Mobile Mapping Market by Application (Road Surveys, Topographic Mapping, 3D Modelling, Asset Management), Industry Vertical (Oil and Gas, Real Estate, Government) and Region - Global Forecast to 2026

Mobile Mapping Market Forecast

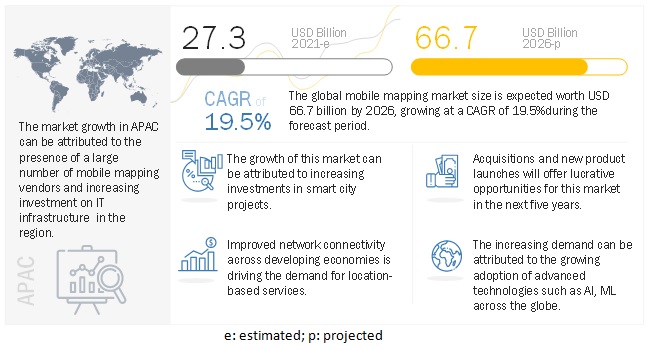

The global Mobile Mapping Market size is expected to increase from USD 27.3 billion in 2021 to USD 66.7 billion by 2026, at a CAGR of 19.5% during the forecast period.

Key factors that are expected to drive the growth of the market are the growing investments in smart city projects, adoption of advanced technology for surveying and mapping and increase in use of geospatial data. Over the years, mobile mapping has become one of the most popular geospatial processes, enabling companies and researchers to capture data faster and create accurate 3D models, even in difficult conditions. The mobile mapping technology involves digitalization at a very high spatial resolution of complex environments using a mobile device. The aim is to acquire precise and accurate geospatial data of objects and places of interest. Mobile mapping is not one coherent field of integrated technologies but a technological frontier where individual technologies are used to enhance specific mapping tasks. The first modern maps were made with theodolites in the late 18th century by finding absolute positions of fixed, typically high points from solar observations, then measuring out the edges of large triangles over the landscape to find the positions of other high points. Mobile mapping technology has reduced the cost and logistics of all the mapping processes by utilizing digital technology.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The impact of the COVID-19 pandemic on the market is covered throughout the report. The pandemic has had a positive impact on the mobile mapping market. Mobile mapping has increasingly gained market traction amid the ongoing COVID-19 pandemic for mapping the travel history and location of infected individuals. Governments are substantially adopting mobile mapping tools to map demographics data and correlate this data with the spread of the disease across a region. At the same time, the pandemic has had a significant impact on hardware manufacturers due to disruptions in the supply chain and government-imposed restrictions. It presents a detailed analysis, market sizing, and forecasting of the emerging sub-segments of the market. The report has been segmented on the basis of application, industry vertical, and region.

Mobile Mapping Market Dynamics

Driver: Growing investments in smart city projects

Digitization of city infrastructures, planning and optimization of resources is the foundation of the Smart City, and a digital strategy is key for a successful transformation. With many smart cities projects underway or being launched, the digitalization of cities and the vision of urban development integrated with information and communication technology is expanding. For smart city projects, geospatial data serves as the bedrock of any urban development plan. It includes accurate ground information represented in the form of maps and mixed reality 3D models. A reliable and accurate geospatial database is required to create and manage smart cities as well as serve as a revenue source for the city administrators. For instance, the city of Amsterdam utilized the Trimble MX7 mobile mapping system. The various departments such as tax collection, public space management, and public safety rely on street-level imagery. Thus, the mobile mapping system enabled Amsterdam to capture street-view imagery anytime and share it with any stakeholder inside the organization.

Restraint: Initial CAPEX for infrastructure

Enterprises are rapidly moving toward digitalization by adopting emerging technologies to automate and accelerate their business processes efficiently. Mobile mapping solutions might increase the speed of scanning the environment, increase flexibility, security but still add to the CAPEX of companies. Companies looking for comprehensive mobile mapping solutions would require investing heavily in scanners, encoders, cameras, and other IT software. They would also be required to spend more on making the devices and the entire network secure. The initial cost of utilizing mobile mapping solutions will limit adoption in organizations that have budget constraints. Thus, the high cost of system acquisition and deployment has considerably limited the use of such systems for routine road corridor surveys.

