Mobile Augmented Reality (AR) Market by Device Type (Smartphones, Tablets, PDAs), Offering (Software, Services), Application (Consumer, Healthcare, Enterprise, Commercial), and Region - Global Forecast to 2025

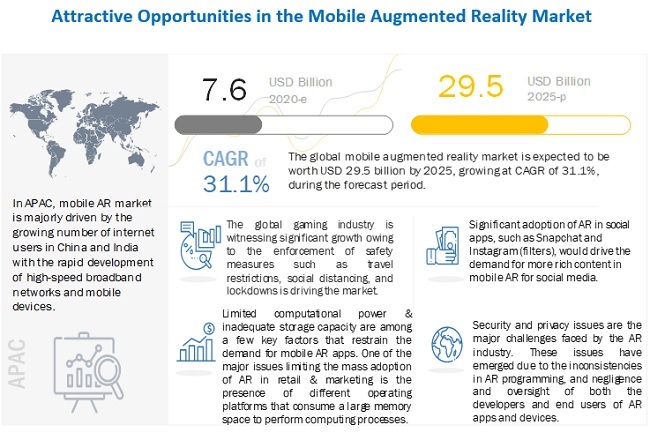

According to Industry Research Firm MarketsandMarkets™, The Mobile Augmented Reality (AR) Market is anticipated to witness significant growth, surging from USD 7.6 billion in 2020 to USD 29.5 billion by 2025, at an impressive CAGR of 31.1% from 2020 to 2025.

The growing application of mobile AR in e-commerce, retail, gaming, entertainment, and various other industries is propelling the market expansion. The report aims to offer a detailed analysis of the market based on type, offering, device type, application, and region while defining, describing, and forecasting its growth prospects. The upsurge in the adoption of mobile AR apps by tech giants has been identified as a significant driving factor of the MAR market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on current mobile AR market size and forecast

The year-on-year growth rate of the MAR market has dropped by -34% in 2020 due to the outbreak of COVID-19. However, post-COVID-19 AR/VR technology is gaining slight traction owing to its benefits in visualization, annotation, and storytelling. AR/VR technologies are aiding online learning and also offering access to cultural events, which is helping users to overcome the isolation of COVID-19 lockdowns. Apart from China, countries such as Japan, South Korea, and India in APAC are also expecting quick control over the outbreak, following a pre-emptive response in the form of lockdowns and social distancing. Many companies in APAC have switched to work remotely to curb the spread of the virus. The market players based in APAC are likely to gain through the growing use of AR through mobile devices in the healthcare and enterprise sectors.

Mobile AR Market Dynamics

Driver: Rise in demand for mobile AR from retail sector to enhance consumers’ shopping experience

The retail industry is growing at a rapid pace. Retailers are witnessing pressure to demonstrate the utility of goods without hampering their quality. These retailers are also involved in taking control of the exchange process of goods. All these factors are together promoting the use of AR technology in the retail sector. The retail industry involves the sale of products and merchandise online or from static locations, for example, a physical store. Retail shops are overcrowded, and customers do not want to invest a lot of time in purchasing. Hence, the trend of online shopping has grown over the years. Hence, many small and large retailers have increased their investments in e-commerce platforms. However, they are still facing issues when entering the online shopping space. It is mainly due to the lack of interaction with physical products due to which customers are not able to get into the depth of the products while purchasing online. The use of mobile AR in the retail space helps retailers reduce the purchasing gap between customers and online products. With the help of mobile AR, customers can see brands and their stocks online. Additionally, 3D AR products tempt customers to try out in-store products, making their purchase decisions easier, which, in turn, increases sales.

Restraint: Limited user interface affecting navigation performance of AR apps

Mobile AR apps are in demand for several applications in tourism, commercial, consumer, aerospace, and healthcare industries. However, the adoption of this technology in certain sectors is difficult due to the poor quality of user interfaces in devices. Due to the small screen size of mobile phones and incompatible user interface, a user has limited access with defined boundaries, which is likely to affect the navigation view. Hence, the limited user interface affects the quality of augmented reality-featured navigation apps in sectors such as tourism. The user interfaces in mobile AR systems are complicated and are different from monitor-based augmented reality. User interfaces in mobile AR systems should be available to users irrespective of the user-location or the occupation. These apps should be location-aware and should provide links to the physical world surrounding the user.

Opportunity: Unique value proposition through social media apps

Companies’ decisions are highly dependent on their capacity to understand demand signals, the ability to forecast certain things in advance, the capacity to monitor social media demand behavior, and how quickly they respond to fulfill customers’ demands. These capabilities are essential for better performance of the business in the usual scenario, as well as when there are supply chain disruptions in the pandemic situation. Significant adoption of AR in social apps, such as Snapchat and Instagram (filters), would drive the demand for more rich content in mobile AR for social media. Brands and marketers, in particular, are finding ways to boost their sales using mobile AR apps through different campaigns using social media platforms. This would provide a huge opportunity even for the developers who create different platforms for the marketers to sells their products.

