainBEST PRACTICES OF MVNO MARKETMVNO SOFTWARE APPLICATIONS AND USE CASESCURRENT AND EMERGING BUSINESS MODELS- CaaS model- Managed services model- Revenue sharing model- PaaS model

-

6.1 INTRODUCTIONOPERATIONAL MODEL: MVNO MARKET DRIVERS

- 6.2 RESELLER

- 6.3 SERVICE OPERATOR

- 6.4 FULL MVNO

-

7.1 INTRODUCTIONSUBSCRIBER: MVNO MARKET DRIVERS

- 7.2 CONSUMER

- 7.3 ENTERPRISE

-

8.1 INTRODUCTIONSERVICE TYPE: MVNO MARKET DRIVERS

- 8.2 POSTPAID

- 8.3 PREPAID

- 9.1 INTRODUCTION

- 9.2 DISCOUNT

- 9.3 SPECIALIST DATA

- 9.4 ETHNIC

- 9.5 BUSINESS

- 9.6 INTERNATIONAL/ROAMING

- 9.7 YOUTH/MEDIA

- 9.8 BUNDLED

- 9.9 OTHERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTNORTH AMERICA: IOT MVNO MARKET DRIVERSUNITED STATES- Increasing demand for flexible data packs and affordable mobile services to drive marketCANADA- Rise in adoption of innovative delivery methods to propel growth of market

-

10.3 EUROPEEUROPE: RECESSION IMPACTEUROPE: IOT MVNO MARKET DRIVERSGERMANY- Low infrastructure-related costs and government initiatives to boost marketUNITED KINGDOM- Increased adoption of IoT and M2M technologies to fuel market growthFRANCE- Support from government and growing internet penetration to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: IOT MVNO MARKET DRIVERSCHINA- Surge in demand for Wi-Fi data connections to fuel growth of marketJAPAN- Expansion of 5G services and increasing use of VoIP to drive marketAUSTRALIA AND NEW ZEALAND- Service differentiation by MVNOs to propel growth of marketREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST AND AFRICAMIDDLE EAST AND AFRICA: RECESSION IMPACTMIDDLE EAST AND AFRICA: IOT MVNO MARKET DRIVERSMIDDLE EAST- Widespread adoption of IoT and digital transformation to drive marketAFRICA- Business transformations and supportive policies to gain market traction

-

10.6 LATIN AMERICALATIN AMERICA: RECESSION IMPACTLATIN AMERICA: IOT MVNO MARKET DRIVERSBRAZIL- Increasing adoption of Wi-Fi and broadband by enterprises to drive marketMEXICO- Wireless internet connectivity initiatives to fuel growth of marketREST OF LATIN AMERICA

- 11.1 INTRODUCTION

- 11.2 HISTORICAL REVENUE ANALYSIS

- 11.3 MARKET SHARE ANALYSIS OF KEY PLAYERS

- 11.4 COMPETITIVE BENCHMARKING

- 11.5 EVALUATION MATRIX METHODOLOGY FOR KEY PLAYERS

-

11.6 EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 STARTUP/SME EVALUATION MATRIX: METHODOLOGY AND DEFINITIONSPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSVIRGIN MEDIA BUSINESS (UK)- Business overview- Services offered- Recent developments- MnM viewDATAXOOM- Business overview- Solutions and services offered- MnM viewLEBARA- Business overview- Services offered- Recent development- MnM viewKDDI- Business overview- Services offered- Recent developments- MnM viewASAHI NET- Business overview- Services offered- MnM viewVIRGIN MOBILE USA- Business overview- Services offeredTRACFONE WIRELESS- Business overview- Services offeredFRIENDI MOBILE- Business overview- Services offeredBOOST MOBILE- Business overview- Services offeredLYCAMOBILE- Business overview- Services offeredTESCO MOBILEPOSTEMOBILEAIRVOICE WIRELESSASDA MOBILEGIFFGAFFKAJEETVOICEWORKSTINGRED POCKET MOBILECONSUMER CELLULAR

