Mining Software Market by Solutions (Workforce Management, Asset Maintenance Management, Process Control, Analytics, & Reporting, Fleet Management, Industrial Safety & Security, Mine Site Modelling & Planning, Enterprise Collaboration, Compliance Management), by Mining Type (Surface Mining [Strip Mining, Open-pit Mining], Underground Mining [Room and Pillar Mining]), by Application (Exploration, Assessment, Development, Production Operation, Reclamation), by Deployment & Region – Global Forecast to 2028

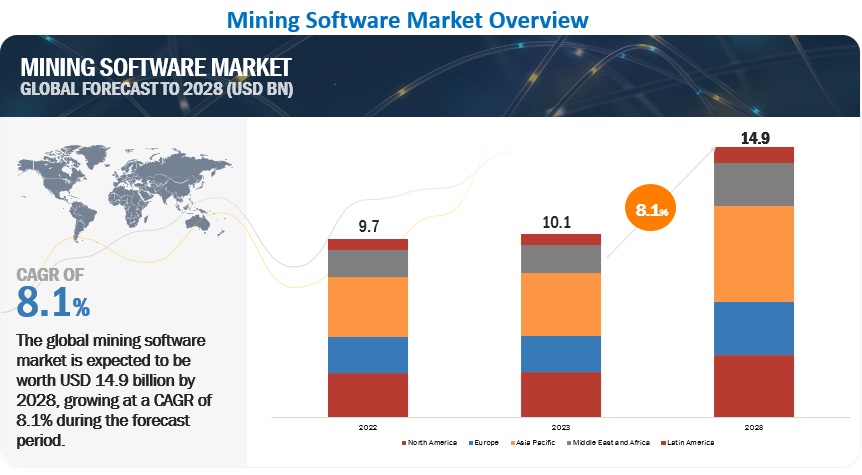

The global Mining Software Market size accounted for USD 10.1 Billion in 2023 and is estimated to achieve a market size of USD 14.9 Billion by 2028 growing at a CAGR of 8.1% from 2023 to 2028. The demand for more efficient and economical mining operations is the key driver propelling the growth of the industry. Mining software solutions are being adopted by governments and mining firms to boost productivity, increase safety, and lessen environmental impact. Mining software solutions aid in the optimization of mine design, planning, processing of minerals, safety management, and environmental management for mining firms. To enhance mining operations, these solutions are progressively utilizing cutting-edge technologies like automation, artificial intelligence, and blockchain. By enabling the creation of "smart mines," the integration of these technologies is anticipated to transform the mining sector.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Mining Software Market Dynamics

Driver: Need for enhanced safety and security

Mining activities can be dangerous because there is a chance for mishaps, harm, or even death. The safety and security of its employees and assets, as well as observing legal requirements, are responsibilities of the mining corporations. By offering real-time monitoring and analysis of many operational factors, software solutions can aid mining businesses in improving safety and security.

Mining software solutions can be used to track assets, monitor employees and equipment, and identify potential dangers. Software solutions, for instance, can be used to track the performance of machinery, spot irregularities, and notify maintenance staff of potential problems before they result in machinery failure or safety risks. Similar to how people’s movements can be tracked, potential safety risks can be identified, and security staff can be informed of potential security breaches using software solutions.

The market for mining software solutions that offer safety and security features is expanding along with the requirement for increased safety and security in the mining industry. Because it is encouraging the adoption of new software solutions that can aid mining businesses in enhancing safety and security, this driver has a significant impact on the market. Businesses are well-positioned to gain a sizable market share and expand if they provide mining software solutions with safety and security features.

Restraint: Integration with existing systems

Systems from many different manufacturers, comprising complicated and diverse equipment and software, are frequently used in mining operations. Integrating new software with existing systems can be difficult since it necessitates system compatibility, data processing and exchange, and system configuration. Adoption can be significantly hampered by the complexity of integrating new software solutions with current systems, particularly for small and mid-sized mining enterprises that may have limited IT resources. Moreover, integrating new software with old systems can be costly and time-consuming, increasing expenses and delaying adoption.

Hence, mining software providers must make sure that their products are simple to integrate with current systems and offer customers clear instructions and support during the integration process. Businesses that can provide simple integration with current systems might stand out in the market and gain a larger customer base.

Opportunity: Growing need in mining operations for technologies to provide predictive maintenance

The mining software market has a sizable opportunity due to the growing need for predictive maintenance solutions in mining operations. To identify equipment breakdowns before they enable prompt maintenance and repair, prompt maintenance refers to the use of data analytics and machine learning algorithms. Predictive maintenance can decrease downtime, boost output, and enhance safety in mining operations by proactively recognizing, and addressing equipment concerns. Predictive maintenance is becoming more and more popular among mining firms, and they are searching for software solutions to help them adopt it in their operations. By providing solutions for predictive maintenance that interact with their current software systems, mining software suppliers may take advantage of this trend.

Challenge: Conventional ways of thinking and resistance to change

The mining software market faces substantial challenges from conventional mindsets and resistance to change. It can be challenging for many mining businesses to accept new technology and alter their current workflows and processes because they have established operating procedures and traditional mindsets.Many things can cause people to oppose change. Mining enterprises could be dubious about the advantages of mining software solutions and uncertain of the full benefits of these innovations. The price of installing mining software solutions and the time and money needed to train staff members in these new technologies may raise issues.

