Military Truck Market by Application (Cargo/logistics, Troop, Utility), Axle (4x4, 6x6, 8x8), propulsion (Electric, Gasoline, Diesel), Truck (Light, Medium, Heavy), Transmission (Automatic, Semi-Automatic, Manual), and Region - Global Forecast to 2027

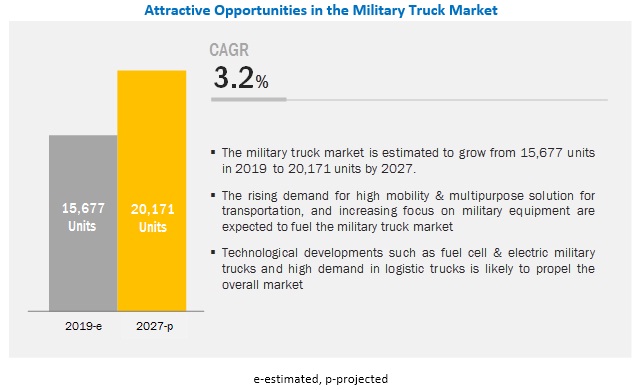

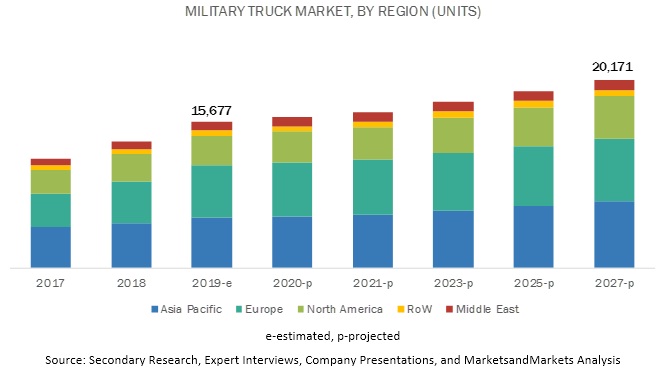

The gobal military truck market was valued at 15,677 units in 2019 and is expected to reach 20,171 units by 2027, at a CAGR of 3.2% during the forecast period 2019 to 2027. Factors such as high demand for customized trucks, technological advancements, increasing popularity of transportation of military equipment, and continuous growth of army personnel are driving the military truck market.

Automatic transmission segment is expected to be the fastest-growing market during the forecast period

The automatic transmission is being adopted due to their fuel efficiency and comfort offered to the driver through automated gear shift and minimal torque interruption. For instance, Allison Transmission produces fully automatic transmissions for light-, medium- and heavy-duty military wheeled and tracked vehicles.

Suppliers are concentrating on offering technologies with better efficiency rates, comfort levels, and durability, along with the minimal impact on the environment. The adoption of new technologies is also dependent on customer preferences, which differs by region. The benefit of high speed, more fuel efficiency, and reduced risk of engine stop during heavy loads increase the market for automatic transmission. In military purposes, these trucks offer all-terrain high-speed transport of troops, cargo, and other supplies.

Heavy trucks are expected to lead the military truck market during the forecast period

These heavy trucks are capable of operating off-road, in deep water, mud or snow. With a payload capacity of 1,000 kg, these trucks can tow weight of 3,000 kg. Also, manufacturers add protection from small arms fire, artillery shell splinters, grenades, small anti-personnel mines in these military trucks. Versions of heavy tactical 8x8, 10x10 axle configurations are manufactured by companies like Oshkosh Corporation, Mercedes-Benz, MAN, Krauss-Maffei Wegmann, and others. Heavy military trucks are used for select applications as they offer better torque at the wheel and peak power ratings. Some of the major applications are refrigeration, dumping, firefighting, disaster management, tankers, RMC, and containers.

