miRNA Sequencing and Assay Market by Product (Library Preparation, Consumables), Technology (Sequencing By Synthesis, Nanopore, Ion Semiconductor Sequencing), End User (Research Institute, Academia, CRO), Region - Global Forecast To 2024

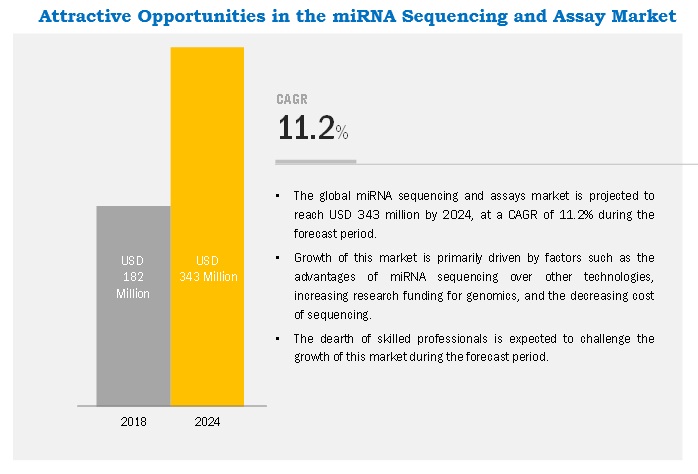

The miRNA sequencing and assays market is projected to reach USD 343 million by 2024, at a CAGR of 11.2%. Growth in this market is driven by factors such as the advantages of miRNA sequencing over other technologies, increasing research funding for genomics, and the decreasing cost of sequencing.

By product, the library preparation segment is expected to grow at the fastest rate during the forecast period.

Based on product, the miRNA sequencing & assays market is segmented into library preparation kits and sequencing consumables. The library preparation segment is projected to grow at the higher CAGR between 2018 and 2024. Growth in this segment is mainly driven by the increasing adoption of NGS techniques for miRNA analysis.

The sequencing by synthesis technology held the largest market share in 2018

Based on technology, the miRNA sequencing & assays market is segmented into sequencing by synthesis, ion semiconductor, SOLiD, and nanopore sequencing. The sequencing by synthesis segment dominated the market with the largest share in 2018. The large share of this segment is due to the technological advancements in sequencing by synthesis platforms and the reduced cost of sequencing.

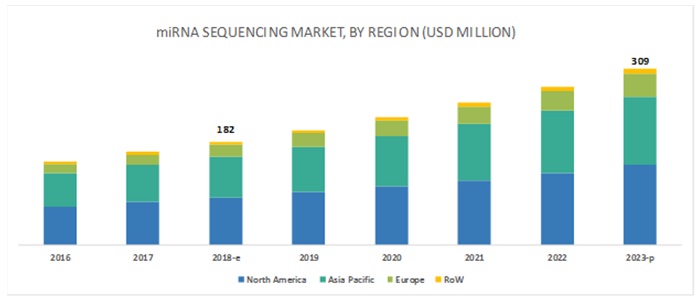

North America is expected to account for the largest market share during the forecast period.

North America held the largest share of the market in 2018 and this trend is expected to continue during the forecast period. Factors such as increasing investments in the development of sequencing, growing research in the fields of Genomics and RNA biology, and the rising demand for economical, high-throughput techniques for miRNA analysis are driving the growth of the miRNA sequencing & assays market in this region.

The major players operating in the global miRNA sequencing and assays market include Illumina (US), Thermo Fisher Scientific (US), QIAGEN (Germany), Takara Bio (Japan), NEB (UK), and 5 others.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017-2024 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2024 |

|

Forecast units |

Values (USD Million), and Volume (Thousand) |

|

Segments covered |

Product, Technology, and End User |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Illumina (US), Thermo Fisher Scientific (US), QIAGEN (Germany), Takara Bio (Japan), NEB (UK), and 5 others |

This research report categorizes the miRNA sequencing and assays market based on products, technology, and end user.

