Military Vehicle Sustainment Market by Vehicle Type (Armored Vehicles, Military Trucks), Service (Maintenance, Repair, & Overhaul (MRO), Training & Support, Parts and Components Supply, Upgrades & Modernization), End User, and Region- Global Forecast to 2028

Update:: 26.09.24

Military Vehicle Sustainment Market Size & Growth

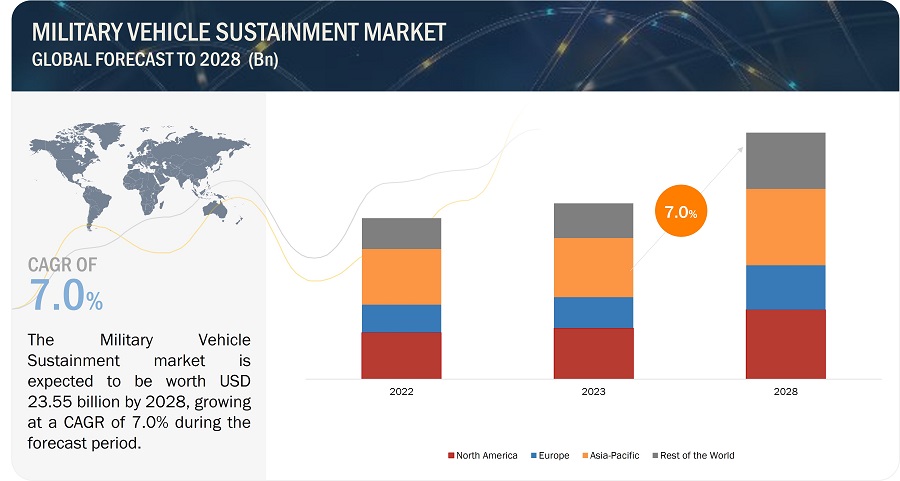

[211 Pages Report] The Military Vehicle Sustainment market is projected to grow from USD 16.8 billion in 2023 to USD 23.5 billion by 2028, at a CAGR of 7.0%. The need of sustainment services for the old military vehicles rises. The Sustainment services keeps the military vehicle operational. Government support and growing investments are propelling the development of Military vehicles , further boosting the growth of the Military Vehicle Sustainment market. The Military Vehicle Sustainment services enhances the vehicle efficiency and increase the life of military vehicles. The various types of maintenance like condition based maintenance and predictive maintenance are used to maintain the military vehicles.

Military Vehicle Sustainment Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Military Vehicle Sustainment Market Trends

Driver: Increased adoption of data-driven and predictive maintenance

The rising technology integration and upgrades in military vehicles are transforming the military vehicle sustainment market. Modernizing and enhancing existing military platforms have become vital for maintaining competitiveness on the battlefield. Integration and upgrades include the installation of advanced sensors, communication systems, and AI-driven analytics to enhance situational awareness and decision-making capabilities. The integration of unmanned aerial systems (UAS) with ground vehicles offers better reconnaissance and surveillance capabilities, reducing the risk to human operators and providing real-time intelligence. One of the key trends in military vehicle sustainment is the integration of advanced technology to improve vehicle performance, efficiency, and overall survivability. These integration and upgrades for military vehicle sustainment offers benefits like Improved reliability and availability of vehicles, reduced time and cost of repairs, improved safety of personnel, increased readiness of forces, and enhanced mission effectiveness.

Restraints: High cost and Maintenance time for Fleet modernization

Fleet modernization is crucial for enhancing military vehicle capabilities, extending service life, and meeting evolving operational requirements. It involves upgrading, retrofitting, and, in some cases, replacing vehicles in a fleet to ensure they remain effective, reliable, and mission-ready. Fleet modernization also involves replacing outdated military vehicles with new ones. Fleet modernization includes proper availability of spare parts and maintenance support as new vehicles may use different parts and systems than older vehicles, which can make it difficult to find spare parts and maintenance support. The process of modernization can be complex and expensive, making it difficult for the military to afford the modernization of their entire fleet. This leads to delays in repairs and can increase the cost of sustainment. The transition from old to new vehicles can also be troublesome to military operations as for new vehicles it may require training and stimulation for military personnel. This can take time and resources, and it can impact the readiness of forces. It is important to modernize the fleet to ensure that the military has the most capable and reliable vehicles. Fleet modernization includes the integration of advanced technologies. It involves incorporating communication systems, sensors, and data analytics tools to improve situational awareness, communication capabilities, and overall vehicle performance.