North America is expected to be the fastest-growing market during the forecast period

North America is expected to be the fastest-growing market. Border disputes and diplomatic developments between the US and Mexico has led to increasing procurement of army vehicles in the country, which includes military trucks, armored vehicles, and weapon systems. Hence, Mexico is looking forward to expanding its adoption of military equipment.

The Canadian government is also focusing on strengthening its military by procuring military equipment. For instance, The Canadian armed forces signed a contract of 628.98 USD million with Mack Defense includes the supply of new trucks, trailers, armor protection systems, and in-service support. In 2015, Mack Defense was awarded USD 834 million by the Canadian government to deliver 1,587 trucks with five years of in-service support.

The US Government awarded a contract worth USD 6.7 billion to Oshkosh Corporation for the development of JLTVs to replace its dependable but aging Humvee in 2016. The increased investments in the North American region for the development of advanced military trucks are also fuelling the growth of the market.

Key Market Players

The global military truck market is dominated by major players such as Oshkosh Corporation (US), Rheinmetall AG (Germany), IVECO S.p.A., (Italy), TATRA TRUCKS A.S., (Czech Republic), Arquus (France), Textron Inc., (US), General Dynamics (US), and Mitsubishi Heavy Industries (Japan), and many others. These companies have strong distribution networks at a global level. Besides, these companies offer a wide range of military trucks in the market. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2027 |

|

Forecast units |

Volume (Units) |

|

Segments covered |

Truck Type, application, propulsion, transmission type, axle configuration, and region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East, and Rest of the World. |

|

Companies Covered |

Oshkosh Corporation (US), Rheinmetall AG (Germany), IVECO S.p.A., (Italy), TATRA TRUCKS A.S., (Czech Republic), Arquus (France), Textron Inc., (US), General Dynamics (US), and Mitsubishi Heavy Industries (Japan), and many others. Total of 25 major players are covered under the report. |

This research report categorizes the military truck market based on truck type, application, propulsion, transmission type, axle configuration, and region.

Based on truck type:

- Light

- Medium

- Heavy

Based on the application:

- Cargo/logistics

- Troop

- Utility

Based on the propulsion type:

- Electric/Hybrid

- Gasoline

- Diesel

Based on the transmission type:

- Automatic

- Semi-Automatic

- Manual

Based on the axle configuration:

- 4x4

- 6x6

- 8x8

- Others

Based on the region:

-

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Russia

- Turkey

- UK

- Rest of Europe

-

Middle East

- Saudi Arabia

- Israel

- Rest of Middle East

-

Rest of the World

- Brazil

- Iran

- Others

-

Asia Pacific

Recent Developments

- In February 2019, The U.S. Army Tank-automotive and Armaments Command (TACOM) Life Cycle Management Command (LCMC) placed an order for 354 Family of Medium Tactical Vehicles (FMTV) A1P2 trucks and trailers at a value of USD75 million to Oshkosh Defense.

- In January 2019, Rheinmetall AG and BAE Systems signed an agreement to create a joint UK based military vehicle design, manufacturing and support business. Rheinmetall AG will acquire a 55% share in BAE Systems Land UK Tank and Combat Vehicles division. The joint venture will be known as Rheinmetall BAE Systems Land (RBSL).

- In February 2019, The Kalyani Group and Belcan, LLC announced a partnership to provide highly advanced technological products and services in defense, aerospace, and other technical segments in India.

Critical Questions:

- How will customization of truck impact the growth of military truck?

- What is the impact of electrification on the market?

- What are the upcoming trends in the military truck market? What impact would they make post-2022?

- What are the key strategies adopted by the top players to increase their revenue?