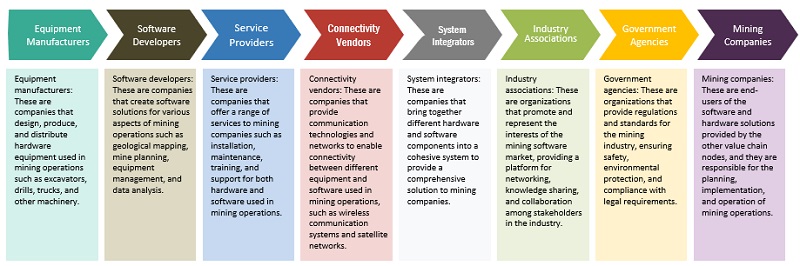

Mining Software Market Ecosystem

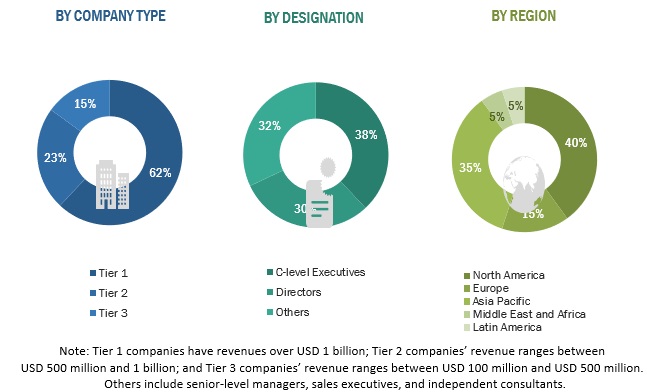

Prominent companies in this market include well-established, financially stable providers of mining software solutions and services. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Hitachi (Japan), SAP (Germany), Microsoft (US), IBM(US), Hexagon AB (Sweden), Komatsu (Japan), Epiroc AB (Sweden), Sandvik AB (Sweden), RPM Global (Australia), Trimble (US), Rockwell Automation (US), Siemens (Germany), ABB(Switzerland), Cisco (US), Accenture (Ireland), Caterpillar (US).

Segment review

Based on deployment type, cloud-based segment expected to grow with highest CAGR during forecast period

This growth is attributed to various benefits offered by cloud-based solutions, such as scalability, cost-effectiveness, and flexibility. With cloud-based solutions, mining companies can quickly add or subtract users, features, or storage, making it easier to adjust to changing market circumstances or mining operations. They also save businesses from having to invest in expensive infrastructure, hardware, and maintenance costs, making them a more economical option. Furthermore, cloud-based solutions allow customers to access data and software programs from any location at any time, as long as they have an internet connection, providing greater flexibility and convenience.

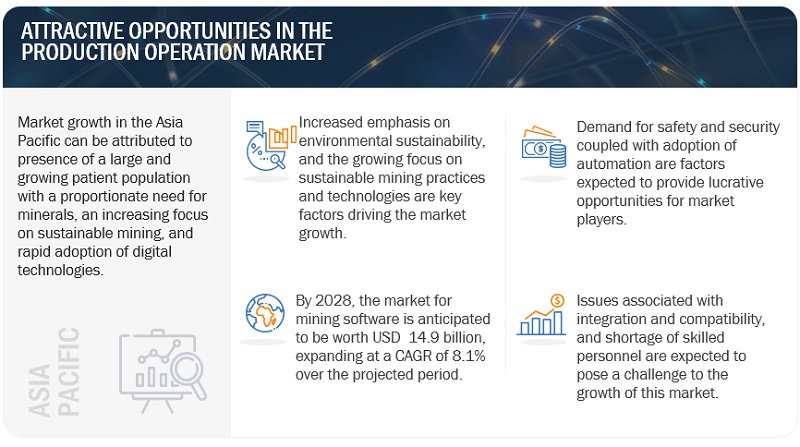

Based on application, production operations segment expected to hold largest market share during forecast period

The production operations segment is expected to hold the largest market share during the forecast period, as mining companies can use production operations software solutions to monitor and manage the production process, increase equipment usage, and reduce downtime. By leveraging these technologies, mining companies can optimize production in both underground and surface mines, leading to increased productivity and efficiency. The software can also be used by businesses to find areas for improvement and ultimately save costs and increase profitability.

By Mining type, Surface Segment To Grow During Forecast Period

Over the course of the forecast, the mining software market is anticipated to be dominated by surface mining. To collect minerals and ores from the surface of the ground, mining corporations are increasingly using surface mining techniques. Since it involves less manpower and equipment than underground mining, surface mining is more economical and efficient. In addition, surface mining is frequently used to harvest minerals like coal, iron, copper, and gold, which are utilized in numerous industries like construction, energy, and electronics. As mining businesses look to optimize their operations and boost production, mining software solutions are becoming more widely used in surface mining operations. Governments all over the world are also fostering surface mining operations to stimulate economic growth and generate job opportunities, which is further fueling the expansion of the surface mining market.

Asia Pacific Expected To Be Market Leader During Forecast Period

Asia Pacific holds the largest share in the mining software market due to the region's significant mineral resources, increasing demand for metals and minerals, and the adoption of advanced technologies in the mining industry. Countries like India, and China have a large number of mines and mining activities, leading to a higher demand for mining software. The increasing focus on operational efficiency and safety in the mining industry is also driving the adoption of mining software solutions in the region. The presence of key mining software providers and growing investments in research and development activities are also contributing to the growth of the market in the Asia Pacific region.

Top Companies

The major players in the mining software market are Hitachi (Japan), SAP (Germany), Microsoft (US), IBM(US), Hexagon AB (Sweden), Komatsu (Japan), Epiroc AB (Sweden), Sandvik AB (Sweden), RPM Global (Australia), Trimble (US), Rockwell Automation (US), Siemens (Germany), ABB(Switzerland), Cisco (US), Accenture (Ireland), Caterpillar (US).

These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the market.