By product, the miRNA sequencing and assays market is segmented as follows:

- Sequencing Consumables

- Library Preparation Kits

By technology, the miRNA sequencing and assays market is segmented as follows:

- Sequencing by Synthesis

- Ion Semiconductor Sequencing

- SOLiD

- Nanopore Sequencing

By end user, the miRNA sequencing and assays market for Life Sciences is segmented as follows:

- Academic & Research Institutes

- CROs

Recent Developments:

- In 2018, Illumina partnered with Thermo Fisher to provide Ampliseq technology solutions to its customers.

- In 2017, Takara Bio acquired WaferGen to augment and expand Takara Bios worldwide commercial offerings in transcriptomics and create new market opportunities in other areas of genomics.

- In 2016, PerkinElmer acquired Bioo Scientific, which provides consumables solutions for life science research, and food and animal-feed safety testing.

Key questions addressed by the report:

- Who are the major market players in the miRNA sequencing and assays market?

- What is the largest revenue-generating region for Global miRNA Sequencing and Assay Industry? What growth trends is this market likely to follow in the next five years.

- What are the major types of miRNA sequencing kits and platforms?

- Who are the major end users of the miRNA sequencing products?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 16)

2.1 Research Approach

2.1.1 Secondary Research

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Research

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Break Down of Primaries

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.3 Data Triangulation Approach

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 miRNA Sequencing & Assays Market Overview

4.2 miRNA Sequencing & Assays Market, By Technology (20162024)

4.3 North America: miRNA Sequencing & Assays Market, By Product (2018)

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Market Drivers

5.2.1.1 Advantages of miRNA Sequencing Over Other Technologies

5.2.1.2 Increasing Research Funding for Genomics

5.2.1.3 Decreasing Cost of Sequencing

5.2.2 Market Opportunities

5.2.2.1 Increasing Focus on miRNA Biomarker Discovery

5.2.3 Market Challenges

5.2.3.1 Dearth of Skilled Professionals

6 miRNA Sequencing and Assays Market, By Product (Page No. - 33)

6.1 Introduction

6.2 Sequencing Consumables

6.2.1 Increasing Demand for miRNA Sequencing is Boosting the Adoption of Sequencing Consumables

6.3 Library Preparation Kits

6.3.1 Library Preparation Kits Segment to Grow at the Highest Cagr During the Forecast Period

7 miRNA Sequencing and Assays Market, By Technology (Page No. - 38)

7.1 Introduction

7.2 Sequencing By Synthesis

7.2.1 Sequencing By Synthesis Segment Accounted for the Largest Market Share in 2018

7.3 Ion Semiconductor Sequencing

7.3.1 Platforms Developed Using This Technology are Low-Cost Instruments and Possess High-Throughput Capabilities

7.4 Sequencing By Oligonucleotide Ligation and Detection

7.4.1 Solid Sequencing Offers Accurate Sequencing of Short Reads

7.5 Nanopore Sequencing

7.5.1 Nanopore Sequencing Segment to Witness the Highest Growth During the Forecast Period

8 miRNA Sequencing and Assays Market, By End User (Page No. - 46)

8.1 Introduction

8.2 Research and Academic Institutes

8.2.1 Research and Academic Institutes Segment to Dominate This Segment

8.3 Contract Research Organizations

8.3.1 Contract Research Organizations Such as Genomics Services Companies to Grow at Highest Cagr"

9 miRNA Sequencing and Assays Market, By Region (Page No. - 51)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 US Dominates the North American miRNA Sequencing and Assays Market, Due to the Favorable Funding Scenario for Research and StroPlayers