- How will the change of transmission impact the growth of military truck?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Military Truck Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.3.3 Key Data From Primary Sources

2.4 Military Truck Market Size Estimation

2.4.1 Data Triangulation Approach

2.4.2 Bottom-Up Approach

2.5 Military Truck Market Breakdown and Data Triangulation

2.6 Assumptions

2.7 Risk Assessment & Ranges

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 33)

4.1 Military Truck Market to Grow at a Significant Rate During the Forecast Period (2019–2027)

4.2 North America is the Fastest Growing Market By 2027

4.3 Market, By Truck Type and Application

4.4 Market, By Application

4.5 Market, By Axle Configuration

4.6 Market, By Propulsion Type

4.7 Market, By Truck Type

4.8 Market, By Transmission Type

5 Military Truck Market Overview (Page No. - 38)

5.1 Introduction

5.2 Military Truck Market Dynamics

5.2.1 Drivers

5.2.1.1 High Mobility and Multi-Purpose Solution for Transportation

5.2.1.2 Increasing Military Troops/Cargo

5.2.1.3 Increasing Focus on Military Equipment

5.2.2 Restraints

5.2.2.1 Use of Robots in Military

5.2.3 Opportunities

5.2.3.1 Customization of Trucks and Technology Used

5.2.3.2 Electrically Powered Military Trucks

5.2.4 Challenges

5.2.4.1 Raw Material Price Fluctuations

5.2.5 Revenue Shift Driving Market Growth

5.2.6 Impact of Market Dynamics

5.3 Revenue Missed: Opportunities for Military Truck Manufacturers

5.4 Military Truck Market, Scenarios (2019–2027)

5.4.1 Market, Most Likely Scenario

5.4.2 Market, Optimistic Scenario

5.4.3 Market, Pessimistic Scenario

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Technological Overview

6.2.1 Rise of Electric Military Vehicles

6.2.2 Robotic Trucks in Military

6.2.3 Hyrogen Fuel-Cell Powered Military Trucks

6.3 Porters Five Forces

6.4 Macroindicator Analysis

6.4.1 Growth of Military Truck Market

6.4.2 GDP (USD Billion)

6.4.3 GNI Per Capita, Atlas Method (USD)

6.4.4 GDP Per Capita PPP (USD)

6.4.5 Macroindicators Influencing the Market, Top 3 Countries

6.4.5.1 Germany

6.4.5.2 US

6.4.5.3 China

7 Military Truck Market, By Application (Page No. - 49)

7.1 Introduction

7.1.1 Research Methodology

7.2 Assumptions

7.3 Cargo/Logistics Carrier

7.3.1 Rising Demand for Transporting Cargo and Logistics Will Drive the Market

7.4 Troop Carrier

7.4.1 Continuous Growth of Military Personnel in the US, Russia, China, and Other Countries Will Impact the Demand for Military Trucks

7.5 Utility

7.5.1 Rising Requirement of Ambulances, Fuel Tankers, Dump Trucks in Remote Areas Will Increase the Demand for Military Utility Trucks

7.6 Market Leaders

8 Military Truck Market, By Truck Type (Page No. - 55)

8.1 Introduction

8.1.1 Research Methodology

8.2 Assumptions

8.3 Light Truck

8.3.1 Rising Focus on High Performance Lightweight Trucks for Logistics and Patrolling Will Drive the Overall Market

8.4 Medium Truck

8.4.1 Capabilities of Medium Trucks to Transport Cargo Hauling, Carrying, or Winching Have Increased the Demand Significantly