Opportunity: Emergence of automated driving technology

Rising consumer demands and various technological advancements have led to the proliferation of autonomous and connected vehicle infrastructure. Mobile mapping systems help vehicles plan and provide a safety net to sensors when visibility and conditions are poor, making automated driving even safer. Automation increases driver comfort by taking over the tiring aspects of driving. The various use cases of automated driving, including Predictive Powertrain Control, Predictive Cruise Control, and Intelligent Speed Assistance, are supported by mobile mapping systems. To increase safety in autonomous driving, TomTom and HELLA Aglaia teamed up to enable crowdsourced HD map updates that are faster and more accurate. Mobile mapping systems consist of an online service and onboard client software designed to deliver map content rapidly and reliably with minimal data and integration costs. Thus, automated cars are likely to adopt mobile mapping systems to improve the driving experience.

Challenge: Limited range of laser in mobile mapping systems

The limited range of the lasers used in these systems results in a relatively narrow acquisition swath. Mobile mapping systems use Class 1 eye-safe lasers for point cloud acquisition. The upside is that this allows the acquisition to take place even during times with many people in very close proximity to the sensor, which is common in the urban collection, without any health risks. The only downside is the relatively limited power of these eye-safe lasers, which results in restricted acquisition swaths. Most high-end systems have ranges of 200 m to 400 m extending on each side of the mobile platform.

Topographic Mapping segment is expected to hold at a higher market share during the forecast period

Based on applications, the mobile mapping market is segmented into road surveys, topographic mapping, 3D modeling, asset management and other applications. Topographic mapping segment to hold a larger market size during the forecast period. A topographic survey is typically based upon systematic observation and published as a map series, consisting of two or more map sheets that combine to form the whole map. A topographic map series uses a common specification that includes the range of cartographic symbols employed, as well as a standard geodetic framework that defines the map projection, coordinate system, ellipsoid, and geodetic datum. Official topographic maps also adopt a national grid referencing system. Recent advances in mobile mapping technology enable new capabilities and complement or even replace traditional survey methods of topographical surveying.

Manufacturing industry vertical is expected to grow at a higher CAGR during the forecast period

The manufacturing industry vertical to grow at a higher CAGR during the forecast period. The manufacturing vertical faces various challenges, such as cargo, machinery, and equipment tampering; uneven operational workflow; false trade billing; liability protection; property damages; fires; and raw material thefts. Security of the staff, inventory, machinery, plant, and tools have to be managed and controlled to avoid any type of damages and provide an accident-free working environment. These challenges can be addressed using advanced and intelligent mobile mapping solutions. Mobile mapping technology further enables organizations to monitor the working environment and employee activities by providing increased workplace safety, preventing losses, monitoring daily operations, saving time and efforts by remote monitoring, and reducing OPEX. Further, mobile mapping technology plays an important role in the production of autonomous driving technology as it provides the digital world to meet the navigation safety requirements of future autonomous vehicle applications. Thus, car manufacturers utilize mobile mapping technology to produce accurate navigation services to meet the demand from the automotive industry.

To know about the assumptions considered for the study, download the pdf brochure

APAC to grow at the highest CAGR during the forecast period

The mobile mapping market in APAC is expected to witness exponential growth, mainly because of the rising awareness and development of smart city projects, and the growing manufacturing industry. The rapid growth in mobile device manufacturing has considerably reduced the cost of cameras, scanners, and other components, thereby making it cheaper for SMEs and private individuals to utilize location-based services. Moreover, the rapid GDP growth in APAC countries has resulted in infrastructure modernization projects, such as smart city projects and mass public transit systems, which have increased the demand for mobile mapping technology. The Yinchuan city in China is one of the most advanced smart cities in APAC, with almost all infrastructure integrated into a unified system. Singapore is also moving toward the goal of becoming a smart nation, which would lead to an increased demand for efficient mobile mapping solutions.

Key Market Players

The mobile mapping vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The mobile mapping market comprises major providers, such as Apple(US), AutoNavi(China), Black & Veatch(US), Garmin International(US), Google(US), Land Surveys(Australia), MapQuest(US), Microsoft (US), Mitsubishi Electric Corporation(Japan), Novatel Inc (Canada), Qualcomm (US), Comtech Telecommunications(US), Trimble (US), Ericsson(Sweden), TomTom(Netherlands), Foursquare Labs(US), Pasco Corporation (Japan), Topcon(Japan), NavVis(Germany), GeoSLAM(England),and Leica Geosystems (Switzerland).