9.2.2 Canada

9.2.2.1 Increase in Genomics Research to Drive the Adoption of miRNA Sequencing in Canada

9.3 Europe

9.3.1 Germany

9.3.1.1 Growth of the Genomics Market to Drive the Growth of the Market Growth

9.3.2 UK

9.3.2.1 Government Initiatives in Genomics to Drive the Market for miRNA Sequencing

9.3.3 ROE

9.4 Asia Pacific

9.5 Rest of the World

10 Competitive Landscape (Page No. - 71)

10.1 Overview

10.2 Vendor Benchmarking

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Innovators

10.3.3 Dynamic Differentiators

10.3.4 Emerging Companies

10.4 Market Ranking Analysis, 2017

10.5 Competitive Situation and Trends

10.5.1 Collaborations, Partnerships, and Agreements

10.5.2 Product Launches

10.5.3 Acquisitions

11 Company Profiles (Page No. - 76)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

11.1 Illumina, Inc.

11.2 Thermo Fisher Scientific

11.3 Qiagen

11.4 Perkinelmer, Inc.

11.5 Takara Bio, Inc.

11.6 New England Biolabs, Inc.

11.7 Norgen Biotek Corporation

11.8 Trilink Biotechnologies

11.9 Lexogen

11.10 Oxford Nanopore Technologies

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 92)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (61 Tables)

Table 1 miRNA Sequencing and Assays Market, By Product 20162024 (USD Million)

Table 2 miRNA Sequencing Consumables Market, By Region, 20162024 (USD Million)

Table 3 North America: miRNA Sequencing Consumables Market, By Country, 20162024 (USD Million)

Table 4 Europe: miRNA Sequencing Consumables Market, By Country, 20162024 (USD Million)

Table 5 miRNA Library Preparation Kits Market, By Region, 20162024 (USD Million)

Table 6 North America: miRNA Library Preparation Kits Market, By Country, 20162024 (USD Million)

Table 7 Europe: miRNA Library Preparation Kits Market, By Country, 20162024 (USD Million)

Table 8 miRNA Sequencing Market, By Technology, 20162024 (USD Million)

Table 9 miRNA Sequencing Market for Sequencing By Synthesis, By Region, 20162024 (USD Million)

Table 10 North America: miRNA Sequencing Market for Sequencing By Synthesis, By Country, 20162024 (USD Million)

Table 11 Europe: miRNA Sequencing Market for Sequencing By Synthesis, By Country, 20162024 (USD Million)

Table 12 miRNA Sequencing Market for Ion Semiconductor Sequencing, By Region, 20162024 (USD Million)

Table 13 North America: miRNA SequencingMarket for Ion Semiconductor Sequencing, By Country, 20162024 (USD Million)

Table 14 Europe: miRNA Sequencing Market for Ion Semiconductor Sequencing, By Country, 20162024 (USD Million)

Table 15 miRNA Sequencing Market for Solid Sequencing, By Region, 20162024 (USD Thousand)

Table 16 North America: miRNA Sequencing Market for Solid Sequencing, By Country, 20162024 (USD Million)

Table 17 Europe: miRNA Sequencing Market for Solid Sequencing, By Country, 20162024 (USD Million)

Table 18 miRNA Sequencing Market for Nanopore Sequencing, By Region, 20162024 (USD Thousand)

Table 19 North America: miRNA Sequencing Market for Nanopore Sequencing, By Country, 20162024 (USD Thousand)

Table 20 Europe: miRNA Sequencing Market for Nanopore Sequencing, By Country, 20162024 (USD Thousand)

Table 21 miRNA Sequencing Market, By End User, 20162024 (USD Million)

Table 22 miRNA Sequencing Market for Research and Academic Institutes, By Region, 20162024 (USD Million)

Table 23 North America: miRNA Sequencing Market for Research and Academic Institutes, By Country, 20162024 (USD Million)

Table 24 Europe: miRNA Sequencing Market for Research and Academic Institutes, By Country, 20162024 (USD Million)

Table 25 miRNA Sequencing Market for Contract Research Organizations, By Region, 20162024 (USD Million)