8.5 Heavy Truck

8.5.1 Usage of Heavy-Duty Trucks in Various Special Applications Drives the Overall Market Growth

8.6 Market Leaders

9 Military Truck Market, By Axle Configuration (Page No. - 61)

9.1 Introduction

9.1.1 Research Methodology

9.2 Assumptions

9.3 4x4

9.3.1 Rising Demand for Light Military Trucks Will Fuel the Growth of 4x4

9.4 6x6

9.4.1 Increasing Troop Size and Defense Budget Will Fuel the Demand for 6x6 Military Trucks

9.5 8x8

9.5.1 Demand for Modular Multi-Wheeled Trucks in Military Will Drive the Market

9.6 Others

9.6.1 Rising Demand for Special Superstructure Trucks for All Terrain Increases the Growth of Military Trucks

9.7 Market Leaders

10 Military Truck Market, By Propulsion Type (Page No. - 67)

10.1 Introduction

10.1.1 Research Methodology

10.2 Assumptions

10.3 Electric/Hybrid

10.3.1 Introduction of Electric and Hybrid Components in Military Trucks Can Help Reduce Cost and Improve Performance

10.4 Gasoline

10.4.1 Rising Focus on Low Emission Military Trucks to Minimize Environmental Impact Will Drive the Gasoline Market

10.5 Diesel

10.5.1 High Power Generation Capacity Makes a Diesel Engine Suitable for Pulling Heavy Load Applications

10.6 Market Leaders

11 Military Truck Market, By Transmission Type (Page No. - 73)

11.1 Introduction

11.1.1 Research Methodology

11.2 Assumptions

11.3 Automatic Transmission

11.3.1 Automatic Transmission is Beneficial for Long-Haul Transportation in Military Trucks

11.4 Semi-Automatic Transmission

11.4.1 Increasing Demand for Fuel-Efficient and High-Performance Trucks in Defense Will Boost the Overall Growth

11.5 Manual Transmission

11.5.1 Improved Gas Mileage and Driving Ease Would Increase the Demand for Manual Transmission in Military Trucks

11.6 Market Leaders

12 Military Truck Market, By Region (Page No. - 79)

12.1 Introduction

12.2 Asia Pacific

12.2.1 China

12.2.1.1 Increasing Investment and Army Troops to Strengthen Military Would Increase the Demand for Military Trucks in China

12.2.2 India

12.2.2.1 Increasing Instances of Terrorist Strikes & Border Disputes Would Lead to More Procurement of Military Trucks in India

12.2.3 Japan

12.2.3.1 High-End Military Technologies Drive the Market of Military Truck in Japan

12.2.4 South Korea

12.2.4.1 Military Truck Modernization Programs and Conflicts With North Korea are Driving the Growth of the Market

12.2.5 Australia

12.2.5.1 Increasing Contacts for Acquisition of Modern Military Trucks and Other Defense Vehicles Drive the Overall Market in Australia

12.2.6 Rest of Asia Pacific

12.2.6.1 Increasing Troop Deployment and Investments in Army Logistics Have Fueled the Demand for Military Trucks

12.3 Europe

12.3.1 France

12.3.1.1 Procurement of New Generation Military Trucks for Defense Forces is Driving the Market in France

12.3.2 Germany

12.3.2.1 Significant R&D Investments Will Drive the Procurement of Modernized Defense Systems

12.3.3 Russia

12.3.3.1 The Replacement of Aged Military Vehicle Fleets in Russia is Driving the Growth of Military Truck Market

12.3.4 UK

12.3.4.1 Internal Security Safeguarding has Led to the Growth of Military Trucks in UK

12.3.5 Italy

12.3.5.1 Growing Exports of Military Vehicles From Italy Will Drive Market Growth in the Country

12.3.6 Turkey

12.3.6.1 Defense and Security Budget Increase to Provide Logistics and Supplies for Army Would Boost the Market in Turkey

12.3.7 Rest of Europe

12.3.7.1 Increasing Contacts for Acquisition of Modern Military Trucks and Other Defense Vehicles Drive the Overall Market in Rest of Europe

12.4 North America

12.4.1 US

12.4.1.1 High Procurement of Military Trucks and Other Advanced Defense Vehicles in the US is Expected to Drive the Market

12.4.2 Canada

12.4.2.1 Replacement and Modernization of the Current Fleet of Medium Weight Logistics Trucks Will Drive the Military Truck Market in Canada

12.4.3 Mexico

12.4.3.1 Major Shift in Military Equipment Will Fuel the Market in Mexico

12.5 Middle East

12.5.1 Saudi Arabia

12.5.1.1 Increase in Defense, Homeland Security, and Public Safety Spending Per Capita Will Drive the Market in Saudi Arabia