Opportunities: Use of autonomous systems

The military vehicle sustainment market is growing due to increased research and development in fully autonomous systems by leading service providers and system developers worldwide. The increased use of autonomous systems in military vehicle will significantly transform the technological shift in military organizations, allowing for more efficient fleet operation and maintenance. The integration of autonomous systems in military vehicle sustainment enhances mission readiness and improves maintenance processes. Autonomous systems are streamlining the process of spare parts provisioning for the logistics and supply chain aspect of military vehicle sustainment. Autonomous drones and robots are being utilized to deliver critical spare parts to military units in remote or challenging environments, reducing lead times and improving logistics efficiency. The increased use of autonomous systems in military vehicle sustainment represents a technological advancement that is revolutionizing military vehicle upkeep. Autonomous hardware systems and autonomous software solutions play a prominent role in enhancing the efficiency, effectiveness, and safety of military vehicle sustainment activities. By leveraging predictive maintenance, autonomous inspections, and streamlined logistics, these systems contribute to improving readiness, cost savings, and overall effectiveness in maintaining military vehicles. Autonomous systems will likely play an increasingly integral role in military vehicle sustainment for enhancing the capabilities of modern armed forces.

Challenges: Lack in resource allocation

The lack of resource allocation in military vehicle sustainment is a concern that can have comprehensive effects for a nation’s defense capabilities. Government and defense organizations are facing challenges when it comes to allocating sufficient resources to support the maintenance, repair, and modernization of their military vehicle fleets. Military vehicles, particularly advanced platforms like tanks, heavy tactical vehicles , and other combat vehicles require specialized expertise, advanced technology, and high-quality spare parts for effective maintenance and upgrades. One of the primary issues contributing to this resource allocation shortfall is budget constraints. The funds available for sustainment activities may not be appropriate with the scale and complexity of modern military vehicles due to limited budget competing priorities, economic conditions, and political considerations. This can lead to delayed maintenance, reduced readiness levels, and increased operational risks.. These resources often come at a premium, and if budgets are not adjusted accordingly, the sustainment efforts can suffer for military vehicles. Defense organizations mostly focus on short-term objectives and immediate needs, neglecting the importance of long-term planning.

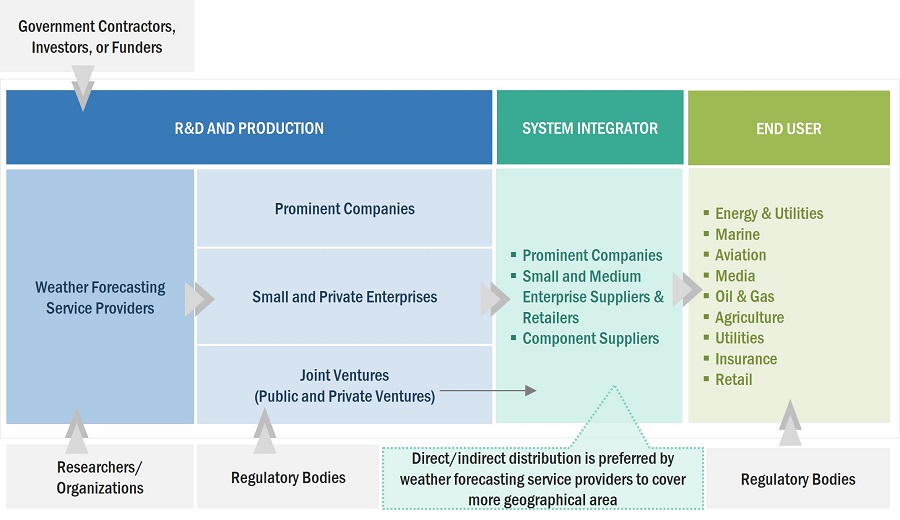

Military Vehicle Sustainment Market Ecosystem

Companies that provides services Military Vehicle Sustainment, includes government firms, industries as key stakeholders in Military Vehicle Sustainment Market. Investors, funders, academic researchers, integrators, service providers, and licensing authorities are the major influencers in this market. Prominent companies in this market include Rheinmetall AG (Germany), BAE Systesms (UK), Gneral Dynamics Corporation (US), Elbit Systems Ltd. (Israel), and Oshkosh Corporation (US).

Military Vehicle Sustainment Market Segmentation

Based on the Vehicle Type, the Armored Personnel Carrier segment is estimated to grow at highest rate during the forecast period.

Based on the Vehicle type, the Armored Personnel Carrier is estimated to grow at highest rate. To keep Armored Personnel Carriers operational regular maintenance is essential, including preventive maintenance to identify and address issues before they become major problems, and corrective maintenance to fix any damage. Armored personnel carriers (APCs) are used for transporting troops and providing protection in combat situations. Sustainment services for Armored Personnel Carriers are crucial to enhance the operational readiness, longevity, and effectiveness of military vehicle.

Based on End User, the Army is anticipated to dominate the market.

Based on the End User, the Army holds the largest market share. Army uses ground vehicles like armored personnel carriers (APCs), tanks, and transport vehicles. The Army maintains huge fleet of these vehicles that require constant upkeep, maintenance, and logistical support. Military vehicle sustainment services includes maintenance, spare parts procurement, training for vehicle operators and maintainers, and upgradation. Due to more number of active fleet in operational the need for sustainment services rises in the Army to drive the military vehicle sustainment market.