The study includes an in-depth competitive analysis of key players in the mobile mapping market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Application (Road Surveys, Topographic Mapping, 3D Modelling, Asset Management), Industry Vertical (Oil and Gas, Real Estate, Government), and Region |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Companies covered |

Apple(US), AutoNavi(China), Black & Veatch(US), Garmin International(US), Google(US), Land Surveys(Australia), MapQuest(US), Microsoft (US), Mitsubishi Electric Corporation(Japan), Novatel Inc (Canada), Qualcomm (US), Comtech Telecommunications(US), Trimble (US), Ericsson(Sweden), TomTom(Netherlands), Foursquare Labs(US), Pasco Corporation (Japan), Topcon(Japan), NavVis(Germany), GeoSLAM(England),and Leica Geosystems (Switzerland). |

This research report categorizes the Mobile Mapping Market based on application, industry vertical, and region.

Based on the application:

- Road Surveys

- Topographic Mapping

- 3D Modeling

- Asset Management

- Others(automotive navigation, and precision farming)

Based on industry vertical:

- Oil and Gas

- Real Estate

- Government

- Manufacturing

- Transportation and Logistics

- Energy and Utilities

- Telecommunication

- Retail

- Others(agriculture and mining)

Based on the region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In September 2021, With the release of iOS 15, Apple introduced the latest updates for its Apple Maps mapping service. It would offer rich details, driving routes with better navigation, immersive walking directions shown in augmented reality and an interactive globe. The update would be available in London, Los Angeles, New York City, and the San Francisco Bay Area.

- In September 2021, TheAutoNavi partnered with the Beijing government to provide mapping data to Beijing Taxi, offering a model that could undermine private ride-hailing businesses.

- In April 2020, Black and Veatch developed a geospatial tracking tool to additionally safeguard field services and construction crews during the current COVID-19 global health crisis.

- In January 2021, Garmin International acquired GEOS Worldwide Limited and its subsidiaries to help active lifestyle customers safely find their way home by providing advanced emergency response and safety services.

- In October 2021, Google launched a new website experience for Google Maps Platform, offering quick access to solutions, developer documentation and project budgeting.

Frequently Asked Questions (FAQ):

What is the projected market value of the mobile mapping market?

The global mobile mapping market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% during the forecast period, to reach USD 66.7 Billion in 2026 from USD 27.3 Billion in 2021.

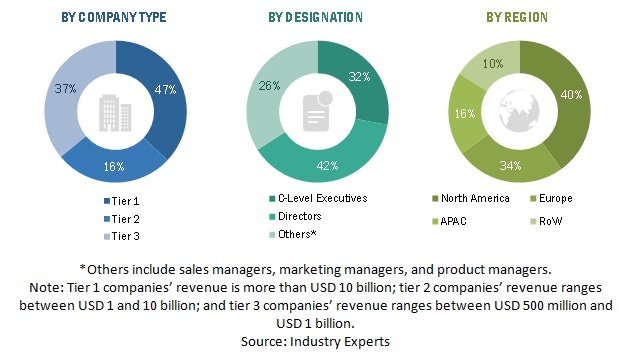

Which region has the highest market share in the mobile mapping market?

North America and APAC region have the highest market share in the mobile mapping market, where these two regions together contribute more than half of the global mobile mapping market in the year 2021.

Who are the major vendors in the mobile mapping market?

Despite the presence of a large number of vendors, the market is dominated mainly by vendors such as Apple(US), AutoNavi(China), Black & Veatch(US), Garmin International(US), Google(US), Land Surveys(Australia), MapQuest(US), Microsoft (US), Mitsubishi Electric Corporation(Japan), Novatel Inc (Canada), Qualcomm (US), Comtech Telecommunications(US), Trimble (US), Ericsson(Sweden), TomTom(Netherlands), Foursquare Labs(US), Pasco Corporation (Japan), Topcon(Japan), NavVis(Germany), GeoSLAM(England), and Leica Geosystems (Switzerland).

What are some of the latest trends that will shape the mobile mapping market in the future?