Challenge: Social and privacy-related issues impacting adoption rate

AR is an emerging technology. Some mobile AR applications have features through which a user can see details of any person on all social media platforms. Hence, the widespread use of AR apps and devices is expected to significantly reduce the levels of personal privacy. Security and privacy issues are the major challenges faced by the AR industry. These issues have emerged due to the inconsistencies in AR programming, and negligence and oversight of both the developers and end users of AR apps and devices. A few AR apps are not capable of securing user identity and privacy. There are no regulations that define the dos and don’ts associated with the AR environment. This implies that the AR technology can incorporate malicious intent and lead to the misuse of personal information of users. For instance, the try-before-you-buy concept for clothing retailers can be misused. If the concept is not secured well, it can be hijacked. The hacker can overlay a nude body image instead of clothes, which can harm the reputation of the user. All these issues pose challenges for the adoption of AR technology in the retail sector.

To know about the assumptions considered for the study, download the pdf brochure

Mobile AR SDKs to play a significant role in the growth of mobile augmented reality market

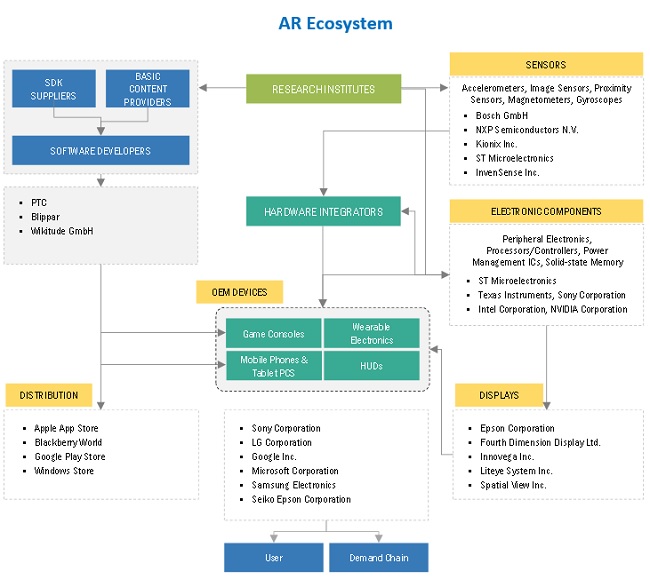

The healthy growth of companies involved in the development of AR SDKs would drive the growth of the MAR market. Numerous companies have begun targeting the enterprise applications of MAR and are exploring new business opportunities. The mobile AR SDKs developed by Google, and Apple, namely, ARCore, and ARKit have helped widespread adoption of mobile AR. Gaming and lifestyle are the key AR apps that have been downloaded by numerous users.

Tablets are estimated to hold the second largest share of the mobile AR market in 2020

Tablet-installed AR apps are widely used in e-commerce & marketing, gaming, and many other application areas. The large screen size of tablets is convenient for location-based applications. A tablet allows switching the orientation of the screen according to a user’s orientation and adjusting the zoom level according to the current speed. Tablets use GPS and other tracking mechanisms to overlay digital content or information onto the real environment. Therefore, the installation of gaming apps is preferred more in tablets than in smartphones; hence, tablets account for the second-largest market share.

The e-commerce & marketing sector in the mobile AR market is projected to grow at a high CAGR from 2020 to 2025

E-commerce and marketing sector is thriving, which can be attributed to the advantages it provides to buyers and sellers. With the help of AR, a buyer can compare products by superimposing virtual images in the real world using a smartphone or tablet camera. This not only helps a buyer to make effective decisions but is also convenient for a seller. The enhanced buying experience is beneficial for the entire retail sector.

APAC is expected to lead the mobile augmentd reality market and is projected to grow at the highest CAGR from 2020 to 2025.

The presence of multiple manufacturers and vendors for AR technology-based products in Japan and China has boosted the MAR market growth in the region in recent years. The growing consumer and commercial applications in Japan, India, and China are expected to witness lots of investments in new technological developments. The use of AR has grown in commercial and consumer applications in the APAC region owing to the easy availability of AR technology in the region. The use of AR technology through smartphones and tablets has helped the market in the region to grow at a faster pace. The APAC region would witness the highest growth rate in the global MAR market in the coming years.

Top Mobile AR Companies- Key Market Players

Major vendors in the mobile augmented reality market include Google (US), PTC (US), Apple (US), Wikitude (Austria), Samsung Electronics (South Korea), Blippar (UK), MAXST (South Korea), Magic Leap US), Upskill (US), and Atheer (US).

Scope of the Report:

|

Report Metric |

Details |

| Estimated Market Size | USD 7.6 Billion |

| Projected Market Size | USD 29.5 Billion |

| Growth Rate | CAGR of 31.1% |

|

Market size available for years |

2020–2025 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Rise in demand for mobile AR from retail sector to enhance consumers’ shopping experience |

| Largest Growing Region | Asia-Pacific (APAC) |

| Largest Market Share Segment | Tablets Segment |

| Highest CAGR Segment | E-commerce and Marketing Segment |

This report categorizes the mobile augmented reality market based on type, offering, device type, application, and geography.