Military Vehicle Sustainment Market Regional Analysis

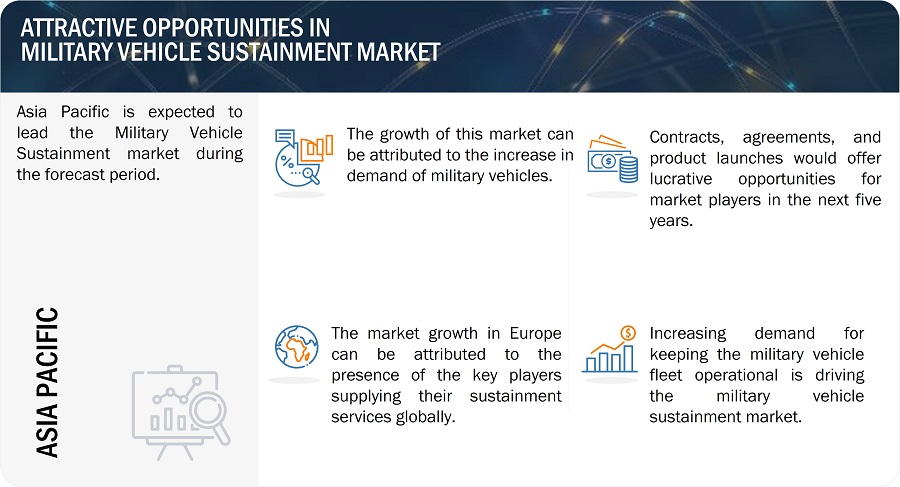

The Asia Pacific market is projected to dominate Military Vehicle Sustainment market.

Asia Pacific is projected to dominate the Military Vehicle Sustainment market during the forecast period. India is projected to show highest growth rate for the Military VehicleS Sustainment market in Asia Pacific. The domination of the Military VehicleS Sustainment market in Asia Pacific can be attributed by the rapid modernization of military vehicles in the region. The Military Vehicle Sustainment market in India is predicted to develop and evolve in future years, owing to the privatization in military vehicle sustainment services.

Military Vehicle Sustainment Markett by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Military Vehicle Sustainment Companies: Key Market Players

The Military Vehicle Sustainment companies is dominated by a few globally established players such as The Rhienmetall AG (Germany), BAE Systems (UK), General Dynamics Corporation (US), Elbit Systems Ltd. (Israel), and Oshkosh Corporation (US) are some of the leading players operating in the Military Vehicle Sustainment market; they are the key service providers that secured Military Vehicle Sustainment contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements of government and defense.

Military Vehicle Sustainment Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 16.8 billion in 2023 |

| Projected Market Size | USD 23.5 billion by 2028 |

| Military Vehicle Sustainment Market Growth Rate (CAGR) | 7.0% |

|

Market size available for years |

2020–2022 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By Vehicle Type, By Service, By End User |

|

Geographies covered |

North America, Europe, Asia Pacific, Rest of the World |

|

Companies covered |

Rheinmetall AG (Germany), BAE Systems (UK), General Dynamics Corporation (US), Elbit Systems Ltd. (Israel), and Oshkosh Corportaion (US) and among others. |

Military Vehicle Sustainment Market Highlights

The study categorizes Military Vehicle Sustainment market based on Forecast Type, Purpose, Industry,Organisation Size, and Region.

|

Segment |

Subsegment |

|

By Vehicle Type |

|

|

By Service |

|

|

By End User |

|

|

By Region |

|

Recent Developments

- In June 2023, Rheinmetall AG :- Rheinmetall AG presented a new solution for the mobile production of spare parts for military vehicles. The Mobile Smart Factory (MSF) offers metal 3D printing and postprocessing capabilities and is fully integrated into Rheinmetall’s IRIS (Integrated Rheinmetall Information System) digital ecosystem.

- In June 2022, General Dynamics Corporation : - General Dynamics Corporation demonstrated Autonomous Vehicle System (AVS) at CANSEC 2022. The AVS solution will optimize equipment performance and increase operational readiness to reduce the military's cost of ownership of vehicle fleets.

Frequently Asked Questions (FAQs) Addressed by the Report

Which are the major companies in the Military Vehicle Sustainment market? What are their major strategies to strengthen their market presence?

Some of the key players in the Military Vehicle Sustainment market Rheinmetall AG (Germany), BAE Systems (UK), General Dynamics Corporation (US), Elbit Systems Ltd. (Israel), and Oshkosh Corporation (US) and among others, are the key service providers that secured Military Vehicle Sustainment system contracts in the last few years.

What are the drivers and opportunities for the Military Vehicle Sustainment market?

The market for Military Vehicle Sustainment has grown substantially across the globe, especially in Asia Pacific. There is high demand of military vehicles globally to increase the fleet size. Due to this increased demand, there is an increased need for Military Vehicle Sustainment market with the necessary capabilities.

