Missile Seekers Market by Technology (Active Radar, Semi-active Radar, Passive Radar, Infrared, Laser, Multi-mode), Missile Type (Interceptor, Ballistic, Cruise, Conventional), Launch Mode, and Region (North America, Europe, APAC, & RoW) (2021-2026)

Update:: 22.10.24

The Missile Seekers Market is experiencing significant growth, driven by the increasing demand for advanced missile systems across military and defense sectors. Technological advancements in seeker technologies, such as infrared, radar, and electro-optical systems, are enhancing the accuracy and effectiveness of missile guidance, enabling precision strikes and improved targeting capabilities. Additionally, the rising geopolitical tensions and the need for national security are further propelling the demand for sophisticated missile systems. As countries invest in modernizing their defense arsenals, the Missile Seekers Market is poised for continued expansion, reflecting the critical role of these technologies in contemporary warfare and defense strategies.

Missile Seekers Market Size & Share

The global missile seekers market size is projected to grow from USD 5.3 billion in 2021 to USD 6.8 billion by 2026, growing at a CAGR of 5.2% from 2021 to 2026. The market is driven by factors such as development of smaller missiles and their seekers, growing demand for missile defense systems and advancements in guidance systems.

To know about the assumptions considered for the study, Request for Free Sample Report

Infrared based missile seekers market is the least impacted because of COVID-19 outbreak. Market for missile seekers used in interceptor missiles is expected to grow at a very healthy rate, from 2382 Million USD in 2021 to 3140 Million USD in 2026.

COVID-19 Impact on the missile seekers Market

The missile seekers market includes major players Leonardo S.p.A. (Italy), Raytheon Technologies (US), Northrop Grumman Corporation (US), Thales (France), and Safran Group (France). These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East, Africa, and Latin America. COVID-19 has impacted their businesses as well. Industry experts believe that COVID-19 has affected the services for defense sector globally in 2020.

During the COVID-19 outbreak, the orders and deliveries of missile were intact. However, owing to supply chain disruptions, slight negative impact is expected on the Missile seekers market which recovers slowly in 1st quarter of 2021.

Missile seekers Market Dynamics

Driver: Geopolitical Instabilities

Geopolitical instabilities in various countries across the globe have led to increased defense budgets of these countries. For instance, during the cold war era from the 1950s to 1990s, countries such as the U.S. and Russia made significant investments in submarine-launched ballistic missiles, nuclear warheads, long-range rockets, and other weapon systems. The number of active conflicts has also increased, globally, especially in the last five years. Some of the ongoing conflicts include the Afghanistan war, the India-Pakistan dispute, the North Korea issue. The latest addition to that is US-China dispute, which may convert into a naval war. To counter navy, air-to-surface guided missiles to be fired from fighter planes to ships, plays an important role. The rise in the number of such conflicts across the globe is expected to drive the demand and motivation for improvements in missile seekers in near future.

Opportunity: Depleting stock of precision guided missiles

Manufacturing of guided missiles is a lengthy process. US is one of the key consumers in the missile markets. But the recent reports suggests that the stock of missiles of US military is depleting. Which will be creating a huge demand for missiles by US military in near future. Considering the recent tensions with China, US would be ready from their end, which means the depleting stock of missiles needs an urgent refill. Which is expected to create a huge demand for missile seekers used in those missiles as well, which will create an opportunity for the missile seekers market to grow.

Challenges: Regulations on the use of missiles

Missile is a weapon which does mass destruction. So, there are certain regulations which are to be followed while using the missile. The missile cannot be used in cities in the presence of civilians or buildings which may fall down because of missile impact. Because of such limitations on the usage of missiles, they are not preferred over other weapons by most of the countries.

Demand for Infrared based missile seeker system will drive the demand for technology type segment

Infrared technology is capable of tracking the heat generated by an object. In missile guidance systems, infrared tracks the target based on the heat generated by it. Infrared is a passive type of homing technology which is effective in anti-aircraft missiles as it detects the heat generated by the jet engines of aircraft. Cross-array seekers and rosette seekers make use of infrared technology to guide missiles.