-

12.3 OTHER KEY PLAYERSHOLOGRAM1OTSORACOMONOMONDOAIRLINQEMNIFY1NCE

- 13.1 INTRODUCTION

-

13.2 IOT MVNO MARKET – GLOBAL FORECAST TO 2027MARKET DEFINITIONMARKET OVERVIEWIOT MVNO MARKET, BY OPERATIONAL MODELIOT MVNO MARKET, BY SUBSCRIBERIOT MVNO MARKET, BY ENTERPRISEIOT MVNO MARKET, BY REGION

-

13.3 TELECOM ANALYTICS MARKET – GLOBAL FORECAST TO 2023MARKET DEFINITIONMARKET OVERVIEW5G SERVICES MARKET, BY COMPONENT5G SERVICES MARKET, BY APPLICATION5G SERVICES MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 TOP 20 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 4 DETAILED LIST OF CONFERENCES & EVENTS, 2023

- TABLE 5 AVERAGE SELLING PRICE RANGES OF SUBSCRIPTION-BASED/PAY-AS-YOU-GO MVNO SERVICES

- TABLE 6 IMPACT OF EACH FORCE ON MVNO MARKET

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISE SUBSCRIBERS

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISE SUBSCRIBERS

- TABLE 9 MARKET, BY OPERATIONAL MODEL, 2018–2022 (USD MILLION)

- TABLE 10 MARKET, BY OPERATIONAL MODEL, 2023–2028 (USD MILLION)

- TABLE 11 RESELLER: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 12 RESELLER: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 13 SERVICE OPERATOR: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 14 SERVICE OPERATOR: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 15 FULL MVNO: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 16 FULL MVNO: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 MARKET, BY SUBSCRIBER, 2018–2022 (USD MILLION)

- TABLE 18 MVNO MARKET, BY SUBSCRIBER, 2023–2028 (USD MILLION)

- TABLE 19 CONSUMER: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 20 CONSUMER: MARKET, BY REGION 2023–2028 (USD MILLION)

- TABLE 21 ENTERPRISE: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 22 ENTERPRISE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 MARKET, BY SERVICE TYPE, 2018–2022 (USD MILLION)

- TABLE 24 MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 25 POSTPAID: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 POSTPAID: MVNO MARKET, BY REGION 2023–2028 (USD MILLION)

- TABLE 27 PREPAID: MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 PREPAID: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 MARKET, BY REGION, 2018–2022 (USD BILLION)

- TABLE 30 MARKET, BY REGION, 2023–2028 (USD BILLION)

- TABLE 31 NORTH AMERICA: MARKET, BY OPERATIONAL MODEL, 2018–2022 (USD MILLION)

- TABLE 32 NORTH AMERICA: MARKET, BY OPERATIONAL MODEL, 2023–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: MARKET, BY SUBSCRIBERS, 2018–2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: MVNO MARKET, BY SUBSCRIBERS, 2023–2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2018–2022 (USD MILLION)

- TABLE 36 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 38 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 39 EUROPE: MARKET, BY OPERATIONAL MODE, 2018–2022 (USD MILLION)

- TABLE 40 EUROPE: MARKET, BY OPERATIONAL MODE, 2023–2028 (USD MILLION)

- TABLE 41 EUROPE: MARKET, BY SUBSCRIBERS, 2018–2022 (USD MILLION)

- TABLE 42 EUROPE: MARKET, BY SUBSCRIBERS, 2023–2028 (USD MILLION)

- TABLE 43 EUROPE: MVNO MARKET, BY SERVICE TYPE, 2018–2022 (USD MILLION)

- TABLE 44 EUROPE: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 45 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 46 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: MARKET, BY OPERATIONAL MODEL, 2018–2022 (USD MILLION)

- TABLE 48 ASIA PACIFIC: MARKET, BY OPERATIONAL MODEL, 2023–2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: MARKET, BY SUBSCRIBERS, 2018–2022 (USD MILLION)

- TABLE 50 ASIA PACIFIC: MARKET, BY SUBSCRIBERS, 2023–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: MVNO MARKET, BY SERVICE TYPE, 2018–2022 (USD MILLION)