Which region is expected to grow at the highest rate in the next five years?

The market in the Asia Pacific region is projected to grow at the highest CAGR from 2023 to 2028, showcasing strong demand for Military Vehicle Sustainment services in the region. Several Asia Pacific countries and organizations are also actively investing in the development of Military Vehicles around the region.

What is the CAGR of the Military Vehicle Sustainment Market?

The CAGR of the Military Vehicle Sustainment Market is 7.0%

Which segment to show highest CAGR of the Military Vehicle Sustainment Market?

The Armored Personnel Carriers by Vehicle type to show highest growth rate during the forecasted year for Military Vehicle Sustainment Market

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising technology integration and upgrades in military vehicles- Increased adoption of data-driven and predictive maintenance techniques- Growing focus on lifecycle management strategiesRESTRAINTS- Complexity and high cost of fleet modernization- Technology gaps in military vehicle sustainment market- Limited utilization of data for sustainmentOPPORTUNITIES- Use of autonomous systems- Rising adoption of lifecycle optimization strategies for sustainment- Supply chain efficiency enhancementCHALLENGES- Lack of resource allocation- Lack of cost optimization for sustainment

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.5 ECOSYSTEM MAPPINGPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.7 INDICATIVE PRICING ANALYSIS

- 5.8 TARIFF AND REGULATORY LANDSCAPE

- 5.9 TRADE ANALYSIS

-

5.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.11 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.12 CASE STUDY ANALYSISPREDICTIVE MAINTENANCE TO ENHANCE VEHICLE SUSTAINMENTSOLUTIONS FOR INVENTORY MANAGEMENTMODERNIZATION AND INFRASTRUCTURE DEVELOPMENTADVANCED TRAINING PROGRAMS

- 6.1 INTRODUCTION

-

6.2 KEY TECHNOLOGY TRENDSFLEET MANAGEMENT NETWORK SYSTEMENERGY INSTALLATIONS AND ENERGY RESILIENCECONNECTED VEHICLES AND AUTONOMY3D PRINTINGADVANCED MATERIALSMODULAR PLATFORMSCYBERSECURITYPREDICTIVE MAINTENANCE

-

6.3 IMPACT OF MEGATRENDSINTERNET OF THINGS (IOT)ARTIFICIAL INTELLIGENCE (AI) AND ROBOTICS

- 6.4 SUPPLY CHAIN ANALYSIS

- 7.1 INTRODUCTION

-

7.2 ARMORED VEHICLESTANKS- Requirement of scheduled and regular maintenance to drive marketINFANTRY FIGHTING VEHICLES- Increasing demand in modern warfare to drive marketARMORED PERSONNEL CARRIERS- Protective system maintenance to drive marketRECONNAISSANCE VEHICLES- Lifecycle management and repairs to drive market

-

7.3 MILITARY TRUCKSUTILITY TRUCKS- Sustainment activities to maximize utility truck reliability to drive marketTRANSPORT TRUCKS- Cost-effective sustainment solutions for longevity and fleet support to drive marketRECOVERY VEHICLES- Need for regular maintenance to drive market

- 8.1 INTRODUCTION

-

8.2 MAINTENANCE, REPAIR, AND OVERHAUL (MRO)PREVENTIVE MAINTENANCECORRECTIVE MAINTENANCEFIELD REPAIR

- 8.3 TRAINING AND SUPPORT

- 8.4 PARTS AND COMPONENTS SUPPLY

- 8.5 UPGRADES AND MODERNIZATION

- 9.1 INTRODUCTION

-

9.2 ARMYLARGEST END USER SEGMENT OF MARKET

-

9.3 NAVYMAINTENANCE, REPAIR, AND UPGRADES OF MILITARY VEHICLES TO DRIVE MARKET

-

9.4 AIR FORCENEED FOR LOGISTICS SUPPORT ON AIRBASES TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAPESTLE ANALYSIS- Political- Economic- Social- Technological- Legal- EnvironmentalUS- Continuous investment in military vehicle sustainment to drive marketCANADA- Modernizing military vehicle sustainment strategies to drive market

-

10.3 EUROPEPESTLE ANALYSIS- Political- Economic- Social- Technological- Legal- EnvironmentalRUSSIA- Increase in demand for repair of military vehicles due to Russia-Ukraine war to drive marketUK- Presence of key players for military vehicle sustainment to drive marketFRANCE- Increase in military spending to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICPESTLE ANALYSIS- Political- Economic- Social- Technological- Legal- EnvironmentalCHINA- Rise in need of sustainment and support for extensive military vehicle fleet to drive marketINDIA- Privatization in military vehicle sustainment to drive marketJAPAN- Increasing number of contracts for military vehicles with European countries to drive marketAUSTRALIA- Development of military vehicle sustainment centers to drive marketREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLDMIDDLE EAST & AFRICA- Border tensions and geopolitical competition to drive marketLATIN AMERICA- Increasing demand for military vehicles to drive market