The Interceptor missile type sector is projected to witness a higher CAGR during the forecast period

The revenue generated by the interceptor missiles market, which recorded USD 2382 million in 2021, is expected to grow up to USD 3140 million in 2026 with CAGR of 5.69%. The demand interceptor missiles will be largely driven by border tensions persisting in countries such as Israel, India, China, South Korea, and Saudi Arabia.

Market for missile seekers used in surface to Air launch mode missiles is projected to witness highest CAGR during the forecast period

Market for missile seekers used in surface to air missiles is expected to grow 2142 Million USD in 2021 to 2513 Million USD in 2026 with CAGR of 5.58%. Surface-to-air rockets and missiles are launched from the ground and are designed to hit aerial targets, such as aircraft and helicopters. They are also used to destroy other missiles as well. These missiles form the major part of an anti-aircraft system and are used for anti-air warfare operations.

Missile Seekers Market Regional Analysis

The North America market is projected to contribute the largest share from 2021 to 2026

North America is projected to be the largest regional share of the missile seekers market during the forecast period. In the North America section, the market is majorly divided into two countries: US and Canada. The US is one of the leaders in the missile seekers industry. Major companies such as Raytheon Technologies, Northrop Grumman Corporation and Analog Devices, and small-scale private companies such as Wxcelitas Technologies Ltd., Janos Tech, and MAROTTA controls have their headquarters in the US. The above-mentioned major players continuously invest in the R&D of new & improved designs of missile seekers.

The progress of missile seekers in North America is growing because of the steady demand in the defence sector and the development of advanced and compact missiles.

To know about the assumptions considered for the study, download the pdf brochure

Missile Seekers Companies - Key Market Players

The missile seekers market is largely fragmented. Established players in the market include BAE Systems (UK), Boeing (US), Leonardo S.p.A. (Italy), Safran Group (France), Raytheon Technologies (US), Thales (France), Northrop Grumman Corporation (US).

Missile Seekers Market Report Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 5.3 billion in 2021 |

|

Projected Market Size |

USD 6.8 billion by 2026 |

|

Missile Seekers Market Growth Rate (CAGR) |

5.2% |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2021 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Technology, By Missile Type, By Launch Mode, By Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, and Rest of the World |

|

Companies covered |

BAE Systems (UK), Leonardo S.p.A. (Italy), Raytheon Technologies (US), Safran Group (France), Thales (France), and Northrop Grumman Corporation (US) |

The study categorizes the missile seekers market based on Technology, Missile Type, Launch Mode, and Region.

By Technology

- Active Radar

- Semi-active Radar

- Passive Radar

- Infrared

- Laser

- Multi-mode

By Missile Type

- Cruise Missile

- Ballistic Missile

- Interceptor Missile

- Conventional

By Launch Mode

- Surface-to-Surface

- Surface-to-Air

- Air-to-Surface

- Air-to-Air

By Region

- North America

- Asia Pacific

- Europe

- Middle East

- Rest of the World

Recent Developments

- In June 2021, Rafael Advanced Defense Systems Ltd. unveils Sea Breaker, a 5th generation long range, autonomous, precision-guided missile system, enabling significant attack performance against a variety of high-value maritime and land targets.

- In October 2020, Raytheon Missiles & Defense, a Raytheon Technologies business, announced the StormBreaker smart weapon, which uses an innovative multi-mode seeker, has been approved for use on the F-15E by the U.S. Air Force's Air Combat Command.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the missile seekers market?

The missile seekers market is expected to grow substantially owing to the technological development in designing of the new and compact missiles.

What are the key sustainability strategies adopted by leading players operating in the missile seekers market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the missile seekers market. The major players include BAE Systems (UK), Boeing (US), Leonardo S.p.A. (Italy), Safran Group (France), Raytheon Technologies (US), Thales (France), Northrop Grumman Corporation (US), these players have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the missile seekers market?

Some of the major emerging technologies and use cases disrupting the market include Compact size of missiles, Imaging Infrared Technology, Hybrid seekers.

Who are the key players and innovators in the ecosystem of the Missile seekers market?

The key players in the missile seekers market include Leonardo S.p.A. (Italy), Safran Group (France), Raytheon Technologies (US), Thales (France), Northrop Grumman Corporation (US).