- TABLE 52 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 53 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 54 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 55 MIDDLE EAST AND AFRICA: MARKET, BY OPERATIONAL MODEL, 2018–2022 (USD MILLION)

- TABLE 56 MIDDLE EAST AND AFRICA: MARKET, BY OPERATIONAL MODEL, 2023–2028 (USD MILLION)

- TABLE 57 MIDDLE EAST AND AFRICA: MARKET, BY SUBSCRIBERS, 2018–2022 (USD MILLION)

- TABLE 58 MIDDLE EAST AND AFRICA: MARKET, BY SUBSCRIBERS, 2023–2028 (USD MILLION)

- TABLE 59 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE TYPE, 2018–2022 (USD MILLION)

- TABLE 60 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 61 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 62 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 63 LATIN AMERICA: MARKET, BY OPERATIONAL MODEL, 2018–2022 (USD MILLION)

- TABLE 64 LATIN AMERICA: MVNO MARKET, BY OPERATIONAL MODEL, 2023–2028 (USD MILLION)

- TABLE 65 LATIN AMERICA: MARKET, BY SUBSCRIBERS, 2018–2022 (USD MILLION)

- TABLE 66 LATIN AMERICA: MARKET, BY SUBSCRIBERS, 2023–2028 (USD MILLION)

- TABLE 67 LATIN AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 68 LATIN AMERICA: MARKET, BY SERVICE TYPE, 2018–2022 (USD MILLION)

- TABLE 69 LATIN AMERICA: MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 70 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 71 MARKET: DEGREE OF COMPETITION

- TABLE 72 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 73 SD-WAN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 74 PRODUCT LAUNCHES, 2021–2023

- TABLE 75 DEALS, 2020–2023

- TABLE 76 VIRGIN MEDIA BUSINESS: BUSINESS OVERVIEW

- TABLE 77 VIRGIN MOBILE BUSINESS (UK): PRODUCT LAUNCHES

- TABLE 78 DATAXOOM: BUSINESS OVERVIEW

- TABLE 79 LEBARA: BUSINESS OVERVIEW

- TABLE 80 LEBARA: PRODUCT LAUNCHES

- TABLE 81 LEBARA: DEALS

- TABLE 82 KDDI: BUSINESS OVERVIEW

- TABLE 83 KDDI: DEALS

- TABLE 84 ASAHI NET: BUSINESS OVERVIEW

- TABLE 85 VIRGIN MOBILE USA: BUSINESS OVERVIEW

- TABLE 86 TRACFONE WIRELESS: BUSINESS OVERVIEW

- TABLE 87 FRIENDI MOBILE: BUSINESS OVERVIEW

- TABLE 88 BOOST MOBILE: BUSINESS OVERVIEW

- TABLE 89 LYCAMOBILE: BUSINESS OVERVIEW

- TABLE 90 IOT MVNO MARKET, BY OPERATIONAL MODEL, 2018–2022 (USD MILLION)

- TABLE 91 IOT MVNO MARKET, BY OPERATIONAL MODEL, 2023–2028 (USD MILLION)

- TABLE 92 IOT MVNO MARKET, BY SUBSCRIBER, 2018–2022 (USD MILLION)

- TABLE 93 IOT MVNO MARKET, BY SUBSCRIBER, 2023–2028 (USD MILLION)

- TABLE 94 IOT MVNO MARKET, BY ENTERPRISE, 2018–2022 (USD MILLION)

- TABLE 95 IOT MVNO MARKET, BY ENTERPRISE, 2023–2028 (USD MILLION)

- TABLE 96 IOT MVNO MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 97 IOT MVNO MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 98 TELECOM ANALYTICS MARKET, BY COMPONENT, 2016–2023 (USD MILLION)

- TABLE 99 TELECOM ANALYTICS MARKET, BY APPLICATION, 2016–2023 (USD MILLION)

- TABLE 100 TELECOM ANALYTICS MARKET, BY REGION, 2016–2023 (USD MILLION)