- 11.1 INTRODUCTION

- 11.2 MARKET RANKING ANALYSIS

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.6 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.7 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHESDEALS

- 12.1 INTRODUCTION

- 12.2 DEPOT MAINTENANCE LOCATIONS IN US

-

12.3 KEY PLAYERSBAE SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRHEINMETALL AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewELBIT SYSTEMS LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGENERAL DYNAMICS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOSHKOSH CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMOOG INC.- Business overview- Products/Solutions/Services offeredTHALES- Business overview- Products/Solutions/Services offeredSAIC- Business overview- Products/Solutions/Services offeredLEONARDO S.P.A.- Business overview- Products/Solutions/Services offeredSAAB AB- Business overview- Products/Solutions/Services offeredST ENGINEERING- Business overview- Products/Solutions/Services offered- Recent developmentsKBR INC.- Business overview- Products/Solutions/Services offeredVSE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsKRATOS DEFENSE & SECURITY SOLUTIONS, INC.- Business overview- Products/Solutions/Services offeredCUMMINS INC.- Business overview- Products/Solutions/Services offeredGM DEFENSE LLC- Business overview- Products/Solutions/Services offered- Recent developmentsMAHINDRA & MAHINDRA LTD.- Business overview- Products/Solutions/Services offeredMANTECH INTERNATIONAL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsAMENTUM SERVICES INC.- Business overview- Products/Solutions/Services offered- Recent developmentsNAVISTAR DEFENSE LLC- Business overview- Products/Solutions/Services offered- Recent developments

-

12.4 OTHER PLAYERSAM GENERALGORIZIANEDGC INTERNATIONALEDGE GROUP PJSCEXCALIBUR ARMY SPOL. S R.O.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE

- TABLE 2 MILITARY VEHICLE SUSTAINMENT MARKET ESTIMATION PROCEDURE

- TABLE 3 ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 4 PORTER’S FIVE FORCE ANALYSIS

- TABLE 5 INDICATIVE PRICING OF MAIN BATTLE TANKS (USD MILLION)

- TABLE 6 INDICATIVE PRICING OF INFANTRY FIGHTING VEHICLES (USD MILLION)

- TABLE 7 INDICATIVE PRICING OF ARMORED PERSONNEL CARRIERS (USD MILLION)

- TABLE 8 INDICATIVE PRICING OF MINE-RESISTANT AMBUSH-PROTECTED VEHICLES (USD MILLION)

- TABLE 9 INDICATIVE PRICING OF LIGHT PROTECTED VEHICLES (USD MILLION)

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 COUNTRY-WISE IMPORTS, 2019–2022 (USD THOUSAND)

- TABLE 16 COUNTRY-WISE EXPORTS, 2019–2022 (USD THOUSAND)

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MILITARY VEHICLE SUSTAINMENT SERVICES, BY END USER

- TABLE 18 KEY BUYING CRITERIA FOR MILITARY VEHICLE SUSTAINMENT SERVICES, BY END USER

- TABLE 19 KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 20 MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 21 MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 22 MILITARY VEHICLE SUSTAINMENT MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 23 MILITARY VEHICLE SUSTAINMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 24 MILITARY VEHICLE SUSTAINMENT MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 25 MILITARY VEHICLE SUSTAINMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 27 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 29 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 31 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET IN TRUCKS, BY END USER, 2020–2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET IN TRUCKS, BY END USER, 2023–2028 (USD MILLION)

- TABLE 34 US: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 35 US: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 36 US: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 37 US: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 38 CANADA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 39 CANADA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 40 CANADA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 41 CANADA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 42 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 43 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 44 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 45 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 46 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 47 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 48 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET IN TRUCKS, BY END USER, 2020–2022 (USD MILLION)

- TABLE 49 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET IN TRUCKS, BY END USER, 2023–2028 (USD MILLION)

- TABLE 50 RUSSIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 51 RUSSIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 52 RUSSIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 53 RUSSIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 54 UK: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 55 UK: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 56 UK: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 57 UK: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 58 FRANCE: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 59 FRANCE: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 60 FRANCE: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 61 FRANCE: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 62 REST OF EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 63 REST OF EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 64 REST OF EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 65 REST OF EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 67 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 69 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 71 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY END USER, 2020–2022 (USD MILLION)

- TABLE 73 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 74 CHINA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 75 CHINA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 76 CHINA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 77 CHINA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 78 INDIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 79 INDIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 80 INDIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 81 INDIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 82 JAPAN: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 83 JAPAN: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 84 JAPAN: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 85 JAPAN: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 86 AUSTRALIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 87 AUSTRALIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 88 AUSTRALIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 89 AUSTRALIA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 94 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 95 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 96 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 97 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 98 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 99 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 100 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET IN TRUCKS, BY END USER, 2020–2022 (USD MILLION)

- TABLE 101 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET IN TRUCKS, BY END USER, 2023–2028 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 106 LATIN AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2020–2022 (USD MILLION)