Which region is expected to hold the highest market share in the missile seekers market?

missile seekers market in Asia Pacific is projected to hold the highest market share during the forecast period. The key factor responsible for Asia Pacific, leading the missile seekers market owing to the rapid growth of the demand for missiles by emerging economies like India and China, and technological advancements of missiles in terms of accuracy and compact size. The increasing demand for missile seekers and the presence of some of the leading players operating in the market, such as Defence Research and Development Organisation (DRDO) (India), Bharat Dynamics Ltd. (BDL) (India) are expected to drive the missile seekers market in Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 INCLUSIONS & EXCLUSIONS

1.5 CURRENCY & PRICING

1.6 USD EXCHANGE RATES

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 1 REPORT PROCESS FLOW

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 SEGMENTS AND SUBSEGMENTS

2.3 RESEARCH APPROACH & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

2.3.2 MISSILE SEEKERS MARKET FOR VERTICALS

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.3 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

2.5 GROWTH RATE ASSUMPTIONS

2.6 ASSUMPTIONS FOR THE RESEARCH STUDY

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 6 BY TECHNOLOGY, MULTI-MODE SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 7 BY MISSILE TYPE, INTERCEPTOR SEGMENT ESTIMATED TO LEAD MISSILE SEEKERS MARKET DURING FORECAST PERIOD

FIGURE 8 NORTH AMERICA ESTIMATED TO LEAD THE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 41)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MISSILE SEEKERS MARKET

FIGURE 9 CHANGING NATURE OF WARFARE TO DRIVE THE MARKET GROWTH

4.2 MARKET, BY LAUNCH MODE

FIGURE 10 SURFACE-TO-AIR SEGMENT ESTIMATED TO LEAD MISSILE SEEKERS MARKET FROM 2021 TO 2026

4.3 NORTH AMERICA MARKET, BY TECHNOLOGY

FIGURE 11 INFRARED SEGMENT TO LEAD MISSILE SEEKERS MARKET FROM 2021 TO 2026

4.4 MARKET, BY COUNTRY

FIGURE 12 INDIA PROJECTED TO BE FASTEST-GROWING MARKET FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 MISSILE SEEKERS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Geopolitical instabilities leading to procurement of advanced missile systems

TABLE 1 LIST OF ONGOING GEOPOLITICAL ISSUES AND CONFLICTS

5.2.1.2 Changing nature of warfare

5.2.1.3 Increasing defense expenditure of emerging economies

TABLE 2 DEFENSE BUDGET OF INDIA & CHINA, 2015–2020 (USD BILLION)

5.2.1.4 Technological advancements in missile seekers

5.2.2 RESTRAINTS

5.2.2.1 Procurement of conventional warfare systems rather than advanced precision-guided munition by many countries

5.2.2.2 High manufacturing cost

TABLE 3 MANUFACTURING COST OF MISSILES DEVELOPED FOR US MILITARY

5.2.3 OPPORTUNITIES

5.2.3.1 Miniaturization of missiles and their components

5.2.3.2 Support for researchers and manufacturers for developing missile seeker solutions

5.2.3.3 Depleting stock of precision-guided missiles

5.2.4 CHALLENGES

5.2.4.1 Delivering products of highest standards every time

5.2.4.2 Regulations on the use of missiles

5.3 COVID-19 IMPACT SCENARIOS

5.4 COVID-19 IMPACT ON MISSILE SEEKERS MARKET

FIGURE 14 COVID-19 IMPACT ON MISSILE SEEKERS MARKET

5.4.1 DEMAND-SIDE IMPACT

5.4.1.1 Key developments from January 2020 to August 2021

TABLE 4 KEY DEVELOPMENTS IN MISSILE SEEKERS MARKET 2020-2021

5.4.2 SUPPLY-SIDE IMPACT

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.5.1 DEVELOPMENT OF HIGHLY ACCURATE MISSILES CAPABLE OF HITTING MOVING TARGETS (STORMBREAKER)