Table 26 North America: miRNA Sequencing Market for Contract Research Organizations, By Country, 20162024 (USD Million)

Table 27 Europe: miRNA Sequencing Market for Contract Research Organizations, By Country, 20162024 (USD Million)

Table 28 miRNA Sequencing Market, By Region, 20162024 (USD Million)

Table 29 miRNA Sequencing Market, By Country, 20162024 (USD Million)

Table 30 North America: miRNA Sequencing Market, By Country, 20162024 (USD Million)

Table 31 North America: miRNA Sequencing Market, By Product, 20162024 (USD Million)

Table 32 North America: miRNA Sequencing Market, By Technology, 20162024 (USD Million)

Table 33 North America: miRNA Sequencing Market, By End User, 20162024 (USD Million)

Table 34 US: miRNA Sequencing Market, By Product, 20162024 (USD Million)

Table 35 US: miRNA Sequencing Market, By Technology, 20162024 (USD Million)

Table 36 US: miRNA Sequencing Market, By End User, 20162024 (USD Million)

Table 37 Canada: miRNA Sequencing Market, By Product, 20162024 (USD Million)

Table 38 Canada: miRNA Sequencing Market, By Technology, 20162024 (USD Thousand)

Table 39 Canada: miRNA Sequencing Market, By End User, 20162024 (USD Million)

Table 40 Europe: miRNA Sequencing and Assays Market, By Country, 20162024 (USD Million)

Table 41 Europe: miRNA Assays Market, By Product, 20162024 (USD Million)

Table 42 Europe: miRNA Assays Market, By Technology, 20162024 (USD Million)

Table 43 Europe: miRNA Assays Market, By End User, 20162024 (USD Million)

Table 44 Germany: miRNA Assays Market, By Product, 20162024 (USD Million)

Table 45 Germany: miRNA Assays Market, By Technology, 20162024 (USD Million)

Table 46 Germany: miRNA Assays Market, By End User, 20162024 (USD Million)

Table 47 UK: miRNA Assays Market, By Product, 20162024 (USD Million)

Table 48 UK: miRNA Assays Market, By Technology, 20162024 (USD Million)

Table 49 UK: miRNA Assays Market, By End User, 20162024 (USD Million)

Table 50 ROE: miRNA Assays Market, By Product, 20162024 (USD Million)

Table 51 ROE: miRNA Assays Market, By Technology, 20162024 (USD Million)

Table 52 ROE: miRNA Assays Market, By End User, 20162024 (USD Million)

Table 53 APAC: miRNA Assays Market, By Product, 20162024 (USD Million)

Table 54 APAC: miRNA Assays Market, By Technology, 20162024 (USD Million)

Table 55 APAC: miRNA Assays Market, By End User, 20162024 (USD Million)

Table 56 RoW: miRNA Assays Market, By Product, 20162024 (USD Million)

Table 57 RoW: miRNA Assays Market, By Technology, 20162024 (USD Thousands)

Table 58 RoW: miRNA Assays Market, By End User, 20162024 (USD Million)

Table 59 Collaborations, Partnerships, and Agreements, 20162018

Table 60 Product Launches, 20162018

Table 61 Acquisitions, 2016-2018

List of Figures (24 Figures)

Figure 1 miRNA Sequencing and Assays Market

Figure 2 Research Design

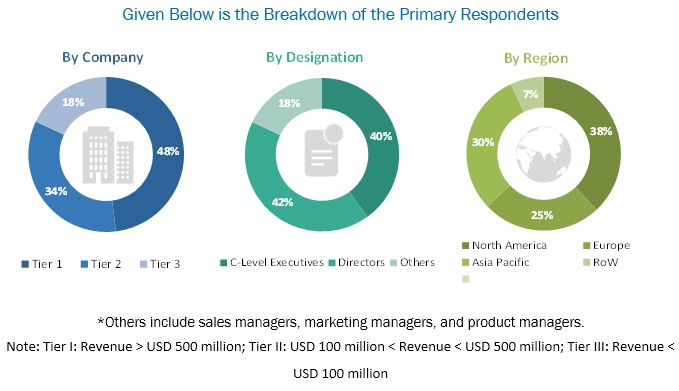

Figure 3 Breakdown of Primary Interviews: By Company Type, Designations, and Region