Mobile Augmented Reality Market, by Type:

- Marker-based (Passive Marker, Active Marker)

- Markerless (Model-based, Image Processing-based)

- Anchor-based

Mobile Augmented Reality Market, by Offering:

- MAR Software (AR application platforms, AR SDKs )

- MAR Services (AR Design & Development, Deployment & Support Services)

- Impact of COVID-19 on offering

Mobile Augmented Reality Market, by Device Type:

- Smartphones

- Tablets

- Personal Digital Assistants (PDAs)/Handheld Gaming Consoles

- Other Devices (Smartglasses, Wearables)

- Impact of COVID-19 on device types

Mobile Augmented Reality Market, by Application:

- Consumer (Gaming, Sports & Entertainment)

- Aerospace & Defense

- Healthcare

- Commercial (Tourism & Sight-seeing, E-learning, E-commerce & Marketing)

- Enterprise (Manufacturing)

- Others (Architecture & Building Design, Geospatial Mining)

- Impact of COVID-19 on various applications

Mobile Augmented Reality Market, by Geography:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

- Impact of COVID-19 on various regions

Recent Developments

- In December 2019, PTC partnered with Magic Leap to introduce AR-integrated enterprise solutions. The partnership is likely to allow Magic Leap to use AR capabilities of the Vuforia engine in its Magic Leap 1 headset.

- In December 2019, Samsung collaborated with Librestream, a provider of AR enterprise solutions, to deliver an AR solution for improved worker safety and communication. This solution was integrated with Samsung’s latest ruggedized tablet—Samsung Galaxy Tab Active Pro.

- In May 2019, Google announced new addons in Google Search, which deploys (AR) and Google Lens. The new features in Google Search use a combination of augmented reality, computer vision, and camera to superimpose information and content onto real space.

Frequently Asked Questions (FAQ):

Which is the leading application in the mobile AR market?

The MAR market is led by the consumer application. Gaming has been the most important sector in which mobile AR has been used. Pokémon Go has led the market and contributed significantly to the MAR market growth.

What would be the driving factor for widespread adoption of mobile augmented reality?

The widespread adoption of mobile AR depends on the compatibility of smartphones for AR. Currently, only about 10% of smartphones are compatible with AR technology, but with the growing compatibility features provided by mobile developers, the AR adoption in smartphones is expected to grow.

How would use of apps benefit the mobile augmented reality market?

The increasing app-store revenue with the in-app and premium app purchases would be the critical factor for the growth of the MAR market. The next major revenue-fetching stream could be AR-as-a-Feature. The availability of AR features in non-AR apps would be one of the major drivers for the growth of the MAR market.

Which region is expected to adopt mobile augmented reality solutions at a fast rate?

APAC is expected to adopt mobile augmented reality solutions at the fastest rate. Countries such as China, Japan, and India have a high potential for future growth of the market.

What are some of the technological advancements in the market?

The use of AR smart glasses in the enterprise, healthcare, retail, and automotive verticals to improve work efficiency has been one of the major factors propelling the AR market growth. Osterhout Design Group, Epson, Google, Vuzix, Optinvent, Solos, and Meta are some major players that offer AR smart glasses. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 SUMMARY OF CHANGES

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 2 MOBILE AR MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 3 MOBILE AUGMENTED REALITY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MOBILE AR MARKET: RESEARCH METHODOLOGY

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market share by bottom-up analysis (demand side)

FIGURE 6 MOBILE AR MARKET: BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE CALCULATION BY BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 8 MOBILE AR MARKET: TOP-DOWN APPROACH

FIGURE 9 MARKET SIZE CALCULATION BY TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 11 ASSUMPTIONS OF RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 12 MOBILE AR MARKET, 2016–2025 (USD MILLION)

FIGURE 13 MOBILE AR MARKET SHARE, BY DEVICE TYPE (2019 VS. 2025)

FIGURE 14 CONSUMER APPLICATION TO ACCOUNT FOR LARGEST SIZE OF MOBILE AR MARKET IN 2025

FIGURE 15 NORTH AMERICA TO CAPTURE LARGEST SIZE OF MOBILE AR MARKET IN 2025

3.1 COVID-19 IMPACT ON MOBILE AUGMENTED REALITY MARKET

FIGURE 16 COVID-19 IMPACT ON MOBILE AUGMENTED REALITY MARKET

3.1.1 REALISTIC SCENARIO (POST-COVID-19)

3.1.2 OPTIMISTIC SCENARIO (POST-COVID-19)

3.1.3 PESSIMISTIC SCENARIO (POST-COVID-19)

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 MOBILE AUGMENTED REALITY MARKET, 2020–2025 (USD BILLION)

FIGURE 17 ATTRACTIVE OPPORTUNITIES FOR MARKET

4.2 MARKET, BY APPLICATION

FIGURE 18 CONSUMER APPLICATION TO CONTINUE TO HOLD LARGEST SHARE OF MARKET FROM 2016 TO 2025

4.3 MOBILE AUGMENTED REALITY MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY

FIGURE 19 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2025

4.4 APAC IS EXPECTED TO EMERGE AS FASTEST GROWING MARKET FROM 2020 TO 2025

FIGURE 20 CHINA AND JAPAN ESTIMATED TO EMERGE AS FAST-GROWING MARKETS

4.5 MARKET, BY OFFERING

FIGURE 21 SERVICES TO CONTINUE TO RECORD LARGEST MARKET SIZE DURING FORECAST PERIOD

4.6 MARKET, BY DEVICE TYPE

FIGURE 22 SMARTPHONES WILL CONTINUE TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