5.5.2 DEVELOPMENT OF AKASH SURFACE-TO-AIR MISSILE SYSTEMS FROM BEL

5.5.3 3-D PRINTED MISSILES

FIGURE 15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 16 MISSILE SEEKERS ECOSYSTEM

TABLE 5 MISSILE SEEKERS MARKET ECOSYSTEM

5.7 PRICING ANALYSIS

5.7.1 AVERAGE SELLING PRICE ANALYSIS OF MISSILE SEEKERS IN 2020

5.8 TARIFF REGULATORY LANDSCAPE FOR DEFENSE INDUSTRY

5.9 TRADE DATA

5.9.1 TRADE ANALYSIS

TABLE 6 COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

TABLE 7 COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

5.10 VALUE CHAIN ANALYSIS OF MISSILE SEEKERS MARKET

FIGURE 17 VALUE CHAIN ANALYSIS

5.11 PORTER’S FIVE FORCES MODEL

5.11.1 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.11.2 THREAT OF NEW ENTRANTS

5.11.3 THREAT OF SUBSTITUTES

5.11.4 BARGAINING POWER OF SUPPLIERS

5.11.5 BARGAINING POWER OF BUYERS

5.11.6 COMPETITION IN THE INDUSTRY

5.12 TECHNOLOGY ANALYSIS

5.12.1 DEVELOPMENT OF PRECISION-GUIDANCE SEEKERS

5.13 USE CASES

5.13.1 MISSILE SEEKERS DEVELOPED BY TATA ADVANCED SYSTEMS LTD.

6 INDUSTRY TRENDS (Page No. - 61)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 18 SUPPLY CHAIN ANALYSIS

6.2.1 MAJOR COMPANIES

6.2.2 SMALL AND MEDIUM ENTERPRISES

6.2.3 END USERS/CUSTOMERS

6.3 EMERGING INDUSTRY TRENDS

6.3.1 REDUCTION IN SIZE

6.3.2 IMAGING INFRARED(I2R) TECHNOLOGY

6.3.3 PRECISION GUIDED MISSILE SEEKER

6.3.4 FIBER-OPTIC GUIDANCE SYSTEMS

6.3.5 AUTOMATIC TARGET RECOGNITION (ATR)

6.3.6 USE OF SYNTHETIC APERTURE RADAR (SAR) IN MISSILE SEEKERS

6.4 INNOVATIONS AND PATENTS REGISTRATIONS, 2012-2021

6.5 IMPACT OF MEGATREND

6.5.1 USE OF AI IN DEFENSE

6.5.2 CONSTANT INNOVATION IN THE DEFENSE SECTOR

7 MISSILE SEEKERS MARKET, BY TECHNOLOGY (Page No. - 65)

7.1 INTRODUCTION

FIGURE 19 INFRARED SEGMENT TO COMMAND LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 8 BY TECHNOLOGY, MARKET SIZE, 2018–2026 (USD MILLION)

7.2 RADAR

7.2.1 ACTIVE RADAR

7.2.1.1 High accuracy makes active radar an attractive technology

TABLE 9 MISSILES USING ACTIVE RADAR SEEKERS

7.2.2 SEMI-ACTIVE RADAR

7.2.2.1 Demand for anti-aircraft systems will drive the market

TABLE 10 MISSILES USING SEMI-ACTIVE RADAR SEEKERS

7.2.3 PASSIVE RADAR

7.2.3.1 Simple design to drive demand

TABLE 11 MISSILES USING PASSIVE RADAR SEEKERS

7.3 INFRARED

7.3.1 IMAGING INFRARED TECHNOLOGY TO DRIVE DEMAND

TABLE 12 MISSILES USING INFRARED SEEKERS

7.4 LASER

7.4.1 SHORT RANGE MISSILES TO DRIVE DEMAND

TABLE 13 MISSILES USING LASER-BASED SEEKERS

7.5 MULTI-MODE

7.5.1 NEED FOR HIGH ACCURACY IN UNKNOWN TERRAIN WILL DRIVE DEMAND

TABLE 14 MISSILES USING MULTI-MODE SEEKERS

8 MISSILE SEEKERS MARKET, BY MISSILE TYPE (Page No. - 70)

8.1 INTRODUCTION

FIGURE 20 INTERCEPTOR SEGMENT TO COMMAND LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 15 BY MISSILE TYPE, MARKET SIZE, 2018–2026 (USD MILLION)