Mining Software Market Report Highlights

|

Report Metrics |

Details |

|

Market size value in 2023 |

USD 10.1 billion |

|

Revenue forecast for 2028 |

USD 14.9 billion |

|

Growth Rate |

8.1% CAGR |

|

Forecast units |

Value (USD) Billion |

|

Segments covered |

Component, Mining type, Application, Deployment type, and Region |

|

Region covered |

North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Companies covered |

Hitachi (Japan), SAP (Germany), Microsoft (US), IBM(US), Hexagon AB (Sweden), Komatsu (Japan), Epiroc AB (Sweden), Sandvik AB (Sweden), RPM Global (Australia), Trimble (US), Rockwell Automation (US), Siemens (Germany), ABB(Switzerland), Cisco (US), Accenture (Ireland), Caterpillar (US) |

This research report categorizes the mining software market to forecast revenues and analyze trends in each of the following submarkets:

Based on Component:

- Solutions

- Services

Based on Mining type:

-

Surface

- Strip mining

- Open-pit mining

- Other surface mining types (mount-top removal, dredging, and high wall mining)

-

Underground

- Room and pillar mining

- Other underground mining types (narrow vein stoping; and large-scale mechanized mining)

Based on Application:

- Exploration

- Discovery/assessment

- Development

- Production operations

- Reclamation/closure

Based on Deployment type:

- Cloud

- On-premises

Based on Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Russia

- Rest of Europe

-

Asia Pacific

- Australia

- China

- Rest of Asia Pacific

-

Middle East and Africa

- UAE

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In July 2021, Hexagon Mining, a global mining technology provider, launched a new software suite called HxGN MinePlan, which is designed to improve mining planning, scheduling, and operations management.

- In June 2021, MICROMINE, a global provider of mining software solutions, released the latest version of its flagship software Micromine, which includes new features and enhancements for exploration, resource modeling, and mine design.

- In May 2021, Dassault Systèmes, a French software company, announced that it had acquired MineRP, a South African mining software solutions provider, to expand its presence in the mining industry and strengthen its 3DEXPERIENCE platform for natural resources.

- In August 2021, Maptek, a provider of mining software and services, announced the release of Vulcan 2021, a major update to its flagship mine planning and modeling software. The new version includes a range of new features and improvements to help mining companies optimize their operations.

- In May 2021, Komatsu Mining, a leading supplier of mining equipment and services, announced the launch of its new digital platform, Komatsu FrontRunner, which is designed to improve the efficiency and productivity of mining operations by providing real-time data and analytics.

Frequently Asked Questions (FAQ):

What is the market forecast for Mining Software?

Who are the key players in Mining Software Market?

What is the Mining Software Market growth?

What are the key drivers supporting the Mining Software Market growth?

Which is the key Opportunities for the Mining Software Market growth?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rise in demand for advanced data analytics- Increased emphasis on environmental sustainability- Increased need for enhanced safety and security- Extensive adoption of automation and robotics- Increased need for improved efficiency and productivityRESTRAINTS- Compatibility issues pertaining to integration with existing systems- Requirement of customized solutions to meet unique needs of different mining operationsOPPORTUNITIES- Rise in demand for automation and digitalization in emerging markets- Increased adoption of IoT in mining industry- Rise in demand for predictive maintenance solutions in mining operations- Increased focus on environmentally sustainable mining practices- Increased need for remote monitoring and control of mining operationsCHALLENGES- Limited penetration in emerging countries- Resistance to change and traditional mindsets

-

5.3 INDUSTRY TRENDSVALUE CHAIN ANALYSISECOSYSTEM ANALYSISREGULATORY LANDSCAPECASE STUDY ANALYSIS- Boliden chose Komatsu to introduce automated haulage at its copper mine in Sweden- Rio Tinto used FactoryTalk suite of Rockwell Automation to improve transparency in mining operations- Rio Tinto chose Caterpillar to create connected value chain at its Gudai-Darri mine- Maptek provided AI-based algorithms to boost efficiency of drilling and blasting operations of Newmont Corporation- Hexagon provided predictive analytics for fleet management to Anglo American- Surpac offered geostatistical modeling for mining operations to Barrick Gold- IBM offered data analytics for mining operations to Goldcorp- SAP and Accenture will upgrade Rio Tinto’s mining enterprise resource planning solutions to cloud- ABB Ability Asset Vista improving efficiency and safety at Shanyang coal mine- Wenco fleet management system and Readyline asset health management system to be deployed at Gold Fields' Salares Norte minePATENT ANALYSIS- Methodology- Innovation and patent applicationsAVERAGE PRICING ANALYSISPORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of suppliers- Bargaining power of buyers- Intensity of competitive rivalryTECHNOLOGY ANALYSIS- Artificial Intelligence (AI)- Cloud computing- Digital twin- Internet of Things- Blockchain- Augmented reality- Robotics- Data analytics- Geospatial technology- Wearable technologyKEY CONFERENCES AND EVENTS, 2022–2023

- 6.1 INTRODUCTION

-

6.2 SOLUTIONSIMPLEMENTATION OF ADVANCED MINING SOFTWARE SOLUTIONS FOR EFFICIENT OPERATIONS TO DRIVE SEGMENTSOLUTIONS: MINING SOFTWARE MARKET DRIVERSSOLUTIONS: RECESSION IMPACTWORKFORCE MANAGEMENTASSET MAINTENANCE MANAGEMENT- Asset health monitoring- Asset performance management- Reliability-centric maintenancePROCESS CONTROL, ANALYTICS, & REPORTINGFLEET MANAGEMENTINDUSTRIAL SAFETY & SECURITYMINE SITE MODELING & PLANNINGENTERPRISE COLLABORATIONCOMPLIANCE MANAGEMENT