12.5.2 Israel

12.5.2.1 Increased Focus of Israel to Address Operational Challenges Will Drive the Overall Market

12.5.3 Rest of Middle East

12.5.3.1 Increased Investments in Development of Military Trucks and Armaments Will Boost the Military Truck Market

12.6 Rest of the World (RoW)

12.6.1 Brazil

12.6.1.1 Low Manufacturing Cost and Availability of Economic Workforce Will Fuel the Market in Brazil

12.6.2 Iran

12.6.2.1 Dangerous and Unstable Situation in the Middle East Will Fuel the Market in Iran

12.6.3 Others

12.6.3.1 Major Shift in Military Components and Increasing Investments to Strengthen the Army Will Fuel the Market

12.7 Operational Data

12.7.1 Military Manpower for 2019, By Country

12.7.2 Defense Budget (2018), By Country

13 Competitive Landscape (Page No. - 103)

13.1 Overview

13.2 Military Truck Market Ranking Analysis

13.3 Product Comparison Mapping, By Key Competitors

13.4 Competitive Leadership Mapping

13.4.1 Visionary Leaders

13.4.2 Innovators

13.4.3 Dynamic Differentiators

13.4.4 Emerging Companies

13.5 Strength of Product Portfolio

13.6 Business Strategy Excellence

13.7 Winners Vs. Losers

13.8 Competitive Scenario

13.8.1 Partnerships/Contracts, 2017–2019

13.8.2 Acquisition

14 Company Profiles (Page No. - 112)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

14.1 Oshkosh Corporation

14.2 General Dynamics Corporation

14.3 Rheinmetall AG

14.4 Textron Inc.

14.5 Tata Motors

14.6 Krauss-Maffei Wegmann

14.7 Arquus

14.8 Iveco

14.9 Mitsubishi Heavy Industries

14.10 Hyundai Rotem

14.11 Tatra Trucks A.S

14.12 The Kalyani Group

14.13 Daimler

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

14.14 Other Key Players

14.14.1 Asia Pacific

14.14.1.1 Ashok Leyland

14.14.1.2 Hanwha Corporation

14.14.1.3 Ordnance Factory Board

14.14.2 Europe

14.14.2.1 Nexter Group

14.14.2.2 Bae Systems PLC

14.14.2.3 Volat

14.14.2.4 Rába Automotive Holding PLC.

14.14.2.5 Kamaz PTC

14.14.3 North America

14.14.3.1 AM General

14.14.3.2 Lockheed Martin

14.14.4 Middle East

14.14.4.1 IMI Systems

14.14.5 Rest of the World

14.14.5.1 Paramount Group

15 Appendix (Page No. - 138)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author Details

List of Tables (109 Tables)

Table 1 Currency Exchange Rates (Per 1 USD)

Table 2 Primary Data Sources

Table 3 Major Assumptions

Table 4 Risk Assessment & Ranges

Table 5 Military Truck Market: Armed Forces Personnel, By Country, 2017 Vs. 2018

Table 6 Market: Defense Budget, By Country, 2017 Vs. 2018

Table 7 Market: Impact of Market Dynamics

Table 8 Market (Most Likely), By Region, 2017–2027 (Units)

Table 9 Market (Optimistic), By Region, 2017–2027 (Units)

Table 10 Market (Pessimistic), By Region, 2017–2027 (Units)

Table 11 Major Assumptions, By Application

Table 12 Military Truck Market, By Application, 2017–2027 (Units)

Table 13 Cargo/Logistics: Market, By Region, 2017–2027 (Units)

Table 14 Troop Carrier: Market, By Region, 2017–2027 (Units)

Table 15 Utility: Market, By Region, 2017–2027 (Units)