- TABLE 107 LATIN AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 108 LATIN AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2020–2022 (USD MILLION)

- TABLE 109 LATIN AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET, BY TRUCK, 2023–2028 (USD MILLION)

- TABLE 110 MILITARY VEHICLE SUSTAINMENT MARKET: DEGREE OF COMPETITION

- TABLE 111 SERVICE FOOTPRINT

- TABLE 112 SPARE PARTS FOOTPRINT

- TABLE 113 OVERALL FOOTPRINT

- TABLE 114 REGION FOOTPRINT

- TABLE 115 MILITARY VEHICLE SUSTAINMENT MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 116 MILITARY VEHICLE SUSTAINMENT MARKET: PRODUCT LAUNCHES, JUNE 2022–JUNE 2023

- TABLE 117 MILITARY VEHICLE SUSTAINMENT MARKET: DEALS, APRIL 2020–MAY 2023

- TABLE 118 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 119 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 120 BAE SYSTEMS: DEALS

- TABLE 121 RHEINMETALL AG.: COMPANY OVERVIEW

- TABLE 122 RHEINMETALL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 123 RHEINMETALL AG: PRODUCT LAUNCHES

- TABLE 124 RHEINMETALL AG: DEALS

- TABLE 125 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 126 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 ELBIT SYSTEMS LTD.: DEALS

- TABLE 128 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- TABLE 129 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 GENERAL DYNAMICS CORPORATION: PRODUCT LAUNCHES

- TABLE 131 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 132 OSHKOSH CORPORATION: COMPANY OVERVIEW

- TABLE 133 OSHKOSH CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 OSHKOSH CORPORATION: DEALS

- TABLE 135 MOOG INC.: COMPANY OVERVIEW

- TABLE 136 MOOG INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 THALES: COMPANY OVERVIEW

- TABLE 138 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 SAIC: COMPANY OVERVIEW

- TABLE 140 SAIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 142 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 SAAB AB: COMPANY OVERVIEW

- TABLE 144 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 ST ENGINEERING: COMPANY OVERVIEW

- TABLE 146 ST ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 ST ENGINEERING: DEALS

- TABLE 148 KBR INC.: COMPANY OVERVIEW

- TABLE 149 KBR INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 VSE CORPORATION: COMPANY OVERVIEW

- TABLE 151 VSE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 VSE CORPORATION: DEALS

- TABLE 153 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 154 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 CUMMINS INC.: COMPANY OVERVIEW

- TABLE 156 CUMMINS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 GM DEFENSE LLC: COMPANY OVERVIEW

- TABLE 158 GM DEFENSE LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 GM DEFENSE LLC: DEALS

- TABLE 160 MAHINDRA & MAHINDRA LTD.: COMPANY OVERVIEW

- TABLE 161 MAHINDRA & MAHINDRA LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 MANTECH INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- TABLE 163 MANTECH INTERNATIONAL CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 164 MANTECH INTERNATIONAL CORPORATION: DEALS