8.2 CRUISE

8.2.1 NEED FOR MISSILES TO TRAVEL UNDETECTED WILL DRIVE THE DEMAND

8.3 BALLISTIC

8.3.1 RISING BORDER DISPUTES WILL FUEL GROWTH

8.4 CONVENTIONAL GUIDED

8.4.1 GROWTH IN COMBAT UAVS WILL DRIVE THE MARKET

8.5 INTERCEPTOR

8.5.1 BORDER TENSION BETWEEN COUNTRIES WILL FUEL THE MARKET

9 MISSILE SEEKERS MARKET, BY LAUNCH MODE (Page No. - 73)

9.1 INTRODUCTION

FIGURE 21 SURFACE-TO-AIR SEGMENT TO COMMAND LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 16 BY LAUNCH MODE, MARKET SIZE, 2018–2026 (USD MILLION)

9.2 SURFACE-TO-SURFACE

9.2.1 INVESTMENT BY HOMEGROWN COMPANIES WILL DRIVE THE MARKET

9.3 SURFACE-TO-AIR

9.3.1 INCREASE IN MISSILE DEFENSE SYSTEM WILL DRIVE THE MARKET

9.4 AIR-TO-AIR

9.4.1 BORDER DISPUTES WILL FUEL THE MARKET

9.5 AIR-TO-SURFACE

9.5.1 INCREASE IN OVERSEAS COMBAT OPERATIONS BY NATO COUNTRIES WILL DRIVE THE MARKET

10 REGIONAL ANALYSIS (Page No. - 76)

10.1 INTRODUCTION

FIGURE 22 MISSILE SEEKERS MARKET: REGIONAL SNAPSHOT

10.2 IMPACT OF COVID-19

FIGURE 23 COVID-19 IMPACT ON MISSILE SEEKERS MARKET

TABLE 17 MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 18 MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 19 MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 20 MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.3 NORTH AMERICA

10.3.1 IMPACT OF COVID-19

10.3.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 24 NORTH AMERICA: MARKET SNAPSHOT

TABLE 21 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2026(USD MILLION)

TABLE 22 NORTH AMERICA: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 23 NORTH AMERICA: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 24 NORTH AMERICA: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.3.3 US

10.3.3.1 Presence of key manufacturers to drive the missile seekers market in the US

FIGURE 25 US: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 25 US: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 26 US: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 27 US: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.3.4 CANADA

10.3.4.1 Increasing demand for small satellites leading to expansion of manufacturing facilities

FIGURE 26 CANADA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 28 CANADA: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 29 CANADA: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 30 CANADA: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.4 EUROPE

10.4.1 IMPACT OF COVID-19

10.4.2 PESTLE ANALYSIS: EUROPE

FIGURE 27 EUROPE: MISSILE SEEKERS MARKET SNAPSHOT

TABLE 31 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2026(USD MILLION)

TABLE 32 EUROPE: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 33 EUROPE: MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 34 EUROPE: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.4.3 RUSSIA

10.4.3.1 Development of advanced missiles by the Russian Army is driving the market growth in the country

FIGURE 28 RUSSIA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 35 RUSSIA: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 36 RUSSIA: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 37 RUSSIA: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.4.4 UK

10.4.4.1 The presence of missile manufacturers to drive demand

FIGURE 29 UK: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 38 UK: MISSILE SEEKERS MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 39 UK: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 40 UK: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.4.5 FRANCE

10.4.5.1 The presence of key defense manufacturers to drive demand for missile seekers

FIGURE 30 FRANCE: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 41 FRANCE: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 42 FRANCE: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 43 FRANCE: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.4.6 NORWAY

10.4.6.1 The use of advanced missiles by Norway’s military to drive the market for missile seekers

TABLE 44 NORWAY: MISSILE SEEKERS MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 45 NORWAY: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 46 NORWAY: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.4.7 REST OF EUROPE

10.4.7.1 The development of new missiles to drive the demand

TABLE 47 REST OF EUROPE: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 48 REST OF EUROPE: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 49 REST OF EUROPE: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.5 ASIA PACIFIC