-

6.3 SERVICESPROFICIENT SERVICES FOR EFFICIENT IMPLEMENTATION AND MAINTENANCE OF MINING SOFTWARE SOLUTIONS TO BOOST SEGMENTSERVICES: MINING SOFTWARE MARKET DRIVERSSERVICES: RECESSION IMPACTPROFESSIONAL SERVICES- Advisory- Integration & deployment- Training, support, & maintenanceMANAGED SERVICES

- 7.1 INTRODUCTION

-

7.2 ON-PREMISESMAXIMIZED CONTROL AND SECURITY TO DRIVE SEGMENTON-PREMISES: MINING SOFTWARE MARKET DRIVERSON-PREMISES: RECESSION IMPACT

-

7.3 CLOUDENHANCED EFFICIENCY AND SCALABILITY TO PROPEL SEGMENTCLOUD: MINING SOFTWARE MARKET DRIVERSCLOUD: RECESSION IMPACT

- 8.1 INTRODUCTION

-

8.2 SURFACEINCREASED DEMAND FOR MINERALS AND METALS FROM VARIOUS INDUSTRIES TO DRIVE SEGMENTSURFACE: MINING SOFTWARE MARKET DRIVERSSURFACE: RECESSION IMPACTSTRIP MININGOPEN-PIT MININGOTHER SURFACE MINING- Other surface mining: mining types

-

8.3 UNDERGROUNDRISE IN DEMAND FOR RARE EARTH MINERALS TO PROPEL SEGMENTUNDERGROUND: MINING SOFTWARE MARKET DRIVERSUNDERGROUND: RECESSION IMPACTROOM AND PILLAR MININGOTHER UNDERGROUND MINING

- 9.1 INTRODUCTION

-

9.2 EXPLORATIONMAXIMIZED RESOURCE DISCOVERY AND REDUCED EXPLORATION COSTS TO BOOST SEGMENTEXPLORATION: MINING SOFTWARE MARKET DRIVERSEXPLORATION: RECESSION IMPACT

-

9.3 ASSESSMENTOPTIMIZED MINERAL RESOURCE ESTIMATION TO DRIVE SEGMENTASSESSMENT: MINING SOFTWARE MARKET DRIVERSASSESSMENT: RECESSION IMPACT

-

9.4 DEVELOPMENTSTREAMLINED PLANNING AND DESIGNING WITH USE OF INNOVATIVE SOFTWARE SOLUTIONS TO PROPEL SEGMENTDEVELOPMENT: MINING SOFTWARE MARKET DRIVERSDEVELOPMENT: RECESSION IMPACT

-

9.5 PRODUCTION OPERATIONOPTIMIZED MINING OPERATIONS TO BOOST SEGMENTPRODUCTION OPERATION: MINING SOFTWARE MARKET DRIVERSPRODUCTION OPERATION: RECESSION IMPACT

-

9.6 RECLAMATIONRESPONSIBLE MINE CLOSURE AND SITE REHABILITATION TO PROPEL SEGMENT- Environmental data management softwareRECLAMATION: MINING SOFTWARE MARKET DRIVERSRECLAMATION: RECESSION IMPACT

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: PESTLE ANALYSISNORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Increased operational efficiency through use of advanced technologies to drive marketCANADA- Extensive adoption of automation technologies to propel market

-

10.3 EUROPEEUROPE: PESTLE ANALYSISEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTRUSSIA- Improved mining efficiency and safety to boost marketUK- Focus on sustainable mining operations to propel marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: PESTLE ANALYSISASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Increased digitalization and introduction of innovative technologies to drive marketAUSTRALIA- Increased efficiency and sustainability to boost marketREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: PESTLE ANALYSISMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTUAE- Rise in efficiency and safety to boost marketSOUTH AFRICA- Sustainable mining practices through use of innovative software solutions to boost marketREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: PESTLE ANALYSISLATIN AMERICA: MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTMEXICO- Improved operational efficiency to drive marketBRAZIL- Enhanced safety and reduced environmental impact to propel marketREST OF LATIN AMERICA

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

11.3 KEY MARKET DEVELOPMENTSPRODUCT LAUNCHESDEALS

- 11.4 HISTORICAL REVENUE ANALYSIS

-

11.5 COMPANY EVALUATION QUADRANTMETHODOLOGY AND DEFINITIONSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

- 11.7 MARKET SHARE ANALYSIS, 2022

- 11.8 COMPANY MARKET RANKING ANALYSIS

-

11.9 STARTUPS/SMES EVALUATION QUADRANTMETHODOLOGY AND DEFINITIONSPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.10 DETAILED LIST OF KEY STARTUPS/SMES

-

12.1 MAJOR PLAYERSHITACHI CONSTRUCTION MACHINERY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHITACHI ENERGY- Business overview- Products/Solutions/Services offered- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHEXAGON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKOMATSU- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSAP- Business overview- Products/Solutions/Services offered- Recent developmentsEPIROC- Business overview- Products/Solutions/Services offered- Recent developmentsSANDVIK- Business overview- Products/Solutions/Services offered- Recent developmentsRPMGLOBAL- Business overview- Products/Solutions/Services offered- Recent developmentsTRIMBLE- Business overview- Products/Solutions/Services offered- Recent developmentsROCKWELL AUTOMATIONSIEMENSABBCISCOACCENTURECATERPILLAR

-

12.2 STARTUPS/SMESSERVICEMAXGROUNDHOG APPSRIO TINTOFASTRAK SOFTWORKSILOBBYDINGO SOFTWAREINFOTEK SOFTWAREDATAMINETROBEXISMAPTEK