4.7 MARKET, BY REGION

FIGURE 23 NORTH AMERICA WILL HOLD LARGEST SIZE OF GLOBAL MOBILE AUGMENTED REALITY MARKET THROUGHOUT FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 EVOLUTION OF AUGMENTED REALITY TECHNOLOGY

FIGURE 24 EVOLUTION OF AUGMENTED REALITY TECHNOLOGY

5.3 MARKET DYNAMICS

FIGURE 25 INCREASED DEMAND FOR MOBILE AR IN GAMING AND RETAIL SECTORS DRIVES MOBILE AR MARKET GROWTH

5.3.1 DRIVERS

5.3.1.1 Increase in online gaming activities during COVID-19 pandemic

5.3.1.2 Rise in demand for mobile AR from retail sector to enhance consumers’ shopping experience

FIGURE 26 ADOPTION OF AR TECHNOLOGY IN RETAIL SECTOR, BY APPLICATION

5.3.1.3 Surge in adoption of AR technology by travel & tourism and education sectors

5.3.2 RESTRAINTS

5.3.2.1 Limited processing power and storage capacity

5.3.2.2 Limited user interface affecting navigation performance of AR apps

5.3.3 OPPORTUNITIES

5.3.3.1 Increased demand for AR technology from automotive sector

5.3.3.2 Unique value proposition through social media apps

5.3.3.3 High focus of armed forces on digitalization, along with rise in demand from aerospace industry

5.3.4 CHALLENGES

5.3.4.1 Social and privacy-related issues impacting adoption rate

5.3.4.2 Requirement to reconfigure and redesign AR apps for different platforms and applications

5.4 PRICING ANALYSIS

TABLE 1 DEVELOPERS’ HOURLY RATES FOR DIFFERENT REGIONS

TABLE 2 COMPARISON OF SDK PRICING

5.5 MOBILE AUGMENTED REALITY MARKET: CASE STUDIES

5.5.1 MOBIDEV CREATED AR APP TO INCREASE CUSTOMER ENGAGEMENT

5.5.2 RUFFLES COULD INCREASE SALES WITH AR GAME—AMIGO

5.6 REGULATORY LANDSCAPE

5.7 PATENT ANALYSIS

FIGURE 27 AR AND VR PATENT FILINGS

6 INDUSTRY TRENDS (Page No. - 63)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 28 AR VALUE CHAIN ANALYSIS (2019): MAJOR VALUE IS ADDED DURING RESEARCH & PRODUCT DEVELOPMENT AND MANUFACTURING STAGES

6.2.1 AR ECOSYSTEM

FIGURE 29 ELEMENTS OF AR ECOSYSTEM

FIGURE 30 MOBILE AR MARKET VALUE CHAIN ANALYSIS (2019): MAJOR VALUE IS ADDED THROUGH PRIMARY ACTIVITIES

6.3 INDUSTRY TRENDS

6.3.1 HIGH ADOPTION OF AR SMART GLASSES TO IMPROVE WORK EFFICIENCY

6.3.2 INCREASED DEMAND FOR AR FOR RUGGED DISPLAY APPLICATIONS

6.4 AUGMENTED REALITY TECHNOLOGIES

6.4.1 MOBILE AUGMENTED REALITY

6.4.2 MONITOR-BASED TECHNOLOGY

6.4.3 NEAR-EYE-BASED TECHNOLOGY

7 TYPES OF MOBILE AR (Page No. - 69)

7.1 INTRODUCTION

TABLE 3 COMPARISON BETWEEN MARKER-BASED AND MARKERLESS AR

7.2 MARKER-BASED AUGMENTED REALITY

7.2.1 PASSIVE MARKER

7.2.1.1 Passive marker is most widely used type of marker-based augmented reality

7.2.2 ACTIVE MARKER

7.2.2.1 Active marker uses LED to track objects

7.3 MARKERLESS AUGMENTED REALITY

7.3.1 MODEL-BASED TRACKING

7.3.1.1 Model-based tracking depends on camera movements

7.3.2 IMAGE PROCESSING-BASED TRACKING

7.3.2.1 Image processing-based tracking requires optical scanners or cameras for processing images

7.4 ANCHOR-BASED AUGMENTED REALITY

7.4.1 ANCHOR-BASED AR IS USED TO OVERLAY VIRTUAL IMAGES IN REAL SPACE

8 MOBILE AR MARKET, BY OFFERING (Page No. - 72)

8.1 INTRODUCTION

FIGURE 31 MOBILE AUGMENTED REALITY FOR SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 4 MARKET, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 5 MARKET, BY OFFERING, 2020–2025 (USD MILLION)