Table 16 Recent Developments, By Application

Table 17 Major Assumptions, By Truck Type

Table 18 Market, By Truck Type, 2017–2027 (Units)

Table 19 Light Truck: Market, By Region, 2017–2027 (Units)

Table 20 Medium Truck: Market, By Region, 2017–2027 (Units)

Table 21 Heavy Truck: Market, By Region, 2017–2027 (Units)

Table 22 Recent Developments, By Truck Type

Table 23 Major Assumptions, By Axle Configuration

Table 24 Military Truck Market, By Axle Configuration, 2017–2027 (Units)

Table 25 4x4: Market, By Region, 2017–2027 (Units)

Table 26 6x6: Market, By Region, 2017–2027 (Units)

Table 27 8x8: Market, By Region, 2017–2027 (Units)

Table 28 Others: Market, By Region, 2017–2027 (Units)

Table 29 Recent Developments, By Axle Configuration

Table 30 Major Assumptions, By Propulsion Type

Table 31 Market, By Propulsion Type, 2017–2027 (Units)

Table 32 Electric/Hybrid: Market, By Region, 2017–2027 (Units)

Table 33 Gasoline: Market, By Region, 2017–2027 (Units)

Table 34 Diesel: Market, By Region, 2017–2027 (Units)

Table 35 Recent Developments, By Propulsion Type

Table 36 Major Assumptions, By Transmission Type

Table 37 Military Truck Market, By Transmission Type, 2017–2027 (Units)

Table 38 Automatic Transmission: Market, By Region, 2017–2027 (Units)

Table 39 Semi-Automatic Transmission: Market, By Region, 2017–2027 (Units)

Table 40 Manual Transmission: Market, By Region, 2017–2027 (Units)

Table 41 Recent Developments, By Transmission Type

Table 42 Market, By Region, 2017–2027 (Units)

Table 43 Asia Pacific: Market, By Country, 2017–2027 (Units)

Table 44 China: Market, By Application, 2017–2027 (Units)

Table 45 India: Market, By Application, 2017–2027 (Units)

Table 46 Japan: Market, By Application, 2017–2027 (Units)

Table 47 South Korea: Market, By Application, 2017–2027 (Units)

Table 48 Australia: Market, By Application, 2017–2027 (Units)

Table 49 Rest of Asia Pacific: Military Truck Market, By Application, 2017–2027 (Units)

Table 50 Europe: Market, By Country, 2017–2027 (Units)

Table 51 France: Market, By Application, 2017–2027 (Units)

Table 52 Germany: Market, By Application, 2017–2027 (Units)

Table 53 Russia: Market, By Application, 2017–2027 (Units)

Table 54 UK: Market, By Application, 2017–2027 (Units)

Table 55 Italy: Market, By Application, 2017–2027 (Units)

Table 56 Turkey: Military Truck Market, By Application, 2017–2027 (Units)

Table 57 Rest of Europe: Market, By Application, 2017–2027 (Units)

Table 58 North America: Market, By Country, 2017–2027 (Units)

Table 59 US: Market, By Application, 2017–2027 (Units)

Table 60 Canada: Market, By Application, 2017–2027 (Units)

Table 61 Mexico: Market, By Application, 2017–2027 (Units)

Table 62 Middle East: Market, By Country, 2017–2027 (Units)

Table 63 Saudi Arabia: Market, By Application, 2017–2027 (Units)

Table 64 Israel: Market, By Application, 2017–2027 (Units)

Table 65 Rest of Middle East: Market, By Application, 2017–2027 (Units)

Table 66 Rest of the World: Market, By Country, 2017–2027 (Units)

Table 67 Brazil: Military Truck Market, By Application, 2017–2027 (Units)

Table 68 Iran: Market, By Application, 2017–2027 (Units)

Table 69 Others: Market, By Application, 2017–2027 (Units)