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 miRNA Sequencing & Assays Market, By Product, 2018 vs. 2024 (USD Million)

Figure 8 miRNA Sequencing & Assays Market, By Technology, 2018 vs. 2024 (USD Million)

Figure 9 miRNA Sequencing & Assays Market, By End User, 2018 vs. 2024 (USD Million)

Figure 10 Geographical Snapshot of the miRNA Sequencing & Assays Market

Figure 11 Increasing Research Activities in the Life Science IndustryA Key Driver for Market Growth

Figure 12 Sequencing By Synthesis to Continue to Dominate the miRNA Assays Market in 2024

Figure 13 Sequencing Consumables Accounted for the Largest Share of the North American miRNA Assays Market in 2018

Figure 14 miRNA Assays Market: Drivers, Opportunities, and Challenges

Figure 15 Cost Per Genome, 20082017

Figure 16 North America: miRNA Assays Market Snapshot

Figure 17 Europe: miRNA Assays Market Snapshot

Figure 18 miRNA Assays Market (Global), Competitive Leadership Mapping, 2017

Figure 19 Rank of Companies in the Global miRNA Assays Market, 2017

Figure 20 Illumina: Company Snapshot

Figure 21 Thermo Fisher Scientific: Company Snapshot

Figure 22 Qiagen N.V: Company Snapshot

Figure 23 Perkinelmer, Inc.: Company Snapshot

Figure 24 Takara Bio, Inc.: Company Snapshot

The study involved three major activities in estimating the current market size for the miRNA sequencing and assays market. Exhaustive secondary research was done to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, Forbes, and Dun & Bradstreet have been referred to, so as to identify and collect information useful for a technical, market-oriented, and commercial study of the miRNA sequencing and assays market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; and reports published by organizations such as the World Bank (US), Organisation for Economic Co-operation and Development (OECD), US Food and Drug Administration (FDA), World Health Organization (WHO), RNA Society, Genome Canada, European Society of Human Genetics (ESHG), National Human Genome Research Institute (NHGRI), American Society of Gene & Cell Therapy (ASGCT), Biotechnology and Biological Sciences Research Council (BBSRC), Department of Biotechnology (DBT), and European Molecular Biology Laboratory (EMBL).

The secondary data was collected and analyzed to arrive at the overall market splits, which were further validated by primary research. Secondary research was mainly used to obtain key information about the industrys supply chain, the total pool of key players, market classification, and segmentation, according to the industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

Extensive primary research was conducted after acquiring extensive knowledge about the miRNA sequencing and assays market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as researchers and professors) and supply-side respondents (such as library preparation and sequencing kits manufacturers and distributors and instrument manufacturers) across all four major geographies. Approximately 30% and 70% of primary interviews were conducted with both the demand and supply sides, respectively. This primary data was collected through questionnaires, e-mails, online surveys, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the miRNA sequencing and assays market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following steps:

- The key players have been identified through extensive secondary research

- Product portfolios were studied for each player

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After deriving the overall miRNA sequencing and assays market value data from the market size estimation process explained above, the total market value data was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various qualitative & quantitative variables as well as by analyzing regional trends for both the demand and supply side macro-indicators.

Report Objectives

- To define, describe, segment, and forecast the miRNA sequencing and assays market by product, technology, end user, and region

- To provide detailed information about factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their core competencies in terms of key market developments, product portfolios, and financials

- To track and analyze competitive developments such as acquisitions, product developments, partnerships, agreements, collaborations, and expansions in the miRNA sequencing and assays market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in miRNA Sequencing and Assay Market