-

13.1 INTRODUCTIONLIMITATIONS

-

13.2 WORKPLACE SAFETY MARKET – GLOBAL FORECAST TO 2027MARKET DEFINITIONMARKET OVERVIEW- Workplace safety market, by component- Workplace safety market, by system- Workplace safety market, by application- Workplace safety market, by deployment mode- Workplace safety market, by end user- Workplace safety market, by region

-

13.3 INTERNET OF THINGS IN ENERGY MARKET – GLOBAL FORECAST TO 2025MARKET DEFINITIONMARKET OVERVIEW- Network automation market, by component- Network automation market, by solution- Network automation market, by service

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATES, 2019–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 MINING SOFTWARE MARKET: ECOSYSTEM

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 TOP 20 PATENT OWNERS, 2012–2022

- TABLE 9 MINING SOFTWARE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 10 MINING SOFTWARE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2022–2023

- TABLE 11 MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 12 MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 13 COMPONENT: MINING SOFTWARE MARKET SIZE, BY SOLUTIONS, 2018–2022 (USD MILLION)

- TABLE 14 COMPONENT: MINING SOFTWARE MARKET SIZE, BY SOLUTIONS, 2023–2028 (USD MILLION)

- TABLE 15 SOLUTIONS: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 16 SOLUTIONS: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 WORKFORCE MANAGEMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 18 WORKFORCE MANAGEMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 SOLUTIONS: MINING SOFTWARE MARKET SIZE, BY ASSET MAINTENANCE MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 20 SOLUTIONS: MINING SOFTWARE MARKET SIZE, BY ASSET MAINTENANCE MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 21 ASSET MAINTENANCE MANAGEMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 22 ASSET MAINTENANCE MANAGEMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 ASSET HEALTH MONITORING: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 ASSET HEALTH MONITORING: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 ASSET PERFORMANCE MANAGEMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 ASSET PERFORMANCE MANAGEMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 RELIABILITY-CENTRIC MAINTENANCE: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 RELIABILITY-CENTRIC MAINTENANCE: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 PROCESS CONTROL, ANALYTICS, & REPORTING: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 PROCESS CONTROL, ANALYTICS, & REPORTING: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 FLEET MANAGEMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 FLEET MANAGEMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 INDUSTRIAL SAFETY & SECURITY: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 INDUSTRIAL SAFETY & SECURITY: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 MINE SITE MODELING & PLANNING: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 MINE SITE MODELING & PLANNING: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 ENTERPRISE COLLABORATION: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 ENTERPRISE COLLABORATION: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 COMPLIANCE MANAGEMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 COMPLIANCE MANAGEMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 COMPONENT: MINING SOFTWARE MARKET SIZE, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 42 COMPONENT: MINING SOFTWARE MARKET SIZE, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 43 SERVICES: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 SERVICES: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 SERVICES: MINING SOFTWARE MARKET SIZE, BY PROFESSIONAL SERVICES, 2018–2022 (USD MILLION)

- TABLE 46 SERVICES: MINING SOFTWARE MARKET SIZE, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 47 PROFESSIONAL SERVICES: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 PROFESSIONAL SERVICES: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 ADVISORY: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 ADVISORY: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 INTEGRATION & DEPLOYMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 INTEGRATION & DEPLOYMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 TRAINING, SUPPORT, & MAINTENANCE: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 TRAINING, SUPPORT, & MAINTENANCE: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 MANAGED SERVICES: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 MANAGED SERVICES: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 58 MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 59 ON-PREMISES: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 60 ON-PREMISES: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 CLOUD: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 CLOUD: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 64 MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 65 MINING TYPE: MINING SOFTWARE MARKET SIZE, BY SURFACE MINING, 2018–2022 (USD MILLION)

- TABLE 66 MINING TYPE: MINING SOFTWARE MARKET SIZE, BY SURFACE MINING, 2023–2028 (USD MILLION)

- TABLE 67 SURFACE: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 68 SURFACE: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 STRIP MINING: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 STRIP MINING: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 OPEN-PIT MINING: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 72 OPEN-PIT MINING: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 OTHER SURFACE MINING: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 OTHER SURFACE MINING: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 MINING TYPE: MINING SOFTWARE MARKET SIZE, BY UNDERGROUND MINING, 2018–2022 (USD MILLION)

- TABLE 76 MINING TYPE: MINING SOFTWARE MARKET SIZE, BY UNDERGROUND MINING, 2023–2028 (USD MILLION)

- TABLE 77 UNDERGROUND MINING: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 UNDERGROUND MINING: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 ROOM AND PILLAR MINING: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 80 ROOM AND PILLAR MINING: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 OTHER UNDERGROUND MINING: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 82 OTHER UNDERGROUND MINING: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 84 MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 85 EXPLORATION: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 86 EXPLORATION: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 ASSESSMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 88 ASSESSMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 DEVELOPMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 90 DEVELOPMENT: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 PRODUCTION OPERATION: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 92 PRODUCTION OPERATION: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 RECLAMATION: MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 94 RECLAMATION: MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 MINING SOFTWARE MARKET SIZE, BY REGION, 2018–2022 (USD MILLION)

- TABLE 96 MINING SOFTWARE MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY SOLUTIONS, 2018–2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY SOLUTIONS, 2023–2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY ASSET MAINTENANCE MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 102 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY ASSET MAINTENANCE MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY PROFESSIONAL SERVICES, 2018–2022 (USD MILLION)

- TABLE 106 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 108 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 110 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY SURFACE MINING, 2018–2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY SURFACE MINING, 2023–2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY UNDERGROUND MINING, 2018–2022 (USD MILLION)