8.2 MAR SOFTWARE

8.2.1 SOFTWARE, BY FUNCTION

8.2.1.1 Workflow optimization and remote collaboration are most trending applications of augmented reality

8.2.1.1.1 Remote collaboration

8.2.1.1.2 Workflow optimization

8.2.1.1.3 Documentation

8.2.1.1.4 Visualization

8.2.1.1.5 3D modeling

8.2.1.1.6 Navigation

8.2.2 MOBILE AR APPLICATION PLATFORMS

8.2.2.1 Mobile AR application platforms are easy to learn

TABLE 6 COMPARISON BETWEEN ONLINE AR PLATFORMS AND AR PROGRAM

8.2.3 MOBILE AR SOFTWARE DEVELOPMENT KITS

8.2.3.1 SDKs are used for deploying AR solutions for specific requirements and frameworks

8.3 MAR SERVICES

8.3.1 AR DESIGN AND DEVELOPMENT

8.3.1.1 AR design and development service providers ensure successful installation of MAR apps

8.3.2 DEPLOYMENT AND SUPPORT SERVICES

8.3.2.1 Cloud-based services

8.3.2.1.1 Emergence of mobile devices with AR capabilities creates need for cloud-based AR services

8.3.3 AR AS A SERVICE

8.3.3.1 Samsung has developed new AR Zone—AR as a Service

8.3.4 AR SUPPORT SERVICES

8.3.4.1 Maintenance and support services help users to make their AR mobile apps convenient to use

8.4 IMPACT OF COVID-19 ON OFFERINGS

9 MOBILE AUGMENTED REALITY (AR) MARKET, BY DEVICE TYPE (Page No. - 79)

9.1 INTRODUCTION

FIGURE 32 MOBILE AUGMENTED REALITY (AR) MARKET, BY DEVICE TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 7 MARKET, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE 8 MARKET, BY DEVICE TYPE, 2020–2025 (USD MILLION)

9.2 SMARTPHONES

9.2.1 USE OF SMARTPHONE-INSTALLED AR APPS FOR MARKETING AND ADVERTISING APPLICATIONS FOSTERS MAR MARKET GROWTH

TABLE9 MARKET FOR SMARTPHONES, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE10 MARKET FOR SMARTPHONES, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE11 SMARTPHONE-BASED AUGMENTED REALITY APPS

9.3 TABLETS

9.3.1 BIGGER SCREEN SIZE OF TABLETS HELPS INCREASE THEIR DEMAND FOR GAMING AND REMOTE LEARNING APPLICATIONS

TABLE12 MOBILE AR MARKET FOR TABLETS, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE13 MOBILE AR MARKET FOR TABLETS, BY APPLICATION, 2020–2025 (USD MILLION)

9.4 PERSONAL DIGITAL ASSISTANTS/HANDHELD GAME CONSOLE

9.4.1 ADOPTION OF PERSONAL DIGITAL ASSISTANTS IN CONSUMER APPLICATIONS PROPELS MAR MARKET GROWTH

TABLE14 MOBILE AR MARKET FOR PERSONAL DIGITAL ASSISTANTS/HANDHELD GAME CONSOLE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE15 MOBILE AR MARKET FOR PERSONAL DIGITAL ASSISTANTS/HANDHELD GAME CONSOLE, BY APPLICATION, 2020–2025 (USD MILLION)

9.5 OTHER DEVICES

TABLE 16 MOBILE AR MARKET FOR SMART GLASSES AND WEARABLES, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 17 MOBILE AR MARKET FOR SMART GLASSES AND WEARABLES, BY APPLICATION, 2020–2025 (USD MILLION)

9.6 COVID-19 IMPACT ON MOBILE AUGMENTED REALITY MARKET FOR DEVICE TYPES

10 MOBILE AUGMENTED REALITY (AR) MARKET, BY APPLICATION (Page No. - 90)

10.1 INTRODUCTION

FIGURE 33 CONSUMER APPLICATION TO CAPTURE LARGEST SIZE OF MARKET IN 2025

TABLE 18 MOBILE AR MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 19 MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

10.2 CONSUMER

10.2.1 GAMING

10.2.1.1 Augmented reality enhances interactivity in gaming and provides more immersive experience to gamers

10.2.2 SPORTS & ENTERTAINMENT

10.2.2.1 Entertainment sector is major market for 3D display technology, thereby creating need for AR technology

TABLE20 MOBILE AR MARKET FOR CONSUMER APPLICATION, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE21 MOBILE AUGMENTED REALITY MARKET FOR CONSUMER APPLICATION, BY DEVICE TYPE, 2020–2025 (USD MILLION)

TABLE22 MOBILE AR MARKET FOR CONSUMER APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE23 MOBILE AR MARKET FOR CONSUMER APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE24 MOBILE AR MARKET FOR CONSUMER APPLICATION IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE25 MOBILE AR MARKET FOR CONSUMER APPLICATION IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE26 MOBILE AR MARKET FOR CONSUMER APPLICATION IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE27 MOBILE AR MARKET FOR CONSUMER APPLICATION IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE28 MOBILE AR MARKET FOR CONSUMER APPLICATION IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE29 MOBILE AR MARKET FOR CONSUMER APPLICATION IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE30 MOBILE AR MARKET FOR CONSUMER APPLICATION IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE31 MOBILE AR MARKET FOR CONSUMER APPLICATION IN ROW, BY REGION, 2020–2025 (USD MILLION)

10.3 AEROSPACE & DEFENSE

10.3.1 AR IS BEING USED IN AEROSPACE & DEFENSE APPLICATIONS TO COMBAT ENEMIES

TABLE32 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY DEVICE TYPE, 2016–2019 (USD THOUSAND)

TABLE33 MARKET AEROSPACE & DEFENSE APPLICATION, BY DEVICE TYPE, 2020–2025 (USD MILLION)

TABLE34 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2016–2019 (USD THOUSAND)

TABLE35 MARKET FOR AEROSPACE & DEFENSE APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE36 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE37 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE38 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE39 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE40 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN APAC, BY COUNTRY, 2016–2019 (USD THOUSAND)