- TABLE 165 AMENTUM SERVICES INC.: COMPANY OVERVIEW

- TABLE 166 AMENTUM SERVICES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 AMENTUM SERVICES INC.: DEALS

- TABLE 168 NAVISTAR DEFENSE LLC: COMPANY OVERVIEW

- TABLE 169 NAVISTAR DEFENSE LLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 170 NAVISTAR DEFENSE LLC: DEALS

- TABLE 171 AM GENERAL: COMPANY OVERVIEW

- TABLE 172 GORIZIANE: COMPANY OVERVIEW

- TABLE 173 DGC INTERNATIONAL: COMPANY OVERVIEW

- TABLE 174 EDGE GROUP PJSC: COMPANY OVERVIEW

- TABLE 175 EXCALIBUR ARMY SPOL. S R.O.: COMPANY OVERVIEW

- FIGURE 1 MILITARY VEHICLE SUSTAINMENT MARKET SEGMENTATION

- FIGURE 2 REPORT PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

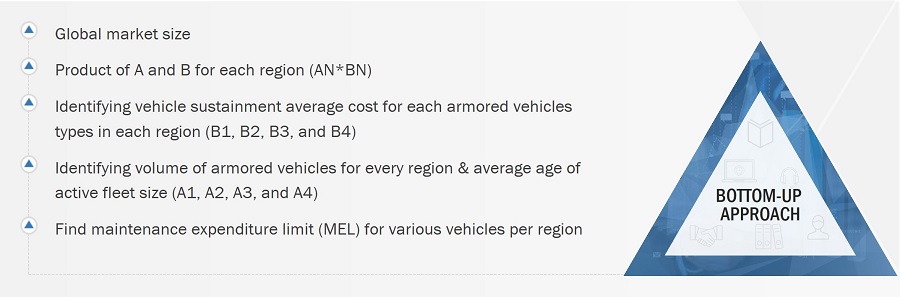

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

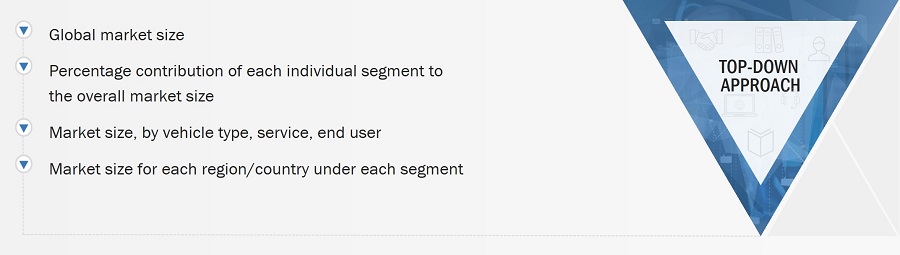

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 ARMORED PERSONNEL CARRIERS SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 9 ARMY END USER SEGMENT TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 10 ASIA PACIFIC TO CAPTURE LARGEST MARKET SHARE IN 2023

- FIGURE 11 RISE IN DEMAND TO INCREASE FLEET SIZE OF MILITARY VEHICLES TO DRIVE MARKET

- FIGURE 12 ARMORED PERSONNEL CARRIERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 ARMY SEGMENT TO ACCOUNT FOR MAXIMUM MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 MIDDLE EAST & AFRICA TO BE FASTEST-GROWING MARKET FROM 2023 TO 2028

- FIGURE 16 MILITARY VEHICLE SUSTAINMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 VALUE CHAIN ANALYSIS

- FIGURE 18 REVENUE SHIFT IN MILITARY VEHICLE SUSTAINMENT MARKET

- FIGURE 19 ECOSYSTEM MAPPING

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MILITARY VEHICLE SUSTAINMENT SERVICES, BY END USER

- FIGURE 21 KEY BUYING CRITERIA FOR MILITARY VEHICLE SUSTAINMENT SERVICES, BY END USER

- FIGURE 22 TECHNOLOGY ROADMAP IN MILITARY VEHICLE SUSTAINMENT MARKET, 2000–2050

- FIGURE 23 TECHNOLOGY TRENDS IN MILITARY VEHICLE SUSTAINMENT MARKET

- FIGURE 24 BENEFITS OF HYBRID ELECTRIC PROPULSION SYSTEMS FOR MILITARY VEHICLE SUSTAINMENT MARKET

- FIGURE 25 PREDICTIVE MAINTENANCE AND ITS BENEFITS FOR MILITARY VEHICLE SUSTAINMENT MARKET

- FIGURE 26 MILITARY VEHICLE SUSTAINMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 MILITARY VEHICLE SUSTAINMENT MARKET, BY VEHICLE TYPE, 2023–2028

- FIGURE 28 MILITARY VEHICLE SUSTAINMENT MARKET, BY END USER, 2023–2028

- FIGURE 29 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE FROM 2023 TO 2028

- FIGURE 30 NORTH AMERICA: MILITARY VEHICLE SUSTAINMENT MARKET SNAPSHOT

- FIGURE 31 EUROPE: MILITARY VEHICLE SUSTAINMENT MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: MILITARY VEHICLE SUSTAINMENT MARKET SNAPSHOT

- FIGURE 33 REST OF THE WORLD: MILITARY VEHICLE SUSTAINMENT MARKET SNAPSHOT

- FIGURE 34 MARKET RANKING OF TOP 5 PLAYERS, 2023

- FIGURE 35 REVENUE ANALYSIS FOR TOP 5 PLAYERS, 2022

- FIGURE 36 MARKET SHARE ANALYSIS FOR TOP 5 PLAYERS, 2022

- FIGURE 37 MILITARY VEHICLE SUSTAINMENT MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 38 MILITARY VEHICLE SUSTAINMENT MARKET: START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 39 DEPOT MAINTENANCE LOCATIONS IN US: SNAPSHOT

- FIGURE 40 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 41 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 42 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 43 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 OSHKOSH CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 MOOG INC.: COMPANY SNAPSHOT

- FIGURE 46 THALES: COMPANY SNAPSHOT

- FIGURE 47 SAIC: COMPANY SNAPSHOT

- FIGURE 48 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 49 SAAB AB: COMPANY SNAPSHOT

- FIGURE 50 ST ENGINEERING: COMPANY SNAPSHOT

- FIGURE 51 KBR INC.: COMPANY SNAPSHOT

- FIGURE 52 VSE CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: COMPANY SNAPSHOT