The emergence of technologies including artificial intelligence, cloud, machine learning, data analytics which significantly improve the mobile mapping market, is expected to shape the market in coming years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 6 MOBILE MAPPING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF MOBILE MAPPING MARKET FROM VENDORS

FIGURE 11 MARKET: MARKET ESTIMATION APPROACH: SUPPLY SIDE ANALYSIS

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 12 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 13 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 14 GLOBAL MOBILE MAPPING MARKET SNAPSHOT, 2019-2026

FIGURE 15 TOP-GROWING SEGMENTS IN THE MARKET

FIGURE 16 TOPOGRAPHIC MAPPING SEGMENT IS EXPECTED TO ACCOUNT FOR THE HIGHEST MARKET SHARE DURING THE FORECAST PERIOD

FIGURE 17 MANUFACTURING INDUSTRY VERTICAL IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 18 NORTH AMERICA TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 44)

4.1 BRIEF OVERVIEW OF THE MOBILE MAPPING MARKET

FIGURE 19 GROWING INVESTMENTS IN SMART CITY PROJECTS AND TECHNOLOGICAL EVOLUTION TO DRIVE THE MARKET GROWTH

4.2 MARKET, BY APPLICATION, 2021 VS. 2026

FIGURE 20 TOPOGRAPHIC MAPPING SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2026

4.3 MARKET, BY INDUSTRY VERTICAL, 2021 VS. 2026

FIGURE 21 TELECOMMUNICATION SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2026

4.4 MOBILE MAPPING MARKET INVESTMENT SCENARIO

FIGURE 22 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENT IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing investments in smart city projects

FIGURE 24 WORLD URBANIZATION TREND, 1950–2050

5.2.1.2 Adoption of advanced technology for surveying and mapping

5.2.1.3 Increase in use of geospatial data

5.2.2 RESTRAINTS

5.2.2.1 Initial CAPEX for infrastructure

5.2.3 OPPORTUNITIES

5.2.3.1 The emergence of automated driving technology

5.2.3.2 Advent of 5G network to deliver instant location information

FIGURE 25 MOBILE CONNECTIONS BY NETWORK TYPE AS A PERCENTAGE OF REGIONAL SHARE, 2023

5.2.4 CHALLENGES

5.2.4.1 Limited range of laser in mobile mapping systems

5.2.4.2 Concerns regarding data accuracy

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 1: REDEFINED ASSET MAPPING AND BUILT NEW BUSINESSES

5.3.2 CASE STUDY 2: EXPANSION OF GLASS FIBRE NETWORK

5.3.3 CASE STUDY: 3 IMPROVED CUSTOMER EXPERIENCE

5.3.4 CASE STUDY: 4 DELIVERED A LOCATION AWARE APP

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 26 MOBILE MAPPINGMARKET: SUPPLY CHAIN

5.5 COVID-19-DRIVEN MARKET DYNAMICS

5.5.1 DRIVERS AND OPPORTUNITIES

5.5.2 RESTRAINTS AND CHALLENGES

5.6 PORTERS FIVE FORCES ANALYSIS

FIGURE 27 MOBILE MAPPING MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

6 MOBILE MAPPING MARKET, BY APPLICATION (Page No. - 57)

6.1 INTRODUCTION

FIGURE 28 ROAD SURVEYS SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

6.1.1 APPLICATION: MARKET DRIVERS

6.1.2 APPLICATION: COVID-19 IMPACT

TABLE 5 MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 6 MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

6.2 ROAD SURVEYS

TABLE 7 ROAD SURVEYS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 8 ROAD SURVEYS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 TOPOGRAPHIC MAPPING

TABLE 9 TOPOGRAPHIC MAPPING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 10 TOPOGRAPHIC MAPPING: MOBILE MAPPING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4 3D MODELLING

TABLE 11 3D MODELLING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 12 3D MODELLING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.5 ASSET MANAGEMENT

TABLE 13 ASSET MANAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 14 ASSET MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.6 OTHERS

TABLE 15 OTHERS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 16 OTHERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 MOBILE MAPPING MARKET, BY INDUSTRY VERTICAL (Page No. - 66)

7.1 INTRODUCTION

FIGURE 29 MANUFACTURING VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 17 MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 18 MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