TABLE41 MOBILE AUGMENTED REALITY MARKET FOR AEROSPACE & DEFENSE APPLICATION IN APAC, BY COUNTRY, 2020–2025 (USD THOUSAND)

TABLE42 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE43 MARKET FOR AEROSPACE & DEFENSE APPLICATION IN ROW, BY REGION, 2020–2025 (USD MILLION)

10.4 HEALTHCARE

10.4.1 AUGMENTED HEALTHCARE APPS CAN HELP SAVE LIVES AND TREAT PATIENTS SEAMLESSLY, IRRESPECTIVE OF SEVERITY OF ISSUE

TABLE44 MARKET FOR HEALTHCARE APPLICATION, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE45 MARKET FOR HEALTHCARE APPLICATION, BY DEVICE TYPE, 2020–2025 (USD MILLION)

TABLE46 MARKET FOR HEALTHCARE APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE47 MARKET FOR HEALTHCARE APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE48 MARKET FOR HEALTHCARE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE49 MARKET FOR HEALTHCARE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE50 MARKET FOR HEALTHCARE APPLICATION IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE51 MARKET FOR HEALTHCARE APPLICATION IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE52 MARKET FOR HEALTHCARE APPLICATION IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE53 MARKET FOR HEALTHCARE APPLICATION IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE54 MARKET FOR HEALTHCARE APPLICATION IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE55 MOBILE AUGMENTED REALITY MARKET FOR HEALTHCARE APPLICATION IN ROW, BY REGION, 2020–2025 (USD MILLION)

10.5 COMMERCIAL

10.5.1 RISING DEMAND FOR MOBILE AR APPS IN E-LEARNING AND E-COMMERCE SECTORS DRIVES MARKET GROWTH

10.5.1.1 Tourism and sightseeing

10.5.1.2 E-learning

10.5.1.3 E-commerce and marketing

TABLE56 MARKET FOR COMMERCIAL APPLICATION, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE57 MOBILE AUGMENTED REALITY MARKET FOR COMMERCIAL APPLICATION, BY DEVICE TYPE, 2020–2025 (USD MILLION)

TABLE58 MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE59 MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE60 MARKET FOR COMMERCIAL APPLICATION IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE61 MARKET FOR COMMERCIAL APPLICATION IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE62 MARKET FOR COMMERCIAL APPLICATION IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE63 MARKET FOR COMMERCIAL APPLICATION IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE64 MARKET FOR COMMERCIAL APPLICATION IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE65 MARKET FOR COMMERCIAL APPLICATION IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE66 MARKET FOR COMMERCIAL APPLICATION IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE67 MARKET FOR COMMERCIAL APPLICATION IN ROW, BY REGION, 2020–2025 (USD MILLION)

10.6 ENTERPRISE (MANUFACTURING)

10.6.1 TRAINING, DEVELOPMENT, DESIGNING ARE FACTORS THAT DRIVE ADOPTION OF MOBILE AR IN ENTERPRISES

TABLE68 MARKET FOR ENTERPRISE APPLICATION, BY DEVICE TYPE, 2016–2019 (USD THOUSAND)

TABLE69 MARKET FOR ENTERPRISE APPLICATION, BY DEVICE TYPE, 2020–2025 (USD MILLION)

TABLE70 MARKET FOR ENTERPRISE APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE71 MARKET FOR ENTERPRISE APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE72 MARKET FOR ENTERPRISE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE73 MARKET FOR ENTERPRISE APPLICATION IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE74 MARKET FOR ENTERPRISE APPLICATION IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE75 MARKET FOR ENTERPRISE APPLICATION IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE76 MARKET SIZE FOR ENTERPRISE APPLICATION IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE77 MARKET SIZE FOR ENTERPRISE APPLICATION IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE78 MARKET SIZE FOR ENTERPRISE APPLICATION IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE79 MARKET SIZE FOR ENTERPRISE APPLICATION IN ROW, BY REGION, 2020–2025 (USD MILLION)

10.7 OTHERS

10.7.1 ARCHITECTURE AND BUILDING DESIGN (BIM)

10.7.2 GEOSPATIAL MINING

TABLE80 MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2016–2019 (USD MILLION)

TABLE81 MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2020–2025 (USD MILLION)

TABLE82 MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE83 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE84 MARKET FOR OTHER APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE85 MARKET FOR OTHER APPLICATIONS IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE86 MARKET FOR OTHER APPLICATIONS IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE87 MARKET FOR OTHER APPLICATIONS IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE88 MARKET FOR OTHER APPLICATIONS IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE89 MARKET FOR OTHER APPLICATIONS IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE90 MARKET FOR OTHER APPLICATIONS IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE91 MARKET FOR OTHER APPLICATIONS IN ROW, BY REGION, 2020–2025 (USD MILLION)

10.8 IMPACT OF COVID-19 ON MOBILE AUGMENTED REALITY MARKET

11 GEOGRAPHIC ANALYSIS (Page No. - 125)

11.1 INTRODUCTION

FIGURE 34 APAC TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 92 MOBILE AUGMENTED REALITY MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 93 MARKET, BY REGION, 2020–2025 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 35 US TO CONTINUE TO COMMAND NORTH AMERICAN MARKET DURING FORECAST PERIOD