- TABLE 114 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY UNDERGROUND MINING, 2023–2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 116 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 117 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 118 NORTH AMERICA: MINING SOFTWARE MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 119 US: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 120 US: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 121 US: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 122 US: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 123 US: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 124 US: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 125 US: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 126 US: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 CANADA: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 128 CANADA: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 129 CANADA: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 130 CANADA: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 131 CANADA: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 132 CANADA: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 133 CANADA: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 134 CANADA: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 135 EUROPE: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 136 EUROPE: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 137 EUROPE: MINING SOFTWARE MARKET SIZE, BY SOLUTIONS, 2018–2022 (USD MILLION)

- TABLE 138 EUROPE: MINING SOFTWARE MARKET SIZE, BY SOLUTIONS, 2023–2028 (USD MILLION)

- TABLE 139 EUROPE: MINING SOFTWARE MARKET SIZE, BY ASSET MAINTENANCE MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 140 EUROPE: MINING SOFTWARE MARKET SIZE, BY ASSET MAINTENANCE MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 141 EUROPE: MINING SOFTWARE MARKET SIZE, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 142 EUROPE: MINING SOFTWARE MARKET SIZE, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 143 EUROPE: MINING SOFTWARE MARKET SIZE, BY PROFESSIONAL SERVICES, 2018–2022 (USD MILLION)

- TABLE 144 EUROPE: MINING SOFTWARE MARKET SIZE, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 145 EUROPE: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 146 EUROPE: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 147 EUROPE: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 148 EUROPE: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 149 EUROPE: MINING SOFTWARE MARKET SIZE, BY SURFACE MINING, 2018–2022 (USD MILLION)

- TABLE 150 EUROPE: MINING SOFTWARE MARKET SIZE, BY SURFACE MINING, 2023–2028 (USD MILLION)

- TABLE 151 EUROPE: MINING SOFTWARE MARKET SIZE, BY UNDERGROUND MINING, 2018–2022 (USD MILLION)

- TABLE 152 EUROPE: MINING SOFTWARE MARKET SIZE, BY UNDERGROUND MINING, 2023–2028 (USD MILLION)

- TABLE 153 EUROPE: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 154 EUROPE: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 155 EUROPE: MINING SOFTWARE MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 156 EUROPE: MINING SOFTWARE MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 157 RUSSIA: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 158 RUSSIA: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 159 RUSSIA: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 160 RUSSIA: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 161 RUSSIA: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 162 RUSSIA: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 163 RUSSIA: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 164 RUSSIA: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 165 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 166 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 167 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY SOLUTIONS, 2018–2022 (USD MILLION)

- TABLE 168 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY SOLUTIONS, 2023–2028 (USD MILLION)

- TABLE 169 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY ASSET MAINTENANCE MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 170 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY ASSET MAINTENANCE MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 171 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 172 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 173 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY PROFESSIONAL SERVICES, 2018–2022 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 175 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 176 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 178 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY SURFACE MINING, 2018–2022 (USD MILLION)

- TABLE 180 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY SURFACE MINING, 2023–2028 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY UNDERGROUND MINING, 2018–2022 (USD MILLION)

- TABLE 182 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY UNDERGROUND MINING, 2023–2028 (USD MILLION)

- TABLE 183 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 184 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 185 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 186 ASIA PACIFIC: MINING SOFTWARE MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 187 CHINA: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 188 CHINA: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 189 CHINA: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 190 CHINA: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 191 CHINA: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 192 CHINA: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 193 CHINA: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 194 CHINA: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY SOLUTIONS, 2018–2022 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY SOLUTIONS, 2023–2028 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY ASSET MAINTENANCE MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY ASSET MAINTENANCE MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY PROFESSIONAL SERVICES, 2018–2022 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY SURFACE MINING, 2018–2022 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY SURFACE MINING, 2023–2028 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY UNDERGROUND MINING, 2018–2022 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY UNDERGROUND MINING, 2023–2028 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: MINING SOFTWARE MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 217 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2018–2022 (USD MILLION)

- TABLE 218 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 219 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY SOLUTIONS, 2018–2022 (USD MILLION)

- TABLE 220 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY SOLUTIONS, 2023–2028 (USD MILLION)

- TABLE 221 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY ASSET MAINTENANCE MANAGEMENT, 2018–2022 (USD MILLION)

- TABLE 222 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY ASSET MAINTENANCE MANAGEMENT, 2023–2028 (USD MILLION)

- TABLE 223 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY SERVICES, 2018–2022 (USD MILLION)

- TABLE 224 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY SERVICES, 2023–2028 (USD MILLION)

- TABLE 225 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY PROFESSIONAL SERVICES, 2018–2022 (USD MILLION)

- TABLE 226 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY PROFESSIONAL SERVICES, 2023–2028 (USD MILLION)

- TABLE 227 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2022 (USD MILLION)

- TABLE 228 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 229 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2018–2022 (USD MILLION)

- TABLE 230 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY MINING TYPE, 2023–2028 (USD MILLION)

- TABLE 231 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY SURFACE MINING, 2018–2022 (USD MILLION)

- TABLE 232 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY SURFACE MINING, 2023–2028 (USD MILLION)

- TABLE 233 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY UNDERGROUND MINING, 2018–2022 (USD MILLION)

- TABLE 234 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY UNDERGROUND MINING, 2023–2028 (USD MILLION)

- TABLE 235 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 236 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 237 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 238 LATIN AMERICA: MINING SOFTWARE MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 239 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MINING SOFTWARE MARKET

- TABLE 240 MINING SOFTWARE MARKET: PRODUCT LAUNCHES, FEBRUARY 2021–FEBRUARY 2023

- TABLE 241 MINING SOFTWARE MARKET: DEALS, JULY 2022–MARCH 2023

- TABLE 242 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 243 COMPANY FOOTPRINT