7.1.1 INDUSTRY VERTICAL: MARKET DRIVERS

7.1.2 INDUSTRY VERTICAL: COVID-19 IMPACT

7.2 OIL AND GAS

TABLE 19 OIL AND GAS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 20 OIL AND GAS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 REAL ESTATE

TABLE 21 REAL ESTATE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 22 REAL ESTATE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4 GOVERNMENT

TABLE 23 GOVERNMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 24 GOVERNMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.5 MANUFACTURING

TABLE 25 MANUFACTURING: MOBILE MAPPING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 26 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.6 TRANSPORTATION AND LOGISTICS

TABLE 27 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 28 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.7 ENERGY AND UTILITIES

TABLE 29 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 30 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.8 TELECOMMUNICATION

TABLE 31 TELECOMMUNICATION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 32 TELECOMMUNICATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.9 RETAIL

TABLE 33 RETAIL: MOBILE MAPPING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 34 RETAIL: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.10 OTHERS

TABLE 35 OTHERS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 36 OTHERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 MOBILE MAPPING MARKET, BY REGION (Page No. - 80)

8.1 INTRODUCTION

FIGURE 30 NORTH AMERICA TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 37 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 38 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.2 NORTH AMERICA

8.2.1 NORTH AMERICA: MARKET DRIVERS

8.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

TABLE 39 NORTH AMERICA: MOBILE MAPPING MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

8.3 EUROPE

8.3.1 EUROPE: MOBILE MAPPING DRIVERS

8.3.2 EUROPE: COVID-19 IMPACT

TABLE 43 EUROPE: MOBILE MAPPING MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 44 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 45 EUROPE: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 46 EUROPE: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

8.4 ASIA PACIFIC

8.4.1 ASIA PACIFIC: MARKET DRIVERS

8.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 47 ASIA PACIFIC: MOBILE MAPPING MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 48 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 49 ASIA PACIFIC: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

8.5 MIDDLE EAST AND AFRICA

8.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

8.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 51 MIDDLE EAST AND AFRICA: MOBILE MAPPING MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 53 MIDDLE EAST AND AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

8.6 LATIN AMERICA

8.6.1 LATIN AMERICA: MARKET DRIVERS

8.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 55 LATIN AMERICA: MOBILE MAPPING MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 56 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 57 LATIN AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 58 LATIN AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 97)