FIGURE 36 NORTH AMERICA: MOBILE AUGMENTED REALITY SNAPSHOT

TABLE 94 MOBILE AUGMENTED REALITY MARKET IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 95 MARKET IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 96 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 97 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

11.2.1 US

11.2.1.1 US to continue to account for largest share of North American market during 2020–2025

TABLE98 MOBILE AR MARKET IN US, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE99 MOBILE AR MARKET IN US, BY APPLICATION, 2020–2025 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Growing use of AR by Canadian companies to market and sell their products fuel market growth

TABLE100 MARKET IN CANADA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE101 MARKET IN CANADA, BY APPLICATION, 2020–2025 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Increased government spending on AR-related R&D activities fuels market growth in Mexico

TABLE102 MARKET IN MEXICO, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE103 MARKET IN MEXICO, BY APPLICATION, 2020–2025 (USD MILLION)

11.3 EUROPE

FIGURE 37 GERMANY TO CONTINUE TO LEAD MARKET IN EUROPE DURING FORECAST PERIOD

FIGURE 38 EUROPE: MOBILE AUGMENTED REALITY MARKET SNAPSHOT

TABLE 104 MARKET IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 105 MARKET IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 106 MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 107 MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

11.3.1 UK

11.3.1.1 Digital drive in UK to boost demand for mobile AR technology

TABLE108 MARKET IN UK, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE109 MARKET IN UK, BY APPLICATION, 2020–2025 (USD MILLION)

11.3.2 GERMANY

11.3.2.1 Increasing use 3D sensing technology by German companies accelerates demand for mobile AR

TABLE110 MOBILE AUGMENTED REALITY MARKET IN GERMANY, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE111 MARKET IN GERMANY, BY APPLICATION, 2020–2025 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Robust presence of established players, such as Total Immersion, would propel market growth in France

TABLE112 MARKET IN FRANCE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE113 MARKET IN FRANCE, BY APPLICATION, 2020–2025 (USD MILLION)

11.3.4 REST OF EUROPE

TABLE114 MOBILE AUGMENTED REALITY MARKET IN REST OF EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE115 MARKET IN REST OF EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

11.4 ASIA PACIFIC (APAC)

FIGURE 39 CHINA TO CONTINUE TO DOMINATE MOBILE AUGMENT REALITY MARKET IN APAC DURING FORECAST PERIOD

FIGURE 40 APAC: MARKET SNAPSHOT

TABLE 116 MARKET IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 117 MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 118 MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 119 MOBILE AUGMENTED REALITY MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Rise of start-ups in country creating opportunities for mobile AR technology providers

TABLE120 MARKET IN CHINA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE121 MARKET IN CHINA, BY APPLICATION, 2020–2025 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Use of mobile AR technology by Japan-based companies to automate workflow and reduce human errors propels market growth

TABLE122 MARKET IN JAPAN, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE123 MARKET IN JAPAN, BY APPLICATION, 2020–2025 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Mobile AR technology in India is still in its nascent stage

TABLE124 MARKET IN INDIA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE125 MARKET IN INDIA, BY APPLICATION, 2020–2025 (USD MILLION)

11.4.4 SOUTH KOREA

11.4.4.1 Increased investments in AR/VR technologies accelerate market growth

TABLE126 MARKET IN SOUTH KOREA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE127 MOBILE AUGMENTED REALITY MARKET IN SOUTH KOREA, BY APPLICATION, 2020–2025 (USD MILLION)

11.4.5 REST OF APAC

TABLE128 MARKET IN REST OF APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE129 MARKET IN REST OF APAC, BY APPLICATION, 2020–2025 (USD MILLION)

11.5 REST OF THE WORLD (ROW)

TABLE 130 MARKET IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 131 MARKET IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 132 MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 133 MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

11.5.1 MIDDLE EAST AND AFRICA

11.5.1.1 Consumer electronics is major application area of mobile AR in MEA

FIGURE 41 MIDDLE EAST AND AFRICA TO REGISTER HIGHER CAGR IN MOBILE AUGMENT REALITY MARKET IN ROW REGION DURING FORECAST PERIOD

TABLE134 MARKET IN MIDDLE EAST AND AFRICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE135 MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION, 2020–2025 (USD MILLION)

11.5.2 SOUTH AMERICA

11.5.2.1 High demand for mobile AR technology in consumer applications accelerates South American market growth

TABLE136 MARKET IN SOUTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE137 MARKET IN SOUTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

11.6 COVID-19 IMPACT ON GEOGRAPHIES

12 COMPETITIVE LANDSCAPE (Page No. - 158)

12.1 OVERVIEW

FIGURE 42 STRATEGIES ADOPTED BY KEY PLAYERS

12.2 RANKING OF PLAYERS IN MARKET

FIGURE 43 RANKING OF TOP 5 PLAYERS IN MARKET

12.3 MARKET SHARE

FIGURE 44 MARKET SHARE FOR MARKET

12.4 COMPANY EVALUATION MATRIX

12.4.1 STAR

12.4.2 EMERGING LEADER

12.4.3 PERVASIVE

12.4.4 PARTICIPANT

FIGURE 45 MOBILE AUGMENTED REALITY MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2019