- TABLE 244 COMPANY FOOTPRINT, BY MINING TYPE

- TABLE 245 COMPANY FOOTPRINT, BY COMPONENT

- TABLE 246 COMPANY FOOTPRINT, BY REGION

- TABLE 247 MINING SOFTWARE MARKET: DEGREE OF COMPETITION

- TABLE 248 HITACHI CONSTRUCTION MACHINERY: BUSINESS OVERVIEW

- TABLE 249 HITACHI CONSTRUCTION MACHINERY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 HITACHI CONSTRUCTION MACHINERY: PRODUCT LAUNCHES

- TABLE 251 HITACHI CONSTRUCTION MACHINERY: DEALS

- TABLE 252 HITACHI ENERGY: BUSINESS OVERVIEW

- TABLE 253 HITACHI ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 MICROSOFT: BUSINESS OVERVIEW

- TABLE 255 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 MICROSOFT: DEALS

- TABLE 257 IBM: BUSINESS OVERVIEW

- TABLE 258 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 IBM: DEALS

- TABLE 260 HEXAGON: BUSINESS OVERVIEW

- TABLE 261 HEXAGON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 HEXAGON: PRODUCT LAUNCHES

- TABLE 263 HEXAGON: DEALS

- TABLE 264 KOMATSU: BUSINESS OVERVIEW

- TABLE 265 KOMATSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 KOMATSU: PRODUCT LAUNCHES

- TABLE 267 KOMATSU: DEALS

- TABLE 268 SAP: BUSINESS OVERVIEW

- TABLE 269 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 SAP: DEALS

- TABLE 271 EPIROC: BUSINESS OVERVIEW

- TABLE 272 EPIROC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 EPIROC: DEALS

- TABLE 274 SANDVIK: BUSINESS OVERVIEW

- TABLE 275 SANDVIK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 SANDVIK: DEALS

- TABLE 277 RPMGLOBAL: BUSINESS OVERVIEW

- TABLE 278 RPMGLOBAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 RPMGLOBAL: PRODUCT LAUNCHES

- TABLE 280 RPMGLOBAL: DEALS

- TABLE 281 TRIMBLE: BUSINESS OVERVIEW

- TABLE 282 TRIMBLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 TRIMBLE: PRODUCT LAUNCHES

- TABLE 284 TRIMBLE: DEALS

- TABLE 285 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 286 SIEMENS: COMPANY OVERVIEW

- TABLE 287 ABB: COMPANY OVERVIEW

- TABLE 288 CISCO: COMPANY OVERVIEW

- TABLE 289 ACCENTURE: COMPANY OVERVIEW

- TABLE 290 CATERPILLAR: COMPANY OVERVIEW

- TABLE 291 SERVICEMAX: COMPANY OVERVIEW

- TABLE 292 GROUNDHOG APPS: COMPANY OVERVIEW

- TABLE 293 RIO TINTO: COMPANY OVERVIEW

- TABLE 294 FASTRAK SOFTWORKS: COMPANY OVERVIEW

- TABLE 295 ILOBBY: COMPANY OVERVIEW

- TABLE 296 DINGO SOFTWARE: COMPANY OVERVIEW

- TABLE 297 INFOTEK SOFTWARE: COMPANY OVERVIEW

- TABLE 298 DATAMINE: COMPANY OVERVIEW

- TABLE 299 TROBEXIS: COMPANY OVERVIEW

- TABLE 300 MAPTEK: COMPANY OVERVIEW

- TABLE 301 WORKPLACE SAFETY MARKET SIZE, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 302 WORKPLACE SAFETY MARKET SIZE, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 303 WORKPLACE SAFETY MARKET SIZE, BY SYSTEM, 2016–2021 (USD MILLION)

- TABLE 304 WORKPLACE SAFETY MARKET SIZE, BY SYSTEM, 2022–2027(USD MILLION)

- TABLE 305 WORKPLACE SAFETY MARKET SIZE, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 306 WORKPLACE SAFETY MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 307 WORKPLACE SAFETY MARKET SIZE, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 308 WORKPLACE SAFETY MARKET SIZE, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 309 WORKPLACE SAFETY MARKET SIZE, BY END USER, 2016–2021 (USD MILLION)

- TABLE 310 WORKPLACE SAFETY MARKET SIZE, BY END USER, 2022–2027 (USD MILLION)

- TABLE 311 WORKPLACE SAFETY MARKET SIZE, BY REGION, 2016–2021 (USD MILLION)

- TABLE 312 WORKPLACE SAFETY MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

- TABLE 313 IOT IN ENERGY MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

- TABLE 314 IOT IN ENERGY MARKET SIZE, BY SOLUTIONS, 2018–2025 (USD MILLION)

- TABLE 315 COMPONENT: IOT IN ENERGY MARKET SIZE, BY SERVICE, 2018–2025 (USD MILLION)

- FIGURE 1 MINING SOFTWARE MARKET SEGMENTATION

- FIGURE 2 MINING SOFTWARE MARKET: GEOGRAPHIC SCOPE

- FIGURE 3 MINING SOFTWARE MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE) - REVENUE FROM SOLUTIONS/SERVICES

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE FROM SOLUTIONS/SERVICES

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 MINING SOFTWARE MARKET, 2021–2028

- FIGURE 11 SHARES OF KEY MARKET SEGMENTS, 2023

- FIGURE 12 ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 13 INCREASED ADOPTION OF IOT IN MINING INDUSTRY TO PROPEL MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 14 SOLUTIONS SEGMENT AND US TO LEAD MINING SOFTWARE MARKET IN 2023