Table 70 US Military Manpower for 2019

Table 71 Canada Military Manpower for 2019

Table 72 Mexico Military Manpower for 2019

Table 73 China Military Manpower for 2019

Table 74 India Military Manpower for 2019

Table 75 Japan Military Manpower for 2019

Table 76 South Korea Military Manpower for 2019

Table 77 Australia Military Manpower for 2019

Table 78 France Military Manpower for 2019

Table 79 Germany Military Manpower for 2019

Table 80 Italy Military Manpower for 2019

Table 81 UK Military Manpower for 2019

Table 82 Russia Military Manpower for 2019

Table 83 Turkey Military Manpower for 2019

Table 84 Saudi Arabia Military Manpower for 2019

Table 85 Israel Military Manpower for 2019

Table 86 Brazil Military Manpower for 2019

Table 87 Iran Military Manpower for 2019

Table 88 US Defense Budget

Table 89 Canada Defense Budget

Table 90 Mexico Defense Budget

Table 91 China Defense Budget

Table 92 India Defense Budget

Table 93 Japan Defense Budget

Table 94 South Korea Defense Budget

Table 95 Australia Defense Budget

Table 96 France Defense Budget

Table 97 Germany Defense Budget

Table 98 UK Defense Budget

Table 99 Italy Defense Budget

Table 100 Russia Defense Budget

Table 101 Turkey Defense Budget

Table 102 Saudi Arabia Defense Budget

Table 103 Israel Defense Budget

Table 104 Brazil Defense Budget

Table 105 Iran Defense Budget

Table 106 Product Comparison Mapping, By Key Competitors

Table 107 Partnerships/Contracts, 2017–2019

Table 108 Acquisition, 2018–2019

Table 109 List of Companies: Military Truck Market

List of Figures (47 Figures)

Figure 1 Military Truck Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market Size Estimation Methodology for the Market: Bottom-Up Approach

Figure 6 Data Triangulation

Figure 7 Military Truck: Market Outlook

Figure 8 Military Truck Market, By Axle Configuration, 2019 Vs. 2027 (Units)

Figure 9 Continuous Demand for Cargo/Logistics and Increasing Focus on Military Equipment Will Boost the Market

Figure 10 Market Share, By Region, 2019

Figure 11 Heavy Truck & Cargo/Logistics Carrier are Expected to Account for the Largest Share of the Market in 2019

Figure 12 Cargo/Logistics Carrier is Expected to Hold the Largest Market Share, 2019 Vs. 2027 (Units)

Figure 13 8x8 is Estimated to Hold the Largest Market Share, 2019 Vs. 2027 (Units)

Figure 14 Diesel is Expected to Dominate the Market, 2019 Vs. 2027 (Units)

Figure 15 Heavy Trucks Dominate the Market, 2019 Vs. 2027 (Units)

Figure 16 Automatic Transmission is Expected to Hold the Largest Share in the Market, 2019 Vs. 2027 (Units)

Figure 17 Market: Market Dynamics

Figure 18 Military Truck Market– Future Trends & Scenario, 2017–2027 (Units)

Figure 19 Key Primary Insights

Figure 20 Market, By Application, 2019 Vs. 2027 (Units)

Figure 21 Key Primary Insights

Figure 22 Market, By Truck Type, 2019 Vs. 2027 (Units)

Figure 23 Key Primary Insights

Figure 24 Market, By Axle Configuration, 2019 Vs. 2027 (Units)

Figure 25 Key Primary Insights

Figure 26 Market, By Propulsion Type, 2019 Vs. 2027 (Units)

Figure 27 Key Primary Insights

Figure 28 Market, By Transmission Type, 2019 Vs. 2027 (Units)

Figure 29 Military Truck Market, By Region, 2019 Vs. 2027 (Units)