- FIGURE 54 CUMMINS INC.: COMPANY SNAPSHOT

- FIGURE 55 MAHINDRA & MAHINDRA LTD.: COMPANY SNAPSHOT

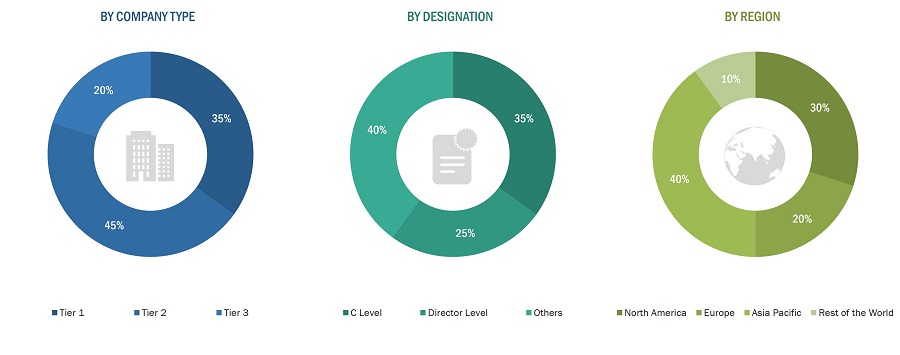

The study involved four major activities in estimating the current size of the Military Vehicle Sustainment market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The ranking analysis of companies in the Military Vehicle Sustainment market was carried out using secondary data from paid and unpaid sources, as well as by analyzing the product portfolios and service offerings of key companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study included the conference and Expo of Military Vehicles, corporate filings such as annual reports, investor presentations, and financial statements of trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Military Vehicle Sustainment market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, and Asia Pacific. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from Military Vehicle Sustainment companies; service providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using Military Vehicle Sustainment, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Military Vehicle Sustainment and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the Military Vehicle Sustainment market includes the following details.

- The top-down and bottom-up approaches were used to estimate and validate the size of the Military Vehicle Sustainment market. The research methodology used to estimate the market size includes the following details.

- The key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders, including chief executive officers (CEO), directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Military Vehicle Sustainment market size: Bottom-Up Approach

The bottom-up approach was employed to arrive at the overall size of the Military Vehicle Sustainment market from the revenues of the key players in the market.

Steps involved in the bottom-up approach:

- Historical, current, and future contracts, deals, and partnerships have been mapped based on press releases and company news Identifying the annual revenue of major companies operating in the Military Vehicle Sustainment market.

- By modeling estimations, the current and future volume of the land vehicles need to be delivered has been derived.

- The ASP of military vehicle sustainment services on each vehicle type (armored vehicles, military trucks) has been identified through company press releases, database and contracts, and maintenance expenditure limit sheets.

- Market = (Volume of vehicle types (armored vehicles, military trucks) that need to be delivered* ASP of military vehicle sustainment services).

Global Military Vehicle Sustainment Market Size: Top-Down Approach

- In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the market segmentation) acquired through percentage splits from secondary and primary research.

- The size of the most appropriate and immediate parent market has been used to calculate specific market segments to implement the top-down approach.

- Companies providing military vehicle sustainment services are included in the report.

- The total revenue of these companies has been identified through their annual reports and other authentic sources. In cases where annual reports are unavailable, company earnings have been estimated based on the number of employees, Factiva, ZoomInfo, press releases, and publicly available data.

- Company revenue has been calculated based on the various operating segments.

- All publicly available company contracts related to the military vehicle sustainment market have been mapped and summed up.

- Based on the parameters (contracts, agreements, partnerships, joint ventures, product matrix, secondary research), the share of military vehicle sustainment in each segment has been estimated.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures explained below have been implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for military vehicle sustainment segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the size of the military vehicle sustainment market based on Vehicle type, Services and End User

- To forecast the size of the market segments with respect to four regions: North America, Europe, Asia Pacific, Middle East and the Rest of the World (RoW), along with their key countries

- To identify and analyze drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify the industry and technology trends prevailing in the military vehicle sustainment market

- To analyze micromarkets1 with respect to their individual growth trends, prospects, and contribution to the market

- To profile leading companies in the market based on their product portfolios, market shares, and key growth strategies

- To track and analyze competitive developments such as joint ventures, mergers, and product launches carried out by the key players in the market

Market Definition

The main aim of vehicle sustainment is to maximize the availability of the assets by minimizing downtime and lifecycle costs. Military vehicle sustainment refers to the process of maintaining and supporting military vehicles throughout their lifecycle to ensure their operational readiness and longevity. It involves activities aimed at preserving, repairing, upgrading, and managing military vehicles to sustain their functionality and combat effectiveness. The importance of military vehicle sustainment is to provide operational readiness, cost efficiency, and safety.

The military vehicle sustainment market includes a wide range of products and services that are essential to ensure military vehicles are operational, safe, and effective throughout their operational lifecycle.

Market Stakeholders

- Suppliers of Military Vehicles

- Software/Hardware/Service and Solution Providers

- Original Equipment Manufacturers (OEMs)

- Maintenance, Repair, and Overhaul (MRO) providers

Available Customizations

MarketsAndMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Military Vehicle Sustainment market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Military Vehicle Sustainment market

Growth opportunities and latent adjacency in Military Vehicle Sustainment Market