- FIGURE 1 MVNO MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 MARKET TO WITNESS SLIGHT DIP IN Y-O-Y IN 2023

- FIGURE 4 MARKET, 2021–2028 (USD MILLION)

- FIGURE 5 MARKET: REGIONAL SHARE, 2023

- FIGURE 6 INCREASING INTERNET SERVICES AND NEW DATA CENTERS TO DRIVE MARKET IN ASIA PACIFIC

- FIGURE 7 SERVICE OPERATOR SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 8 ENTERPRISE SEGMENT TO WITNESS HIGHER GROWTH IN 2023

- FIGURE 9 POSTPAID SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 10 FULL MVNO AND US TO HOLD LARGEST MARKET SHARES IN 2023

- FIGURE 11 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 12 MVNO MARKET: ECOSYSTEM

- FIGURE 13 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 14 NUMBER OF PATENTS GRANTED, 2013–2022

- FIGURE 15 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

- FIGURE 16 PORTER’S FIVE FORCES MODEL: MVNO MARKET

- FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ENTERPRISES

- FIGURE 18 KEY BUYING CRITERIA FOR TOP THREE ENTERPRISE SUBSCRIBERS

- FIGURE 19 SERVICE OPERATOR SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 ENTERPRISE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 21 POSTPAID SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 22 EUROPE: MARKET SNAPSHOT

- FIGURE 23 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 24 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 25 EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 26 EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 27 SME/STARTUP EVALUATION MATRIX, 2023

- FIGURE 28 KDDI: COMPANY SNAPSHOT

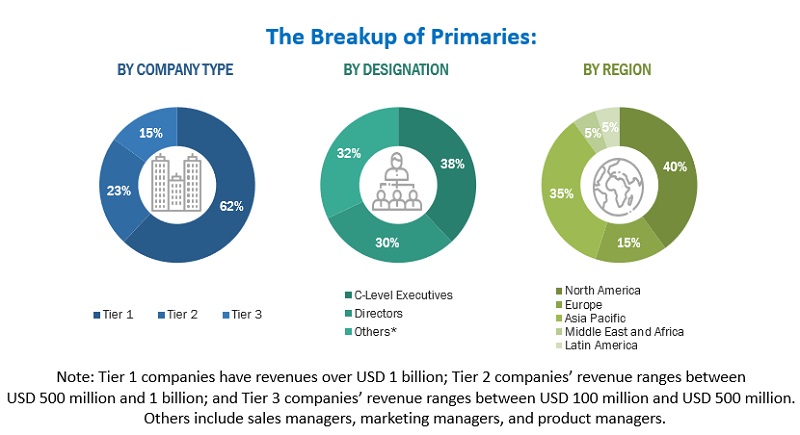

The study involved four major activities in estimating the current size of the global MVNO market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total MVNO market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the MVNO market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the MVNO market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global MVNO market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the MVNO market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

MVNO market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

MVNO market Size: Top-Down Approach

Data Triangulation

With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

A mobile virtual network operator (MVNO) is a mobile device service provider who does not own wireless network infrastructure and spectrum on which its services operate. The MVNO leases wireless capacity from a third-party mobile network operator (MNO) at wholesale prices and resells it to consumers at reduced retail prices under its business brand. MNOs such as Verizon Wireless, AT&T, Sprint, and T-Mobile chose to sell telecommunication services to MVNOs because MNO networks have extra capacity that would otherwise be unused. The MVNO may use its own customer service, billing support systems, marketing, and sales personnel, or it could employ the services of a Mobile Virtual Network Enabler (MVNE).

Key Stakeholders

- MVNO Operators

- MVNO Service Providers

- Government Organizations

- Regulatory Authorities

- Policymakers and Financial Organizations

- Consulting Firms

- Research Organizations

- Academic Institutions

- Resellers and Distributors

- Training Providers

Report Objectives

- To determine, segment, and forecast the global MVNO market by operational model, subscriber, service type, and business model and region in terms of value.

- To forecast the size of the market segments to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape.

- To strategically analyze the macro and micro markets to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market.

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the MVNO market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions, product launches & developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional two market players

Growth opportunities and latent adjacency in MVNO Market