12.5 COMPETITIVE SITUATION AND TRENDS

12.5.1 PRODUCT AND TECHNOLOGY LAUNCHES AND DEVELOPMENTS

TABLE138 PRODUCT AND TECHNOLOGY LAUNCHES AND DEVELOPMENTS, 2017–2020

12.5.2 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE139 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS, 2017–2020

12.5.3 ACQUISITIONS

TABLE140 ACQUISITIONS, 2017–2020

12.5.4 EXPANSIONS

TABLE 141 EXPANSIONS, 2017–2020

12.6 FUNDRAISING

TABLE 142 FUNDRAISING, 2017–2020

13 COMPANY PROFILES (Page No. - 166)

13.1 INTRODUCTION

FIGURE 46 GEOGRAPHIC REVENUE MIX OF MAJOR PLAYERS

13.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

13.2.1 GOOGLE, INC.

FIGURE 47 GOOGLE, INC.: COMPANY SNAPSHOT

13.2.2 PTC INC.

FIGURE 48 PTC INC.: COMPANY SNAPSHOT

13.2.3 APPLE

FIGURE 49 APPLE: COMPANY SNAPSHOT

13.2.4 WIKITUDE GMBH

13.2.5 SAMSUNG ELECTRONICS

FIGURE 50 SAMSUNG ELECTRONICS: COMPANY SNAPSHOT

13.2.6 MAXST

13.2.7 MAGIC LEAP, INC.

13.2.8 BLIPPAR

13.2.9 UPSKILL

13.2.10 ATHEER INC.

* Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

13.3 RIGHT TO WIN

13.4 OTHER KEY PLAYERS

13.4.1 MARXENT LABS, LLC

13.4.2 INGLOBE TECHNOLOGIES

13.4.3 AUGMENT

13.4.4 NIANTIC

13.4.5 NEXT/NOW

13.4.6 8NINTHS INC.

13.4.7 GROOVE JONES

13.4.8 VIRONIT

13.4.9 SCOPE AR

13.4.10 EON REALITY

13.4.11 INDE

13.4.12 ZAPPAR

13.4.13 HQSOFTWARE

13.5 START-UP ECOSYSTEM

13.5.1 TALEPSPIN

13.5.2 SCANTA

13.5.3 CRAFTARS

13.5.4 APPENTUS TECHNOLOGIES

13.5.5 BIDON GAMES STUDIO

14 APPENDIX (Page No. - 204)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

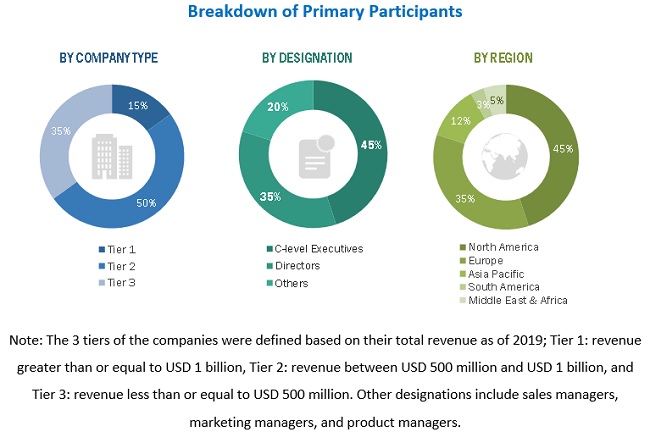

The study involved four major activities in estimating the size for mobile augmented reality market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information pertinent to this study on the mobile augmented reality market. Secondary sources included annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles by recognized authors, directories, and databases. The secondary sources referred to for this research study include organizations such as the Consumer Technology Association (CTA), Integrated Systems Europe, Camera & Imaging Products Association (CIPA), the Society for Information Display (SID), and Touch Taiwan. Secondary research was conducted to obtain key information about the supply chain of the industry, value chain of the market, the total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives.

After the complete market engineering (which included calculations for the market statistics, market breakdown, data triangulation, market size estimations, and market forecasting), extensive primary research was carried out to gather information, as well as to verify and validate the critical numbers obtained.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the mobile AR market through secondary research. Several primary interviews were conducted with the market experts from both demand and supply sides across 4 major regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). Approximately 20% and 80% of primary interviews were conducted with parties from the demand side and supply side, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, were used to estimate and validate the size of the mobile AR market and other dependent submarkets. Key players in the market were determined through primary and secondary research. This entire research methodology involved the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives for key insights (both qualitative and quantitative) about the mobile AR market. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the market segments covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analyses from MarketsandMarkets and presented in the report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the estimation processes explained above, the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both demand and supply sides.

Report Objectives

- To describe and forecast the mobile augmented reality (MAR) market, by offering, device type, application, and geography, in terms of value

- To define different types of mobile AR technology

- To forecast the market size for various segments with regard to 4 main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)—in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges, which influence the growth of the market

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments in the MAR market

- To study the evolution and timeline of the MAR market using the value chain analysis and market roadmaps

- To analyze competitive developments such as funding, acquisitions, product launches and developments, and research and development (R&D) activities in the MAR market

- To strategically profile key players, comprehensively analyze their core competencies2, and describe the competitive landscape of the MAR market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Product matrix that gives a detailed comparison of the product portfolio of each company

- Profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Mobile Augmented Reality (AR) Market