9.1 INTRODUCTION

FIGURE 33 MARKET EVALUATION FRAMEWORK

9.2 KEY MARKET DEVELOPMENTS

9.2.1 PRODUCT LAUNCHES

TABLE 59 NEW LAUNCHES, 2019–2021

9.2.2 DEALS

TABLE 60 DEALS, 2019–2021

9.2.3 OTHERS

TABLE 61 OTHERS, 2019–2021

9.3 COMPANY EVALUATION QUADRANT

9.3.1 STARS

9.3.2 EMERGING LEADERS

9.3.3 PERVASIVE PLAYERS

9.3.4 PARTICIPANTS

FIGURE 34 MOBILE MAPPING MARKET (GLOBAL): COMPANY EVALUATION QUADRANT

TABLE 62 COMPANY APPLICATION FOOTPRINT

TABLE 63 COMPANY VERTICAL FOOTPRINT

TABLE 64 COMPANY REGION FOOTPRINT

TABLE 65 COMPANY FOOTPRINT

10 COMPANY PROFILES (Page No. - 105)

10.1 INTRODUCTION

(Business overview, Products offered, Recent developments & MnM View)*

10.2 KEY PLAYERS

10.2.1 APPLE

TABLE 66 APPLE: BUSINESS OVERVIEW

FIGURE 35 APPLE: COMPANY SNAPSHOT

TABLE 67 APPLE: PRODUCTS OFFERED

TABLE 68 APPLE: PRODUCT LAUNCHES

TABLE 69 APPLE: DEALS

10.2.2 AUTONAVI

TABLE 70 AUTONAVI: BUSINESS OVERVIEW

TABLE 71 AUTONAVI: PRODUCTS OFFERED

TABLE 72 AUTONAVI: DEAL

10.2.3 BLACK & VEATCH

TABLE 73 BLACK & VEATCH: BUSINESS OVERVIEW

TABLE 74 BLACK & VEATCH: PRODUCT LAUNCHES

TABLE 75 BLACK & VEATCH: DEALS

10.2.4 GARMIN INTERNATIONAL

TABLE 76 GARMIN INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 36 GARMIN INTERNATIONAL: COMPANY SNAPSHOT

TABLE 77 GARMIN INTERNATIONAL: PRODUCTS OFFERED

TABLE 78 GARMIN INTERNATIONAL: PRODUCT LAUNCHES

TABLE 79 GARMIN INTERNATIONAL: DEALS

10.2.5 GOOGLE

TABLE 80 GOOGLE: BUSINESS OVERVIEW

FIGURE 37 GOOGLE: COMPANY SNAPSHOT

TABLE 81 GOOGLE: PRODUCTS OFFERED

TABLE 82 GOOGLE: PRODUCT LAUNCHES

TABLE 83 GOOGLE: DEALS

10.2.6 LAND SURVEYS

TABLE 84 LAND SURVEYS: BUSINESS OVERVIEW

TABLE 85 LAND SURVEYS: PRODUCTS OFFERED

10.2.7 MAPQUEST

TABLE 86 MAPQUEST: BUSINESS OVERVIEW

TABLE 87 MAPQUEST: PRODUCTS OFFERED

10.2.8 MICROSOFT

TABLE 88 MICROSOFT: BUSINESS OVERVIEW

FIGURE 38 MICROSOFT: COMPANY SNAPSHOT

TABLE 89 MICROSOFT: PRODUCTS OFFERED

TABLE 90 MICROSOFT: PRODUCT LAUNCH

TABLE 91 MICROSOFT: DEAL

10.2.9 MITSUBISHI ELECTRIC CORPORATION

TABLE 92 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 39 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 93 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED

TABLE 94 MITSUBISHI ELECTRIC CORPORATION: DEALS

10.2.10 NOVATEL INC

TABLE 95 NOVATEL INC: BUSINESS OVERVIEW

TABLE 96 NOVATEL INC: PRODUCTS OFFERED

TABLE 97 NOVATEL INC: PRODUCT LAUNCH

10.2.11 QUALCOMM

TABLE 99 QUALCOMM: BUSINESS OVERVIEW

FIGURE 40 QUALCOMM: COMPANY SNAPSHOT

TABLE 100 QUALCOMM: PRODUCTS OFFERED

TABLE 101 QUALCOMM: DEALS

10.2.12 COMTECH TELECOMMUNICATIONS

TABLE 102 COMTECH TELECOMMUNICATIONS: BUSINESS OVERVIEW

FIGURE 41 COMTECH TELECOMMUNICATIONS: COMPANY SNAPSHOT

TABLE 103 COMTECH TELECOMMUNICATIONS: PRODUCTS OFFERED

TABLE 104 COMTECH TELECOMMUNICATIONS: DEALS

10.2.13 TRIMBLE

TABLE 105 TRIMBLE: BUSINESS OVERVIEW

FIGURE 42 TRIMBLE: COMPANY SNAPSHOT

TABLE 106 TRIMBLE: PRODUCTS OFFERED

TABLE 107 TRIMBLE: PRODUCT LAUNCHES

TABLE 108 TRIMBLE: DEALS

10.2.14 ERICSSON

TABLE 109 ERICSSON: BUSINESS OVERVIEW

FIGURE 43 ERICSSON: COMPANY SNAPSHOT

TABLE 110 ERICSSON: PRODUCTS OFFERED

TABLE 111 ERICSSON: DEALS

10.2.15 TOMTOM

TABLE 112 TOMTOM: BUSINESS OVERVIEW

FIGURE 44 TOMTOM: COMPANY SNAPSHOT

TABLE 113 TOMTOM: PRODUCTS OFFERED

TABLE 114 TOMTOM: PRODUCT LAUNCHES

TABLE 115 TOMTOM: DEALS

10.2.16 FOURSQUARE LABS

TABLE 116 FOURSQUARE LABS: BUSINESS OVERVIEW

TABLE 117 FOURSQUARE: PRODUCTS OFFERED

TABLE 118 FOURSQUARE LABS: DEALS

10.2.17 PASCO CORPORATION

TABLE 119 PASCO CORPORATION: BUSINESS OVERVIEW

FIGURE 45 PASCO CORPORATION: COMPANY SNAPSHOT

TABLE 120 PASCO CORPORATION: PRODUCTS OFFERED

TABLE 121 PASCO CORPORATION: DEALS

10.2.18 TOPCON

TABLE 122 TOPCON: BUSINESS OVERVIEW

FIGURE 46 TOPCON: COMPANY SNAPSHOT

TABLE 123 TOPCON: PRODUCTS OFFERED

TABLE 124 TOPCON: PRODUCT LAUNCH

TABLE 125 TOPCON: DEALS

10.2.19 NAVVIS

TABLE 126 NAVVIS: BUSINESS OVERVIEW

TABLE 127 NAVVIS: PRODUCTS OFFERED

TABLE 128 NAVVIS: PRODUCT LAUNCHES

10.2.20 GEOSLAM

TABLE 129 GEOSLAM: BUSINESS OVERVIEW

TABLE 130 GEOSLAM: PRODUCTS OFFERED

TABLE 131 GEOSLAM: PRODUCT LAUNCHES

TABLE 132 GEOSLAM: DEALS

10.2.21 LEICA GEOSYSTEMS

TABLE 133 LEICA GEOSYSTEMS: BUSINESS OVERVIEW

TABLE 134 LEICA GEOSYSTEMS: PRODUCTS OFFERED

TABLE 135 LEICA GEOSYSTEMS: PRODUCT LAUNCHES

TABLE 136 LEICA GEOSYSTEMS: DEALS

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

11 ADJACENT MARKET (Page No. - 151)

11.1 INTRODUCTION

11.1.1 RELATED MARKET

11.2 3D MAPPING AND MODELING MARKET

TABLE 137 3D MAPPING AND MODELING MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 138 3D MAPPING AND MODELING MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 139 3D MAPPING AND MODELING MARKET SIZE, BY 3D MAPPING APPLICATION, 2014–2019 (USD MILLION)

TABLE 140 3D MAPPING AND MODELING MARKET SIZE, BY 3D MAPPING APPLICATION, 2019–2025 (USD MILLION)

TABLE 141 3D MAPPING AND MODELING MARKET SIZE, BY 3D MODELING APPLICATION, 2014–2019 (USD MILLION)

TABLE 142 3D MAPPING AND MODELING MARKET SIZE, BY 3D MODELING APPLICATION, 2019–2025 (USD MILLION)

TABLE 143 3D MAPPING AND MODELING MARKET SIZE, BY DEPLOYMENT MODE, 2014–2019 (USD MILLION)

TABLE 144 3D MAPPING AND MODELING MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

TABLE 145 3D MAPPING AND MODELING MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 146 3D MAPPING AND MODELING MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 147 3D MAPPING AND MODELING MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 148 3D MAPPING AND MODELING MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 149 3D MAPPING AND MODELING MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 150 3D MAPPING AND MODELING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.3 INDOOR LOCATION MARKET

TABLE 151 INDOOR LOCATION MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 152 INDOOR LOCATION MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 153 INDOOR LOCATION MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 154 INDOOR LOCATION MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 155 INDOOR LOCATION MARKET SIZE, BY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 156 INDOOR LOCATION MARKET SIZE, BY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 157 INDOOR LOCATION MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 158 INDOOR LOCATION MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 159 INDOOR LOCATION MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 160 INDOOR LOCATION MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 161 INDOOR LOCATION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 162 INDOOR LOCATION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12 APPENDIX (Page No. - 161)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the global mobile mapping market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total virtual event platform market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from virtual event platform vendors, industry associations, and independent consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making the market estimates and forecasting the virtual event platform market, the top-down and bottom-up approaches were used to estimate and validate the size of the mobile mapping market and various other dependent subsegments. The research methodology used to estimate the market size includes the following:

- The key players in the mobile mapping market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the mobile mapping market based on application, industry vertical, and regions

- To provide detailed information about major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market.

- To analyze the impact of COVID-19 on application, industry vertical and regions across the globe

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the mobile mapping market

- To profile key players in the market and comprehensively analyze their core competencies in each microsegment

- To analyze key players based on pricing models, technology analysis, and their market shares

- To analyze competitive developments, such as new product launches, product enhancements, partnerships, and mergers and acquisitions, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mobile Mapping Market