- FIGURE 15 SOLUTIONS SEGMENT AND CHINA TO LEAD MINING SOFTWARE MARKET IN 2023

- FIGURE 16 UAE TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 MINING SOFTWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 MINING SOFTWARE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 19 NUMBER OF PATENTS GRANTED ANNUALLY, 2012–2022

- FIGURE 20 TOP 10 PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2012–2022

- FIGURE 21 IMPACT OF PORTER’S FIVE FORCES MODEL ON MINING SOFTWARE MARKET

- FIGURE 22 SOLUTIONS TO BE LARGER SEGMENT DURING FORECAST PERIOD

- FIGURE 23 PROCESS CONTROL, ANALYTICS, & REPORTING SEGMENT TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 24 RELIABILITY-CENTRIC MAINTENANCE TO BE LARGEST SEGMENT OF ASSET MAINTENANCE MANAGEMENT MARKET DURING FORECAST PERIOD

- FIGURE 25 PROFESSIONAL SERVICES TO BE LARGER SEGMENT DURING FORECAST PERIOD

- FIGURE 26 TRAINING, SUPPORT, & MAINTENANCE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 27 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 28 SURFACE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 29 OPEN-PIT MINING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 ROOM & PILLAR MINING SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 PRODUCTION OPERATION TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC TO BE LARGEST MARKET FOR MINING SOFTWARE DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 36 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS, 2019–2021 (USD MILLION)

- FIGURE 37 MINING SOFTWARE MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 38 RANKING OF KEY PLAYERS IN MINING SOFTWARE MARKET, 2022

- FIGURE 39 STARTUPS/SMES EVALUATION MATRIX: WEIGHTAGE CRITERIA

- FIGURE 40 MINING SOFTWARE MARKET STARTUPS/SMES: COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 HITACHI CONSTRUCTION MACHINERY: COMPANY SNAPSHOT

- FIGURE 42 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 43 IBM: COMPANY SNAPSHOT

- FIGURE 44 HEXAGON: COMPANY SNAPSHOT

- FIGURE 45 KOMATSU: COMPANY SNAPSHOT

- FIGURE 46 SAP: COMPANY SNAPSHOT

- FIGURE 47 EPIROC: COMPANY SNAPSHOT

- FIGURE 48 SANDVIK: COMPANY SNAPSHOT

- FIGURE 49 RPMGLOBAL: COMPANY SNAPSHOT

- FIGURE 50 TRIMBLE: COMPANY SNAPSHOT

This research study used extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg BusinessWeek, to identify and collect information useful for this technical, market-oriented, and commercial study of the global mining software market. The primary sources were mainly several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, Service Providers (SPs), technology developers, alliances, and organizations related to all the segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents that included key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants to obtain and verify critical qualitative and quantitative information as well as assess prospects.

Secondary Research

The market for the companies offering mining software solutions and services for various mining operations is based on the secondary data available through paid and unpaid sources and by analyzing different solutions and services of major companies in the ecosystem and rating them based on their performance and quality. In the secondary research process, various sources were referred for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), Chief Technology Innovation Officer (CTIO), and related key executives from different key companies and organizations operating in the mining software market.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

Sl. No |

Companies |

|

1. |

SAP |

|

2. |

PTC |

|

3. |

Cisco |

|

4. |

Reliance Power Limited |

|

5. |

ContractWorks |

Mining Software Market Size Estimation

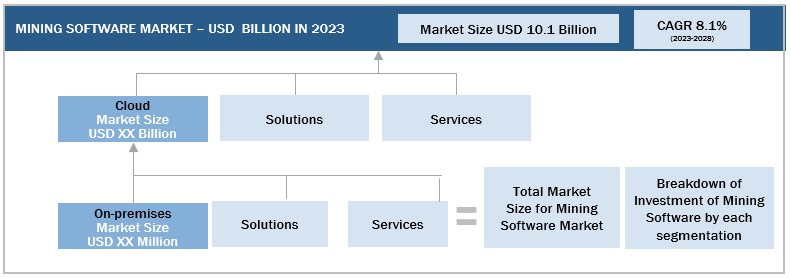

Multiple approaches were adopted for the estimation and forecasting of the mining software market. The first approach involves estimating the market size by summating companies’ revenue generated through mining software solutions and services. In this approach for market estimation, we identified the key companies offering mining software solutions and services among various industrial applications.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the mining software market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares split, and breakups have been determined using secondary sources and verified through primary sources.

Mining Software Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Mining Software Market Size: Top- Down Approach

Data Triangulation

After arriving at the overall market size, the overall mining software market was divided into several segments and subsegments with the help of data triangulation procedures to complete the overall market engineering process. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Mining Software Market Definition

Mining software solutions involve the application of various software solutions to optimize the mining process, including geological modeling and mine planning, resource estimation, production planning and scheduling, fleet management, and asset maintenance. The adoption of mining software solutions enables mining companies to improve their operational efficiency and productivity while reducing costs. The growing demand for automation and digitalization in mining operations is driving the growth of the global mining software market, creating substantial business opportunities for software providers and other solution providers in the mining industry.

Key Stakeholders

- Senior Management

- Finance/Procurement Department

- R&D Department

- IT Department

Report Objectives

- To determine and forecast the global mining software market by component, by mining type (Surface, Underground), by Application (Exploration, Discovery/Assessment, Development, Production operations, Reclamation/closure), by Deployment type (Cloud, On-premises), and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA)

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the mining software market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall mining software market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the mining software market

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing nearly 35% to the regional market size

- Further breakup of the Latin American market into countries contributing nearly 45% to the regional market size

- Further breakup of the MEA market into countries contributing nearly 75% to the regional market size

- Further breakup of the European market into countries contributing nearly 50% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mining Software Market