10.5.1 COVID-19 IMPACT ON ASIA PACIFIC

10.5.2 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: MISSILE SEEKERS MARKET SNAPSHOT

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 51 ASIA PACIFIC: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 52 ASIA PACIFIC: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 53 ASIA PACIFIC: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.5.3 CHINA

10.5.3.1 High defense expenditure to drive the market for missile seekers in China

FIGURE 32 CHINA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 54 CHINA: MISSILE SEEKERS MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 55 CHINA: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 56 CHINA: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.5.4 INDIA

10.5.4.1 Modernization of armed forces to drive the market for missile seekers in India

FIGURE 33 INDIA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 57 INDIA: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 58 INDIA: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 59 INDIA: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.5.5 SOUTH KOREA

10.5.5.1 Increasing development of advanced surface-to-surface ballistic missiles by the country to drive the demand

FIGURE 34 SOUTH KOREA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 60 SOUTH KOREA: MISSILE SEEKERS MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 61 SOUTH KOREA: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 62 SOUTH KOREA: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.5.6 AUSTRALIA

10.5.6.1 The presence of prominent missile seeker manufacturers to drive the demand for missile seekers in the country

FIGURE 35 AUSTRALIA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 63 AUSTRALIA: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 64 AUSTRALIA: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 65 AUSTRALIA: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.5.7 REST OF ASIA PACIFIC

10.5.7.1 Procurement of advanced missiles by Japan to drive the market

TABLE 66 REST OF ASIA PACIFIC: MISSILE SEEKERS MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 67 REST OF ASIA PACIFIC: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 68 REST OF ASIA PACIFIC: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.6 MIDDLE EAST

10.6.1 COVID-19 IMPACT ON MIDDLE EAST

10.6.2 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 36 MIDDLE EAST: MISSILE SEEKERS MARKET SNAPSHOT

TABLE 69 MIDDLE EAST: MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 70 MIDDLE EAST: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 71 MIDDLE EAST: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 72 MIDDLE EAST: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.6.3 ISRAEL

10.6.3.1 Presence of major defense players resulted in growth of missile seekers market in Israel

FIGURE 37 ISRAEL: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 73 ISRAEL: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 74 ISRAEL: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 75 ISRAEL: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.6.4 TURKEY

10.6.4.1 Increasing procurement of advanced intercepting missiles, such as S-400, is driving the missile seekers market in the country

FIGURE 38 TURKEY: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 76 TURKEY: MISSILE SEEKERS MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 77 TURKEY: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 78 TURKEY: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.6.5 REST OF MIDDLE EAST

10.6.5.1 Increasing procurement of missile launching platforms by the UAE is driving the growth of the missile seekers market

TABLE 79 REST OF MIDDLE EAST: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 80 REST OF MIDDLE EAST: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 81 REST OF MIDDLE EAST: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.7 REST OF THE WORLD

10.7.1 COVID-19 IMPACT ON REST OF THE WORLD

10.7.2 PESTLE ANALYSIS: REST OF THE WORLD

FIGURE 39 REST OF THE WORLD: MISSILE SEEKERS MARKET SNAPSHOT

TABLE 82 REST OF THE WORLD: MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 83 REST OF THE WORLD: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 84 REST OF THE WORLD: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 85 REST OF THE WORLD: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.7.3 LATIN AMERICA

10.7.3.1 Strengthening of the naval warfare by countries such as Brazil to drive the market

FIGURE 40 BRAZIL: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 86 LATIN AMERICA: MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 87 LATIN AMERICA: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 88 LATIN AMERICA: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

10.7.4 AFRICA

10.7.4.1 Increasing territorial conflicts in the country to drive the demand

FIGURE 41 SOUTH AFRICA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 89 AFRICA: MISSILE SEEKERS MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 90 AFRICA: MARKET SIZE, BY MISSILE TYPE, 2018–2026 (USD MILLION)

TABLE 91 AFRICA: MARKET SIZE, BY LAUNCH MODE, 2018–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 125)