Figure 30 Asia Pacific: Market Snapshot

Figure 31 Europe: Market Snapshot

Figure 32 Market Ranking of Key Industry Players

Figure 33 Market (Global): Competitive Leadership Mapping, 2019

Figure 34 Key Developments By Leading Players in the Market, 2016–2019

Figure 35 Oshkosh Corporation: Company Snapshot

Figure 36 Oshkosh Corporation: SWOT Analysis

Figure 37 General Dynamics Corporation: Company Snapshot

Figure 38 General Dynamics: SWOT Analysis

Figure 39 Rheinmetall AG: Company Snapshot

Figure 40 Rheinmetall AG: SWOT Analysis

Figure 41 Textron Inc: Company Snapshot

Figure 42 Textron Inc.: SWOT Analysis

Figure 43 Tata Motors: Company Snapshot

Figure 44 Tata Motors: SWOT Analysis

Figure 45 Mitsubishi Heavy Industries: Company Snapshot

Figure 46 Hyundai Rotem: Company Snapshot

Figure 47 Daimler: Company Snapshot

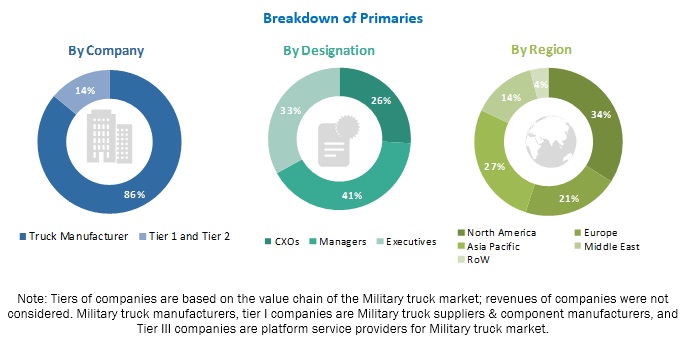

The study involved estimating the current size of the military truck market. Exhaustive secondary research was done to collect information on the market, the peer market, and model mapping. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used for estimating the market size of segments and subsegments.

Secondary Research

Various secondary sources were used in the secondary research process to identify and collect information useful for an extensive commercial study of the global military truck market. Secondary sources include company annual reports/presentations, press releases, paid databases, journals, automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and MarketsandMarkets data repository.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the Military truck market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-side (government authorities, Military truck providers) and supply-side (Military truck manufacturers, suppliers, and military truck part manufacturers) across 5 major regions, namely, North America, Europe, Asia Pacific, Middle East, and the Rest of the World. Approximately 14% and 86% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts from major companies, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the military truck market. In this approach, the military truck production statistics are considered at the country level by mapping the contracts of military trucks for each country.

To determine the market size, in terms of volume, model mapping of trucks is done for each application. Through the model mapping, penetration is determined for all segments like application, axle configuration, propulsion, transmission, and truck type. The penetration, from the model mapping, is multiplied by the country level military truck production considered in the study, which will give us the volume of each segment type. The country-level data will sum up to make the region level data in terms of volume. Further summation of the regional market size provides the global military truck market size.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To estimate the overall military truck market size and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the military truck market size, in terms of volume (units)

- To define, describe, and forecast the market based on application, transmission type, truck type, axle configuration, propulsion type, and region

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market size, in terms of volume, by application (cargo/logistics, troop, and utility)

- To segment and forecast the market size, in terms of volume, by transmission type (automatic, semi-automatic, and manual)

- To segment and forecast the market size, in terms of volume, by truck type (light, medium, and heavy)

- To segment and forecast the market size, in terms of volume, by axle configuration (4X4, 6X6, and 8X8)

- To segment and forecast the market size, in terms of volume, by propulsion type (electric/hybrid, gasoline, and diesel)

- To forecast the market size with respect to key regions, namely, North America, Europe, Asia Pacific, Middle East, and Rest of the World

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze markets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities for stakeholders and details of a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the military truck market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Military truck market, by application at country level (for countries not covered in the report)

- Military truck market, by transmission type at country level (for countries not covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Military Truck Market