11.1 INTRODUCTION

TABLE 92 KEY DEVELOPMENTS BY LEADING PLAYERS IN MISSILE SEEKERS MARKET BETWEEN 2018 AND 2021

11.2 MARKET SHARE ANALYSIS OF LEADING PLAYERS 2020

TABLE 93 DEGREE OF COMPETITION

FIGURE 42 COLLECTIVE REVENUE SHARE OF TOP 5 PLAYERS

11.3 RANK ANALYSIS, 2020

FIGURE 43 REVENUE GENERATED BY MAJOR PLAYERS IN MISSILE SEEKERS MARKET, 2020

TABLE 94 COMPANY REGION FOOTPRINT

TABLE 95 COMPANY PRODUCT FOOTPRINT

TABLE 96 COMPANY APPLICATION FOOTPRINT

11.4 COMPETITIVE EVALUATION QUADRANT

11.4.1 MISSILE SEEKERS MARKET COMPETITIVE LEADERSHIP MAPPING

11.4.1.1 Star

11.4.1.2 Pervasive

11.4.1.3 Emerging Leader

11.4.1.4 Participant

FIGURE 44 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

11.4.2 MISSILE SEEKERS MARKET COMPETITIVE LEADERSHIP MAPPING (SME)

11.4.2.1 Progressive companies

11.4.2.2 Responsive companies

11.4.2.3 Starting blocks

11.4.2.4 Dynamic companies

FIGURE 45 MISSILE SEEKERS MARKET COMPETITIVE LEADERSHIP MAPPING (SME)

11.5 COMPETITIVE SCENARIO

11.5.1 NEW PRODUCT LAUNCHES

TABLE 97 NEW PRODUCT LAUNCHES, AUGUST 2018–AUGUST 2021

11.5.2 DEALS

TABLE 98 DEALS, AUGUST 2018– AUGUST 2021

12 COMPANY PROFILES (Page No. - 138)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 INTRODUCTION

12.2 KEY PLAYERS

12.2.1 BAE SYSTEMS

TABLE 99 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 46 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 100 BAE SYSTEMS: DEALS

12.2.2 BOEING

TABLE 101 BOEING: BUSINESS OVERVIEW

FIGURE 47 BOEING: COMPANY SNAPSHOT

12.2.3 RAYTHEON TECHNOLOGIES

TABLE 102 RAYTHEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 48 RAYTHEON TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 103 RAYTHEON TECHNOLOGIES: NEW PRODUCT DEVELOPMENT

TABLE 104 RAYTHEON TECHNOLOGIES: DEALS

12.2.4 SAFRAN GROUP

TABLE 105 SAFRAN GROUP: BUSINESS OVERVIEW

FIGURE 49 SAFRAN GROUP: COMPANY SNAPSHOT

12.2.5 NORTHROP GRUMMAN CORPORATION

TABLE 106 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 50 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

12.2.6 LEONARDO S.P.A

TABLE 107 LEONARDO S.P.A.: BUSINESS OVERVIEW

FIGURE 51 LEONARDO S.P.A.: COMPANY SNAPSHOT

12.2.7 THALES

TABLE 108 THALES: BUSINESS OVERVIEW

FIGURE 52 THALES: COMPANY SNAPSHOT

12.2.8 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

TABLE 109 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: BUSINESS OVERVIEW

FIGURE 53 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY SNAPSHOT

TABLE 110 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: NEW PRODUCT DEVELOPMENT

12.2.9 ASELSAN AS

TABLE 111 ASELSAN AS: BUSINESS OVERVIEW

FIGURE 54 ASELSAN AS: COMPANY SNAPSHOT

12.2.10 SEMICONDUCTOR DEVICES

TABLE 112 SEMICONDUCTOR DEVICES: BUSINESS OVERVIEW

TABLE 113 SEMICONDUCTOR DEVICES: DEALS

12.2.11 KONGSBERG DEFENCE & AEROSPACE

TABLE 114 KONGSBERG DEFENCE & AEROSPACE: BUSINESS OVERVIEW

FIGURE 55 KONGSBERG DEFENCE & AEROSPACE: COMPANY SNAPSHOT

12.2.12 JANOS TECHNOLOGY LLC

TABLE 115 JANOS TECHNOLOGY LLC: BUSINESS OVERVIEW

12.2.13 ANALOG DEVICES

TABLE 116 ANALOG DEVICES: BUSINESS OVERVIEW

FIGURE 56 ANALOG DEVICES: COMPANY SNAPSHOT

12.2.14 DEFENCE RESEARCH & DEVELOPMENT ORGANISATION

TABLE 117 DEFENCE RESEARCH & DEVELOPMENT ORGANISATION: BUSINESS OVERVIEW

12.2.15 BHARAT ELECTRONICS LIMITED

TABLE 118 BHARAT ELECTRONICS LIMITED: BUSINESS OVERVIEW

12.2.16 TATA ADVANCED SYSTEMS

TABLE 119 TATA ADVANCED SYSTEMS: BUSINESS OVERVIEW

12.2.17 EXCELITAS TECHNOLOGIES CORP.

TABLE 120 EXCELITAS TECHNOLOGIES CORP.: BUSINESS OVERVIEW

12.2.18 DIEHL DEFENCE

TABLE 121 DIEHL DEFENCE: BUSINESS OVERVIEW

TABLE 122 DIEHL DEFENCE: DEALS

12.2.19 TONBO IMAGING

TABLE 123 TONBO IMAGING: BUSINESS OVERVIEW

12.3 OTHER KEY PLAYERS

12.3.1 ADANI AEROSPACE & DEFENCE

TABLE 124 ADANI AEROSPACE & DEFENCE: BUSINESS OVERVIEW

12.3.2 MBDA MISSILE SYSTEMS

TABLE 125 MBDA MISSILE SYSTEMS: BUSINESS OVERVIEW

12.3.3 MAROTTA CONTROLS

TABLE 126 MAROTTA CONTROLS: BUSINESS OVERVIEW

12.3.4 KODA TECHNOLOGIES INC.

TABLE 127 KODA TECHNOLOGIES INC.: BUSINESS OVERVIEW

12.3.5 VEM TECHNOLOGIES PVT. LTD.

TABLE 128 VEM TECHNOLOGIES PVT. LTD.: BUSINESS OVERVIEW

12.3.6 RADIONIX

TABLE 129 RADIONIX: BUSINESS OVERVIEW

TABLE 130 RADIONIX: NEW PRODUCT DEVELOPMENT

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 180)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATION

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the missile seekers market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

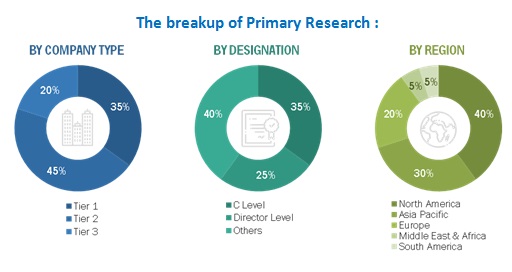

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from missile seekers vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using missile seekers vendors were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of missile seekers vendors and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

MISSILE SEEKERS OEMs |

Others |

|

BAE Systems |

Northrop Grumman Corporation |

|

Leonardo S.p.A |

Thales |

|

Raytheon Technologies |

Safran Group |

|

Rafael Advanced Defence Systems |

Aselsan AS |

Market Size Estimation

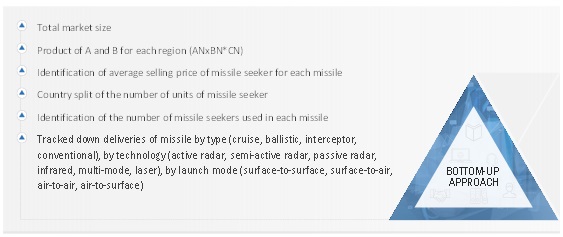

Both top-down and bottom-up approaches were used to estimate and validate the total size of the missile seekers market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Missile Seekers Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall size of the missile seekers Market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the missile seekers market.

Report Objectives

- To define, describe, segment, and forecast the size of the missile seekers market based on technology, missile type, launch mode, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, and Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the missile seekers market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets1, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the missile seekers market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Missile Seekers Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Missile Seekers Market